Publications & Thought Leadership

The Complex World of Wills and Testaments: Thinking Ahead and Getting it Right

Aug 10, 2021

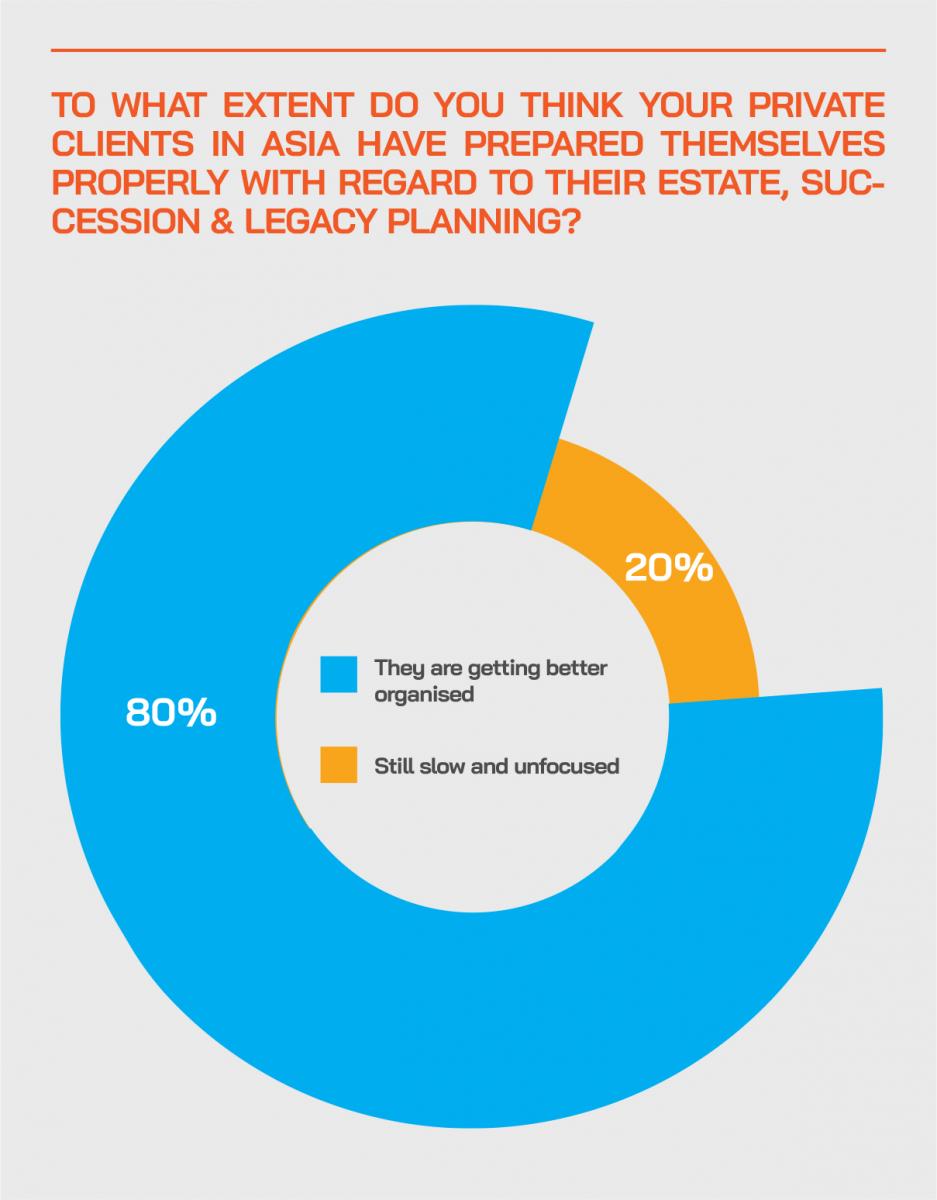

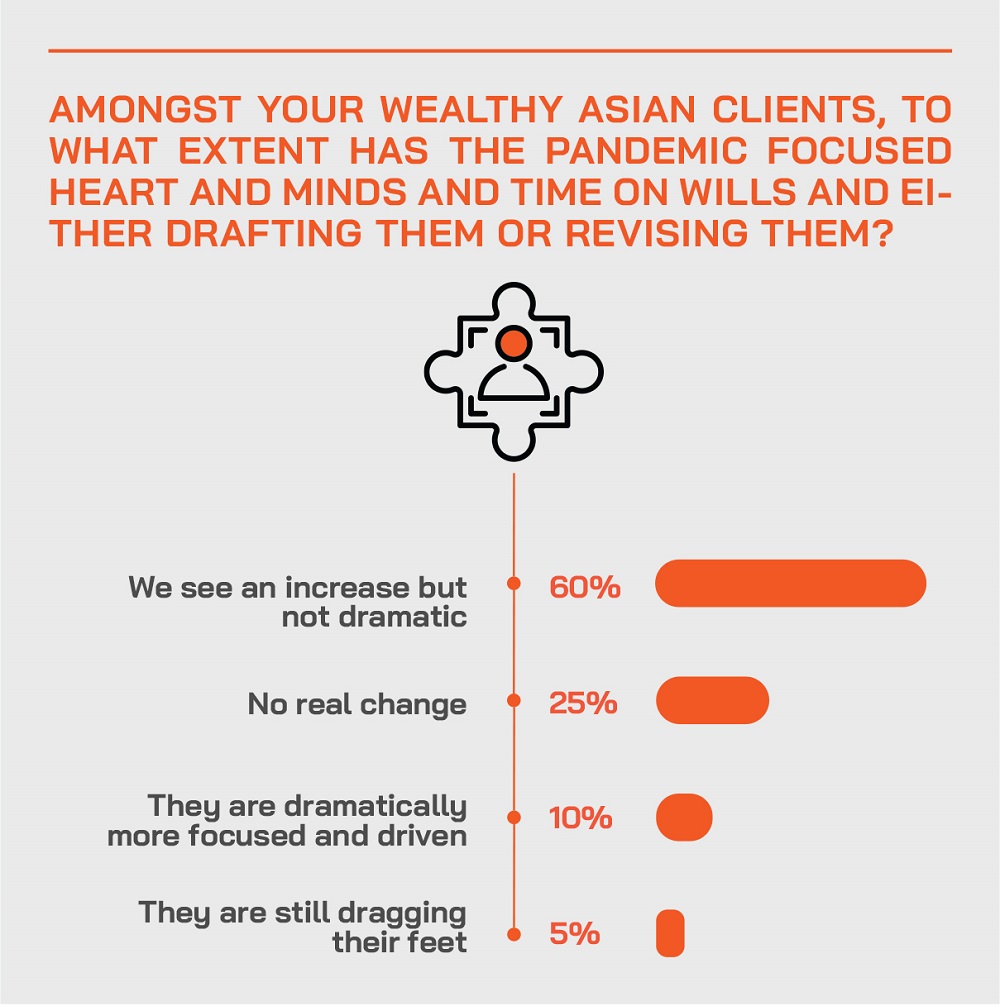

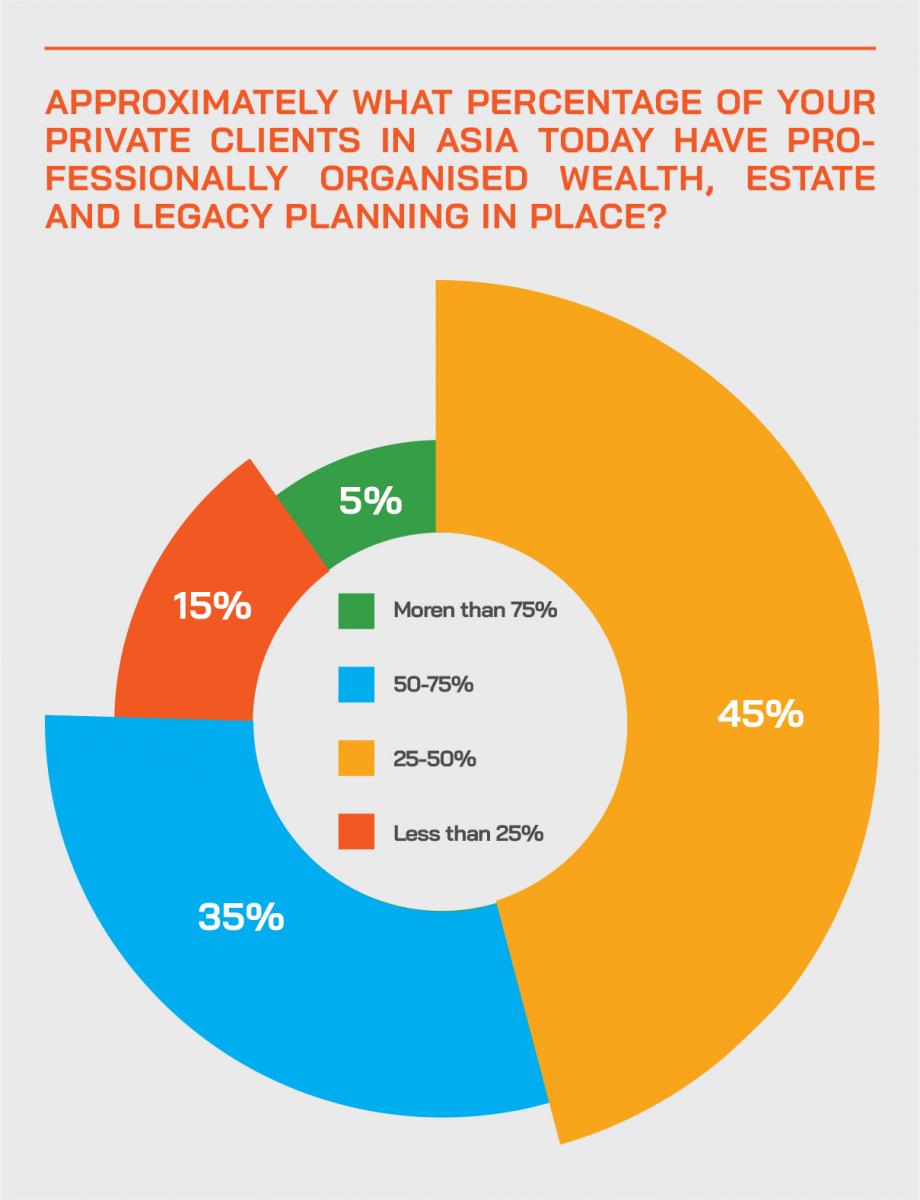

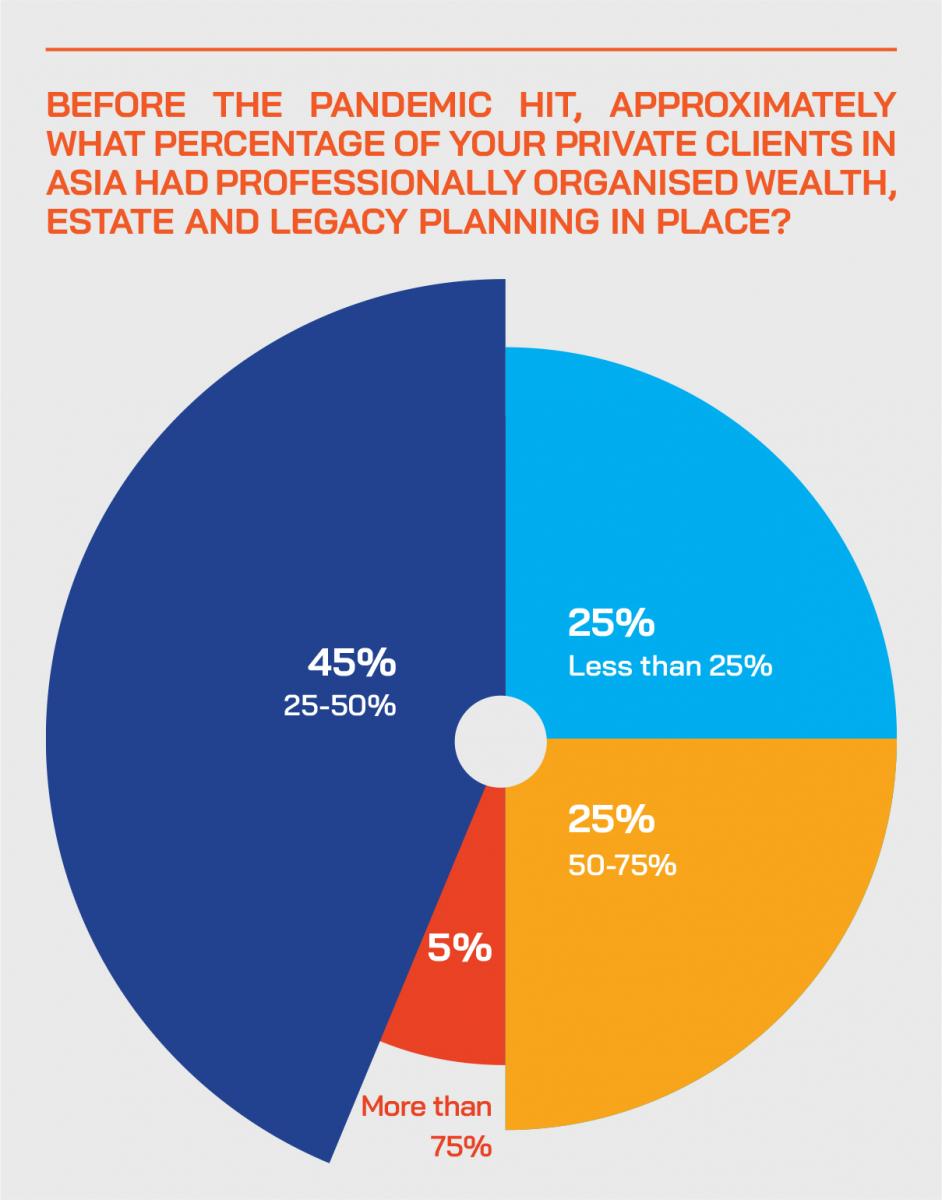

The global pandemic has focused hearts and minds across the world on issues of mortality, and in the world of private wealth management, bankers, advisors, trustees and lawyers are all reporting a dramatic increase of estate and legacy planning. As well all know, lives are complex these days, and the more wealth individuals have, so too usually the greater the complexity in their family lives and the