Wealth Solutions & Wealth Planning

The Rich, Tax and Compliance – The Pressure is Mounting Across the Globe

Jan 31, 2022

The fallout from the pandemic on often already stressed government finances – particularly in the developed world - has perhaps not yet been fully felt, and many believe that a new reality will dawn that will shift the dials in many countries to significantly higher taxes. In many emerging market economies as well, the significant additional funding that some sectors of society and the economy have needed, combined with lower revenues from key segments - for example, travel and leisure – as well as rising inequalities all offer compelling reasons, many believe, for why governments should raise more tax. The headline income tax numbers might not change, but there are numerous ways in which governments can tinker with tax to produce greater revenues without hitting the average working person. And right bang in the spotlight are the wealthy investors, who are deemed able to withstand additional taxes, for example, inheritance tax, or even perhaps a wealth/assets tax, in some cases. The Hubbis Digital Dialogue of January 13 brought together a highly erudite and experienced panel of tax, compliance, wealth management and investment professionals to look into the current imperatives around tax and tax compliance, and to start into their crystal balls and analyse where these new taxes might arise, and most importantly, what private clients in Asia might think about doing in advance in order to protect their assets, for example through wealth and trust structures, foundations, through life insurance solutions, or perhaps through the early disbursement of chunks of their wealth to family members.

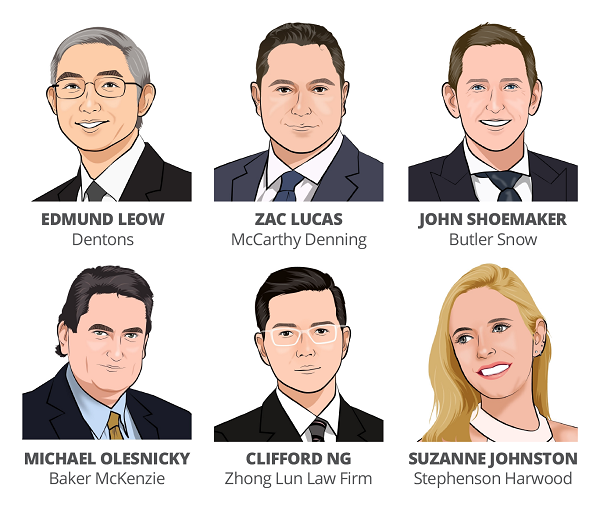

The Panel of Experts:

- Michael Olesnicky, Senior Consultant, Tax & Wealth Management, Baker McKenzie

- John Shoemaker, Registered Foreign Lawyer, Butler Snow

- Edmund Leow, Senior Partner, Dentons

- Zac Lucas, Partner, McCarthy Denning

- Suzanne Johnston, Partner, Stephenson Harwood

- Clifford Ng, Partner (Hong Kong), Zhong Lun Law Firm

These are some of the questions addressed by the panel of experts:

- In broad-brush terms, what sort of pressure are government finances under in Asia and from which segments of their economies and societies are they likely to source additional tax revenues?

- What is the likelihood of the wealthier being the key targets for the higher tax revenues in the foreseeable future, and why?

- Will we likely see estate/wealth taxes in any of the leading economies, such as China, Hong Kong, Singapore, Indonesia and others?

