Wealth Solutions & Wealth Planning

Asia’s Wealth Management Industry: Adapting to the Needs and Expectations of Nextgen Client

May 4, 2021

On April 29, Hubbis hosted a fascinating discussion on how the wealth management industry in Asia can or perhaps should adapt its products, services and indeed mindset to cater to the needs and expectations of the next generations of Asia’s private clients, some of whom will inherit increasing volumes of Asia’s vast private wealth, and some of whom will be creating the next wave of affluence. This is not an exercise, it is a necessity, and with the right intent and strategy, the incumbent private banks and the independent wealth management community can tailor their offerings and their approaches to retain and/or attract those Nextgen clients, and therefore maximise their potential and longevity. With many trillions of dollars of wealth due to change hands in the coming few decades from the founder and second generations to the younger generations, and with so many of the younger generations also building their own businesses or planning to do so, the wealth management community in Asia must not delay their efforts to grasp the opportunity to future-focus their activities and their propositions.

Panel Members

- Ross Belhomme, Managing Director, Singapore, Asiaciti Trust

- Lee Woon Shiu, Managing Director & Regional Head of Wealth Planning Family Office & Insurance Solutions, DBS Private Banking

- Dominic Volek, Member of the Executive Committee and Group Head of Private Clients, Henley & Partners

- Nick Xiao, Chief Executive Officer, Hywin International

- Lee Wong, Head of Family Services, Asia, Lombard Odier

It is well known that the younger generations of HNW and UHNW families in Asia are usually highly educated, often in long-established Western institutions, which leads to a wider understanding of worldly matters, of wealth management issues, and often serves to boost their entrepreneurial hunger as well as enhancing their focus on governance generally, and on sustainability in the family business and indeed in financial investments. They are digital natives and often more inclined than their parents or grandparents to adopting a more professional structured approach to family wealth, frequently desiring to focus on either their new businesses, their lifestyles, or even social impact pursuits. As a result, we know that Asia’s wealth management community, and indeed the global wealth management ecosystem, must adapt their products, solutions and services to cater to the needs and expectations of these younger generations. They are perhaps more engaged than their parents or grandparents in social and sustainability issues, especially those who are inheriting truly vast wealth, as is happening on a daily basis.

The clear conclusion from the discussion was that the wealth industry in Asia needs to understand and address the key differences between the generations to develop value, trust and a pull-together attitude, and then design products and solutions to suit the different generations. Empathy, expertise, professionalism, transparency, sustainability, relevance, suitability, seamless digital solutions and a state-of-the-art client experience are some of the key ingredients that our panel of experts highlighted.

The Key Observations & Insights

The typical Nextgens are somewhat different from Asia’s founders, patriarchs and matriarchs

As a broad generalisation, the Nextgen clients in Asia are highly educated, sophisticated, tech-savvy, inquisitive, socially conscious; they value living well, they increasingly embrace issues of sustainability, and they value living purposefully. They want to build networks with their peer groups so as to be able to do things together as a community, and they're sensitive to wealth transfer issues. Accordingly, for a client of this nature, they expect their private bankers and advisors to address issues that are relevant to them.

The WM community must be transparent, concise and on top of details

These Nextgens need to be informed, professional and thorough, as these Nextgens expect a concise explanation of products, structures and concepts. They are not simply buyers of products or ideas; they are analytical in their approach.

They want a seat at the table

Bankers on the panel reported that the Nextgens generally want a seat at the family estate and business transition discussions and are often key proponents of such engagement. They prefer open communication, they like clarity, and they wish to avoid the potential for conflict amongst family members. They prefer to be inclusive rather than exclusive, especially where there are large families and multiple generations involved.

The banks and other incumbents need to make a commitment to the Nextgens

There are plenty of bankers who are expert in managing existing relationships, promoting products and solutions, but the banks and other organisations need to future proof their revenues by reaching out to and engaging with the Nextgens, even before they start to produce meaningful revenues. This requires patience, a collegiate approach and an institution that values longevity at its core.

