Thematic Investments: What Strategies are in Favour, Why and How do Asia’s Private Investors Build their Exposures?

Apr 18, 2023

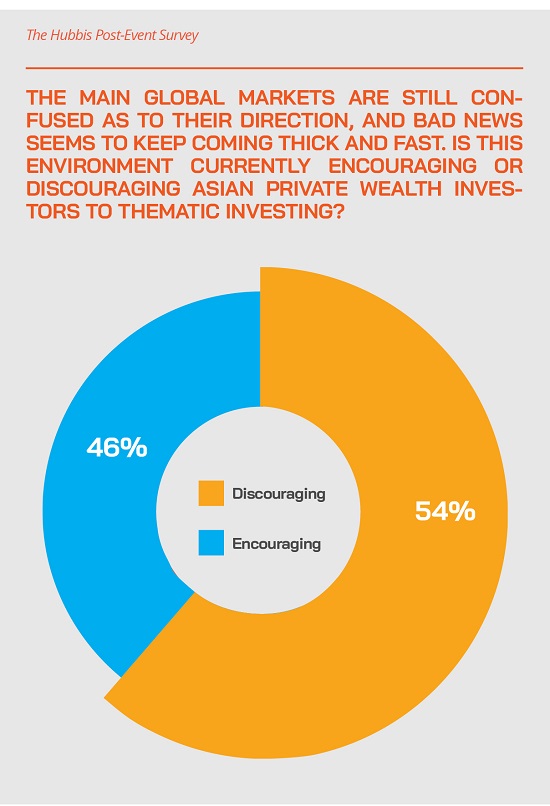

The world is a very different place from the one we all inhabited until the end of 2021. And as we saw very recently from the Credit Suisse crisis, more surprises on the negative side are hitting the markets, sentiment and indeed all our daily lives. Investors and advisors have been redefining and refining portfolio allocations, as they attempt to adapt to the current and anticipated environments in the global economy and in the various investment markets around the world. And thematic strategies – both active and passive - have become more and more in demand in recent years. But where are we now? Is the current environment conducive to more or less thematic investment exposure amongst Asia’s private clients? A panel of experts pondered exactly this on our digital dialogue of March 16.

The Panel:

- Barbara Lee, Vice President, ETF Strategist, CSOP Asset Management

- Arjan de Boer, Head of Markets, Investments & Structuring, Asia, Indosuez Wealth Management

- Freeman Le Page, Portfolio Specialist, Regnan

These are some of the questions the panel addressed:

- What are the desirable attributes that make a good thematic opportunity today?

- What is in favour today, and what is out of favour, and why?

- How should you frame conversations with clients when comes to thematic investing?

- What are the commonly faced issues and misperceptions when it comes to thematic investing?

- How does sustainable thematic investing differ from ESG integration and impact investing?

- What role does thematic investing play in robust portfolio allocation?

- Having identified an attractive theme, how do you deliver alpha, beyond thematic beta?

- What are the expectations of wealthy private investors in relation to thematic investments and how should they fit these into their broader/diversified portfolios?

- What is the Asian WM community doing to adapt their products, services and expertise to the evolution of thematic investing amongst their private clients?

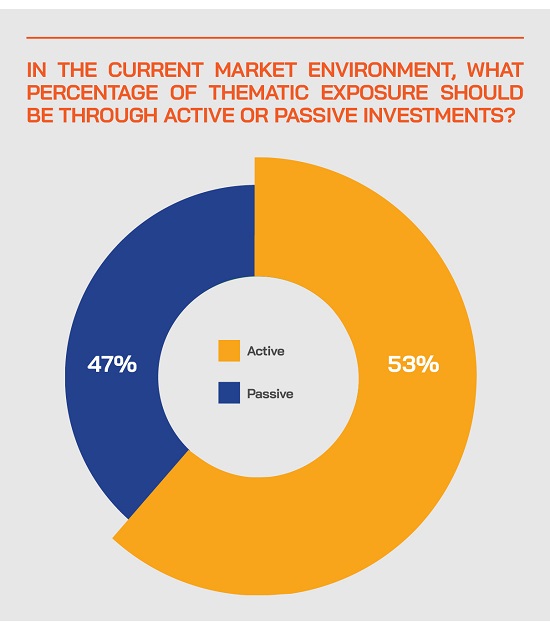

- Do you buy into Passive or Active funds? Or perhaps both? Why?

