The Adoption of Digital Assets & Tokenisation Amongst HNW and UHNW Private Clients in Asia

Apr 28, 2022

Setting the Scene

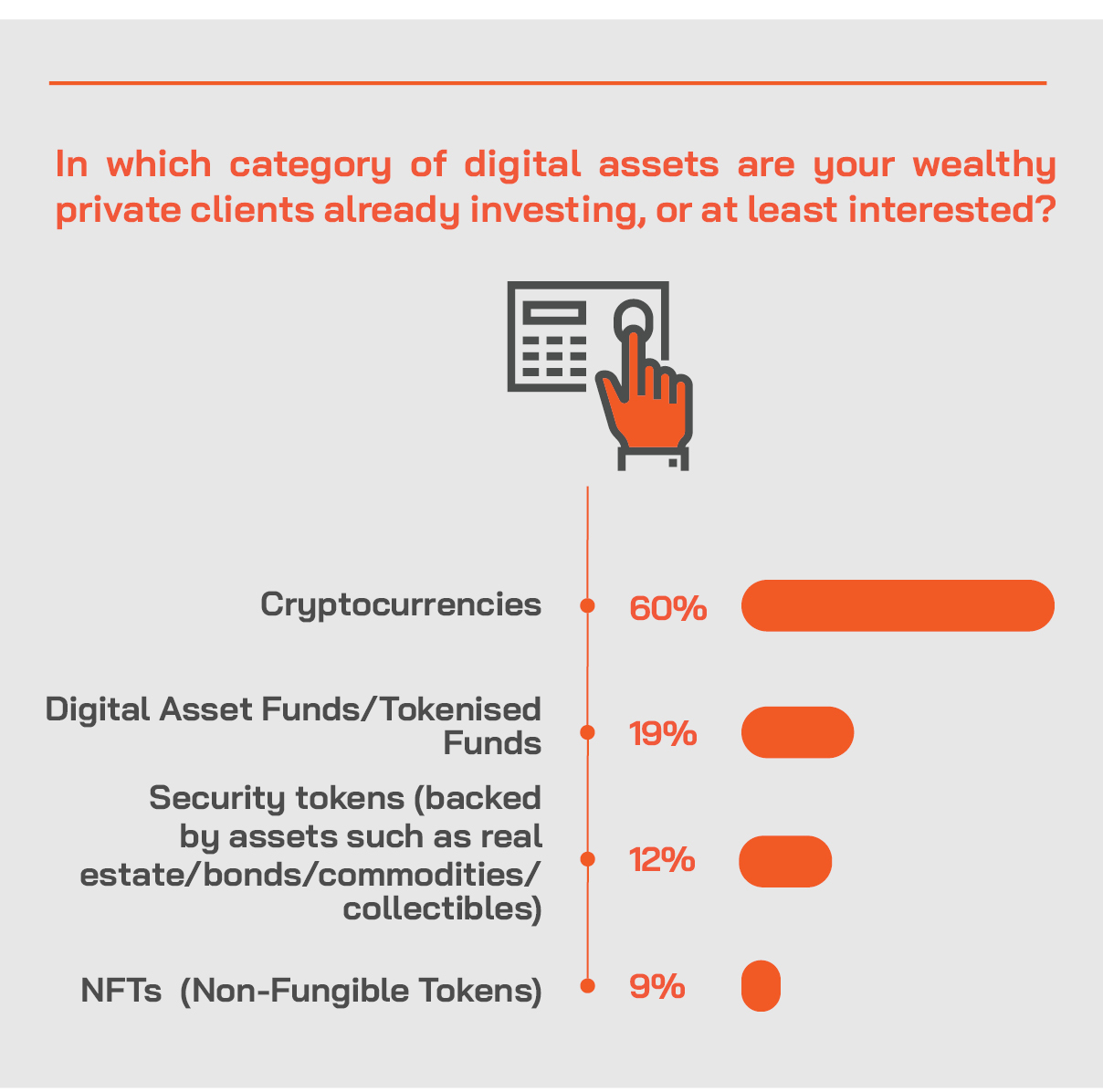

We all know the speed at which the universe of digital assets is expanding, as cryptocurrencies, digital tokens and non-fungible tokens and the rapidly growing sphere of Decentralised Finance (DeFi) proliferate at such a pace as to be literally mind boggling.

At the same time, the digital assets ecosystem, encompassing exchanges, custody, specialised brokerages/platforms, funds, regulatory and compliance, is evolving apace. Meanwhile, some of the regulators are ahead of the game and encouraging these developments – Switzerland and Singapore are two key protagonists – while others lag somewhat behind, and several major jurisdictions appear totally opposed to these developments, with China as the core example.

So where does all this leave wealthy private investors? Should they be dipping their toes into this rising ocean of digital assets, or taking a larger plunge? Should the professional wealth management industry be facilitating or perhaps even encouraging their participation?

