Publications & Thought Leadership

The Evolution of the Malaysian Wealth Management: Maturing and Rising to the Challenges Ahead

Oct 13, 2022

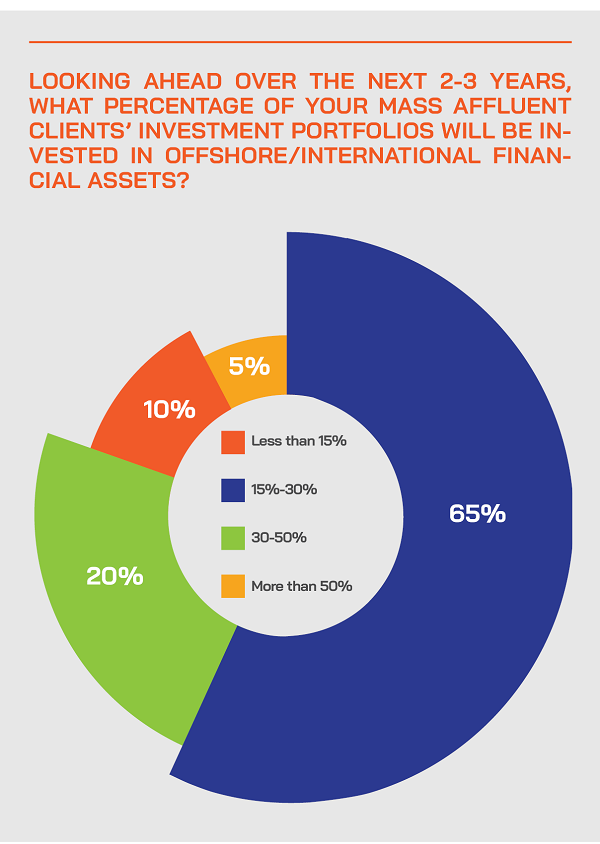

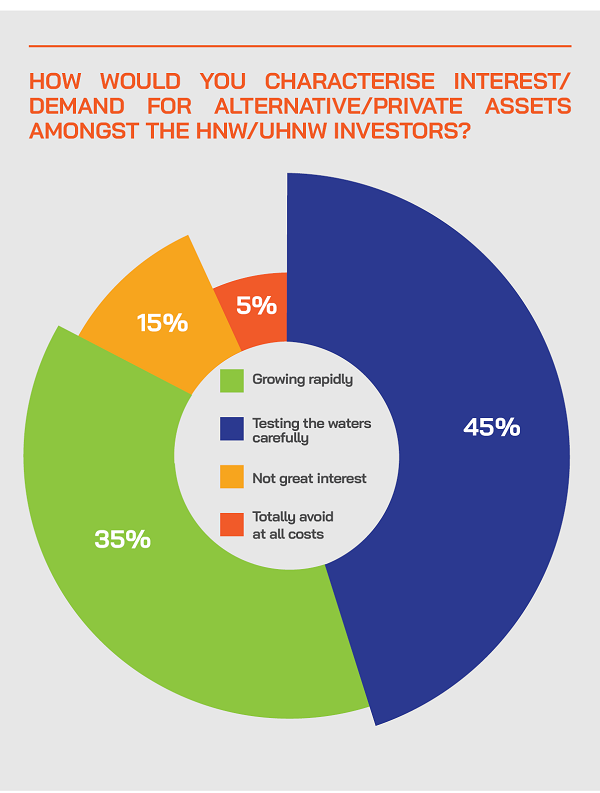

There is plenty happening in the Malaysian wealth management market, as incumbents and new entrants jostle for position, from new leaders coming to take the reins at some of the bigger name local and global banks and firms, to the arrival of new strategic partnerships, new strategic visions being launched to propel Islamic wealth management, and other key developments. The Hubbis Digital Dialogue discussion of 29th September analysed how Malaysia’s wealth market is evolving to cater to the evolving client base of today and the decades ahead, and how it can compete more effectively with the offshore models that many of the older wealthy in the country have traditionally sought out since the 1990s, when the country’s private wealth really started to flourish and boom. The experts looked closely at the need for dispassionate, objective advice and the need to evolve a more diverse product and asset offering, enhance professionalism and encourage a broader approach to portfolio curation and to estate and legacy planning as well. Digitisation continues apace, they observed, helping access more of the potential customers in the country. And the new wave of digital banking licenses presages a further thrust towards customer diversification. Meanwhile, the panellists also highlighted the increasingly global allocation within portfolios and encouraged greater financial awareness around the risks and rewards of different types of investments.