greater the diversity and dispersion of their businesses, homes, financial assets and overall wealth. Whatever the scenario facing the individual and the families, the first advice from any good family lawyer is ‘Make a Will’. But to do so inclusively and professionally takes time and planning, and to do so poorly risks horror stories ahead. And if an individual dies without having a valid will in place, he is ‘intestate’, and possibly at risk of forced heirship provisions in some jurisdictions, and that should really be avoided if at all possible. For those who write proper Wills, they need to be aware that they must be written extremely carefully, they must include literally everything that they own, and they must be aware that in a litigious world such as well all inhabit, they can be challenged by family or indeed third parties, if they feel hard done by, or aggrieved, or if there are cloudy areas that might need interpretation. Sometimes, other family members arrive on the scene unexpectedly, unbeknown to the principal family members. In a complex world in which wealthy families have so many overseas assets of different types, the Will must be comprehensive and tax efficient wherever possible. The individual might need multiple Wills to cover different jurisdictions. Then the Wills should link tidily to the lifetime trusts in place, or contain proper provision for the creation of trusts on demise, known as pour-over trusts. Executors must be appointed in the Wills, and substitute executors as well potentially. Remember, during probate the Will is publicly accessible, so to maintain privacy perhaps all disbursements should be conducted through the trust. And the process of probate is often extremely time consuming, and stressful and a very careful eye must always be on the tax implications, not only in the domicile of the deceased, but also in the jurisdictions where various businesses and assets are held. In our Hubbis Digital Dialogue of July 22, our carefully assembled panel of experts offered their perspectives and advice on these and other vital issues.