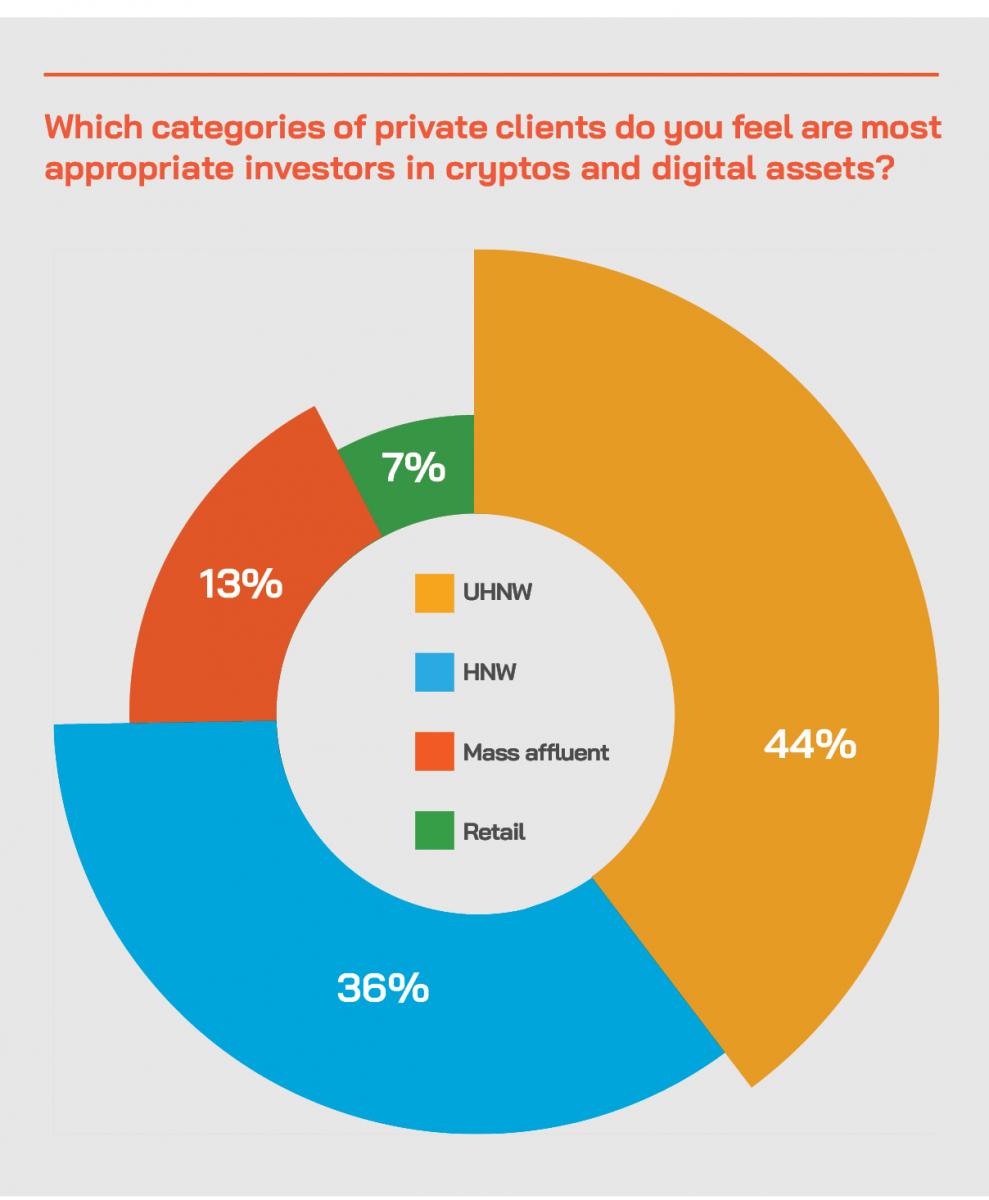

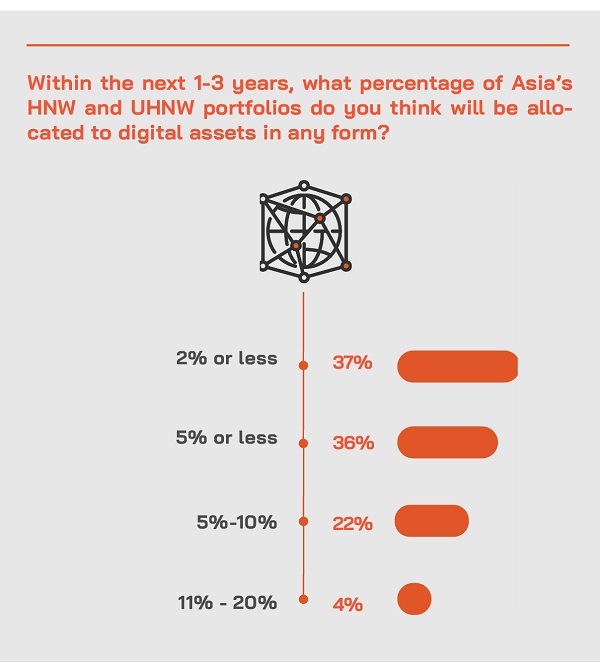

Hubbis, in partnership with Chintai, attempted to gauge the sentiment of the market in Asia through a recent mini survey that we conducted amongst leading wealth management professionals in the region. We focused, in particular, on their HNW and UHNW private clients, being those with the financial wherewithal to diversify their broader investment portfolios to include a rapidly widening array of digital assets.

