Publications & Thought Leadership

Maximising the Discussions & Outcomes Around Wealth, Estate & Legacy Solutions in the Middle East

Nov 25, 2021

Approaching private clients on matters of wealth structuring and estate planning is difficult anywhere in the world, and perhaps especially sensitive in regions such as the Middle East. The November 16 Hubbis Digital Dialogue event saw a panel of experts review the state of the wealth management industry in the GCC and in particular the evolution of carefully planned and well-executed wealth, estate and succession planning and structuring, all from the perspective of the engagement with the client base and the nurturing of the right types of discussions around these important subjects. The mission was to help unravel the nuances of the right approaches, and how the wealth industry and associated advisors can encourage private clients in the region to adopt the best products, solutions and structures to safeguard and build their investible wealth in their lifetimes, as well as to help facilitate the transition of their estate to their loved ones later on.

Panel Members

- Laurence Black, Regional Director, Client Solutions, EMEA, Asiaciti Trust

- Nirav Dinesh Kumar Shah, Founder and Managing Director, FAME Advisory

- Tim Searle, Chairman, Globaleye

- Sunita Singh Dalal, Of Counsel, Stephenson Harwood

- David Varley, Chief High Net Worth Officer, Hong Kong, Sun Life Financial

Setting the Scene – A Wealth of Opportunity in the Region

Estate and succession planning solutions are certainly key areas for rising emphasis in the GCC, as the founder generations age and as the younger generations return from overseas armed with their Western education. For wealth management to thrive in the Middle East, there is accordingly no doubt that the quality of advice on investments, wealth structuring, and estate planning must improve; hence there is a growing emphasis on both the professionalisation and related expansion of the products and solutions the industry can offer in order to keep their private clients engaged.

There are some fascinating developments that will facilitate a more active wealth structuring and estate planning market in the region. For example, there is ongoing liberalisation of the financial markets and the availability of Common Law structures through the Dubai International Financial Centre. The Abu Dhabi Global Market is also nowadays increasingly a hub of liberasation, greater creativity and ongoing diversification and liberalisation.

Our panel of experts analyses how wealth management and other professionals can turn these developments to the advantage of their clients and help devise the right solutions for their Middle East clients. They debate what approaches, talent, experience and expertise are required, and how the client-facing advisors and professionals should most effectively approach and communicate with these clients. Only if the correct approaches and the right communication are taken will clients in the region take up more advice and more solutions in the region, rather than quickly heading off to overseas jurisdiction for their wealth structuring and estate planning and solutions. And they discussed the evolution of life insurance solutions, and how the Middle Eastern clients are embracing far more than the Universal Life policies of perhaps five or ten years ago, and now increasingly warming to an array of products, such as Indexed UL, Variable UL, Whole of Life, Savings Plans and Private Placement Life Insurance, some of which, perhaps especially PPLI are ideal for more robust estate and legacy planning.

Key Observations & Insights

The momentum for estate and legacy structuring within wealth management is accelerating in the UAE

An expert highlighted the quickening pace of expansion of the proposition in the region, helped by the regulators, supported by the governments, and enhanced by the management of the pandemic.The 15th annual STEP Arabia conference held face to face in Dubai and online this month represent major boosts, adding to the encouraging developments around regulation, policy evolution, new legislation and so forth. Cross-border structuring is now becoming more the norm than the exception. This is clearly benefitting the Dubai International Financial Centre (DIFC) and the Abu Dhabi Global Market (ADGM), as well as the Ras Al Khaimah Commerce Centre, known as RAK ICC, in the AUE’s sixth largest city.

There are plenty of reasons for the rapidly growing and diversifying activity

“We have been extremely and consistently busy, inundated actually, working with clients looking to structure, protect and preserve wealth in the region,” the same guest reported. “If we take a step back to, say, five years ago, the options available for succession and estate planning, not just in terms of operational businesses, but also ownership of ancestral wealth, heritage legacy assets, putting in place provisions for the next generations, all of that was actually limited in terms of choice, until we saw the introduction of foundations, legislations and trust laws. And it's very refreshing to see that we're not just talking about plain vanilla assets such as operational businesses and immovable properties, but also things are a little bit more creative and reflective of wealth in the region such as luxury assets, high value art, jewellery, thoroughbred horses, a whole variety of asset portfolios.”

