Wealth Solutions & Wealth Planning

Hong Kong – Will it Remain a Key Centre for UHNW Wealth and Family Offices?

Mar 25, 2022

Hong Kong is, of course, the well-known traditional epicentre of the offshore wealth management industry in North Asia. Not only has it over many decades carved out a formidable reputation in the global wealth management universe, with clients from the world over, but it boasts a totally international approach, an advanced regulatory environment and a highly developed wealth management infrastructure and professional services ecosystem. Hong Kong has also carved out a formidable reputation as the global capital markets centre in the Asian time zone. And nowadays, Hong Kong is increasingly interconnected with both Mainland China and with the Greater Bay Area. Moreover, as the world’s regulators and governments demand more substance, as clients focus more on reputation, and as they increasingly park and manage assets where lifestyles and security align, mid-shore is gathering even greater momentum, and Hong Kong is well-positioned to win back or attract business from the more esoteric offshore financial centres. But what specifically does Hong Kong have to offer the regional and indeed global UHNW community, and is Hong Kong able to compete head-to-head with Singapore as a go-to jurisdiction for family offices, or indeed with Switzerland, historically such a powerful magnet for top tier wealth?

The Panel:

- Michael Olesnicky, Senior Consultant, Tax & Wealth Management, Baker McKenzie

- David Loo, Head of Private Clients, North Asia, Lombard Odier

- Peter Stein, CEO and Managing Director, Private Wealth Management Association

- Richard Grasby, Founder, RDG Fiduciary Services

- Chi Man Kwan, Group Chief Executive Officer and Founder, Raffles Family Office

Some of the Questions the Panel Considered:

- How would the panel characterise the current state of the Hong Kong wealth management market, and what are the key advantages it offers regional and global UHNWIs?

- How are UHNW client requirements changing, why and is Hong Kong ahead of the game?

- Is Hong Kong today mainly a wealth management hub for HNW and UHNW clients from Mainland China and North Asia, and a conduit to and from China, or is it more, is it global in its appeals for these clients?

- What do UHNW clients expect of their providers? More products? A wider range of assets? Better and more sophisticated advice? DPM? Estate & Succession planning? In short, what do they need, and can Hong Kong match up to their expectations?

- What have the government and the regulators/authorities been doing to widen the appeals of Hong Kong for the location or expansion of single-family offices? In short, why should families set up a SFO in Hong Kong?

- Can Hong Kong compete effectively with Singapore as a go-to centre for single-family offices? And if so, how?

- What are the key strengths of the Hong Kong wealth management market for UHNWIs, and how are the key competitors adapting their products, service, strategies and talent to the opportunities that lie ahead?

- Does Hong Kong have a sufficiently deep talent pool of private bankers, advisors, asset managers, funds, hedge funds, lawyers, accountants, trustees and others to attract the global UHNW clientele?

Setting the Scene

The Hubbis Digital Dialogue event of March 10th focused the minds of our panel of experts on the many key pluses and minuses of Hong Kong and its role as a centre for UHNW wealth and family offices. They looked to identify the key appeals of Hong Kong. They looked at its geographical position in North Asia, its historical and current position as a global financial hub, and at how it is benefitting from China’s extraordinary growth and wealth. They considered the depth of the financial ecosystem, its array of private banks, independent wealth managers and multi-family offices, and at the sophistication of the professional services ecosystem. The reviewed how Hong Kong is adjusting and refining its regulations as well as its tax and other incentives to appeal to UHNWIs worldwide and to attract more single-family offices, and broadly at how Hong Kong is fighting back against Singapore’s allure, and reviewed what additional or unique proposition and value-added Hong Kong offers today and can offer UHNWIs in the future.

Optimism amongst many of those that know Hong Kong long and well remains consistently high

It is all too easy to casually write off Hong Kong. There were numerous media articles in the lead-up to and after the 1997 handover cataloguing all the reasons why Hong Kong would soon fade into the global financial wilderness. It only grew stronger and activity levels increased dramatically, while real estate and other valuation soared. The same sort of situation persists today, with many only too willing to look at the negatives and brush over the positives.

