Estate, succession and legacy planning and solutions are of increasing importance to all clients as the founder generations age, as the younger generations return from overseas armed with their Western educations and perspectives, and as the region embraces the trends taking place around the world amongst HNW and UHNW clients. There are some fascinating developments taking place that will facilitate a more active wealth structuring and estate planning market in both Singapore and UAE. The UAE has been working hard to position itself as a wealth managing centre. And some might argue it’s becoming increasingly appealing to many – including wealth Indian Families. But how does it compare and contrast to other options like Singapore? A panel of experts debated these issues in a fascinating and lively discussion on July 7 during the latest Hubbis Digital Dialogue event.

The Panel

- Sunita Singh Dalal

- Laurence Black, Regional Director, Client Solutions, EMEA, Asiaciti Trust Group

- Lee Woon Shiu, Managing Director & Group Head of Wealth Planning, Family Office & Insurance Solutions, DBS Private Banking

- Nirav Dinesh Kumar Shah, Founder and Managing Director, FAME Advisory

- Philippe Amarante, Managing Partner, Head of Dubai and Pakistan, Henley & Partners

Setting the Scene

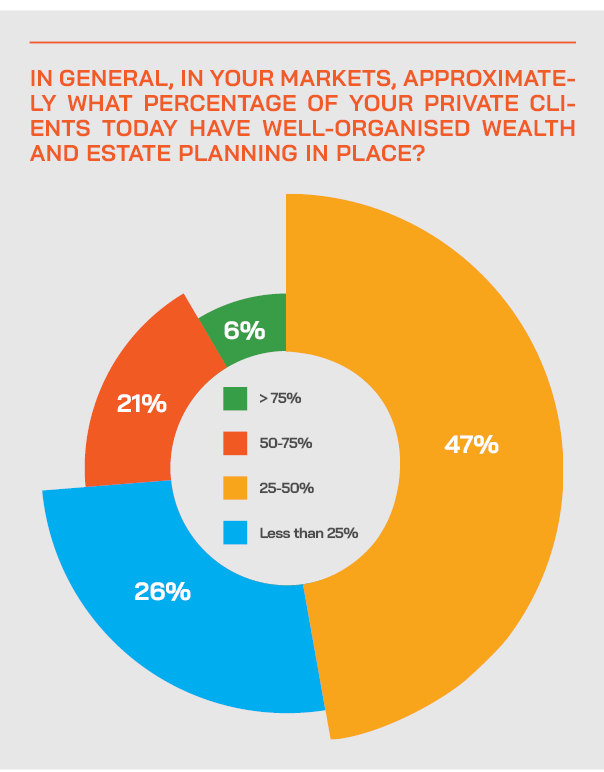

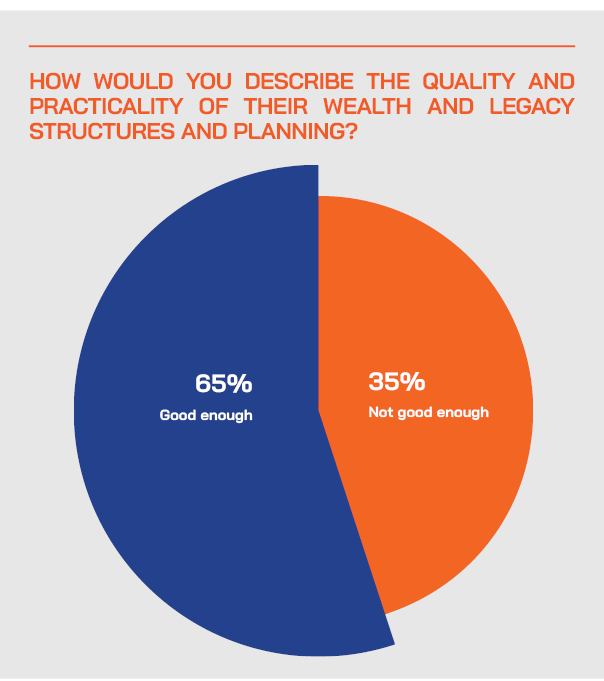

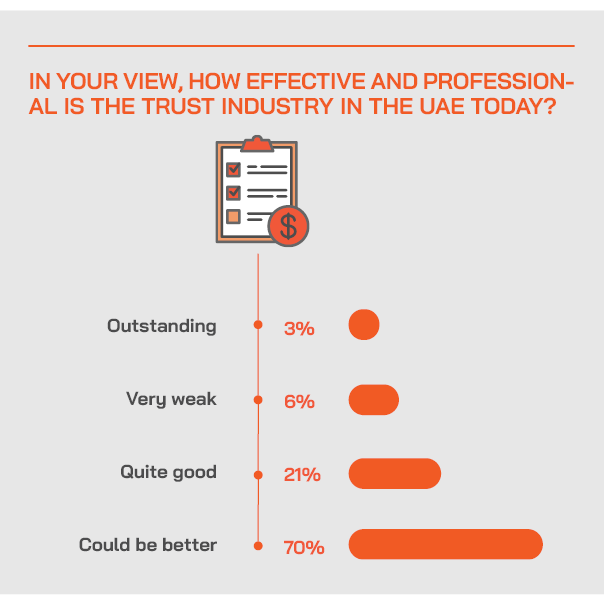

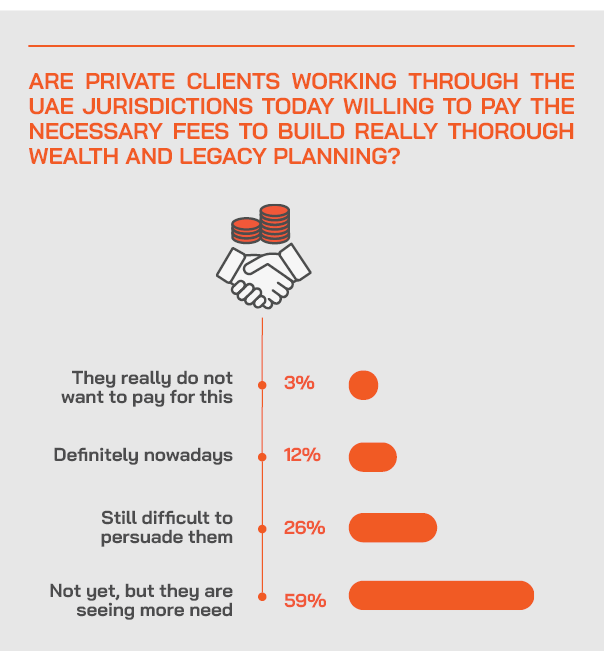

In order for wealth management to thrive in the Middle East, there is no doubt that the quality of advice on investments, wealth structuring, and estate planning must continue to improve. And this is happening - there is a growing emphasis on both the professionalisation and related expansion of the products and solutions the industry can offer in order to keep their private clients engaged. For example, there is ongoing liberalisation of the financial markets and the availability of Common Law structures through the Dubai International Financial Centre. Approaching private clients on matters of wealth structuring and estate planning is difficult anywhere in the world, and perhaps especially tricky in culturally sensitive in regions such as the Middle East.

Our panel of genuine experts who truly understand the market and their clients reviewed the state of the wealth management industry in the GCC and Singapore, in particular the evolution of carefully planned and well-executed wealth, estate and succession planning and structuring, all from the perspective of the engagement with the client base and the nurturing of the right types of discussions around these important subjects.

They helped unravel the nuances of the right approaches, and how the wealth industry and associated advisors can encourage private clients to adopt the best products, solutions and structures to safeguard and build their investible wealth in their lifetimes as well as to help facilitate the transition of their estates to their loved ones later on.

