Asian Private Clients and the Rise of ESG & Sustainability in Investment Portfolios

May 14, 2023

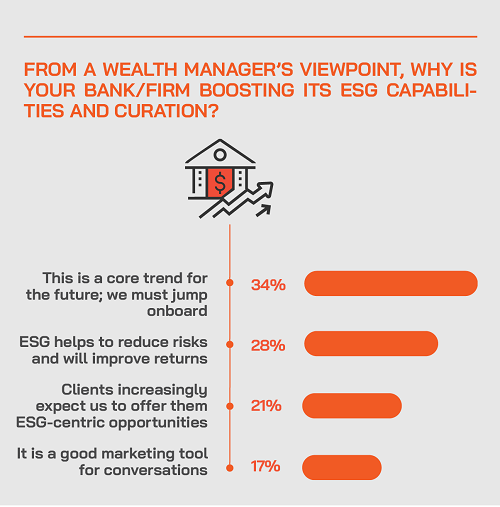

If there is one highly significant investment movement to ride today, it is surely the wave of ESG, impact and sustainability. Although ESG metrics first originated some two-plus decades ago in the US and then Europe, in recent years, ESG has gained traction and momentum to such an extent that these concepts or principles are now flooding the investment landscape worldwide and increasingly so in Asia. The Hubbis Digital Dialogue of April 13th saw a panel of experts analyse the world of ESG and sustainability from the viewpoint of how this impacts the Asian private wealth market. They sought to determine what the fund management community, the private banks, the EAMs/IAMs/MFOs and the single-family office are doing to help private clients jump in and ride this wave or to find out why some of them might still be watching cautiously – perhaps even suspiciously - from the safety of the shore.

The Panel:

- Jaye Chiu, Head of Investment Products & Advisory, Bank of East Asia

- Arjan de Boer, Head of Markets, Investments & Structuring, Asia, Indosuez Wealth Management

- Thomas Hohne-Sparborth, Head of Sustainability Research, Lombard Odier

- Freeman Le Page, Portfolio Specialist, Regnan

These are some of the questions the panel tackled in the discussion:

- From a ‘big picture’ viewpoint, why has ESG-driven investing evolved so rapidly worldwide, and how is it impacting Asia’s wealth management community?

- Where does ESG investing fit within the bigger picture of SRI, Impact investing and even Philanthropy and is the Asian wealth industry succeeding in communicating such nuances?

- Does ESG investing merely serve to soothe the investor’s conscience, or does ESG investing reduce risks and/or improve investment returns as well?

- Who rates/quantifies the ESG criteria? Are there viable or consistent ESG metrics and ratings, or is it all still fragmented and somewhat confusing?

- Are Asia’s wealthy private clients jumping on board the ESG bandwagon? In a nutshell, why or why not?

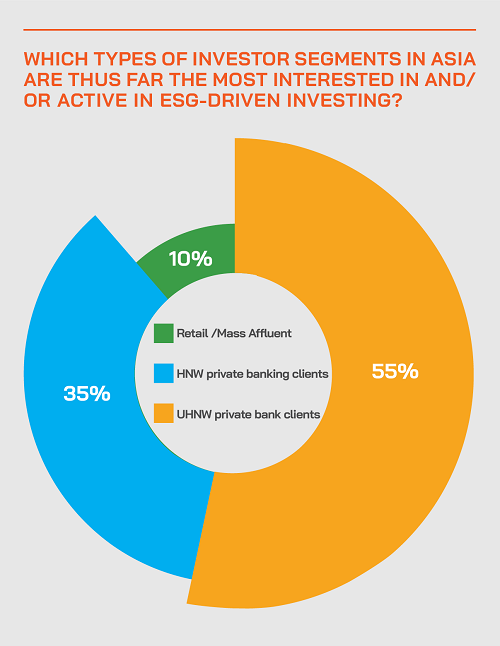

- Does the wealth industry understand where the demand is coming from today and in the future? The older or younger clients? From the more mature/developed Asian economies? From the newer economies and/or newer wealth? From the wealthiest type of investors or the mass affluent?

