The Wealth Management Industry and the Expanding Universe of Cryptocurrencies and Digital Assets

Feb 7, 2022

On January 27, Hubbis presented a Digital Dialogue event focusing on the rapidly evolving world of digital assets, from cryptocurrencies to digital coins and tokens. Our panel of experts centred their attention on the evolution of this market segment – which is constantly expanding and with increasing energy – and put into context why Asia’s private clients might be considering investing in these markets, and if so, what they might think about buying, and how. Many investors might have already dabbled their toes in the Bitcoin ocean, or maybe taken a bigger plunge across other cryptocurrencies, as well as possibly trying their hand at Non-fungible Tokens (NFTs) and the expanding universe of Decentralised Finance (DeFi). And it goes without saying that all these elements have of course been turbocharged by investors seeing the incredible performance of Bitcoin in the past year, even though since the November 2021 high, cryptocurrencies have slumped very significantly. It is fair to report that some private banks and wealth management firms remain sceptical about cryptocurrencies, citing their inability to link their prices to any fundamentals whatsoever. But there are other private banks – and some of these include the oldest brands in the business – and plenty of EAMs and MFOs that believe that digital assets are part of our collective futures. These banks and firms believe that their private clients should not only understand more about digital assets, but they should actively participate by building some exposures in order to understand more about buying, storing, custody, and, of course, the vicissitudes of market pricing and volatility. The experts on the panel also analysed how the diversification of the digital assets universe is moving in line with the rapid development of the evolution towards a professional, more institutional level market infrastructure and ecosystem, and held out some hope that the regulators around the globe might gradually come together and provide a more comprehensive regulatory vision for the future of digital assets in all their forms.

The Panel of Experts

- David Packham, Founder, Chintai

- Harmen Overdijk, Chief Investment Officer, Leo Wealth

- Daniel Liebau, Founder, Lightbulb Capital

- Stephanie Leung, Director & Head of StashAway HK and Group Deputy CIO, StashAway

- James Dougall, Founding Partner, blufolio

These are some of the questions addressed in the discussion:

- Should Asia’s HNW and UHNW investors be considering digital assets, and why?

- Are there investment fundamentals that can be analysed and computed in the emerging world of digital tokens?

- What sustainable options are available in this space?

- What are the investment strategies available to clients looking to access thus space? For example – staking and yield farming.

- What sort of allocations to digital assets should HNW and UHNW investors consider as part of their broader portfolios?

- How do intermediaries and advisors educate investors on cryptocurrencies, what they are, how they work and what relationship do they have to blockchain or other confirmatory protocols?

- Aside from cryptos such as Bitcoin and Etherum, what other forms of digitised assets are already in existence, and what is likely to emerge in the foreseeable future, and how should investors be educating themselves on those?

- Non-fungible tokens – what are they, and how do they work?

- For those private clients buying into these assets or thinking of doing so, how should they buy safely and efficiently, and how should they hold/store these invisible assets?

- What is happening to the digital asset ecosystem (intermediaries, brokerages, custodians etc), and how does that fit with the evolving, albeit differentiated regulation around the world?

- How are digital asset brokerages evolving, and are they being properly regulated, are they secure, and are they achieving the growth they expected?

- For the allocation to digital assets, what choices should, or could, investors be sensibly making?

- What is next for digitised assets?

The Key Insights & Observations

Some members of the private wealth community believe the digital assets universe has become too big (and too exciting potentially) to ignore, even if it will take time to see the true winners and losers

“The whole digital asset space has already become so big that you simply can't ignore it as a wealth manager,” a guest opined, on opening the discussion. “High net worth clients are definitely asking questions about it, are definitely willing to invest in this area, some more aggressively than others. And they definitely expect us to have an opinion on this field as an investment area.”

“Maybe some of the cryptocurrencies as they are today might not work as they were intended,” he continued, “and some of the art NFTs might not be as valuable as some people might think today, but I strongly believe that tokenisation and NFTs, at least the technology behind NFTs, will actually change the way we deal in financial securities. I can say it would be so much more efficient if we can trade company tokens directly against each other effectively 24 hours a day, rather than if you have to go to different national exchanges, exchange currencies, go to brokerage platforms to be able to buy exposure to an underlying.”

He said the next question is how this will impact the development of digital assets within the financial services arena. “We do not know the winners longer term, but I do believe that we will see a huge shift in the financial industry in the coming years, where digital assets will play a much bigger role. Of course, that is like the early years of the internet, when the winners were largely unclear to most, ditto with the online ecommerce businesses. Big picture, we strongly believe you want to be in this field and you want to be investing at least some of your assets in this area.”

And another guest commented that cryptos manifest themselves in various categories. “If you think about these smart contract platforms, they are almost like the operating system of a decentralised ecommerce type of future,” he said. “In the past, everyone wanted to own a chunk of Amazon, but nowadays, the smart contract platforms are incredibly interesting, because many different products and services can basically be built on top of them. That is what I am most excited about.”

