Publications & Thought Leadership

Wealth Management in India – How Digitisation Helps Deliver the Proposition Amidst Robust Demand

Mar 8, 2021

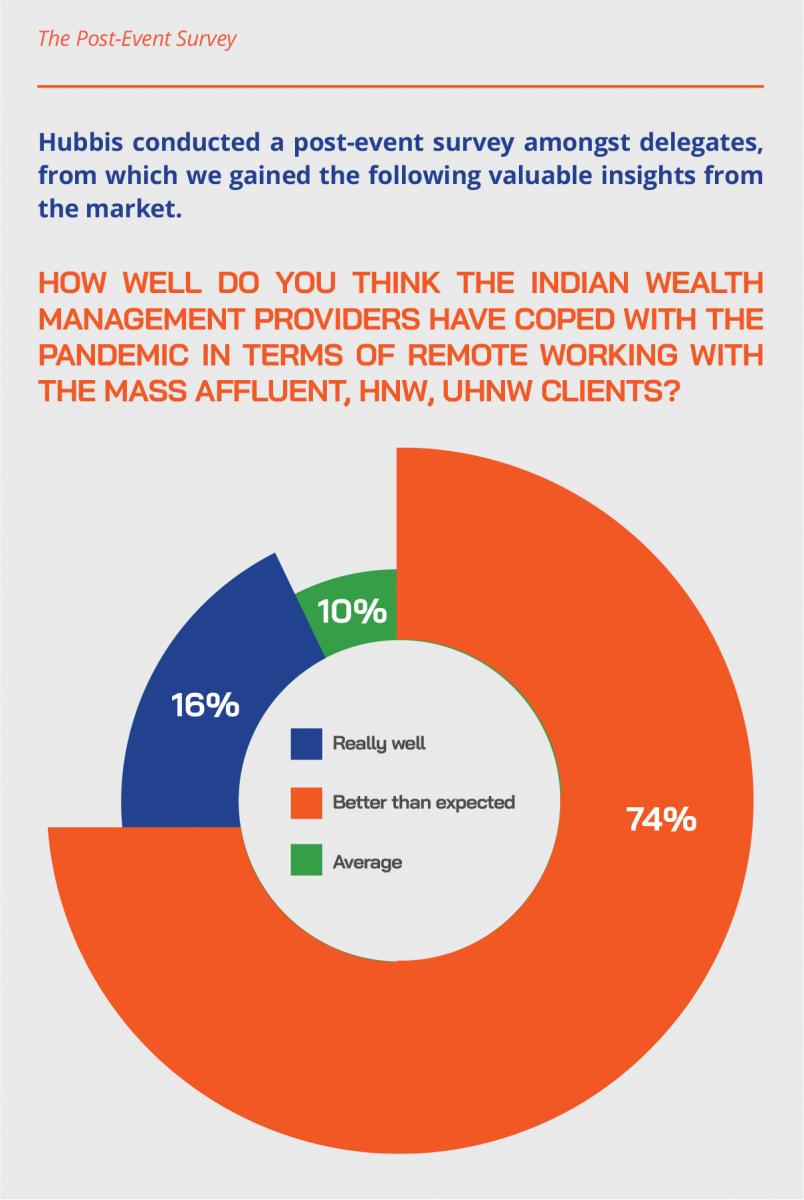

The trajectory of the Indian wealth management market remains the same, but the speed of travel in certain directions has accelerated due to the global pandemic. Hubbis assembled a panel of wealth management leaders for our Digital Dialogue of February 23 at which the experts cast their expert eye over a variety of key topics, including market development, the growth outlook and challenges across the different segments of wealth, the democratisation of the wealth management offering in India, the evolution of the onshore investment universe, the expansion of investor appetite for international assets, the industry’s efforts to shift the model from transactional and self-directed more towards advisory and discretionary, the expansion of estate and succession planning amongst the upper echelons of wealth, and the search for talent to help the industry expand in the decade ahead. The panel also emphasised the incredible potential that the hugely populous country has, especially (hopefully) when India’s economic growth resumes its remarkable dynamism of the past two decades. Another key topic was the rise and rise of digitalisation in India, itself one of the fastest-growing technology centres in the world. Amongst the key characteristics of India’s wealth management has been a very high touch client engagement model in the higher wealth segments. Naturally, the pandemic has impeded this type of personal engagement, but the panel analysed how the banks and other players have coped, and discuss how and where digitisation has been helping the incumbent players cope with the new normal and what lies ahead.