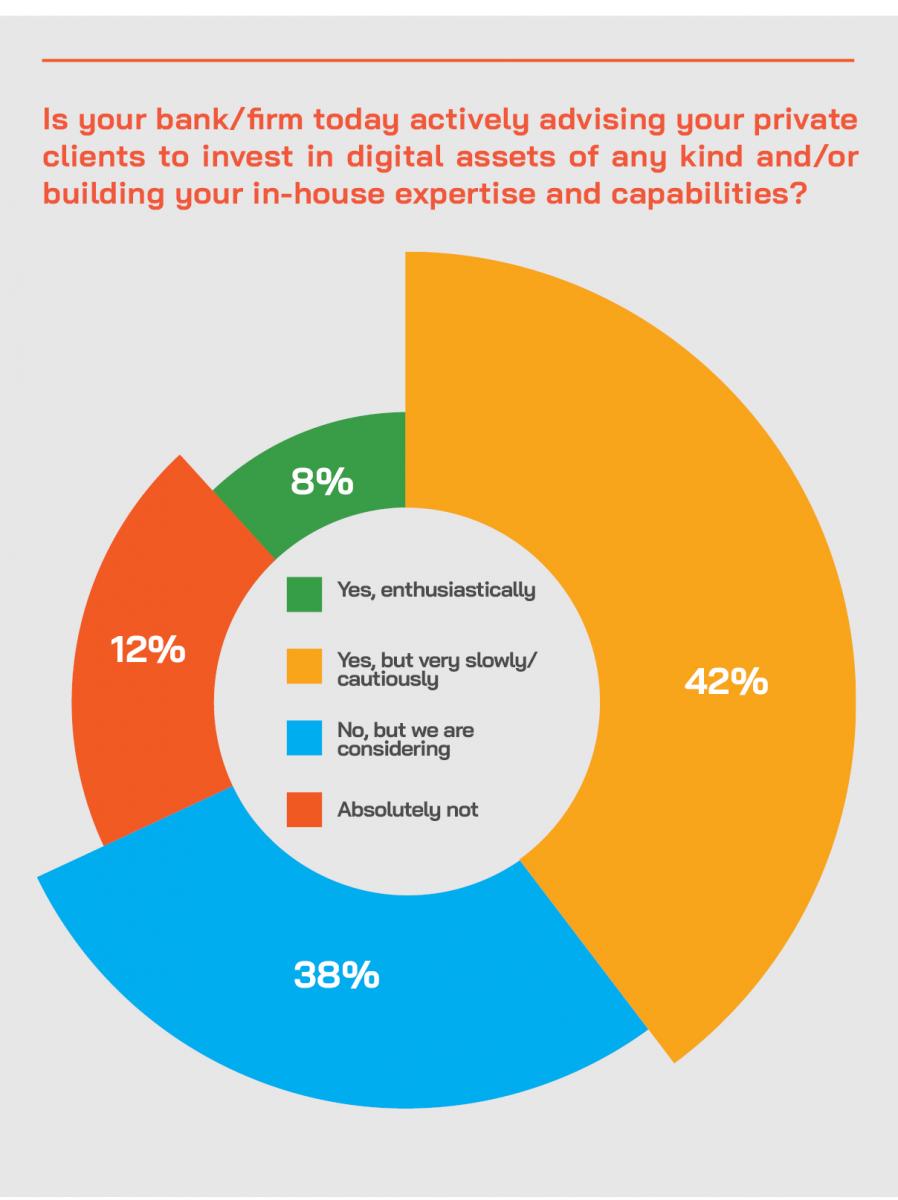

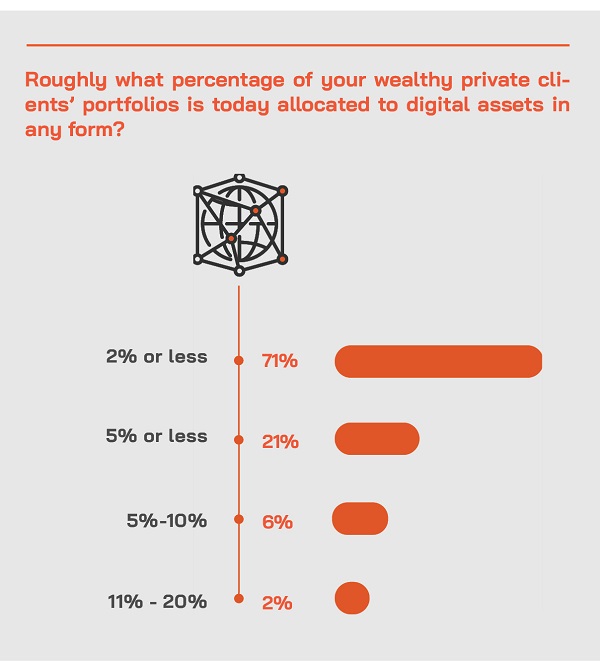

From the 96 replies we received from senior participants in the Asian wealth management industry, it is fair to report that some private banks and wealth management firms remain sceptical about cryptocurrencies, citing their inability to link their prices to any fundamentals whatsoever, and concerned about non-fungible tokens, but more positive in general about digital tokenisation via fractionalisations of underlying physical or financial assets ranging, for example, from major real estate projects to collectibles to private equity and much more.

And there are other private banks – and these include some of the oldest brands in the business – and plenty of firms within the independent wealth management community that believe digital assets are core to our collective futures. And there is a growing number who report that some of their clients are vigorously and enthusiastically engaging in digital assets. Yet of course there are others who remain far more cautious, albeit becoming more receptive, and some – more of a minority nowadays – who are downright dismissive.

Taken as a whole, the survey underscores how the stage is set for the ongoing rapid and remarkable expansion of the universe of digital assets. However, to take things to the next stage, the colossal dynamism of key proponents must be aligned to a deeper and more professional ecosystem, greater security, better regulatory oversight, and a more ‘comfortable’ compliance protocol for the private banks and other intermediaries.

It appears from this short survey as if our respondents consider that is indeed now taking place, albeit not quite as fast as the creators and innovators might like.

Assuming progress continues and the right roads are followed, the participation of the leading banks and wealth management firms looks more assured today than at any time before.

In short, there is much work to be done, but very considerable cause for optimism.

Additional Observations & Commentary

To put some more flesh on these bones, but at the same time trying to avoid over-complicating matters, Hubbis has summarised some of the associated commentary we obtained from our 96 respondents. Read on…