The Panel:

- John Shoemaker, Registered Foreign Lawyer, Butler Snow

- Zac Lucas, Partner, McCarthy Denning

- Mark Smallwood, CEO, Rapier Consulting

- Tim George, Partner, Withers Worldwide

- Richard Grasby, Founder, RDG Fiduciary Services

Some of the questions addressed by the panel:

- What exactly is a Will, and does it differ in different jurisdictions?

- What are the key components of a Will, and what are the essential elements that must be considered and included?

- How does the Will relate to other estate and business legacy planning structures that wealthy private clients might have in place?

- Do HNW and UHNW clients with assets dotted around the world need just one Will or will they need multiple Wills?

- What are some of the risks of preparing Wills badly, or worse, neglecting to do so entirely?

- How should lifetime or possibly pour-over trusts be aligned with Wills?

- Is the Will private during probate, or do we need some form of trust to ensure privacy?

- How does all this align with liquidity for the family after someone passes away, and what should be done to ensure smooth transition and sufficient liquidity?

- How does tax – both in the main domicile and in the locations of overseas assets – factor into the writing of Wills?

- Who are the right Executors?

- What exactly is probate and how long does it take, and who should handle it all?

- How do Wills also encompass the challenges of the new world of cryptocurrencies and digital assets?

- Which professionals should be involved in the Will preparation?

- How to safely store the Will and what are the pitfalls of not planning this properly?

- The value of being inclusive and transparent, but where do you draw the line?

Key Observations

A Will is vital, perhaps more than one, but this should be constructed as part of holistic planning

Everyone knows what a Will is, but for HNW and UHNW clients a Will should also form a constituent element of a much broader holistic approach to legacy planning, and for that to take place there needs to be a deep understanding of a client's family situation and their diverse asset base, whether moveable or immoveable assets and in whichever jurisdictions around the world. Typically, there will be potentially more than one Will to cover different countries, and connectivity can be achieved between them by the judicious use of trusts and insurance policies.

Domicile matters in a globalised world and inventories are essential

Clients very often have assets and family and business ties to various jurisdictions but from a common law perspective, a key fundamental is domicile, which is fixed, but that under some circumstances can change. Domicile is finally determined at date of death, although at some times, it can be determined at the date of the writing of the Will, and can be affected by capacity. “Domicile used to be fairly non-contentious in the sense that it was fairly easy to establish,” an expert commented, “but in today’s world of expats, mixed domicile marriages, children and grandchildren domiciled overseas, it is not such an obvious answer.”

And then numerous issues must be considered in terms of movable or immovable assets, in joint assets, joint tenancy with rights of survivorship, and so forth. Accordingly, an inventory of what is owned is vital as part of the whole process.

Movable and immovable assets can and should be consolidated well in advance

There are many steps that can and probably should be taken well in advance. For example, immovable assets can be put into a company or other vehicle that is effectively then a moveable asset. Company shares and other assets can be consolidated into trusts. All such moves should be debated openly and discretely with professional advisors, lawyers and tax specialists. In the US, an expert added, these matters must be considered on a Federal basis, and from the viewpoint of the 50 different states across the nation.

The tax residency of the beneficiaries must also be carefully considered

Where do your beneficiaries reside? What are the tax implications for them, wherever they reside? In short, tax efficiency of the assets distributed can be improved by proper forethought and with the right structures.