Panel Members:

- Satheesh Krishnamurthy, Executive Vice President & Business Head - Affluent & NRI, Axis Bank.

- Abhra Roy, Head, Finacle Wealth Management Solution, Infosys Finacle.

- Deepak Khurana, Proposition Sales Director- Sustainable Finance & Lipper, Asia-Pacific, Refinitiv.

- Shiv Gupta, Founder & Chief Executive Officer, Sanctum Wealth Management.

- Atul Singh, Founder & Chief Executive Officer, Validus Wealth.

The discussion opened with the leader of a wealth firm observing that India remains in the early stages of its journey towards well-rounded wealth management, with the penetration of advice and products low, but therefore offering massive headroom for growth.

Matching the demand with supply

“The demand side has never been in question,” he said, “but it has all been about the supply side, trying to put together a firm and products and an offering that work well with the clientele and that can be profitable. The market has matured significantly in the past 10 years, the market is gradually shifting from product push to advice-led, which is significantly higher than before.”

He added that the complexity of products has increased, opening the door further for good advice, as the market has shifted from simple, plain vanilla products. He summarised that there have been a lot of changes in the right direction, and greater sophistication emerging in terms of both what we can offer, how the providers offer that, and amongst the clients themselves.

Expert Opinion - Abhra Roy, Head, Finacle Wealth Management Solution, Infosys Finacle: “As the number of wealthy and affluent individuals have steadily grown in the country, so has their expectations from the new-age wealth management products and services providers. Today’s customers demand personalised advisory, priority service and a unified digital platform to monitor their investments and assets. This is forcing the Wealth Management players to re-think their business model, re-look at their engagement models and as well as re-skill their advisors.”

Secular and topical changes

Another expert said there have been secular changes that span years and there are more topical, trend-driven changes. “I agree that the product universe has expanded, the sophistication of clients as well, and there is a more professional approach to portfolios and more holistic advice.”

And on the more topical changes, investors are of course reacting to market conditions, interest rates, economic expectations and monetary policy. At the same time, he reported that regulatory changes have affected the approach of the firms, and that digitisation continues apace, while regulatory changes have impacted the way firms are structured and the general professionalism of the wealth market. “And while this takes place, talent is being upgraded as the industry requires greater expertise and skills, making the search for talent a priority,” he added.

Another guest pointed to the several critical elements for success in the business, of which talent is remarkably important, as the RMs need to be able to handle very successful clients across a wide variety of backgrounds and industries. “There are so many wealth creators who are CXOs in various top companies in India, and it's very critical that you identify the right talent match to face off with that client audience,” he stated.

Digitisation accelerates

Digitisation is helping leverage existing relationships, building loyalty and improving share-of-wallet and client retention,” said one guest. “There is a shift in the demographics of the customers and their aspirations, there are more millennials and female customers, so the offerings must be tailored increasingly to them. There is a democratisation of access to diverse asset classes and increasingly for all segments of customers, as retail investors are demanding access to the asset classes that only the seasoned investors once would venture into. And regulatory changes in the market and technology are helping keep pace with the changes.”

“How are we able to build a platform that delivers a brilliant customer experience?” he also pondered. “Technology will play a fundamentally high impact role in the year ahead and indeed many of the years ahead.”

Another key factor, he observed, is the curation of the right products and the right advice based on information and data on the clients themselves, so that a 360-degree view of those customers can then be aligned to the right solutions that suit their objectives, behaviour and risk appetite. “And when that has happened,” he remarked, “success then centres on the optimisation of information and analytics in order to curate and deliver those best ideas and solutions.”

