The Growing Appeal of Private Placement Life Insurance for Private Clients in Asia

Jun 23, 2022

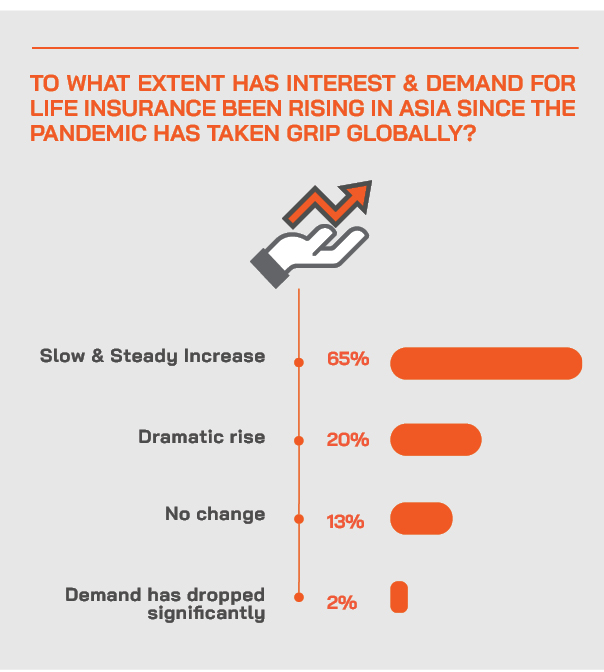

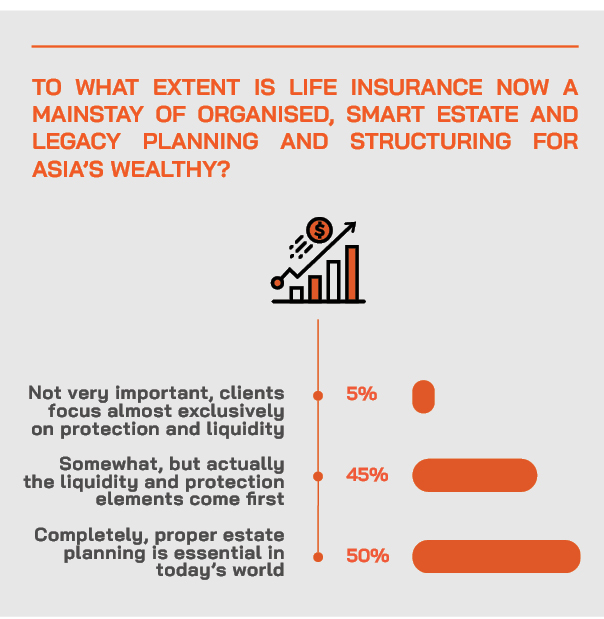

HNW Life Insurance Solutions have certainly been centre stage in Asia’s dynamic, expansive wealth market for many years and have made a significant contribution to the revenues of many banks and private wealth managers across the region. And today life solutions are even more in favour than ever before for a host of reasons. The onset of the pandemic initially slowed the market due to the difficulty of remote paperwork, medical certificates and other impediments. But at the same time, it also turbocharged interest in and demand for life and other solutions, and the life industry and the wealth management distributors rose rapidly to the digital and logistical challenges to meet the additional demand for security and family protection and for more robust estate and succession planning. The Hubbis Digital Dialogue event of June 9 delivered plenty of information and lots of invaluable insights into this growing tributary of the life solutions market in Asia.