Private bankers and advisors can help their clients, providing they have genuine trust

Is your relationship with your private client strong enough to allow him/her to trust you enough to open up to discussions about Wills and legacies? If so, you are clearly in a trusted advisor role, and can add significant value to your clients by helping them focus on the key issues and then potentially helping bring in the right legal experts to draft and execute the Wills. But as an expert had already commented, it is not about just drafting the Wills, it is about the additional planning required, which can be facilitated with the help of wealth planners, lawyers with real expertise in Wills and legacies, who truly understand the intricacies required. A good starting point is often the inventory of wealth and assets, in great detail, and lists of beneficiaries and their jurisdictions of residence, marital status, their children and so forth.

Expert Opinion - Richard Grasby, Founder, RDG Fiduciary Services: Today’s clients have much more of an international exposure in terms of residence, citizenship and asset ownership. In many common law jurisdictions, an individual’s domicile is key. This should not be assumed and requires analysis by an advisor with experience in this regard. For most clients it is unlikely that one advisor will know all of the answers. The question of whether to have one will or multiple wills is one which should be dealt with on a case-by-case basis.”

Once the Will has been drafted, secure storage away from possible tampering is vital

With all the necessary structures in place and a Will or multiple Wills if necessary to cover other jurisdictions, the Will(s) need to be stored securely and away from possible tampering, with the asset inventory also in place and secure, and with the right people aware of the key details.

Multiple Wills might be required, so plan ahead appropriately and beware of revocation

An expert observed that the decision on whether to have multiple Wills rests partly on which assets are located in which jurisdictions, and whether they are civil law or possibly Shariah law jurisdictions. “In many cases, if you try to execute a global will effectively, it might not work if you're dealing with immovable assets in a jurisdiction that has forced heirship, for instance, as it will just override the provisions of the Will that you intended to have in place,” he observed. “But you must be careful of the revocation clause, as most Wills start with revoking everything that is in place.”

“I think sometimes people get that question backwards from a cost or timeliness perspective, they're thinking, well, okay, one's going to be simpler and cheaper and multiple will be the problem, but that is certainly not the case,” came another opinion. “Doing one could be a lot more time consuming and expensive and restrictive than multiple Wills as long as each of the multiple Wills is aware of each other and coordinates so that they're not inadvertently revoking or limiting the outcome.”

Beware of some of the more obvious mistakes in the drafting of the Will(s)

An expert remarked that mistake sometimes arise in not taking account of forced heirship and matrimonial property regimes. Other mistakes tend to centre on tax, either on the assets themselves, or on the beneficiaries receiving the proceeds of the estate. Another mistake might be one Will accidentally revoking another Will, perhaps in another jurisdiction.

Pour-over Wills have advantages, but be wary of poorly constructed ‘pour-over’ provisions

A pour-over Will is a testamentary device whereby the creator of the Will creates a trust and distributes the estate to the trustee of that trust on his/her demise. The concept of ‘pour-over’ therefore centres on a Will that has a provision that on someone’s passing, their residuary estate will ‘pour’ into a pre-existing trust, which an expert reported is very popular, particularly in the US, where there is a coordinated regulatory environment at Federal and state levels to handle them.

An additional benefit is that any assets not included in a lifetime trust, if the deceased had one, can be mopped up in the pour-over Will into this trust. And Wills are public, but trusts are private, so there is also a privacy benefit.

But an expert cautioned: “The danger is in Common Law we have no specific provisions for this, and the danger is therefore that once you begin tinkering with the beneficial ownership, or at least the provisions on the beneficial ownership of that trust, you can invalidate that going forward. There are recent Canadian decisions on this, which invalidate ‘pour-over’ trusts of themselves, just because they have the ability to be amended. Accordingly, you must talk to your local counsel to avoid an invalidation.”

