Using Digital Wealth Solutions to Curate the Best Portfolios and Deliver Tailored & Relevant Advice

Apr 28, 2021

As we all continue to endure the ebbs and flows of the Covid-19 pandemic, the vital role that technology and digital transformation have to play in the financial services industry has become ever more visible, and indeed more widely accepted, and nowhere more so than in the curation of digitally-enhanced relevant, personalised portfolio assembly and investment advice. The Hubbis Digital Dialogue of April 22 mined down the digital shafts of Asia’s wealth management markets to see how effective digital solutions have been in helping client-facing bankers and advisors assemble the right products and solutions to provide optimised advice and also thereby keep client’s portfolios highly relevant and efficient, and also to make sure the awareness of client facing advisors and clients themselves around markets, opportunities and events is more comprehensive and up-to-date than ever before. The private banks and independent wealth management firms across the region are racing to boost their digital offerings and solutions, from the back-end through the middle and, of course, very importantly, at the front-end where the revenues are garnered and where clients are serviced. The panel of experts focused their attention on how the RMs and advisors can be empowered by digital transformation, freed up from an excessive burden of mundane but necessary jobs through enhanced software solutions and processes, allowing them more time to leverage the new and growing offering of analytics and insights, driven by AI and machine learning to attain products, insights, and as a result, good advice, all of which are so relevant to their clients and that will boost their own productivity and their client outcomes and therefore loyalty. They considered how algorithms and digital tools should truly help deliver better portfolios and better advice, fit for the clients and fit for the years ahead.

Panel Members

- Julien Le Noble, Senior Director, InvestCloud

- Vivek Mohindra, Co-Founder & Responsible Officer, Kristal.AI

- Will Lawton, Global Head, QUO

- Juan Aronna, Head of Investments, Asia and the British Isles, RBC Wealth Management

- Freddy Lim, Co-founder & Chief Investment Officer, StashAway

- Dhruv Arora, Founder, CEO, Syfe

The market in Asia offers great potential

A guest highlighted how Citi worldwide was withdrawing from consumer banking in some markets while in Asia the banking giant had announced it would be significantly expanding its wealth offering, including announcing plans to hire about 2,300 new employees in both Hong Kong and Singapore, including 1,100 relationship managers and private bankers. Essentially, he remarked, they are doubling down on wealth management and they stated their objective is to triple AUM and multiply by 2.5 times the number of clients by 2025. This is an emphatic statement of both the great potential in Asia and of the intent of a global banking giant.

To realise the potential the market has to offer the RMs/advisors need better tools

He also stated that there is no doubt whatsoever that to make these client advisors as efficient and productive as possible, these specialists will need specialist digital tools to support them in delivering top-notch service, at scale when it's in the lower segments of the wealth, retail or mass affluent, and increasingly customised and personalised in the higher segments.

Greater personalisation – the potential and value are indeed there

A guest offered his comments around personalisation, observing that in terms of curation of portfolios, there is a lot more that the wealth industry, in all its guises, could do to even make it more personalised. He explained that their algorithm-enhanced portfolio creations had performed better than their same risk benchmarks in the several years since launching and that the outperformance was enabled by the algorithm that mitigates the downside scenarios by structuring in what is effectively insurance against market meltdowns.

He added that in the future, full on-demand curation of portfolios is on his wish-list, and that his firm is investing money and resources to achieve those goals. “Clients will, for example, say this is a list of asset classes I'm interested in, but I will leave the other parts of it to you, and please re-optimise this particular portfolio for me. This will result in a more curated, more personalised, more on-demand sort of technology, which is very difficult to do right, but I think that's the goal for us in the long term.”

To be successful amidst many challenges

Another guest reported that there are numerous headwinds for the private banking industry, and that the providers must focus on the perceived value they offer, across the range of clients from the older to the younger, from more traditional delivery to more digitised access and delivery. He observed that compliance and suitability requirements are constant demands, and so too the rising competition. “The role of the RMs in the future is one of the most interesting topics, and how we can deliver the outstanding value proposition to our clients,” he observed.

