How Technology can be Harnessed to Drive Success in Asian Wealth Management

May 21, 2021

Hubbis and our exclusive partner Azqore, hosted a virtual discussion on the application of digital solutions to the world of Asian wealth management, as technology revolutionises the offerings and efficiencies of private wealth managers and the broad wealth management community across the region.

Speakers

- Yves Saint-Marc Girardin, Chief Executive Officer, Asia, Azqore

- Omar Shokur, Chief Executive Officer Asia & Singapore Branch Manager, Indosuez Wealth Management

- Alvin Lee, Head of Group Wealth Management & Community Financial Services, Maybank

- Terence Chow, CEO, Wealth Management - Asia, RBC Wealth Management

- Michael Blake, CEO Private Banking Asia, UBP

- Alex Sim, Managing Director, Chief Operating Officer, UOB Private Bank

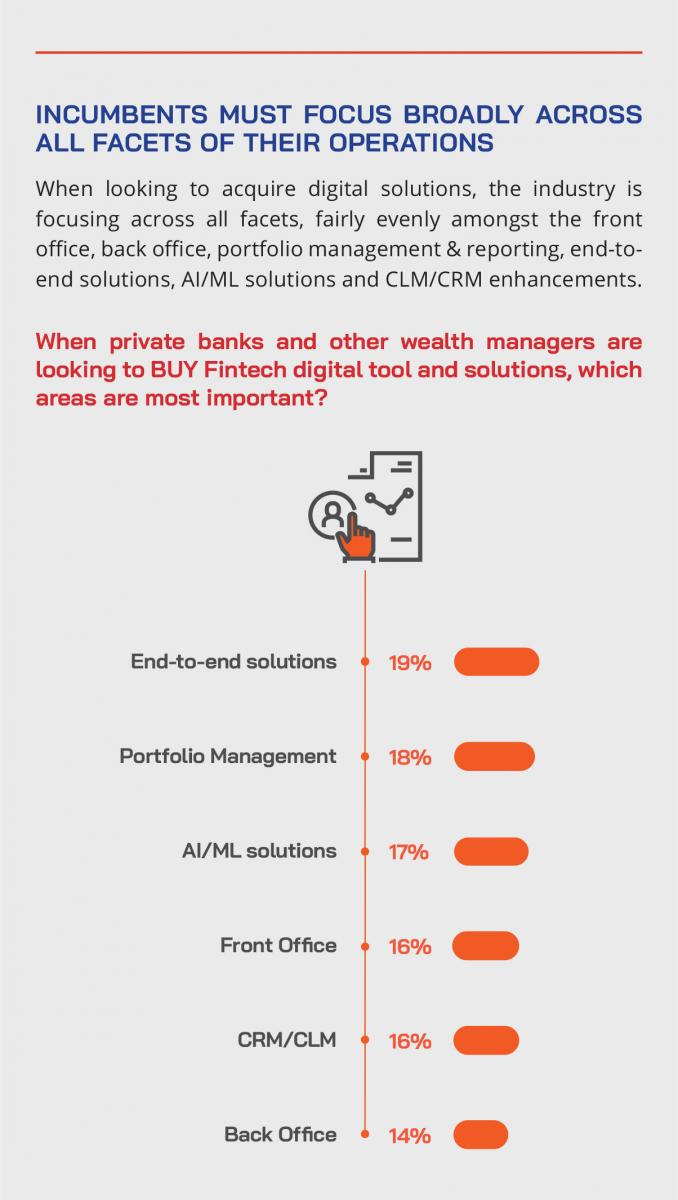

The high-profile discussion focused on how the pandemic has turbo-charged the drive towards digitisation that had been gaining momentum for quite some years and delved in-depth into what key solutions are most in demand today, and what the next suite of solutions might be. The panel discussed the nature of the Asian wealth management market, defining their business and digital needs for the years ahead. They pondered whether this broad digital revolution is being properly embraced and, if not, who might get left behind. They also debated whether technology investment is being properly targeted and executed and analysed how the wealth management organisations competing in the Asia region can best adopt, adapt and assimilate these new technologies. The reality is that much time and money can be wasted by not taking the right approach to digitalisation, but that smart, targeted investment with clearly defined operational and business goals in sight – all with the private client’s needs and experience front of mind - can and will significantly boost their competitive position. The panel also looked into the merits of outsourcing for both efficiency and cost savings, as well as for flexibility in the integration of third-party IT and FinTech solutions that they might want to add on during their digital transformation journeys.

