Asia’s Independent Wealth Management Market – Opportunities, Challenges & The Road Ahead

Jul 22, 2020

On July 16, Hubbis hosted a lively and insightful virtual discussion on the future of the independent wealth management sector in Asia. A decade ago, when some of our expert panellists formed their own independent firms, and when digital platforms were hardly heard of in Asia, there was only scant understanding of the proposition they represented, and considerable resistance from the main protagonists in the industry. Ten or more years later, the EAMs/IAMs have been able to build and retain true relationships and have won an ever-larger share of the client wallet. Yet the independent sector in Asia remains far less established than for example in Europe or the US, with an estimated 30% of assets managed by boutique firms in Switzerland against only about 5% in Asia. But that represents opportunity, and Asia is working hard to catch up with Europe. The July 16 discussion was designed to offer insights into the current state and future evolution of Asia’s IAMs, EAMs, and also Multi-Family Offices (MFOs). The experts ranged over the many attributes that make the independent proposition valuable to Asia’s HNW and UHNW private clients, and what the industry can do to further accelerate its penetration in the decade ahead. The experts who spoke not only offered a remarkable depth of experience of both the private bank and independent models, but they all have a deep understanding of what makes the wealthy Asian private client tick.

The Market & the Expanding IAM Proposition

“In terms of growth,” said an Independent Asset Manager (IAM) head on opening the discussion, “we definitely think the future is in External Asset Management (EAM). Everybody talks about Switzerland with more than 40% AUM actually managed by EAM, and here in Asia I certainly see that percentage rising. Rather than talking about client neutrality, I want to talk about structure, as I believe the EAM segment is structurally destined to win, for two reasons. Firstly, every private bank has one booking system, so every private banker is a captive who has to live with all the constraints. For every EAM, they can choose from multiple banks, multiple booking platforms. By that fact alone, we have bargaining power, and we have flexibility. The second thing is every private bank is a fixed-cost animal, and they have to make certain fees and commissions just to break even to achieve their cost-income ratio. In contrast, every EAM is a variable cost animal, so if we charge 50bps we can survive and flourish, and the private bank cannot. With this structural arbitrage, I firmly believe the EAMs are not the small fish swimming next to a blue whale, but more like a white shark that is growing fast.”

“We find that being in a private bank is no longer the same as in previous years or decades,” a fellow panellist added. “We think the solution that can be provided to clients as a private banker actually are not as holistic as before. Turning independent was really the way for us to continue doing what we feel is right for the clients.”

Expert Viewpoint – Kenny Ho, Managing Partner & Founder, Carret Private Capital: “EAM growth in Asia is a natural maturation of the industry to find suitable business models to best represent family offices against the banks. It is not a matter of if EAMs will establish themselves but when.”

Expert Viewpoint – Veronica Shim, Founder & CEO, Envysion Wealth Management: “The independent model is the way forward for the wealth management industry. We’re firm believers in ensuring that our clients’ best interests are met, and the only way this can be achieved is if we are unbiased in our approach and in the solutions that we can offer.”

Expert Viewpoint – Nicholas Burton, Managing Director & Head of Private Wealth, Conduit Asset Management: “As a group at Conduit, we strive to cater to the needs of our clients by utilising the whole value chain of independence from custody and advice to execution.”

Another expert remarked that he had opened his EAM four years earlier with three other colleagues who had become disillusioned of working with the private banks. And after running successfully for a year or so, the firm started getting inquiries from different bankers, ex-colleagues, who were attracted by the perceived success and independence.

“There later came a time when we felt we were ready to take this up to another level, to run it like a proper corporation, not a retirement home for senior bankers,” he said. “We realised that the EAM sector would grow rapidly, that it lacks conflict of interest, that we can choose multiple platforms, and today we have 23 custodian banks in five jurisdictions. We have wanted to and have succeeded in building scale, investing in long-term branding, PR, our internal operating systems, reporting systems, internal sales force, all the required software, in short, building capabilities and scale. At the moment we have four offices, and it is going to grow by the end of this year, with clients and relationships across different jurisdictions, and serviced by different offices.”

Expert Viewpoint – Kenny Ho, Managing Partner & Founder, Carret Private Capital: “We are fortunate to be in an industry where the growth of HNWI wealth will continue at a breakneck pace. Assuming an EAM has the right model in place, it will surely benefit from that growth.”

Expert Viewpoint – Nicholas Burton, Managing Director & Head of Private Wealth, Conduit Asset Management: “Traditional private banks hampered by the increasing weight of regulation and costs, coupled with a naturally risk-averse nature, may seem long on innuendo and short on offering.”

