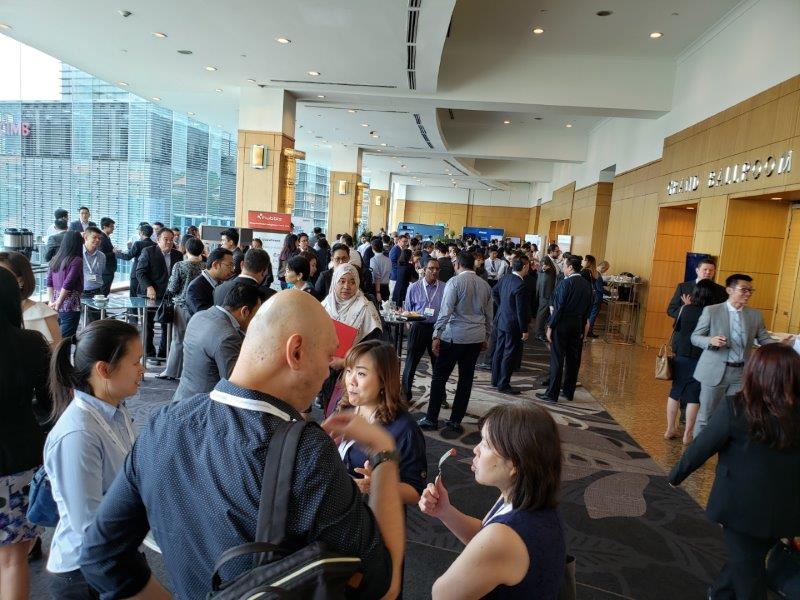

We were delighted to host our 8th annual event or the private wealth management community in Malaysia.

More than 250 CEOs, COOs, Independent Asset managers and other senior practitioners attended – from a mix of local and international Private Banks, Retail Banks, Insurance Companies, Independent Firms & Family Offices, Asset Management Companies, and IFAs.

Thank you to all of our event partners: Henley & Partners, Quantifeed, 360F, Bordier & Cie, GAM, IMTF, IRESS, Intellect Design Arena, Jersey Finance, Leonteq Securities, Wealth Dynamix, ERI Banking Software, Sun Life Financial, Bunker Gold & Silver, CSOP Asset Management, FNZ, Hawksford, InvestaCrowd, J O Hambro Capital Management, Malca Amit, Samsung Asset Management and Swissquote.

Hubbis events are –

FUN, CONSISTENT, RELEVANT, ENGAGING AND UNIQUE

Malaysian Wealth Management Forum 2019

Hilton Kuala Lumpur, Malaysia

A community of leading organisations within Asian Wealth Management

Senior figures in Asian Wealth Management are speaking at this event

Carolyn Leng

Michael Gerber

360F

Kenny Suen

Bill Morrisons Wealth Management

Tony Wong

CSOP Asset Management

Allen Chote

FNZ

Rossen Djounov

GAM Investments

Dominic Volek

Henley & Partners

CheeMee Ho

Henley & Partners

Why you should attend Hubbis events

Experience our latest event for yourself

INDEPENDENT WEALTH MANAGEMENT FORUM - Singapore 2024

Hilton Kuala Lumpur, Malaysia

Hubbis was delighted to host the 2024 Independent Wealth Management Forum in Singapor...

read moreGet involved in Hubbis events

-

8.30am

Registration

-

8.55am

Welcome Address

-

9.00am

Panel Discussion

Private wealth management - a time of dramatic change

- What are the main opportunities that will continue to drive growth in wealth management in Malaysia?

- What are the challenges that will prevent growth in wealth management in Malaysia?

- Any regulatory hindrances and roadblocks?

- What trends are we seeing in global and regional wealth management?

- How can you get the right people and proposition in front of the right clients?

- Do you have a structured sales process? To what extent does this need to be improved / changed?

- What can you do to improve the value proposition in wealth management?

- What changes are we seeing in client expectations and behaviour?