The Panel:

- Carolyn Leng, Managing Director, Bordier & Cie

- Reuben Tan, Head of Wealth Management, OCBC Bank

- Wai Ken Wong, Country Manager, Malaysia, StashAway

- Anurag Pandey, Head of Platform and Partnerships (APAC), additiv

Setting the Scene

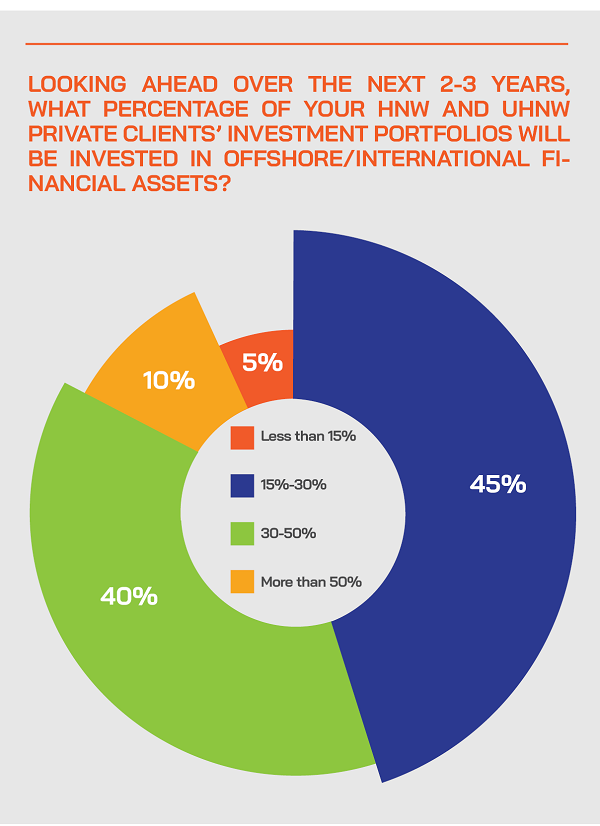

The Malaysian financial markets are more mature than most of the fellow ASEAN countries aside of course from Singapore, and as HNW and UHNW wealth is relatively older, more of those clients have, for years, and often decades, spread their investments across the border to Singapore, or further afield to Hong Kong or even to London and Switzerland.

A core challenge for Malaysia has therefore been to boost its onshore proposition and diversify the products and advisory offering in order to draw more of the AUM back onshore, but also to make sure that as much of the newer wealth remains under management in Malaysia, and that the growing ranks of younger wealthy inheriting so much of the founder/first-generation, even second-generation wealth are also properly serviced onshore. And of course, the region-wide drive to digitisation to cater to the newer demographics and the remote working environment is vitally important to the wealth market’s development.

With a significant Muslim population, the drive towards Islamic wealth management is an increasingly important element of the overall model on offer in Malaysia; hence we are seeing some interesting developments there, for example giant Maybank’s comprehensive Islamic Wealth Management plan for the future, released in late July this year.

There is certainly plenty of room for Malaysia’s market to grow robustly alongside those more well-established offshore financial centres, as long as participants in Malaysia can manage the tighter regulatory demands, boost the array of investment products and solutions, and if they continue to develop the Islamic finance wealth market. At the same time, the incumbent players will need to compete energetically and smartly against new entrants that have been becoming more prominent locally as the regulators continue to gradually liberalise the financial markets.