They also looked carefully at the regulatory infrastructure and environments in Asia and the Middle East, to determine what liberalisation is taking place that will help more of the advice and solutions to be given, and then expedited within the region. And they analysed what talent, experience and expertise are required in the region, as well as how the client-facing advisors and professionals should most effectively approach and communicate with these clients.

Expert Opinion - Nirav Shah, Director, FAME Advisory DMCC: “As to the key advantages the UAE offers regional and global UHNWIs, the wealth management industry is growing, and we have seen the Swiss EAMs and new fund establishment inquiries increasing. Key advantages include political stability, neutrality, world class infrastructure and a positive regulatory framework, all of which are conducive. However, a word of caution is in relation to bank accounts and for new structures, which can be challenging, but realistically that’s the case everywhere.”

Expert Opinion - Laurence Black, Asiaciti Trust, Regional Director, Client Solutions, EMEA: “As to how the UAE is now positioning itself as a wealth managing centre, I would say that with its well-developed legislation both on the mainland and mature free zones the UAE has firmly positioned itself as an attractive and competitive wealth management centre to serve both regional and global private clients. Since 2012, Asiaciti Trust has successfully served and grown its regional client base from the Dubai.”

The expanding and increasingly inclusive role and higher visibility of the UAE as a wealth centre

A guest opened proceeding by observing that the UAE used to be considered a good hub for the GCC countries and part of Africa, but that UAE is making progress in transforming itself from being a hub for HNW and UHNW families of the world.

The United Arab Emirates is a federation of seven emirates, consisting of Abu Dhabi, which is also the capital, Ajman, Dubai, Fujairah, Ras Al Khaimah, Sharjah and Umm Al Quwain. Abu Dhabi and Dubai have made great efforts in recent years to expand and diversify their economies and to build their financial centres and capabilities, to considerable effect.

“The bold shift of the national work week to days off on Saturday and Sunday is achieving its desired impact and improving the country's competitiveness through an alignment with the global financial markets,” he reported. “The government is pulling out the stops to provide clarity and flexibility to attract the world's leaders in this industry, and to consider Dubai as a global hub. By really cleverly pivoting to key industries and sectors of the future, the government has certainly demonstrated its ambitions and its clarity of thought and wanting to up the stakes to stay relevant. As a major financial institution, we see this and intend to be part of that evolution and movement as well.”

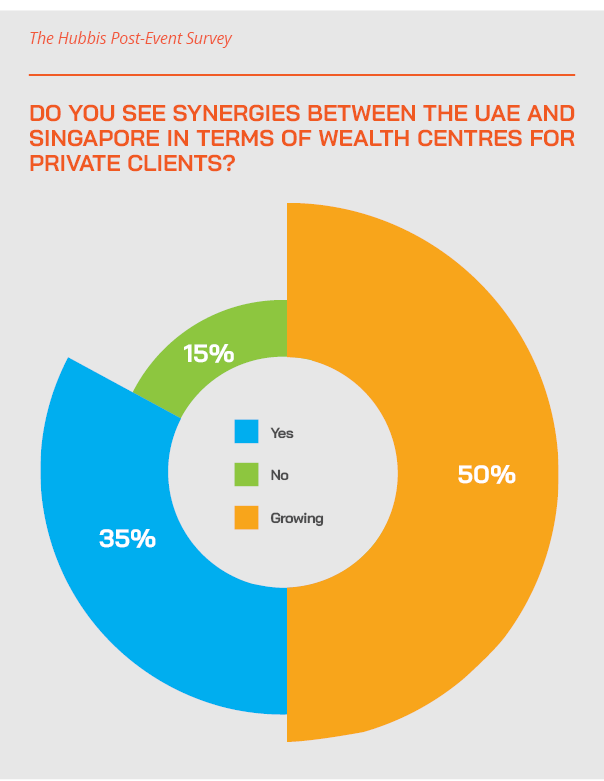

Moreover, he added that there are some families shifting for example from Hong Kong, which has had some headwinds, to Dubai, and now see Dubai as a hub through which to work, for example alongside the somewhat more advanced and more diverse Singapore. “For example, more Indian wealth is working through Dubai and there is a strong relationship between the UAE and also Singapore for these types of clients.”