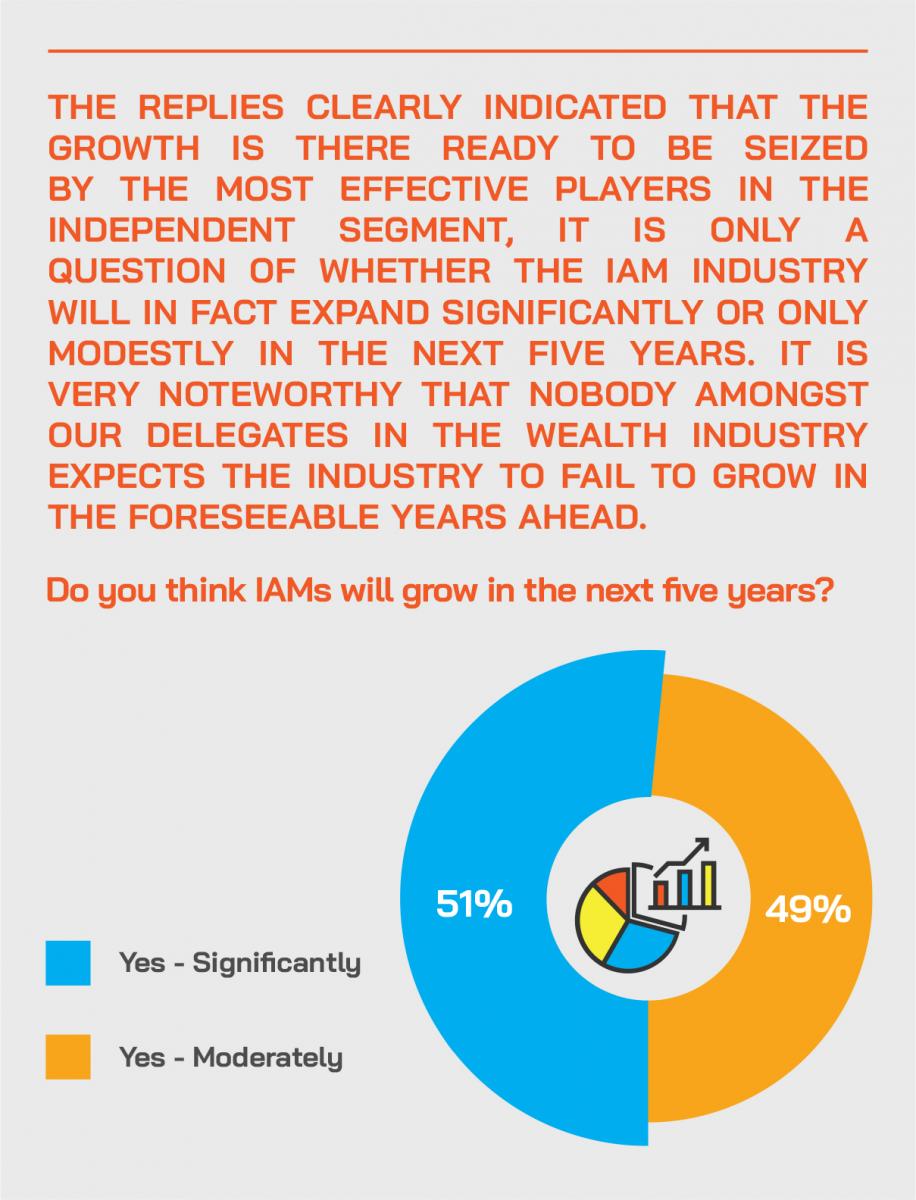

Post-Event Perspectives from the audience on the outlook for the independent wealth sector in Singapore and Hong Kong in the years ahead.

After the discussion, Hubbis immediately sent out a post-dialogue Survey to delegates. We asked them to briefly comment on what they see as the development potential for the independent wealth management firms in the decade ahead in Singapore and Hong Kong. There was overwhelming positivity amongst the delegates surveyed, literally a tsunami of ‘yes’ replies. We have edited their replies to provide the following insights from the wealth management community.

In your view, will the independent wealth sector thrive in the decade ahead in Singapore and Hong Kong? Why, or why not?

- Yes. Regardless of what is happening economically, politically or with regards to the pandemic,

- there is a growing spending class in Hong Kong, Singapore and Asia that will demand high-class,

- independent wealth advice on a number of fronts.

- Yes. Wealth management in Asia has been growing and will continue to expand at a quick pace. The HNW segment continues to be more and more aware of the benefits of independent wealth management.

- Yes. It offers a more flexible approach, with its open architecture platform and is not restrained by in-house products and services.

- Yes, because these two cities have the most mature financial systems in Asia outside Japan. EAM is also a trend for HNW clients as they love to diversify their assets.

- Yes. We can adjust much faster to client needs and provide a more personalised service to clients than larger organisations. For example, by cooperating with the best partners and providers in various sectors, including international tax, property and financial asset managers, business has grown apace in the past 5 years, and this will continue for at least the next 10 years.

- Yes, for Singapore, possibly not so much for Hong Kong. Geopolitical fallout and the prospect of a ‘cold war’ with China may derail the ambitions of Hong Kong-based companies. The new VCC structure and open markets of Singapore may rise and dominate.

- Yes, both. Hong Kong will be primarily benefitting from the growing China market, while Singapore will be driven by ASEAN and the South Asian economies.

- Yes. More and more private bankers are looking towards this so that they do not need to put up with the bureaucracies of bigger financial institutions and also because of the diversity of IAM approach and the platforms they can work with for the benefit of their clients.

- No, I find it hard to see a clear value proposition.

- Yes, definitely. The value proposition of the EAM is too strong for any UHNW to ignore – open architecture, multi-custodian, true independence, and best execution, just to name a few.

