Independent Wealth Managers – Embracing Digital Tools to Enhance their Wealth Proposition

Dec 16, 2020

As the world waits with anticipation to see what happens next around the planet in terms of the pandemic, it is becoming clearer that in practical terms, doing business will likely not be the same in the future as it was pre-2020 for financial institutions. In short, a new normal awaits. A high-quality virtual panel of technology and independent wealth management experts assembled for the Hubbis Digital Dialogue of December 10 to gauge the digital health of the IAM/EAM community, to assess their competitive needs compared with the incumbent private banks and other financial institutions they compete with and work or partner with around the region, and to determine their ability to survive and thrive in wealth management in the years ahead. Are they investing wisely in technologies/digital? Which segments of their businesses should they most focus on, the back- and middle-offices? The front-end and the client USX? Specifically, what solutions and tools are most valuable to these firms, which have a far lower budget for digital transformation than the global, boutique or regional private banks, and which cannot afford to invest unwisely?

Partners: Canopy, Investsuite, Pershing, a BNY Mellon company, QUO, SS&C Eze, Swissquote

Some of the IAM community have been focusing more on the onboarding, KYC and AML elements, especially after the pandemic hit, concentrating for example on digital identity applications to ease and speed the process, remotely as well, and at the same time, to meet practical cyber-security and privacy challenges, as well as compliance requirements. Others have been investing in CRM and client lifecycle solutions, and accordingly, exactly what are their intentions, cost savings and efficiencies, or boosting RM/CRO relevance and productivity?

What value is technology to the IAM community, does this enhance their ability to compete amongst other IAMs, or does this elevate their proposition to move them closer to the private banks? How do the IAMs work with and or partner with the FinTechs/solutions providers to ensure their tech dollar is invested accurately and wisely? What types of investments are required, and are the buyers focused sufficiently on the end result, in other words on boosting the proposition and ultimately safeguarding and building revenues? Can digital enhancements enable wealth management institutions to truly deliver products, solutions and advice relevantly and remotely? And what needs to be done amidst the ongoing social distancing demands to adapt platforms to the potential landscape of the post-pandemic world?

Data and the new gold standard

A key area of FinTech solutions is data, data aggregation and investment analytics, and an expert concentrated on this sphere to offer specific insights to the evolution of these solutions and also painted a broader canvas of digital transformation in Asia from his considerable experience and bird’s eye view. His comments showed how passionate he is about the whole process and logic of digitisation in the wealth industry. It was very clear how this expert is even more convinced than ever that deep data aggregation and analytics are essential for the wealth industry as they strive to offer both a differentiated proposition and evolve the customer USX.

The buyers of these and other digital solutions must, he advised enthusiastically, first drive all decisions from the top line, as without a good return from these digital investments, the wealth management business model itself will likely falter, and this is particularly the case for the IAM community as it has smaller financial resource than the banks and cannot afford to waste either time or money.

Transparency and cybersecurity

When this expert founded his business in Singapore some years ago, he saw the urgent need for Asia to follow the rising global trend to data transparency and security, and the need for accessibility as the financial world transits from an analogue world to a digital world. He knew that banks and wealth managers and the end clients would want data to become more accessible and that this would drive a better client USX and help the wealth management community drive more complete and relevant advice.

The firm processes data from numerous custodian banks and reports on billions of assets, aggregate financial data across all banks and all asset classes into a single portfolio, anonymously, and also takes data from the banks, cleans it, fixes inconsistencies with the data and then it is good as the platform for deep analytics and reporting.

Rising demand from the IAMs

“We are actually seeing very, very strong growth in the independent wealth management industry, with many enquiries from that sector,” he told the delegates. “We see that whenever somebody is setting up a new wealth management firm, they do their rounds of all the providers, so we see our share of people who are ‘pinging’ us, so we can see the demand and the trends clearly. The pandemic has been horrible but it has resulted in a very significant pickup in all things digital, from our clients and their end-clients too. People are suddenly vastly more comfortable with digital tools, and that has definitely helped companies like us, but it has also helped the IAMs in making their offerings a lot more digital and scalable.”

He also reported that there is also a consistent interest across all clients for custom-built reporting. “If you look at an independent wealth manager’s business, your client, to be honest, is not so fussed about your onboarding process, your back-end, but the element that touches the client in every meeting is the report or the interface that the wealth manager shows the client, and that is the part that gets you more business, that is exactly the part that results in client loyalty, and also the element that helps you acquire new clients, and bring in more referrals. Accordingly, the digital dollar is as we see it going increasingly to those facets of the offering that touch your client. There is a lot of interest in this space, and a lot of interesting developments taking place.”

Personalisation driving differentiation

He commented also that the IAM community wants to offer a personalised and high-quality service and offering. “If your data is wrong,” he warned, “then the client will not take you seriously, you will lose business and reputation.”

He explained that key to the offering is not only the connection with the IAMs and the custodians, but the curation of the data just to get it right, just to make sure that the trade wasn't reported on the wrong day or wasn't classified incorrectly or, for example, reported five days later. “You must get this right,” he advised, “we see this as an existential issue for the independent wealth managers.”

