Publications & Thought Leadership

Residency & Citizenship in and out of APAC – Trends, Developments and Advice to Consider

May 26, 2022

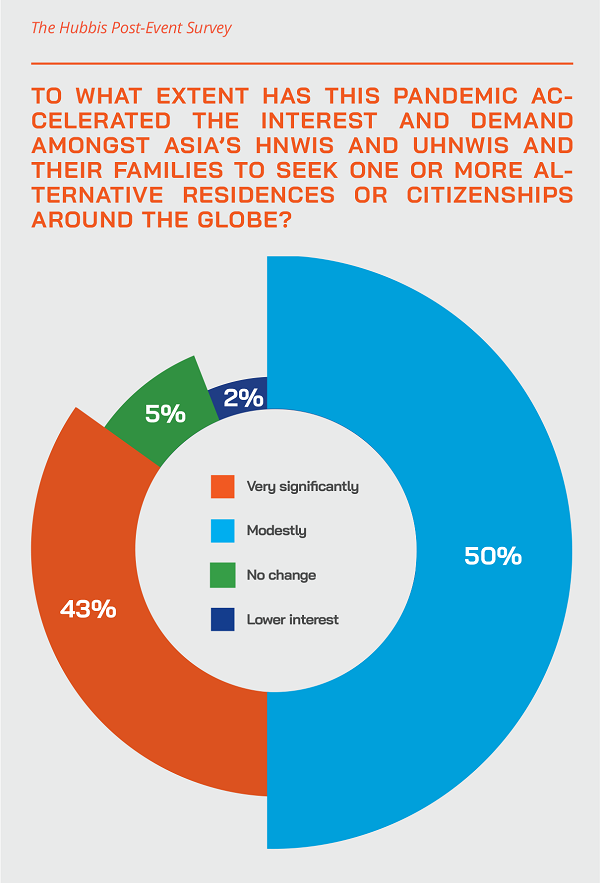

While the private banking and wealth management industry has managed to flourish amidst seeming adversity since Covid-19 hit, another business encompassing the world of investment migration has also been thriving, turbo-charged by the uncertainties wrought by the pandemic. To plot the coordinates of exactly where the global investment migration industry is right now, where it is heading, and what it all means to Asia’s private clients looking overseas and to global HNWIs and UHNWIs looking at Asia, Hubbis held a Digital Dialogue event on May 5th that uncovered the key trends and identified the most compelling opportunities both for Asian wealthy as they scan the globe for residence and citizenship alternatives, and for the world’s mobile wealthy as they survey opportunities in Asia Pacific.

Panel Members

- Michael Olesnicky, Senior Consultant, Tax & Wealth Management, Baker McKenzie

- John Shoemaker, Registered Foreign Lawyer, Butler Snow

- Dominic Volek, Group Head of Private Clients, Henley & Partners

- Paul Knox, Managing Director, JP Morgan Private Banking

- Bijal Ajinkya, Partner, Khaitan & Co

- Jason Pearce, Head of Technical Sales, Hong Kong & NE Asia, Utmost Wealth Solutions

Setting the Scene

The overriding narrative of the panel discussion was that demand for global residence and citizenship alternatives from Asia’s private clients has never been stronger, and demand for APAC alternatives amongst global clients remains remarkably robust, with, somewhat surprising, the US as the source of the most outward demand. In short, even more of the world’s wealthy and mobile individuals and families see the value of these alternatives, and the investment migration industry is in a dramatic expansion phase. At the same time, regulation and oversight are expanding, further professionalising the industry. And the private wealth industry is more aware and more closely involved as their clients increasingly see investment migration as part of their overall estate and legacy planning.

There are nuances in the demand. Interest came historically from many emerging countries with weaker passports, but today demand from the wealthy in the US has been remarkably strong, with clients from the States sometimes even assembling a mini portfolio of residence and citizenship alternatives. The Middle East market is no longer just an exit launchpad – it has opened significantly for inward migration as liberalisation takes place there and as the economies diversify and expand, with demand strong within Asia from India.