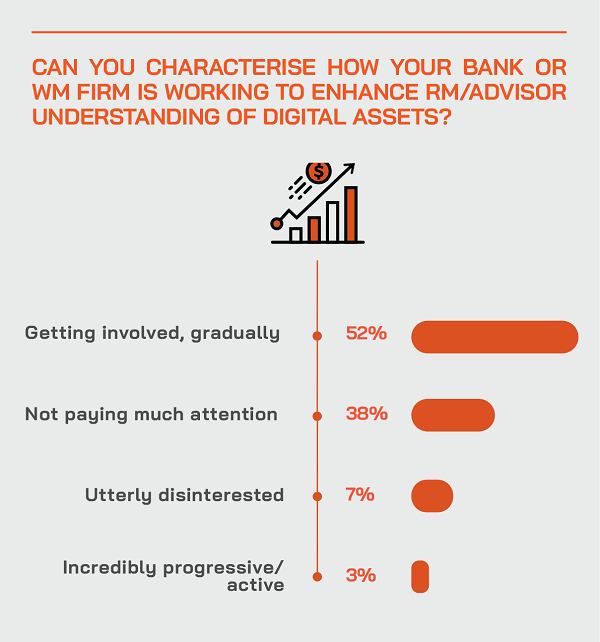

The approach of the financial institutions and advisory community does indeed vary greatly, from one end of the spectrum to the other

A guest agreed that the adoption or lack of digital assets varies dramatically across the wealth industry. “For the larger financial institutions and global banks, the real draw right now for them is the massive efficiency of savings by being able to remove the whole settlement layer out of the trade lifecycle, and that alone is a great draw for them to actually implement different forms of blockchain technology,” he commented. “For others, for example mid-tier asset managers, they are seeing a huge potential opportunity to actually make major growth strides, expand into new areas and really get a competitive edge over the likes of the global banks, by being able to provide their clients with something distinctively different, such as create some sort of dynamic fund that's tokenised, for example perhaps fractionalised real estate for younger investors priced out of residential housing. These and other ideas are actually on the radar of some of the more innovative asset managers, for sure, and we will see more and more.”

Safe, high-quality access and execution efficiency are vital to the proposition for anyone wanting to enter the digital assets universe

A panellist reported that they have been buying cryptocurrencies as a small part of some discretionary or managed portfolios for clients. He explained that the investors need to be professional [accredited] buyers in Hong Kong, but said they are in the process of developing solutions that might appeal to a broader group of clients and across different parts of the whole digital asset space to access different types of exposures.

He said international investors have a variety of ways to access crypto exposure overseas, such as through ETFs listed in Switzerland, for example. In the US, he reported that it is easier to use key platforms [he mentioned Gemini and Coinbase], which are set up to handle wealth management firms and deliver crypto services.

Access, another expert agreed, is a central key to the puzzle. “Even today, it is not so easy,” they reported. “We have seen new ETFs coming online in jurisdictions such as Canada or Europe, and in the US, we have a futures-based crypto ETF. There are more coming, and for a digital asset manager utilising ETFs for our clients these are very positive developments, making it a lot easier to help our clients to build exposures. Nevertheless, even though a major barrier remains in the form of volatility, we see a huge opportunity to help our clients to navigate the various risks.”

Expert Opinion - David Packham, Founder, Chintai: “The broader move toward digital assets across all asset classes, is in our view the single biggest trend that will dominate and disrupt the global economy over the next five years.”

Expert Opinion - James Dougall, Founding Partner, blufolio: “Staking and yield farming are popular solutions in DeFi to obtain more stable, yield-based returns on crypto assets. This is clearly distinct from the huge price swings that occur in the cryptocurrencies themselves. DeFi centres around how participants can pledge their crypto assets in decentralised applications or protocols.”

Diversification, theoretical non-correlation to mainstream assets, and innovation are all drivers of the digital asset markets

A guest reported how as a digital multi-asset portfolio manager, they are covering a broad array of traditional asset classes, sectors and geographies, and they are “quite positive” that digital assets will become a very substantial part of the asset allocation for a multitude of clients, not just high net worth clients, but also potentially, for the majority of their clients, including retail investors.

“There is a lot of innovation happening,” they reported, “and as asset allocators, we want to be in assets that are growing in terms of economic value, and they are in general not so correlated with some of the more traditional asset classes, meaning that adding a slice of digital assets will provide some diversification benefits, even if in recent weeks everything has been sold down, and there are of course phases when correlations do indeed break down. However, we still think cryptos offer considerable and increasing portfolio benefits.”

Whatever the intent and the applications, whatever your belief in this market, you still need better infrastructure

Expert Opinion - David Packham, Founder, Chintai: “Integrating regulatory compliance into wider digital asset innovation is the final component that will enable mass adoption of the technology right down to the retail consumer level.”

Another expert explained they specialise in enabling different forms of digital asset issuance, helping create liquid secondary markets, and handling compliance, all as an integrated service.