The Key Insights from the Panel of Experts

2020 – a challenging year, but with some real positives on the business front

The panel was fairly positive about the business aspects of 2020 from the private banking and wealth management perspectives, with positive responses from team members and clients alike to remote working and digital connectivity, and with positive investment returns for those who weathered the early market storms and remained invested. Clearly, the need for digital transformation accelerated due to the pandemic and many institutions fast-forwarded their acquisition or at least investigation of new solutions, from bolt-ons to outsourcing, all of which is to boost client centricity, boost RM capabilities and productivity, and also for improved and lower-cost processes and operations. Talent remains a high priority, with panellists reporting ongoing hiring throughout 2021.

Remember – Asia still offers an appealing market and great upside potential

There are plenty of opportunities and also more challenges ahead during 2021 and beyond, but as a banker commented, Asia remains the fastest-growing region in the world where the vast majority of wealth is still not professionally managed, so there are great opportunities in almost every market for professional wealth managers.

New entrants are pushing the incumbents to play smarter and enhance technologies

Clients in general are demanding both greater innovation and a faster speed of delivery, and at the same time, there are more new players into the market, whether it's Neo banks, FinTechs or the low-cost digital/electronic platforms. These arrivals force banks to choose and to shift either towards being a high-volume lower margin business, or to become more niche and more specialised.

In times of crisis, the relationship seems more important than ever, and agility is vital

A senior banker reported how their bankers spent a lot of time and effort reassuring clients during 2020 and helping them navigate the financial market and indeed personal ramifications of the pandemic, at the same time as the bank had to overcome many of the operational and logistical hurdles of remote working and lack of travel, and other issues. He also reported how encouraged he was with the agility of clients and RMs and other team members in adapting so rapidly to the new situation, embracing new ways of communication and doing business.

Freeing up the RMs and advisors is a key part of digital transformation

The panel members all offered their own particular insights into the enhancement of the RM and advisor community within their organisations and broadly in the wealth industry. There are differing approaches, but the key messages were that the RMs need to be freed up by digital solutions from many of the mundane chores they face daily, they need to be able to offer easier, seamless self-service to their clients, while being more available for human (albeit still remote) communication, they need to leverage data and client behaviour for greater relevance and better ideas, and a more comprehensive approach to CLM/CRM should be adopted by private banks.

Technology can bring scale and prepare institutions for a challenging future

It is well known how rapidly the mass affluent market has been developing in Asia. While the private banks have been deriving most of their business from the HNW and UHNW segments, smart investment in technology can help the banks leverage their mass affluent relationships, especially those private banks in the region that are part of major universal banks with multiple locations and product and service lines, from retail banking to business banking to capital markets and investment banking.

Focus and selectivity is also essential for many of the incumbents

While there are opportunities broadly across all segments of the wealth markets in the region, some of the competitors in the region are international banks and brands that within Asia must play to their core strengths and focus on their niches. The right combination of strategy, technology and talent is essential, aligned with a clear focus on where their core strengths are and where these banks and other firms can compete most effectively.

The world has changed; digital transformation is even more embedded than ever before

Not only has the pandemic accelerated the process of digitisation, but the panel seemed in agreement that even if the virus were somehow to be tamed or to disappear, the combination of technology-driven and human-driven wealth management would continue. At the upper end, the clients value more human connectivity, but they have also seen that they can self-service their trading and investments while leaning on their RMs for tailored and more complex advice. At the mass affluent levels, they tend to be younger anyway, and have increasingly embraced the new digital and remote connectivity, and are likely to continue to prefer this type of arrangement.