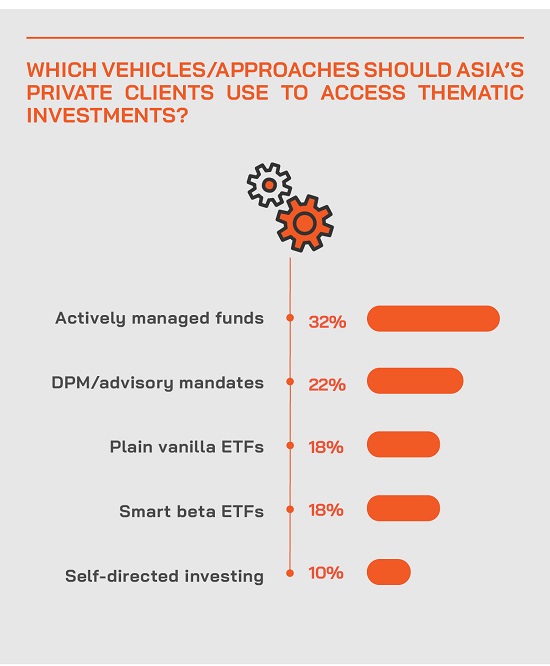

- Does thematic investing fit well into the advisory and DPM mandates?

Setting the Scene

MSCI defines thematic investing as a top-down investment approach, designed to capitalise on opportunities created by macroeconomic, geopolitical, and technological trends that are both structural and transformative in nature. In short, this investment approach therefore offers investors a fascinating way to capture powerful global trends that may drive future stock or asset performance.

Thematic investing strategies take into account long-term trends, ideas, beliefs, and values when choosing stocks, bonds, mutual funds, ETFs, and other investments, with some of the most popular types of thematic strategies focused on disruption, megatrends, individual economies and markets, and on ESG. Thematic mutual funds or ETFs can clearly provide opportunities to invest in themes as well as offering the benefits of professional investment research and management.

Accordingly, thematic investment strategies are considered of great value for the curation of key elements of robust portfolios, as they help take into account many of the world’s more immediate and predicted financial, economic and geopolitical uncertainties and also opportunities.