- What is the Asian WM community doing to adapt products, services and expertise to the evolution of the ESG investment market today and for the future?

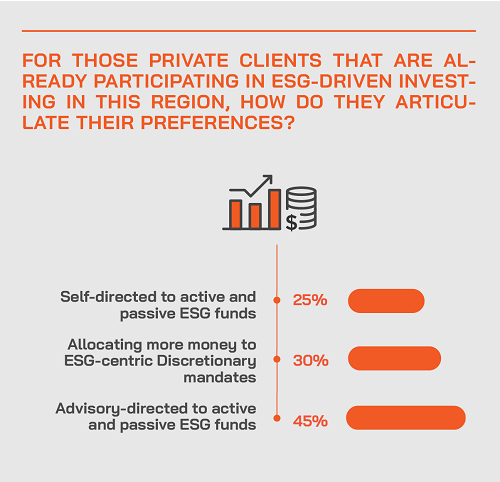

- How can Asia’s wealth industry curate the best range of ESG investments, from individual stocks, through funds, ETFs, DPM mandates, and so forth?

- What about ESG and private investments/assets?

- What about the regulators in Asia? Are they helping or hindering these initiatives?

- What next for Asia’s wealth industry and ESG and/or impact investing?

Setting the Scene

ESG on paper sounds simple, but it is not. As we know, environmental criteria aim to define how a company performs from an environmental impact perspective. Social criteria define how a company manages relationships with employees, suppliers, customers, and the communities in which it operates. And governance deals with a company’s corporate culture, its leadership, executive and broader compensation, audits, internal controls, and shareholder rights.

But what does it all mean to investors? Well, a growing body of research shows that ESG investors who support these more ‘sustainable’ companies/assets can make a positive difference to the world whilst reducing investment risks and also harvesting more competitive financial returns.

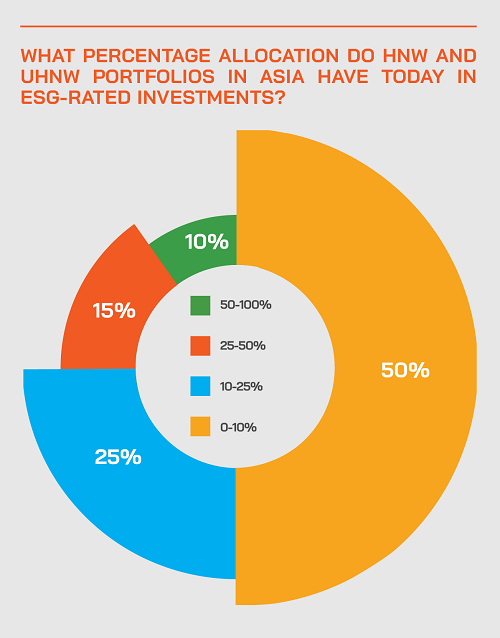

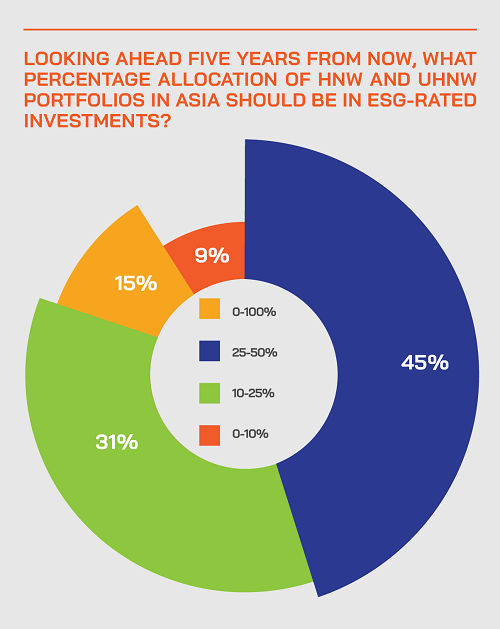

This recognition is spreading, and the growth of ESG in both popularity and coverage is almost certain to continue, especially as the arrival of more data and more ratings and a greater confluence of standards will increasingly influence the decisions of fund managers from sovereign wealth funds through the world’s largest pension funds and all the way down to retail investors, especially these days the HNW and UHNW investors.