The regulatory environment has also improved although there is much more to achieve in this regard - they were grey listed earlier this year. Compliance standards are a key leg of the expansion effort for the authorities, he said, adding that if they do make things better in this regard, it will certainly give Dubai a stronger look in the future for HNW and UHNW global type clients.

Expert Opinion - Nirav Shah, Director, FAME Advisory DMCC: “The government and the regulators/authorities been working to widen the appeals of UAE for the location or expansion of single-family offices. More and more options are available from UAE – from hiring resources to creating substance its more economical and still quite convenient location and hence families are preferring that. Compliance issues are likely to increase in all parts of the world and hence increasing compliance and transparency is something one needs to accept as a norm. The proposed corporate tax in UAE is not likely to impact Investment structures. In fact, dividends and capital gains are either exempt income or free-zone companies only earning passive income from investments will enjoy the 0% tax rate. Accordingly, in either case, there may not be any impact on existing structure. It will actually be more encouraging for people to set up such structures because post the introduction of corporate tax the UAE cannot be held as a tax haven and that would improve its perception.”

Expert Opinion - Laurence Black, Asiaciti Trust, Regional Director, Client Solutions, EMEA: “The UAE market in general and the wealth management market are currently buzzing with activity. Ease of residency and doing business coupled with world class education and housing enables individuals to secure a lifestyle that makes the UAE an attractive place to reside. Local laws have evolved to protect both indigenous and non-indigenous individual, their families and their wealth.”

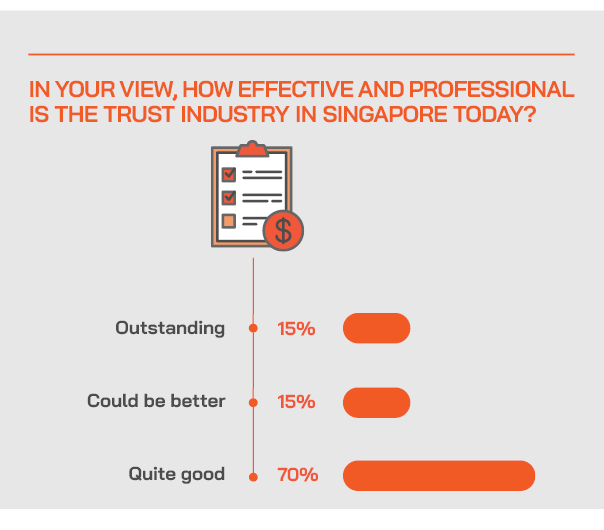

A local expert agreed, adding that Singapore, inevitably, has a longstanding track record, but that in a remarkably short space of time, the UAE has managed to introduce robust legislation and police that legislation, enforce that legislation to ensure that it creates a very credible, viable, long-term sustainable ecosystem for wealth management.

She said that over the last two years, UAE has introduced almost 100 new laws. “They are catching up fast with developments across the globe, and wherever they need to change the laws, they move fast,” this expert reported. “They handled the pandemic very well, and many wealthy families are now considering this as a second home or second hub for them on their operational or family wealth matters, so it becomes natural for them to consider a family office, or a wealth structure based out of here.”

Another important factor, they added, is that the UAE as a hub is an easier place from which to demonstrate or create substance, easier to hire resources, and the visa system is quite open as compared to maybe a Singapore or a Switzerland. “If a family wants to hire a very good talent from outside, they can still bring them in, and it's a very easy place to live. An improving regulatory environment is helping, and I think the authorities will introduce new structuring and asset management vehicles here to compete for example with Singapore’s Variable Capital Company (VCC). The regulators are constantly looking at what are the changes that they need to make.