“Digital assets are such a versatile new innovation, with numerous different applications. “Some clients are in areas like the green tech space, for example looking to utilise tokenised carbon as a way of effectively replacing the obsolete carbon credit market, which is definitely not fit for purpose. But tokens can extend out to real estate, bonds, securities, and of course, the various utility tokens we've seen in use in the existing crypto system as well. What we do is provide a back end for anyone from start-ups right up to big financial institutions, with a core differentiator being the compliance control framework on the blockchain from the inception.”

Expert Opinion - David Packham, Founder, Chintai: “We are seeing a large number of disruptive and innovative use cases looking to tokenise everything from carbon and agricultural land, through to commodities and securities. In all cases, the opportunity to expand access to forms of value exchange in early issuance, is the most powerful potential change that will help reduce the gap between the wealthiest and poorest in society. In fact, we expect to see the applications of NFTs mature rapidly over the next two years. At present there is a lot of speculation and experimentation. Where NFTs will reach their potential, however, is when they embed underlying utility and purpose; that will enable them to further enrich digital business models, commerce and interaction.”

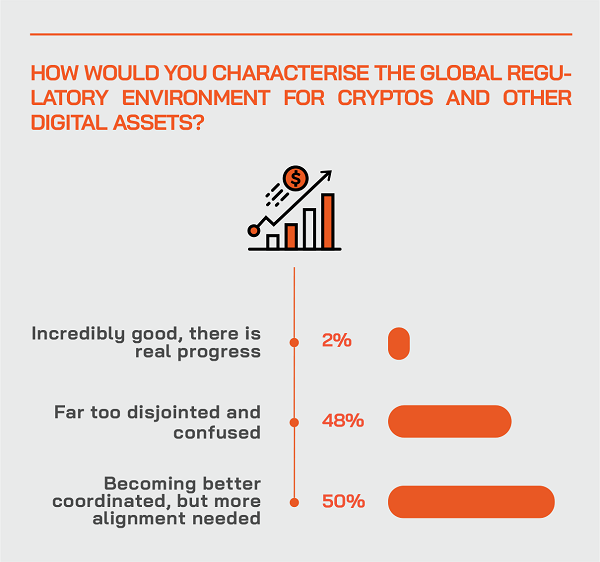

Aside from market infrastructure, you need to know how exactly to be compliant, for your bank, your firm and your clients, but let’s face it, the regulators continue to struggle with the technologies and there is still little global coordination

A guest noted how in Asian markets in general, digital assets are still not well or fully understood by many of the regulators. “For us as industry protagonists, we see our mission as involved in the education or the digital asset landscape and demystifying these for regulators, which in turn can consider the right regulations, and to that end, we are in close contact with some regulators, helping them to frame the right approaches to these the digital asset offerings for not just professional investors but also retail investors in the region. I think this is a key concern and issue in the foreseeable future.”

This same expert reported that the regulators are tending to watch their Asian counterparts’ moves first, but watching other regions as well. “There will be different approaches, but the overall mission is investor protection.”

Another he added that as this industry matures and expands, regulatory compliance has to be factored in right from the start to enable mass adoption. In short, the regulators need to improve their understanding of these assets and present a more codified and coordinated approach to regulation, to help everyone involved and those who want to participate.

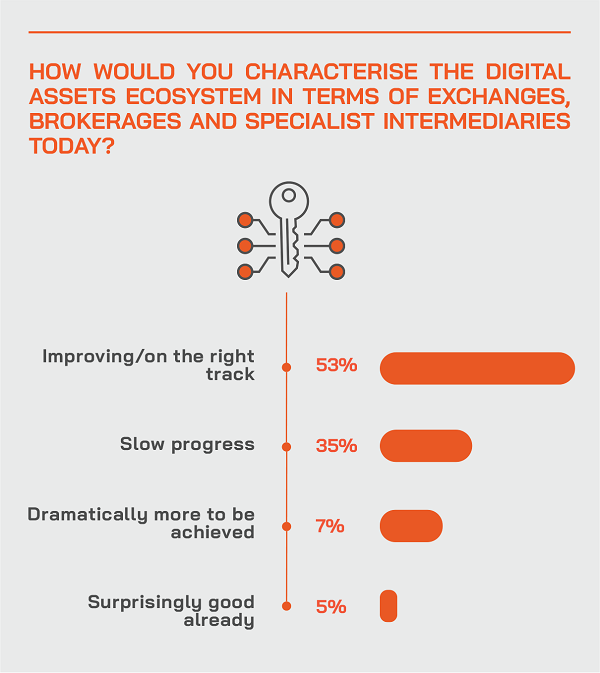

The exchanges and ecosystem are improving rapidly, but there is much more to come and again, better regulatory clarity is essential

An expert reported that some of the digital exchanges that were previously largely ignoring client onboarding and KYC protocols were now building processes and practices more comparable with a conventional securities exchange. Without mentioning names specifically, he explained that the end users will soon see a more consistent and professional approach from the outset of their activity and engagement.