The Panel:

- Marc-André Sola, Founder & Chairman, 1291 Group

- Philipp Piaz, Partner, Finaport

- Anthony Chan, CEO, Isola Capital

- Lee Sleight, Head of Business Development, Asia, Lombard International Assurance

Setting the Scene

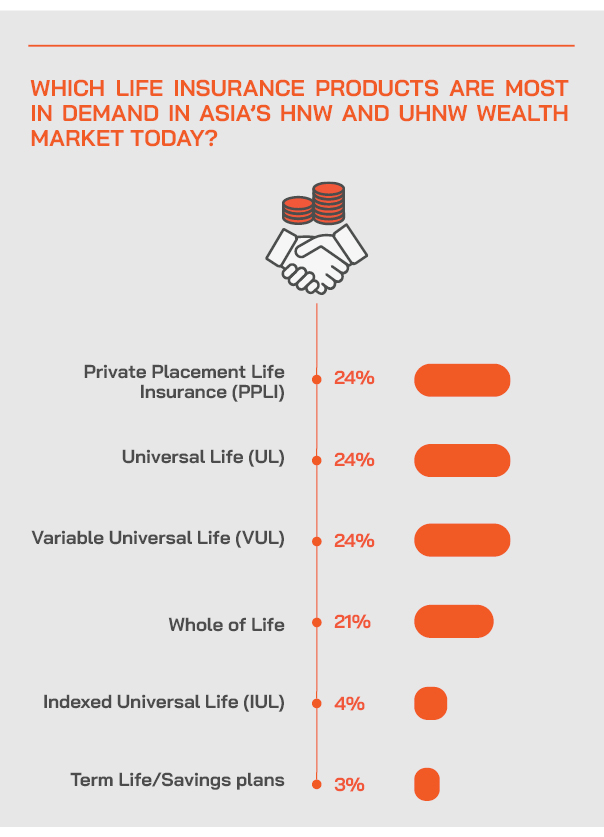

In our Digital Dialogue discussion on Thursday, June 9th, our panel of experts explored the state of the life solutions industry in Asia today. The industry is replete with a host of acronyms, from UL, to VUL, IUL, PPLI, and Whole of Life, but for this event our panel focused in particular on the growing understanding of the many appeals of Private Placement Life Insurance (PPLI) for Wealthy Private Clients in the region, and why this solution is increasingly in the spotlight and what it offers above and beyond other structures.

The PPLI structure has a long history, first emerging in the US in the 1960s, and it still functions today in almost exactly the same format. It can be refined and designed for each individual client, can hold almost any assets, and in the immensely complex world of global regulation, offers clients – and the intermediaries who promote it – very significant compliance advantages and on a worldwide basis.

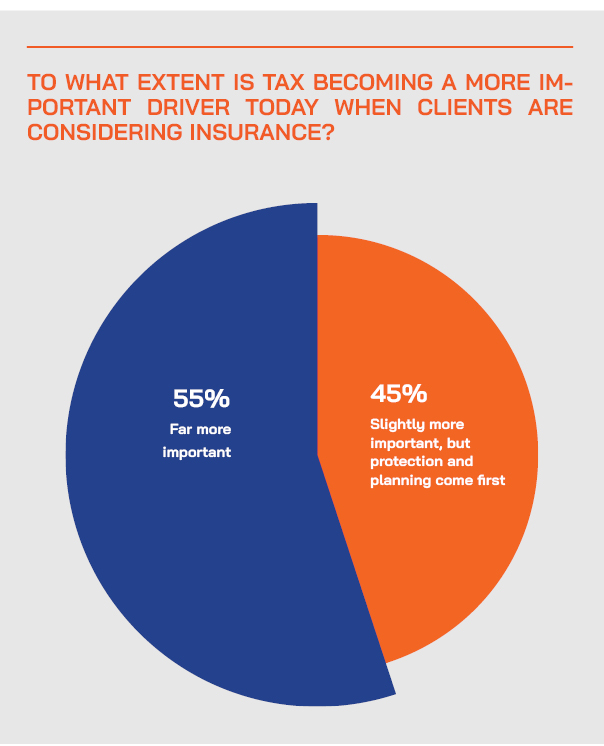

With CRS and the automatic exchange of information now becoming widespread, the focus for international wealth management is on legitimate, unchallengeable structuring and tax solutions that avoid conflicts of laws between civil law and common law jurisdictions and protect clients against the progressive invasion of personal privacy. PPLI addresses these challenges head-on as an ideal asset-holding vehicle, and an ideal wealth planning structure, often used in combination with Trusts, Foundations or other SPVs.

