Thailand has been getting back to normal, but what does this mean for the economy, the country and for the increasingly diverse and dynamic wealth market? The country has seen tremendous growth and many exciting developments within the wealth management sector in the past decade, but there remain some questions about the political situation, and questions over how the economy is resuming its growth trajectory after the devastating impact of the pandemic on its very important travel and healthcare markets. Nevertheless, the wealth management market appears to have weathered many of these storms and to be both maturing and diversifying in terms of its overall proposition. The Hubbis Digital Dialogue discussion of December 1 mined down into many of these shafts to bring key trends, issues, and future developments to the surface.

The Speakers:

- Marie-Pascale Bonhomme, Deputy Managing Director, Amundi Asset Management

- Win Udomrachtavanich, Executive Chairman, DAOL Thailand Financial Group

- Triphon Phumiwasana, Managing Director, Private Banking Business Head, Kasikornbank

- Vincent Magnenat, Limited Partner, Global Head of Strategic Alliances, Asia Regional Head, Lombard Odier

- Anurag Pandey, Head of Platform and Partnerships (APAC), additiv

These are some of the questions the panel addressed:

- What is the current state of the wealth and asset management market in terms of the client

- base and the delivery of advice and investment solutions?

- How will Thailand’s regulators, authorities and private institutions further develop its wealth

- management market?

- What are local private clients investing in these days, why and what is the outlook?

- What is the state of digital transformation, and where are the banks and other players

- focusing their main investment and effort?

- How do wealth managers in Thailand boost the quality and integrity of advice, enhance client centricity and help deliver a more personalised offering?

- How do competitors enhance their range of products, and their services?

- Are there wealth management talent wars in Thailand?

- The crystal ball - what next for Thailand’s wealth market?

Setting the Scene

Thailand’s wealth management market is in surprisingly robust shape, with greater dynamism amongst the private sector competitors than ever before, a shift to the onshore proposition, improving expertise, commitment and digitisations, and a largely supportive and liberalising regulatory environment.

Local and international players have been upgrading and enhancing their platforms and propositions as they compete for market share, with these moves largely being supported by a robust and consistent effort from the regulators and from the government itself. The pandemic clearly somewhat hindered the progress, of course, but experts believe it also offered a moment to incumbents and to newer competitors to hone their business plans, their models and their digital strategies to help them compete more effectively in the future.

While there are negatives, particular around the global investment and geopolitical situations, there is considerable optimism that the private sector, the regulators and the government will pull together to help the country’s economy and financial sector burst fully back into life. In the wealth sector, the range of products and advice available across the different segments of wealth in Thailand has been improving, as the regulators gradually liberalise and help the diversification of products and the development of talent in the local market.

The December 1 discussion analyse the evolution of the onshore wealth management offering compared with the offshore proposition, it drilled down into the regulatory environment and anticipated future developments there, and the experts reviewed the evolution of the customer base and their expectations and analysed in some considerable detail the competitive environment as major financial institutions and other players jostle for differentiation and for position for the years and even decades ahead, including assessing the success to date of some of the local/foreign JVs or partnerships between international private banks and established domestic financial market brands.

Most importantly, the discussions highlighted both the great opportunities and also some of the challenges ahead in what is an increasingly diverse and robust wealth management market.

Key Observations & Insights

The quality of advice needs elevating and that is happening, say wealth leaders in Thailand

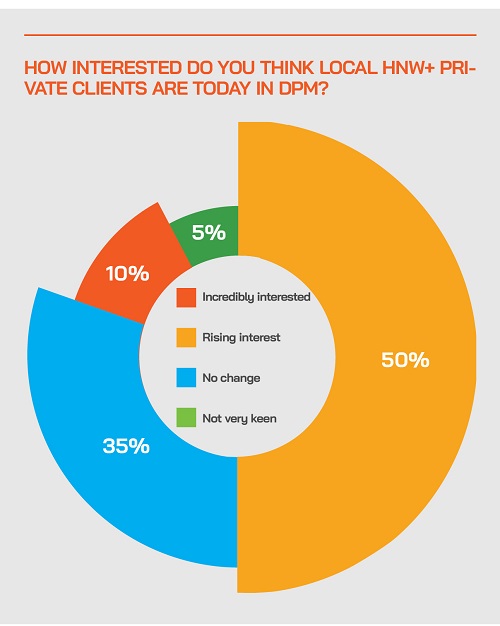

The general quality and ‘vision’ around advice is gradually improving, in keeping with industry norms in the region, or further afield, and also to keep pace with client expectations. The need for sensible and more personalised advice has become more apparent amidst the more difficult global market and geopolitical conditions. “Clients want tailored and differentiated advice and service,” said one expert. “And the younger generation in particular have higher expectations of service and also at higher speed in the digital world. Through digital, they have their private banker at hand, essentially, rather than waiting to speak to them in person. Expectations are rising around the world, and that is certainly the case also in Thailand.”