But one panellist who had lived and worked there for several decades said he and many others who know the region well remains highly optimistic about the future. The protests are a somewhat distant memory, Hong Kong remains remarkably robust as a business and financial hub, the growth spurred by the vast Chinese economy is remarkable, and Hong Kong continues to attract global wealth. Moreover, he said that while the restrictions since the pandemic hit are indeed tough, things will improve. Meanwhile, the government and regulators are improving the overall appeals and the general ease of doing business.

The assets under management (AUM) of the wealth management industry have steadily increased over recent years and the fairly recent initiatives to attract more family offices to Hong Kong are working. He remarked that after Switzerland, Hong Kong is the second largest offshore wealth hub globally.

He reiterated that the vast and dynamic Chinese economy is of course on the doorstep and represents an incredible two-way flow opportunity for many years ahead. The financial, legal, accounting, trust and other corporate and technology services ecosystem is remarkably experienced and strong. Talent is plentiful, even after many people have left during the pandemic.

Clarifications on regulations and other government incentives are making the family office scene more vibrant

Another guest said research had indicated Hong Kong will surpass Switzerland as an offshore financial hub by 2025. Growth will also be driven by the family office space, and he pointed, for example, to improvements afoot, such as a clarification issued by the Hong Kong SFC regarding licensing requirements.

In particular, he said these make it easier to treat single family offices as corporate professional investor clients. “Why does that matter?” he pondered. “Because before it was very difficult for private banks and other intermediaries to treat family offices as effectively institutional investors, so they had to spend a lot of time on disclosures and doing suitability checks for investors who really didn't need this. The SFC has thereby made it possible to treat [these SFOs] as professional investors.”

He also pointed to government plans to introduce tax incentives for family offices to more rapidly level the playing field with Singapore. “We have pushed for these changes for a few years, and a public consultation is underway that is likely to produce positive results,” he reported.

“Moreover,” he added, “the government has created ‘Family Office Hong Kong’, which is a division of ‘Invest Hong Kong’ specifically to target family offices. This puts forth experts who meet with family offices or families who are thinking of setting up a structure in Hong Kong, to explain to them the process, to help answer their questions, and basically try and make it just a more user friendly experience all around.”