- Yes. The number of HNW clients continues to grow with particular speed in China and South East Asia. To accommodate the demand, the wealth sector will thrive in Singapore and Hong Kong, the two major financial centres in Asia.

- Yes. I think the independent sector will thrive because they can provide a tailored/customised services to their clientele. The RMs will personally take the right time to understand clients’ needs, there is more of a drive amongst the IAMs to source the best investment products compared to private banks that tend to only look at major global investment management firms.

- Yes. I feel the EAMs are not pressured to meet sales targets, which allows them to focus on the long-term success of a relationship, and to be more fully aligned with their clients. Compared to RMs in PBs, EAMs provide clients with a sense of stability as they are less likely to change banks/firms.

- Yes. Complex investors with very diverse needs in HK and SG have been driving the need for expertise in wealth managers. HNW and UHNW clients use wealth managers to have a more tailor-made/unique solutions, rather than a private bank where it tends to be more a one size fits all approach. The fact that Asia is multi-currency, multi regulatory and very diverse also encourages the drive to IAM expertise to help clients navigate all this.

- Yes. We are actually still at a comparatively nascent stage in Asia as far as EAMs are concerned. The growth has been tremendous over the last 5 years or so. We are heading towards an environment where clients will see increasing value in working with focused EAM platforms.

- Yes. Singapore in particular is witnessing a lot of interest for China’s private wealth, for example, rather than Hong Kong. And there is more interest from the European countries to book their assets in Asia, not to evade taxes, this is in anyway a thing of the past, but because that is where the action is, be that asset managers, be that custodians, the diversification of wealth management as well as custody makes a lot of sense.

- Yes, definitely. We see great value in costs vs revenue, relationship building is much stronger than amongst RMs in the private banks, there is more flexibility, greater transparency, and more diversification of custodians.

- Yes. But there will be consolidation in the sector.

- Yes. The IAMs will thrive as clients are demanding for the best, and they work for the clients, whereas there is an impression that RMs in the private banks are actually working really for the banks not so much the clients, and limited by the one execution platform. IAMs are able to conduct and book business on different platforms that serve the best for the clients through the principles of open custodian, open architecture and open bureaucracy.

- Yes. The wealth pie is huge, with good growth potential and requires bespoke services across the entire spectrum of clients' needs.

Another head of a prominent IAM said their proposition was all about being open custodian, offering open architecture and open bureaucracy.

Open architecture, he elucidated, is hailed by the private banks, but realistically at least 30% of the products they promote are in-house, and it is unfortunately getting worse over time, but the independent model can be truly open architecture. “Regarding open bureaucracy,” he continued, “we know many of the banks are very much limited across the different departments and services that they have to compete with within their own organisation, so it makes it difficult when you work within a bank to really offer something that the clients need.”

“At the end of the day,” he added, “I think all of us are here today within the EAM industry because we are trying to do what is best for our client, and I always say that the big difference is that we no longer represent the bank, we represent the client, and that’s what our value proposition is at the end of the day.”

An expert commented that he is encouraged by the arrival of more IAMs over time, and that is valuable for diversity and as the market itself has been growing so robustly, including of course the huge expansion in China and greater China. “I don’t see more competitors as negative,” he said, “I see it as kind of educating the market, as Hong Kong is definitely behind in this industry compared to Singapore and Singapore is behind North America and Europe. The market is big enough to accommodate these new players.”