The Nextgens feel some pressure and responsibility to do ‘good’, to give back

A panellist observed that the world appears to be becoming more and more unequal, and there are indications that those who have privileged backgrounds are increasingly focused on giving something back to society, on having some social and sustainable impact and being a force for good. To achieve those goals, they need help. It is very difficult balance to be struck between initiating the next generation into wealth and not allowing the wealth to be a burden. Many of the next generations feel a great sense of responsibility to use family wealth or the costs of very expensive education to do good in the world. Can the private wealth industry act as a guardian as well as a service provider? As one expert commented, it used to do this better in the past, and to some extent, should return to its core values.

Expert Opinion - Lee Woon Shiu, Managing Director & Regional Head of Wealth Planning Family Office & Insurance Solutions, DBS Private Banking: “Younger generations of wealthy in Asia today seek to forge their own path in wealth creation whilst making an impact in their community by leveraging on their legacy. Unlike old-economy industries that built most Asian family fortunes, start-ups, venture capitalist and impact investing opportunities drive the new wave of change among the younger generations.”

Expert Opinion - Ross Belhomme, Managing Director, Singapore, Asiaciti Trust: “Wealth is a mindset. It’s not enough to pass on the assets themselves, wrapped up in some legal device, but you need to be able to pass on the mindset, which is a creative mindset, an energetic ability to use their money to generate sparks that themselves attract more abundance and have an impact on society in the process. You also have to keep the assets working hard.”

Expert Opinion - Dominic Volek, Member of the Executive Committee and Group Head of Private Clients, Henley & Partners: “We’ve seen a growing demand for our services as the appeal of investment migration heightens amid the ongoing volatility. Increasingly, HNW investors are seeking to overcome the limitations and risks of being restricted to a single jurisdiction. Even HNWIs from some of the world’s most advanced economies are now looking to create a portfolio of complementary citizenship and residence options. They all share the same intention — to access health security and optionality in terms of where they can live, do business, study, and invest, for themselves and their families.”

Expert Opinion - Lee Wong, Head of Family Services, Asia, Lombard Odier: "The NextGen value living well and living purposefully. They want to build networks with their peer groups and form communities and they’re sensitive to wealth transfer issues. Thus, what they expect from us, as wealth managers, is that we are able to address issues relevant to them and provide platforms that meet their needs. For example, we have clients who want us to bridge the gap between the current generation and their generation by facilitating dialogue and to help them have a bigger voice when it comes to family investments or family businesses. They are also eager to participate in our NextGen-focused programmes so that they can foster ties with fellow NextGen members, and lean on our expertise on topics such as entrepreneurship and sustainability, so that they are better prepared when they take over the reins of managing their family wealth."

A combination of local and global expertise can work well

A guest highlighted how partnerships between leading onshore financial institutions and international private banks can offer the best of both worlds, with local understanding and expertise aligned to global products suites and solutions. Cultural empathy amongst the domestic bankers combined with an understanding of the working of the global markets and compliance is a potent mix.

Engagement, education, training, and idea generation all add value

There are many different ways and means of engaging the Nextgens, and the private banks are increasingly working to create webinars, build peer-group networks, enhance education and training – for their bankers and their clients – and thereby build their relationships, rapport and engagement.

Expert Opinion - Ross Belhomme, Managing Director, Singapore, Asiaciti Trust: “The ability to bring a global network is massively appreciated, as Nextgens are operating globally. Moreover, the world is very complicated and too easy to trip up, so they need someone in their corner thinking of the things they wouldn’t have considered, and then proactively problem spotting and solving the issues.”

Expert Opinion - Lee Woon Shiu, Managing Director & Regional Head of Wealth Planning Family Office & Insurance Solutions, DBS Private Banking: “The younger private clients of today demonstrate four key attributes which also exemplify the X factors behind some of the most successful unicorns today. They strive to be Innovators, Disruptors, Enablers and Adapters, and seek collaboration with wealth managers who share similar values and have the requisite expertise which is aligned with their priorities.”

Mainland China offers an immense opportunity

Chinese private wealth has been expanding at a phenomenal rate and as Chinese HNWIs and the ultra-wealthy globalise their investment portfolios, their footprint, and also their lifestyles, leading more and more banks and firms to shape their services and networks to cater to their needs and expectations. China’s wealth is relatively young, and so many of these younger generation clients are leading the way to the future.