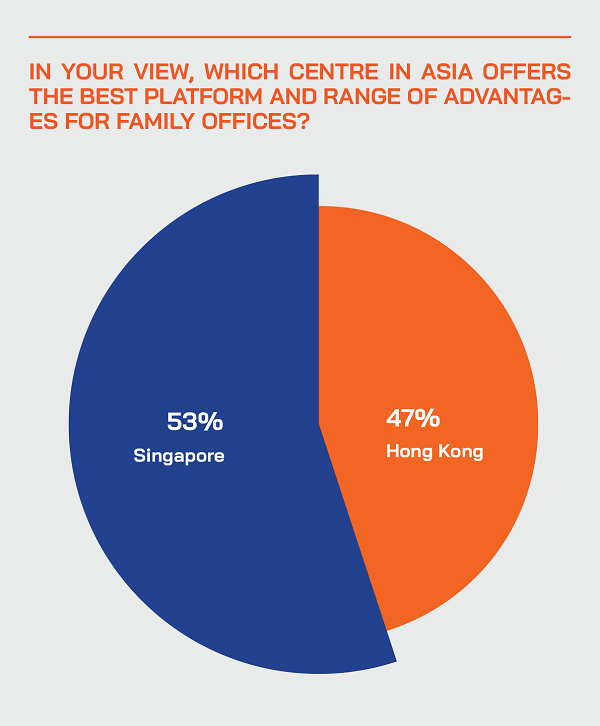

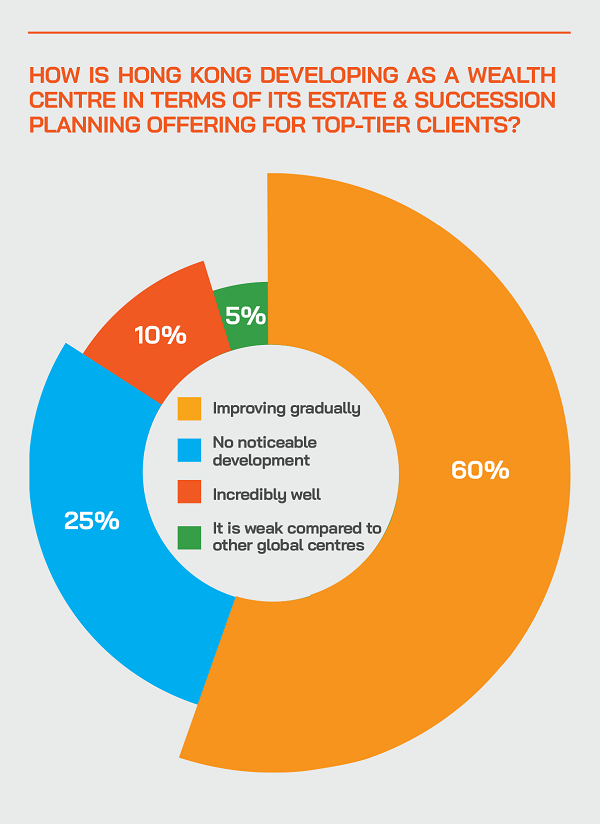

The Post-Event Survey - Views from the Market

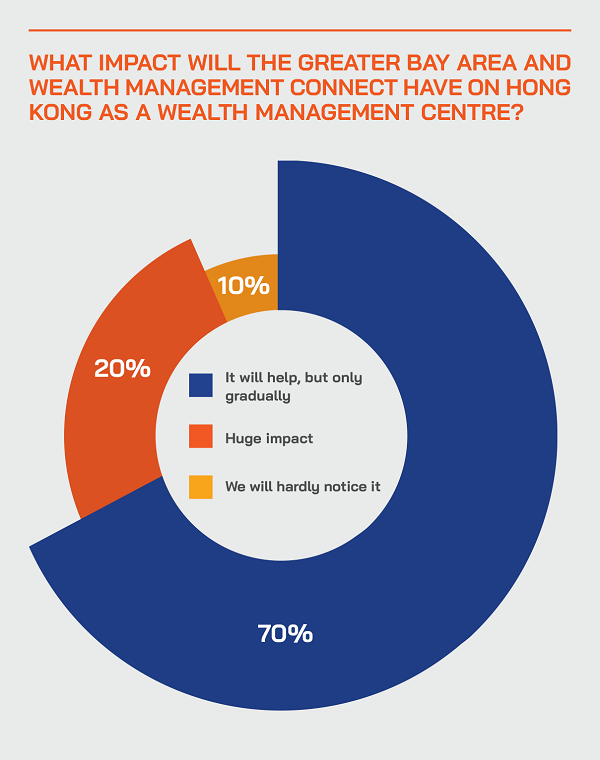

After the webinar, we asked delegates for their opinions on the market’s evolution. There were many replies, which we have distilled here. With the caveat that there is some understandable bias towards Hong Kong in the types of delegates who replies, the overwhelming impression is that they believe Hong Kong will not only survive as a global financial centre and a global/regional wealth centre, but it will continue to prosper.

What key strengths and advantages does Hong Kong hold as a wealth management centre for UHNW clients and their family offices?

Comment: Virtually every respondent highlighted China as Hong Kong’s hinterland and source of current and future clientele, and with Hong Kong as the gateway to and from the mainland.

Other key positives they pointed to include:

- Enterprising market and talented people.

- Great infrastructure and ecosystem.

- Transparent legal system.

- Simple tax regime, and outside of the pandemic a great location and travel hub.

- Very strong in the capital markets.

- Robust government and tax incentives to set up family offices.

- Strong history as a financial and wealth management centre.

- Broad range of excellent professional advisory services across the board.

- Strong regulatory history and outlook .

- International hub for cross border transactions, gateway between China and US/EU.

- Technology-savvy and friendly environment.

- Billionaires arriving all the time.

- Freeport, no FX controls.

- Quality of life, education infrastructure, security, safety, healthcare (putting aside an over-zealous approach to the pandemic).

What are the negatives that concern UHNW individuals and families?

Comment: We also asked delegates to consider the negatives around Hong Kong. Again, there were many replies, summarised as below.

- Some political uncertainty.

- Hong Kong is not the happy and positive place it was, many want to leave.