The core characteristics of private banking will prevail long into the future

What has not changed is that private wealth clients still need and expect a combination of longer-term trusted relationships, they will expect solidity and stability from the institutions they work with, they will seek relevance and suitability, and at the upper end of the wealth spectrum, they will increasingly demand a highly customised investment strategy, which is in line with their objectives. Within all these areas, technology must be employed to deliver on those expectations and elevate levels of service to their clients more effectively, faster, and with better outcomes and performance.

Digital transformation is a journey, and each journey is different

A banker highlighted how when approaching digital transformation and the digital strategy, you have to always look at it as a journey. It will take some time; it's a progressive journey, and you have to look at the different areas you want to improve. Some improvements could be for internal processes, greater efficiency and cost savings, while some advances could be to help the bankers to focus more on the added value of their proposition, and some will deliver better communication and exchanges with clients.

There are numerous enhancements; each bank and wealth firm must deliver their priorities

The panel members listed their priorities for technology investment and adoption. These covered a range of missions. One banker explained that they are launching a new investment proposal tool for their investment advisors and private bankers to help them build investment propositions and deliver it through their dedicated platform, thereby also freeing up those bankers to focus on the added-value elements of their offering. A banker said they were focusing on CRM tools to boost the understanding of the client’s activity and to help sharpen the focus of the RM follow-up with their clients. Another said they were focusing on data analytics, AI and machine learning to drive better outcomes for their clients. There was broad agreement that more investment is required in onboarding and remote KYC and form-filling in delivering seamless access to execution, trading and portfolio assessment/views. One banker explained that they had invested heavily in boosting their FX platform and proposition. Everyone agreed that more money and effort was being focused on remote communication tools. Everyone also agreed that boosting education and skills around technology is essential.

Time will demonstrate that the traditional ways must align with the digital future

A banker reported how the pressure from the new entrants has not really yet been felt, as this is a hiatus period while those new competitors open shop and gear up, at the same time refining where they can compete. The pressure will intensify in the years ahead, so the incumbents need to recognise who these challengers are, and the challenges they will present, and react by becoming themselves increasingly digitally enabled. If not, there are major risks posed by these agile smaller players or from Big Techs who gradually evolve their propositions into the world of wealth management, many of them armed with some global-scale tools and ‘tricks’ of their trade.

Positioning for the future generations of wealth

All of these changes are taking place within the wider context of time, with the second and Millennial generations inheriting control of so much of Asia’s vast private wealth in the years ahead, as well as generating more of their own wealth. At the same time, a patriarch’s wealth, when inherited, will be split into smaller chunks, meaning more clients to deal with in the future, rather than a single source for oftentimes vast wealth. Those incumbents who do not appreciate the scale and speed of this transition will risk losing traction and disappointing the next generations of clients, many of whom are perhaps less loyal to the traditional banks and brands.

Scale will count in the future, more perhaps than the situation today

Incumbents can achieve scale by leveraging technology and digital transformation strategies – including outsourcing as well as the outright purchase of solutions – and they therefore need to continue to invest in technology, in talent, in innovation, and thereby react and adapt to their future marketplace, whilst also keeping some of the non-traditional entrants at bay. If not, as one guest stated, they will risk others eating their lunch.

Relevant and tailored advice is an essential

The panel agreed that relevance, suitability, imaginative insights and interesting products, assets and solutions are all in greater demand. The markets since the global financial crisis had been a rising tide that floated all investment classes, but today there is far greater dispersion in performance, so providers need to align technologies to help their RMs and advisors deliver the best and most relevant and most suitable ideas. If they do not, they will not differentiate themselves from the competition.