Local, regional and global challenges sharpen client focus on diversification, smart portfolio formation and objective, altruistic, client-centric advice

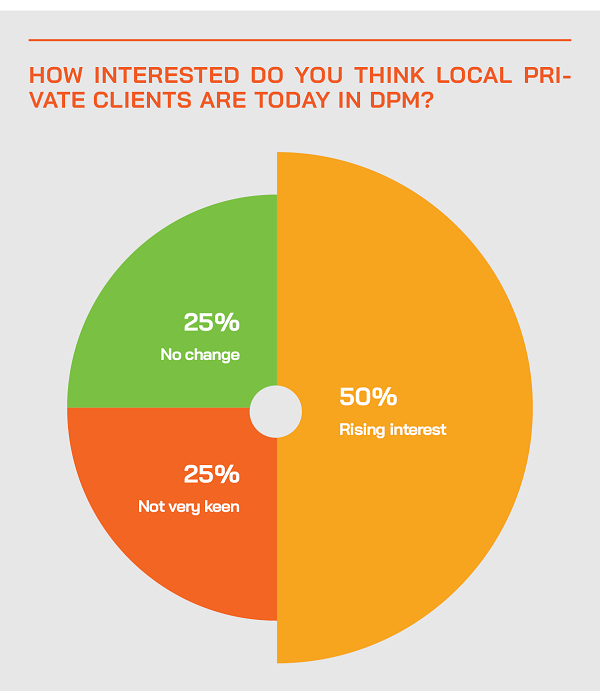

An expert observed that the many challenges around inflation, rising rates, weak market, deflating asset prices and geopolitical turmoil called for increasingly sophisticated wealth management platforms able to deliver relevant advice and diverse portfolio allocation for wealthy clients across the region, especially ASEAN.

Another banker highlighted the growing drive to client centricity. “Clients are a lot more sophisticated nowadays, and we need to ensure there is genuine objectivity and neutrality in our product selection and advice. Our organisation is structured and approaches wealth management almost like a family office, with clients secure in the knowledge that their best interests are protected. I am also confident that based on this, we can talk to clients about their total wealth; they are more open and to such discussions here.”

They explained that such conversations are not about selling products, but about devising structures and planning for the future. “What really matters is that we are here to make sure that we capture their entire family's wealth, and this type of approach is in favour, including amongst the Malaysian UHNW clientele. Actually, I hear more and more of them now feeling that they have spread themselves far too wide among too many banks, and they need to rationalise and consolidate. To do so, they need advice that spans their entire spectrum of assets, business, and family members.”

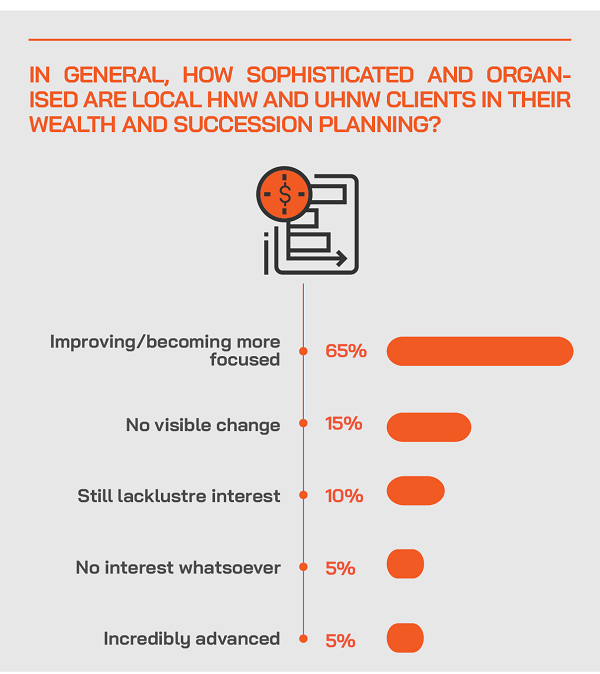

Estate and succession planning is now much more central to the wealth advisory proposition, especially for the wealthier clients

This same expert indicated that there is a significant evolution in thinking in Malaysia and more broadly across ASEAN about estate and succession planning. “The typical families in SE Asia are larger and the older generations want to pass wealth to all their heirs more equally, while in China there is often only one child and in Hong Kong it still tends to be the male heirs as the main inheritors of assets. These types of conversations are really important.”

And they said it is also vital to ensure that communication within families is more open and transparent, as these patriarchs and matriarchs still do not spend enough time and effort on making sure their beneficiaries buy into the succession plans, including of course around the family businesses.