These are some of the questions the panel addressed:

- What sort of clients are prime candidates for PPLI and why?

- How does PPLI fit into a broader conversation around wealth structuring, legacy planning and tax optimisation?

- What developments and challenges are we seeing in the life solutions market globally and what specific trends are we witnessing or expecting in Asia?

- Why has the life solutions market become so diversified in terms of solutions in recent years, when UL was so popular and dominant in past years?

- What assets can a PPLI policy hold?

- What are the key advantages of PPLI, such as legitimate tax optimisation, overseas assets and inter-generational/legacy planning, its role in compliantly overcoming the challenges of AEOI, CRS, FATCA and other regulations, and so forth?

- How can PPLI sit alongside trusts, foundations and other structures?

- How much flexibility is there with PPLI to tailor the solution precisely to the needs of the individual clients?

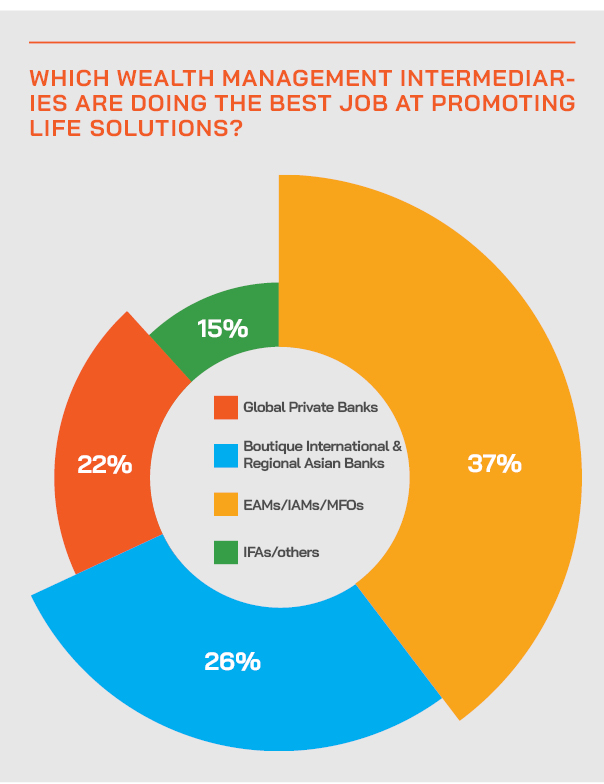

- How is PPLI being marketed and executed in Asia and what roles can private banks and IAMs play?

The Key Observations & Insights from the Panel

The importance of life insurance has increased dramatically in recent years and PPLI is an ideal solution