He explained that there are always going to be areas though of the digital asset space that are completely operating in a decentralised manner, where anyone can in theory sit outside the system, and despite different positions taken by various regulators, the regulatory community is working earnestly to prevent fraud and money laundering and to protect consumers.

“We saw that with the ICO [initial coin offering] boom, when they started to crack down and that was primarily because they saw consumers being exploited in scams and other kinds of issues back in 2017 and 2018,” he reported. “But that has also put off adoption and particularly amongst the larger financial institutions who are only now beginning to cautiously come back in. But what we see is that anyone who wants to do some sort of token issuance, also need to be on the right side of the law, to be as compliant as possible, in fact fully compliant, and that's no small challenge.”

He explained that is why they had built their service, in order to help clients by effectively mapping all the global rules. He said that clients are highly innovative and often want to do lots of interesting things that perhaps fall outside the regulations as they stand now, so this will all take time, this is a maturing and growing digital asset industry and there is not yet any harmonious or really well thought-through framework.

He reported that some regulators, including the Monetary Authority of Singapore are coming up with sensible licensing and controls, and in London the Financial Conduct Authority has some sensible guidance in place. However, the US is all over the place, and varies from state to state, which is pushing more of the growing levels of crypto activity overseas, including to Asia.

Another guest noted that high volatility and often high returns translate to potential taxes, which is why the western economies are very keen to get to grips with this space. “In the US and Europe there are quite high taxes on investments and on wealth, and they although the whole crypto space developed as a decentralised platform effectively as an alternative to, or outside traditional financial system, for governments definitely, rather than just the financial regulators, the taxability of crypto wealth is very important. And realistically, people simply don't know how to deal with complying with tax laws around owning and trading crypto in different jurisdictions. Here in Asia, it's relatively simple, at least in Hong Kong and in Singapore, it's relatively simple because we don't have a lot of taxes on investments and gains, but in the rest of the world, that's very different.”

He added that protections are related to sophistication often. In Hong Kong he said they are not willing to let retail investors invest in digital assets or cryptos in the foreseeable future, and they have specific rules asset managers will need to comply with. In Singapore, the MAS takes a slightly different approach, and countries in Europe generally take a bit more practical approach indeed to the crypto space, especially Switzerland which is a major centre.

He said that the blockchain will potentially be better used not for NFTs, but for tracking who owns and generates carbon credits, or for example, in trade finance, where it's important to understand who actually owns the contracts and who owns the underlying goods and where they are. “Because the blockchain is a much more secure system for these types of financial transactions, I see a huge opportunity there, but it will be a little less exciting than trading your NFTs over the weekend. I can't believe that major mainstream exchanges such as NASDAQ, for example, are not thinking ahead on how to incorporate more of this blockchain technology in their current offering as well.”

Regulation is part of the equation, but operational risk must also be very carefully approached and managed

Another guest remarked that good management of operational risk around these assets is essentially, partly because trades and deals are irreversible. “We have been working in a partnership project with an asset manager here in Singapore on how to set up an infrastructure or platform that allows safe investment in these assets,” he explained. “The devil is in the detail, such as choosing a custodian that you can rely on for accessing different liquidity venues, and then also having your sort of operational risk management frameworks in the company well organised. This is vital, especially for the more conservative investors; with the volatility already, they don't want to hold on an additional layer of risk around the operational matters.”