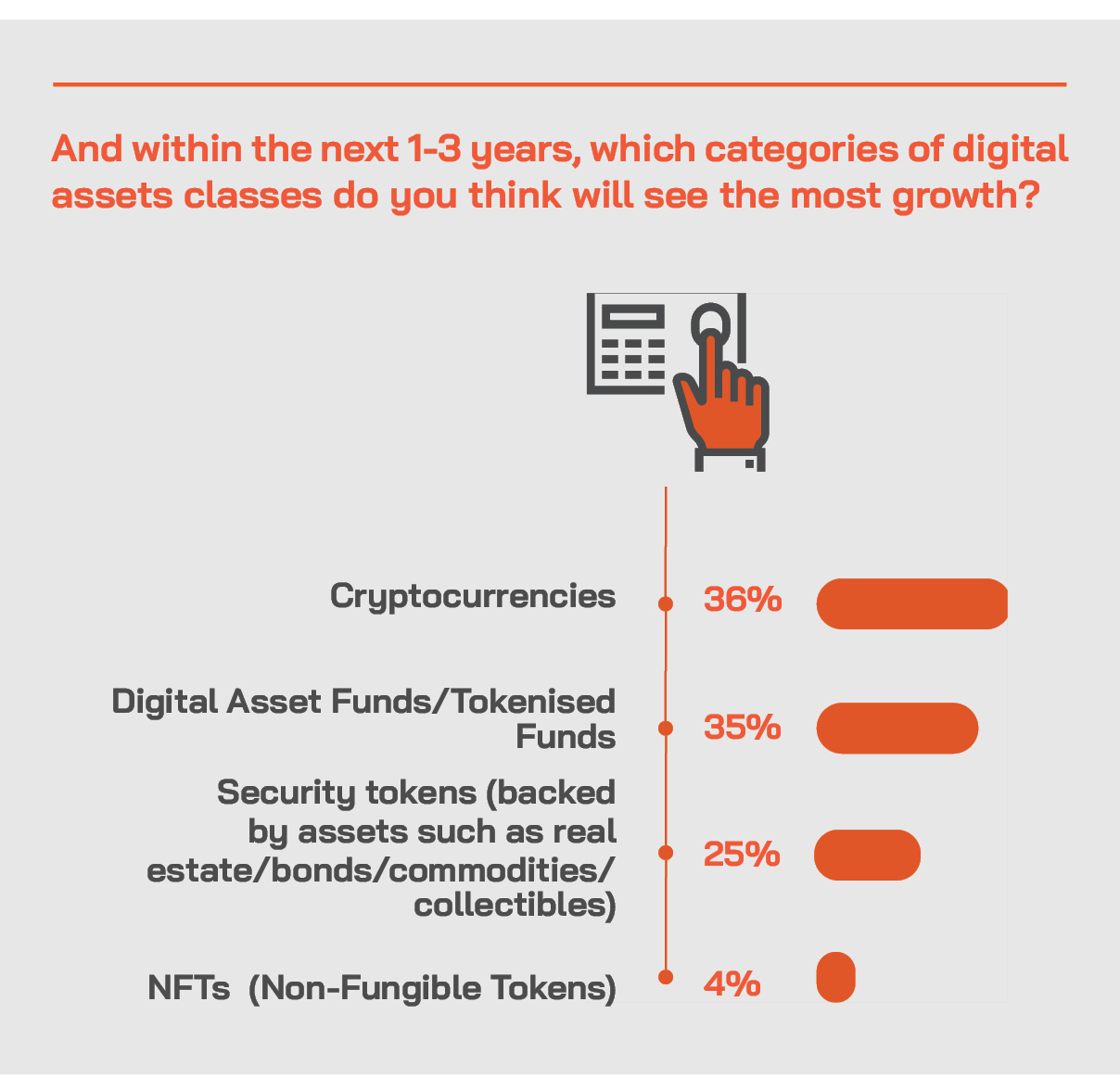

There are those in the wealth management community in Asia who are believers, there are the more tacit supporters, and there are also still plenty of detractors. But the trend line is clear – digital assets are on the rise and there is constantly growing diversification and an expanding array of choices available

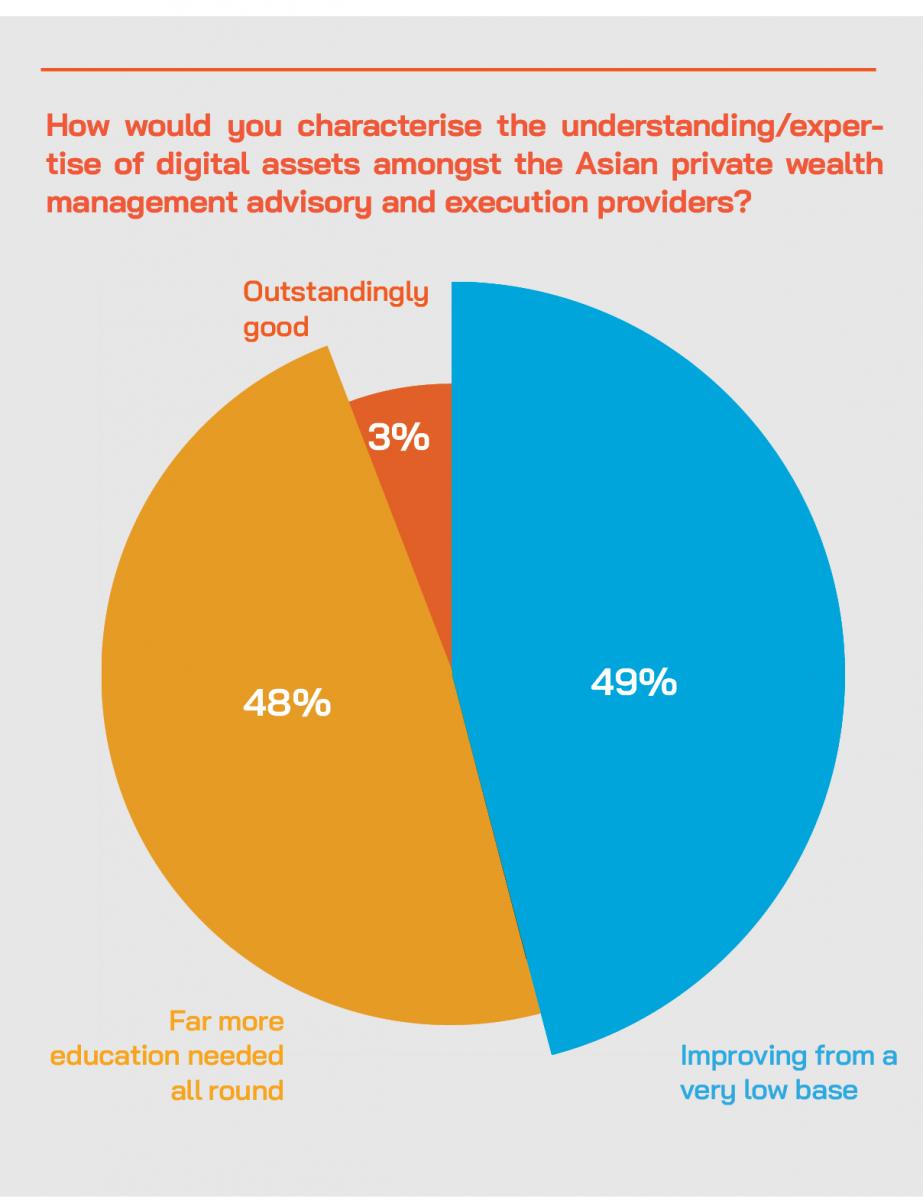

For those in the wealth management community who are more on the negative or reticent side of the fence, we can summarise their replies briefly as follows. They cite excess volatility amongst the leading cryptocurrencies, they worry about lack of clear of coordinated regulation, they have concerns around the weak understanding of the assets. They think the infrastructure and ecosystem remains under-developed for clients and the advisory community. They point to the difficulty in valuing cryptos in particular, and concerns over regulation and compliance.