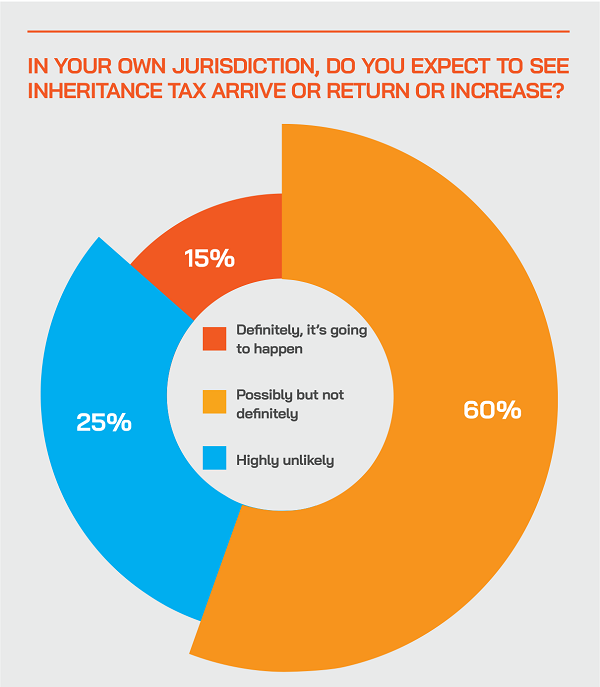

- Will inheritance tax emerge or return across Asia? Why? Where?

- Are we likely to see new tax amnesties aimed at inducing wealth repatriation in the region, for example, in China?

- What does all this mean for wealth, estate and legacy planning & structuring for Asia’s private clients?

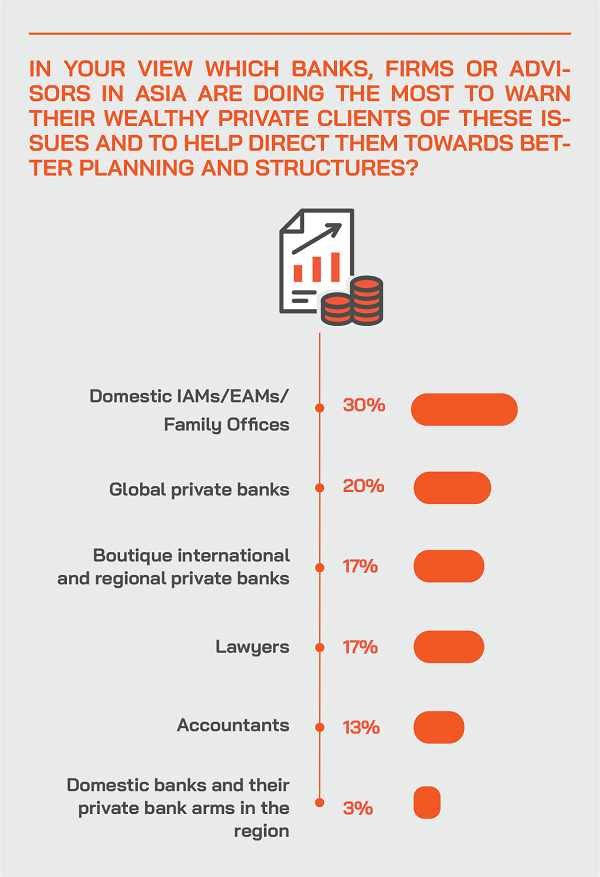

- Who do they turn to for advice and solutions?

- What sort of conversations should advisors have with their clients around these issues?

A seismic shift has taken place in the past decade or two in tax gathering, surveillance and behaviour

In the last 10 years or so, an expert observed there had been a seismic shift in tax regulation and surveillance, driven out of the US and to some extent the UK, especially with the US Department of Justice and their broad outreach beyond the borders of the US to prosecute tax crimes. That led into the FATCA and eventually, the CRS regime and information exchange.

“And even most recently, as we start to see pressure towards a global minimum corporate tax rate, mature, developed complex jurisdictions like the US and the UK, tend to have an outside influence, perhaps by cajoling through their financial power the other countries of the world into participation,” he commented. “I think as we start to talk about post pandemic tax pressures, and particularly wealth and estate taxes, I believe that the US will play an outsized, influential role. So, we must watch politics watch developments carefully around wealth taxes, estate duties and so forth. If the US adjusts these, I think that will embolden some other countries to either reinstitute or begin the idea of preventing or restricting inter-generational wealth transfer.”

Another guest agreed, noting that in the past 20 years the world had moved from clandestine behaviour amongst the wealthy to near total transparency in a world of regulation and information exchange that makes it incredibly difficult to secrete wealth and assets around the globe. “And the people who are going to be caught are those who just haven't kept up to date with all of these trends,” he cautioned. “You have to be conscious that everything you do is going to become known to the tax authorities, you simply have no alternative but to comply. So, the emphasis now has changed very much to compliance, away from aggressive tax planning. Our task is partly therefore to work out how to actually convince clients not to be too aggressive and accept the fact that they do have to pay some share of tax.”