Lombard Odier’s Sustainability Expert on why the World is on the cusp of a New Industrial Revolution of sustainability

Expert Opinion - Thomas Hohne-Sparborth, Head of Sustainability Research, Lombard Odier: “We believe we are at the cusp, if not already in the midst of, a new industrial revolution – characterised by the rise of cheaper, greener technologies, the rapid electrification of buildings, mobility and industry, and driven by simple economics.

Solar power is now the cheapest form of energy on the planet, electric vehicles are at cost parity with regular vehicles, and battery prices continue to fall. We approach the sustainability revolution as an investment conviction, recognising the shifting flows in capital expenditure that it will bring about, the new profit pools it will create, and the investable opportunities along the way for investors. Transitions in energy, land and oceans, and material systems make environmental sense but also financial and economic sense.

The challenge for investors is to understand which industries, sectors and companies are well-positioned for these transitions and which are not. This requires a far more holistic approach than merely considering the policies and practices of a company. Rather, we must understand the nature of a company’s business model and how the economy will likely evolve now, in the coming decade, and beyond.

We expect significant shifts in market opportunities, and by identifying the economics of the transition and of new technologies, we seek to understand what the roadmap ahead looks like and where we should be deploying our capital to participate in the transition.”

In short, these ESG criteria are used to help investors identify companies with corporate values that they feel comfortable with and therefore that accordingly meet their investment requirements. The theory goes that investing in single assets or in funds that are aligned with approved or rated ESG criteria will help private investors align with the major institutional investors who increasingly shun investments that do not appear to do their utmost to improve their E, S and G footprints and qualities.

The mission for our panel of experts on April 13th will be less to analyse ESG itself and more to look under the hood of the approach that Asia’s wealth management community is taking to spreading the ESG word across the region. As the world’s leading global investors continue to embrace ESG, what progress is being achieved amongst wealthy investors in Asia, and specifically, are Asia’s private clients jumping increasingly on the ESG express? If they are, why and are the results thus far to their satisfaction? If not, then why not? And has the downturn in major global markets diminished appetite for ESG-centric investments?

The shift from exclusion to inclusion as the world hurtles toward a new set of industrial values

An expert reported that in recent years the ‘science’ around ESG investing had transitioned more from exclusion to inclusion. He said that ESG and sustainability are now in synch with a new industrial revolution as the world moves headlong towards net zero and renewable energy. As this takes place, we need to stop thinking about ESG just as a question of policies and practices and see where to deploy capital that fits with the emerging vision of the future.

He explained that the sums involved are simply vast – total capital expenditure that is likely to be deployed this decade into energy transition, and all related areas could be anywhere between USD3 trillion to USD5 trillion per annum. “If we thought the technology and IT revolution was significant, then this can be just as important, just as huge, and will likely also take place over several decades, as with technology.”

He said investors do not want to put their money in companies that have blatant sustainability risks so most importantly we need to understand the future better, whether it is a purely electric future, or perhaps there will be more hydrogen-based power, we need to appreciate where the heavy steel, cement, chemical and other industries will power themselves, and all these factors will inform us where to deploy capital.

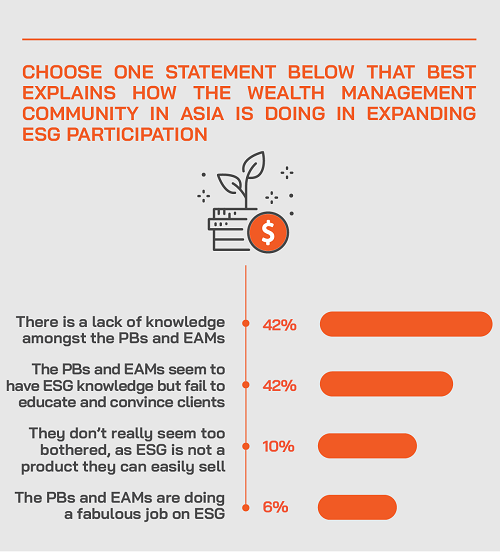

There is rising interest in ESG in Greater China as China’s government push the sustainability agenda