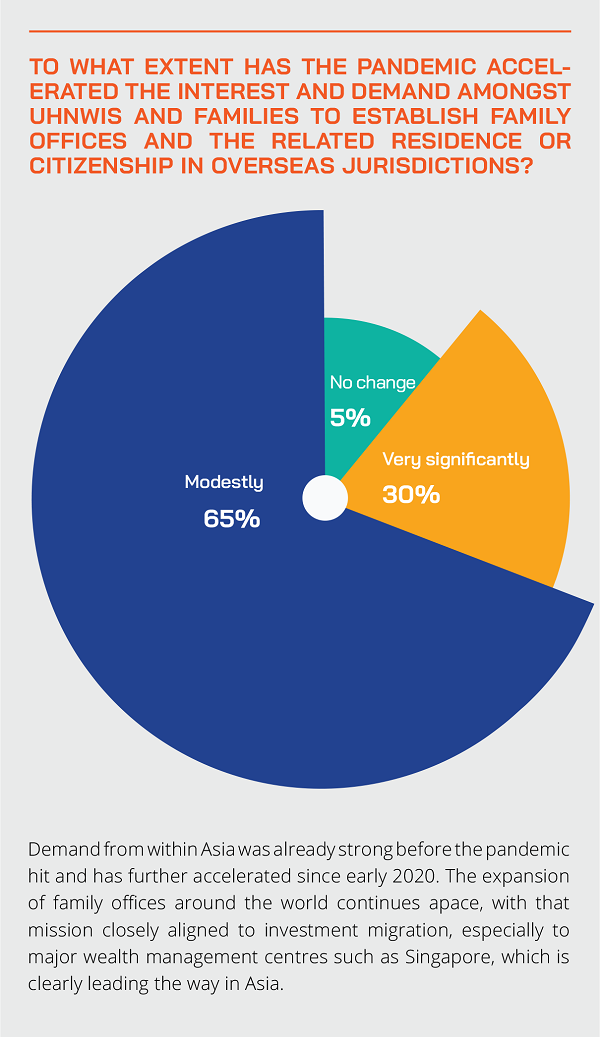

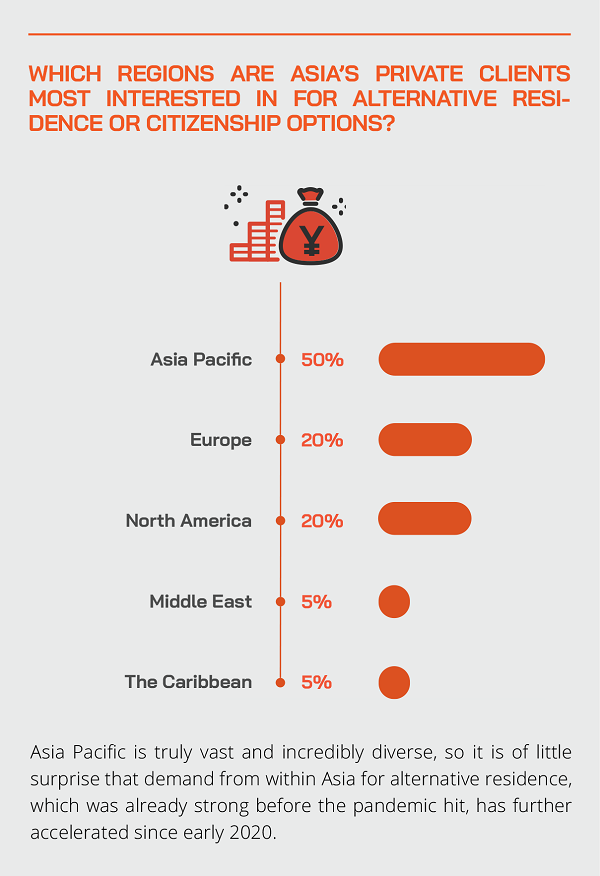

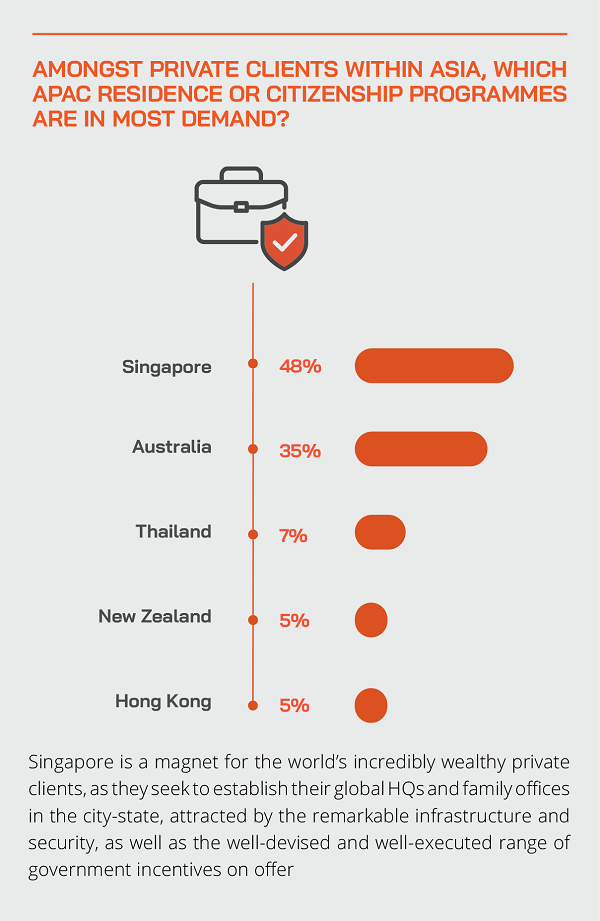

The Singapore market for inward migration of very wealthy clients, some establishing large single-family offices, is robust, although somewhat hampered still by tough pandemic restrictions. Hong Kong is a source of major outward demand, as the government keeps a very tight lid on mobility and travel in the (possibly vain) attempt to stamp out the virus. Demand from the more emerging markets of Asia continues to be strong, with clients eyeing an expanding world of opportunities in Europe, the Americas and the Caribbean, the Middle East and Australia/New Zealand.

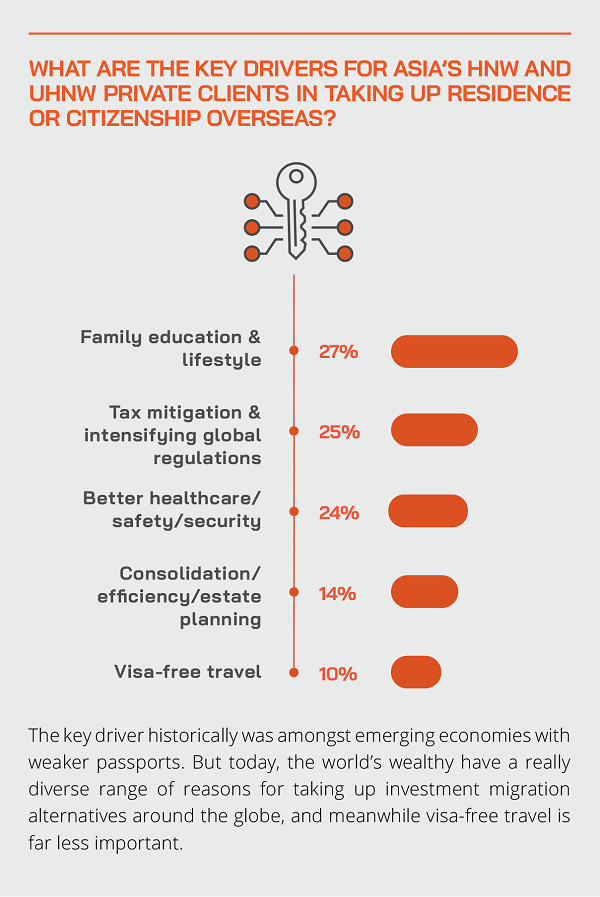

The motivations for investment migration are far more disparate than ever before, spanning from the historical drivers of visa-free travel and political instability at home to many more of the world’s wealthy diversifying their residence alternatives for asset and family consolidation, lifestyle, family education and also increasingly for access to better healthcare and security.

Some of the key recent and evolving trends in investment migration demand globally

An expert first reviewed the market, noting that demand from the emerging markets around the world remains robust, with, for example, many clients in India, China, the Philippines, Bangladesh, Nigeria, South Africa, and other EM countries looking for other options in terms of a second residence or new passport or an alternative passport, if they're not allowed dual citizenship. “

There has always been that motive for greater global mobility and visa-free access to key markets, whether it's for business or for leisure,” he reported, and demand in those markets certainly continues to be extremely strong.” Indeed, he reported that his firm would likely open another 10 offices within 2022 to add to the 35 in operation around the world.