Expert Opinion - Clifford Ng, Partner (Hong Kong), Zhong Lun Law Firm: “The tax trend from China will likely be greater enforcement of existing laws and largely overseas. The information exchange and transparency rules have allowed all governments to better enforce their laws out of jurisdiction and this will be a vast and largely untapped source of revenue for China. We are already seeing more and more clients take steps to comply with these laws for their offshore holdings.”

Expert Opinion - Edmund Leow, Senior Partner, Dentons: “In Singapore, like most countries, there has been discussion on potential wealth taxes, including inheritance tax. But the government is also conscious of the need to keep Singapore attractive to the ultra high net worth as a destination for migration. Accordingly, there will have to be a careful balancing act.”

Expert Opinion - John Shoemaker, Registered Foreign Lawyer, Butler Snow: “Much like we are seeing with the push for a global minimum corporate tax rate, I suspect that the United States will have an outsized influence on the issue of estate and wealth tax expansion globally post-pandemic…we should all be watching the Biden White House and the US Senate for signalling and legislative development.”

Expert Opinion - Suzanne Johnston, Partner, Stephenson Harwood: “There is nothing new in proposals to introduce a Robin Hood tax (a tax which taxes the rich to give money to the poorer in society). What is interesting is the different forms a Robin Hood tax can take. Taking Singapore as an example, it doesn’t tax capital gains, inheritance or net worth directly, although high value real estate and cars are subject to higher taxes than in other jurisdictions. The Singapore government has suggested that any wealth tax must be fair and progressive. This implies that a ‘wealth tax’ will not necessarily be targeted at a wealthy elite but at the population as a whole.”

With a potential wealth tax looming not only in Singapore but in China too, it is crucial that wealthy families get their ‘ducks in a row’. To me, this means harnessing succession planning tools eg wills, trusts, family constitutions, insurance products, family offices and VCCs to devolve wealth sensibly and effectively. It is always better to be proactive rather than reactive. Fortunately, in Singapore, we have an array of expert wealth planning and insurance professionals, lawyers and accountants to help wealthy individuals navigate the legacy planning landscape. There is no one size fits all approach and holistic, tailored and considered planning is essential.”

Family business wealth is so core to many Asian economies that wealth and inheritance taxes might be unlikely, but tighter compliance and surveillance will emerge

Another speaker observed that especially in Southeast Asia, so much wealth is tied up in family businesses, and these types of taxes end up fragmenting businesses, if implemented. “I don't think Singapore will introduce these, because it's an international financial centre, and generally it wouldn't want to put off clients. You have family offices tax exempt, and then if you introduce an inheritance tax, it will be counterproductive. I think it more likely that we will see more audits, a lot more enforcement of existing tax rules. For example, many BVIs are run out of Malaysia or Indonesia, but are they actually foreign companies or not? This sort of approach is more realistic going forward than introducing yet another tax and all that goes with it. In the West, even these inheritance taxes, they're quite negligible in terms of the amount that they contribute. So, I think we're looking more at an enhanced compliance regime coming in, rather than new taxes at all.”

Seeing things from the perspectives of the people on the street, things are more black and white, so governments will likely tighten for the wealthier elements of society, but will remain pragmatic

Another lawyer observed that away from the gilded cages of wealth management experts and lawyers working on lofty cross-border matters, the man or woman on the street across Asia see the rich getting richer and themselves becoming relatively marginalised.

“They may not be aware of Pandora papers, they may not be aware of what's going on in the offshore world at large, but they see things clearly, so there is more political pressure for the governments – including Singapore - to do something about that,” he reported. “And for that reason, the [Singapore] government has been talking about the wealth tax, although they're not very precise about what they're talking about, because obviously, people like us when we use the term wealth tax, we are looking at maybe something like what some of the European countries have done.”