How you approach technology and digital transformation is key to delivering your USP

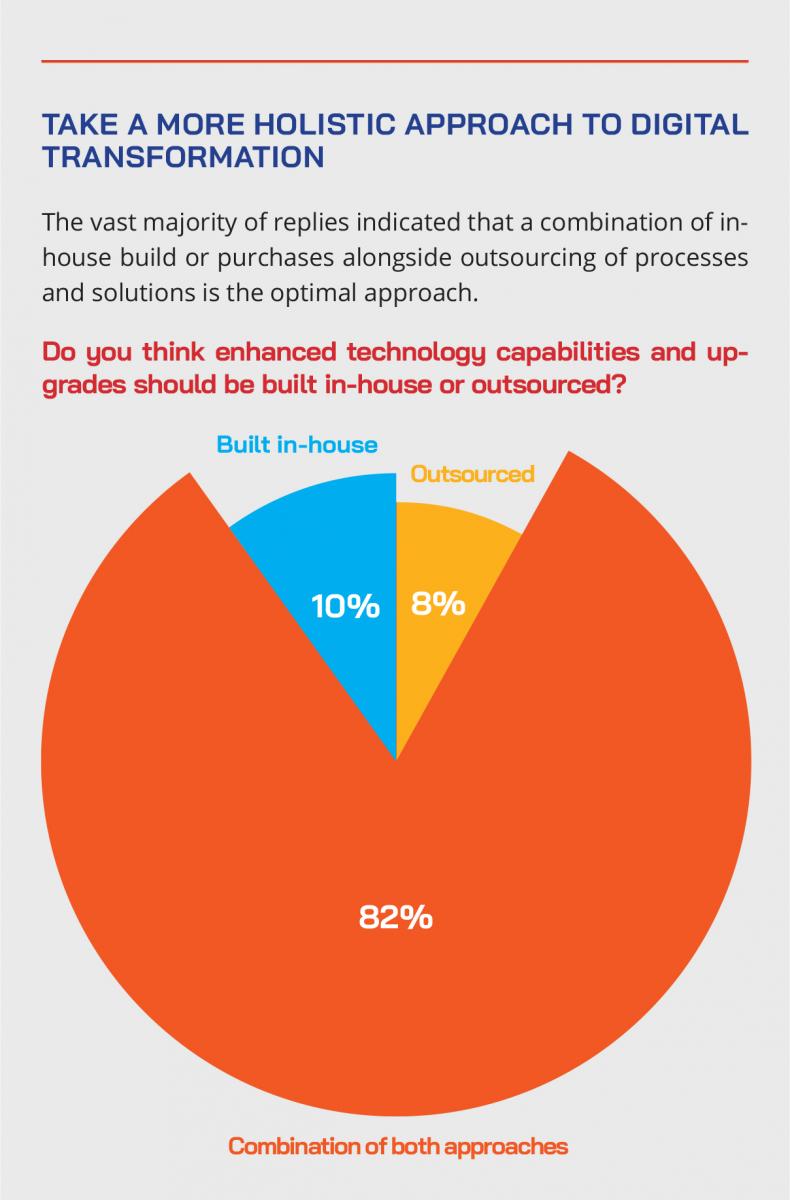

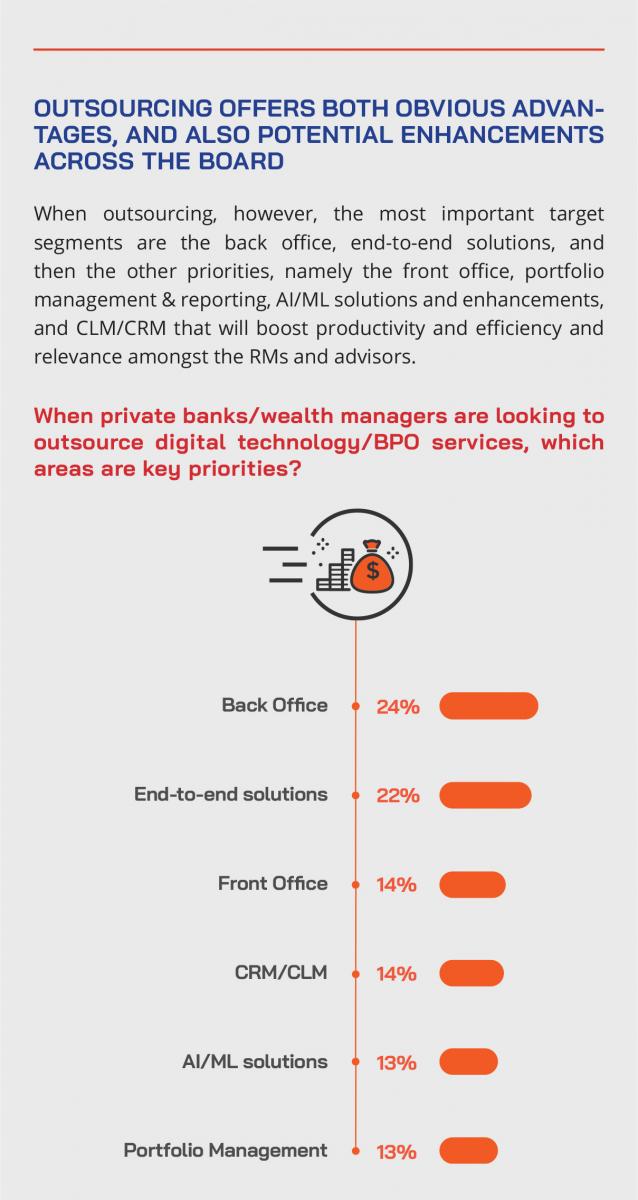

The build or buy, buy or outsource debate continues throughout the wealth management industry. It is important to appreciate that outsourcing of processes and solutions can be an all-encompassing approach, as it should not restrict the institution from a continuous evolution of other digital solutions; in fact the right outsourcing providers help their clients bring more add-on solutions and enhancements into the fold and make it far easier to select those solutions and to integrate them within the operations of the banks or other clients.

Outsourcing should therefore not be viewed as a passive activity driven only by efficiencies and cost savings but as a proactive strategy that will also help the banks and other firms remains agile and proactive in the future. Time to market is also an essential element of the equation, as the speed of technology advances is accelerating all the time. Banks and private banks are experts in their fields of financial products and advice, whilst technology experts are exactly that.

The best of both worlds is to align both through an outsourcing provider that is remarkably engaged with the financial and wealth management universe, with immense experience as well across the globe. The panel agreed that differentiation is tough to deliver, but that the core of that is relevance and customisation, and if through the right approach to outsourcing and incremental solutions, a leading bank can free up its systems, talent and investment to achieve those goals, then that is a truly smart approach. It might not be for every institution, but for many of the banks in the region that are to some extent hampered by legacy systems and attitudes, it is a remarkably viable and appealing approach.