- The departure of a lot of local and expat talent for greener pastures.

- Perhaps any recent growth is just transitory, being the first steps for people moving money from one jurisdiction prior to moving on elsewhere.

- Uncertainty around China’s role in Hong Kong.

- The response to the pandemic has been catastrophic for travel and morale.

- Singapore and Shanghai are rising fast.

- Concerns about speaking openly, we could say a lot more but…

- The National Security Law and local politics and troubled geopolitics.

- Questionable social stability.

- The protests and the reasons for those protects have scarred the image and created a mood of negativity.

- Some UHNW families seriously concerned about stability in the future, hence they either do not come to these shores, or they are diversifying assets and family and control away to other jurisdictions.

- No longer a free-wheeling (but alas well-regulated) economy under a benign political system.

- The 2019 protests may now be behind us, but this is now overtaken by apprehension over the Covid-19 pandemic and the government’s response.

- Freedom of the press? Self-censorship? Hmmmm…

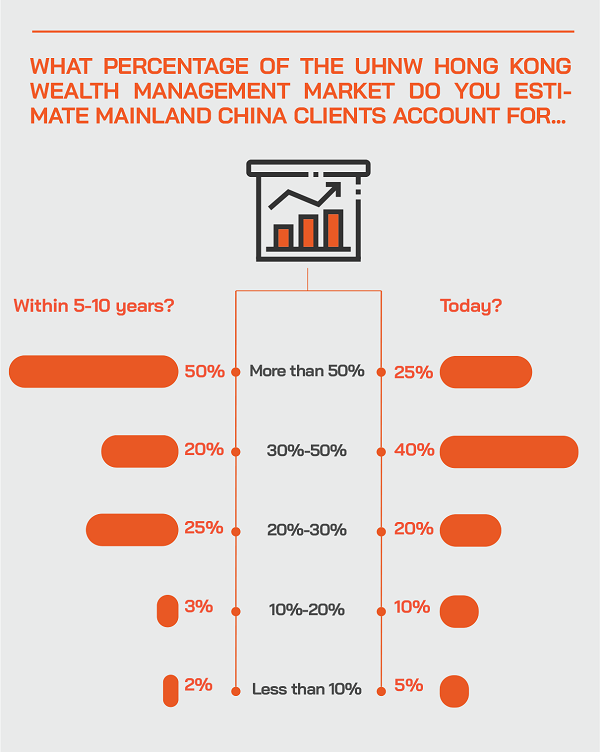

Can Hong Kong hold on to Mainland China’s UHNW private clients, or are they increasingly heading to Singapore or Europe, and why?

Comment: To summarise the replies, the answer is both ‘Yes’ and ‘No’. Many UHNW families, including those from the Mainland, prefer to have some diversification away from their home market, or even home region. Singapore appears to be the go-to choice for those families making this diversification, due to robust and clear regulation, a very competitive tax systems and great tax efficiency for UHNWIs and their investment vehicles, as well as political stability, a strong currency, a growing pool of talent and of course Chinese heritage and language. Europe is well regarded, especially Switzerland, and the US even less so.

Nevertheless, many Mainland UHNW families feel comfortable in Hong Kong with the language, the proximity, the lifestyle and culture. Many replies expressed the view that Hong Kong still has many advantages and unique characteristics and would not in the foreseeable future be replaced by either Singapore or Europe but can be complemented by those jurisdictions. In particular, Hong Kong’s power in the capital markets means it is a great hub for Chinese companies looking to access global investors to raise funds, while mainland exports routed through HK could be subject to lower tariffs.

One of the more detailed replies read: “The answer is ‘Yes’ because Hong Kong is close to Mainland China and hence their UHNW private clients are acquainted and comfortable with the legacies in the wealth management space that have been built up over the years. And culturally, they also feel comfortable in Hong Kong, which is close to home. There may be need to also establish presence in Singapore from a diversification of risks perspective as Chinese typically believe that one should not put all their eggs in one basket, and this is especially the case where families have significant wealth and are diversified in terms of businesses and also family needs such as medical/healthcare, education, lifestyle, and so forth.”