- Transparency, Margins, Costs and Fees – what’s changing?

Chair

Speakers

Sammeer SharmaManaging Director, Head - Consumer, Private, and Business Banking, Malaysia

Standard Chartered Bank

-

9.50am

Presentation - The digital watch or the hand-made Swiss?

- How is private banking developing?

- How do you add value and differentiate yourself?

- What are the different business models you can consider?

-

10.00am

Head - to - Head Q & A - Investment Migration: Trends and Developments for HNWIs

- Why is the Investment Migration industry booming?

- Why does Henley & Partners attend the Hubbis events?

- Where do our clients come from?

- Why do PBs/IAMs etc work with us?

- How can Henley & Partners help your HNWI clients?

- What are the pitfalls that HNWIs should be aware concerning investment migration?

-

10.10am

Presentation - Consistent, holistic and valuable advice – hope or reality?

- Today, clients and advisors are experimenting to find the right investment and protection products

- The life of client is unpredictable and hence, followed by a disappointing relationship – sometime for both parties

- For clients who understand all potential risks and unforeseen events can step into financial happiness

-

10.20am

Panel Discussion

Technology - the future of private wealth and asset management?

- Are banks going in the right direction in their digital journey?

- What digital expectations do clients have?

- Has the investment in ‘digital’ justified the cost? What has worked elsewhere?

- How can we improve efficiency?

- What does the word ‘platform’ mean to you?

- What’s the role of AI?

Chair

Speakers

-

11.00am

Presentation - Scaling wealth management with digital automation

- Scaling to thousands of customers with rising wealth is exciting and challenging

- The threat of failing to do so is immense

- The answer is automation and a local market perspective

-

11.10am

Refreshment & Networking

-

11.35am

Presentation - IMTF’s Modular RegTech Platform – Building blocks to achieve regulatory compliance

- Forward-looking technologies to tackle business challenges (Client Onboarding, Name Screening, AML / Fraud)

- Building on a strong case management foundation to achieve cohesive business operations benefits

- Enabling and ensuring end-to-end leading client and user experience

-

11.45am

Presentation - Market dislocations: Challenge or opportunity?

- Should slower growth, weaker earnings and elevated stock and bond valuations be considered a challenge or an opportunity?

- The classic ‘balanced’ portfolio is no longer fit for purpose; diversification could be enhanced by including non-directional, alpha-generating and relative value strategies

- Opportunities within the credit universe, emerging market debt and commodity trade finance can offer new sources of return that are less correlated with traditional assets

-

11.55am

Presentation - How to use Structured Investment Solutions in a changing market

- A suitable solution for each market conditions

- Benefit from market volatility

- A great diversification tool

-

12.05pm

Presentation - RM Office - 2020 Advantage

- Possibility to Increase RMs productivity by 20%

- Possibility to reduce operational cost by 20%

- Let your system take care of compliance - 3D Compliance

- Leveraging Digital - Enhanced Outreach and contextualized experience

- Actionable insights to direct the destiny of the business

-

12.15pm

Head - to - Head Q & A - The HNW Insurance Market has Changed – Here’s how you win

- What’s happening in the HNW Market?

- How HNW Brokers, Bankers, EAM can adapt to win in the new HNW Insurance Market

- What are the new Products and Trends in HNW Market

- Why should Bankers and Financial Advisers be interested in HNW Insurance

-

12.25pm

Presentation - International Finance Centres: past, present and future

- How IFCs have evolved and what the future now holds

- Beneficial ownership: what just happened?

- The impact and opportunity for Islamic Finance

-

12.35pm

Panel Discussion

What are the growing opportunities for Islamic wealth management in Malaysia?

- How is Islamic asset and wealth management developing?

- Opportunities and Challenges?

- How is Malaysia competing as the preeminent Sharia-compliant Finance Centre? In comparison to KSA, UAE or Bahrain?

- Malaysia has spearheaded a number of innovative developments in Islamic finance – including FinTech. How would you like to see the market develop from here?