“But,” he continued, “I agree it will not be the style of wealth tax we see in Europe, it will be by other means, and the Singapore government is very practical, they want to keep Singapore attractive to high net worth foreigners who are coming here in droves to set up their family offices and so on. But having said that, the government politically has to do something, so they might for example raise existing taxes, like we saw stamp duty on property going up, which was not a surprise. However, it was not positioned as a wealth tax but as an adjustment to the property market, because the property market is overheating somewhat. They will take some other measures as well I am sure, for example tightening up on those who use BVIs. In short, they need to address inequality, so Singapore for example will likely do more but not cause damage to the overall proposition.”

Perhaps money really does grow on trees and pressures on governments have evolved from financial to societal

Another perspective came from an expert who observed that the money printing of leading governments around the globe almost disproves the old adage that money does not grow on trees. “The idea that economic pressure and financial pressure is what's going to drive these new taxes or these new collections may be inaccurate, old world thinking,” he observed. “The new thinking is that there genuinely is a social impact, where newer generations are resentful of wealth gaps. And even if it's not going to raise a lot of revenue, there'll be pressure on governments from a general population and voting perspective to please that mob that is saying you've got to raise those taxes, even if it's not going to create a lot of revenue. So, we need to be mindful of that and don't get stuck in our old mindsets.”