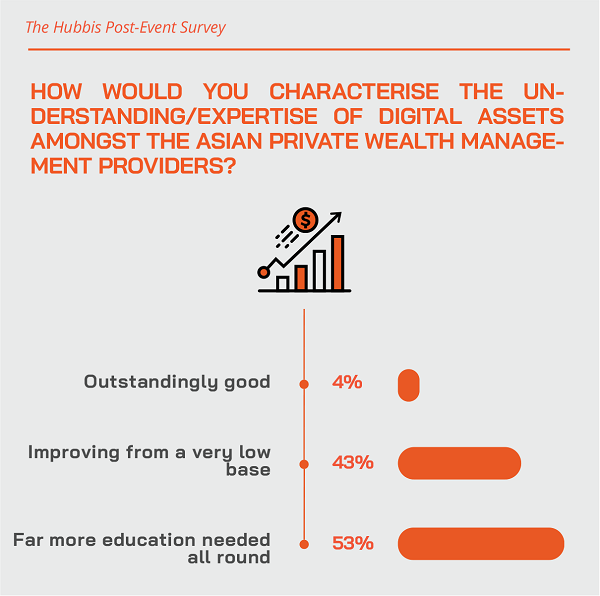

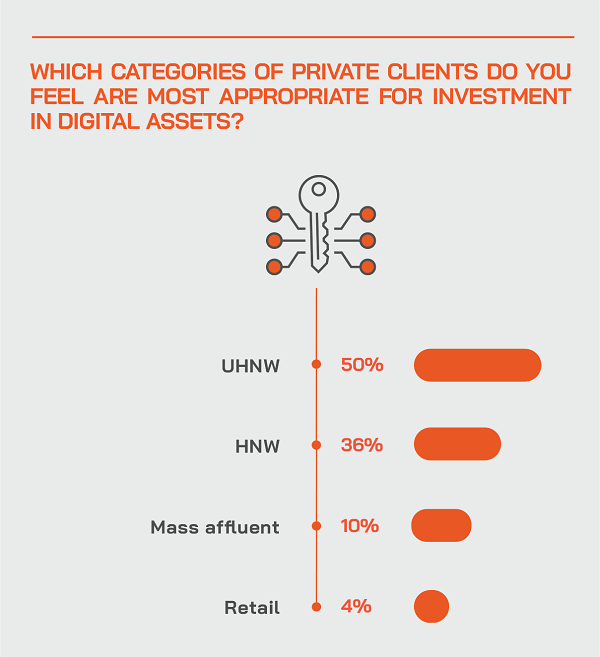

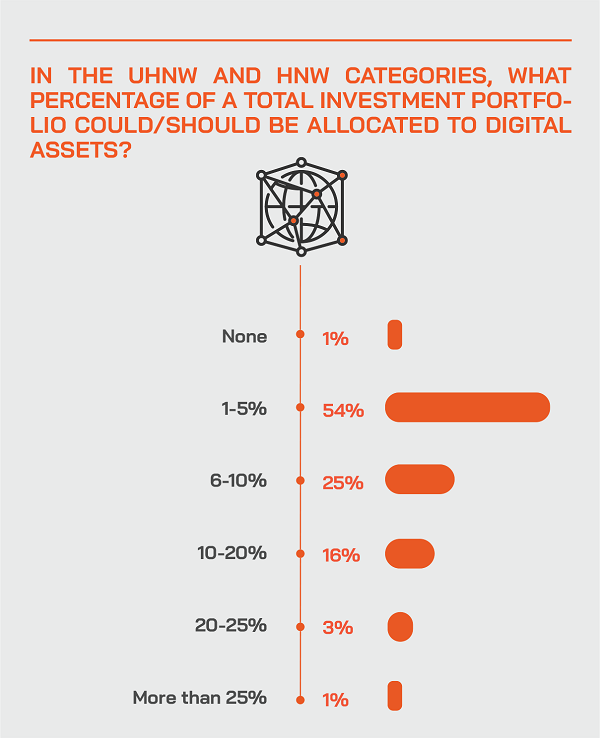

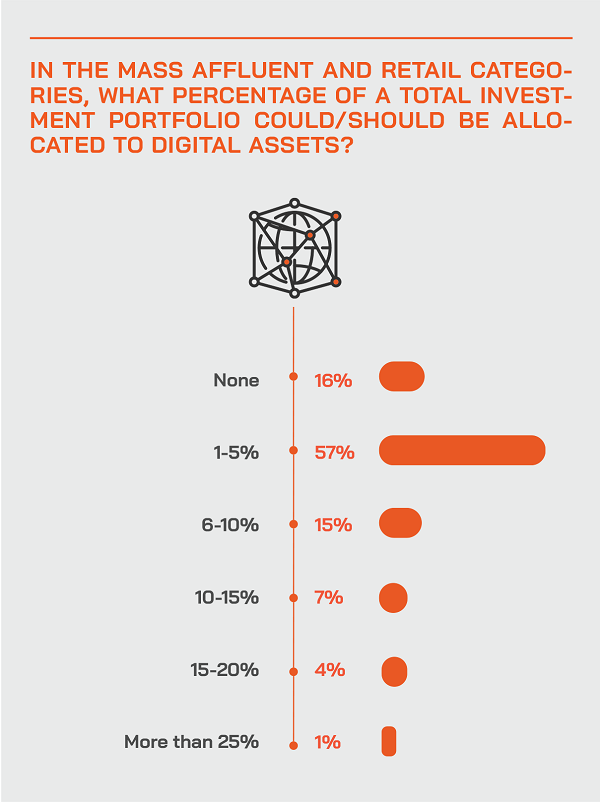

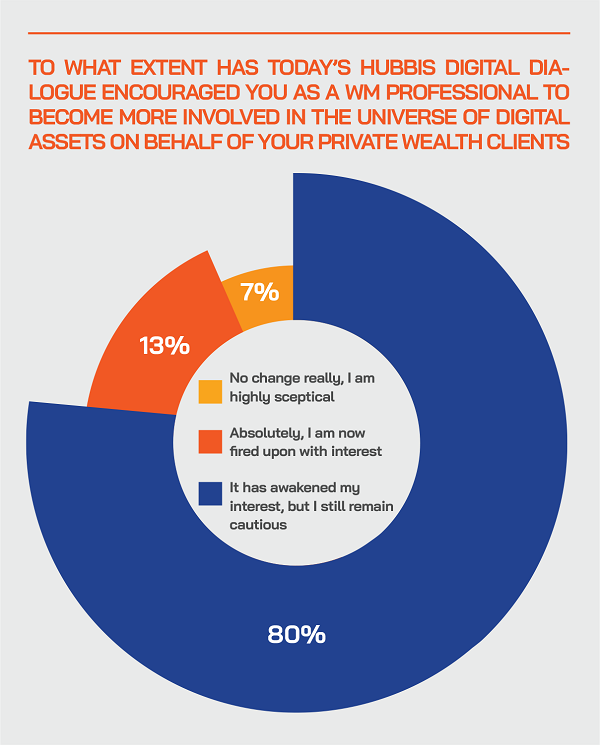

The Hubbis Post-Event Survey

Question: Should the private banks and independent wealth management firms be actively promoting cryptos and/or other digital assets to their private clients? Why or why not?