Thinking far ahead

“Driving digital transformation, there is a need to rethink the long-term goals in the wake of Covid-19 and lay the technology foundations for the future,” came another view. “There needs to be a unified platform for customers and RMs, customers should be able to monitor and operate their entire portfolio, RMs should be able to seamlessly manage all their clientele, facilitate engagements, generate reports, simulate model investment plans, make sure the portfolios are rebalanced, and ensure the quality of communication with clients continue to improve.”

He agreed how important it was vital to properly leverage data analytics. “AI, data, and analytics is proving to be both a competitive advantage as well as a key-differentiator among WM players,” he said. “An effective combination of human and digital channels to deliver a seamless omnichannel experience is essential, with powerful elements of hyper-personalisation, and the ability to offer customised alerts based on portfolio performance, to both customers and RMs.”

Keeping it all relevant

A technology expert offered his own insights to digital trends and the rollout of relevant digital solutions in India. He focused in particular on the data and information trends that are preferred by the investor community “They are the focal point for the industry and during the pandemic they have wanted to monitor their portfolios even more actively, as the financial impact has been significant, and many long held financial plans have changed to reflect the new reality. This makes it a very timely juncture for us to examine their trading activities, data needs and digital expectations and how those are likely to evolve in the future.”

Digital roads to ESG

He explained his firm had conducted a survey with around 1000 investors across both advisory and self-directed investment preferences, seeing key trends emerge, such as more and more investors looking at ESG and sustainability, especially the millennials.

“There is no doubt from our survey that this interest has risen since the onset of the pandemic,” he observed. “To align to this changing world, wealth management providers are making great efforts as it is very important for them to expose their investors to high quality ESG opportunities supported by reliable data. We also need to keep the presentation of the data and analytics very simple and easy to understand, given ESG analytics is quite new to most investors.”

More discerning clients

He reported that another finding from the survey was that not enough investors feel equipped with the data and content they are offered to make investment decisions.

“Investors are maturing and becoming data savvy; they are happy to navigate across multiple data sources to get insights on investment strategies,” he commented. “They're quite comfortable with having discussions on price, performance, macroeconomic data, asset fundamentals, even news and policy announcements. Investors are even more engaged on price performance and fundamental content compared to other data sets and the older investors that have been in the investing process for longer period of time tend to look at more data sources for their investment decisions.”

Leveraging non-traditional data

The study also highlighted the importance of analytics and non-traditional data “Millennials and advisory clients are quicker than others to spot opportunities using non-traditional data,” he reported. The main components of non-traditional data are largely news analytics, web activity, internet forums, ESG signals, and others. “The more innovative wealth firms that take a lead in introducing these non-traditional data sources to investors would be able to build strong client loyalty and stickiness,” he observed.

Another technology expert commented that the solutions required are based on key trends in the industry, including wealth generation, wealth transfer between the generations, and the rise of the millennials and digital-savvy clients.

“For all the clients out there,” he said, “how we contextualise the data is vital. It is no good bombarding your customers with a lot of data which does not have context, it needs to be in the right context of which segment they are in, what type of portfolio they have or manage, and so forth. Additionally, more and more people are looking at alternate investments, non-traditional assets so data needs to be aggregated and delivered that is also relevant to that key trend. Better digital solutions will in fact enable more data sanctity and the data is going to become of higher quality.”

Data privacy essential

And another key element he pointed to is the importance of reacting compliantly to new regulations with respect to market or data privacy. And with that he advised an incremental, step-by-step approach of finding solutions and technology partners along the whole back- to front-end of the banks or wealth firms.

Expert Opinion - Abhra Roy, Head, Finacle Wealth Management Solution, Infosys Finacle: “The relationship managers are still vital to the Wealth management businesses. However, they must evolve with the times and leverage analytics and digital tools to understand their clients better, collaborate with them remotely and provide timely and contextual advices. The data analytics can further the effectiveness of risk assessment, portfolio customizations, goal setting, portfolio rebalancing, reviews and the overall relationship management. We see the clear emergence of Hybrid services which is a mix of Personal and Automated advice.”