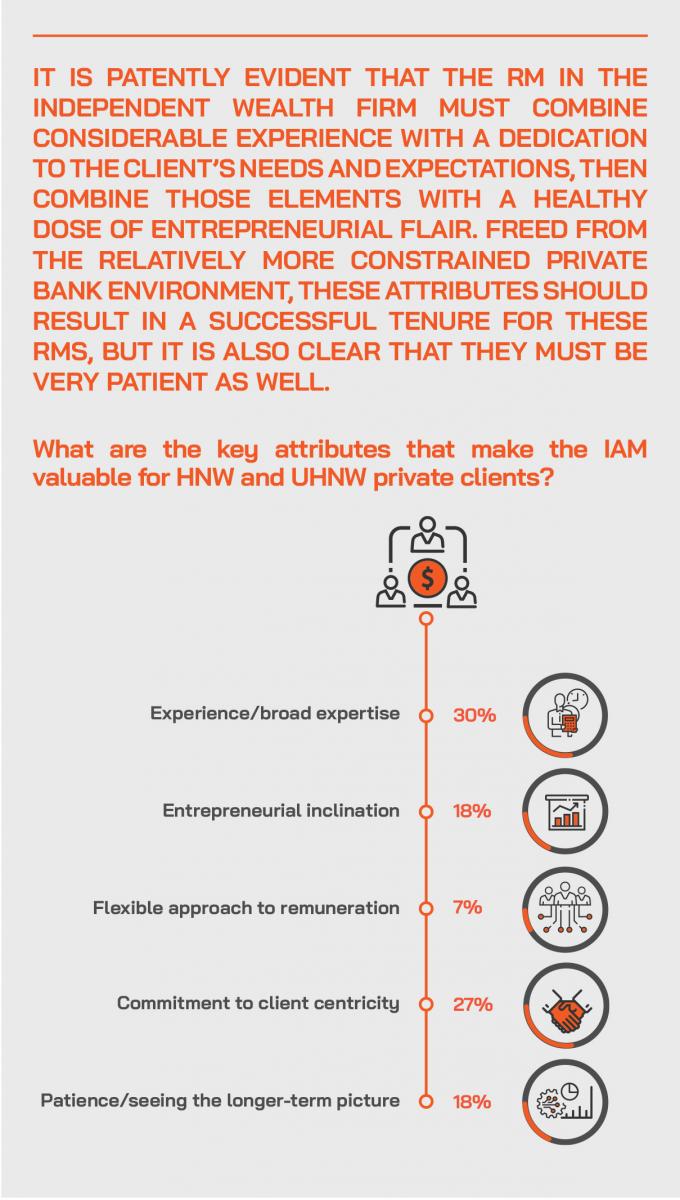

Nevertheless, he conceded that it remains tough to hire suitable bankers to join the platform to grow the business. “However,” he said, “by having more players out there it serves to educate not only clients but also the bankers that are out there of the value of the IAM model.”

Another IAM founder and leader observed that finding the right colleagues to work alongside and the right bankers to work at the client-face is one of the core challenges. “We are lucky to have built a really robust team,” they commented, “across investments, compliance, execution, operations and so forth, but it remains a challenge to hire the right bankers. We aim to have a pleasant, contented firm and happy clients, so when we hire, we really need to ensure that the banker fits in here and really works successfully with the clients. Just by choosing bankers that have a strong client base, good revenue at the bank they work with does not mean they will fit into the IAM platform or our firm. It is really about really matching and finding the people that share the same value and same wavelength.”

The discussion focused on investments and the approach of the IAMs compared to the private banks. “In a private bank,” came an expert’s opinion, “of course you can have the product people organising different teams, strategies, asset classes, but they all work for one house view. To be slightly cynical, one of the bigger fund houses had a chat with the CEOs of a couple of big banks, then all of a sudden hundreds, thousands of bankers across the world discover the beauty of a certain strategy or certain hedge fund manager. Whereas, for an EAM, I think the big advantage is that we are not constrained by one house view.”

He added that this is easier said than done. “Every day when I open the computer, I have a number of house views, then go through the judgment and humility and shrewdness to be able to tell clients how we see the world evolving over the next year or the next day, based on our an in-house investment team and our bankers who are proven specialists. We call the private banks and ask to speak to someone, reminding them we are the client, we have the volume and we have the flexibility to give or withhold any clients at any time, and the private banks honestly dislike us because we always seem to grab the resources and we get the best out of their system, but this is only because we are able to choose.”