Taking the high road towards value and values

A panellist pointed to a key mission of his firm to help the younger wealthy clients in China and elsewhere transition from simply wealthy and creating value to managing and creating wealth that helps reflect true values, the values of society and community and sustainability. The Nextgens, he said, are increasingly ‘authentic’; having grown up with security and affluence, they now seek authentic advice, authentic care, and authentic values, and that is probably the biggest challenge for wealth managers.

Expert Opinion - Ross Belhomme, Managing Director, Singapore, Asiaciti Trust: “Very often, sharing stories can help with engagement with clients, and often seems the best way to have key points stick in a mind that is unfamiliar with many of these issues. Trustees have been good at hiding behind emails, but they need to develop new platforms to deliver services to the next generations who want information at their fingertips; they like to self-help and want to know the ‘wiring’ of what you are saying or recommending. They are tech-savvy and data driven, and trust companies have huge amounts of data, but it is hugely unstructured. It needs improving.”

Expert Opinion - Lee Woon Shiu, Managing Director & Regional Head of Wealth Planning Family Office & Insurance Solutions, DBS Private Banking:” The focus of the Nextgen may range from artificial intelligence to cryptocurrencies, governance and leadership, communication, sustainability, as well as investments with a positive environmental and social impact and venture philanthropy.”

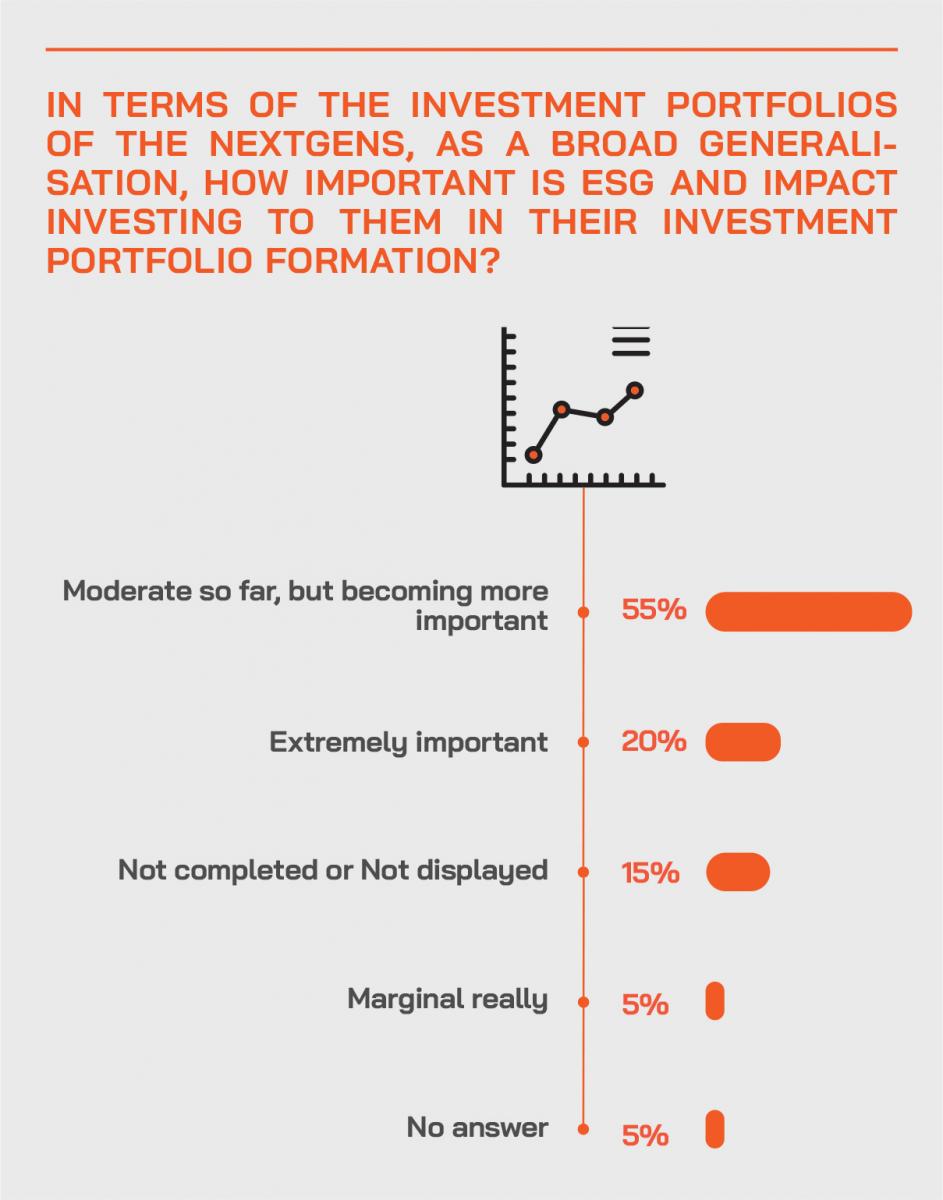

Succession, ESG, impact investment, sustainability – certainly no longer afterthoughts

A decade ago, issues such as estate and succession planning, sustainable investing and so forth were afterthoughts, but today people’s time horizons and priorities are different, even more so since the pandemic hit last year. As people face mortality, all these issues including the future of the planet, are front and centre of the agenda, especially for those whole will inhabit the planet longer, the younger generations who increasingly want to use their wealth to positive effect, not just to feel good but to do good. An expert highlighted how in China, the younger wealthy are increasingly working together on more social initiatives, citing, for example, a nationwide effort to boost reading by setting up libraries across the country.

Expert Opinion - Lee Wong, Head of Family Services, Asia, Lombard Odier: "There is an old adage about wealth not being able to survive the transition across generations, which I believe does not hold true nowadays. The challenge is how to grow this wealth beyond the successes and achievements of the previous generations. Part of the education process is to equip the NextGen with the right skillsets and mindsets to behave like wealth generators at every generation, especially as with every generation, the number of family members are increasing exponentially. More importantly, how can we, as wealth managers, support the NextGen so that they just don’t grow from riches to riches, but from riches to values – to have certain entrepreneurial value systems, to be conscious of their responsibility to society, so that their wealth in itself creates lasting impact, not just for their family and future generation, but to the world at large."