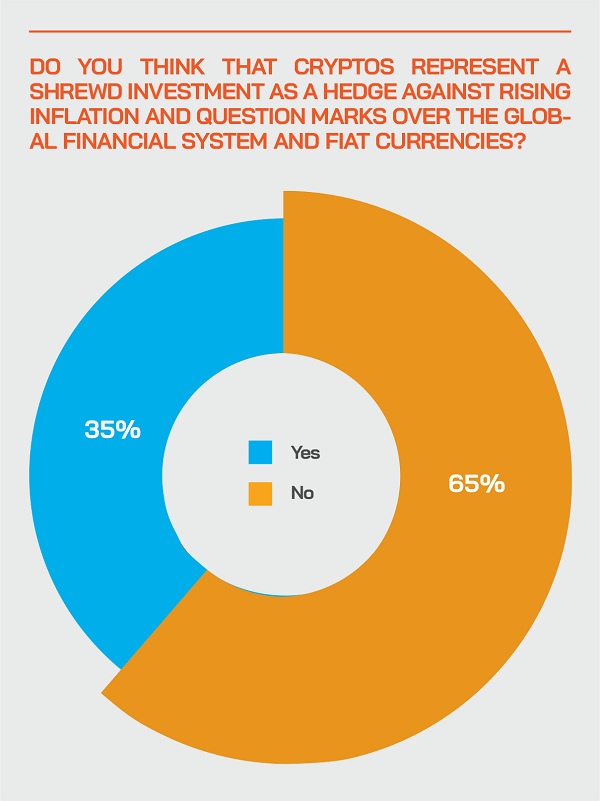

Answer: The ‘no’ replies outweighed the ‘yes’ replies by roughly 65% to 35%.

For the ‘no’ replies, these are the key reasons they offered:

- Excess volatility

- Regulation unclear and uncoordinated

- Educate only for the time being

- Too complex for most people to understand

- Only if the clients specifically request, but they should not promote this

- Not while countries are banning their people from owning or trading cryptos

- Excessive risks involved, no underlying substance to cryptos

- Few people understand what they are or why they exist

- Not unless for a very, very small portion of a well-diversified portfolio and only using money that is essentially ‘lost’ on investment and therefore psychologically entirely upside

- Far too early

- Cryptos are still very opaque

- Cryptos are worthless, only a dream, but the blockchain and its technology are real and that is where we will see dramatic implications and change ahead

- No viable ecosystem or market infrastructure

- Those trying to promote this do a poor job of communicating

The ‘yes’ replies can be distilled as follows:

- Yes, they are becoming more mainstream

- Yes, but only for investors to buy what they can afford to lose and almost as a ‘taster’ for what is surely to come later

- Yes, for some diversification

- Yes, it's an emerging asset class and the banks can't afford to fall behind

- Yes, it is the next generation asset class

- Virtual assets are the future, and the blockchain will disrupt the whole financial industry

- Definitely, but make sure the investors are aware of the risks

- Yes, digital assets have become an 'asset class', and we now need to see if they can evolve to

- become a 'store of value', and that is well open to debate.

Question: Are your private client investors in Asia only speculating in cryptocurrencies, or are they actually taking a more serious and studied approach to them?

Answer: This was a slam dunk, as every single reply indicated that this is speculation not investing. Why? Because there are no fundamentals to cryptos. Nevertheless, some replies indicated that the process of speculation allows those investors to learn about the market and infrastructure and prepare them for the times ahead when digital assets will be more grounded in economic fundamentals.

Excesses are deterring many investors and advisors from participating, so less excess and more education are needed

An expert said when one sees headlines about people paying USD1.3 million - in August 2021, someone paid 400 Ether, the equivalent then of USD1.3 million for a cartoon jpeg of a rock, through Etherock, a brand of crypto collectible that first emerged in 2017 – it all seems very strange indeed. “There is a lot of speculative froth that's fuelling the existing DeFi system as well as the NFT space,” he reported. “If you look at the fundamentals underlying certain aspects of those, I think we're in for some substantial corrections as the system really establishes a proper equilibrium and we'll see some valuations probably collapse, and quite rightly.”

He said that sort of activity certainly makes people extrapolate and cause negative views of the whole industry. Many simply however have absolutely no idea what the underlying blockchain technology is, what the point of it is, they don't really understand most of the fundamentals.