Four areas of digital intent – data aggregation for a holistic view

An expert reported four key areas where digital solutions can support RMs and ICs. The first one is an ability to support the RM in providing relevant advice, to take a truly holistic view of your client, and that in turn means providing to the banks the ability to aggregate the client's financial situation and data across multiple sources, core banking, books of records, CRM, systems and so forth. Then the tools can help alert both the advisors and the clients based on this aggregated data and thereby help tailor the portfolios and adjust to needs and market situations.

Four areas of digital intent – personalisation of advice and relevance

The second key area centres on the personalisation of advice. That is all about data mining capabilities, using AI and machine learning and genes to generate insights, analytics, in short, recommendations that are personalised, if not hyper-personalised. This expert reported that next-best action engines encompass exactly those capabilities; they are a great example of AI and machine learning algorithms that analyse client behaviours and predict their preferences in order to show recommendations that are hyper-personalised.

Four areas of digital intent – digital delivery

A third area where RMs and ICs can be supported with digital tools is in how advice is delivered. For this delivery of advice, whether it's through client channels or the client portal, or whether it's through hybrid channels with digital collaboration tools, you need to keep the customer always engaged and informed with personalised content, with portfolio analysis, collaborative and secure channels that engage interaction. This truly helps get the RM into a position to be able to provide value to the customer and maintains the value of the human element of advice, driven by insights and also empathy.

Four areas of digital intent – keeping it all compliant

The tools must also help keep the advice delivered compliant, a vital requirement in the intensely regulated world of wealth management these days. Everything that the wealth manager does digitally needs to be compliant, recorded, auditable, and that's something we're very mindful of, and we always factor this into our solutions.

More on hyper-personalisation – far from just a buzzword

An expert observed that hyper-personalisation is far more than a buzzword; it is grounded in reality and efficacy. An expert observed that how they approach hyper-personalisation as a B2B FinTech working with many Tier 1 banks and regional wealth managers is to focus on two elements – the advisory content and the digitally-enhanced process of supporting that advice. Offering a real-world analogy, he explained that everybody is used to watching a movie on-demand, ordering food on their phones, streaming music on demand, all this on the basis of recommendations and nudges that they receive on their phone or on their channel, related to how they previously interacted and consumed that service. They now want the same experience out of their financial advisors and bankers, and he said this is the case also across the entire wealth spectrum.

Expert Opinion - Will Lawton, Global Head, QUO: “Private Banks should not fear the Fintechs but rather embrace them as they will give the banks opportunity to protect their client base and give superior service; if however banks feel they can rely on their historical strength and power without embracing technical advance, then their demise will be slow and painful.”

The ‘Netflixing’ of advice

Accordingly, an expert reported, AI and ML can be used to mine and analyse client data, and compare that client data with the aggregated, synthetic population, if you like, and predict client preferences and affinities. “This is what you will find in solutions such as ‘next-best action’, which we call the ‘Netflixing’ of advice,” he said. “It's a solution or it's a set of algorithms that work, and in our case, for instance, we have that deployed with banks in Switzerland that are regulated, and therefore it's a proven product, it is not just a buzzword, it is something that exists and is possible to comprehend.”

Hyper-personalisation is also about being and feeling unique

The other dimension of hyper-personalisation is found in the ability that the bank or the wealth manager will have to deploy digital experiences for clients that are unique and fit with their unique personas. An expert reported that what he meant by that is that everybody is different. “It's not just about a client segmentation. Within the UHNW, HNW, the mass affluent, and the retail segments, you're going to have, and you should have, identified a number of unique personas. We've developed over the years over 8000 unique user journeys and personas.”

Behavioural science is a key and growing ingredient in digital advice curation

A guest reported that as the client experience or user experience is critical, then behavioural science must be incorporated into the design of digital tools, with the aim of maximising user adoption and engagement. “Behavioural science, such as gamification or decision theory principles included in the experience that you put together for your customers helps thereby maximise your adoption and engagement,” he explained. “These gamification principles or decision theory principles, really, whether it's in the retail mass affluent or high net worth segments, they enable you at scale to maximise adoption, and if you maximise adoption, inevitably, you will maximise your objective.” Essentially, you will either retain more clients and do more business, or win new clients, or, more hopefully, achieve both goals.