Empowering the client-facing advisors

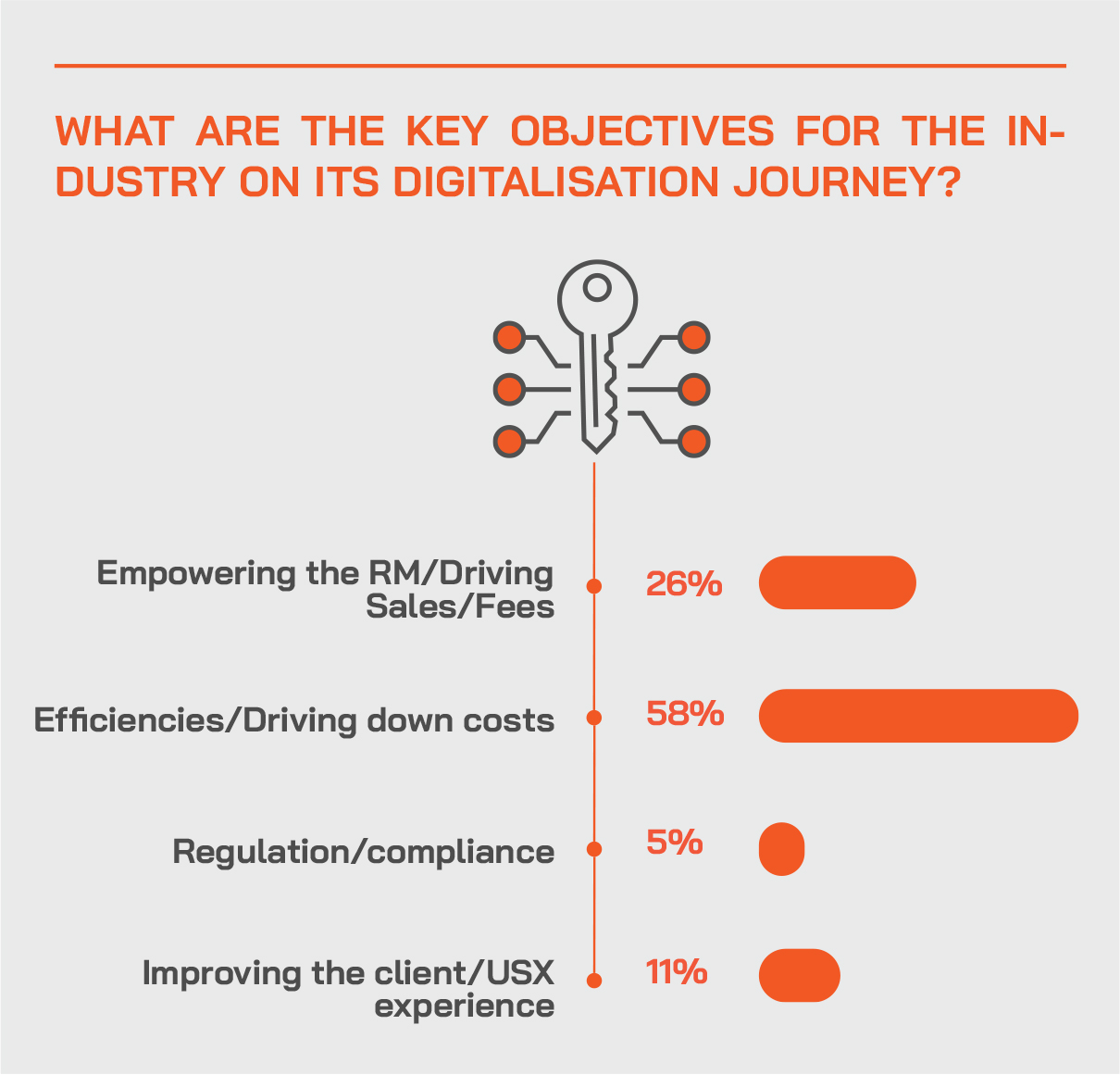

A fellow panellist commented that growth today for the wealth management providers is really driven far more than before by empowering the revenue generators and the front end, with expertise, tools and technology.