A fellow expert concurred, adding that he had witnessed the evolution from a financial village 30 years ago to an increasingly sophisticated global financial hub. He said that the connectivity of the UAE to the world with its air routes and infrastructure was a driving force for the global connectivity of the region to the world’s wealth and financial centres. He reiterated the points on regulation improving, he agreed on lifestyle and the quality of infrastructure and facilities in Dubai and of the diversifying product and advisory offerings. He agreed that the thrust to achieve economic substance is an important plus point.

Expert Opinion - Philippe Amarante, Managing Partner, Head of Dubai and Pakistan, Henley & Partners: “UAE’s rather neutral stance in current geopolitical dynamics is a rare proposition and thus very attractive for HNWIs as it appears to be one of the very few jurisdictions providing a reliable and predictable framework. Moreover, the agility and nimbleness of UAE’s policy making catalyses and stimulates regional competition in ‘war on capital and talent’, which elevates the overall attractiveness of the UAE and the middle east as a global trade and commerce hub.”

Expert Opinion - Nirav Shah, Director, FAME Advisory DMCC: “The UAE is taking all necessary steps to position itself as a wealth management centre. It is creating necessary framework in terms of regulations and infrastructure to support the requirements. We would not be surprised if they introduce equivalent regulatory framework such as a VCC offers in Singapore in UAE also in near future. So, it is taking necessary steps. The handling of the pandemic and overall approach makes it a strong alternative to existing centres. The wealth management industry is adopting technology and has access to market information at its fingertips and hence it is possible to advise seamlessly on investment options across various jurisdictions. For the right structures and implementation, one needs to engage the right experts and evolve suitable structures that meet a family’s requirements and that are robust and compliant.”

Talent is lacking but the doors are relatively easy to open to experienced professionals

The panel agreed that there is still a lack of depth of talent in the UAE, but things can improve. “For instance, private equity fund managers, custodians who know how to custodise more complex fund structures, associated legal staff who know the complexities of the private equity structuring possibilities, all these experts are somewhat lacking here. But the regulators are aware of this and are encouraging training and development, they have the Wealth Management Institute, and a generally strong programme to train younger professionals and decade to really up the game. The aim is to be able to better serve the needs of family offices, fund managers, PE managers and VC managers. Singapore has this recognition, and the UAE is working hard to improve things.”

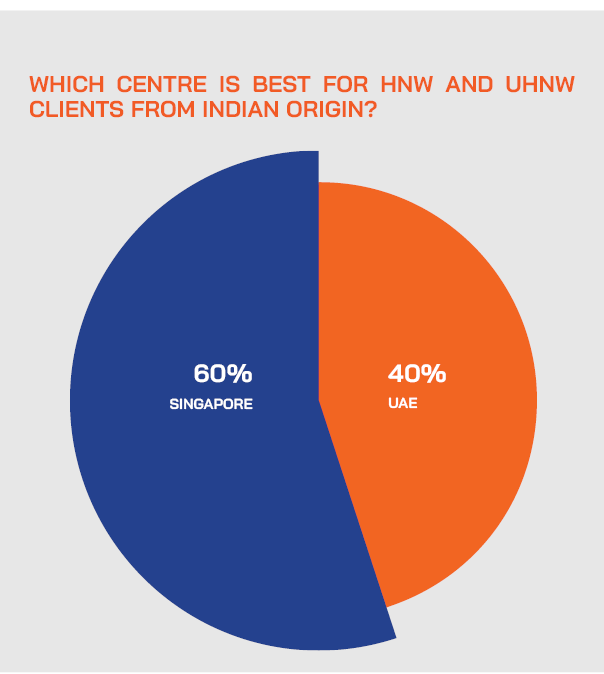

Dubai is a very important centre for Indian wealth of all categories

A panellist highlighted the UAE’s importance historically and very much today as a wealth centre for India’s private clients of all types, onshore and offshore.