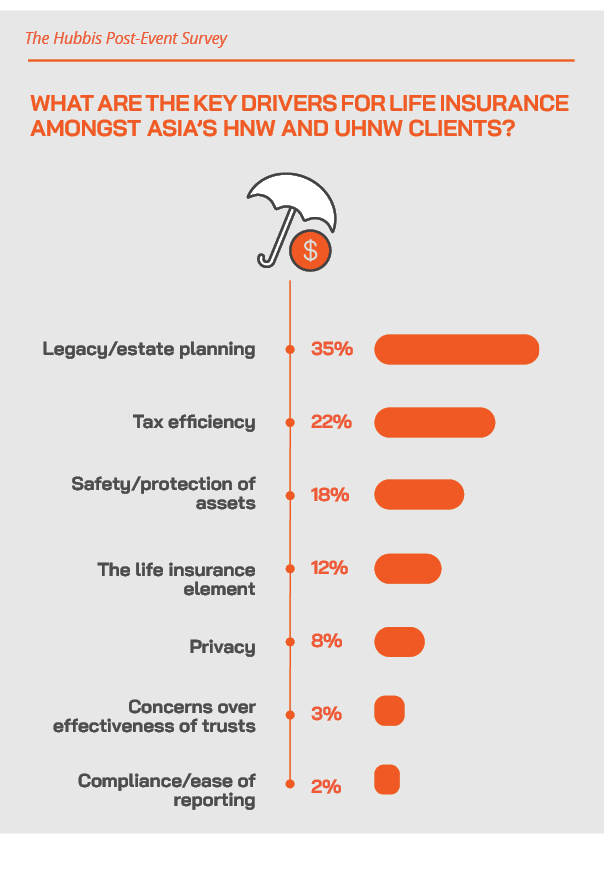

An expert observed how demand for life insurance solutions had risen substantially in the last several years, partly due to regulatory imperatives and transparency, partly due to the uncertainties highlighted by the pandemic and also geopolitical concerns.

He explained that private placement life insurance or PPLI, has a number of features that make it a rather ideal structure for wealthy, mobile, forward-focused clients.

The number one appeal, he said, is that PPLI is the most efficient and most complete wealth protection tool in the market. It is a life insurance policy with two components, a surrender value or an investment component. And it is an insurance wrapper around assets in a segregated account invested according to a tailored investment strategy, which then gives the client all the typical benefits an international investor wants.

“For example,” he reported, “it can increase your privacy tremendously. It can increase your asset protection. And clients can enjoy tax preferred growth because assets inside an insurance policy in most countries grow tax preferred.”

Her said that PPLI is also ideal for estate planning, especially for international families. “Estate planning can become very complicated with multiple jurisdictions involved and with insurance you can solve that issue very easily,” he told delegates. “And the last thing is of course, you can increase the liquidity after death, so you can generate a lot of additional liquidity through the life cover to pay off estate tax or pay out business partners and so on.”

PPLI is immensely portable and therefore especially ideal for international and mobile clients and families

Another expert agreed, adding several points starting with the value of PPLI in terms of its cross-border portability. “Internationally mobile clients who are looking to move around their assets are drawn to PPLI as it is widely recognised in most jurisdictions across the world,” he reported. “The ability for the clients to take PPLI if they move or relocate is well recognised. Clients are often looking to enhance their current planning and combining PPLI with a trust or offshore holding company is rather a powerful structure. So PPLI can be incorporated into many clients’ existing planning and structuring and make that all even stronger.”

He elaborated on the earlier comments regarding estate planning, noting that many clients want to ensure smooth transfer of their wealth to the next generations in a controlled fashion.

“And as clients effectively retain the control over the assets, and as these assets are placed within the policy, and looked after at the custodian bank and held in a segregated account, clients can rest easy,” he explained.

The appeals of PPLI can be summarised under several key headings, all beginning with P for PPLI. They are Policyholder Protection, Preservation of Wealth, Privacy, Planning (tax, estate and succession), Precision (and transparency), Passing on family wealth, and Portability.

Working with the wealth management industry to enhance understanding and improve awareness

A panellist explained that there are multiple levels on which the private banks and EAMs or family office leaders can help their clients. “The first step is to truly understand the clients, and what they need,” he said. “We could spend hours boring them all senseless on all the advantages, but first we need to see if the clients have specific goals and then you can map on what PPLI can offer by way of solutions.”