But let’s be realistic - there are some major challenges still ahead

Another guest pointed to challenges to face around FATCA, and also beneficial ownership, with some misunderstanding amongst regulators around the distinction between genuine nominees and also shadow directors. “There has to be better pushback on these regulations, we cannot grind to a halt in trying to help people with their complex needs in navigating their way through all of this legislation.” But he said there are however major positives happening, with multi-discipline approaches taking place and much more collaboration and cooperation helping the clients put the most effective solutions in place and navigate through the complexities.”

Expert Opinion - Sunita Singh Dalal, Of Counsel, Stephenson Harwood: “The recent changes introduced by the UAE Government such as revised categories of residency options, visas and liberalised ownership within more than 1000 business activities, has encouraged new businesses to grow organically in the region. Conducting business in an agile, smart and flexible manner, whilst adhering to global compliance and operational standards, is now the norm. The UAE has proven that it remains open and accessible to all business, regardless of the Pandemic – this is simply remarkable!”

Expert Opinion - Laurence Black, Asiaciti Trust, Regional Director, Client Solutions, EMEA: “I believe recent events have heightened awareness that succession planning and the transfer of wealth should be carried out as a structured long-term strategy as soon as possible, seamlessly with communication, trust and support among all parties.”

Expert Opinion - Nirav Dinesh Kumar Shah, Founder and Managing Director, FAME Advisory: “As to the developments we are seeing in the Middle East, sophisticated tools are increasing available locally and leading local families or businesses are taking advantage of that. UAE Foundations have recently become hugely popular and similarly changes to foreign ownership rules and others are increasing attractiveness to establish local structures which are easier to manage and meet substance requirements.”

Some major advances have taken place, liberalisation is happening and there is greater collaboration across borders

A guest highlighted some key developments in the region. “We see three fundamental changes. One, the change in the foreign ownership rules, and therefore now you can have ownership structure for your business vehicles which can be fully owned by you, and you don't need a local sponsor for that. Second, and more important, is the tax treaty network that UAE has; this will become much more relevant in two or three years down the line, and will move on to corporate tax radar, thanks to BEPS. Indeed, the UAE already has 100 plus tax treaties, and one can take advantage of that, especially from the MNC perspective. And third, we have now local structures available like foundation, like the holding companies under common law regime, which are very attractive, even for local families to organise their affairs, even their philanthropic aspirations. Clients never had these options before.”

Dubai is a beacon of hope and social activity amidst the pandemic’s gloom

A guest pointed out how Dubai is now presenting live conferences and events and how the Dubai Mall is packed with people, day in day out, with more and more from outside the region heading there. He argued that might to some extent detract from the appeal of Singapore and Hong Kong, where re-opening is tentative still.

Money is pouring in from overseas, attracted by security, stability and a pleasant lifestyle as well as new rules and structures

“We have also seen a significant move of wealth to the region,” this expert reported. “Families from UK, Europe, they've had enough, they want to come to the UAE, they want to live their lives here, they can go to lovely restaurants, they can have lovely homes, their children are safe, their wives can wear their jewellery without worrying about being mugged, you can drive a nice car without it being scratched. And you can bring your money here, there is no direct taxation. We have seen a lot more activity, including in the insurance solutions market which offers very robust tools complementing what other estate practitioners and trustees are doing in making more robust solutions for their clients.”