Leveraging digital tools to achieve the portfolio curation goals

Another expert pointed to a professional portfolio for institutional only investors that his firm has operated for some four years and that returned 30% in both 2019 and 2020. And he explained that the firm also offers customised portfolios for individual investors, mostly HNWIs, based on his or her interests, geographical preferences, instrument preferences, sector preference and so forth. He explained that to achieve this, they do indeed adopt a hybrid model wherein the human relationship manager is supported by digital tools to help curate portfolios from ETFs, other funds, bonds, hedge funds, pre-IPO funding and so forth.

He explained that the underlying philosophy for the firm has been to use digital tools, firstly to help the RM to do his job better, in their case by seeing the activity of the clients. “When the RMs later speak to clients to review portfolios, they not only refer to the actual portfolio,” he reported, “but also to the searches and clicks the client has made in recent weeks or months. This is really important, and as we want one RM to service many clients, far more than the traditional one RM to 50 clients, this really helps make them more efficient.” And additionally, he explained that with digital technology and access to external fund platforms, they can offer a very broad universe of assets from which to select.

Expert Opinion - Will Lawton, Global Head, QUO: “While at retail and mass affluent sectors service will largely be digital, clearly at the HNW and UHNW space, a hybrid service will be required; however, the Private Banks have considerable room for improvement in the digital parts of that hybrid service – bankers currently do not have the digital tools for many of the service requirements – real-time execution, investment advice, compliance, suitability and pre-trade checks etc. – and most of these tools are available in the market but not wholly embraced by Private Banks.”