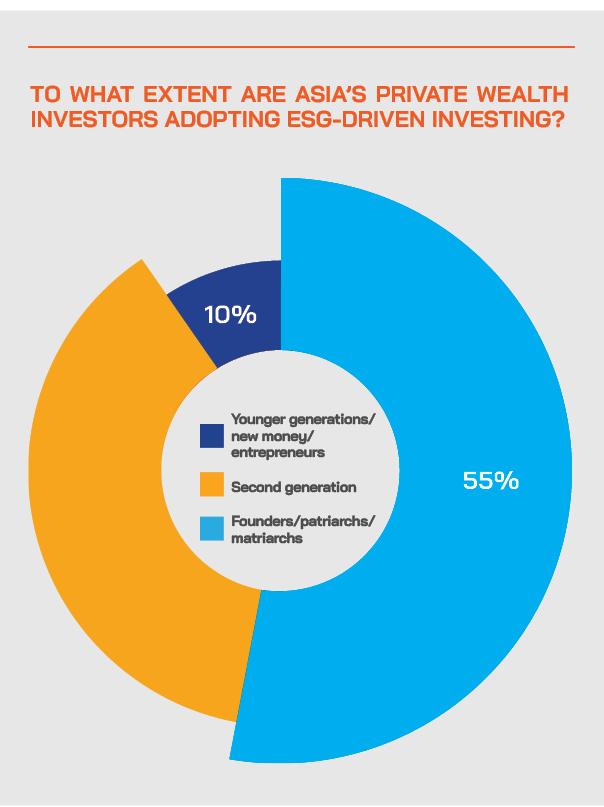

He added that people are more discerning now, they expect and seek more information, and the wealth industry is becoming more sophisticated in its approach. “The old days of one insurance solution that fitted everybody no longer exist,” he said. “Planning is becoming more sophisticated; and clients are becoming more demanding.”

Another guest agreed, adding that clients are seeking a wealth planning solution, first and foremost. “And this generally comes down to privacy, asset protection, tax, estate planning and liquidity needs,” he told delegates “And all these needs, we can cover with PPLI. It is an ideal wealth panning tool.”

PPLI is relevant today and is future-proofed against many foreseeable changes ahead

PPLI is a long-term sustainable solution, one expert stated, emphatically. If we see what has happened from a regulatory point of view in the last decade or more, the world has been completely turned around. The trust structure can be a fantastic tool when it comes to estate planning, but it's not a tax planning tool in most countries. There is more and more of a regulatory focus on offshore companies, holding companies, substance and so forth. But the insurance industry is completely different, it is strong in every jurisdiction, insurers are leading investors in government bonds, and have a super strong lobby, and they will make sure that insurance grows tax preferred. This tool is socially accepted, politically accepted in almost every country.”

He said he had been in the life industry for 30 plus years, and PPLI was actually born in the 1950s in the US as an investment linked insurance policy where they realised individuals have different appetite for risk and investment. He said the structure remains largely as it was from the outset and had been adopted widely across the globe, all of the time with the assets green lighted to grow tax preferred, and the structure to remain portable yet also private.

“PPLI is all the major jurisdictions is, for me, extremely sustainable, because of the strong lobby, as long as it is structured properly,” he said. “It should be conducted through strong, highly regarded insurers which know what they are doing and why.2

Expert Opinion - Lee Sleight, Head of Business Development, Asia, Lombard International Assurance: “Reflecting on its established use and recognition in Europe, PPLI remains well positioned to address the increasingly complex regulatory and legal environment that we see evolving across Asia. Today, a sound compliance is a must-have and PPLI can be instrumental in simplifying reporting for clients and their advisors alike.”

For wealthy clients and family offices, PPLI offers welcome flexibility and open architecture, as well as the wide range of assets that can be included

Another guest whose focus is on UHNW clients and family offices, explained that those very wealthy investors with large asset bases welcome the adaptability of the asset management elements of PPLI. “For each of the vehicles or parts of the toolkit that they want to use, we help create a portfolio that generates the results that they want,” he explained. “For example, a PPLI in different jurisdictions may allow you to distribute a certain amount every year tax free, or you may want to lend out certain proceeds from the vehicle to yourself for self-use subject to certain conditions.”

A fellow panellist agreed, adding that it is important to appreciate that PPLI offers open architecture. “Rather than the insurance company managing the assets or holding the assets themselves, it helps maintain those existing trusted relationships that the client already has with banks and advisors and EAMs and so forth,” he explained. “The open architecture is very important for the clients and for the wealth industry, which can enhance their relationships with these clients, provide them an additional service, but that also allows them to maintain that trusted relationship.” And, of course, they can retain the client’s AUM.