Advice and guidance are more holistic, the regulators generally supportive of gradual liberalisation, and investor clients are more patient and resilient

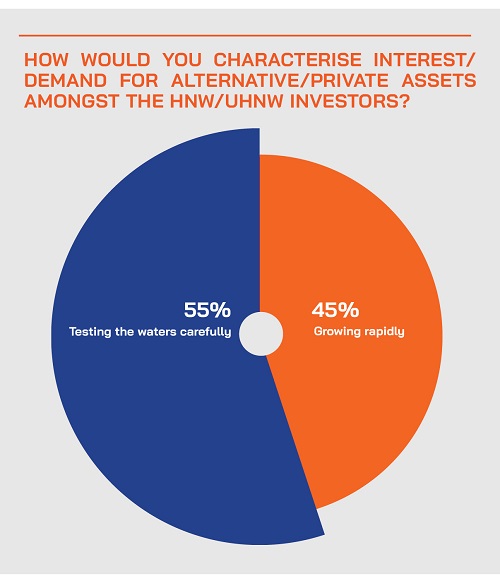

A fellow panellist agreed, noting that in recent years, Thailand has seen more clients taking a broader global product perspective, with demand for more private assets, including loans and private fixed income, driven by the lower interest rate environment than in the past. The regulator is more open to accredited investors expanding their range of assets, as well. And the general regulatory environment is supportive, especially for the HNW and UHNW investors, enabling access to more investments, both onshore and offshore.

“We also see the regulators encouraging the development in general of upgraded investment advice, and that is why they are allowing more foreign players to compete onshore in different ways, especially the investment advisory platforms, which is helping local players, local advisors, and IAMs to upgrade their offerings,” this speaker reported.

At the same time, he added that clients are generally more patient over their portfolios amidst the current global downturn, holding on more tolerantly than in past periods of decline, including in the early sell-off caused by the pandemic in early 2020. He said this is aided by more information, more experience of the downturns and upticks, better advice, more diversification in portfolios, and perhaps more expectation that the authorities, for example the US Federal Reserve, might pivot in their strategies.

All this is translating to more solidity and patience amongst the clientele. “When there was a 10% drop before, there was panic,” he said, “but this time around we see investors waiting and hoping that the cycle will adjust again.”

Client expectations are higher, competition is more intense, and the quest for differentiation of offering and talent are both more acute

Another banker agreed that the typical client expects more and more nowadays. “They are increasingly looking for guidance, for more sophisticated advice, and this is true across the emerging generations of decisionmakers as well, many of them returning to Thailand armed with overseas education and work experience,” he explained. “That plays to our strengths, as we have been boosting the skills of our bankers to deliver sharper and more relevant advice, and a more complete array of products and opportunities.”

Addressing the intensifying competitive environment, he agreed with the view that the domestic banks, the brokerages, and new entrants, as well as foreign players are all adding to the diversity and quality of the market, broadening and enhancing their offerings and also targeting certain specific niches.

He explained that in partnership with their foreign private bank partner, they have been strengthening the product line and distinguishing their brand in terms of access to and expertise in private assets.

He added that another competitive edge for the bank has been in providing liquidity for wealthy Thai’s non-liquid assets, such as land or private company shares. “We estimate the perhaps around one-third of wealthy Thais’ overall assets are liquid financial assets, while the majority of their wealth is tied up on their businesses, land, or properties, and we have worked to provide liquidity based on those assets, to help them, including a newer team advising on business structures and restructuring and so forth. In these ways, we are aiming to deliver a more comprehensive set of solutions to their wealth management needs.”

He also said that the quality of their training and their bankers is a real priority. “We believe this is core to the future,” he said. “A natural extension of this is the simultaneous challenge to retain the talent, and yes, there are concerns about retaining our bankers, as this is a competitive market for skilled people, but we have been able to successfully grow our numbers by training, hiring and building.”

Looking to the longer-term, certain key trends prevail across the region and are very clear in Thailand

A guest told delegates how their bank had identified four key megatrends in the region. One trend is the great wealth transfer between generations. Another is the ‘onshorisation’ of wealth in markets with increasing regulation and transparency. There is also the increased market volatility that had led to clients thinking increasingly about revising their allocations and the diversification of their portfolios - globally and beyond traditional allocations. And of course, there is a major shift underway to more sustainable investments. And he said all these trends apply neatly to what is going on in Thailand.