“Accordingly,” he reported, “the challenge is really present the benefits, for example how you can obviously decentralise the ownership structures, the ability to exchange value in a variety of different ways and just add massive efficiencies to supply chains, across industries. Investors and end consumers want to see and understand the underlying benefits, be it the disruption in an industry or just greater savings and choice.”

Expert Opinion - Daniel Liebau, Founder, Lightbulb Capital: “Are there are investment fundamentals that can be analysed and computed in the emerging world of digital tokens? During a recent joint project between Modular Asset Management and Lightbulb Capital, we started analysing the fundamentals of smart contract platforms. We believe that features like the consensus mechanism, the platform's wealth distribution, and the quality of the governance mechanisms are vital to the adoption and sustainability of these platforms.”

Blockchain and Cryptocurrencies can directly align with and express ESG Investment Principles

Expert Opinion - Daniel Liebau, Founder, Lightbulb Capital: “Sustainability and cryptocurrencies are two prominent investment themes of the decade. Unlike the press suggests, they are absolutely compatible. Not every cryptocurrency is the same. For example, Proof-of-Stake based Algorand or Tezos consume orders of magnitude less energy (and therefore have a significantly lower carbon footprint) than currently Proof-of-Work-based Ethereum.”

A guest explained how his firm’s premise is that enterprise blockchain adoption is evolving rapidly into a multi-trillion dollar opportunity, as digital assets and cryptocurrencies are crossing into the mainstream, while decentralised finance, non-fungible tokens and tokenisation have emerged as truly viable investment options over the past two years roughly. He explained how ESG and blockchain can interplay ideally through investments in blockchain-related companies that support and express those ESG investment principles. He explained that they offer two different avenues, one an actively managed liquid crypto fund and the other a [far less liquid] blockchain venture capital offering.

“We offer a professionally managed solution for those who are interested in this fascinating new world, but perhaps don't have the time and/or the expertise to do it all themselves,” he reported, adding the pitfalls are huge for those who do not know what they are doing. “It is quite a dangerous tightrope to tread,” he cautioned.

Fixing issues

Why is this viable and valuable, he pondered, answering his question by stating that the blockchain is helping fix many broken parts of our current society and economy. “Sustainability and the blockchain, and cryptos are complementary,” he reported. “On the liquid crypto offering, we have for example excluded all proof of work coins and focused on mining done using renewable energy. In short, we don't invest in proof of work for the time being. On the VC offering we can cherry pick projects and early-stage companies that meet at the intersection of blockchain technology and sustainability, so there we are very much into the whole Metaverse, Blockchain gaming space as an investment as well, as well as yield farming.”

This line of discussion evolved further, with this expert adding that they had made a cornerstone investment in a company called ENREX that was due to do their token listing within a number of weeks. “They are the world's first carbon credit exchange and ecosystem on the Solana blockchain,” he explained. “They are appealing to traditional companies which have an offset requirement, but also to the crypto community to do things around carbon neutral ideas, coin issuances, or any kind of carbon footprint tracking using the blockchain.”

Secondly, he explained that Play to Earn is also quite an important element of social and financial inclusion, with more and more people in some poorer countries earning incremental income through this stream.

Expert Opinion - James Dougall, Founding Partner, blufolio: “Sustainable finance and corporate responsibility have become strategic topics for financial institutions as clients’ expectations are increasingly shifting towards green and sustainable products. Crypto and blockchain investing is at the forefront of sustainable investing and social inclusion, this is an area that blufolio has a core focus on.”

The ‘S’ and the ‘G’ can also benefit

A fellow expert concurred with the vision of how sustainability and cryptocurrencies fit together rather nicely. “A recent US Senate hearing focused on making sure we move towards those technologies that are not only environmentally friendly but also otherwise, perhaps a little bit more suitable from the S and G angles,” he commented. “From the social and governance aspects, there are important areas such as the distribution of wealth on a platform. If you have lots and lots of people who have a particular token, then more people have an incentive to actually build on these smart contract platforms, and that's how they gain adoption.”

He explained there is also an important governance perspective, with mechanisms such as on-chain votes for holders to bring more democratisation to the market. “Token holders are basically able to use that token as a sort of mechanism to cast a vote,” he explained.

The democratisation of governance

Another panellist concurred wholeheartedly, remarking that more democratic and fairer voting systems and governance can emerge to offset what he said he sees as the broken political and voting systems in many democracies. “Blockchain based voting sidesteps a lot of those election and voting issues and discrepancies that we have seen in recent years; it might not be a panacea, but I think it offers some hope, and it all ties back to advances on the ESG front. In fact, I believe this can apply to every aspect of our society at the moment, and I believe blockchain technologies can really fast forward ESG across many aspects of society. Indeed, it is a great opportunity to achieve at least some of the change that we absolutely and desperately need on the planet, given what I consider somewhat of a broken state of affairs.”

The emergence of a surprising and somewhat unwelcome correlation between cryptos and mainstream equity markets has exacerbated the falls in prices, but private market and VC access can sidestep this volatility

A rising tide floats all boats, and the inverse appears to be true as well currently, as the air goes out of cryptos such as the benchmark Bitcoin, at one point in January down around 50% from its November 2021 high.