“This business has not been very good in leveraging technology to date,” he observed. “The industry has been far more driven by the traditional type of connectivity with clients., as the emotional empathy that they need to really sort of exhibit and the complexity that is there in a conversation between the RM and the client, those cannot be really fully coded in technology yet. However, much of the advice and analytics and data-driven insights can actually be delivered to that RM using technology, so we need to align the right technology to the right RMs to deliver the right customer experience to the rights clients.”

Technology a key driver of growth

That will, he said, help drive the next level of growth in the industry. “The economics of this business do not allow us to just keep hiring more and more bodies and just cover the clients through that. Every person that you hire needs to be far more productive to make the economics work, because the margins have gone down significantly. That can only happen if you align smart technology to the human to actually deliver efficiently to the client.”

He said that if his firm makes it easier to acquire a client, and if the RM can actually work at 40% more efficiency, and if the firm makes it 30% to 40% easier to advise a client and complete transactions, the same RM can essentially double their productivity. “For us, the path of growth is enabled by technology, not as an incidental factor, but very much as the core.”

Another guest agreed, noting that to achieve this, the right technology needs to be acquired to help the RMs understand their clients fully. Moreover, they also need to better understand the growing range of products including alternative assets, and the shift to more internationalisation of portfolios at the same time.

A more holistic offering

“On the product side of the advice process,” he observed, “you've got this expanding product universe, lots of things that are happening that are near term, some longer-term secular ones, and organisations have to get together to tailor their architectures to be able to use all of these instruments in the right way, in a holistic way for clients.”

Another figure observed that there is a new age of offshore business for Indian residents, with a different mindset from before. “A smart Indian wealth management firm today will need to be better equipped to put the products and services together that are truly suited to the offshore needs of Indian investors,” he said. “First, you need to develop deep sense of understanding of what the client needs are, serving the onshore needs first, which will remain the 90% at least for some time, but also professionally addressing the 10% global needs.

Playing the long game

“Why have foreign banks and firms not been able to build larger businesses in India?” he pondered. “Frist, they cannot localise their businesses and deliver exactly what they do in Switzerland and Singapore. Secondly, the organisational churn in global companies is massive, with people changing all the time, and all that changes strategy on the ground. But in India you need to stay on the one right track, or you don't build anything meaningful.”

“There are too many of the global banks that have not managed to become sufficiently relevant locally,” another guest observed. “And they have not been agile enough. For example, if you have a new product arriving in a fast-moving market like India, and it takes you six months to get it approved internally, then often it's not relevant by that time. Too many international firms, particularly after the global financial crisis, they became so plodding in the way they went about it, that it was just they were not going to be able to move fast enough or with enough agility for the domestic market.”

Expert Opinion - Abhra Roy, Head, Finacle Wealth Management Solution, Infosys Finacle: “The Finacle Wealth Management is a comprehensive solution for the wealth management institutions. It spans the breadth of asset classes and depth of services within each of them helping financial institutions make their front office tasks smarter and streamline their mid-back office operations at the same time. Built on a cloud-ready and modular architecture, the solution is leveraged by leading financial institutions to build a unified platform for wealth products and advisory services.”

He added that many of these competitors were under-capitalised. “Many were very small parts of giant universal banks with investment banking arms,” he remarked, “and often there was not sufficient capital or attention to make them work, to make their domestic platforms competitive here, or to be able to deliver the service standards of their global platform. And they did not have a long enough time perspective to make things work.”

Three pillars

A panellist explained that the future of their wealth platform hinges on a strategy with three pillars, growth, profitability and sustainability. “We definitely believe that the private banking and the wealth management business is an absolute star business in terms of both the market size expanding at a terrific annual growth rate,” he reported. “And we believe we have a great opportunity as a big platform with multiple offerings to dominate this space.”

He noted that there is significant opportunity in advisory which from a regulatory and compliance perspective they have housed in the securities arm, and that the group can offer investment banking, core lending and a wide variety of services and products to private clients, their businesses, and their families. “And we have a dedicated UNHW offering which is a natural fit with us and our 360-degree offering,” he reported. Additionally, he said the bank is sizeable enough to be able to reach into deep pockets for digital transformation.