Regulatory requirements – more and more

“We see a core challenge in the regulatory reporting arena,” said another expert, “and we expect that by 2022 there will be yet more rules to follow. We also need to think about the delivery of compliance information and data and cyber-security issues, especially in the era of cloud technologies and WFH. Investors need to be aware of these challenges. Remember how enforcing regulatory compliance was enough of a challenge when we were all in the office; well, it is even more true nowadays.”

Expert Opinion - Frank Maltais, Sales Director, ASEAN, SS&C Eze: “Investors don’t just want to know their money is safe. They’re scrutinising the entire investment operations, looking at everything from operational risk to compliance rules, especially in the current environment. Equipping your business with a reliable investment management platform and a knowledgeable service team is critical to meeting those demands.”

Another guest, representing a European FinTech, explained that their WealthTech solutions are designed for B2B and to assist existing wealth providers actually leapfrog the competitors. The premise of the business is around open architecture, he said, and armed with the experience of having run a private bank for over a decade, the solutions are all driven by the customer experience.

The customer experience

“I see this next wave, the next five years, as the wave of customer experience and bringing to life the magnificent products and businesses that I'm finding in Southeast Asia and Asia around asset management and wealth management in particular. But unless you've got your customer experience right, you are well behind. We try to provide a very different experience, and you need to be providing something special, different and better to capture the attention. Asia is very transactional compared with some of the other countries and regions around the world, but those days are ending.”

He explained that some of the opportunities that he sees, having dealt with Asia for the last 20 years in various roles, is the ability to really make an impact and bring clients in that might be not receiving the attention and the ‘love’ that they should be getting. “And you can do that digitally,” he said.

Don’t try to go it alone

Another expert agreed with the views expressed and added that there is a rising awareness that wealth managers can't be everything to everyone, and the buy-not-build build approach is therefore better. EAMs, he observed, are recognising that they are looking for providers that can provide best of breed solutions in the market, and that means having to go open architecture.”

He also commented that cybersecurity risks are rising all the time. “It's easy to do things digitally but when you're touching on really confidential information, and in particular for someone in data aggregation, for example, where you're consolidating personal and highly confidential information, the cyber threat really comes to the fore. Having said that, everyone is increasingly focused on this and working together.”

Expert Opinion - Will Lawton, Global Head, QUO: “2020 has been a catalyst for many in the wealth markets to move to digital trading and order management solutions, and we expect this to continue into 2021, especially given the added uncertainty of the markets and elevated volatility.”

Trading and the new order

A guest focused on the cloud-based electronic trading and order management field, both global and across all asset classes, designed he said for family offices, multifamily offices, professional traders, and similar. “With that ability to coordinate orders across multiple brokers and asset classes in a web-type solution for private clients, we don't keep any client data on our platforms, so the setup of our solution has been relatively quick. We have only been out in Asia for 18 months, and in the last six months, our growth has been tremendous, boosted by remote working needs.”