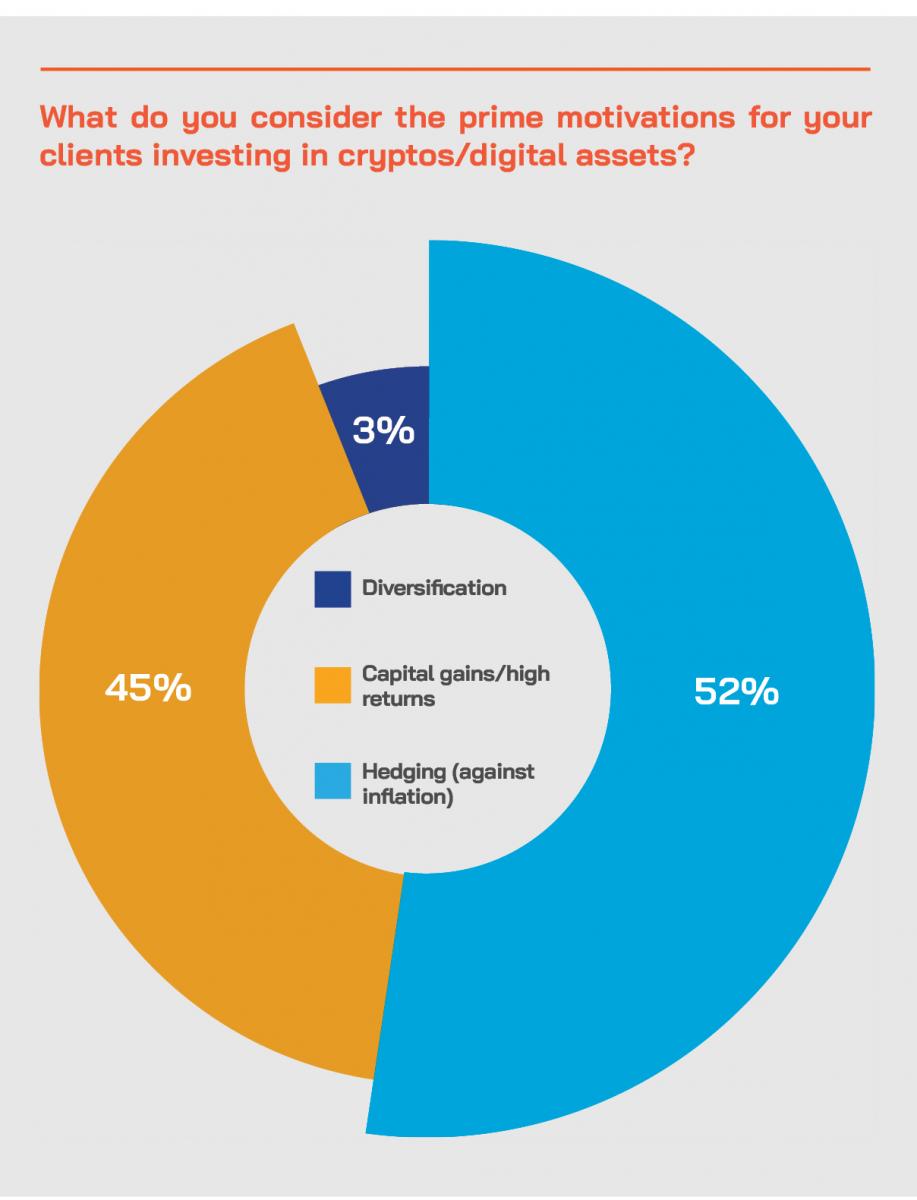

On the more positive side of this particular fence, respondents cite the value in portfolio diversification, and the significant potential for gain, as evidenced by the stratospheric rise in prices of Bitcoin, Ethereum and others over recent years.

They cite the need for clients and team members to boost their knowledge through (cautious) participation, and they highlight the track record of the value created through holding rather than trading the key cryptos.

They point to the accommodating or confirmatory regulatory environments in some markets, for example in Switzerland or Singapore, and some highlight the real risks associated with fiat currencies and their very visible manipulation by the central banks.

It is an emerging asset class, and many are willing to advise investors to experiment and learn, so they are well positioned for the remarkable developments so many expect ahead. Some also point to the younger generations of Asia, who are more digital natives and more receptive to diversification. Many replies point to digital assets and the blockchain representing the future of finance.