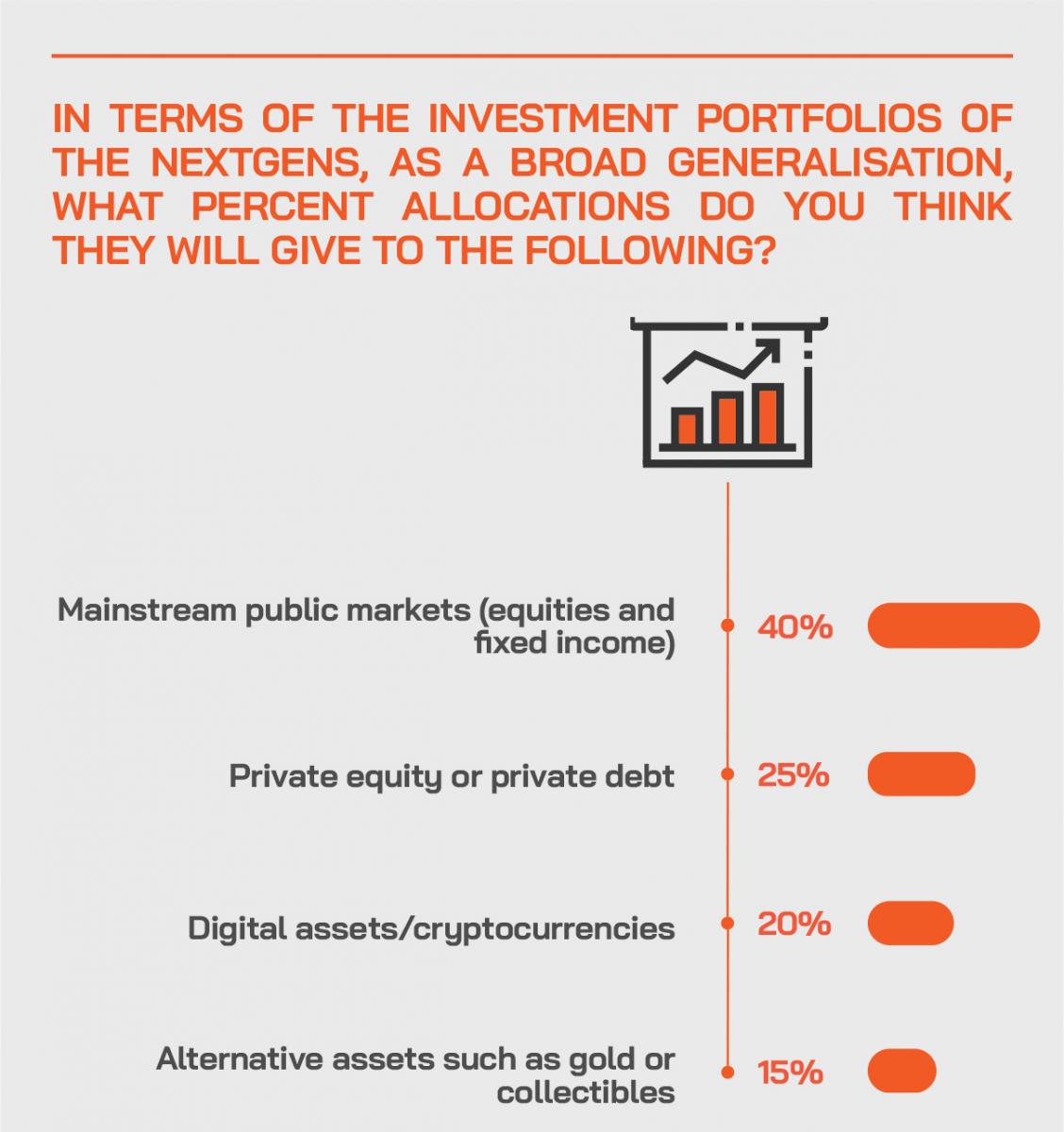

From China to India, Nextgen clients are investing thematically, seeking disruptors and new ideas

Across the region, the Nextgen investors are seeking both income but also alpha, aiming to invest in interesting themes and sectors and in the disruptors who will change the industries and services that we know today. These younger investors are well-informed, inquisitive, ambitious and hungry for ideas and returns.

The Nextgens are taking a far more holistic approach to their wealth, and they want the same from their bankers

A banker observed how the Nextgens of today are very different from the past, they are more intent on forging their own path and they're very keen to create an impact in the community and in the business world. Key values such as being innovative, being disruptive in a business sense, being able to adapt; all these are key attributes and aspirations which they hold true to their vision. This means when they work with wealth managers, they also expect these managers to similarly execute and demonstrate all these attributes, and they want to obtain the maximum value in terms of these wealth managers’ input for all these visions that you want to pursue. Accordingly, the alignment of these values with their private bankers and wealth managers is of great importance.

The whole landscape of estate and succession planning has developed dramatically

A decade or two ago, estate and succession planning was of marginal interest and took place with little involvement between the founder and younger generations. But today, the landscape of succession planning has evolved tremendously; there is far more openness, greater transparency and inclusiveness in the discussions, with the momentum coming