Look at decisions firstly from the perspective of the assets to be transferred and the jurisdictions

The key decision as to whether to use lifetime trusts, the Will alone, a pour-over trust or other solutions needs to be based on the underlying assets and the jurisdictions, a guest stated. “A vital takeaway, I think, for those on the presentation today is to understand that the question of do I need this or that is probably not the right starting point, the right starting point is to understand the types of assets or the types of situations or the types of family situations to determine where one might be better than the other.”

Advisors need to be aware – the creation of trusts can be triggered as testamentary trusts

An expert noted that not many wealth manager generalists are aware that people do not need to set up the trust immediately; they can have what is called a testamentary trust. The Will itself has built into it a trust which would become effective on the death of the testator, and the executor, typically, of the Will, would at that time become the trustee of the testamentary trust. “That can be very useful for most families in any event, for example, where there are young children involved,” he explained. “Clearly young children cannot benefit directly from owning assets until they reach their maturity. So, an executor is going to likely to have to act as a trustee until that time. There are of course many factors to consider with respect to the family situation and what constitutes the best decisions and process.”

Properly constructed Wills can also house provisions for digital assets

An expert observed that it is not only cryptocurrencies and digited assets that sometimes need to be addressed in Wills – for example a share of a work of art or a set of Bitcoin – but also things owned digitally, such as a collection of movies and music acquired, for example, through Apple iTunes. Those assets can and should also be passed on to beneficiaries. And for really valuable digital assets – for example a large holding of cryptocurrencies in a digital wallet – passwords and wallet ‘keys’ must be passed on, and therefore the passwords and other data must be included in the Wills and list of assets and stored securely but also in a manner accessible to beneficiaries. Without those, the executors will not be able to pass that information, and therefore the underlying assets, to the beneficiaries of the Will.

The world of digital assets is immensely fluid, complex and secretive – everyone beware

An expert remarked how difficult it is for lawyers and estate practitioners and indeed almost anyone to keep pace with the speed of developments in the universe of digital assets, and how they can be taxed effectively, and the implications for Wills. He noted that, for example, the Law Commission in the UK are currently looking at this, including the issue of the applicable law jurisdictions for these digital assets.

“This particular asset class is becoming very interesting but the supporting structure around it doesn't exist, and the advice around it doesn't exist either,” he cautioned. “At some point, we're going to have to get some clarity, hopefully the Law Commission’s consultation report will help because it will be taken seriously by common law judges around the world if they need to refer to it but it is a worrying area because this is an asset class, a growing asset class and we're not keeping pace with how the laws that we've been talking about will keep up with all this, even for simple elements such as where are the digital assets even located. I think that's going to be a long-term problem for us.”

Are digital assets the new form of bearer shares or bearer bonds?

Another guest agreed with those comments, adding another perspective: “Albeit this is effectively the digital bearer asset. The bearer share used to be the planning choice in Asia, the key to the drawer with all the bearer shares, and everyone's none the wiser. Now you've just got the digital wallet key, the private key. If you own the key, you own the asset effectively and everyone is none the wiser because it's all encrypted. So, you can trace what happens to that coin, but you don't actually know who now has it.”

It is generally advisable to take action early and pay tax rather than trigger higher tax dues later on

A US tax expert commented that if, for example, someone lived in the US but is no longer resident there for tax purposes but still has assets there, it is often better to sell those assets, pay the taxes due, and save the complexity of beneficiaries needing to unwind those assets and potentially pay much more tax at a later date.

Remember - the Will is a public instrument, so leaving the disposition to the trust offers far greater privacy

An expert cautioned that all those preparing Wills should remember that during probate anyone can request access to a Will. When the testator (other terms can be deceased, settlor, assignor) passes on, the probate process is a public exercise with the information available to anyone who might request it. But very often the information is very limited; for example, very often wealthy people pass on some or part of their trusts, and all the dispositions to beneficiaries are then from the trusts. For wealthy clients to maintain privacy, this is the preferred route.