Expert Opinion - David Packham, Founder, Chintai: “There are many advantages of asset tokenisation, including instant liquidity for illiquid assets such as major real estate projects or private equity, the digitisation of novel and collector assets (for example, art, fine wines, or other collectables), the avoidance of restrictive fees in the traditional issuance outlets and venues, global centric issuance, 24/7 trading, and reduced administration and compliance costs compared to mainstream markets.”

More and more private banks and wealth management firms operating in Asia are climbing on board the cryptos and digital assets express

Some of the global and boutique international private banks are already committed to the universe of digital assets, some are detractors who say they will not join in, and many are thinking seriously about it. But the trend line is clear - rising investor demand and attractive commissions in this space offer magnets for participation. Most of the banks and other firms report that they need to be involved so as not to disappoint clients, even if they are only facilitating participation rather than actively promoting or encouraging investment. Some report that their involvement is helping build understanding and skills within their banks and advisory firms. All tend to advise caution rather than exuberance, with a preference for directing clients towards professionally structured active or passive funds, rather than self-directed trading.

All of them note the improving ecosystem and infrastructure, and indeed some of the larger banks are investing indirectly in businesses or technologies related to the digital asset revolution, not only cryptos, but also the wider range of tokens. Respondents noted the expansion of licensed exchanges and intermediaries, as well as the development of more professional and robust crypto/digital assets wallet infrastructure and custody.

Expert Opinion - David Packham, Founder, Chintai: “We are seeing a large number of disruptive and innovative use cases looking to tokenise everything from carbon and agricultural land, through to commodities and securities. In all cases, the opportunity to expand access to forms of value exchange in early issuance, is the most powerful potential change that will help reduce the gap between the wealthiest and poorest in society.”

There are still many major psychological, procedural and infrastructure hurdles to overcome for some of the major global intermediaries, whilst the more boutique operators are largely more receptive and agile

Some replies from the banks reported that whilst many of their private clients are keen to participate in cryptos and other digital assets, their own systems need to evolve significantly in order to accommodate trading and reporting in digital assets, and for proper compliance.

The smaller banks and some of the IAMs/EAMs/MFOs have more agility to achieve this, and are more interested in adopting White Label solutions from third parties, largely because they see this market as offering differentiation to their clients and a valuable source of incremental revenues.

On the other hand, for the global and major banks, the trading of digital assets on a daily basis remains relatively insignificant, for example in relation to daily trading and spreads in the global currency markets. Rough estimates of daily cryptocurrency volumes are in the region of USD150 billion, while the global currency volumes are more like USD250 billion per hour.

However, some replies stated that the whole digital asset space has already become so big, and is expanding so rapidly, that you simply can't ignore it as a bank or private wealth manager.

With more and more clients taking some exposures to these assets, and larger investments expected, clients are expecting their banks and advisors to have greater knowledge. As digital assets move more into the world of mainstream finance – as many experts believe will increasingly be the case – then more of the major institutions will embrace this market.

Some banks (and others) believe that there is too much reputational risk for them to be proactive in advising clients to invest in this market

It is clear that some of the banks, especially in general the larger brands, are concerned that the regulatory infrastructure in particular remains confused and confusing, which means that their compliance teams struggle to come up with a clear opinion of the risks to the clients and therefore to their own institutions.

The difficulty in valuing cryptocurrencies is often cited as a key impediment, as there appears to be no inherent value associated with them. The world of asset-backed digital tokens is easier to analyse, but here the detractors are concerned about liquidity and transparency, as well as the regulatory environment.

Most of the banks indicate that if they participate, it is to support clients, often related to reverse enquiry, but not to actively advise them in these areas, at least for the time being.

Many cite their fiduciary responsibility to clients, explaining that until they have greater clarity on valuations, the trading, reporting and custody ecosystem, and regulation, they will remain at the edges of the market, helping where they can but not necessarily actively endorsing.

Expert Opinion – David Packham, Chintai Founder: “As to the applications to the Asian wealth management industry, Chintai wants to be the go-to digital asset platform for EAMs, family offices, asset managers and financial institutions. We offer these partners the potential to take a one-step dive into blockchain through our platform. These types of parties do not honestly have the capability, the skill sets, the time and the technology to do it in house. Our blockchain solution has been built with them in mind, with automated compliance, as an AI-enabled platform that ensures that all transactions can be traced, tracked and are immutable. Many of the private banks and plenty of the EAMs are not capturing the needs and aspirations of the new generations of wealth, and digital assets might be the silver bullet for private banks to engage them.”

Digital assets compliance is indeed a work in progress, and, let’s face it, that progress is lagging well behind the market’s evolution and dynamism

Compliance is a key concern, and the bigger the banks usually the more cautious. Moreover, as there is no cohesive view from regulators and governments on digital assets, and as regulation is very much in its early stages, it is very difficult to hit such a fast-moving target.