- What are the specific wealth structuring requirements within Islamic Finance?

- What are the top concerns for wealthy family businesses when considering Sharia compliant investments abroad?

- What are the core criteria you believe are essential for an offshore financial centre to become a leading Islamic Wealth Management Hub?

Chair

Speakers

-

1.10pm

Lunch & Networking

-

1.50pm

Workshop - Global Citizens: Trends and Developments in Investment Migration

- Introduction to the Investment Migration Industry

- Citizenship-by-Investment: Travel and Settlement Freedom for HNWIs

- The world’s leading Residence-by-Investment Programs

-

2.30pm

Workshop - Insights from recent deployments of digital wealth automation to FIs in Asia

- Leading financial institutions across Asia are racing to deploy digital wealth management capabilities

- Quantifeed has deployed digital wealth platforms enabling STP of unlisted fund portfolios leveraging our quantitative and financial software engineering expertise

- A sharing session to present the learnings and the technical solutions developed for digital wealth leaders across Asia

-

3.10pm

Refreshment & Networking

-

3.30pm

Panel Discussion

Investing in more uncertain and challenging markets

- Challenges and Opportunities for 2H 2019?

- How is distribution of funds changing? How is digital affecting this?

- Too many investment products and not enough investment solutions?

- Managing and understanding risk — how do you estimate risk, and how does it impact your investment process?

- How do you think Asian equity market performance will be in 2019?

- What Macro trends will create opportunities and challenges?

- Is Malaysia warming to index and ETF products?

- What’s the interest of private clients today in; ESG, Alternatives, Private equity, Infrastructure and Property

- Are there any thematic / more secular equity ideas that are poised to do well? Like the environment and climate change?

- What's the outlook for China in 2019? Good time to invest? What sectors are best?

- How do you think Asian equity market performance will be in 2019?

- What’s your view on global equity markets?

- What are some of the interesting opportunities in Structured Products today?

Chair

Speakers

-

4.30pm

Forum Ends

Malaysian Wealth Management Forum 2019

Hilton Kuala Lumpur,Malaysia

Carolyn Leng

Michael Gerber

360F

Kenny Suen

Bill Morrisons Wealth Management

Tony Wong

CSOP Asset Management

Allen Chote

FNZ

Rossen Djounov

GAM Investments

Dominic Volek

Henley & Partners

CheeMee Ho

Henley & Partners

Evonne Tan

Henley & Partners

Andreas Wenger

IMTF

Shan Saeed

IQI Global

Kelvin Lim

IRESS

Anand Rai

Intellect Design Arena

Julian Kwan

InvestaX

Richard Nunn

Jersey Finance

David Meier

Leonteq

Robert Foo

MyFP Services

John Robson

Quantifeed

Shadab Taiyabi

Quantifeed

Joanne Siu

Samsung Asset Management

Ranjiv Raman

Schroders Wealth Management

Sammeer Sharma

Standard Chartered Bank

David Varley

Sun Life

Khoo Lin Wein

Techcombank

Elias Moubarak

Trowers & Hamlins

Suhazi Reza Selamat

UOB Islamic Asset Management

Kimmis Pun

VP Bank

Ming Hui Yap

Whitman Independent Advisors

Malaysian Wealth Management Forum 2019

Hilton Kuala Lumpur,Malaysia

platinum

gold

silver

bronze

Malaysian Wealth Management Forum 2019

Hilton Kuala Lumpur,Malaysia

We were delighted to host our 8th annual event or the Private Wealth Management community in Malaysia.

More than 250 CEOs, COOs, Independent Asset managers and other senior practitioners attended – from a mix of local and international Private Banks, Retail Banks, Insurance Companies, Independent Firms & Family Offices, Asset Management Companies, and IFAs.