from all directions, from the Nextgens as well as the parents or grandparents. There is not only greater inclination amongst the older generations to listen to the Nextgen views, but also greater confidence amongst the Nextgens in speaking up and putting their ideas and issues on the table.

It is advisable to match advisors and clients more appropriately

Most of the highly experienced private bankers working in the region are used to working with older clients. But as the Nextgens take the reins of wealth and control more and more of their family assets, there is considerable advantage in more accurately matching younger bankers with these Nextgen clients. A banker observed that the combination of the older, more experienced bankers and those younger RMs more able to communicate easily with the Nextgens was helping the bank build the client platform for the future. He called this hunting in a pack, leveraging the team ethos to serve clients better and offer the widest range of expertise and relationship building.

Expert Opinion - Lee Wong, Head of Family Services, Asia, Lombard Odier: "From our perspective at Lombard Odier, the NextGen are often keen to come to the table to engage in succession issues. In fact, we’ve seen more of these dialogue spearheaded by the NextGen, especially when it comes to larger discussions where there are family governance issues. NextGen family members are aware that the family may need support in facilitating open discussions on topics such as wealth transfer and succession planning. Many of them are sensitive to dispute issues that they see in other families and are conscious to try to avoid these issues; they are invested in carrying on the family’s legacy and passing on the torch to the future generations."