The most difficult area is not necessarily the transactions between fiat currencies and cryptos, as those are easier to track, but between crypto and crypto, or crypto and digital tokens, for example. Respondents cite difficulties in tracking those assets within the wallets and therefore highlight the associated compliance issues, especially in relation to KYC and AML.

On the other hand, some replies pointed out that the blockchain, which supports Bitcoin and so much of the digital asset infrastructure, is actually potentially easier to supervise and monitor than the world of hard cash, which some of the replies noted is traditionally the preferred option for terrorists, drug dealers and all types of other criminals.

Some pointed out that the vast majority of cryptocurrency now comes from sources that have already been subject to AML checks, for example from a licensed exchange or intermediary. And it’s already a regulatory requirement in most jurisdictions to conduct AML for these assets, with sufficient technology available to do so. Moreover, some replies observed that there is already a good network of counterparties who have strong AML policies in place.

Expert Opinion - David Packham, Founder, Chintai: “Integrating regulatory compliance into wider digital asset innovation is the final component that will enable wider and even mass adoption of the technology and open a world of opportunity for wealth management intermediaries and their private clients.”

A deeper digital asset ecosystem is required for secure, high-quality access and execution efficiency; it is happening and at real speed

In recent years, barely a day goes by when one does not read news of some new digital asset exchange, custodian, intermediary or advisory platform emerging, or perhaps obtaining new funding, or obtaining new licences from the relevant authorities, or perhaps a central bank announcing its own digital currency, or new regulations or guidelines emerging.

As all of this takes place, investors and the incumbent private banks and independent firms will feel more empowered to participate in this market. A virtuous circle is emerging of growing and maturing infrastructure, expanding professionalism, the arrival of more active digital asset funds and passive digital asset ETFs, a more mainstream participation from global bodies and institutions, and greater regulatory oversight.

Expert Opinion - David Packham, Founder, Chintai: “We have been creating a comprehensive digital asset issuance platform that increases productivity for issuers by significantly reducing administrative costs in the value chain of digital assets. We offer the capability to rapidly customise an issuance for virtually any asset, and to codify automated compliance requirements specific to the customer’s jurisdiction, as well as providing a secondary market ecosystem, and all within one easy to use blockchain platform. And through White Label customisation, Chintai provides a customised front end with the client’s branding to meet the specific needs of their market and in a relevant compliant and audit-traceable process.”

The Final Word - the direction of travel is clear, there are opportunities galore and colossal innovation, but more must be done to build the ecosystem, infrastructure, and to achieve widespread confidence and trust

The opportunities in this space appear endless, and so too the energy to create. The digital assets universe is, like the cosmos, expanding second by second.

The professional and incumbent wealth management industry in this region appears to be increasingly receptive to shifting their positions to become advocates of these digital assets rather than simply facilitators. Even the naysays would like to find good reasons to throw off their shackles of caution.

But in order for this to happen, and at the speed many hope for, will require immense energy, far more global adoption, much more regulatory thought and consistency, far better education and greatly enhanced communication. Right now, there is considerable cause for optimism that these building blocks will indeed fall into place.

Chintai – A Snapshot

Transforming the capital markets of today into the blockchain opportunities of tomorrow

Chintai (www.chintai.io) is a Singapore-based FinTech company established in 2019 that utilises blockchain technology to modernise capital markets for banks, financial institutions and asset managers. Chintai was co-founded by three partners – Ryan Bethem, David Packham and Phillip Hamnett.

Chintai’s product suite includes dynamic issuance, automated compliance, reporting, data reconciliation, cap table management, automated corporate actions, instant settlement and more. The end-to-end solution offers traditional finance companies a one-stop platform with a robust automated compliance engine powered by our proprietary solution Sentinel-AI.

The firm’s strategic intent is to bridge the world of traditional finance with a blockchain technology platform and build a new competitive advantage with its clients.

The firm received new funding of USD7.5 million from a round one programme in the middle of 2021, allowing it to boost infrastructure, talent and complete its licensing progress in Singapore.

For further insights into Chintai, its products, missions and personalities, please see:

A November 2021 article that Hubbis published: https://hubbis.com/article/blockchain-platform-enabler-chintai-ready-for-explosive-global-growth-of-digital-asset-issuances-and-secondary-markets

and this Hubbis Video (plus transcript) from December 2021: https://hubbis.com/video/helping-asian-wealth-and-asset-managers-embrace-digital-assets

Disclaimer

All opinions and survey results expressed do not reflect the opinion of Chintai Network Services Pte. Ltd. or their affiliate companies. Chintai has no control over the content published and accepts no responsibility for them or any loss or damage that may arise from the use of the content. Nothing in this material shall be deemed to be a direct or indirect provision of investment management services or advice specific to any parties.

Founder & CEO at Chintai