Thank you to all of our event partners: Henley & Partners, Quantifeed, 360F, Bordier & Cie, GAM, IMTF, IRESS, Intellect Design Arena, Jersey Finance, Leonteq Securities, Wealth Dynamix, ERI Banking Software, Sun Life Financial, Bunker Gold & Silver, CSOP Asset Management, FNZ, Hawksford, InvestaCrowd, J O Hambro Capital Management, Malca Amit, Samsung Asset Management and Swissquote.

Below for your interest and reference are links to various content we captured from the day. Please click on the orange headlines – and do send any comments or feedback to [email protected].

Content Highlights

Video Highlights

Video Highlights Summary PDF

Exclusive Insights

Testimonials

I Love Wealth Management

Photos

Event summary

Panel discussions

Presentations & Workshops

Videos

Post event Supplement

Post-event Report

You might also like to view the full Post-Event Report – which is a consolidated summary, including photos of speakers & delegates, the attendee profiles & some delegate feedback, polling results, and more.

Event Summary

Malaysia’s Wealth Management Market: Time to Boost and Accelerate the Proposition

We were delighted to host our 8th annual event in Malaysia for the Private Wealth Management Community. Hubbis assemble an impressive array of private banking, wealth and asset management and insurance sector experts to our forum in Kuala Lumpur to debate the optimal strategies that industry players should adopt to help them survive and prosper in the years ahead.

Video Highlights

We asked leading industry experts - what are the opportunities and challenges for the year ahead? View the combined video highlights, or click on the links to view the individual videos.

Full Video Highlights

Video Highlights Summary PDF

I Love Wealth Management

Testimonials

Carolyn Leng, Head, Private Wealth Malaysia, Group Wealth Management, Community Financial Services, Malaysia, Maybank

Robert Foo, Managing Director, Founder, MyFP Services

Kenny Suen, Principal Officer, Chief Marketing Officer, Bill Morrisons

Dominic Volek, Managing Partner, Head Southeast Asia, Henley & Partners

Shan Saeed, Chief Economist, IQI Global

Kimmis Pun, Senior Managing Director, Head, Greater China, EFG Bank

Julian Kwan, Chief Executive Officer, InvestaCrowd

John Robson, Chief Commercial Officer, Quantifeed

Andreas Wenger, General Manager, Asia Pacific, IMTF

Anand Rai, Senior Manager iWealth, Intellect Design Arena

Exclusive Insights

We asked leading industry experts for their exclusive and incisive insights. Click on the links to view the individual videos:

Carolyn Leng, Head, Private Wealth Malaysia, Group Wealth Management, Community Financial Services, Malaysia, Maybank

What changes are we seeing in client expectations and behavior in Malaysia?

Robert Foo, Managing Director, Founder, MyFP Services

What can you do to improve the value proposition in wealth management in Malaysia?

What trends are we seeing in Malaysian Wealth Management?

Kenny Suen, Principal Officer, Chief Marketing Officer, Bill Morrisons

Do you have a structured sales process? To what extent does this need to be improved / changed?

Dominic Volek, Managing Partner, Head Southeast Asia, Henley & Partners

How can Henley & Partners help HNWI clients in Malaysia?

Shan Saeed, Chief Economist, IQI Global

What Macro trends will create opportunities and challenges in 2H 2019?

Kimmis Pun, Senior Managing Director, Head, Greater China, EFG Bank

What are the main opportunities that will continue to drive growth in wealth management in Malaysia?

Julian Kwan, Chief Executive Officer, InvestaCrowd

Is the Blockchain - the future of private wealth and asset management?

John Robson, Chief Commercial Officer, Quantifeed

What digital expectations do clients have?

Andreas Wenger, General Manager, Asia Pacific, IMTF

Are banks going in the right direction in their digital journey?

Anand Rai, Senior Manager iWealth, Intellect Design Arena

What is RM Office – 2020 Advantage?

Panel Discussions

We held 4 interactive panel discussions throughout the day – which involved senior industry practitioners who we invited to participate and share their thoughts. We have also incorporated into the summaries below the briefing notes which speakers sent to us in advance of the event. Plus, we have included the results of audience polling as well as questions we received from delegates. Click on each headline to view the PDFs.