The challenge is to ensure that wealth is indeed protected, ring-fenced and preserved for onward succession within these families as the family grows and evolves,” she said. “One of the challenges the families face is getting the right calibre of advice that is comprehensive and holistic. It can be incredibly frustrating when a family comes to you, and you find they have been advised in a vacuum, looking at only one aspect of wealth management and not taking an international or global approach.”

She said this raises the importance of collaborative cross-border advice and educating the clients that somebody with the most brilliant mind and most sound credentials in the world, working only in India, is just not qualified and should not be opining on matters outside of that jurisdiction unless they are highly qualified to do so. “It's about piecing together a holistic plan that works not only for the family in India and making sure their wealth wherever it is, should be properly protected,” she opined. “And also, given the mobility of family members, we must ensure that those family members do not inadvertently fall foul of some of the regulations or some of the compliance requirements, or even fiscal tax requirements, wherever they are.”

Expert Opinion - Laurence Black, Asiaciti Trust, Regional Director, Client Solutions, EMEA: “As to how the UAE today mainly is a wealth management hub for HNW and UHNW clients from India and the Middle East, or perhaps more global in its appeals, the UAE maintains strong appeal for those Indian and Middle Eastern clients, but it certainly has a much wider appeal to entrepreneurs and HNWI’s in other continents such as Africa and Europe.”

There are many structuring options today in the UAE and the increasing range of choice is spurring greater competition

A guest highlighted how the range of options have expanded, for example anyone wanting to establish a single-family office (SFO) could think seriously about realistic and robust alternatives in the Dubai International Financial Centre (DIFC), or the Abu Dhabi Global Market (ADGM). The DIFC has got its own codified laws, while the ADGM is in strict compliance with English law, they added.

This expert added that a lighter touch option available to those who want a slightly more informal but well-incorporated environment in which to manage and make investments for families is the DMCC. The Dubai Multi Commodities Centre (DMCC) was established as a free zone in 2002 by the Government of Dubai to provide the physical, market and financial infrastructure required to establish a hub for global commodities trade. And DMCC today has a SFO offering that aims to be as competitive as possible.

And another new entrant is the Dubai World Trade Centre Free Zone, which now offers not only a single family office option, but also that of the first in the region a multifamily office option as well. In fact, this expert reported, the first multifamily office was granted to what she described as an incredibly well-reputed set of professionals who she said had stepped outside of the comforts of the Swiss private banking world, and received their license within 30 days.

All these developments are reflective of the actual wealth management market, and the increasing global wealth in terms of private family-owned wealth. There is rising competition locally to provide the best options. And the speed of progress is helped, they said, by the openness of the government to work and other visas for experts from around the world.

“In short, we've got a fantastic talent pool, we have regulations, we have options, and all of this builds a very, very credible picture for family offices from across the world,” they reported. “And all this comes with increasing trade and other flows that are helping the economies. As we have demonstrated, without a doubt the UAE business environment is unfettered and unhindered. It is becoming a very vibrant marketplace.”

Expert Opinion - Laurence Black, Asiaciti Trust, Regional Director, Client Solutions, EMEA: “The second and third generations are increasingly involved in estate and succession planning. As the first-generation clients age, it is more important than ever to get the second and third generation increasingly involved in family estate and succession matters early. I recently met three generations of the same family for due diligence purposes and whilst one or to family members are leading the process all are engaged in some part of the process. Identifying each family member’s strengths, interests, concerns and needs is the key to effectiveness and sustainability of their long-term planning.”

The UAE is pulling in wealth and HNW and UHNW families from all over the globe

A panel member observed that all of the UAE’s advances and its numerous appeals, as well as its resilience during the pandemic, had, he said, created a situation where UHNW families coming in for either residence, or second homes or to establish family offices, had attracted others to follow suit. “And from our discussions with the governments, they have a clear intention to be as competitive as possible in many areas, including of course developing as wealth management hubs,” he reported. “The UAE alone has 17 Golden visa regimes, and they keep evolving all the time.”