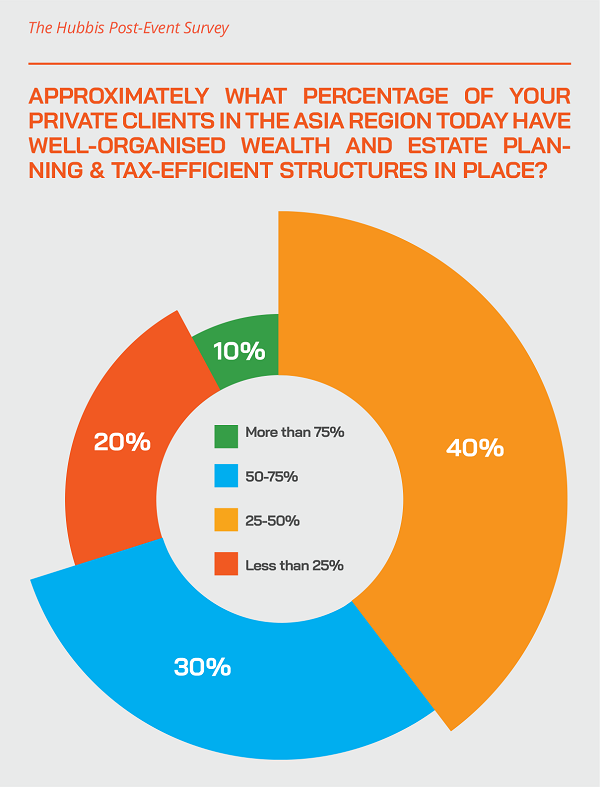

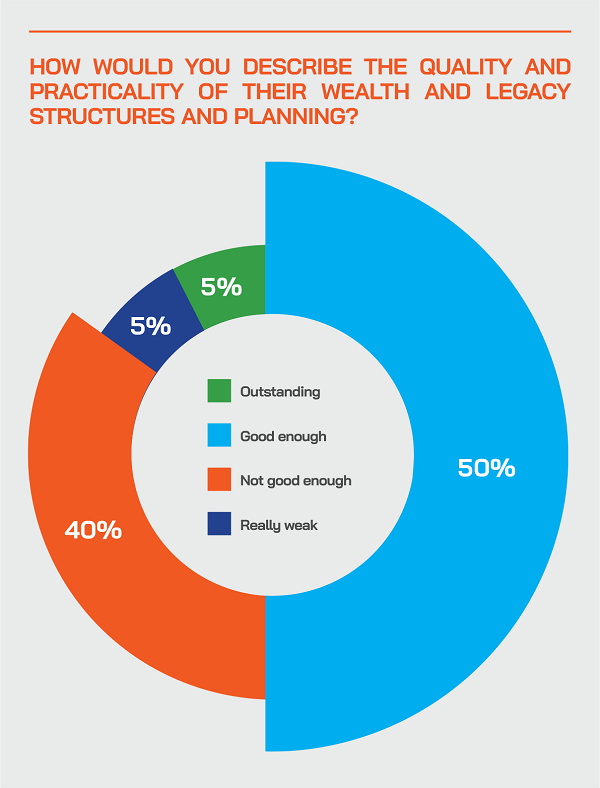

The Hubbis Post-Event Survey

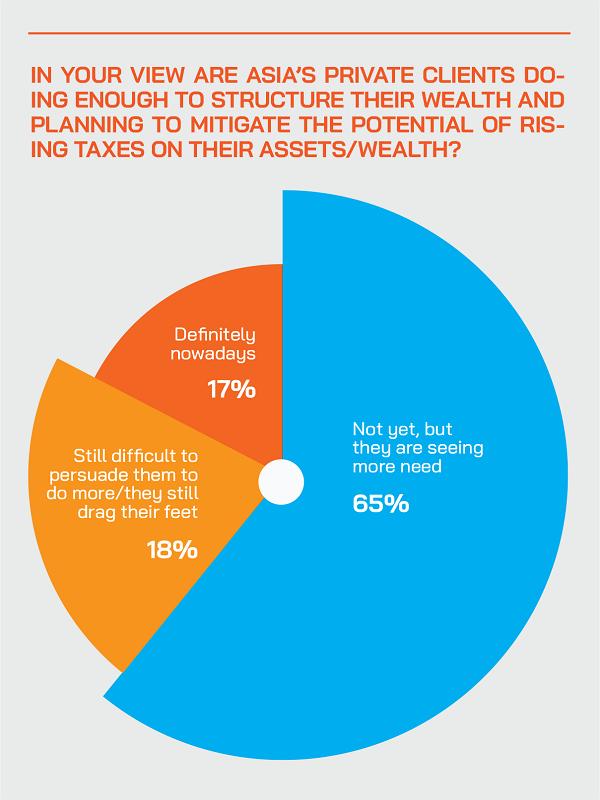

What is the likelihood of your HNW and UHNW clients becoming the key targets for higher tax revenues in the foreseeable future, and why? Will wealth taxes or Inheritance taxes be introduced? What about tax amnesties to bring more money back onshore?

Hubbis has summarised and distilled a selection of the many replies and insights here:

- The likelihood [of higher taxation] is high, but it will depend on their domicile, and their country’s tax regime and political situations.

- Highly unlikely, that topic has been raised for ages but…

- Indirectly, definitely.

- Probably not unless politics dictate.

- Most of my HNW clients are keen to lower their tax obligations, but their situation, such as job and family do not allow them to physically exit their country, so they will mostly be caught up in higher taxation, unless they are uber-wealthy and can move themselves and families anywhere they fancy.

- With the global pandemic, I think it is increasingly likely that tax will escalate, as governments try to plug the deficits that have been created, and as there is a shift to the left taking place, for example in the US and even as we have seen in China, with the introduction of Common Prosperity and other moves. Let’s face it, inequalities in most societies are even worse today than they were before the pandemic hit.

- Very likely. In democratic countries, they are the easy target for ruling party to shift focus of discontent of common people over failing pandemic control and economic downturn. For emerging economies and bureaucratic governments, they are the easy target for governments to squeeze for tax revenue.

- Likely as wealth accumulates with the wealthier.

- High, helped by more sophisticated information systems that capture capital movements.

- It seems inevitable that due to the Covid pandemic many government finances around the world are now stressed and one alternative to mitigate this is to collect higher taxes from the rich, a measure which would be less hurtful on the general population as the UHNW/HNW individuals and families form a minority group and such measures will not hurt them as much as they would on the majority of the population.

- Because most of the countries and government fiscal policies are facing disparity between the rich and the poor, and there are big voices for closing the gap from the public.

- High. Especially inheritance tax.