Life insurance for the Nextgens is all about involvement and engagement

An expert highlighted how life insurance for the Nextgens is a far more engaging process than for the much older clients. The younger buyers of such policies want to be more involved in the investments and more involved in the structuring and the conversations, taking a much more proactive approach. This in turn means that those selling and promoting these solutions need to genuinely expert in their field and be able to help devise the right solutions for these clients.

The trustees can also help oil the wheels and need to exhibit elevated skills these days

Trustees are often requested to make investments in interesting ventures and start-ups. They need to be prepared to have these conversations, entertain reasonable proposals and offer a sense of caution on the more speculative ones. Communication skills are absolutely vital. Emotional intelligence is required in order to be seen as a confidante of the initial wealth creator but also so that the Nextgen clients see your value to themselves also. If done right, you can be the middleman taking a certain sting out of inter-generational conflicts, helping them avoid bumping heads. Time is valuable, and we all have less of it nowadays. Nextgens have better things to do than spend time on the nuts and bolts of the processes; hence they are happy to delegate out when they are fully clear on what the trustees can offer and why they are there.

And the investment migration industry also has a keen eye on the Nextgen clients

An expert reported that his firm had seen a growing demand for its services as the appeal of investment migration heightens amid the ongoing volatility since the pandemic hit. Increasingly, he reported that HNW investors are seeking to overcome the limitations and risks of being restricted to a single jurisdiction. Even HNWIs from some of the world’s most advanced economies are now looking to create a portfolio of complementary citizenship and residence options. They all seem to share the same intention — to access health security and optionality in terms of where they can live, do business, study, and invest, for themselves and their families across the generations, recognising that the younger generations often stay overseas for an early portion of their working lives before returning home to get more involved in the family businesses and affairs.

Expert Opinion - Dominic Volek, Member of the Executive Committee and Group Head of Private Clients, Henley & Partners: “To put it simply, it is best practice to invest in different regions and asset classes, from equities to real estate, to spread the risk and find the greatest value. But what about where you reside? The same principle applies [regarding investment migration]. The more jurisdictions you can access, the more diversified your assets and opportunities, and the lower your exposure to country-specific risks such as poor health security, higher tax burden, or unexpected policy changes. This is about having a truly global perspective, and the best way to do that is to have a diversified portfolio of domiciles — a range of locations where you, your family and extended family, and your assets can be based. For instance, a wealthy entrepreneur residing in Dubai with business interests across Asia might acquire a holiday home and a Portugal Golden Residence Permit in Europe while also applying for the UK Investor Immigration Visa to enable their children to live and study in the UK. At the same time, he might apply for the Thailand Elite Residence Program for his retired parents to enjoy their golden years. Most investment migration programs include the whole family, often extending to parents, siblings, and grandparents. The more jurisdictions a family can access, the more diversified its assets and opportunities will be, and it helps ensure physical and financial longevity and legacy.

Digitisation is absolutely essential for engagement and to offer the best USX

Seamless, high-speed execution, seamless delivery of information and relevant data, accurate, real-time reporting and a great front-end USX are all essentials for the Nextgen clients today and tomorrow. Any wealth manager that’s serious about capturing the eyeballs and the attention span and engaging the second and younger generations more effectively and more impactfully need state-of-the-art digital solutions and a great user experience.

To capture the immense potential the market offers, incumbents need to ‘up their game’

A banker pointed to two key areas where the industry needs to scale up. The first is in really empowering and upskilling their teams, not just the people in the front office but also in the back office and mid-office. Because, for example, when it comes to onboarding of clients, if your front office, front-facing RM knows all these high-fangled new investment strategies, but your back-office people cannot keep up with these trends, that ends up as a field exercise endeavour. Secondly, there needs to be a constant emphasis on expertise and up-skilling throughout the banks and wealth firms. Anyone who is serious about delivering private banking services to these Nextgens needs to be immensely professional, immensely committed. The days of the generalist private bankers are gone or soon to disappear.