Accordingly, he explained that more and more wealthy families want a foothold in the UAE and also perhaps assets there as a stake. “Before the pandemic, our firm was 99.9% helping people who were here and looking outbound, building portfolios of residences but now we're actually also helping wealthy clients from all over the world coming here from all corners of the globe.”

He explained that people have been coming in for many reasons, including the rising quality and integrity of the UAE as a wealth centre and of course, as a corporate hub, a family office location, and for lifestyle and excellent air travel and other communications. Some might be coming in for geopolitical reasons, due to climate change afflicting their home countries, and so forth. “We structure solutions to hedge against the most risks that can apply,” he reported. “Today, there is a strong desire for these families to have a portfolio of residences and/or even citizenship, which gives them the level of comfort and the ability to access markets at any given time.”

Expert Opinion - Nirav Shah, Director, FAME Advisory DMCC: “On the question of whether UAE compete effectively with Singapore or perhaps Switzerland as a go-to centre for single-family offices and UHNW clients, I believe UAE can compete. The cost of operating in UAE is lower, it is easy to obtain work permits and bring in resources and employ them in UAE and it has same access that Singapore or Switzerland provides, and it has some advantage in the time zone as well. Additionally, more and more UHNWIs and families are looking to have second homes in the UAE and thus creating a family office locally is logical and appealing.”

Singapore continues to evolve its wealth management proposition and its structures

A guest highlighted some of the Singapore changes in April to rules for SFOs, further tightening all the requirements expected of applicants. He explained that the ‘13O’ regime requires a minimum of SGD10 million in assets on application, and by the end of year two, you are expected to scale up to SGD20 million, and to hire a minimum of two investment professionals as compared to just one before.

And for both the 13O and 13U schemes, there is now an expectation that you have to invest a minimum of 10% or SGD10 million, whichever is lower, of the AUM into Singapore based securities, including Singapore stocks and shares, bonds and Singapore funds. There is also a tougher regime of tiered minimum expenditure requirement now; in the past this was just SGD200000 annually, but now for SGD50 million in AUM the minimum expenditure requirement is SDG0.5 million and for SGD100 million it is at least SGD1 million in expenses annually.

These actions, he said, are pushing Singapore further up the UHNW ladder to encourage more such families to make a truly serious commitment to wanting to have a full-scale family office in Singapore. He indicated the signal from the authorities is they are not aiming to have families who are just barely making the mark, trying to get in the doors with just perhaps SGD 10 million in assets; they want to attract a higher profile family and wealth these days. “They are certainly laying out the red carpet for them by making the applications even more seamless, and hopefully more efficient, now that the number of qualified applicants will now reduce, because of the new requirements,” he explained.

Corporate tax is coming to the UAE! However, fear not, this is not a cause for concern. Quite possible, it is cause for further optimism

Corporate tax is expected to come to the UAE from 2023. However, an expert reported that investment-related income will be ring-fenced outside the purview of such taxation. “Dividends, and capital gain will either be exempt or zero-rated income for most of the corporates,” they stated. “Moreover, this will be a positive, as there will no longer be the perception of a tax haven type environment. We expect this to actually attract people to look at UAE from their investment structuring potential.”

However, at the same time, this expert acknowledged that opening bank accounts for structures had become challenging. “Nevertheless,” as long as you have the correct profile, the banks will look at it more closely, but if you just want to come here to do business with virtual offices or they are not receptive at all.” All in all, they indicated that all such moves are encouraging, and that they expect that corporate tax, and a tighter regulatory situation will in fact attract more people to come to the UAE as a wealth and structuring centre.

At the same time, another guest added, the calibre of professionals in the UAE continues to rise, making the entire ecosystem more appealing to all types of investors and families considering bringing their assets, and potentially even their families to the UAE.