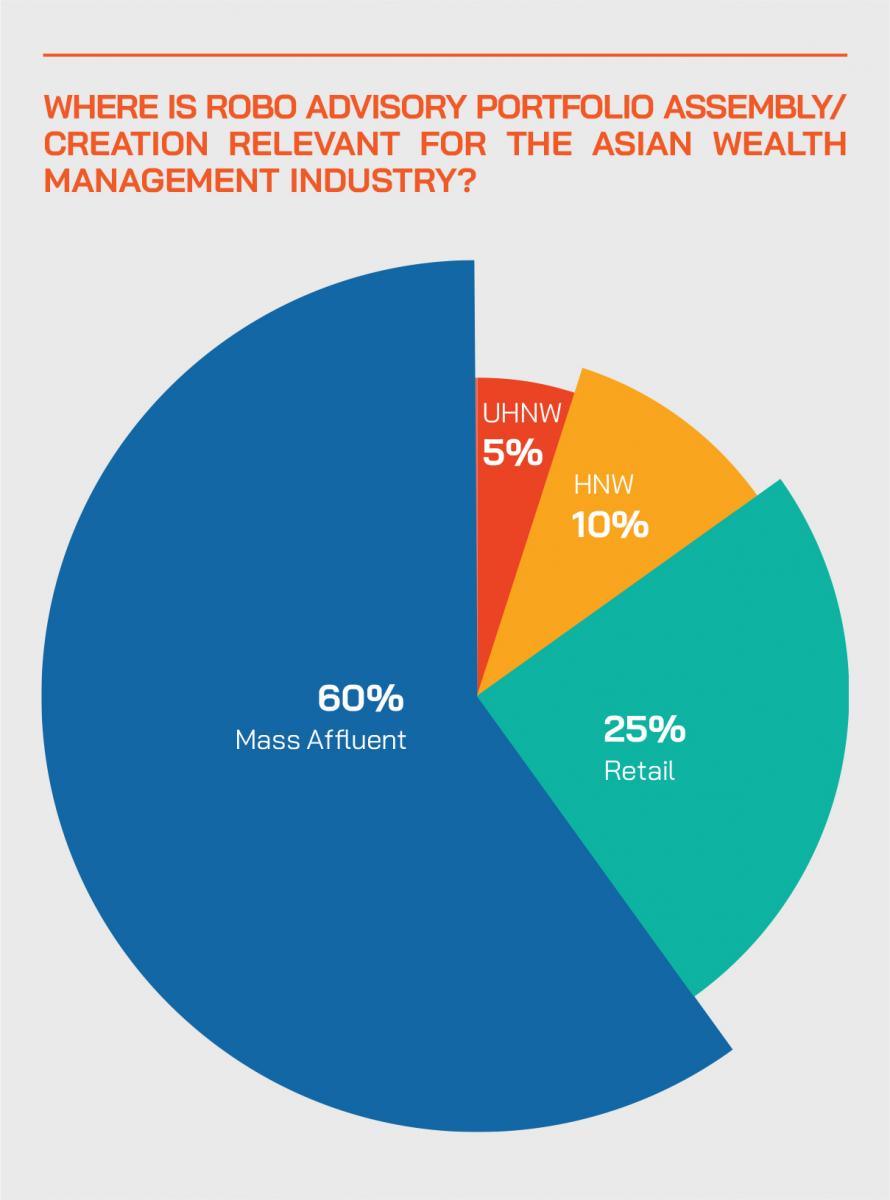

The hybrid model will win, and becomes most important in the HNW wealth segment

The hybrid advisory model offered by established wealth managers really is the most promising advisory model for all the main customer segments today, an expert reported, whether it's 20% or 40% of human intervention or more, it is the way forward, and every client his firm talks to believes in and is talking about the hybrid approach.

Even the robo-advisories are offering some level of human advisor connectivity for the entry-level type clients. At the upper end, the UHNWIs, which is largely human advisor led, but those clients might also adopt some digitally enhanced curation and delivery of advice. And in the HNW sector, the hybrid model really shines bright, with the clients adopting both self-service but also guided to the extent they wish by advice from the RMs, ICs or other specialists to intervene at critical moments. This intervention adds human judgement, adds creativity, adds empathy.

Hybrid brings key attributes of personalisation to digital offerings

Another expert agreed, adding that the human element on top of state-of-the-art digital offerings and delivery results in personalisation and more attention to detail, provided by the human touch, but not at a cost base like the private banks need to carry for their RMs. These digitised models can scale the service to clients who are selectively digital-first by opting for the digital platform, but they are not offering the type of advice that conventional private banking clients would expect. The clients of the robo platforms will happily operate on their own, supplemented by some human elements, especially amongst the bigger clients.

He said he sees the robo and private banking models coexisting. “I think the mass segment will be served 99%, digitally and maybe 1% human, whereas the mass affluent to the high net worth kind of segment increasingly has human participation,” he reported. “But even at the peak of the spectrum, I don't expect, at least advisors like us, who are essentially digital companies, I don't expect the human involvement to represent more than 20% of the entire offering for those clients, so it is scalable, and also allows a much larger number of clients to be serviced by each of the relationship managers.”

Digital tools as the catalysts for the future relationship

A guest concluded that there are many digital tools available to boost the value of client advice and portfolio curation, to enhance the skills and capabilities of the RMs and advisors and that digital solutions are therefore a vital catalyst for the boosting of the proposition and helping the private bank or EAM models endure, in short by improving empathy, relevance, suitability, quality and delivery. This is, of course, all incredibly important too for the holders of Asia’s wealth in the future – the Millennials and the younger generations inheriting or producing Asia’s vast wealth.

Expert Opinion - Julien Le Noble, Senior Director, InvestCloud: "Digital customer experience needs to be hyper-personalised, empathetic and engaging. At the same time, it is also critical to engage at multiple points along the digital continuum and to do this empathetically, many banks are embedding behavioural science in digital experiences to keep customers engaged as their relationship progresses."

“In our view,” an expert concluded, “there remains a huge opportunity for banks to stay a trusted partner with clients in this digital era even though the disruptors, the B2C players are competing hard, going full steam ahead. In short, the hybrid model will persist, we believe in it, and we have the tools to help the banks and other players really compete in the world ahead.”