“We have seen that type of massive drawdown in the liquid crypto space and mainstream crypto space, and it's going to keep happening, and we have seen a very concerning increase in correlation between the crypto space and the mainstream equity indices such as the S&P500 and the NASDAQ, with crypto trading like leveraged equity, which it is not, but who is to sit here and say the markets are wrong. So, we're monitoring that all very closely. It is possible that the flip side of last year's mainstream adoption of crypto is that now the broad banking and wealth management community just looks at crypto as another risk asset, effectively leveraged equity, and when rate expectations tick up by 10 basis points, or risk assets must be sold off indiscriminately. It would be a real shame if that happens, but maybe that's part of the evolution, until there is also perhaps a much broader based understanding of the structural changes and enormous value creation that blockchain technology is already bringing.”

He explained that their private markets VC offering is specifically designed to avoid these massive public market price swings. “We get into projects at extremely low valuations and then realise gains achieving a very high return on capital in a much shorter timeframe than traditional venture capital,” he told delegates. “To give you an example, we will typically invest at the VC or seed level in Project X, a Metaverse player, and even at the token listing, we are typically up three to four times, and even in this [difficult] recent market, we've consistently continued to see IDOs, new token issuances coming in at between three and 30 times gains even in recent weeks. That means there's a lot of buffer there for us, even if then the tokens subsequently get hit in a broader market sell-off.”

Welcome to ‘Yield Farming’ and the world of sustainable cryptoculture

The same expert reported that gains made from the VC investments might then be immediately redeployed into what is known as ‘yield farming’, which is an investment strategy in DeFi, whereby the coins are loaned or ‘staked’ to get rewards in the form of transaction fees or interest, in many ways like making deposits in banks can be seen as lending or ‘staking’ to those banks.

“As a fellow panellist said, yield farming is absolutely fraught with pitfalls, but if you adopt a professional and rigorous structure and approach - which we like to think we've developed - you can achieve some fantastic yields on a relatively low risk basis. For investors, this is deployed to give them sleep-at-night reassurance, targeting yield-based returns rather than effectively punting Solanas. [Solana is a blockchain platform that processes many more transactions per second than for example Ethereum, and is designed to host decentralised, scalable applications with incredibly low fees.]

How the wealth advisory community pursues its conversations with private clients on digital assets is all important to those who seek to boost understanding of this expanding universe

A guest explained how curiosity today is remarkably high around the crypto space and around NFTs, opening the doors to client conversations. Many of the questions addressed in the event are similar to concerns raised by private clients, he explained. “We think blockchain technology is very interesting, very exciting, and right now, we think important enough to include some digital asset allocation in portfolios,” he said. “The level of exposure is client specific and then we include that in the discretionary portfolios we manage. It is not suitable for everyone, but we believe it's in a way a risk asset, and we think there is a high correlation between wealth stocks and crypto assets, rightly or wrongly. Liquidity is still a little bit of a concern despite more institutional players coming into the space. But even for sceptical clients, they can consider a very small percentage of a wider, diversified portfolio as worthwhile, for those investing in the long term.”

The final words – opportunities galore, abundant innovation, huge optimism, the direction of the compass is clear, but as yet, the precise route remains hidden

A panellist drew the discussion towards a close remarking that the possibilities in digital assets are nearly endless, as the conversation had highlighted. “There is a huge amount of new and innovative digital asset management ideas and products that we will see in the next few years,” he said. “So, I'm glad that we're all here. We're all quite early in this, and I just can't wait to see what else is coming to us, or for us, or with us in the next few years.”

Another expert agreed, adding that there are many instances of other industries that been fundamentally disrupted in the past half century, where change is taking place rapidly and where the winners and losers emerge over time.

“You can look at the advent of the internet and streaming and realise that the video rental market as we saw it was eventually going to disappear, but from that came other businesses and then some existing players like Disney adapted themselves and went into the streaming business themselves and so forth.”

He commented that the ‘Blockbuster’ videos of the financial services world are perhaps the settlement and clearance houses that would be made redundant by a full blockchain offering, so those types of firms need to embrace or perhaps fall by the wayside. “And at the same time, there's going to be a swell of opportunities for the way different types of issuances are carried out,” he noted. He said the most successful financial institutions will be the ones that embrace the change and lead in the space, but they will need to be incredibly agile.

And the very final comment centred on the dynamism and fluidity ahead. “When you combine the current global gaming community with the blockchain, and you introduce an enormous economic element by allowing ownership and trading of items and NFTs in the blockchain based games, you have an absolutely enormous potential for value creation, for inclusion, and actually also for just increasing really mass adoption of blockchain technology,” he commented. “The younger generations especially can see how this works, and how cool it is. There will be hype, of course, in all of these things, and the ‘sexier’ the underlying developments are and the potential for value creation, the more hype there will be. There will be a ton of acquisitions, for example as established legacy players will simply try to buy anyone who actually creates a tech stack of value and a revenue generating model.”