A guest explained how in their marketing travels, there is a snowballing of interest in ESG and sustainability across Greater China, and one of the key takeaways from his firm’s roadshows is that they really need to engage with clients in this area; they need to train the RMs, they need to be on the road spreading these messages, and they need to embrace ESG at the core of the institution, and not simply as a marketing tool. He added that Hong Kong is also returning from a few years in the wilderness, with strong and reinvigorated appeals for regional and global wealth, including major family offices.

Performance is a critical element of ESG centricity today; it is not only about risk mitigation.

Another expert reported that their global asset management group had long espoused ESG centricity, and their research had highlighted how it was as long ago as 2014 when ESG-rated investments had begun to shine in terms of performance.

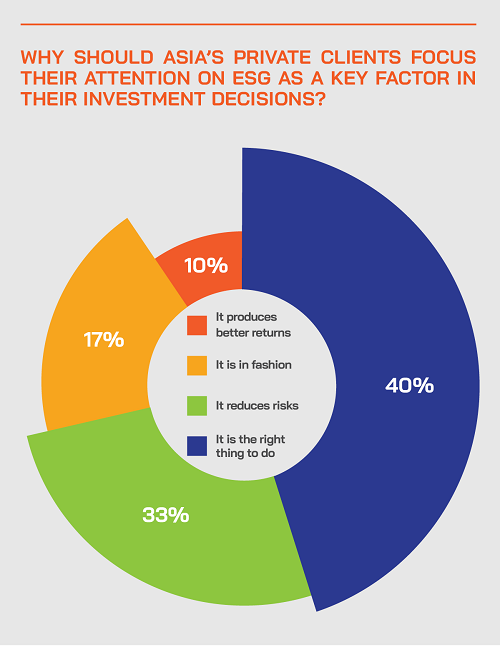

“Starting with institutional investors, followed by professional investors like family office, and then followed ultimately by private wealthy and also retail investors, there is rising demand for companies and securities with high ESG credentials so by dint of the laws of supply and demand, those investments will on average perform better,” he explained. “Moreover, there is a groundswell of interest from the younger generations, often for more ideological reasons, and as older investors increasingly see the value perspective of ESG, there is more and more likelihood that those companies and investments that score high on ESG will also perform better financially.”

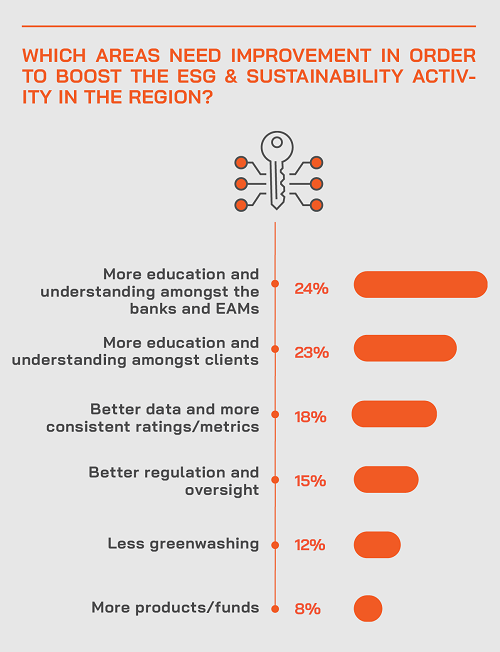

Regulation lags and is not entirely consistent around the globe, but the direction of travel is clear for all to see

In Europe, the latest version of MiFID has very strict rules against greenwashing with regard to reporting, but that does not mean there are any specific global ESG metrics or rules. “Everybody is still doing their own thing,” a panellist reported. “There might be adherence to the 17 UN Sustainable Development Goals, which are very broad in nature, but the regulators around the world are not that aligned yet. In Asia, things are fairly early, even in Singapore, but we hope there will be both greater consistency and additional impetus.”