Additionally, outward demand has risen sharply in countries such as the US, the UK, Canada and Australia. “For the first time, we see more Tier 1 countries in the top 10 nationalities that we are assisting, and the US is now our single biggest jurisdiction for new clients,” he reported. “And in the UK, post-Brexit, we have a lot of interest now from UK citizens that potentially already had real estate in some of the Golden Visa countries in Europe, such as Spain, Portugal and Greece, and they are now looking to capitalise on the investment they've already made or make a fresh investment in order to reclaim the borderless access to Europe that they lost because of Brexit.”

Portugal, he reported, was seeing sustained demand, even though they had changed their programme due to high levels of interest, directing more inward real estate investment to less developed parts of the country.

The same expert explained that US clients had increasingly realised that they are allowed dual citizenship. He said the demand had started to grow in 2019 in the lead up to the election that saw Biden win narrowly. And then the pandemic turbo-charged demand.

“Our numbers of clients coming from the US has expanded dramatically,” he reported. “Moreover, US clients like to work on a combination of diversified residence and citizenship options, so they might look at passport options in the Caribbean, where they are familiar, together perhaps with an option in the EU, such as Austria, Malta or Portugal from a residence by investment viewpoint.”

He also pointed to the development of the supply side. “Russians used to be a major source of clients, but the UK and many other countries have suspended programmes and closed their doors for the time being at least,” he reported.

The US is today a leading source of new clients and also still a key market for inward investment migration, despite the regulatory and tax implications

Another guest picked up on the comments on the US market. “It actually continues to amaze me that, despite all of the associated complexity, despite all of the high taxation implications, we still see a huge interest in people taking up US residence,” he told delegates. “Hopefully, these people are nowadays properly prepared for all the ramifications, and not surprised to obtain EB5 or a Green Card and only then realise they were henceforth subject to worldwide taxation.”

He explained that his firm has been seeing a lot of demand for pre-immigration help prior to US residence applications. He reported that there are, however, some issues involved that do not receive enough attention.

He said, for example, that the Treasury Inspector General in the US had fairly recently concluded an audit of the IRS and came up with the conclusion that FATCA as a regime had been wholly a failure in improving the IRS’s ability to identify and collect tax. Moreover, they have reported that the IRS was not using the data as they should have to penalise folks who are not in compliance either with the FATCA regime itself or with the end taxes.

“The IRS is therefore feeling somewhat chastised internally, and they are as a result becoming more proactive now in going after financial institutions outside the US,” he reported. “This is the deputisation knock-on effect from FATCA, the concept that government authorities are effectively deputising banks and financial institutions around the world to be their enforcers, and therefore not need tax officers to chase people. We are seeing more people raising concerns, so the Department of Justice and the IRS talking to banks in the Asian region about US estate tax exposures, about withholding tax, and making sure that obligations are properly identified.”

Additionally, he observed that the Commissioner of the IRS is under pressure from the audit report and had introduced a bill to grant broader powers to the IRS to make reciprocal FATCA a genuine equivalent to CRS. “Many folk that are conducting residence planning right now are sort of arbitraging on the idea that the US is not participating in CRS and is not in AEOI, or global information exchange. But actually, FATCA IGA is reciprocal, and data could be flowing to any country that has signed a reciprocal IGA. Singapore is one that has switched to a reciprocal IGA. And now, if the US does indeed start to develop one-for-one data exchange, meaning trusts in the US would collect and report data just like trusts outside the US do under both FATCA and CRS, that will be a major game-changer.”

He recalled that when FATCA first came into being and the OECD was having conversations about implementing their version globally, he had observed repeatedly that never in the history of human development had there been a government or a tax authority that, once they see assets or income, could resist the temptation to tax it. That is still the case today, even more so as government finances the world over have been under pressure since the pandemic and now with rising inflation and rates.

Repatriation is a major source of activity since the pandemic struck but careful consideration should be given before making the leap

An expert reported that there is a lot of activity amongst expats returning to their home countries, for example many going back to the UK and heavily from jurisdictions such as Hong Kong where pandemic restrictions remain acute, even today. But of course, full repatriation means returning to the inheritance tax net.