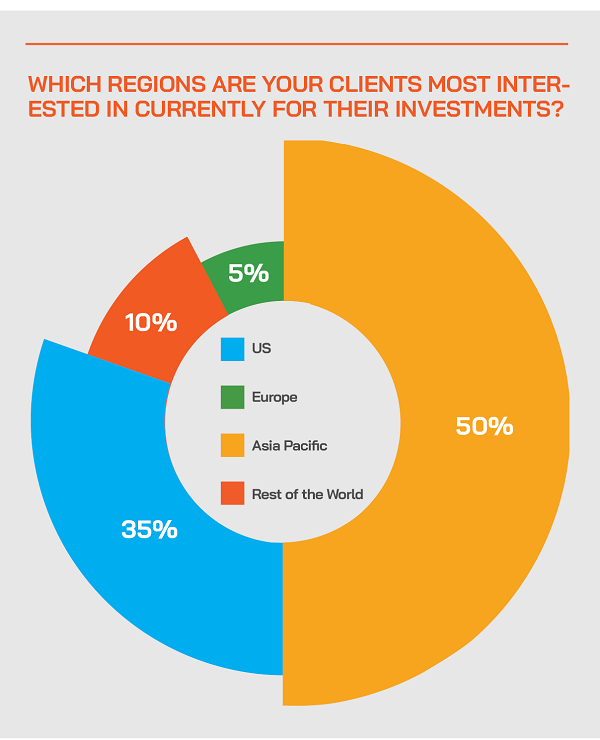

As to the specifics of estate planning, this same expert observed that from a currency perspective, most of the wealth is derived locally, but the currency has been declining against the dollar, making a more compelling argument for diversification from the Ringgit. But they also noted that many wealthy clients are asset rich but not immensely cashed up or liquid, hence often use credit, which needs to be carefully structured, including the relevant hedging if the borrowing is against local assets but in foreign currencies. The diversification away from domestic assets and local currency therefore needs to be carefully managed.

They noted that the Malaysian government has started to tax trusts, leading to a significant re-think on structuring vehicles. She explained that this is also helping encourage families to think bigger picture about potentially diversifying form the family business and reinvesting proceeds, perhaps in businesses and assets more appropriate for the future economy than the traditional sources of wealth.

And they said that no matter what the decisions later taken, the key was to encourage the right types of conversations and the right thinking on these matters.

Their final comment was that Southeast Asia is quite volatile politically, leading more and more clients to think further about diversification of their wealthy and the future of their family members. “Will your next generation continue to be in Malaysia or offshore, and that type of conversation needs to be taking place earlier, not later,” they remarked. “You need to communicate, strategise, simplify, and protect the family.”

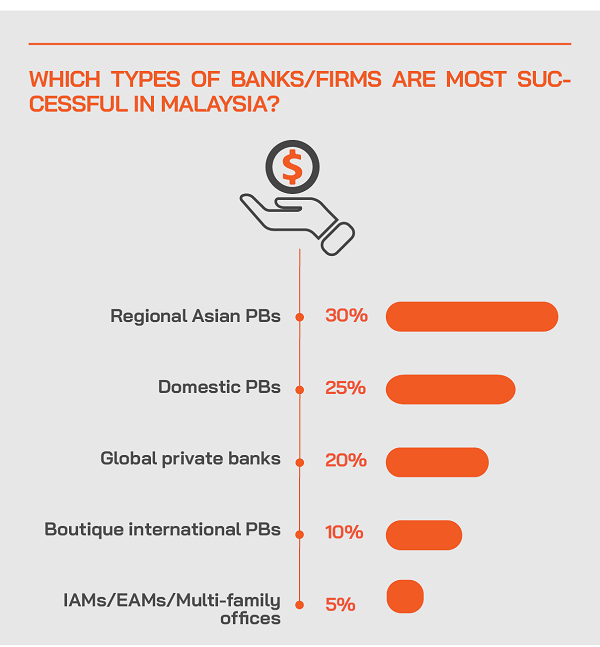

Competition is rising in the wealth management market locally, but the private wealth pot is also growing apace and diversifying across the wealth segments

The discussion turned to rising competition, including from new robo platforms, FinTechs and digital banks, with some new licenses granted.

“Competition is healthy,” said one guest, “and there are enough clients in Malaysia today, and wealth is spread over more segments. As a bank, we are always looking for ways to tap into new markets, analysing how we can reach those customers through digital or other means, rather than the old bricks and mortar approach. How we acquire digitally and onboard clients digitally is key to our approach.”