- Unlikely to see wealth and IHT in Hong Kong and Singapore as both countries want to be business friendly financial centres. China is also not likely as they want to focus on implementing a more structured income tax structure. Indonesia has introduced the tax amnesty for the second time now and this has given rich opportunities to declare their offshore assets properly; this will enable the tax authority to ensure taxes are paid accordingly.

- Wealth taxes are likely in China, Hong Kong and Indonesia, but not in Singapore. The wealthy in Singapore will be taxed in different form like properties, luxurious cars and other items.

- China and Indonesia are likely to launch the wealth taxes and Hong Kong and Singapore may try to keep the tax scheme lean. However, that is the beauty of one country two systems to be deployed in Hong Kong, while Singapore will try to compete with Hong Kong for snatching more asset to be under management in future.

- It seems unlikely that inheritance tax will return to Asia, especially in Singapore as this would be counter-productive to some of the tax incentives or initiatives that the government has implemented, such as the establishment of Single Family Offices and Variable Capital Companies where certain income is exempted from Singapore income tax if they arise from designated investments which are exempted from Singapore taxes.

- We will see more IHT in the region because there is such vast wealth in transition from the older or founder generations.

- There might be tax amnesties, as they sound like a reasonable proposition, as see in Indonesia.

- Many moves are politically not viable, but they will look to using CRS data to impose higher or more accurate taxes.

China as usual dances to different tunes but it is clear that the government wants to reduce the wealth gap and inequalities

Another expert observed that China’s focus had since the pandemic been in keeping the domestic economic chugging along and in supporting the export-led economy. He explained that some 40% of revenues come from VAT not income tax and that there was no real political or economic pressure to levy wealth taxes, estate taxes, or gift taxes, or IHT. However, he observed that the drive towards Common Prosperity and other policies are designed to cut the income and wealth gap.

“You have to be very careful indeed now in terms of foreign exchange, moving money offshore, China has tightened all these areas,” he observed. “And with CRS, and all these enforcement mechanisms, the exchange of information, data hacks as well, there will be widespread government pressure to clamp down on [non-compliant] individuals, as well as potentially public pressure. They have the tools that they need to get the information, to get their enforcement moving, so there will be fewer and fewer ways to go for aggressive tax planning.”

Expert Opinion - Clifford Ng, Partner (Hong Kong), Zhong Lun Law Firm: “China’s take on crypto so far is akin to how it dealt with social media: manage and regulate from the outset and after it has metastasized when it has become unmanageable. China has largely avoided the very negative individual and societal consequences of an unbridled social media space and its tight regulation of crypto and early introduction of the digital Yuan point to a more proactive approach to tackle crypto.”

Expert Opinion - John Shoemaker, Registered Foreign Lawyer, Butler Snow: “Again, I believe that the US will play an outsized influence role regarding amnesty development….with the expansion of foreign ownership of US property reporting and recent new corporate transparency regulations we appear to be on a slow pathway to United States participation in global information exchange…that would most definitely spur amnesty programs overseas.”

Expert Opinion - Suzanne Johnston, Partner, Stephenson Harwood: “Advisors play an important role in challenging their clients to dig deep and consider what is important to them and their family in the longer term. It is important to create a ‘safe space’ for clients to reflect on their objectives and the needs of their families. A comprehensive succession plan should pivot to meet the demands of a family, and of political and economic circumstances over time. If the pandemic has taught us anything, it is that not everything is in our control. However, with careful planning and sound advice, a family can weather the storm. For this reason, in this ever-evolving landscape, families should be encouraged to keep their succession plans under regular review.”

Expert Opinion - Edmund Leow, Senior Partner, Dentons: “During the current Covid pandemic, governments have been forced to spend more, while receiving less tax revenue. They have to find ways to raise the revenue to plug the hole in their budgets. In addition, the rich have been getting richer, while the poor have been getting poorer, which is causing political tensions in almost every country around the world. This gives us an indication of where most governments are going to try to find the additional tax revenue.”