The Post-Event Survey

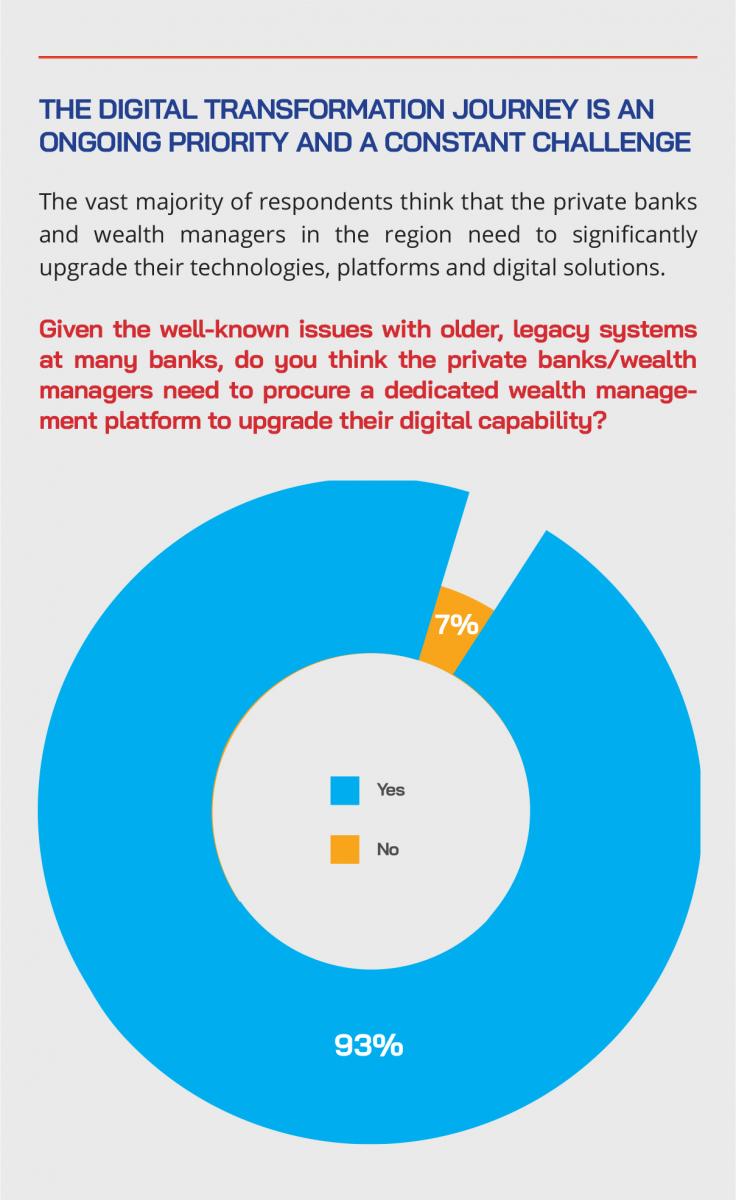

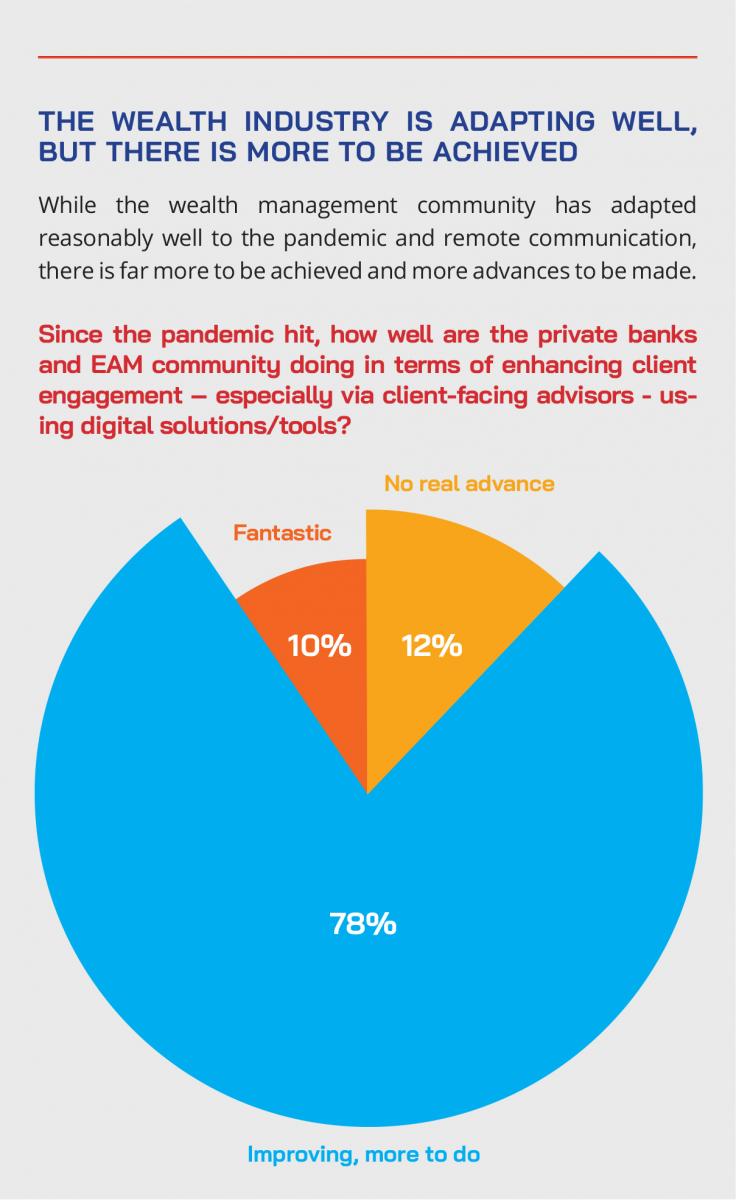

Hubbis sent out a brief Post-Event Survey. The key findings are set out below.

Azqore, Discussion Host for the Day and Wealth Management Technology Partner for Tomorrow

Azqore, the partner alongside Hubbis for the April 7 discussion event, is a next generation Information Systems and banking operations provider.

As a subsidiary of Indosuez Wealth Management and with Capgemini holding a 20% stake, Azqore is a global company that is committed to providing wealth managers with integrated turnkey solutions for their digital needs. From its headquarters in Switzerland and its Asia branch in Singapore, Azqore currently supports some 30 clients on its proprietary S2i platform, with assets of approximately CHF200 billion.

Originally from Switzerland and also covering Asia from the Singapore base since early 2016, Azqore’s offering is based around the sharing and pooling of the S2i core banking system, which is an in-house software that was first developed some 30 years ago and that is continuously updated every three months and that Azqore provides as SaaS.

The result is is therefore an end to end core banking system, with enhanced processing of the back-office activities on behalf of clients, delivered by Azqore in a very timely, cost-efficient manner and with high-quality service for clients. Azqore’s big picture mission is therefore to provide wealth managers with access to economies of scale and to facilitate their broader digital transformation with advice. The open S2i platform also supports customisation via the seamless integration of selected additional digital tools along the way.

See also links to Hubbis feature articles and reports on Azqore -

https://hubbis.com/article/azqore-s-growth-in-asia-propelled-by-twin-dna-engines-of-banking-and-it

Key Observations from Yves Saint-Marc Girardin

During the April 7 discussion event, Yves Saint-Marc Giradin, the Singapore-based CEO of Azqore for Asia, offered some views to complement the flow of the discussion. In brief, these observations are set out below.

Adaptability

The wealth industry in Asia was quick to adapt and remained resilient to the tremendous changes demanded by the arrival of the global pandemic.