Wealth spread across India

“And across India, there is money in multiple geographies,” he commented. “It is not simply the major cities where there is opportunity, it is spread across the nation. So, the ability to offer scale, to attract talent, to play the full geography, and the ability to look at customers holistically are very important. You can't be a top tier wealth manager here if you don't understand corporate banking requirements, the needs of these clients are really institutional, so if you do not have an institution of very considerable stature and scale and size, it will become harder and harder.”

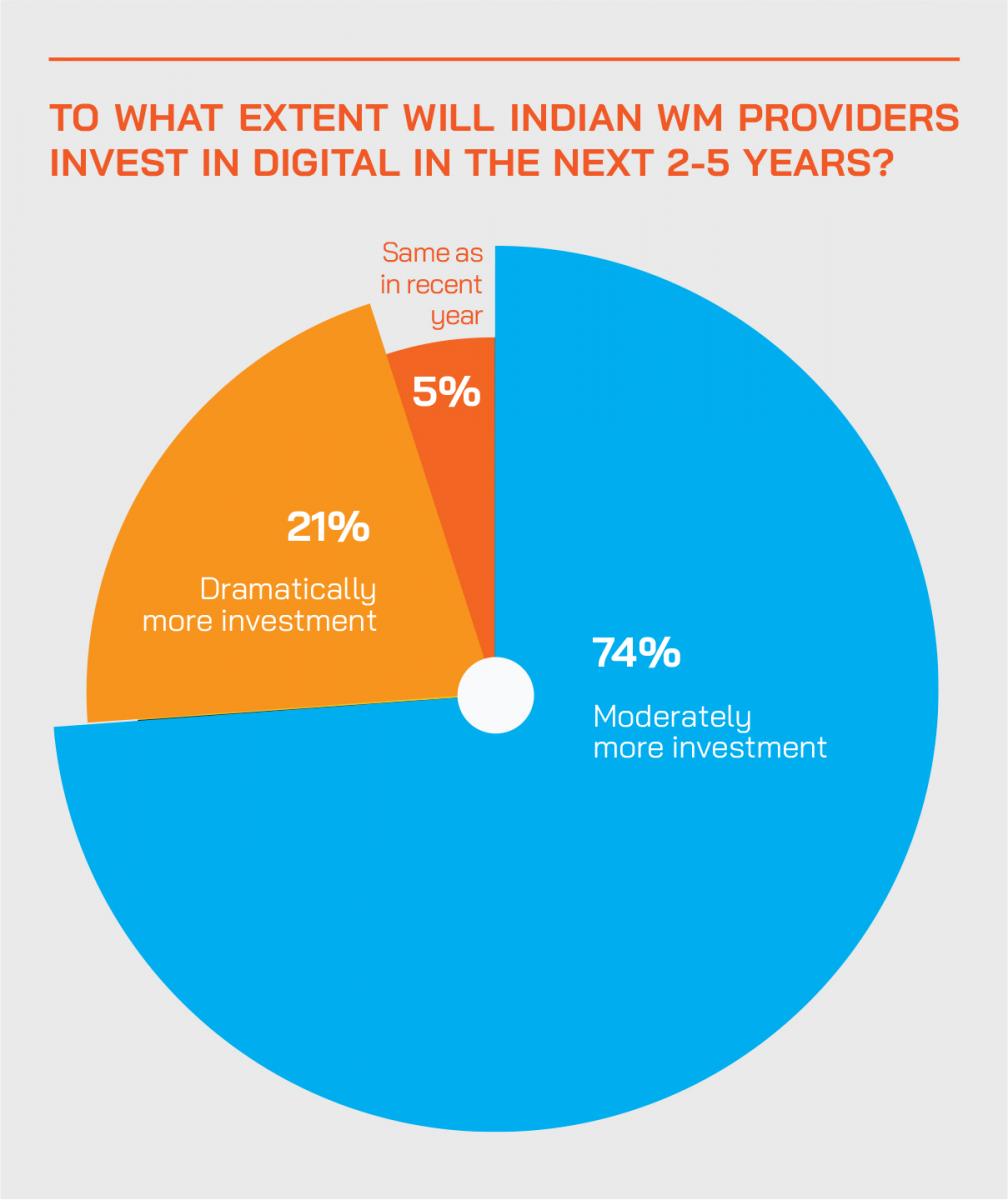

He said the pandemic had exposed the vulnerabilities of some players without enough capital to see through the tough times. “And it is vital to keep investing in digital, to really use technology as a strategic asset for a genuine advantage, to control costs, but also to really help build revenues. I would say that we are at a very exciting time, in perhaps the most exciting market, I would say in the globe, not only in Asia.”

Talent and delivering expertise

A technology expert picked up on those comments, observing that his firm is at the cutting edge of helping banks and firm empower their advisors with efficient workflows and automation, emphasising scale, helping enable next generation platforms that improve productivity as well as support business growth.

“Looking specifically at the advisors’ typical demands, they're asking for a platform that is powered by natural language search function, and they want their platform to enable contextual search to spot opportunities on timely basis,” he explained. “The advisors want to quickly respond to unexpected client calls on a timely basis by using natural language search and associated workflow. So, this is where we come in and enable platforms to offer contextual research and search. Advisors are also looking for deep market and portfolio analytics, and on a real-time basis. And our research study shows that investors prefer wealth providers that enable market and portfolio insights on a real-time basis, so we are able to provide those deep market and portfolio analytics.”

Expert Opinion - Abhra Roy, Head, Finacle Wealth Management Solution, Infosys Finacle: “Hyper personalisation in Wealth Management needs to be driven by Context and not just offering generic advice and information.”

He explained that advisors are also demanding aggregation of client portfolios across various wealth firms, absorbing multi-asset data from varied sources and feeding into one core system. “Again, we are able to provide scalable platforms wherein the data and the portfolios from multi-assets investments as well as from multi-wealth platforms, can be consolidate in one place,” he clarified.