Private Wealth Management - A Time of Dramatic Change

The wealth management industry is going through a substantial shake-up in Asia, not least in Malaysia, due to digitalisation, increased regulation and changing business models. Panellists suggested ways to boost revenue and cater to those most valuable assets, namely the customers. The topics included the main opportunities that will continue to drive growth in wealth management in Malaysia, the challenges to that growth being realised, regulatory matters, talent, open architecture, or the lack of, client needs and extactions, as well as broadening the overall proposition.

Panel Members

Lin Wein Khoo, Head of Private Wealth, Malaysia, Maybank

Kimmis Pun, Senior Managing Director, Head, Greater China, EFG Bank

Robert Foo, Managing Director, Founder, MyFP Services

Sammeer Sharma, Managing Director & Head - Wealth Management Malaysia, Standard Chartered Bank

Ming Hui Yap, Founder & Managing Director, Whitman Independent Advisors

Kenny Suen, Principal Officer, Chief Marketing Officer, Bill Morrisons

Technology: The Digital Future of Private Wealth and Asset Management

Panellists at the Hubbis Malaysia Wealth Management Forum explained how the industry must embrace the emerging digitalisation trends in wealth management. In Malaysia, there is great potential in the mass affluent segment and overall there is much progress needed in the world of digital solutions for all types of wealth management clients. Panellists therefore put their heads together to discuss the emerging digitalisation trends in wealth management. Symbiotic partnerships, the prudent use of digital advances as well as ensuring clients feel supported were top priorities in surviving these increasingly tech-reliant times.

Panel Members

John Robson, Chief Commercial Officer, Quantifeed

Andreas Wenger, General Manager, Asia Pacific, IMTF

Kelvin Lim, Head of Business Development, Asia, IRESS

Michael Gerber, Chief Executive Officer, 360F

Julian Kwan, Chief Executive Officer, InvestaCrowd

Allen Chote, Head of Strategic Partnerships – South East Asia, FNZ

The Outstanding Opportunity for Islamic Wealth Management in Malaysia

The Islamic finance industry and the wealth management industry in Malaysia both continue to develop apace, especially as the regional market shifts more towards the onshore proposition. How far has Islamic wealth management come in Malaysia, is the country nurturing the industry through encouraging regulation, are the necessary skills, erudition and expertise in place? Are there enough products available, and if not, will the Islamic investment universe grow sufficiently fast? These are other questions were addressed briefly in a mini-panel discussion during the recent Hubbis Malaysia Wealth Management Forum. The broad conclusion was that there is much work ahead, but the path is clear, participants have their compasses well set and considerable opportunity lies ahead.

Panel Members

Suhazi Reza Selamat, Chief Executive Officer, UOB Islamic Asset Management

Richard Nunn, Head of Business Development, Jersey Finance

Elias Moubarak, Partner, Trowers & Hamlins

How should Asia’s HNWIs be Investing in a Time of Greater Market Uncertainty?

There were some strong views expressed in the last panel discussion of the day at the Malaysia Wealth Management Forum, with one expert warning that Western economy policymakers and their governments have run out of fiscal ammunition and money. The general consensus was that Asia is far better placed in terms of its government, corporate and personal finances, and China too, despite the ‘noise’ of the US-China trade conflict. And alternative investment strategies such as innovative structured products, or plain vanilla diversification into gold are advisable to underpin the downside and to reduce correlation.

Panel Members

Shan Saeed, Chief Economist, IQI Global

Ranjiv Raman, Head of Investments, Schroders Wealth Management

Tony Wong, Head of Intermediary Sales, CSOP Asset Management

Joanne Siu, ETF Sales Director, Samsung Asset Management

Rossen Djounov, Managing Director, Head of Asia, GAM

David Meier, Director, Sales - Structured Solutions, Leonteq

Presentations

Below are summaries of the Presentations and Wealth TALKS delivered at the event. These were 10-minute slots hosted either by senior industry practitioners who we invited to speak (Wealth TALKS), or by some of our event partners (Presentations). Also listed with each summary are links to the presentation slides (where these are made available by speakers). Click on each headline to view the web versions of these – from which you can also access the 1-page PDFs.