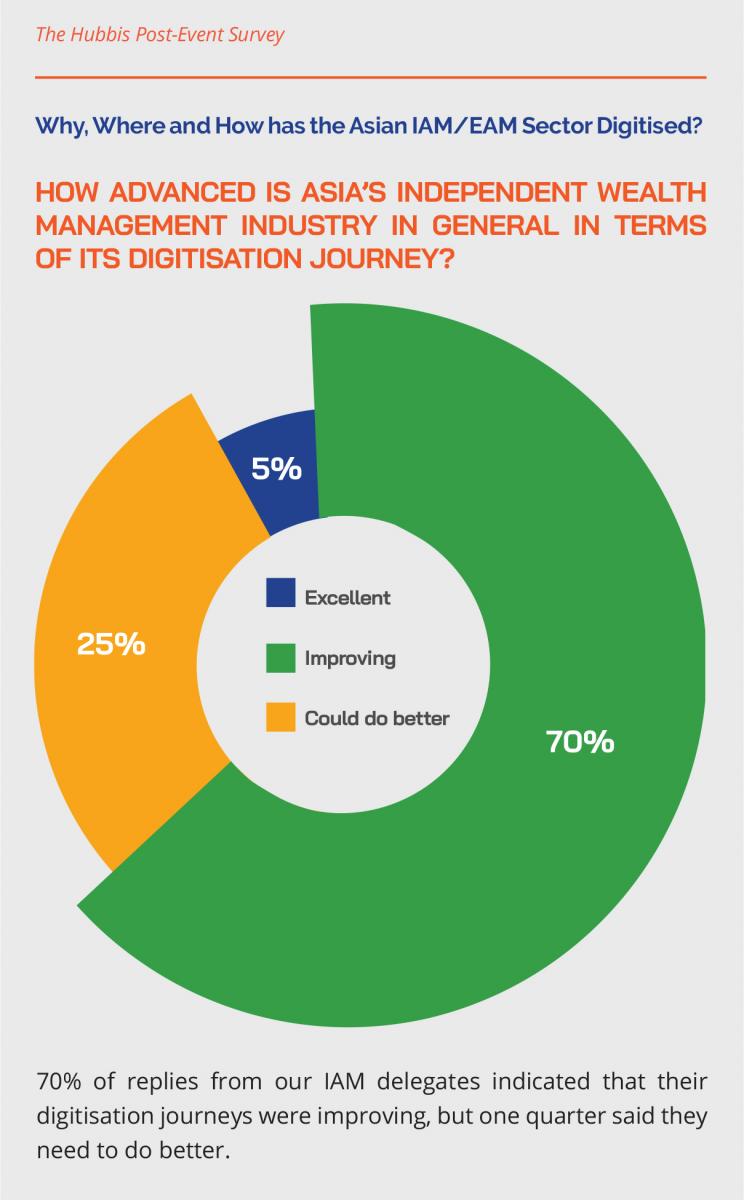

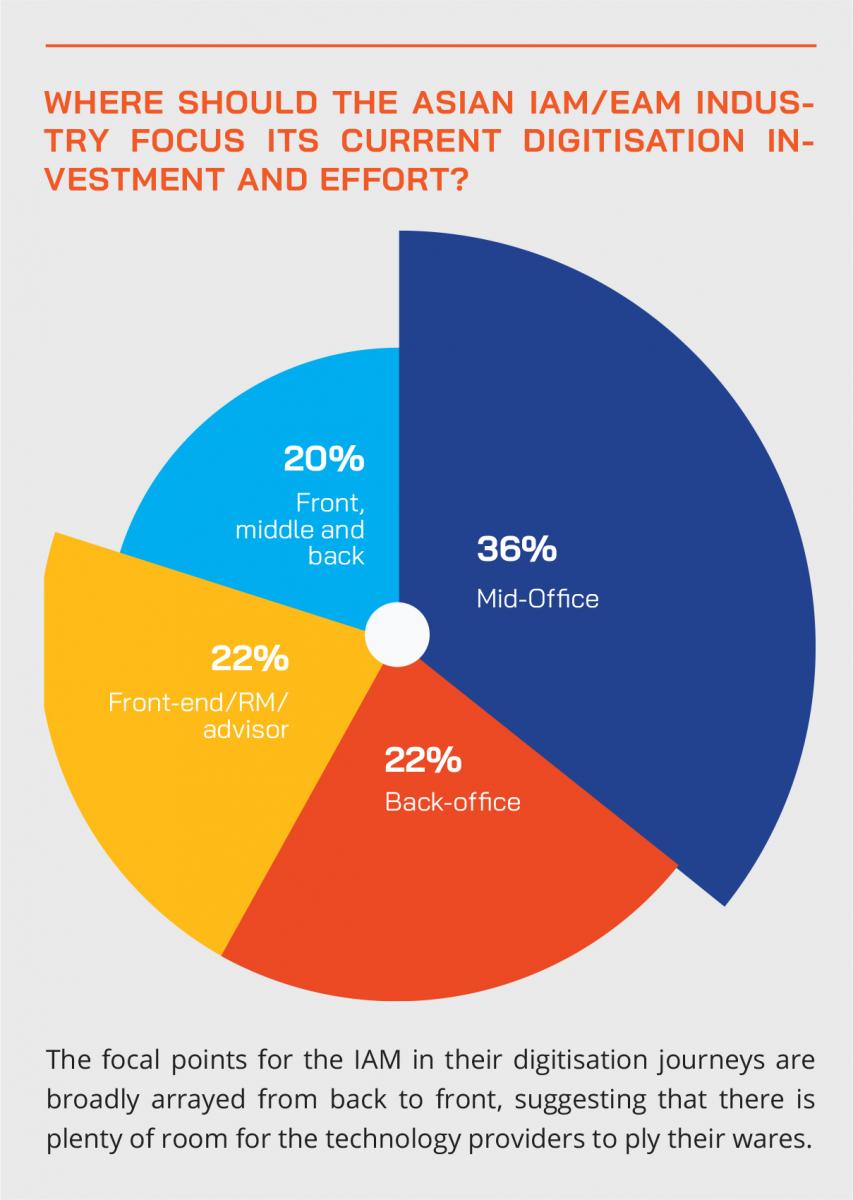

Post-Event Survey

Hubbis polled our delegates immediately after the event to find out where, when and how they were expediting their digital transformation. We have distilled their insights here.

Hubbis: What are the digitisation priorities of your wealth management firm, and why?

- CRM, especially when WFH arrangements need to be more prevalent.

- For marketing purpose.

- Digitalisation of our contracts, AML and KYC processes and customer journey.

- Automation of investment decisions and operations inclusive of trades and analytics.

- Proper dashboards for portfolio and risk evaluation.

- To reduce or automate administrative duties.

- Moving everything into the cloud. Our goal is to have as few physical documents as possible.

- Improving the front-end and addressing client needs and experience.

- Trade execution & trade confirmation. IT digitalisation: online solutions. Automation and efficiency of day-to-day issues and work processes.

- CRM plus centralised lead nurturing, in order to facilitate growth

- Deal Tracking, CRM, curation of research content for consumption.

- The back-office efficiencies.

- Advancing the online platform that can enhance processes.

- Client onboarding.

- Portfolio modelling, analysis and reporting.

- CRM systems.

How much positive impact is this digitisation having on your wealth management capabilities?

- Rather a lot.

- it enables us to reach more clients.