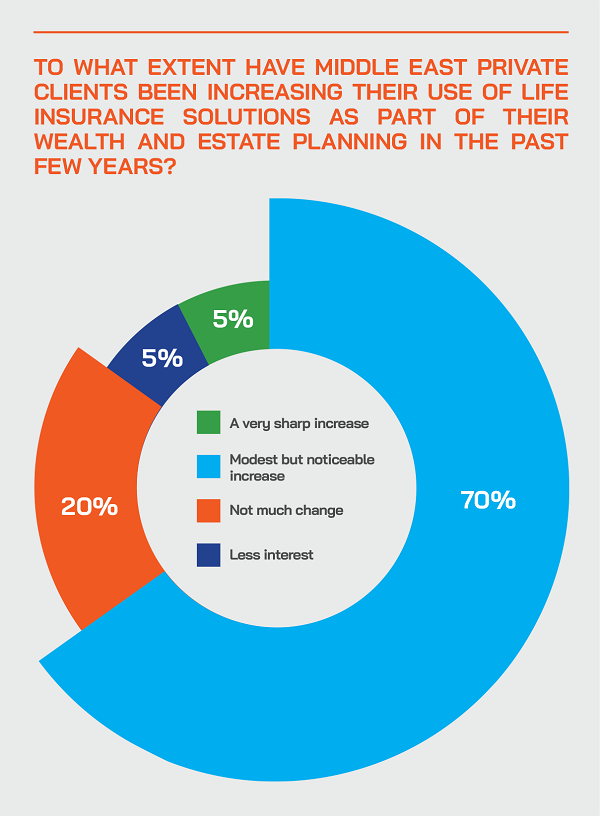

Life insurance solutions move centre stage and offer more diversity, as well as enhancing estate & legacy planning

An insurance expert highlighted the rising number of international life insurance offerings coming into the Middle East. “Universal life is now being joined by IUL, and clients are starting to ask where they can obtain guaranteed cover, what about guaranteed Whole of Life cover. Those types of products are starting to come in, which I think is exciting.”

He explained that working with leading brokerages, he was seeing more of these types of solutions being used for planning wealth or structuring wealth, and for passing on wealth, for potential inheritance tax planning in the future, especially for those who own foreign property. “We will see more different types of solutions, such as PPLI and VUL, as these are very interesting solutions for structuring of wealth and maintain some confidentiality.

In short, he said that the rather dull and somewhat listless insurance sector of some years back is being transformed. “Innovation is happening and there are some great solutions coming in thick and fast into the Middle East and I think that's good for clients and good for us all,” he enthused. “Private wealth has been growing apace, the market here is more liberalised, it is a good place to do business, and there is more and more infrastructure and therefore momentum. The region presents a huge opportunity. The activity levels have been dramatic in Asia for the past decade, and this region is rising fast as well now.”

Expert Opinion - Nirav Dinesh Kumar Shah, Founder and Managing Director, FAME Advisory: “Client requirements are clearly evolving. With overall changes in global regulatory and tax landscape – there is a twofold impact – there is the need to revisit existing structures and decide whether they are still relevant in view of changes made and likely to be made and for those establishing fresh structures, they must discern the optimum solution looking at next few years tax and regulatory landscape ahead.”

Expert Opinion - Sunita Singh Dalal, Of Counsel, Stephenson Harwood: “The Pandemic has created a positive awareness of the requirement to make ethical & sustainable business decisions. In response to this, I have seen service providers recalibrate their client interfacing platforms with extremely robust, secure, state of the art technology, that enables clients to be more involved in every element and aspect of their investment portfolio, should they so choose. Interactive relationships between clients & advisors are here to stay! The younger generation and business savvy client now expects so much more from their service provider and professional advisors; it is refreshing, to say the least, as this demand has a direct corelation to the standard of delivery of services.”

Expert Opinion - Tim Searle, Chairman, Globaleye: “The insurance industry has historically played second fiddle in the HNW advisory process since there were plenty of alternatives. Since governments have created new legislation particularly around disclosure and methods to collect revenue, an array of insurance solutions have become very relevant.”