Lawyers in the estate and tax planning space should embrace good relationships with the private bankers, to help their clients

A lawyer who recently moved from a private bank advised bankers and lawyers to communicate proactively. “When it comes to the area of succession planning and private wealth planning, I think it's very important that lawyers have good working relationships with private bankers and wealth planners, because quite often they know the client best, and they have a deeper insight into the client's needs, at least at the start of the relationship. We can help with proper legal advice and tax advice, whereas the bankers are not permitted to offer legal or tax advice. We can come in to help with the more detailed complexities of the structuring, how it will work from a legal perspective, whether it works at all from a legal perspective, how it will work from a tax perspective.”

“As advisors,” they continued, “we have a duty to work with clients and their other advisors at the banks and insurance companies, wherever they may be, their trusted advisors in their family offices, to educate clients and to open their minds, if you like to the other ways that wealth can be invested, and also to the bigger picture that at the end of the day tax isn't the be all and end all. It's nice to have a structure that's tax efficient, but it's more important to have a structure that works for you and your family.”

Another guest offered a slightly different perspective, namely that outside of the privileged HNW and UHNW segments, many of the mass affluent and would-be wealthy individuals are also tempted to push the envelope of compliance and disclosure a bit too far, and they do not have the luxury of expensive lawyers and experienced RMs to help them. Those types of individuals need to firstly be cautious about their actions and secondly be wary of obtaining the wrong type of advice from those without the right level of expertise or sincerity. “The touchy end of the market is going to be the mass affluent, who are still trying to cut corners, and they have no real advisors around them who are telling them the best way to go, I think that's where a lot of the problems are going to lay in the future.”

Some pointers as to courses of action and appropriate strategies

“What is it that my client should be doing or what should I be telling the client?” an expert pondered. “Well, what I typically say, first and foremost, is use amnesties to the fullest extent that they're available, because all this will only get worse. Get things organised, cleaned up, and then move forward, that is a good message for clients, you will certainly not be able to hide things in the future. Take advantage of whatever agreements or amnesties are out there.”

Another piece of advice is to diversify the types of assets held where the clients have more control over valuations and disclosures. “It is actually perfectly legal and acceptable to have some element of non-disclosure, based upon where you're booking assets or how you're structuring, so take full advantage of that.”

Expert Opinion - John Shoemaker, Registered Foreign Lawyer, Butler Snow: “Attorneys will continue to play an increasingly large role in providing advice in a world of increased information exchange, increased taxation and increased risk of criminal exposure from aggressive planning. An attorney provides subject matter expertise, often multi-jurisdictional awareness and most importantly attorney-client privilege protections.”

Expert Opinion - Suzanne Johnston, Partner, Stephenson Harwood: “Following comments from Singapore PM Lee that any wealth tax should be ‘fair and progressive’ one assumes that it will be targeted not only at the very rich but at ordinary folk too (albeit at lower rates). As PM Lee noted, ‘Fair’ means everybody needs to pay some, but if you’re able to pay more, well, you should bear a larger burden. It is important for Singapore to maintain its economic prowess in the region by continuing to attract investment from UHNWI into family offices and VCC's. Ultimately, if the increase in revenue is key, this means developing taxes that are not targeted at UHNWIs alone.”

Expert Opinion - Clifford Ng, Partner (Hong Kong), Zhong Lun Law Firm: “China’s role in the global supply chains and its Covid policy have probably resulted in less short-term economic impact from the pandemic. That reduces the immediate pressure to increase government revenues. However, China is very much focused on managing the wealth gap with the overarching aim of common prosperity. Tax is one element of this. The information exchange and transparency rules popping up everywhere will be a very powerful tool to ensure compliance and drive enforcement.”

Expert Opinion - Edmund Leow, Senior Partner, Dentons: “In many countries, tax evaders are an easy target, because they provide an easy way to raise more revenue without introducing new taxes. It only requires more enforcement of existing taxes.”