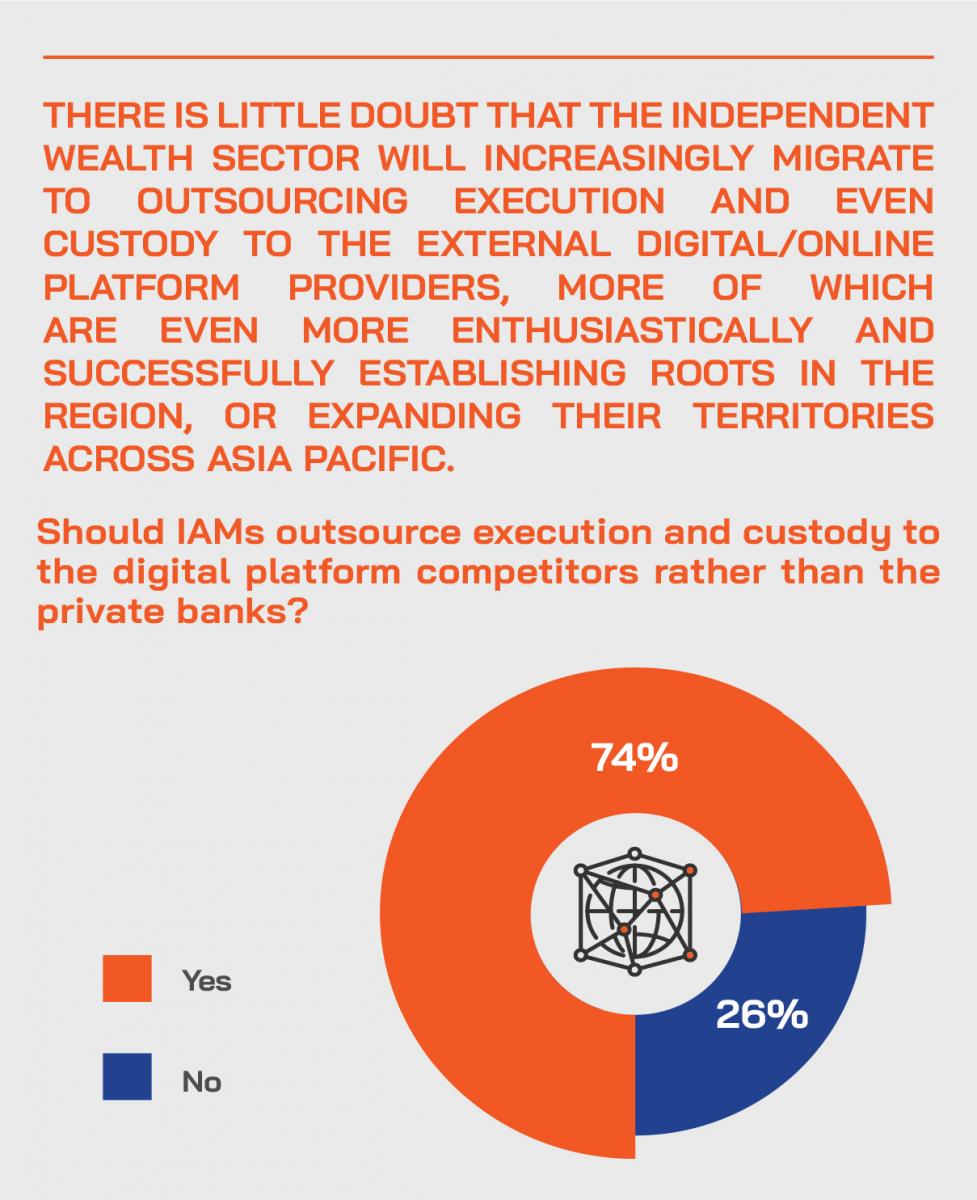

The Evolution of Execution & Custody

Turning to platforms and the growing role in the industry of the external, digital platform providers, an expert highlighted how in providing a state-of-the-art digital global custody and execution platform with open architecture; their aim is to ensure there is total alignment with the customers, so the platform does not manufacture products, or provide advice, accordingly in that respect there is no conflict at all between ourselves and their partner customers who are giving the advice to their private clients.

He commented that the platform model ideally suits the EAM model, addressing some of the key frustrations they faced when dealing with the incumbent private banks and global custodians in terms of their lack of direct access to markets, fee schedules, client connectivity and feedback, reports, and so forth.

Addressing the question of whether the independent model is more appealing than ever, an expert opined: “In short, yes, I believe it is flourishing. But the first step is to distinguish what independence means in the context of wealth management. A traditional EAM, onboarded with numerous private banks providing custody of the assets have independence in terms of advice, but not of whom they use for execution, despite sharing the lion’s share of fees with the incumbent private bank. Moreover, EAMs are beginning to change their business model and no longer enjoy a revenue share but charge the client a running fee. Commensurately, this lowers the banks’ overall wallet and fee income, making the traditional EAM model less attractive. Accordingly, we see a measure of independence in regards to advice, but not with regards to custody or execution.”

However, he considers that a truly independent model requires a measurable distance between the manager of the assets and the relative autonomy of the traditional private banking relationship. “As a group, we offer a hybrid solution by holding both fund management and broker-dealer licences,” he reports. “Clients can choose between global institutional custodians, away from traditional private banks, to provide custody of their assets. They enjoy the freedom of trading away from private banks to secure best-price execution across asset classes, via multiple liquidity pools. Real independence is thereby captured in the value chain of custody, execution and advice.”

He added that increasingly poor liquidity demands better price aggregation, which is cumbersome to achieve in a traditional wealth management model. “True solution-based product creation requires independent market access to multiple issuers allowing for cost-efficient, fit-to-purpose products,” he concluded.

Expert Viewpoint – Nicholas Burton, Managing Director & Head of Private Wealth, Conduit Asset Management: “Tailored custody to meet clients’ requirements, offering products, sourced and created independently, derived from the broad IB universe is paramount.”

Expert View - Damian Hitchen, CEO Singapore, Swissquote: “Whilst we believe that quality face-to-face advice to wealthy clients will always be fundamental, it is clear to us that basic functionality such as clients having their portfolio details available digitally, and straight-through-processing “STP” of online listed orders is now a fundamental, and to not provide that is unacceptable going forward.”

Adding further insight into whether EAMs and MFOs will become more external platform-based, one expert said that they would, as traditional liquidity providers are compromised by a number of internal and external factors. “The diminished risk appetite, higher cost of risk-based capital and the commensurate inability to offer clients true liquidity, particularly in the fixed income sector, will divert asset holders to platforms for access to aggregated pricing sources,” he commented. “Equally, the demand for time-sensitive responses, independent of RM participation, the removal of ‘layers’ in the price discovery process allowing for price distortion and time-to-market inefficiencies will naturally accelerate the need for much greater transparency and adoption of platform solutions.”

This same expert also expects clients to want more choice. “We are in a solid third-generation phase of investors in the wealth management sector in Asia,” he commented. “Investors are better versed in the business of wealth management and hold higher expectations of their product providers and have a clearer opinion on what they require to meet those expectations. Failure to meet these requirements will naturally invoke an increased level of self-direction in the investment decision-making process.”

Expert View - Damian Hitchen, CEO Singapore, Swissquote: “Whilst platform providers by definition can aid the delivery of a move to digital, platform providers need to constantly be in dialogue with their Partners, the users of the platform, to ensure that core functionality, including required markets, reporting, different types of trading orders and so forth are relevant and in sync with market needs.”

Another expert added that a new EAM coming into the marketplace needs to ensure that they have got at least two or three custodians, adding that the platform should aim to offer elegant, rapid, cost-effective and seamless solutions to such EAMs for execution and custody that help those EAMs move into operational mode and be competitive as rapidly as possible. “The EAM at the start needs to be very clear about the basic tenets of what they require from a custodian partner,” he advised.