The 360-degree view

He added that the firm’s advisor platform provides a 360-degree view of any advisor’s wealth practice, combining financial planning, CRM, allocation plans, proposal status, firm proprietary research, a new account opening toolkit, and connection to an internal dashboard and enable actionable items that empower advisors to take action.

A personal approach

Tech-driven hyper-personalisation is important as well, said one guest. “Central to hyper-personalised interactions is the ability to unify data, analytics, and channels to create a seamless, connected experience,” said one guest. “The ability to upsell and cross-sell are also important with providers able to leverage real-time decisioning to identify in-market clients, then trigger a contextual offer automatically, without having to wait for a campaign. There should be a proactive service, with providers identifying clients who will need service and trigger outreach automatically, thereby deflecting a service event before it happens. And as to client retention, nurturing and loyalty, the industry can trigger value-add messages that build loyalty on a day-to-day basis, even when the client isn’t in-market for a product or doesn’t have any open service issues.”

The discussion closed with brief observations on key initiatives underway, with one guest explaining that building the digital experience for the client is central to their proposition. Another expert said their focus was on stitching together digital solutions that are increasing frontline RM/advisor effectiveness with clients and also boosting the client experience dramatically.

A guest added that the pandemic having ushered in a clarity of sorts in terms of priorities amongst most of the players. “I would say the near-term, or one year plus goals are quite evident. They include the digitisation of back-offices, better remote customer onboarding, the STP of orders, efficient reconciliation, brokerage calculations, reporting and so forth. They want better tools for better risk-evaluation, a unified dashboard, the RMs empowered with digital tools for better engagement, the RMs need to be upskilled, and there is far greater awareness amongst customers about the digital channels of engagement, with far greater internal and external adoption.”

The competitive edge

And the final word went to the same expert who opined that evolving from a monolithic wealth management approach to a more component-driven approach was vital. “Technology should facilitate the expansion of services and products portfolio within Wealth Management and Private Banking, there should be the aggregation of products and services with API-led distribution and collaboration and increasing partnerships between the industry and FinTechs for better USX and therefore a greater competitive advantage.”