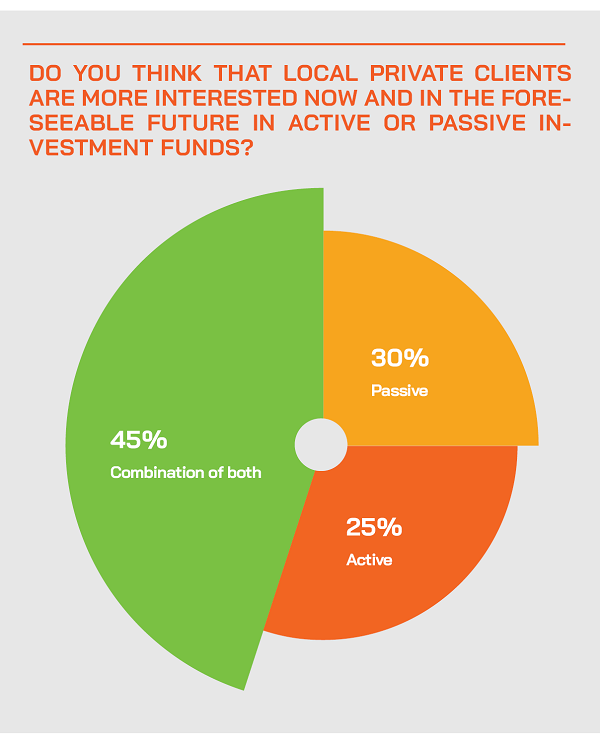

The rise of digital platforms and robo advisories in the past several years has also presaged the printing of new digital banking licences. An expert noted that digital banks will gradually give local banks more of a run for their money, but he said that areas such as insurance and investment products still need high touch points, and need to be sold, to a large extent. Nevertheless, he concurred with the general thesis that there will be more activity across more clients and across more products via digital.

Additionally, he picked up on the earlier theme of international diversification of investments and assets, noting that as a digital platform, they have been offering multi-asset global portfolios from day one. “We actually really started that trend, and we see increasing collaboration between traditional unit trust providers and robo-advisors like ourselves as this theme builds for the future.”

As to client acquisition, he explained that this was conducted largely digitally, having no agency force or branch footprint. Social media is a key avenue for getting their brand and message across, he reported.

“We have always moved ahead of the curve in terms of not just finding the right digital platform to acquire customers, but also to find the right medium, and to be versatile enough to change that when the time comes around. And as you need several touchpoints, we aim for as much PR as possible, radio stations and so forth. We conduct webinars around personal finance and investing and ETF investing, and we go into companies and build relationships with their staff through market updates and so forth. But it is all quite an expensive endeavour, even though it is well worth it.”

Here come the new digital banks to shake up competition

It was back in late April that Bank Negara Malaysia (BNM) announce the successful applicants (out of 29 applicants) for the five new digital bank licences as approved by the Minister of Finance Malaysia. They included five consortiums. The winners included names such as RHB Bank Berhad, GXS Bank Pte. Ltd., Kuok Brothers Sdn. Bhd, YTL Digital Capital Sdn Bhd., AEON Credit Service (M) Bhd and KAF Investment Bank Sdn. Bhd.

“I imagine there will be a war coming for deposits and money market investments as they seek to get as much cash on their books as possible,” a guest reported. “After that, I think we'll probably be looking at credit and probably smaller loans than what the banks offer, including micro credit. Later on, the will probably be either looking at insurance or wealth, to which we'll have to then wait and see.”

Amidst intensifying competition and evolving client expectations, the quest for talent is increasingly challenging

A guest explained that a hurdle for all in the wealth management community is the shortage of experienced talent, especially as clients expect a more comprehensive product and advisory offering and are more demanding in their approach. “We are doing everything we can to help boost our talent pool,” he remarked, “especially around younger talent that we can advance rapidly through structured training.”

A banker observed that a pre-requisite for success as a private banker and RM should be the quest to be a constant learner, to continuously learn about new products, assets, markets, concepts, structures and approaches. And they must have the initiative and drive to bring the right solutions to the table for their clients. “They need to push the boundary and be brave enough to engage clients in difficult conversations to find the right solutions, as well,” they remarked.