Risk mitigation

The enhanced security and cyber risks of remote working demanded greater attention to risk mitigation and, in this regard, the institutions that had one banking platform across all the entities were able to most rapidly and effectively adjust control and operational procedures to achieve this risk mitigation.

Elevating communication and expanding the channels

During the pandemic, there has, ironically, been greater communication between the private clients and their bankers/advisors, as those clients are travelling less and have more time, and also because they often need guidance through the vicissitudes of the markets and remote execution and connectivity. This increased communication will likely endure for the years ahead, and the banks would therefore need to keep elevating their tools and methodologies for enhanced and intensified communication. The integration of a variety of communication channels, and in a secure and compliant manner is essential.

Driving towards hyper-personalisation

Full client lifecycle management is increasingly important, to leverage more data and insights into the clients, and to enhance relevance and adhere to the principles of suitability, and to further personalise and customise the offerings. This can all be summed up in the drive for hyper-personalisation leveraging AI, data, analytics and processes.

Making it easy and seamless to conduct high-quality wealth management

Digital onboarding and digitised KYC are key priorities for all the incumbent players in the wealth industry today.

Outsourcing offers efficiencies, cost savings, but also great flexibility

The banks should in the current and future operating environment consider outsourcing whatever they consider non-differentiating, in other words whatever is not related to their core business, starting with the back office, where there is little added value created and where cost-savings and better processes are achievable. But outsourcing also offers solutions and flexibility to the organisations, as well as offering the adaptability of being able to easily incorporate other digital tools, including those from third-party vendors, wherever the banks see the opportunities to boost their services and overall proposition.