Expert Opinion - Lee Wong, Head of Family Services, Asia, Lombard Odier: "At Lombard Odier, we have built strategic alliances with local domestic banks across the various Asian markets. The proximity of having someone in their home country and who understands their culture is always useful, but to also have someone from another jurisdiction share their knowledge, or to have insights that can widen their perspectives or provide different opportunities, we see this being appreciated by the NextGen. The combination of having the best of both worlds is a unique proposition that we bring to the table. The NextGen Master Series and workshops that we have created lean on these strengths and advantages that we have together with our strategic alliances, such as providing networking platforms with fellow peers in other markets and opportunities that they may not have been able to access before."

Hubbis: Are Asia’s private banks and wealth managers doing enough to reach out across Asia’s generations and enhance their relationships with the Nextgens, and why, or why not?

- Perhaps not enough yet, and we do not see sufficient training or emphasis on this topic.

- No, more specific initiatives are needed to engage them.

- As Asia becomes increasingly affluent, more clients are more receptive to engage in legacy planning than before. I feel more can be done by the private banks and wealth managers in this regard, keeping the Nextgens very much in mind.

- I think they are all sensing the need to reach out to the next generations but then the historical system in private banks make it harder for them to be as nimble in catering to those Nextgens.

- Not enough so far. The Nextgens' thoughts are different from the older or previous generations, these Nextgens in Asia are more internet savvy and more well-read, they are increasingly expecting more from the banks and wealth managers. The banks and wealth managers no longer only provide the Nextgens with brochures alone, the banks and wealth managers need to engage and speak to them, even providing unique services and products, not just what the others in the industry already provided.

- I think it is never enough. The patriarch is generally still in control of the account; more exposure and education is important.

- No. They need to upgrade their systems to keep up with the demands and expectations of the Nextgens.

- I don't think so. The reason is that not all banks and bankers are reacting promptly to the new market trends. Also, not all banks are clearly seeing the evolving customer requirements.

- Yes, progress has been made. The private bankers in Asia are definitely aware and they know the need to understand and address the differences between the generations. The wealth managers are adapting their products, approach and services to cater to the older as well as the younger generations.

- Yes. The banks are moving to more advanced digitalisation in order to be in touch with the new generations, and this is helping considerably.

- It is just starting really. The Nextgens are more proactive, however the introductions are mostly initiated through the current generations who control the assets and businesses.

- Yes, we see increased contribution from Wealth Planners in the banks and WM firms, the hiring of younger RMs as well.

- Problematic. Inherited wealth often creates more confusion than clarity. While dealing with such a person requires a different mindset as his/her experience may not be in line with the needs of wealth creation but more in line with wealth deployment for new experiences. Hence the expectations of the Nextgens would be more aspirational in nature.

- Not really. The Nextgens are very tech-oriented and have high social awareness. Old generations of wealth managers might not be in tune with all this.

- Not really. Some of the private banks and wealth managers are still not fully embracing the new world, such as robo advisory, AI/ML, blockchain, cryptos, and so forth.

- There is always more that could be done to reach out to future generations in different mediums and to communicate new ideas.

- Yes and No. Some have adopted digital banking concepts to capture the demand of the new generations. On the other hand, many banks are still working towards digital banking. There is a time lag often in terms of clients' request for execution of trades and the processes may still be too manual.

- Yes, I believe so - they are making the effort to do more than the golf game or meal out, and aiming to also work across the family and the professional networks to deliver what is required by the Nextgens.

- Yes. They are making a great number of initiatives to reach out to the Nextgen clients by building various client engagement platforms that serve on knowledge aspects, as well as the issues clients are passionate about. The organisations have realised the Nextgens’ needs to understand the process and that they expect transparency, hence the banks are maintaining the highest levels of transparency in processes and providing timely information to clients. They are also developing modern age methods of connecting with clients and going beyond the business realm to build investment portfolios that generate real value.”

- Yes, to some extent, but the Nextgens are more experimental hence retaining them as clients will be more challenging than acquiring. Wealth management organisations will have to keep them excited throughout their journeys with you as a client.

- Asia's PBs and WMs are doing enough to reach out, but it seems that the quality of the relationship of the patriarchs and founders with their children plays a significant factor and there is always room for conflict. Furthermore, the patriarch's PB and WM may have a particular way of doing things that Nextgen consider outdated. Nextgens may therefore prefer using institutions popular amongst their peers with FinTech and perhaps crypto capabilities.