Investment Migration for Asia’s Wealthy Clients - A World of Choice

Dominic Volek, Managing Partner and Head of Southeast Asia at investment migration consultancy Henley & Partners gave a head to head interview and he and his colleague Chee Mee Ho, Country Head for Malaysia, presented a fascinating Workshop. Their topic was global investment migration, and they highlighted why and how increasing numbers of Asia’s wealthy are taking up alternative citizenship and residence options around the globe. Henley & Partners’ activities span the private client practice, which focuses on the needs of high net worth (HNW) and ultra-HNW clients who seek secondary residence or citizenship through investment, as well as the government practice, where Henley works with countries to design, implement and promote their individual programmes. They explained that the global trend towards offshore residence and citizenship is even more intense in Asia due to the phenomenal rise in the number of HNWIs and UHNWIs in the wider Asia Pacific region, which last year set a new record of 6.2 million HNWIs worth USD21.6 trillion, according to Capgemini’s World Wealth Report 2018. And they explained that Asia’s HNWIs and the ultra-rich should seriously consider these options and as they will need the best professional advice should consider Henley, as the reputed leader in this advisory business.

View Slides

Embracing Digital Automation to Build Scale in Wealth Management

A major concern today for banks and wealth advisory firms is how they can satisfy their customers’ evolving wealth management expectations. The danger, John Robson told delegates at the Malaysia Wealth Management Forum, is that failure to act decisively and embrace digital transformation will heighten the risk of customers drifting away to the growing number of competitors with appealing new digital offerings. Robson began by introducing Quantifeed as a Hong Kong-based company he founded around seven years ago and today with offices also in Singapore and Australia.

Rolling Out Vital Digital Wealth Automation Solutions in Asia

Quantifeed’s John Robson and Shadab Taiyabi joined forces to present a Workshop to offer insights from Quantifeed’s recent deployments of digital wealth automation to financial institutions in Asia. They explained that leading FIs across Asia are racing to deploy digital wealth management capabilities and highlighted some of the digital wealth platforms Quantifeed has delivered. They explained how the firm’s quantitative and financial software engineering expertise is significantly enhancing and expanding the digital propositions and delivery for wealth management leaders across Asia. Robson is Chief Commercial Officer and Head of Strategic Partnerships at Quantifeed and founded the firm back in 2012. Shadab Taiyabi is Senior Executive and Head of Strategic Partnerships for Southeast Asia. Both are therefore at the cutting edge of the firm’s relationship building and platform delivery across the region.

The Flexibility and Appeals of Structured Products for Asia’s HNWIs

David Meier, Director of Investment Solutions Sales at Swiss-based Leonteq Securities, gave an informative and detailed presentation to delegates at the Malaysia Wealth Management Forum. Armed with an informative, high-quality slide presentation, Meier highlighted the appeals of structured products as an ideal diversification tool that should be an active part of any well-diversified HNWI portfolio, offering potential returns in sync with the market perspectives of the investors themselves.

View Slides

IMTF's RegTech Platform - Solutions for the digitisation of Client Onboarding

Andreas Wenger, General Manager for Asia Pacific at RegTech IMTF, is passionate about his business and the subject of technology for solving the many issues facing wealth managers in handling the ubiquitous and ever-proliferating global regulation. He gave a presentation at the Malaysia Wealth Management Forum to explain how IMTF’s smart RegTech solutions help with client onboarding, name screening, and AML/Fraud prevention, and all at the same time offering clients positive user experiences. IMTF has three decades of experience, is Swiss by origin, and the regional HQ for Asia is in Singapore.