Expert Opinion - Will Lawton, Global Head, QUO: “QUO from TradingScreen provides real-time execution, aggregation of portfolios and Risk management tools across all asset classes in a web based SAAS solution which is easy to employ. TradingScreen has over 20 years of experience in the institutional OEMS markets and SAAS solutions. QUO can be white-labelled and with a single sign-on to a Banks website, giving a Private Bank the ability to give a digital offering seamlessly, efficiently and with a short time frame to its clients.”

The Hubbis Post-Event Survey

Do you use an external investment management platform for execution and custody and if so why, or why not?

Comment: The ‘yes’ and ‘no’ replies were spread fairly equally for this reply. We have selected some of the comments below.

- No. Generally we use bank provided platforms. The bigger banks have a good platform for access. We are an EAM so data security and counterparty risk are paramount. We want to keep information in a single eco-system.

- No. We use a full-fledged private bank with in house capabilities.

- Yes, due to convenience and efficiency.

- Yes. Convenient, cheap and an extensive range of product solutions is made available to investors.

- No. We have our own investment management platform.

- Yes. Convenient and more secure.

- Yes, we do for some products, the main reason being cost-savings and ease of operation.

- No. We have traditionally (and currently) used our own internal platforms for reasons of close control and security.

- Yes, for both execution and custody. We operate on an omnibus basis, aggregating trades and disaggregating settlement. Easier to tap into an existing solution than developing our own, while we gather AUA/AUM.

- No. We have a strong relationship with a bank.

- No, due to compliance issues.

- Yes, for economies of scale.

- No, we execute through our custodian PB partners and this arrangement has worked fine so far.

- No, our bank has our in-house platform.

- Yes. There is less paperwork to keep up with the compliance work.

- Yes, for efficient and speedy execution of trades.

- Yes, as these platforms are built to provide the skills and expertise for the best results/returns.

- No, but we are working on it and pending approval from management.

Do you use FinTech/digital solutions for portfolio assembly and curation, and if so why or why not?

Comment: Again, the replies were divided here, with some 60% of replies stating no, but many of those also stated that their banks or wealth management firms were looking into the whole area of digital solutions to help in these areas. For example, a reply stated that they were a somewhat traditional brokerage firm that has not yet adopted such tools but which recognises the importance of moving towards digital solutions and that they are accordingly in the midst of researching into this. Those who reported they had adopted such tools were largely very enthusiastic, saying for example how much they greatly facilitate the portfolio construction process and that they also help in the implementation of more effective investment strategies.

Do you think your Relationship Managers and advisors have the right digital technologies to help free them up to offer ideas, products and solutions for portfolio assembly to private clients?

Comment: The answers were emphatic here – ‘no’ came a flood of replies, arguing that there is far more to be done in terms of the adoption of digital tools to boost RM productivity and capabilities for advice, product selection, relevance and portfolio assembly. We have selected some of the more significant replies below.

- No. We are nowhere close to the ideal situation. We are navigating a mosaic of systems and information sources to arrive at an answer. I am sure clients and even managers like us would find it useful to pay for a tool which will make life easier. That said, data security is important and therefore has always been a major hurdle in engaging with third party systems that do not sit on our server. Further, there are many tools available on platforms like Bloomberg Terminal which are more frequently used by us.

- Certainly not, for us creating an investment proposal is still, at this stage, a mish-mash of various elements including Excel sheets and so forth, all of which is incredibly old-fashioned!

- No. We need to have a far more advanced capability here in terms of an RM dashboard and it is something that we are working on internally, together with providers. We already use a CRM solutions provider in the UK.

- Fintech and digital technologies are essential. At this juncture, I believe many private banks are accelerating efforts to develop internal solutions but each at different pace.

- We are moving gradually as we install these technologies into our system.

- No, the (bank) does not even have any real market sense except whatever the desk wants to sell, and then those are the products the bank wants to sell.

- No. More is needed, including the RM embracing new methodologies.