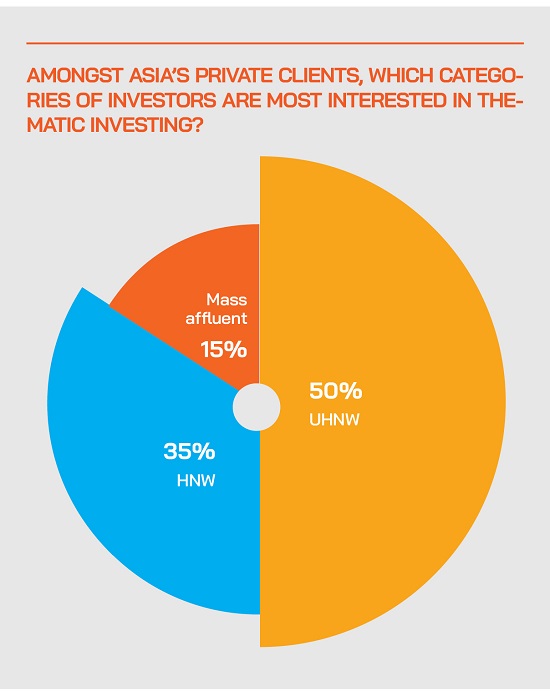

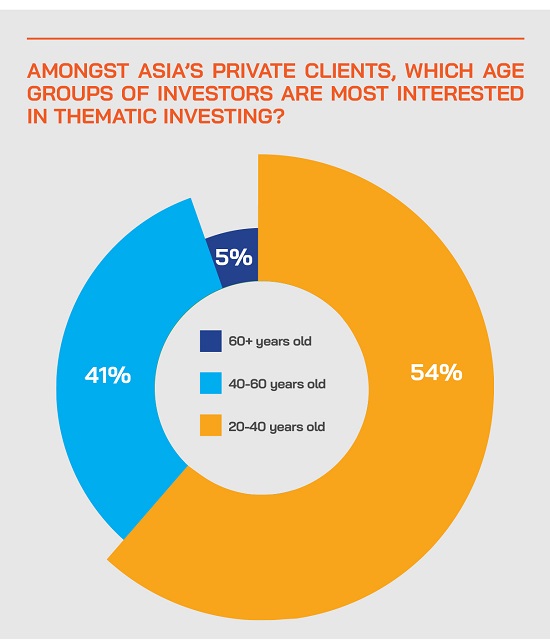

But where are we today, and what strategies and themes work for Asia’s mass affluent, HNW and even UHNW private clients? On March 16, the Hubbis Digital Dialogue event saw a panel of wealth management and investment experts offer their views on some of the more interesting thematic investment strategies that wealthy private clients can adopt. They considered how this can apply to the Asian wealth management market, and to private clients across the generations. And they reviewed what the private banks, the IAMs/EAMs and the fund management architects are doing to tailor and deliver more products and better solutions to meet the continuing strong demand for thematic investing in the region.

Key Insights & Observations

2022 the worst year since 1931 for major markets and assets? Yes, really, and many experts believe longer-term thematic horizons are even more valid amidst the ongoing volatility and uncertainty

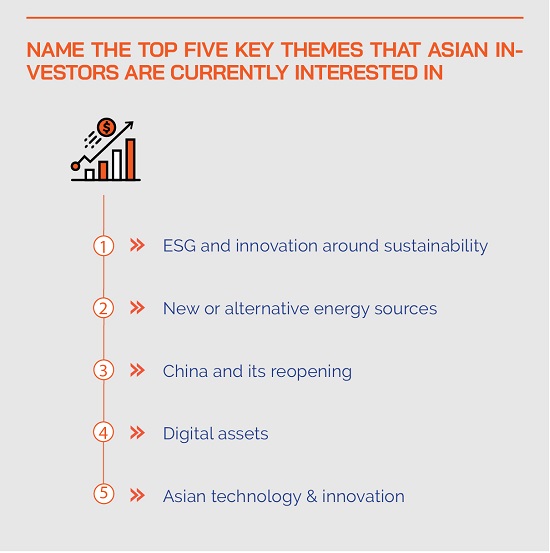

An expert opened proceedings on a surprising note, reporting that the performance amongst all asset classes in major markets made 2022 the worst year since 1931, and worse than during the more recent 2008-2009 global financial crisis. That rocky ride continues and has a major impact on the activity of Asia’s significantly transactional type of private clients. In such an environment of volatility and uncertainty, longer-term horizons as expressed through thematic strategies are even more logical, whether ESG-driven, electric vehicles, the internet of things, robotics, private equity/assets, and so forth. Another expert highlighted how responsible and sustainable investing is ideally suited to thematics fit for the modern world.

Tomorrow’s world and the dawn of new realities

But other themes such as technology, which did so well in the past decade, might not be so appealing, even though listed sector tech valuations and therefore entry levels have dropped significantly since 2021.

An expert observed that in the new world we face, we are likely to see a reversal of a number of the drivers, with the end of disinflation, the end of low cost of capital, more fiscal and government intervention, more regionalisation and higher CapEx and infrastructure spend.

“We therefore expect that real world physical assets are likely to be key beneficiaries of that,” she reported. Areas such as environmental protection, carbon management, climate change, mobility, critical infrastructure that we need to build out in the developed markets, and in emerging economies as well, resource materials, resource management, capacity and productivity improvement, all these will become more pronounced. Another expert agreed, adding that Asia is also a key theme for them, and so too virtual (or digital) assets, such as for example regulated ETFs tracking Bitcoin or other cryptocurrency futures.

Expanding on the Asia theme, she noted large inflows to their Hang Seng Tech ETF in March, and their Hang Seng Tech leveraged fund as well, with strong momentum behind the scenes in stocks such as Tencent, Alibaba and Baidu and with investors seeking out vehicles for accessing those types of companies and their expansion into new areas such as AI, but via ETFs to avoid single stock risks. For shorter-term exposures, investors are also hedging global and financial risks by using inverse products.