The UAE connects to and works closely with multiple jurisdictions to best serve its clients

A trust expert commented on the importance of the UAE within its range of worldwide jurisdictions for corporate and fiduciary services, including Singapore amongst several others. In the Middle East, he explained, most clients hire the firm for estate planning, succession planning, and asset protection. He explained that the world’s increasing complexities around taxation, compliance, and reporting obligations drive demand for their role as a fiduciary and advisor, and in generally assisting clients in navigating their way through the many complexities. “Even well-established family offices may not have, in one jurisdiction or another, the in-house capability to find their own way through these issues and reporting obligations,” he explained.

He added that the softer skills of working with key clients are also essential. He said the process of discovery about the clients and their needs and expectations is essential to ensuring the right structures and solutions emerge. He said there is somewhat of a storm of regulations and obligations facing these families, and all sorts of personal hurdles around location, healthcare and all sorts. Add to all this the reality that wherever they are zero or low tax is no longer a realistic goal. “The prominence of the UAE and Singapore has risen in face of all these challenges,” he reported. “As an indicator, STEP had three members in 2004 and we now have 140 today in the UAE. That underscores the growth and the expanding capability as a jurisdiction.”

Expert Opinion - Laurence Black, Asiaciti Trust, Regional Director, Client Solutions, EMEA: “As to how the region’s wealth advisory community delivers advice and structures across multiple jurisdictions, Asiaciti Trust is a long established multi-jurisdictional business working within a community of professional advisors in the regional wealth advisory space. It is increasingly important for any provider to be able to offer multi-jurisdictional advisory services and when necessary, work together to deliver optimum solutions for our clients.”

Expert Opinion - Philippe Amarante, Managing Partner, Head of Dubai and Pakistan, Henley & Partners: “With the tangible economic partnership by the global HNW and UHNW community committing to the UAE rooting long-term business and presence, the overall eco system will further expand with an accelerated multiplication effect, enticing more business and capital.”

Expert Opinion - Nirav Shah, Director, FAME Advisory DMCC: “More and more next gens are taking interest in being aware and also participate in the process of estate and succession planning and structuring. We now encounter all members of families meeting us together, not only first generations, and they are all keen to discuss key aspects. They clearly feel it’s important to address these matters now and organise properly, rather than leave things for someone else to handle.”

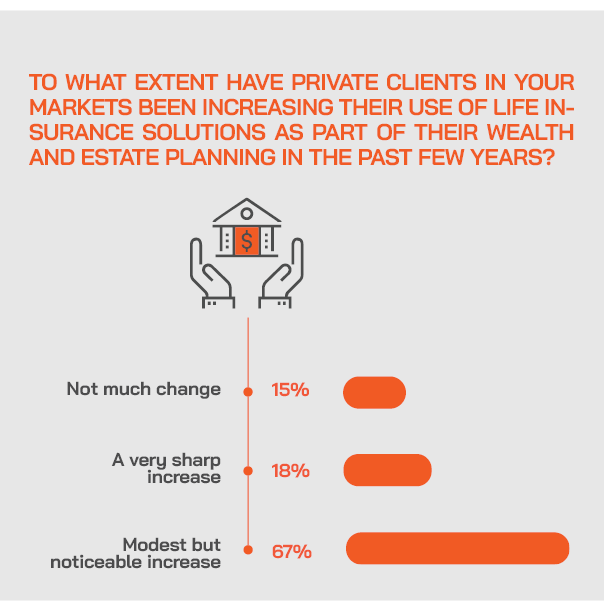

Life insurance solutions are also increasing in prominence in the region as well as more broadly in major wealth centres

And expert reports that for a household name global reinsurer, one of their fastest growing markets in the high-net-worth insurance space is actually the UAE. “There is huge demand from the rising number of high-net-worth families moving to Dubai, and the wave of capital that's being deployed there. We see this demand increasing for some years ahead.”