- Digitalisation is driving our growth. As an execution-oriented fund platform it is important to

- stay ahead of the game.

- All areas. It allows us to lower cost dramatically and pass on savings to clients.

- Digitisation wherever possible is overwhelmingly positive.

- The ability to acquire and manage more detailed information.

- Very high, especially this year the increased working environment flexibility.

- Clients are empowered, there is more time for RMs.

- It can streamline operational flows and could provide a better client experience and journey.

- The ability to work anywhere, anytime: flexibility especially in this covid-19 situation.

- Huge time savings.

- Improved client experience.

- Plenty. The easier and more intuitive we can make the process of explaining and rationalising

- returns, producing what-if scenarios, and so forth, the more the client interaction and building of trust.

Which are the key client segments you focus your digitisation on, and why?

- The mass market segment, as the numbers of huge and less touch may be necessary.

- Institutional, banks, fund companies, brokers.

- All around. B2B, B2C retail and HNW.

- Smaller clients as it makes our business more scalable.

- Customer acquisition, which is a very important component right now.

- Mostly focused on internal processes.

- Middle to back office operational flows, client onboarding and implementation of processes.

- Asia HNW, which is our major clientele.

- The focus is internal now but gradually moving into segmentation and more front-end.

- Family Offices and HNW individuals because they require the most nuance and detail toward

- securing relationships.

- All, as we see many benefits from digitisation.

- Client onboarding.

- Reporting.

- We are partnering with the external platforms, as we require technical support.

- We try to outsource as much as possible since it is not our core business or expertise.

- We work closely with our FinTech and platform partners on an ongoing basis.

- We are working with an external partner on CRM.

- We are not yet working with an external platform, but we would like to.

- We will work closely with platforms predominantly as they have both the motivation to create value-added interfaces for their advisors and clients, plus the resources. Developing digital resources for in-house with FinTechs is a very costly and, in all likelihood, what we are looking for may well be already in the marketplace.

Building the platform(s)