The Hong Kong financial and advisory ecosystem is deep and wide and expertise and talent are proven

Agreeing with these comments, a guest reported that Hong Kong is doing its best to make sure that “non-institutional” in the form of family and family office assets can be deployed effectively there. “We have the whole spectrum of potential services in place, from trusteeships, succession planning, governance, philanthropy, family office concierge and other services, and these make Hong Kong very appealing for at least some of this wealth,” he observed. “The challenge for Hong Kong, and we have seen some movement on that, is to attract more trusts to be set up here, attract more families to come here.” He reported there is positive progress in these regards.

Hong Kong’s AUM is expanding apace, demand for family offices and multifamily offices is growing fast

A guest reported how as a pan-Asia multifamily office, headquartered in Hong Kong, and with a solid presence in Singapore as well, growth was robust, with AUM expanding since 2019 at 20% to 30% yearly. “New billionaires are being minted every three days in China, and Hong Kong by default, because of the geographical area advantage and history is an automatic choice.”

“To me,” he added, “Hong Kong is unique and if I can point to one advantage from the family office perspective, it's really Hong Kong being a place for alpha. This I think this is really important, as Hong Kong is a place where capital is raised and capital expands, it is immensely vibrant. And for me, Hong Kong and Singapore is really not a matter of either one, it's really about Hong Kong and Singapore coming together. The talent pool here is huge, the ecosystem is mature and vast and immensely professional, we have global flexibility from here, and all these are great advantages for our family clients. Longer term, Hong Kong will remain one of the main core pieces of the puzzle that you cannot do without.”

He added that the wealth creation and dynamism of China and the region are second to none. Moreover, trillions of dollars of wealth will transition from the founder or older generations to the younger generations, opening up even more opportunity.

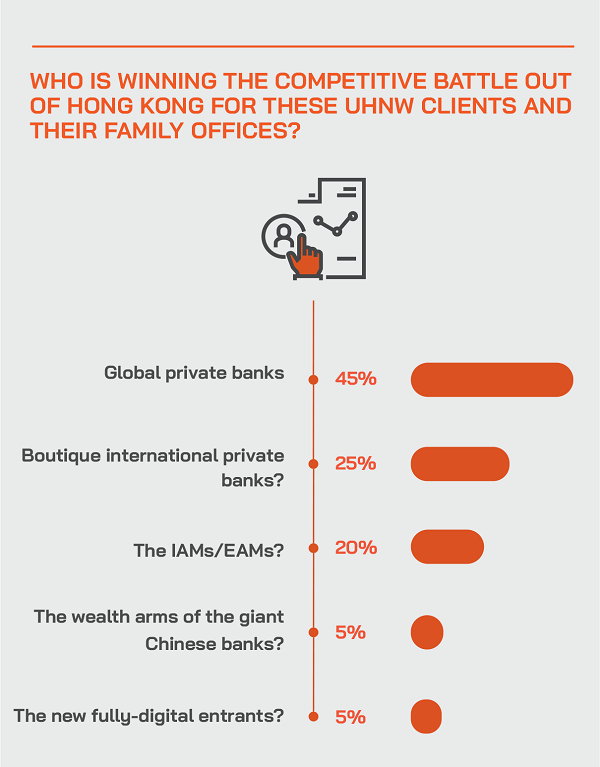

How Hong Kong is fighting back against Singapore

Like it or not, comparisons are constant reading the different appeals of Hong Kong and Singapore as a family office centre. A guest commented that both have their advantages and appeals, but that in terms of tax concessions, Singapore does have a much clearer range of tax exemptions available for family offices, whereas in Hong Kong, this is still a work in progress.

He said it is a positive that the government has now come out with its consultation paper, but for tax and other incentives for family office, the devil is in the detail; we still have to see the final draft of the legislation. “I think from the consultation paper, it's pretty clear that this will follow the format of the existing exemptions that we have for funds, for example, for non-residents. However, it needs to be in place, and that will introduce certainty about the tax treatments.”

He also pointed to the obvious geographical differences between Singapore and Hong Kong. “If I am from Indonesia, for example, or elsewhere in Southeast Asia, Singapore is obviously more natural, whereas in North Asia, Hong Kong is more logical. It is not black and white, but geography is a key determinant in many cases.”