Moreover, an expert added that the PPLI structure can house a very wide variety of assets, including real estate of all types, family businesses, venture capital and private equity, private debt and so forth.

Expanding on these points, a guest explained that from a technical point of view, there is no limitation on what the PPLI can house in terms of assets.

“Everything that has a value can actually be held in theory inside an insurance policy or inside a PPLI,” he stated. “However, we still need to double check regarding regulation and the client’s home base and the insurer’s jurisdiction, but the most important element remains that the client is not controlling the investment strategy. Different jurisdictions, understandably, have different rules on what assets are not permitted for inclusion.” And if the client moves, this may open up more flexibility in terms of assets, or potentially reduce flexibility, depending on the rules in each location.

“One exception,” he reported, “is that we put private companies inside the PPLI, and the private companies then own those assets, so those companies inside the PPLI can even hold your jewellery, gemstones, the art collection, digital assets, cryptocurrencies and so forth.”

Expert Opinion - Lee Sleight, Head of Business Development, Asia, Lombard International Assurance: “The open architecture nature of PPLI allows trusted and sustainable relationships with banks, asset managers and other advisors to be built. This not only gives peace-of-mind to the client, but it also enhances the offerings available from wealth managers allowing them to differentiate themselves from their peers in the market.”

Cross-border regulation misery can be mitigated with PPLI structures

An expert noted how PPLI can help remove or at least alleviate a lot of the stress with respect to cross border regulation. “You have an Indian client whose money you manage, and he moves to the US, and normally you would then need to be licensed with the SEC as an investment advisor to keep managing those funds, but if you manage the money for the insurance policy, you don't have that stress and don't have that risk,” he reported. “It's the insurance company that has to make sure that the policy is in compliance with the local laws, that it's sold in compliance with the local laws, and that it can be amended.”

EAMs and other specialist managers and advisors can and should work closely with an ecosystem of expertise

Another panellist commented on how the EAM community should be working with the specialist insurance distributors and bring them in to their clients when deeper expertise is needed.

“Having the right partners that you can count on is invaluable, because at the end of the day, our expertise is the asset management, not the insurance and structures,” he reported. “We can identify the need or the potential need, we can then take the step back and say, let's take care of this client on a more holistic basis. In this way, working with the right experts, being part of a broader team, we can help deliver the right ideas, structures and outcomes.”

Of course, there is an economic incentive to helping brokers and insurers get deals across the line, he added, but PPLI is also a much more interesting value proposition for the client and definitely not as much of a sales-driven instrument or vehicle as a ULI was known for. “For us, it is really about the right tool for the client to achieve his or her goals in terms of tax planning, relocation, ring fencing, and the many advantages of PPLI.”

Another expert agreed, adding that of course other life structures, for example ULI, might be more appropriate for the clients, but for those with the set of goals that match PPLI, it is one of the very best and most flexible and portable solutions. The key is to ensure that the clients express what they want and then PPLI is offered if it meets all, or most of those key objectives.

PPLI is becoming better known and more widely accepted in Asia’s private wealth markets

A guest observed how ULI had been heavily pushed in Asia as it offers especially hefty upfront commissions for advisors and brokerages, but as the sophistication of clients and the wealth industry increase, the Asian market is increasingly interested in PPLI for its key financial planning and wealth protection planning advantages. “We see a huge increase in the market and actually worldwide, even amongst those who had steered clear of PPLI in the past,” he stated. “PPLI in Asia is on the rise.”

Expert Opinion - Lee Sleight, Head of Business Development, Asia, Lombard International Assurance: “A simple and internationally recognised solution capable of catering to the most complex of wealth planning needs, we are seeing increased awareness and demand for PPLI within Asia as an efficient legacy planning tool that simplifies the transfer of family wealth to multiple generations, across multiple global jurisdictions.”

Naturally, residence affects how the PPLI benefits are delivered

Delving into jurisdictions and residence, an expert noted how PPLI is of course affected by the prevailing legislation in the client’s home country.