He extrapolated from those comments, stating that it will take at least another decade for ESG to really be central to the investment proposition. Moreover, he said there are clear anomalies and contradictions – Electric Vehicles only become environmentally better for the planet if they are kept for 120000 kilometres of use and above, but in the West, and certainly in the leading economies of Asia, cars are only a few years old on average when they are sold on and replaced.

ESG-centric funds are a great way of playing this trend and passing decision-making to genuine experts

Another guest highlighted funds they had created since 2020 that focus on innovative businesses and disruptive technologies and on solutions which will drive change and deliver better and more impactful outcomes against the social and environmental challenges but also achieve sound financial returns. Thematic strategies also work as a means to hitch private capital to key themes such as water efficacy, waste management and so forth.

He explained that both of those strategies are Article 9, which, under the SFDR European regulation, reflects the dual objective of delivering attractive financial returns alongside the sustainability objectives.

Greenwashing and the threats to ESG credibility

The experts highlighted the risks of companies and issuers jumping on the ESG and sustainability bandwagons, but not actually walking the talk. If ESG is all about marketing and branding but not about genuine sustainability and a real change of behaviour, there are many risks ahead. “From an investor's point of view, they really need to consider the purity or the authenticity of the approach that the investment manager is adopting to their selection of companies and securities,” a guest observed.

Another expert said that we must look behind the reputational ambitions and seek out genuine, bona fide change taking place. “Too often, the sustainability thinking in financial institutions still today sits separately from investment analysis and the portfolio process,” he said. “It is not enough to have some green wrapper. You need core conviction around the missions and the transition.”

Investors need leaders and proper guidance from the wealth management community

The experts concurred that the leading wealth management institutions need to provide information, deliver guidance, stick to their principles, and avoid treating ESG as some elaborate marketing ruse.

A guest pointed out that their bank had supplied ESG metrics and ratings to client portfolios for some eight years already, helping nurture clients towards greater understanding and involvement. The metrics now cover both the public market investments and also the rising allocations to private assets and markets. These wealth managers also need to walk the talk in terms of their DPM mandates so that clients know their words and actions are fully aligned.

Adopting ESG as a way of life, not just metrics and ratings

A panellist explained that he and his bank strive to focus on far more than ESG metrics and scores and on living the sustainable and renewable vision. “We have to think about what those scores mean to clients and whether they are buying into truly ESG-compliant companies that live this vision,” he said. “We are not there yet, but we are confident we will be within the coming ten or so years.”

Education and training of the client-facing bankers and RMs are also vital elements, as without sophisticated knowledge of ESG, the clients are left in danger of misinformation and misunderstandings.

“ESG and sustainability are a very different set of terms that we use interchangeably,” a guest reported. “This creates confusion, and that's part of where the education needs to take place, I think. Integration of ESG as part of good investment management, and good investment decision-making, cannot be treated in isolation. ESG investing doesn't deliver outperformance on its own, it needs to be part of the overall transition taking place to the sustainable economy of the future. Those companies that are genuinely transitioning will benefit, including from being early movers.”

Values and economics will increasingly align and investors in ESG and sustainability will increasingly reap the rewards

Another expert agreed, noting that it is important to distinguish between values and value, as ESG reflect historical data, and not necessarily the future. “This is not the first time that we are going through this type of disruptive technological transition,” he commented.

The era when we saw the rollout of steamships, railroads, then cars and telephone networks, such transitions happen slowly at first, and then gain momentum, and that is when the economics align fully for investors, he added. Then suddenly these technologies break into mass markets, and that is exactly what he thinks will happen here again.

“In short,” he said, “It is not only about environmental imperatives; it is all going to happen because it makes sound economic and technological sense. In a petrol engine, some 80% of the energy is wasted in heat generation, while in an EV, only 20% roughly, with 80% focused on mechanical power generation. Yes, the upfront capital cost of some of these new technologies is higher, but the outcome is a massively lower OpEx in the operation of these technologies. And that is what we believe is going to drive this transition forward.”