An IAM head agreed, adding that his firm spends a lot of time working with their counterparty banks trying to get the best out of each of them. “Yes, we view our job as trying to find the best out of each of the banks, the asset managers and relating that and providing that to our clients. I should add that we also spend a lot of time on sourcing what we believe to be outstanding deals, especially in the mid-market space, and offering club deals to our clients. For liquid financial investments, yes, we work closely with our banks, and then in the illiquid space we try to find what we believe are the best counterparties out there to work with on an exclusive basis.”

Expert View - Damian Hitchen, CEO Singapore, Swissquote: “Platform providers also need clarity in their roles in the ecosystem. For ourselves, we are a digital global custodian, execution and institutional client management portal, but we are not an aggregator or risk management provider, so firms need to be clear and deliver on core roles, and then partner or provide a facility to plug-into other specialists.”

Looking to the Future, Positioning to Win

The discussion evolved to the next phases for the IAM sector and what should happen to the industry to make it even more competitive and robust.

Replying to the question of what growth lies ahead and how the IAMs will growth their platforms, an expert said it would be both organic and inorganic, the latter being accumulation of AUM through targeted acquisitions and strategic alliances. “We will drive towards the promotion of uncorrelated asset classes with attractive coupons and dividend returns to attract investors and advocating the freedom of enjoying the full value chain of independence,” he said. “While alliances that allow for a cohesive platform that promotes scope and scale, that affords clients a smooth transition of assets between custodians, reduces the perceived hardships of KYC and AML and promotes a solution-based approach to client engagement, these are all deemed highly attractive to Asian incumbents.”

And looking ahead through the mists of Covid-19, another IAM leader in the panel commented that certainly, most businesses would continue to adopt a more flexible approach to working from home, and flexible hours, as well as continuing to promote greater digital access to markets and improved product dissemination through digital channels and co-branded access to trading platforms.

Expert Viewpoint – Veronica Shim, Founder & CEO, Envysion Wealth Management: “Covid-19 has caused limited disruption in the EAM and wealth management space. In fact, we have seen more trading activities over the past few months despite limited new client acquisition activities. As we get accustomed to new norms, we are confident that the independent space will continue to thrive and develop.”

“Additionally,” he observed, “as a relatively new business we have avoided the pitfalls of reliance on legacy infrastructure. Late technology adoption affords us the agility to assimilate innovative IT solutions fit-to-purpose for our clients, without prohibitive incremental cost and with relatively efficient and simple integration. We intend to react accordingly in response to our clients’ needs in the new post-Covid-19 universe, just as our clients themselves evolve into a new working environment and world ahead.”

In terms of the business operating model, one expert commented that his firm would be implementing further streamlining of market access and price discovery, and continue to search out smart solutions in partnership with best-in-class third-party providers of technology and infrastructure to meet the changing landscape of client engagement. “We believe that in-house solutions can be both fragile and readily open to disruption,” he explained. “Adopting a robust, scalable provider of infrastructure and model client engagement is essential to meeting the needs of the growing Asian wealth management universe.”

Looking at the world of assets and investments, a panel member said his IAM would be promoting and educating clients around non-correlated asset classes with high coupons and dividends. “Judicious adoption of leverage in low volatility products,” he said, “and a strong adherence to a solution-based approach seems paramount. Access to investment banking products, pricing, solutions and transparency are also key attributes ahead. Moreover, understanding the clients’ objectives following the massive market dislocations of the first half of 2020 must be a priority. And we believe that a measurable allocation to hedging tail risk should be clearly defined.”

He also expects to see more internally branded exclusive investment products amongst the IAMs. “This will take place increasingly, but often co-branded with blue-chip market participants to allow for ready acceptability in the marketplace. Currently, the regional wealth management investor base is still a great deal more comfortable with a ‘branded’ solution, but bespoke in-house solutions, matching client investment criteria and incorporating the embedded credit risk of third party providers that meet these requirements, will be sufficient to meet client demands. The more we understand client aspirations and the more they understand and embrace market standard options and solutions to match these, the more relevant internally branded solutions will become fit-to-purpose.”

An expert pointed to the value of consolidation for the expansion of capabilities for existing clients one of or more, and therefore the enhancement of the value proposition. He explained that if IAMs can identify other businesses in other markets that offer a complimentary style and that fit the culture and character of the firm, then that might sometimes be the best way forward to expand into new clients bases, new markets, and therefore to offer their incumbent client base additional range and coverage. This same expert explained how his firm had teamed up with a Singapore operation, for diversification and access through the excellent Singapore wealth market to new structures and opportunities, including the Variable Capital Company (VCC).

Expert Viewpoint – Veronica Shim, Founder & CEO, Envysion Wealth Management: “At Envysion, we provide our clients with unique opportunities and investment strategies. We recently launched our first VCC sub-fund, in trade receivables of nickel, and already, we are working to roll out the second in a couple of months. We look beyond traditional options to help our clients achieve diversified and resilient portfolios.”

Expert Viewpoint – Kenny Ho, Managing Partner & Founder, Carret Private Capital: “Carret Private will continue its growth ambitions through selective hiring of senior, like-minded wealth managers and through mergers and acquisition. For us, it’s about sensible growth whilst retaining our core DNA to improve family offices’ strategic positioning.”