- No, it is still very manual at this stage but recent digital solutions in banking have been in focus and hence we are heading towards that direction, using ML and digital applications .

- No, but I think digital technology will help RMs to bring more tools and smarter and more relevant product ideas to clients.

- Yes, the RMs and advisors have the experience and need to work alongside the right technologies. Nowadays, the customers are also very smart, often collecting their own data and ideas. We must be ahead of the game.

Are the vendors of digital tools and digital platforms achieving the right levels of communication with the buyers and doing enough to ensure the effective deployment of their solutions, and what more can they do?

Comment: There were some forthright views here, some of them expressing concern that their private investment activity was effectively being data mined and exploited.

- No. Most of these tools are mispriced. I say this as a customer/potential customer. The way these tools are structured and data mining is taking place are also concerning. I do not want someone from XYZ digital platform knowing where I clicked in the past and am shocked to learn that is taking place and is considered a feature. I would consider that a violation of my privacy.

- Not really. Perhaps the said vendors could increase their publicity so that more buyers are aware of their existence. Deployment of solutions depends on the capabilities of the digital platform and the appeal to buyers and the subsequent end clients.

- Yes, to a certain extent, but most banks prefer not to increase costs further at this stage.

- No. There is far too much ‘noise’ and it's difficult to pick a reliable and credible solution at this stage.

- No. The market will settle down later to a smaller number of key players.

- Not really. More proactive effort is needed.

- Yes, we think vendors increasingly try to engage clients more to fully understand their requirements before deployment.

- Yes. We have seen continuing improvement in this regard, and we expect things to continue to improve.

Transparency and simplicity

A guest explained that their first core offering was built on smart beta factors where they chose growth over value, or chose low vol over high vol. “It was essentially giving that level of institutional expertise, making it transparent and accessible to retail as well as mass affluent customers and giving them the ability to come in and come out at their comfort with a lower or a higher size, whatever suits them,” he reported.

He added that this approach was helping bring in a lot of first-time users who perhaps found the wealth management industry difficult to work with, and all somewhat complicated. “I think we are just at the beginning of this move,” he reported. “I mean, I always say we are today where ride-hailing type Uber rides were in 2010. I think good things are just about to happen.”

Robo platforms – where exactly do they sit and fit?

A digital platforms expert observed that the offerings of the robo-investment platforms are not comprehensive enough for the high net worth client segment. He explained that to really compete there, they need to first broaden to offer access to private equity funds, getting alternative assets even fine art, fine wine, and digital assets. For now, the hybrid approach of having human advisors and also a digital platform to face the clients is absolutely key, because the human elements remain key ingredients, especially as they go up the income spectrum, the wealth spectrum, where clients have greater need to talk to, to help them with a broader spectrum of assets and ideas, advising on other asset classes that the HNW clients may be investing in today. He said that is the soft-sell approach to this today, and that later on they can broaden the product offering and thereby reap the rewards of this strategy.

The human element has a human cost, but it is manageable in the digitised context

The same expert explained that the advisors that an electronic platform employs are not of the same expertise or cost as RMs in private banks, they are instead there to supplement and complement the digital platform and toolkit. He explained that armed with digital tools such as CRM/CLM processes and solutions, and smart data analytics, they can help offer more targeted advice. “We can direct the customer to the right places and trades based on their profile, and the digital tools really reduce costs, reduce search time, reduce advisors’ time. Armed with tech automation, tech empowerment and smart data analytics, we can offer our proposition while keeping costs down,” he concluded.

The tale of the RM, the product, and the digital experience

Another digital platform expert said he would briefly review the discussion from three aspects, the RM, the product and the digitised experience.

He reported that on the product side, he does not think there is any difference from his firm’s product offering compared to a traditional wealth manager. “Actually, I think we would probably have a wider product offering, so we do pre-IPO secondaries, which typically most private banks will not do, and of course we offer all the funds, we offer all the bonds, convertibles, cryptocurrencies, and so forth. There are now many other players available who enable us to access these product offerings, such as Allfunds for funds, Moonfare for private equity, for secondaries, and so forth. So, there's nothing that a private bank can offer that we cannot offer cheaply, except one, which is leverage.