Drilling down to the great wealth transfer, he explained that in the coming few decades, literally trillions of dollars equivalent of wealth will transition to the next generations. “Obviously, the needs of the next generations are different from the previous generations, so we need to adjust our thinking and approaches, and we need to accompany the clients during these transitions. We have built close cooperation with our friends from Kasikorn, focusing on making sure that we take care of these family clients both onshore and offshore, spread as many of them are around the world today.”

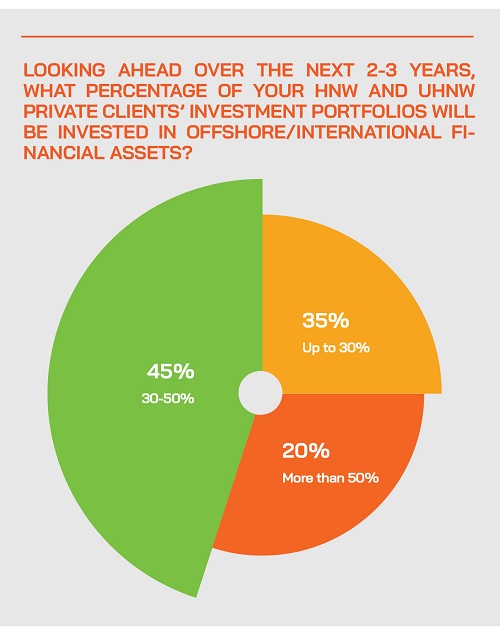

Onshore and offshore

He explained that what the bank calls ‘Onshorisation’ is a recognition that onshore wealth management will grow faster than offshore. “This does not mean offshore is wilting, but that growth will be more robust onshore,” he said. “Why? Because we are in a region and especially Thailand, where we have an upper middle class growing extremely fast, we have clients with a few million dollars to invest who are growing their wealth and their numbers very fast. They have real needs. And they expect the onshore offering to be of the same sort of scope and quality as available offshore, and they want to have the same sort of access to global assets and markets.”

And that, he reported, is precisely why his bank’s approach is to forge alliances in the region. “Product is one issue, but more important is advice, support, expertise, and the overall quality of the offering and the service,” he said. “The mission is to help create the ecosystem that provides clients with this full spectrum of solutions.”

Volatility driving portfolio sophistication

Another megatrend they see is ongoing increased market volatility and how this had led to clients thinking increasingly about revising their allocations and diversifying their portfolios - globally and beyond traditional allocations. “Volatility looks like it is here to stay, and this is driving more and more clients to seek advice and expertise, both the older and the younger generations.”

And the keen focus on ESG & sustainability

And the fourth mega trend he had identified is the sustainability revolution. “Through the survey and study that we conducted across eight markets in Asia, when we also interviewed 500 HNW and UHNW individuals, we found that the number one country interested in sustainability is Thailand, with 78% of the participants saying that they want to invest into sustainability. These are sophisticated investors, who increasingly understand that one of the biggest risks ahead, and opportunities ahead, is sustainability. We are all heading towards the 2050 goals, and we are all actors who can make a positive contribution.”

People, talent, education, training, sustainability, digitisation, and enhancing the proposition

An expert gazed into his crystal ball to explain his key priorities for the coming few years. People and talent, he explained, will remain of high importance. Addressing issues around the elevating the onshore offering and sustainability of investments are other key missions, and he said that the bank is working closely and effectively with its foreign private bank partner on those objectives, including expanding further in private assets, which are seeing rising demand from wealthier investors. Finally, technology and digital transformation are vital to keep the bank ahead of the competition.

Advisory-led wealth management and a greater focus on the NextGens are keys to the future

The discussion evolved to focus on the younger generations and the evolving needs and expectations amongst private clients. “We are moving really from advice around product to a more holistic approach,” a speaker observed. “There are different objectives related to managing money. There are the more basic objectives of money as providing for the essentials throughout our lives, then there are lifestyle and other objectives, such as a great retirement, luxurious homes or yachts, the ability to pass real wealth to the future generations, and so forth. And the portfolios need to reflect these different objectives, and our advice needs to encompass these various goals.”