Expert Opinion - Nirav Dinesh Kumar Shah, Founder and Managing Director, FAME Advisory: “We are of course responding to legal changes. We understand the changes, the practical implications arising from them, and we then update clients about how these can impact them and what they should be doing about that and how to embrace such changes to ensure that those will benefit them. We also collaborate with law firms, fiduciaries, private banks and others to ensure we service them or their clients to evolve suitably compliant solutions which meet client objectives. Collaboration with people who have common objective to add value to clients is key …that works efficiently. As to coverage of other jurisdictions, we have collaborated with mid-sized professional services firms in over 12 jurisdictions who regularly work with us on providing our clients with seamless solutions. For the rest, we use Fiduciaries and similar other service providers to enable us to provide global solutions for client’s multinational requirements.”

Philanthropic structures are also regulated, it is not a charitable, tax mitigation free for all

Another guest noted that there is indeed rising activity in terms of philanthropy and associated structures, but there are also subject to proper regulation. “It is a highly regulated industry here, and a highly regulated sector, so to anyone listening, you must ensure that if philanthropy is core to your activities here, then it has to be regulated and approved by the relevant government authorities and their ministries.

The region is seeing major inflows from a wide variety of countries

This same expert remarked that inflows form India, Africa and other countries are arriving, with more businesses and families using the UAE as their hub for businesses, and also family assets. The UAE is also a hub for exploring business activity further afield, for example in Africa. The UAE is also increasingly a hub for Intellectual Property, with more and more companies using the region as a hub for royalties, taking advantage of the numerous and growing double tax treaties, and taking advantage of the very transparent Economic Substance guidelines, even if the rules and practices around beneficial ownership are not yet so clear.

Trusted advisors should be involved right from the outset, helping with pre-planning, successful outcomes and ongoing governance

A guest commented on how trusted advisors should be involved if possible right from the outset of the planning. “The difference between those of us that pay real attention and do this from a long term perspective as a trusted advisor to families, is that we remain invested and involved right from the very beginnings, the pre-tax planning, the cross border tax planning that can't be ignored, as these are absolutely fundamental and prerequisites step to any form of succession, estate and restructuring that goes on here,” they reported. “We then remain involved and making sure that the governance that we put in place for family run businesses, remains relevant in and runs in conjunction with the evolution of the family. Governance is key, and resonates with many in this region, so it is important to not only draft a core set of family governance rules, but ensure that we all revisit those rules. We keep in close touch with the families, it is an ongoing process and one of learning as well on all sides.”

Expert Opinion - Sunita Singh Dalal, Of Counsel, Stephenson Harwood: “Cross border restructuring both global and regional has definitely kept clients and professional advisors inundated. Clients that had postponed implementation and restructuring during the Pandemic, are now keen to make up for time lost during the global lockdown. Advisors need to be more proactive in terms of operations, expansion, segregation of ownership and succession of family run business, in the Middle East.”

Expert Opinion - Laurence Black, Asiaciti Trust, Regional Director, Client Solutions, EMEA: “It really is often all about working together. This is true both inside the family and with the advisors who assist in formulating and putting the business succession strategy in place. Involving non family advisors in a succession plan may help with objectively balancing the collective interests of the family members. Trustee, lawyers, wealth managers need to engage in effective communication and sharing of knowledge to ensure a robust solution.”

Expert Opinion - Tim Searle, Chairman, Globaleye: “The recent ruling by HMRC which levies 40% death tax on foreign investors of UK property regardless of their holding structure has not only caught the advisory world off guard but more importantly the clients themselves. Both still think that their SPV/PIC/Trust will give them the protection from said tax when in effect they are sorely mistaken. The IHT take in the last year is up +20%; not because more are dying but NRND are picking up the tab.”

Communication is a headline that all parties should remember throughout the estate & legacy planning and advisory

A guest highlighted the vital importance of communication. “It is a headline I always bear in kind,” he said, pointing to the importance of communication and collaboration across different disciplines and across jurisdictions, the first step being to really listen to what the clients need and expect and then to the fellow experts. “It is all highly complex in many cases,” he warned, so making sure everything is fit for purpose, old structures reviewed and upgraded, and the new solutions fit for the future. And communication is core to the success, especially as we families in the region become less guarded as to what they tell us in confidence.” Internally, many such families are also more open with each other, he added.