“Of course,” he reported, “how PPLI will be treated from a tax perspective, from an inheritance perspective, depends on where the clients are resident. Where they are today impacts on the setup of the policy and the overall wealth planning and the structure they put in place. If you're looking at clients in the Asia region, generally, these can take a generic Luxembourg law contract and that would work for them. If you're somebody that's in the EU, or moving into a highly regulated jurisdiction like that, or the US, you need one that is compliant with the laws of your home country. These are important messages to convey when banks or EAMs or advisors are talking about PPLI to clients.”

And PPLI offers very good portability, this expert reiterated, so the structuring needs to take into account where the clients might be located today, and .where they might be in the future in another jurisdiction. The key point, however, is that structured properly and professionally, PPLI offers clients excellent portability and flexibility.

PPLI and its relationship with other holding structures, such as the Singapore Variable Capital Company

In response to a question from the delegates asking about whether PPLI can be held in a VCC, for example, an expert said that from their viewpoint it is the other way round – that a VCC is an eligible asset to place within the PPLI.

“The VCC is a strong holding structure for assets that has emerge in the past two years, and if you put a [PPLI] policy around that, you get the benefits and you also have the VCC as well,” he explained. “So, you can combine those two together to give the client that consolidation and management under the VCC but at the same time benefit from the tax preferential treatment via the PPLI in their home country. Combining the two can be quite powerful.”

Another guest agreed, adding that the VCC is also highly flexible in terms of the broad range of mainstream and alternative assets it can house.

Expert Opinion - Lee Sleight, Head of Business Development, Asia, Lombard International Assurance: “Combining PPLI with existing trust and holding company structures allows clients to update and enhance their wealth and succession planning, ensuring it remains futureproof whilst maintaining valued relationships with their advisors.”

PPLI has a highly transparent fee structure, clear for all to see and understand

An expert reported how any concerns that clients may have about being opaque fees are mitigated by the very transparent reporting and disclosure around fees to the insurer, the brokers or advisors and so forth. “You're looking at basis points based upon the value of the policy,” he reported. “As the policy grows, obviously, the fees increase, but they remain constant in terms of basis points. The key is that it is all transparent to the clients. They can see what they're paying, and they can measure what they get against it.”

He added that there are also advantages to offset the costs, such as tax savings, and also such as peace of mind.

“If you're paying, let's make up a figure, 50 basis points for peace of mind on the security of your assets, that might be acceptable for you,” he said. “If you're paying that for tax saving of perhaps a million or two a year, that is also a good trade off. But the key thing for all of this is that it is transparent, it's easily measurable, you can sit down and say this is what it will cost you on an annual basis for these assets. And it will be clear exactly what assets that can go in. Add to that the affordability, the tax deferral, the peace of mind, the ease of transmission of wealth to future generations, and all the other advantages, and PPLI is a very compelling offering today.”

And don’t forget about the ease of reporting in a world of intensifying regulation

An expert drew the conversation towards a close by reminding delegates how PPLI helps consolidate assets into one line of reporting for CRS purposes. “Instead of reporting per asset, it is only the value of the policy that will be reported, because the underlying assets are not beneficially owned by the policyholder,” he explained. “The assets are beneficially owned by the insurance company, so CRS is circumvented.2

The final word - a case in point of PPLI in action

The final word went to a guest who explained how one of their clients had taken up PPLI very successfully. This was a client who relocated from Asia to the UK in 2021 after many years abroad in Asia.

“The discussion was around how to minimise the tax burden, because at the same time, and before he relocated, this client sold an asset that would have triggered a rather hefty tax in the country of sale,” he reported. “We came to the conclusion with our friends at 1291 that PPLI would cover him on various angles, not only the legacy planning, which of course can be included there, but also the tax optimisation and consolidation of assets because he had different pockets of assets prior to his relocation.” It was a success, he said, and this client started with a clean slate upon his return.