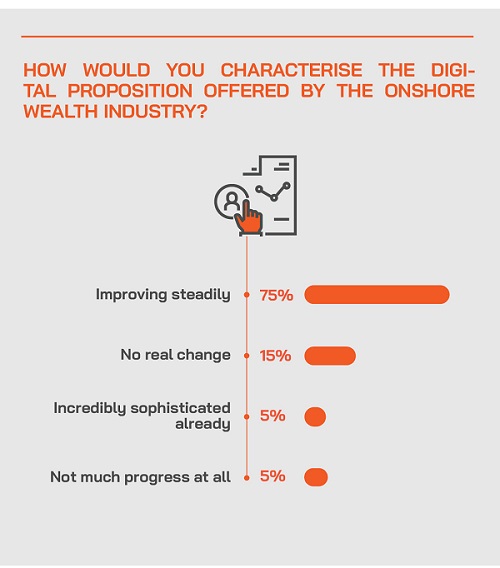

Empowering the client facing RMs and advisors with digital tools and smarter approaches

A digitisation expert highlighted some of the key thrusts towards digitisation, all driving towards a more holistic and also seamless offering. “When we talk about technology tools, one of the clear trends is having an end-to-end value chain supported. Typically, you have had silos of information, and silos of processes that do not necessarily communicate with or link to each other, which means that the RM actually is doing manual work and wasting time doing mundane work, which would better spent on talking to a client. So, achieving an end-to-end value chain that works seamlessly is critical to success.”

2023 will be a different year, but the outlook still remains uncertain, hence caution and diversification are key to performance

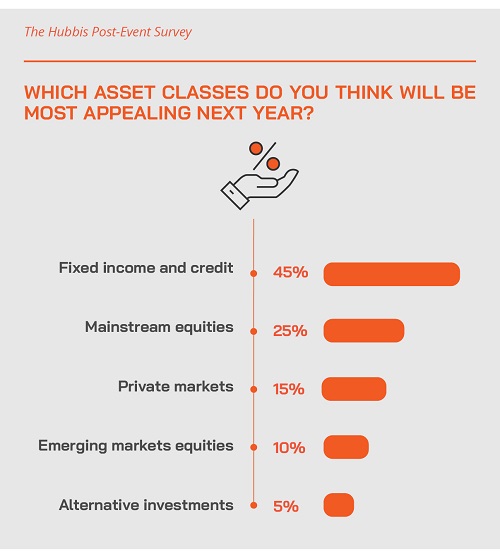

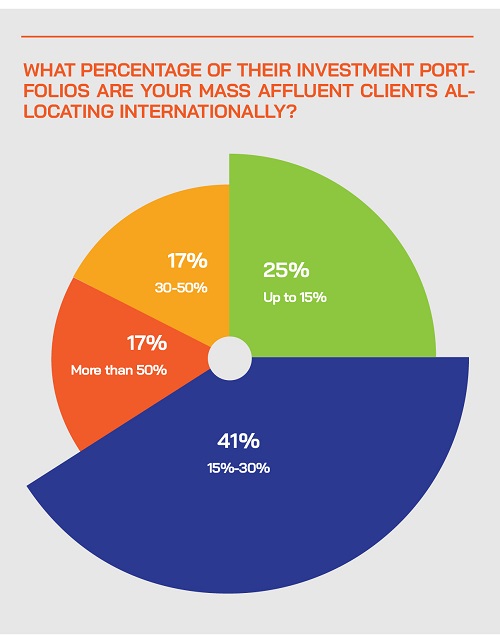

A guest focused on their typical mass affluent type target clients, noting that the investment outlook for 2023 remains unclear, although he does expect fixed income and credit to be go-to segment.

In general, in this environment, he said they will promote diversification and smart risk management. “We like to advise each client to take up diversified assets, diversified strategies and adopt the risk profile that they are comfortable with,” he told delegates. “We anticipate that fixed income will shine bright in 2023 and we expect more interest in private investments such as private loans and private debentures, especially for the wealthiest investors. In the mass affluent segment, where there is less sophistication, we expect greater interest in equities, focused on different sectors and geographies, even China. I think that will be the story, as the macro picture will support that type of approach. But in general, as I have said, the key is diversity, regardless of how low risk you are, or how high risk you might be.”

The final word – in more challenging conditions, the quality of advice and the leadership from the wealth managers will be more significant differentiating factors than in markets where rising tides float all boats

A banker drew his observations towards a close by underlining that in challenging markets and uncertain conditions ahead, the importance of quality advice and explaining that to achieve that mission, the bankers and entire operations need better knowledge, more training, additional skills, and that expertise and understanding needs to be communicated with and shared with the clients themselves. “We need to communicate effectively, and we need to challenge our clients positively, for example to ensure that they properly understand how to build portfolios, and the risks associated with different allocations and assets,” he explained. “In our case the combination of the strengths of a very powerful local financial organisation and a global organisation really brings value to our local clients.