Looking at the RM side, he explained that as they are a digital-first model, the customers come to the platform for the digital experience, not for the private banking relationship, and the RM does not join with his own Rolodex of clients, he services the clients that come to the digital platform. Additionally, in terms of productivity, a single RM, armed with the digital tools the firm provides to him or her, can service perhaps 200 high net worth customers compared with 50 to 75 that he would look after in a traditional bank.

As to the digital experience, he explained that the private banks are not set up to data mine or to deliver information digitally, so the traditional RM at a bank would be speaking on the phone and would have multiple methods of channels of communication. Moreover, the digitised platform captures all the communication in terms of reporting, every element of interaction with the customer and also keeps it all compliant.

“We see what the customers look at, the time they spend doing so, whether they click through, if they ask for additional information from the website,” he reported, “and then when we have captured all this information, we can use it to generate key insights into the behaviour of the customer, which we can again, pass on to the RM. If a traditional bank is not capturing all those data points, what insights are they going to be able to give? The only thing we miss is the RM having drinks with the client and knowing his family, so we can’t capture that. But with our tools and CRM tool, we can offer the Netflix type experience or prompting ideas and suggestions that are relevant and suitable.

In conclusion, in terms of products, he said they can offer what the private banks offer, in terms of data mining and relevance they can offer a superior approach to any private bank, and in terms of cost of RMs, those are far lower, and the digital delivery and experience greatly enhanced.

Don’t fear the FinTechs and robo-advisors, stick to your core values and attributes

A guest said the private bank and EAM/IAM incumbents do not need to excessively fear or worry about new entrants and the robo platforms. He said that private clients in the private banks and EAMS/IAMs are looking for relationships and trust. If when the onboard those providers also offer better digital tools, that is a great advantage now and increasingly in the future, but the first step is the relationship and trust.

He said that what they [as a bank] opted for is to then give all the tools and assistance possible to the relationship manager to provide personalisation, but without a massive spend on AI and other tools, at least for the HNW and UHNW clients. “So, yes, the outstanding client experience for sure will come from a technology enabled that will be helping the relationship manager to provide this personalised advice delivered across different channels, but from what we see is that the client experience is at the top of the house from a private banking perspective. So, if you are able to deliver a superior seamlessly client experience across all the channels to the client, then you will be able to retain clients.”

The power of the ecosystems

A guest patented to the power of the ecosystems. “I think that we are having an increasing networked value chain that is coming through the value to wealth management, and it is the wealth managers that will be able to cover all these parts of the value chain and the competitiveness in this very complex environment who will be winners. There is going to be a fragmentation on the financial services in the industry, and it's happening right now, as everyone responds to offer different types of services to different needs amongst different clients. There is no option for wealth management if we want to be able to compete into this market other than adopting scale, and/or embracing this technology. We must invest in technology, we believe, in order to provide better advice and better service.”

Digital tools – far from a luxury today and certainly not in the future

The discussion concluded by general agreement that i a world in which digitisation is certainly no longer an option, especially after the onset of the pandemic, any bank or wealth management firm wishing to compete and stay ahead in its markets must be on top of smart onboarding, smart compliance, reduced administrative burdens, and offer its clients a much more user-friendly interface and connectivity. Anyone wanting to compete in the wealth industry needs to meet the needs of the ‘on-demand’ generation and to boost their broader client proposition.

Expert Opinion - Julien Le Noble, Senior Director, InvestCloud: "How to create better relationships? Short answer: empower wealth managers and advisors to build and maintain strong client relationships. That means enhanced and integrated digital experiences around collaboration, advice, trading and reporting. That also means experiences for both the advisor and the investor need to be hyper-personalised, empathetic and engaging."

And even for the HNW and UHNW segments of wealth, where private wealth remains high personal touch - quite rightly in most panellists’ views - that should not actually deter banks and other providers from digitising some parts of the workflows to improve compliance, risk management, improve efficiencies and outcomes, and for all parties concerned.