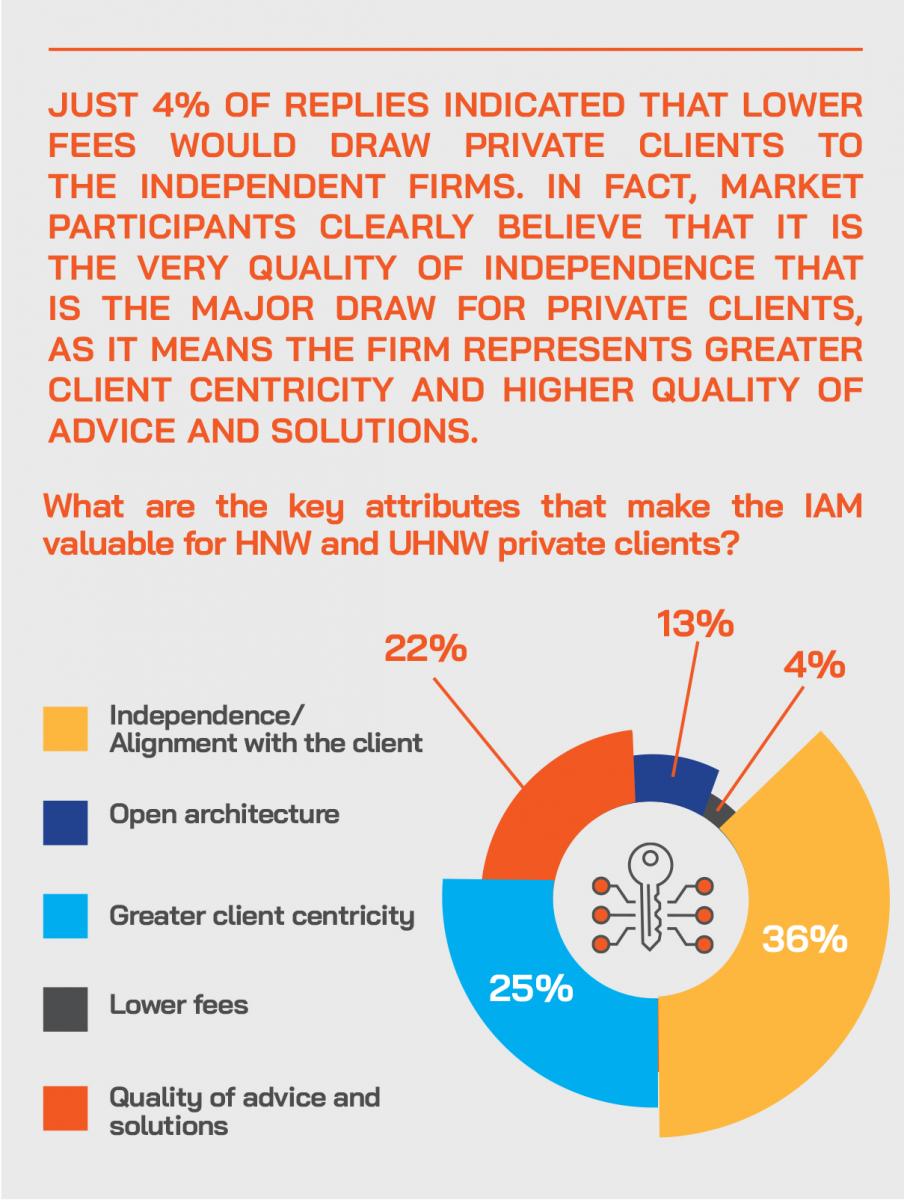

Post-Event Perspectives from the audience on what the key attributes of an IAM are that contribute to its success

After the discussion, Hubbis immediately sent out a post-dialogue Survey to delegates. We asked them to briefly comment on what they consider to be the most important elements of an IAM to determine their actual or potential success. We have edited their replies to provide the following insights from the wealth management community.

What are the key attributes that make an IAM successful today?

- Efficient, elegant and customised customer service.

- Global reach, resourceful, experienced RMs and independent advice and opinions.

- Knowledge, empathy for the client and their needs, strong service and support for their clients and offering a solution to their clients’ needs with bespoke advice, recognising that no one model will fit all.

- Independent, holistic, exclusive bespoke solutions.

- Personalisation, diversity, and genuine expertise.

- The ability to adapt to the ever-changing world.

- Competitive advantage due to lower costs to clients, the provision of independent advice and a wide range of niche product offerings that may not be available via private banks.

- The selection of platforms and custodians, the independence and open architecture, which all offer greater flexibility for their clients.

- Humility, shrewdness, good judgement, consistency, motivation, open architecture.

- Custodian arrangements, open bureaucracy.

- As a bare-bones version of large private banks, it appears that successful IAMs have one really key attribute, and that is their ability to be client-centric. This focus on clients is possible mainly because all other aspects regarding execution and custody are left in the hands of third-party partners, and so forth. Not to be clichéd, but they only have one job, namely to execute to perfection.

- For clients who need true cross-border support, the demand for agility, and flexibility will urge them to commission IAMs to work for them.

- Integrity.