He added that Singapore ties its family office consents more closely to immigration status. Hong Kong does offer immigration benefits if you establish a family office, but the process and outcome are not as crystal clear.

And he remarked that Singapore is creating more trusts under Singapore law with Singapore based trustees, while in Hong Kong, they tend to do less under local law and more in offshore trusts and with local administrators. “Put simply, Singapore is more of a base for establishing Singapore trusts, Hong Kong more a centre of trust administration. For example, I have worked on many Singapore trust with a Singapore trustee, but with the administration being based here in Hong Kong.”

A guest highlighted how the Family Office Association in Hong Kong has a core role to play in promoting the sector and that its members are deeply committed to helping the family office space thrive and expand and aims to represent those family offices with one voice.

Local experts reel off more of the many advantages of Hong Kong

It is of course fair to say that the panel wanted to promote Hong Kong, but not to the detriment of other jurisdictions, in other words their comments were valid and reasonable. A guest, for example concurred with what he had heard, and reiterated the vital role Hong Kong has played as a capital formation centre within APAC. He said it is the largest equities issuing centre in APAC, it is the most important place for private deals in APAC, it is the primary gateway for China and as things open up (assuming the pandemic abates) its star will rise further.

“We were all surprised, certainly in my association, after the civil unrest of 2019, when the official numbers came out for how much the [wealth] industry had grown in 2019,” he reported. “We were surprised to learn AUM grew 17% that year, and for 2020 it was 25%. That speaks volumes about Hong Kong’s resilience and strengths. Yes, we acknowledge the political and social problems are and were problems, but I think they will pass.”

A fellow panellist agreed, saying these issues cannot be brushed under the carpet, but he felt that many concerns are temporary. And he added that the wealth of many Hong Kong conglomerates and families and family offices has always been diversified outside Hong Kong, and will continue to be so in the future, without reducing the importance of the jurisdictions as a centre for that globalisation.

He remarked that the ‘One Country Two Systems’ approach is actually an advantage for Hong Kong because of its connections to China, as well as a disadvantage as it is nearly halfway through the 1997 handover 50-year guarantee. The key he felt is that the integrity of the legal system and courts must remain, otherwise there really could be significant international repercussions.

He said that in terms of where your family office is located, he takes a much more global view that families should create best-in-class structures in jurisdictions that offer the best outcomes, for example for trusts, the Caymans or the Channel Islands are perhaps better than Singapore. “A sophisticated family office will have assets deployed in other jurisdictions, and likewise, have parts of their family office matrix in different jurisdictions. But certainly, any family of significant wealth needs to have a lot of capital deployed here [in Hong Kong], as we will soon be the largest wealth centre and we are on the border of China, [soon] the biggest economy in the world. It is not all about Hong Kong, but Hong Kong has to be part of the puzzle.”

Net new money in China is growing swiftly and so much will flow through Hong Kong

“From the private banking viewpoint, the AUM growth we see is from what we call net new money,” he reported. “This is actually real [net new money] money coming into the bank, rather than investment money growth. China obviously represents a huge part of the new wealth growth, as well as Hong Kong represents a huge part of that liquidity or growth of the business wealth. We position ourselves not as traders of that capital, but as protectors, as a disciplined asset manager, and we have an immensely long history in asset management and wealth planning. And Chinese clients have less experience in both areas, so I think our expertise, and that of the private banking industry in Hong Kong, will still be a very huge attraction for Chinese clients who come from a less exposed environment in terms of outside structure and outside investment planning.”

The core DNA of the family office is taking a long-term vision on family wealth and longevity and Hong Kong fits that approach ideally

An expert observed that there is no fixed definition of what a family office is. However, he said that the DNA is all about taking the very long-term view and also diversification of assets, risk, jurisdictions and even family members and/or geography. “Things happen in the world and the family offices understand that, so we need to look ahead and diversify so as not to panic when surprises and shocks occur. We look back and we see many shocks. We look forward and we must expect many more ahead. nd that's why having a very well-diversified portfolio in terms of geographical jurisdiction for the asset management is crucially important. And Hong Kong is certainly part of the puzzle and solution. Kong Kong’s history, talent pool, and numerous advantages are here to stay.”