Transparency is the key, so choose your structures and your jurisdictions wisely, plan with discipline and get yourselves audit ready

Another piece of advice is to remediate structures and select newer, more forward-thinking jurisdictions. “At the moment, it's all about transparency, it is all about the trappings of understanding the way in which people hold assets, with so much focus on registers and beneficial ownership, and that is pushing people to jurisdictions that have a more reasonable tax rate in place, such as Dubai and the UAE more broadly. They are becoming extremely attractive for families, particularly if they're looking at family offices, perhaps considering the ADGM or DIFC, and obviously, Singapore is ahead of that game at the moment as well. These jurisdictions are encouraging the consolidation of wealth away from what would otherwise be typically offshore financial centres, so the trend is midshore. You're going to see a lot of families becoming sort of audit ready and being a bit more rational about their assets. And the drive to transparency will push this. Once we have publicly available beneficial ownership registers in the BVI, for instance, I can't see many of these clients wanting to have their name publicly available and searchable on a database for free; they'll be very sensitive about the privacy aspects of that. So, that again encourages more to think about midshore.”

And Singapore has a compelling proposition for the world of UHNWIs who can be tax transparent and rest easy at night

A fellow panellist agreed, adding that in all these areas Singapore has a compelling proposition and is a magnet for global wealth and the establishment of family offices. Singapore, he said, is a country which obviously is not an offshore centre but allows wealthy families to conduct their planning in a very legitimate way. “A Singapore family office is nothing like a BVI company at all, it is a real entity and a major difference is also that many of these very wealthy families also come to set up these family offices and actually move to Singapore themselves. This is totally unlike someone who just comes up with a Caribbean passport and thinks that they can get out of CRS reporting in some ways; that sort of ridiculous thinking is what people used to think, but now people know better. If they move to Singapore and give up their previous tax residence, if they take up the right incentives on offer here, they can be transparent and clear. That is why places such as Singapore and Dubai are doing so well. The world is only going to become tighter in these areas, and governments will have more and more data at their disposal.”

Digital assets could well be the tax battleground of the future and the US is ahead in this game

The same expert highlighted how digital assets especially cryptocurrencies will likely be a core sphere of concern for tax authorities in the future. “I do a lot of work with crypto clients, and almost every day come across people who think that cryptos are not taxable, and some of them are billionaires. It is quite amazing really.”

Another guest concurred, remarking on the framework from a US perspective. “The US has been very aggressive over the last two or three years in kind of defining how crypto is going to be taxed,” he reported. “There's an old story of the two US Senators haggling over the income tax bill. And one finally says, ‘look, you can set the income tax rate at whatever you want as long as you let me define what is income’, and that is the big discrepancy we have in the crypto space right now, as the US is going to be hitting the day traders with a capital gain tax that creates a lot of tax exposure and diminishes their returns, but Singapore has chosen not to go forward with a capital gain treatment. Perhaps that could change with crypto, let’s see. Different treatments will arise in different jurisdictions.”

The younger generations of wealthy Asians have a predisposition to pay up for societal advances, aligning with their increasing inclination to impact and ESG-driven investing

The panel then indulged in a somewhat philosophical discussion on whether wealthier people should pay more tax. We know they certainly can, but there are strong opinions from different quarters as to whether they should. To draw the discussion to a close, an interesting point however was raised by one guest who highlighted the increasing willingness of younger wealthy in Asia to pull more tax weight.

“The next generations of wealthy are increasingly open to paying their fair share of tax,” a guest observed. “They are also more focussed on investments that are environmentally friendly, sustainable and in companies which have a reputation for corporate responsibility,” a panellist observed. “This trend is reflected by the private banks who now offer ESG portfolio investments. When I work with the next generation, my feeling is that they view themselves as ‘citizens of the world’. With that in mind, it is vital the planning we put in place is holistic. What I mean by that is that it's always good to have a tax efficient structure but that doesn’t mean paying no tax. It also isn't necessarily the key driver for the structure. The importance of providing for family in a meaningful and responsible way, cannot be underestimated. So, I suppose, just to add a different take on this and to offer a little bit of optimism in terms of the next gen and their willingness to take advice and to also think outside of their bubble of wealth and their country and look to the greater good.”