The importance of expanding the conversations and diving deeper cannot be underestimated

Many private client advisors and IFAs though are not so comfortable or familiar with having this type of conversation around wealth solutions and wealth planning. “But it is important to be open about the bad news as well as the good news,” an expert commented. “That is tough in this industry, but vital. I always say to clients, you'll lose more with the day with the taxman if you get your planning wrong than you will in the stock market.”

Expert Opinion - Laurence Black, Asiaciti Trust, Regional Director, Client Solutions, EMEA: “Listen first is central to the solutions. It remains essential to listen very carefully to the client's requirements, then devise the most robust and most relevant solutions. Understand the unique challenges of our clients’ family dynamics, evolving needs and aspirations requires experienced professionals and specialists to engage in extensive consultations with them. The objective at the outset, is to clearly understand what the family’s ultimate objectives are in relation to asset protection and succession planning.”

Expert Opinion - Sunita Singh Dalal, Of Counsel, Stephenson Harwood: “The Next Gen are being empowered to diversify business, both in terms of expanding the global footprint of family-owned businesses, as well as in relation to expansion into new sectors and industries.”

Expert Opinion - Tim Searle, Chairman, Globaleye: “Intergenerational wealth transfer and succession planning are at the forefront of HNW minds, and their complexity means that all elements of the advisory process need to blend and not be compartmentalised which is presently the case. Financial planning is essential to orchestrate a cohesive and robust strategy for today and future generations.”

Expert Opinion - Nirav Dinesh Kumar Shah, Founder and Managing Director, FAME Advisory: “There are significant new regulatory and compliance challenges. Regulators are learning and trying hard to remain relevant while being efficient. Some of them still have old practices and want to adapt new changes and some have adopted changes but are clue less on how to efficiently embrace those changes. This results in process being longer and at times tricky from regulatory response perspective. This is not only in UAE but our experience in even dealing with Singapore for say re-domiciliation process.”