“Any assets in the UK, mostly real estate of course, but potentially also yachts docked there, are subject to inheritance tax, regardless of the residence or domicile of the owner,” he reported. “Non-domiciles used to be able to shelter, perfectly legally, their UK residential property from inheritance tax by owning it via an offshore company, but that ended in 2017, and now there are over 100,000 properties in London in the Southeast that will be subject to inheritance tax upon the death of the owner. The only way to mitigate that problem is to either have a big mortgage on the property, because it's only the equity that's subject to the tax, or just to insure for it, so that the liquidity to pay the inheritance tax is available when the relevant person passes away.”

He noted that the UK, like Hong Kong, has got complete testamentary freedom. “Not every country has that,” he remarked. “In certain parts of Europe, you're not free to leave how much to whomever you want. There are certain people that you have to look after, especially in civil law countries. And of course, in some of the Middle Eastern countries that would apply as well. So, for these reasons, people may want to consider succession planning tools, the most obvious being trusts, possibly foundations, or insurance policies with nominated beneficiaries.”

Expert Opinion - Jason Pearce, Head of Technical Sales, Hong Kong & NE Asia, Utmost Wealth Solutions: “Looking at the key global mobility and investment migration trends that have emerged in the past year or two since the pandemic struck, we have noticed a significant number of expatriates have brought forward their plans to repatriate or move to other jurisdictions; the approach to COVID restrictions adopted by different countries such as in Hong Kong has been a key driver. We have also seen a marked increase in native Hong Kong people moving abroad. In both instances, portable wealth solutions such as Private Placement Life Insurance (PPLI) and Variable Universal Life (VUL) are both in greater demand than ever.”

Investment migration can fit neatly into broader wealth and legacy planning and structures

Another expert observed that residence and citizenship alternatives need to fit in with robust estate planning. “Many wealthy people thinking of moving country might have BVI or Cayman Islands entities of which they are sole director and shareholder, or sometimes trusts over which they retain extensive powers,” he noted. “Accordingly, my advice to clients is to plan well in advance, to give it nine months to plan and nine months to a year to expedite things properly. You need to review all your structures, all your investments, work out what assets to relocate or perhaps to rebase their values before you move. They might need to extensively reconfigure their investment portfolio to make it more tax-efficient for the country ahead. In short, it involves a lot of work.”

He added that many assets such as hedge funds and alternatives might either be tough to reconfigure or illiquid, so whenever possible, plan well ahead and give yourself time. “This is not always possible, for example, for working expatriates moving jobs and countries at short notice, but it is always advisable,” he said.

Expert Opinion - Jason Pearce, Head of Technical Sales, Hong Kong & NE Asia, Utmost Wealth Solutions: “Thinking about how and where investment migration aligns with estate and legacy planning, the tax regime of some popular migration destinations such as the UK and Australia are more complex and significantly higher than jurisdictions such as Hong Kong and Singapore. In the UK, for example, inheritance tax can be as high as 40%; income tax and capital gains tax (excluding property) can also be as high as 45% and 20%, respectively. Therefore, careful consideration and financial planning before migration which may include the use of portable, tax-efficient solutions such as PPLI and VUL forms a crucial part of overall legacy planning.”

Planning ahead is essential for anyone and any family considering investment migration

“Unless a person is moving to a low tax jurisdiction, any affluent individual planning to relocate should ideally start to plan at least 9 months in advance and take full advice on all aspects of their wealth,” a guest told delegates. “In particular, it is important to have all their trusts, corporate and other structures reviewed so that the tax consequences of those entities are fully understood in the destination location. The entities are often overlooked until the individuals have relocated and there can be unforeseen tax consequences.”

He explained that he and his private bank colleagues had since the pandemic seen a lot of nationalities repatriating early, leaving Asia to return to their original homes, whether in the US or Europe or Australia, or elsewhere. And they had seen many who had been resident full-time in Hong Kong become somewhat nomadic since the pandemic due to the rigorous travel and quarantine restrictions. “They might have been watching carefully how long they've been spending in each country, and just making sure that they don't become tax resident anywhere, but we always advise them to seek professional advice, and once they do so, they tend to change their thinking and avoid the potentially painful tax consequences.”

Expert Opinion - Jason Pearce, Head of Technical Sales, Hong Kong & NE Asia, Utmost Wealth Solutions: “Investment migration is not so simple, so starting financial planning well before migration is key. For example, the tax year in the UK starts from 6 April to 5 April the following year, which means someone may easily fall into the tax liability net even before their arrival. Besides, choosing suitable wealth solutions, such as PPLI and VUL, that are compliant and portable can help avoid any unintended consequences. The longer these solutions are held, the greater the potential tax benefits, so starting as early as possible is always advantageous.”