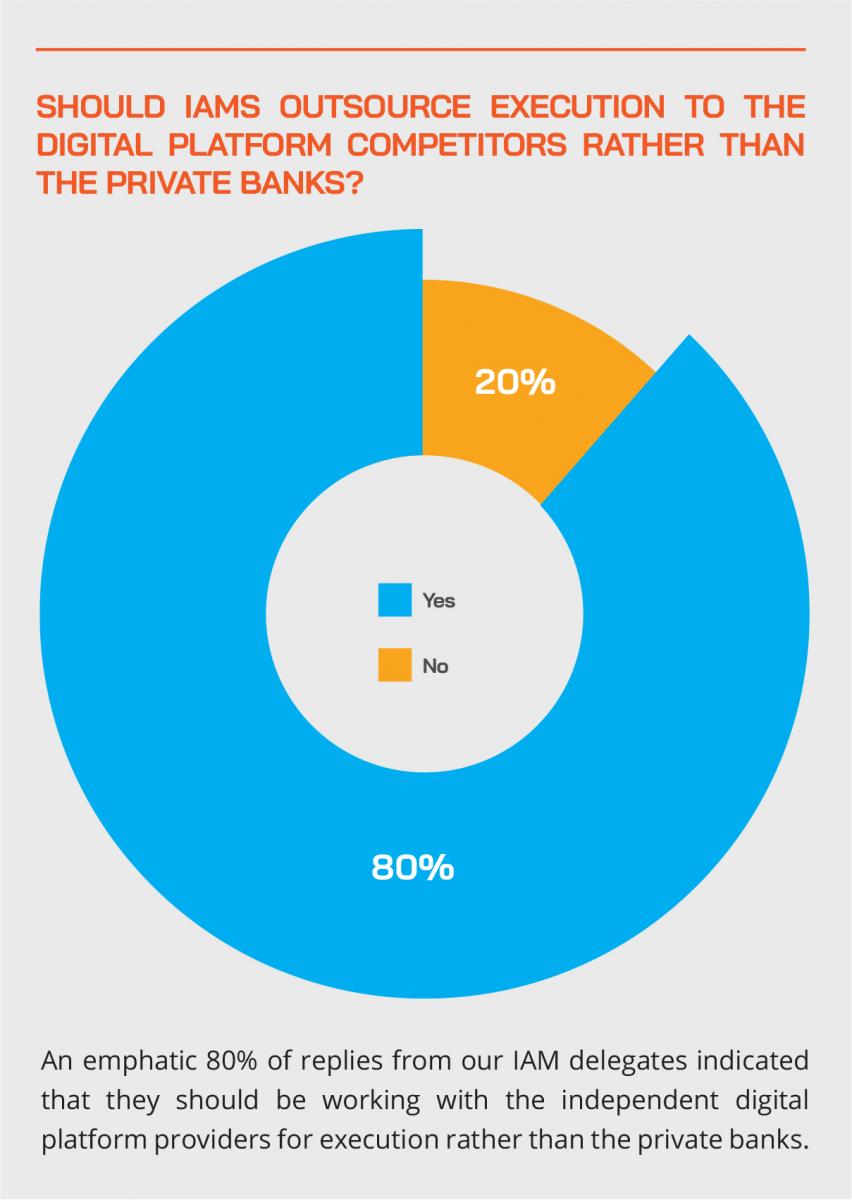

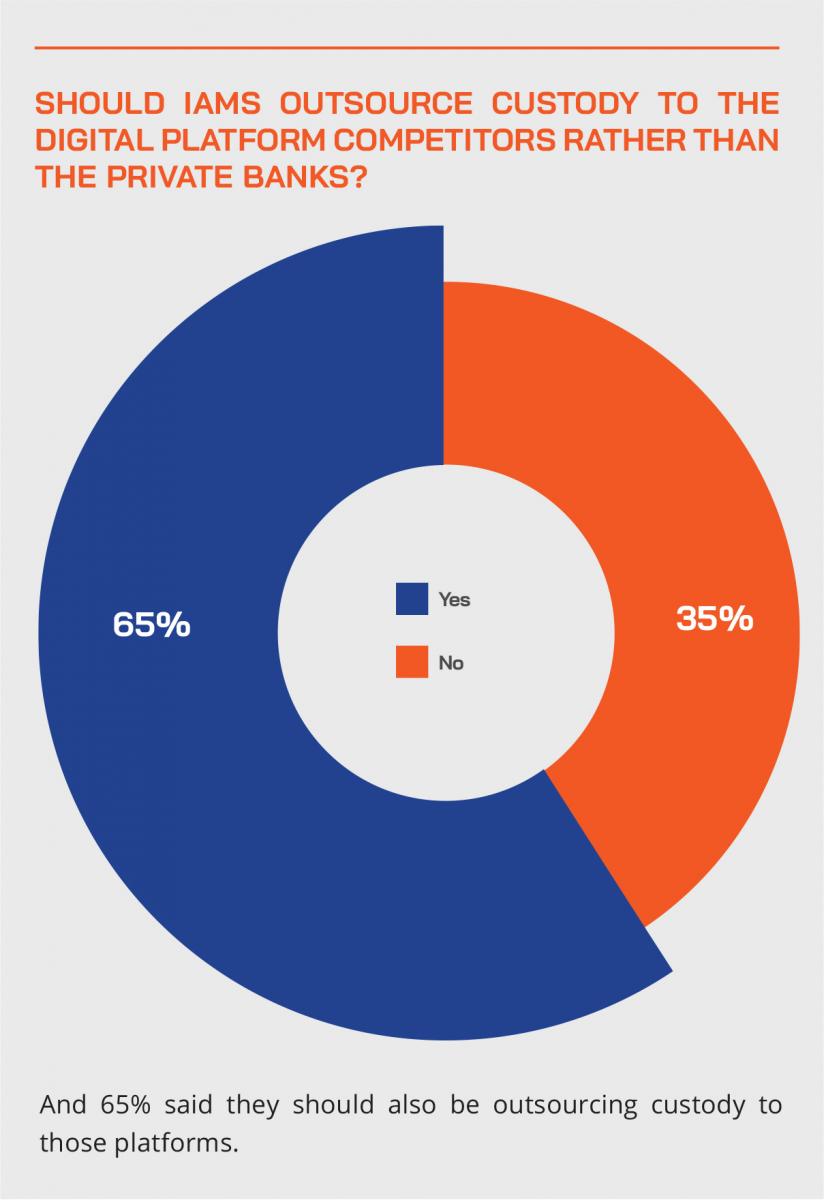

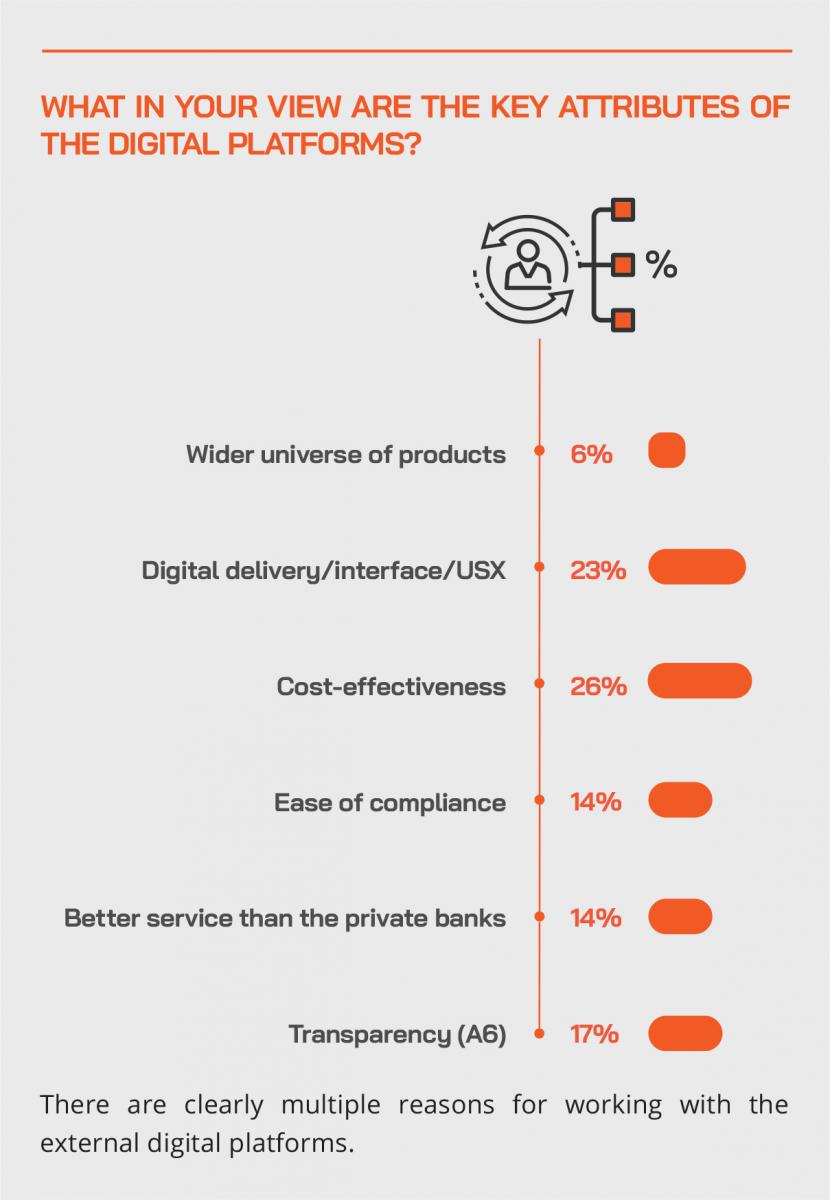

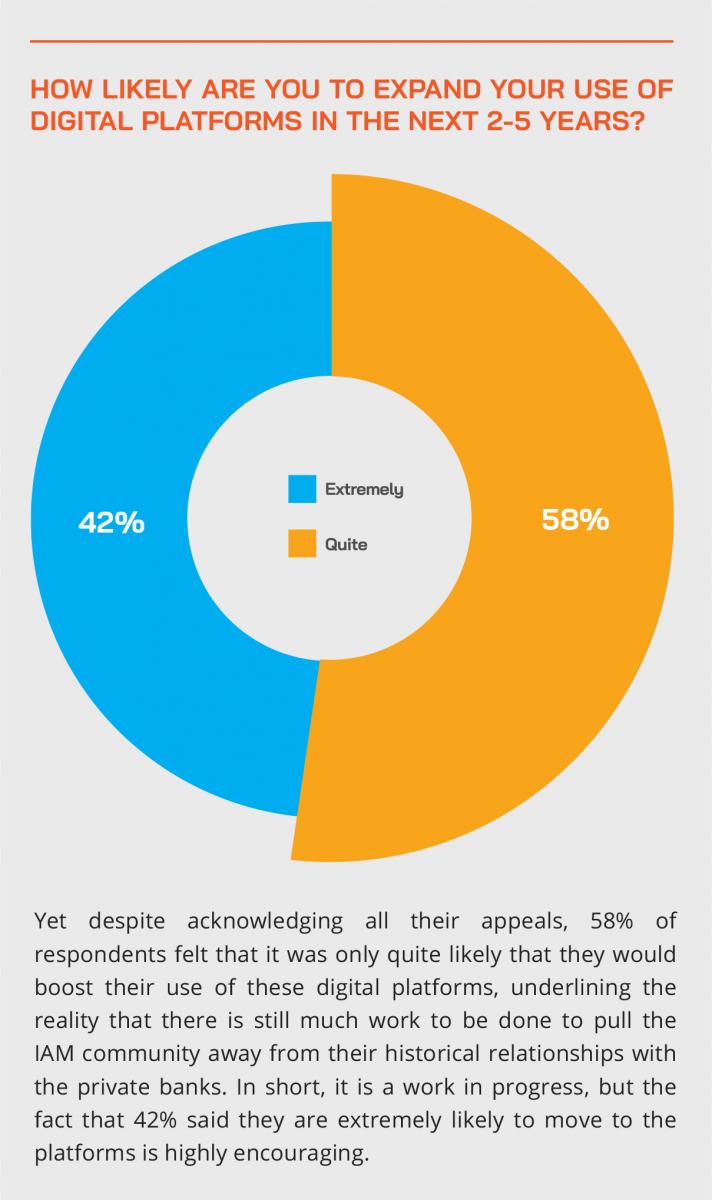

The world of IAMs and EAMs in Asia offers a great opportunity in offering platform solutions to help them evolve and thrive in a rapidly changing global financial landscape. The rise of external digital platforms has been well documented, and one expert whose firm offers a well-regarded global trading and custody platform explained that many such wealth management businesses can significantly enhance their capabilities and offer their clients a world of product and trading opportunities, all at a sensible entry and ongoing cost basis.

“There is rising adoption of external platform providers,” he reported, “as part of the expanding digital journeys many such wealth firms focus on today, especially since the pandemic.

He told delegates how, despite a remarkably difficult year for the industry and everyone concerned, the firm will likely close the year with 40 new clients, or partners as he refers to them, signed up in 2020 for its digital and global execution and custody platform.