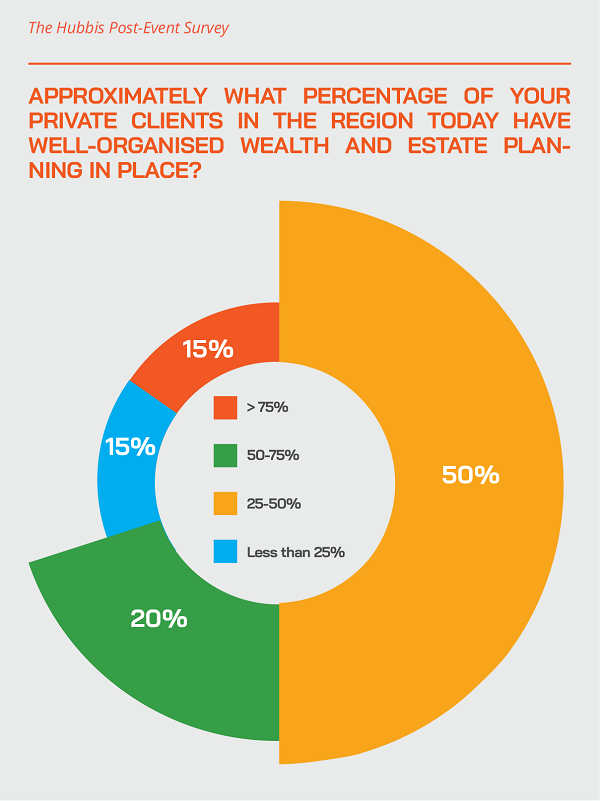

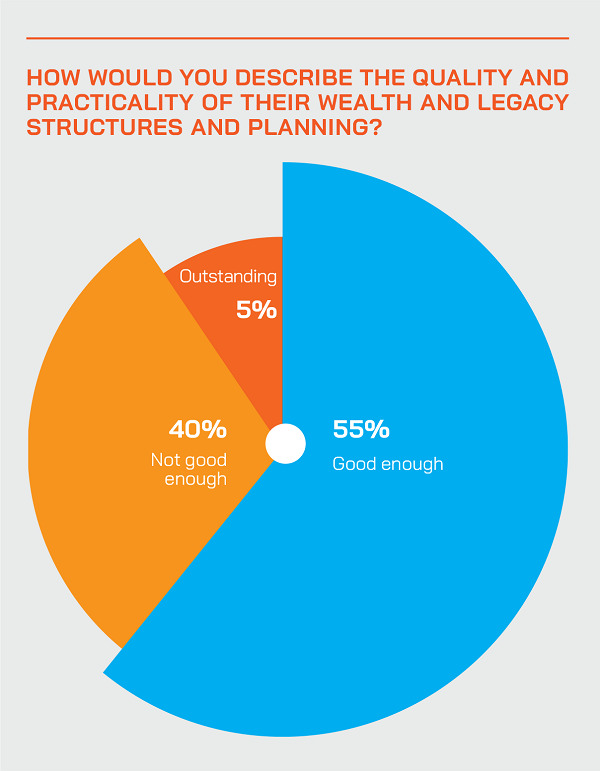

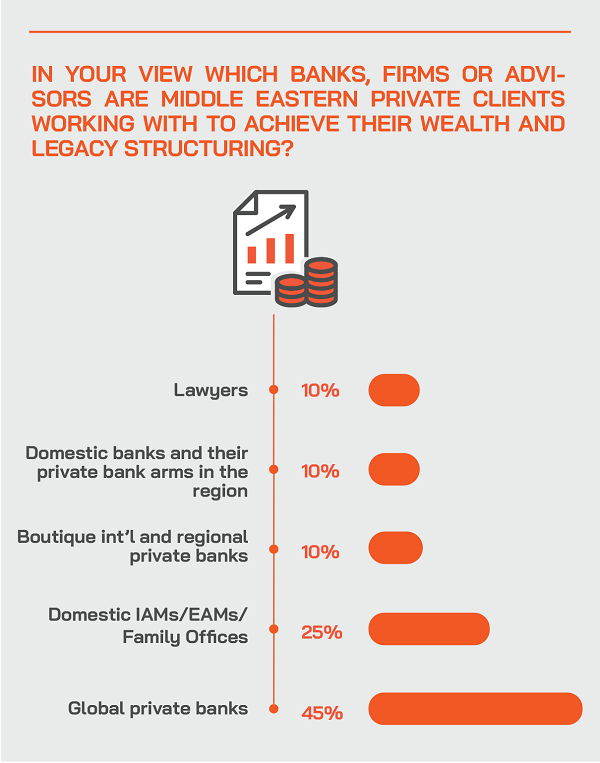

The Hubbis Post-Event Survey

Hubbis: Do you think there is a much more active drive nowadays towards professional wealth, legacy and succession planning amongst private clients in the Middle East? Why, or why not?

The answers were more than 95% ‘Yes’, and we have selected several comments from the respondents, as below:

- Definitely, as people are becoming more aware of the options available for a more seamless transition of wealth.

- The Middle East is starting to open its financial markets and offerings.

- With the way Dubai has managed its Covid-19 response and with the government opening up the economy and welcoming investors via golden visa opportunity, there is certainly an active drive towards consolidating wealth.

- Yes, with financial services firm also pursuing and trying the deepen their relationships with the clients. Firms are becoming fully-fledged solutions providers.

- Yes, the drive is much more evident now. I believe locals recognise they cannot hide from international regulation by maintaining even a low profile in the Middle East. So, some of this is driven by a need to integrate with the rest of the world. There is also the risk that the ruling powers in the region will need to resort to start raising more taxes from their populations. So some type of planning is advisable.

- Yes. As wealth has risen and spread, more people need well-planned wealth structuring schemes handled by experienced professionals.

- Yes, because the clients now have many of their assets across many countries and they also have many businesses for which they need solutions to ensure smooth transition to the next generations.