A guest offered delegates several stories from over his years in wealth management in the UK and Asia, highlighting the dangers of not thinking through these issues.

“These any many other stories only reinforce his view that all such decisions need to be taken very carefully and the requisite time and money spent of making sure it is a good move and then it is properly structured from all aspects,” he said. “So, when clients come to me for advice, I try to help them select properly and then plan ahead,” he told delegates. “It often works best when there is a sound rationale, for example if their children have been educated in the US or the UK or Australia and have ended up settling in those places. Countries where there are robust expat communities – Portugal is a good example nowadays – are often more welcoming and easier to adapt to.”

Expert Opinion - Paul Knox, Managing Director, JP Morgan Private Banking: “Unless a person is moving to a low tax jurisdiction, an affluent individual planning to relocate should ideally start to plan at least nine months in advance and take full advice on all aspects of their wealth. In particular, it is important to have all their trusts, corporate and other structures reviewed so that the tax consequences of those entities is fully understood in the destination location. The entities are often overlooked until the individuals have relocated and there can be unforeseen tax consequences.”

Another expert also observed that among the expatriate communities there had always been, and there still is, a certain romanticism about retiring and going off and buying a chateau in France, or a villa in Tuscany, or moving to a beach resort somewhere in Bali. “But the reality for many is, after a few months, when you don't speak the local language, you don't have the social circle, you realise it's a boring place to be. So, as I see it from the perspective of a tax planning practitioner, you need the right reasons to emigrate, and you also need to make decisions involving tax planning but not driven by tax.”

A fellow panellist concurred. “Not planning properly in advance exposes individuals and their families to some major issues as they all too often inadvertently get caught up in problems when they move to other countries if they have not planned properly in advance,” he cautioned. “Firstly, people must be aware that if you do take up residence in a country, in many of those jurisdictions you are deemed to be resident from the beginning of the tax year, meaning that you have to do your tax planning in the prior year.”

He explained that many people in the past two-plus years might have moved in order to mitigate the impact of the pandemic, and the authorities in some countries might have taken a concessionary view during the worst of Covid-19, for those who might be stuck elsewhere or arriving from elsewhere. “However, this type of approach is on the wane,” he said, “and more recently, many tax authorities have been starting to issue more notices to indicate this generous approach is coming to an end, that the pandemic excuse is no longer valid.”

He added that many companies are becoming increasingly concerned about their employees working from another jurisdiction, because technically, that can create a taxable presence for the employer in that jurisdiction. As a result, he had seen a number of major institutions in the financial sector and from other sectors actually forbidding their employees from working from overseas in order to avoid that type of tax consequence.

Tread carefully to make sure you do unwittingly overstep any hidden or unforeseen regulations

An expert observed that the EU has been looking at these types of programmes, to make sure they are properly regulated in terms of their investment migration processes. He said the OECD approach is more tax focused, trying to make sure that people are not obtaining visas and passports in other countries, and then pretending that they are residents somewhere, when in fact they're not really resident there. He noted that the OECD has its CRS, or Common Reporting Standard programme, but people can obtain visas and passports and still self-declare to the financial institutions that they are resident somewhere where they're not.

“The OECD's approach has been not to try and ban these programmes but to remind financial institutions of the additional due diligence that they need to undertake, for example to properly ascertain where this person is living,” he explained. “And because the OECD is tied in very closely to FATF, I think it is only a matter of time before the due diligence they are seeking become more of a formal requirement.”

Another expert advised clients to start planning as much as 12 to 18 months ahead before making any major moves. He advised restructuring portfolios at the same time so that in the new jurisdiction they are not subject to either punitive income or capital gains taxes. “The earlier and the more comprehensive the planning the better,” he stated.

The investment migration industry has become more mainstream and more central to wealth management

An expert observed that as investment migration had become more mainstream, they were working more closely with wealth planners, private bankers and lawyers.