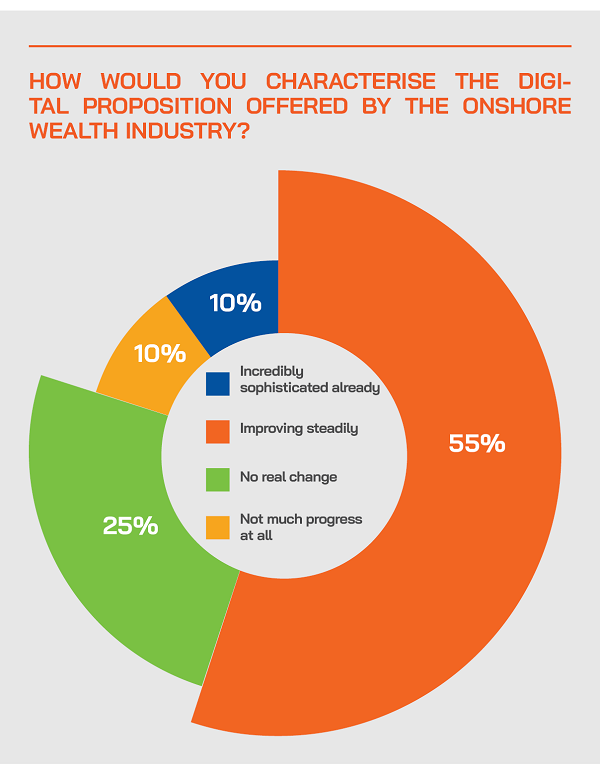

Digitisation is also advancing apace to help boost productivity, engagement and client retention

At the same time, making sure that the RMs and advisory are empowered by the right digital technologies is central to delivering clients ease of access, ease of transacting and reporting, and generally improving cost efficiencies as well as boosting client engagement.

Another guest highlighted how digital solutions and connectivity had become more hygiene in the past several years, while the private banks and wealth managers are now drilling down into niche areas to help improve their overall proposition, at the same time as enhancing productivity, internal job satisfaction and helping drive efficiencies.

“We also see a preference shift in how clients consume the services, with the rise of super apps allowing for multiple operations and transactions within one app, leading to an increased array of financial services more easily accessible. “This is embedded finance,” he explained, “and we are seeing this paradigm shift in Malaysia and more broadly in the region.”

Referring back to an earlier comment from a fellow panellist on connecting to new clients, he added that his firm is developing a new tool to connect digital channels which already have customers and pair them with regulated entities which can offer wealth management services.

“This means it is revenue on day one for the digital channels, because they are immediately able to offer additional financial services in the form of wealth management, which improves their profitability,” he explained. “And for the regulated entity, it means that they are able to acquire customers, they have access to readily available customers, without spending hugely on acquiring those customers. That's why we believe the platform proposition that we are delivering is beneficial for the entities. He added that the traditional models will not bring the kind of growth that people need.”

The same guest noted that there are still many clients who are underserved and unprepared for future issues, including retirement. Indeed, he noted some research his firm had published on the yawning and rising gap in retirement savings of circa USD4 trillion globally.

And as to asset class diversification, he reported that they were conducting some research that indicated for future digital asset and cryptocurrency investments, people are increasingly looking towards FinTechs and non-banks rather than banks. But he added that it is important to note that from a regulatory perspective, there has to be a regulated financial institution involved, so again there needs to be a convergence of non-financial institution channels allied to the regulated institutions.

Looking to the future: experts articulate their wish lists for the Malaysian wealth management market’s evolution

One guest highlighted the need for local players to genuinely commit the capital and resources to become major wealth management leaders in Malaysia. They said it was too often the case of not putting the money and resource where they claimed. In short, it was a call for a less half-hearted and entirely more professional approach onshore to the wealth management market.

Another guest highlighted the need for greater investment awareness and financial literacy, as well as better understanding of some of the risks, including around cyber-security.

Another expert observed that there needs to be a shift from deposits and government related bonds to equities and other capital gain instruments to achieve a more balanced portfolio. He indicated there are too many who fear hefty losses on their capital and therefore resist taking any risk at all, indicating that a more balance approach would be beneficial in the longer term. “If you are a typical mass affluent investor here, taking more risks and diversifying overseas will definitely pay off in terms of the risks and rewards, over time. For domestic assets, they can have safer assets, and for overseas assets they can diversify away from deposits and fixed rate returns to earn higher returns in time.”