- Yes, tax and relocation issues are of great importance.

Hubbis: Is the UAE nowadays able to compete with other long-established offshore financial centres and if so why, or why not?

- Wealth Management is on an upward trend in the Middle East, slowly but surely, but it is not yet mature, still a long way behind Europe and the USA, even key markets in Asia. Proof of this is the expansion of international banks into Middle East with digitalisation as a dynamo for service delivery and quality.

- Yes, financial markets are growing rapidly, and private bankers are also growing in numbers allowing with good portfolio of services and products offered to onshore and offshore private clients.

- Dubai and Abu Dhabi are clearly improving their regulations and their wealth management proposition, it is encouraging to see. In short, the region is moving ahead, although the reputation and diversity and quality of Singapore and Hong Kong are still considerably more advanced.

- The UAE has grown and is becoming one of the top choices for international firms to establish their new offices, in both the DIFC and the ADGM. This is driven by constant efforts by the regulators to provide the comfort

- and to establish the region on a par with other financial centres globally. We are not there yet, but on the right paths. The UAE is also benefitting from the reputational damage to some other offshore centres.

- There is a governmental drive in the region to create the UAE to be the go-to centre for the Arab and Muslim communities, and financial services will help the region be less dependent on fossil fuels.

- Yes, and no. Most banks do not really book clients in the DIFC because of the regulations as they stand. Further regulatory advances are needed, otherwise clients will continue to book in other centres.

- The UAE, particularly Dubai, is surely booming in terms of wealth management opportunities, but there is much further to go. The banks should prioritise the evolving demands of clients as they are now well versed with sustainability investments. Another area that needs to be considered is the changing regulations like the move to transparent fee set-up and cost disclosure to clients.

Hubbis: With improving regulation and a more sophisticated and comprehensive wealth management ecosystem, are more Middle East HNW and UHNW investors moving more money back into the region, or at least keeping more onshore? Why?

- I think yes, due to taxation and as well as we have some HNW wealth from other parts of Asia moving to the Middle East, especially Dubai as they have opened earlier than most countries following the pandemic.

- Yes, relative to previous years. However, it will be gradual process until people see confidence in the overall system.

- Yes, with CRS nowadays, there is really no longer a rationale of keeping wealth offshore and to with the positive ways in which the UAE is developing and enhancing the financial ecosystem clients are encouraged to keep more wealth in UAE.

- Yes, with improving regulation and sophisticated and comprehensive wealth management ecosystems, these are encouraging investor confidence.

- HNW and UHNW investors are slowly getting more invested the region, with regulations becoming more on a par with other financial centres around the world, the Middle East’s reputation is rising.

- We feel that there is the potential for the powerful to seize more control of assets if things go wrong, so we think there will always be a strong rationale for wealthy people to diversify their assets and risks offshore.

- As the Middle East economies mature and laws become more stable, there will be a group of HNWIs and UHNWIs that retain a larger part of their wealth in the region, but they will also diversify globally.

- Yes, more can stay onshore, if the same quality of services is available in the region. But it will not be all their wealth, other than their businesses, as they will want to remain diversified as the political and economic and even geopolitical risks.

- The UAE has a certain cachet as being to some extent distant from the prying regulators and authorities of the Western world, like the BVI was but a more acceptable modern-day version but more infrastructure and a greater perception of quality and transparency.

- Yes, because more and more offshore wealth is exposed to tax and other regulations, for example there is now inheritance tax on UK property, no matter what structures are used to hold that. However, no smart local private client will put all their eggs in the one basket, especially if they have significant business assets already in the region.

- I believe that with the changing investment landscape in the Middle East, there are more Middle East investors are channelling funds back to their home countries. They feel that the UAE is more politically stable with a significant growth potential due to evolving investment opportunities and flexible policies and framework.