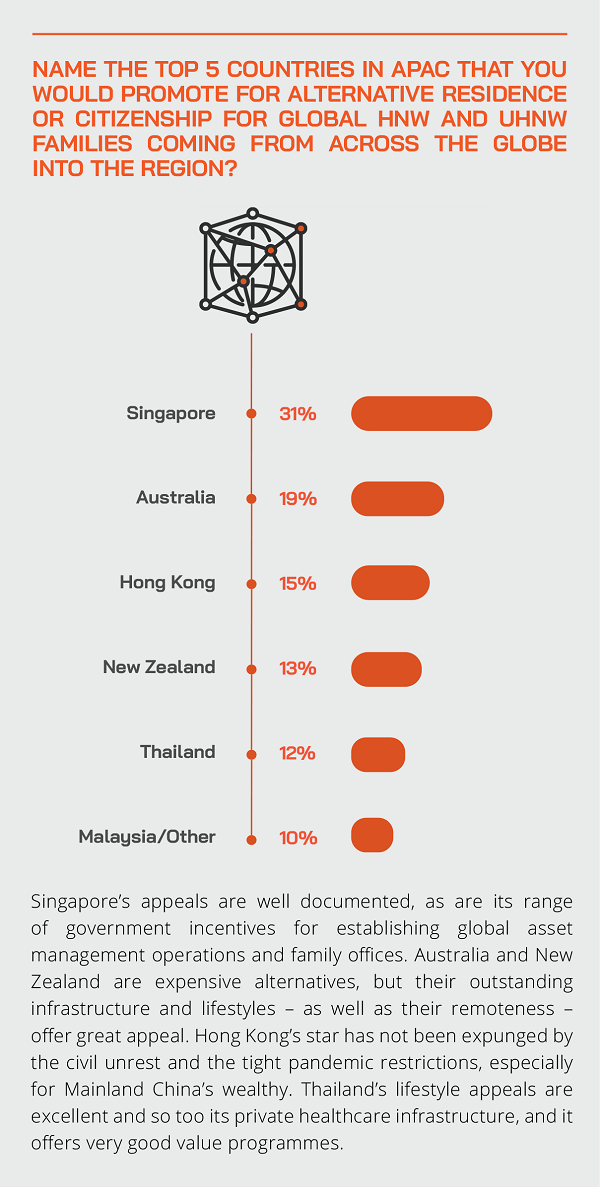

He explained that people are looking the world over, from the Caribbean to Europe, and in Asia to jurisdictions such as Singapore, which has one of the strongest passports in the world, or to Malaysia or Thailand, or further afield to Australia and New Zealand. Some motivations might be related to taxation, some clients are more focused on lifestyle alternatives, and some are seeking more remote boltholes due to geopolitical and global healthcare uncertainties.

He also noted that as a leader in the investment migration business, they work closely with bankers and other professionals around the world, with fee sharing and reciprocity key appeals for both sides. He explained that his firm never crosses the lines in the sand into any form of investment or estate planning areas or into legal or tax advice.

“We work closely and collaboratively with those other experts to help their clients, and these days it is often on the basis of reciprocal referrals,” he explained. “We also help provide education around these options, so that people in the banks and other firms are well-informed to help their clients. And we also work very transparently on fee sharing to ensure that all parties benefit.”

There might be growing multi-lateral pressures on individual governments around investment migration, but sovereignty endures, at least for now…

An expert conceded that the EU and OECD are more carefully watching the investment migration industry and activity. However, he remarked that neither has a legal right to determine what either a member state or other does with its citizenship. He said that programmes need to be well structured and well managed, and that many have quotas. “And there are new programmes emerging,” he reported, “and at the same time the industry is becoming more regulated to squeeze some of the cowboy operators out of the market, which is good for the industry.”

He explained that due diligence on the clients was vital, and that better regulation would help protect all the parties involved and keep the industry healthy. “And the investment migration industry is actually tiny in comparison with the actual volume of new passports issued by sovereign states, for example in Europe,” he said. “There is some negativity in the press that investment migration is all about unsavoury characters buying passports, but the reality is very different.”

He explained that one of his firm’s principles is to only onboard clients if they genuinely think they can help them. “You often have to have the tough conversations,” he explained, “but these are valuable for all parties. Clients need to understand the ramifications of these decisions and need to appreciate that investment migration is not a ticket to tax evasion. If approached with the right type of attitude and professionalism, investment migration alternatives are an outstanding addition to the optionality and flexibility these wealth clients and their families can enjoy for years, indeed many decades to come.”