View Slides

Market Dislocations and the Current Financial Environment: Challenge or Opportunity?

Armed with some detailed and insightful slides, Rossen Djounov, Managing Director and Head of Asia for GAM Investments, gave a presentation at the Hubbis Malaysia Wealth Management Forum to discuss whether slower growth, weaker earnings and elevated stock and bond valuations should be considered a challenge or an opportunity. The classic ‘balanced’ portfolio is no longer fit for purpose, he said, and diversification should be enhanced by including non-directional, alpha-generating and relative value strategies. Moreover, opportunities within the credit universe, emerging market debt and commodity trade finance can offer new sources of return that are less correlated with traditional assets.

View Sildes

The Digital Watch, or the Hand-Made Swiss Timepiece? Views from EFG Bank

Kimmis Pun, Senior Managing Director and Head for Greater China at EFG Bank addressed the delegates at the Hubbis Malaysia Wealth Management Forum, highlighting the need for private banks to add value in order to differentiate themselves from their competitors. How will the world of wealth management reconcile its traditional culture and practices with a new world of digital? For Pun, it is via the hybrid model combining both digital enablement and the human connection. Swiss private bank EFG began life in 1995 in Zurich and ten years later listed on the SIX Swiss Exchange. In 2016 the bank took another leap forward by combining forces with one of the oldest private banks in Switzerland, BSI, in a nearly 1 billion Swiss franc deal.

View Slides

Consistent, Holistic and Valuable Advice – Hope or Reality?

Michael Gerber, Chief Executive Officer of the fintech he founded three years ago, the Singapore-based 360F, has set out to prove that it is indeed possible for wealth management firms to offer digitally-enabled, unbiased portfolio recommendations that are tailored to each client and continuously refined via machine learning, and that even take into account the many life changes of a client in the future. He told the audience at the Hubbis Malaysia Wealth Management Forum how 360F can help clients and advisers identify the optimal investment and protection products on a continuous basis, and thereby contribute to the client’s financial happiness.

View Slides

Intellect Design Highlights its RM Office - 2020 Advantage

Anand Rai, Senior Manager for iWealth, part of Intellect Design Arena Ltd., gave a presentation to the Hubbis Malaysia Wealth Management Forum to highlight how the firm’s 2020 Advantage digital product enhances the performance of relationship managers in the wealth management industry. He said it is possible to Increase RM productivity by 20%, cut operational costs by 20%, while at the same time managing compliance hurdles. All this is achieved through leveraging digitally enhanced outreach and contextualized experience, which result in actionable insights to direct the destiny of the business.

View Slides

International Finance Centres: The Past, Present and the Exciting Future

Richard Nunn, Head of Business Development for Jersey Finance, believes in quality and integrity. Accordingly, he believes that the future is bright for leading international finance centres such as Jersey, which have the history of quality, reliability and reputational integrity. He told delegates at the Hubbis Malaysia Wealth Management Forum why he sees an exciting future ahead for Jersey, and why the connections to Malaysia’s Islamic Finance market are so important. Jersey Finance is a not-for-profit marketing organisation that was formed in 2001 to represent and promote Jersey as an international financial centre of excellence. Funded by members of the local finance industry and the States of Jersey Government, it is an International Finance Centre (IFC) with offices today in Jersey, Dubai, Hong Kong, representation in London, as well as virtual offices in Shanghai and Mumbai.

View Sides

The HNW Insurance Market has Changed – How Do You Win?

David Varley, Chief High Net Worth Officer at Sun Life Hong Kong, Sun Life Financial, told the audience, during a head to head Q&A with Hubbis founder Michael Stanhope, what has been happening in the HNW insurance market, and explained how, in his view, brokers, bankers and external asset managers can adapt their strategies to take advantages of the many opportunities. He also highlighted the key trends in the HNW market and explained why more bankers and financial advisers should be interested in HNW insurance.

Malaysian Wealth Management Forum 2019

Hilton Kuala Lumpur,Malaysia