Then the question comes as to whether you set up a lifetime trust or do you have a pour-over trust directly for the provisions of the Will. You need to get it right if you're doing a pour over will to an existing trust. The lifetime trust can include a lot of immovable and movable assets, but the deceased may have other assets which were not feasible to move during their lifetime to that trust. They may, for example, be immovable assets that would trigger taxable gains on transfer into the trust.

As governments struggle to balance their books, more challenges are anticipated

A guest remarked how there are already more and more challenges from the state regarding Wills, especially related to domicile issues. He noted that the UK HMRC had been winning some of the cases. “There are many who would argue they are for example domiciled in Hong Kong and no longer in the UK,” he said. But HMRC might dispute those assertions, especially if there is a lot of tax to be gained at stake.

And challenges might come from within the families as well

Was the deceased of sound mind when he/she made their last Will? Was it valid for past Wills to be superseded by those new Wills? There can be challenges from within the family or even potentially from family members that might not have been known about, for example if the deceased had had a child with another partner outside the marriage. Perhaps children from former marriages might challenge the Wills, claiming neglect or undue influence from some party over the testator. “There are plenty of arguments that people will run, particularly where they've been disinherited and especially when there are large sums at stake,” an expert warned.

And this becomes even more complex if forced heirship comes into the picture, should there be no Will, or the Will was defective in its drafting or registration. Another expert also noted that amendments to Wills – codicils - must be carefully drafted, including of course where there are pour-over trusts.

Get your ‘Powers’ in place early on, well before mental capacity becomes an issue

A lawyer cautioned that people should be creating their Power of Attorney to deal with the eventuality of losing capacity but not dying. “That entirely separate from a Will,” he explained. “But the particularly annoying thing about powers of attorney is that they are jurisdiction specific,” he commented. “You can have one global Will, but not one global, enduring or lasting power of attorney. In an ideal world, you would therefore have a power of attorney in every single jurisdiction where you have an asset, but that's ridiculous, so it is best at least to pick a few jurisdictions where you have significant assets, where either you're going to need access to those funds, wait and lose capacity, or where they are the type of investments or something that might need to be dealt with urgently, so to ensure that you have someone in place that can do so. In short, make sure you think about capacity issues alongside the Will planning.”

Make sure you have plentiful solutions for instant liquidity for the family and businesses

Even some life insurance policies can take months to pay out, especially at this time of remote and electronic paperwork, so the families might be stuck for liquidity after, for example, a patriarch or matriarch passes away. It is therefore strongly advisable to ensure appropriate liquidity in a host of other ways, properly structured and of course compliantly from a regulatory perspective. “I would say that family members other than the main matriarch/patriarch do need access to cash,” he advised. And therefore plan ahead, pay the necessary fees to lawyers and other parties to structure these matters properly.

Don’t make the obvious mistakes and forget assets that need to be included in Wills and trusts

A guest remarked that all assets, pension and other wealth, even if not yet distributed from policies or state sources must be considered and aligned with the Wills. In Singapore, for example, he remarked that Central Provident Fund (CPF) contributions are not covered by Wills, so people with CPF wealth need a CPF nomination. “And the same with insurance policies, typically, you need to make sure that the beneficiary nominations are right up to date and then keep those in order.”

Finally, there is great value in transparency and inclusiveness within the family circle

The final word went to an advisor who said that, especially for those wealthier families leaving businesses and great wealth, but actually for many people with wealth to disburse, the whole succession process should be discussed with the family prior to the patriarch/matriarch passing on. “One of the biggest problems for the large and wealthy families is family disputes, which typically happen when the patriarch/matriarch has passed on, so, a lot of expectation management can be handled by having family reviews, discussing asset dispositions openly so that the expectations are managed before the event and recorded in writing as well and recorded in the minutes of meetings so that there is plenty of evidence to suggest that everyone was aware of the process long before the event took place and nothing's happening which wasn't expected.”