And elaborating on China and technology, this same expert added that government policy there has again shifted more favourably towards supporting technology and innovation.

“Chinese people are again free to move around and act as they like, but apart from private consumption driving more technology adoption, the Chinese government is also putting a lot of effort and research into building, for example, more semiconductor capabilities needed to help the Chinese economy engine. Other key areas are EVs and solar power, which can also be captured through dedicated ETFs.”

ESG and sustainability are major themes for the future

The evolution of ESG investing is a journey across the different elements of E, S and G and therefore a very broad subject that can mean different things to each person. Perhaps the most accessible element is the sustainability or environmental part, as that is what first comes to mind amongst clients.

A guest reported how within their group, ESG had been part of our DNA for many years, and that in Europe their parent is known as the green bank. “We have been actively promoting this for many years as a first mover, and we see more financial institutions jumping on the movement, and increasingly, more private clients,” he told delegates, noting that ESG began at the institutional level, as in any segment of the financial markets, and has slowly trickled down to the individual investor levels, with adoption rising sharply in recent years.

However, he said there was a lot of scepticism around ESG, based on some confusion as to what defines ESG and ESG metrics, and also on the assumption that returns needed to be sacrificed to achieve a high ESG score on portfolios. But he indicated that belief around sacrificing returns in order to participate is changing, as people can see that those securities with high ESG credentials are actually performing better, and that helps drive adoption across the board, from older investors who focus mostly on returns to younger investors who are more in tune with ESG from an ideological point of view.

He said the whole thrust to ESG is very credible and completely worth supporting, most obviously around key sustainable development goals such as eradicating poverty, increasing diversity, reducing CO2, improving clean water access and so forth.

“Sustainability and ESG are here to stay, and if you look at supply and demand if the large global institutional investors adapt their policies that they have to invest in securities and companies with high ESG credentials, then automatically in terms of supply and demand, those assets will perform better,” he reported. “Accordingly, these are key themes that we have been presenting to our clients.”

He added that the regulators in Asia are helping drive adoption. For example, in Singapore, the MAS recently sent out a notice to banks with regards to ESG education for both staff and clients, and the HKMA had done something similar. “They lag their European peers, but they are making the right noises. In my view, this is such a massive mega trend, and we are still only at the beginning of it.”

Another expert agreed, adding that investors are somewhat challenged as ESG and sustainability are typically historical in terms of data, with more emphasis needed on future risk mitigation in order to help deliver attractive investment returns. “To be frank, investors still need to go on that journey in terms of understanding how sustainable thematics work in portfolios, why impact investing offers opportunity, and perhaps the differences and nuances between that and traditional ESG integration or exclusion,” she explained.

She reported that they run two funds, one a sustainable thematic water and waste fund, which is really about delivering sustainable financial returns from companies which are exposed to the water and waste thematic, looking at the entire value chain, and then through their own propriety selection process to deliver optimised returns via active management. The strategy encompasses population trends and urbanisation, increased consumption, regulation within markets, resource scarcity and other key elements.

Their other key ESG thematic is an impact solution strategy, which covers eight different themes, from health and well-being, education, financial inclusion, water as well, the circular economy, and identifying companies which are really part of the solutions, who are innovation solution providers, businesses which are part of the disruption of the norm and intent on delivering better outcomes, which are aligned to the 17 sustainable development goals.

She added that while the SDGs were built by politicians and think tanks and other bodies, the ingenuity and the innovation within financial services means these are now used to help deliver investments related closely to ESG principles to private clients.

Another guest noted that ESG data and metrics supplied by third parties need to be measured also against in-house assessments to help identify optimal investments that side-step potential greenwashing pitfalls. As a group he said they are committed to these areas are working hard on all this, but also conceded that nobody is quite there in terms of full credibility. It is improving, but there is further to go.

He added that education and training are vital elements to enhancing awareness and also to boosting capital flows towards companies that demonstrated strong ESG credentials and strong impact around sustainability.