“The fact that people have had a little bit more time to do some housekeeping, to maybe do some of the things that they're not able to do in a normal 'business as usual' year has been good for us,” he explains. “We've had a number of EAMs who have added us to their custodian partner list. And a number of EAMs we've been talking to have been either rationalising or expanding the custody partner and execution partner panel.”

This same expert also commented that although the pandemic has been awful, the growth of Asia’s economies and private wealth generation should resume rapidly once we emerge into a post-pandemic world. He explained that the Asia-Pacific market opportunity is therefore still remarkable, offering the largest accumulation of private net worth in the world, indeed surpassing North America back in 2015.

“Our key target partners,” he reports, “include family offices, EAMs or IAMs, general financial advisory firms, local securities brokerages, regional banks with a strong Asia. As we are execution-only, and we offer no advice at all, we steer well clear of conflicts of interest, and this is incredibly valued by our partners, who do not need to be concerned at all.”

Tested in testing times

He also commented that digital solutions in 2020 had been put to the test under stressful conditions. “Back in February and March,” he told the audience, “we had literally three weeks of quite unprecedented volatility, but thankfully, we proved how stable our platform and processes are.”

He also highlighted how the independent wealth community is looking for more bells and whistles, and therefore the firm continues to build out more tools in terms of functionality, such as a tool on the platform that allows them to build model portfolios across various asset classes and rebalance, and also API reporting tools.

Recalibrated

“There is evidently more focus and more investment amongst these IAMs in terms of bringing more automation into their in-house operations, particularly multi-custody. All in all, assuming the world can get to grips with this pandemic and we can return to some sort of new normal in 2021, it should mean that most firms are organised reasonably well to recommence and build for the future.”

Fit for purpose

He also observed that it is vital for digital solutions providers to work very closely with the community to help devise their next solutions and tools. “We must be both fit for purpose today but also forward-thinking and anticipate and reach to anticipated changes in the industry,” he explained. “We must be agile and able to adapt rapidly to actual and predicted evolution in this market. We indeed see our role as being far more than being a global custodian and execution partner, we see the need to build the functionalities for your partners that they need to drive their differentiation and their revenues in the coming five to 10 years.”

Merging different disciplines

A guest who had moved from the world of custody to a FinTech observed that in some ways, the two industries are merging as the lines of demarcation diminish. “And generally, from an execution standpoint, one thing that I've seen here at this firm is the need to innovate, the pandemic really opening more doors to new ideas. Artificial Intelligence, for example, has been around for a long time, and we have developed an AI auto-routing, rule-based system, really based on a client's trade history. It means that traders can easily manage rules that automatically route orders out to different broker destinations, and those trades that are tricky can be dealt with manually and the rest automated.”

Expert Opinion - Will Lawton, Global Head, QUO: We bring institutional-grade EMS/OMS (electronic trading solutions) to the wealth markets designed for EAMs/MFOs as well as private banks and their RMs and central dealing desks so that the trading workflows can create significant efficiencies in terms of time, pre-trade risk management, trade execution and compliance.”

Expert Opinion - Frank Maltais, Sales Director, ASEAN, SS&C Eze: “The key to ensuring successful implementation is about finding a reliable partner, not just a vendor. Ask the right questions. Does your technology partner have the experience and expertise implementing a firm like yours? Are they putting security and reliability of the system at the forefront?”