Expert Opinion - Laurence Black, Asiaciti Trust, Regional Director, Client Solutions, EMEA: “Due to the confidence instilled with the handling of the COVID pandemic and a significant number of residency visa initiatives, the UAE has attracted a significant number of UNWI’s and entrepreneurs who are seeking a stable and safe environment for their family, business activities and wealth. Visa initiatives include, Real Estate Investment, Remote Worker, Entrepreneur, Freelance, 10 year Green or Public Investment, Retirees and Special Talents.”

Expert Opinion - Sunita Singh Dalal, Of Counsel, Stephenson Harwood: “The role of the female family member within family run businesses, shall only become more prominent, as Patriarchs realise the positive impact they have on their businesses.”

Expert Opinion - Nirav Dinesh Kumar Shah, Founder and Managing Director, FAME Advisory: “To make the most of these opportunities, we are spreading awareness amongst clients in relation to the need to revisit and discuss suitable options. However, any changes proposed takes longer to be approved and then due to complexity in each jurisdiction, it takes longer to execute them effectively. There is no one solution that fits all…it depends on client objectives, from Foundations to holding companies to trusts in appropriate jurisdictions all are being used suitably.”

Inheritance tax issues loom large and life insurance structures are ever more valuable as other vehicles diminish in validity

The same expert pointed particularly to the rising prominence of inheritance tax – actual and threatened – around the globe, and its impact on insurance solutions and inter-generational wealth transfer in general, especially as trusts are no longer useful in many key jurisdictions, such as the UK, for sheltering assets. “When the other options of selling or gifting have been exhausted, and they're not popular to the client, we can then come in with a liquidity solution and work with insurers in delivering a solution that will give clients that surety that not only the death tax will be paid, but also that asset will be passed quickly and fully intact to the family as it was intended.”

The right jurisdictions for the right life insurance solutions, which are constantly evolving

A guest agreed, observing that the private clients must determine where the best jurisdictions are for the different life solutions they acquire, for example whether Hong Kong, Bermuda, Singapore, the Isle of Man and so forth. “Maybe the best Universal Life is Singapore, perhaps the best IUL is out of Bermuda, Whole of Life might be Hong Kong, VUL perhaps the Isle of Man, and so forth.” And that, he said, is why insurers need to have a variety of different jurisdictions and different products to meet the needs of the clients.

He added that the Asian and Middle East life solutions markets had been evolving in terms of the preferred solutions for the past decade or more. “We used to talk so much about UL, but now I am delighted to see the innovation by the insurers, and also by the financial advisors and the wealth planners, so we see more IUL, Whole of Life, Savings Plans, and PPLI, bringing better options, better guarantees and therefore being ever more suitable for clients, in short to match their real needs. And going back 10-15 years ago, when it was all universal life in Middle East and Asia, that wasn't perhaps the best solution for all clients, it was all that was promoted.”

Expert Opinion - Laurence Black, Asiaciti Trust, Regional Director, Client Solutions, EMEA: “HNW Insurance does indeed play a part in wealth planning and whether it be for their family wealth or business succession planning many of our clients have life insurance policies in place to provide for a liquidity event upon their demise.”

Savings Plans coming increasingly to the Middle East, and for good reason in an uncertain future

His final comment was on the Savings Plan, increasingly popular out of Hong Kong for example, he reported. He explained it is an insurance product with a very low life cover insurance. He reported see perhaps USD6 billion a year going into these solutions, mainly out of Hong Kong, but with the business coming from all over Asia and the Middle East. “It's a low life cover, single pay solution with an 88% or 85% day one cash value,” he explained. “And the clients therefore can leverage against that with the banks or institutions who will lend up to 80%, 90% or 100% of the day one cash value. So, therefore, the clients are leveraging up and really trying to get IRRs of 8%, 9%, to 10%. So, it's been big business for the banks here. And then there's lots of flexibility in the policies, as the clients can change life assured, you can change policy owner, you can drip the money out to the beneficiary. In short, they've all been designed to be very, very flexible, with certain levels of guarantees, and they're in terms of day one guarantees and also ongoing guarantee. We will see a lot more of this for Middle East clients, as this is really starting to come in over there.”