Hubbis: To some extent, the pandemic has fast-forwarded the transition of wealth to the Nextgens, but are the private banks and IAMs/EAMs/MFOs sufficiently well prepared to cater to their needs and expectations?

- No, the institutions in question need better infrastructure to meet the pace at which the Nextgens work.

- Not really. I feel they are still more reactive than proactive. More banks are putting more emphasis to improve their online banking/advisory platform than before.

- No. I think they are not well prepared for their needs and expectations because the world has changed so much and especially for smaller IAMs/EAMs/MFOs; they may not have the resource/bandwidth to follow and react to the changes.

- The WM incumbents need to re-assess their procedures; they can no longer depend on hardcopy alone, even as simple as a bank statement or utility bill as proof of address, nowadays these are in softcopy or online versions, so the procedure should include how the

- organisation can verify such versions. The organisation should also re-assess the types of documents they require in originals. To some extent, the pandemic does help to 'force' or fast-forward organisation to re-assess their procedure and becomes more digitalised than before.

- Definitely. Training is happening across the banks’ entirety of front liners and middle and back offices must be and are becoming better equipped with technology like digital banking and knowledge of products, speed and right skills to engage with clients' needs and expectations.

- Many banks and wealth managers have fast forwarded the projects to cater for Nextgens but it is not yet being sufficiently well addressed. Nextgens have different needs and demands from wealth managers as compared to the older generations. They require speed of execution, greater transparency, and need better information, as they already have better knowledge of the world of investments.

- Not yet. They are very much behind in technological infrastructure and too reactive to situations rather than proactive. They still need substantial investments for hardware and software including talent acquisition of smart people with international exposure.

- Yes, these institutions have the infrastructure in place to take on the fast-forwarded transition and have successfully done so. From digital client onboarding, to hassle free paperless transactions to regular updates on investment returns, there has been substantial progress made in the past 18 months.

What particular challenges do the banks and wealth managers in the region face with regard to engaging with and working with the Nextgens?

- We have summarised the numerous comments, distilling them to the following bullet points:

- Empathy and chemistry.

- Engaging with the topics that matter.

- Boosting transparency.

- Bridging the gaps between the older bankers and Nextgen requires real communication and real-time communication.

- Need for rapid flows of relevant information and data.

- Recognise that the Nextgens think fast, grasp ideas rapidly and might be less patient.

- Engage through social media, recognise its power.

- Connect with the broader family units.

- Offer greater expertise on a wider variety of assets.

- Focus on sustainability, ESG, impact and social values.

- Digital tools, digital delivery, digital solutions.

- Younger banks working in tandem with experience bankers.

- Focus on the value proposition more than relying on the ‘brand’ of the bank or organisation.

- Constant upskilling of the client-facing bankers and advisors.

- Try to speak the same language, connect on the same level.

- Keep traditional values of the PBs/WMs but bring into the modern world.

- Seamless, rapid execution and reporting are vital.

- Really need to understand who the Nextgens are, their mindset, priorities.

- Recognise they have less time and less patience.

- Be aware of the tech-savvy competitors and new entrants.

- Agility, forward-focus, nimble mentality.

- Be aware of cultural differences in different countries.

- The experienced private banker understands first-gens but needs to understand Nextgens.

- Must offer cutting-edge innovation and creativity.

- Offer more digital delivery alternatives and robo-advisory from within.

- See and build on the transition of wealth and power to the Nextgens.

How important will the RM/advisor be to the private client Nextgens in the future, do you think?

Comment: There were many replies to this question, and Hubbis can report that the general view is that RMs and advisors can work alongside the digital and robo advisory platforms, especially at the upper levels of wealth and for more sophisticated products, portfolio management, and wealth and estate planning. Some believe that their role will evolve to a more consultative than advisory mission, some believe that the simpler transactions and tasks will go entirely digital, everyone seems to argue that the RMs need to upskill and future-proof themselves by greater knowledge across many more products and assets classes, trends and themes.

The old days of the generalist private banker are dying away. Although the Nextgens are sophisticated, highly educated and of high calibre, and much more knowledgeable mot believe that they will still prefer the human touch of having in-depth discussions at a professional level, providing the communication channels are seamless and easy. As one guest comments, the combination of AI + HI (artificial intelligence + human intelligence) should be the way forward.