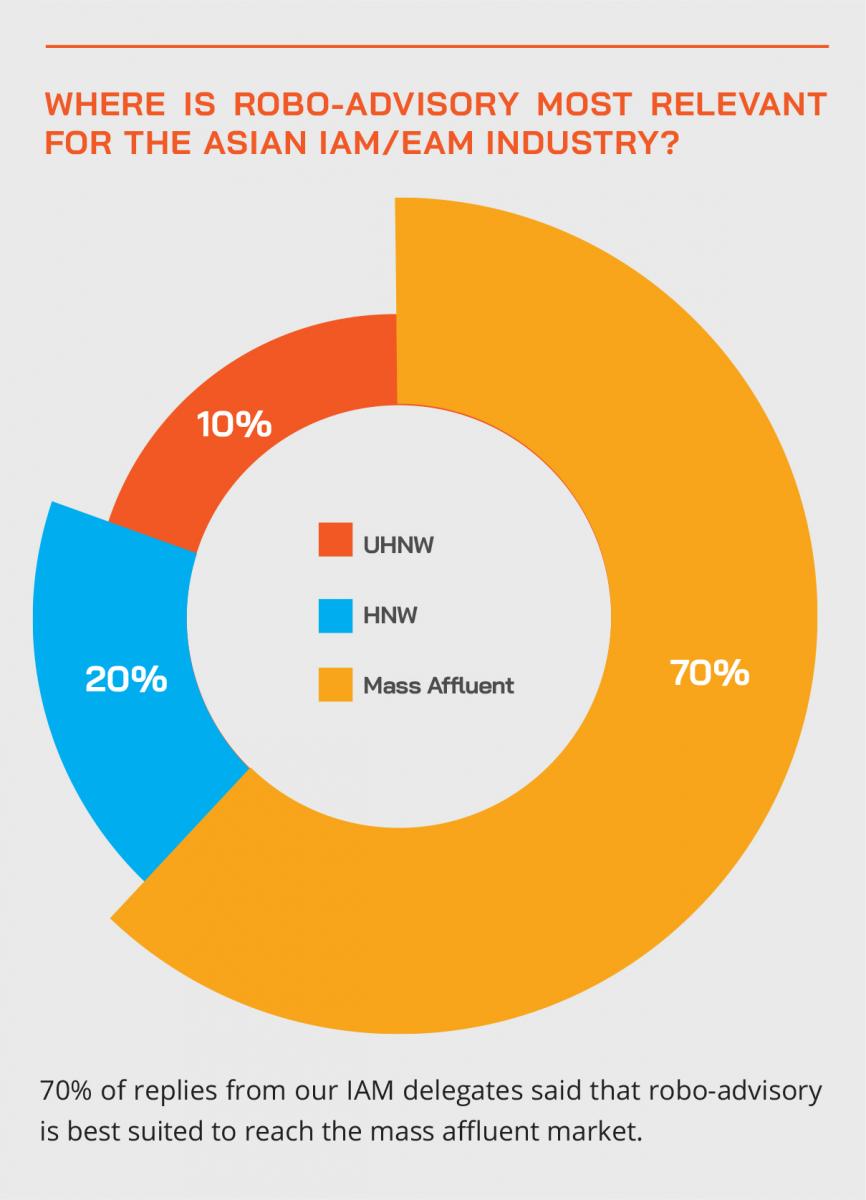

Turning to robo-advisory, a guest remarked that this should really be called automated advice and that it will never replace human interaction. “It will assist, provide a better customer experience, and lower the cost point, hopefully, for customer acquisition. Automation is well underway, and will, for example, affect all elements of portfolio construction, customer experience, reporting, and ultimately execution. And this thrust to automation is very good for the industry and the wealth sector as a whole.”

Data as lifeblood

A guest highlighted how data had become lifeblood. “As a global custodian, three to five years ago, we had looked upon data as very much a traditional custody role, safekeeping, but our thoughts now have gone completely 180 degrees, in that we're trying to give our clients, the managers, the wealth managers, the investment managers, that data back in order to make proper investment decisions and thereby to find alpha. We sit on trillions of dollars’ worth of assets, they move in different directions every single second of the day, so we have a lot of insight into that, and not necessarily sharing individual insights with our clients, but that collective source of information is extremely powerful.”

Collected, cleaned and cleared for delivery

And he reported that they are working with clients to make sure that the data they have, which is very disparate and in different formats and locations is collected, cleaned, and returned to them in a clear format to allow them to make better decisions for their clients. Clean data is essential for all facets of wealth.” And to help achieve that, the open model, the modular model that his firm has adopted is that path to delivering.

Integrated, not disconnected

Another comment came from an expert who observed that it is essential to offer front to back solutions that are fully integrated, because the data needs to be available instantly in real-time in one location.

“It's okay to have a system here or there, but there's definitely a case as well to be made in saying, here's an LMS in the front office that connects seamlessly into a middle and back-office solution also into one database, it's one data set, it's one step for me to cleanse the data and to generate reports that can stitch front office data to that of my back-office valuation and secure massive information all coming from one source. This is definitely important to our clients. And it all needs to be real-time access from anywhere, anytime, you should be able at the click of a button to customise data extracts to your needs and for your clients to be on the line and basically get that quickly. This is the expectation, not even a bonus; it’s a default in the industry today.”

Seeing things from the client’s viewpoint

The importance of reporting from a customer experience viewpoint is the new frontier of the next decade, another guest stated, whether video delivery or the ability to articulate a story with regards to the client’s investment returns and offered in an engaging way. Today, you've got a speed of technological adoption and execution that is breath-taking, he added, but said that identifying what is fit for purpose, what certain FinTechs have achieved, whether they can solve the core problems in a cost-effective way, whether they can execute and implement efficiently and so forth is very difficult. Getting it right, he said, will result in an optimal customer experience, happier clients and a business that is well-aligned for the future.”

Expanded & accelerated digital journey

His final comment is that globally all execution brokers have had a pretty good year, mainly because volumes were up tremendously on any other year, but that this is no cause for resting on their laurels. “We can see that the digital journeys out there have accelerated during 2020, there is a lot more work and tangible progress going on across the industry now, but from our perspective we must continue to stay ahead of the industry, to remain ahead of the game. And we will.”

A guest added his views on the selection of vendors and partnerships. He said that it was very important for the IAMs to navigate the minefield of identifying the right steps to take and finding the right FinTechs and other partners for the digital journey.

Careful how you choose

“We have in the past few years seen many wealth managers, both with existing businesses as well as those starting out, do their rounds to help decide on which vendor to go with,” he reported. “My advice to people who are coming into this space or thinking about this space is focus on the revenue objectives, and everything else will follow. For new entrants, your cash burn will be crucial, so think about whether every dollar you spend is going to result in incremental revenue.”

And his final word to close out the discussion was that in his experience, those who actually survive and prosper have a laser-guided focus on their USP, what will win more business. “My final piece of advice is to reiterate the need to focus on the top line and, assuming all else is professional and well organised, success will follow - you will be making the right decisions in digital transformation and choosing the right vendors who can truly help make a difference.”