- Specialisation.

- Reputation.

- Unique products.

- Open product architecture.

- Independence!

- The ability to win and maintain trust with existing and prospective clients. Credibility is extremely important. Experience and the network to unearth investment opportunities are also very valuable.

- Bespoke structuring and specialisation required by their clients.

- The strong pedigree of key people, more broad based in terms of client relationships, transparency, global reach and effective network.

- A good IAM assessment goes beyond looking at what is, and involves imagining what could be.

- Ability to negotiate the best pricing.

- Autonomous investment advice and open architecture.

- The IAMs believe in working for the client. They focus on serving and finding the best solutions available and can operate through multi platforms, provide different views, better negotiation ability through volumes and flexibility, provide open custodian, and open architecture, and open bureaucracy.

- Incessant attention to detail and the intimate appreciation of clients’ anxieties and pain points.

- Sincerity, honesty, integrity, humility, empathy, ability to listen, a growth mindset, all these elements add up to evolving with the clients and their expectations and lifestyles.

The discussion drew towards a close with the experts offering several more insights into what could improve and how the EAMs could be more competitive.

“We will try very hard to boost connectivity with European custodian banks,” came one reply, “with additional booking centres. Asia has tremendous growth, but increasingly clients may want to keep the custody of their assets at a healthy distance, even at the inconvenience of different time zones. And also, in those respects, if we are truly going to see a systemic move of assets to European booking centres, then EAMs’ relatively competitiveness vis-à-vis these private banks will increase markedly. Suppose I was seeing clients coming from Shanghai with USD200 million, he can come to my office, he can come to a major global bank office, or a larger boutique Swiss private bank, then it comes down to a very granular comparison of everything, assuming relationships are the same. But we can move far faster than the private banks, for a variety of reasons, including the absence of internal conflicts.”

Another expert commented that their business is all about incremental improvements, and being independent without the legacy infrastructural hindrances the incumbent banks may suffer from and his number one priority was to find like-minded partners in the market, be it families, clients, or partner firms. Educating clients from Europe about Asia is also important, he added. As to investments, there is greater and rising interest in alternative assets, so the mission is to boost the range and value of the solutions his firm can offer.

Another IAM head said their mission was to further improve the platform. “We are trying to offer an exclusive, unique solution that's not available in the market, that's not correlated very much to all the financial products, which helps our clients in diversifying their portfolios. We also aim to further diversify our revenue stream across financial and non-financial products and services and solutions, beyond standard private wealth solutions, all of which will also help us survive and build following this crisis.”

Conclusion

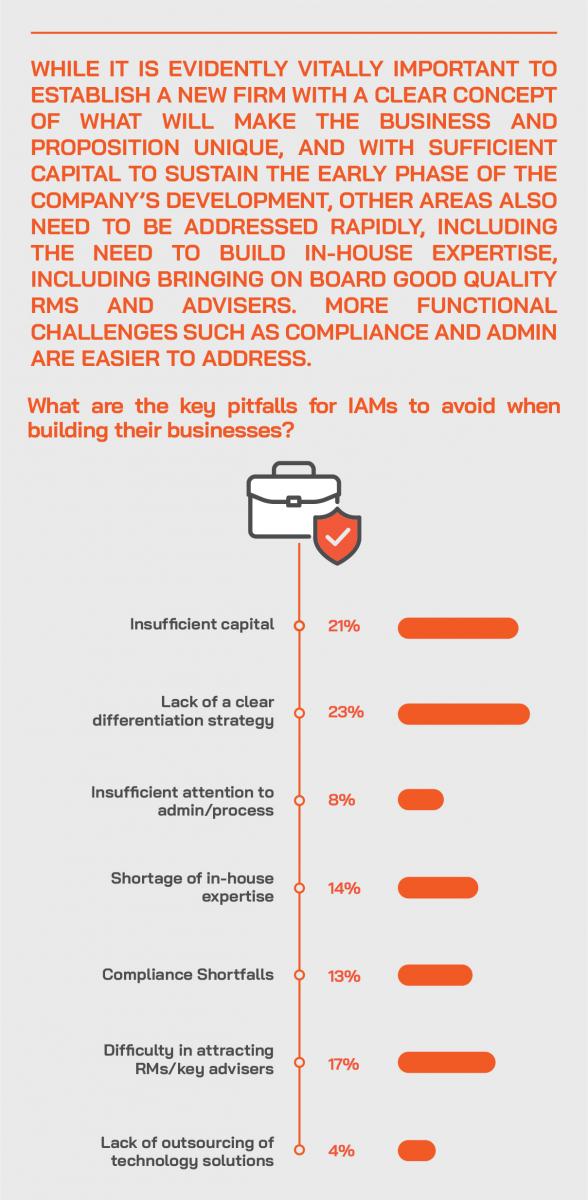

The panel was completely dedicated to the view that the IAM industry in Asia has all the right potential to enjoy solid, possibly dynamic growth in the decade ahead. But they are also realistic about what has been achieved thus far and what needs to improve for the sector to truly embrace its full potential. In short, great opportunities await for those incumbents who are established and can further adapt their models, as well as for the new entrants, providing they heed the collective experience of the market and devise their propositions to fit the market and the needs of the clients.