Publications & Thought Leadership

Private Banking Leaders Discuss their Visions of the Future of Wealth Management in Asia

Aug 10, 2022

When setting or refining their strategies for the years ahead, private bank and wealth management leaders in Asia are faced with a markedly different environment today from the one they faced in 2021. The Hubbis Digital Dialogue discussion of July 21 brought together a panel of wealth management leaders working in the region to analyse the current environment and outlook and to discuss the optimal business and digital transformation strategies to overcome the key challenges ahead and help the industry seize the great opportunities Asia’s wealth markets offer. They looked broadly at the need for ongoing digitisation both for efficiencies and for uplifting the client offering, they discussed the role of the RMs and advisors, and how they can become more productive and relevant, they discussed what personalisation and advice really mean, and they look at the availability and costs of hiring and retaining the best talent. The client must come first, was the conclusion, but to achieve personalisation, relevance and become the trusted advisor will require strategy, technology, culture and expertise to combine harmoniously.

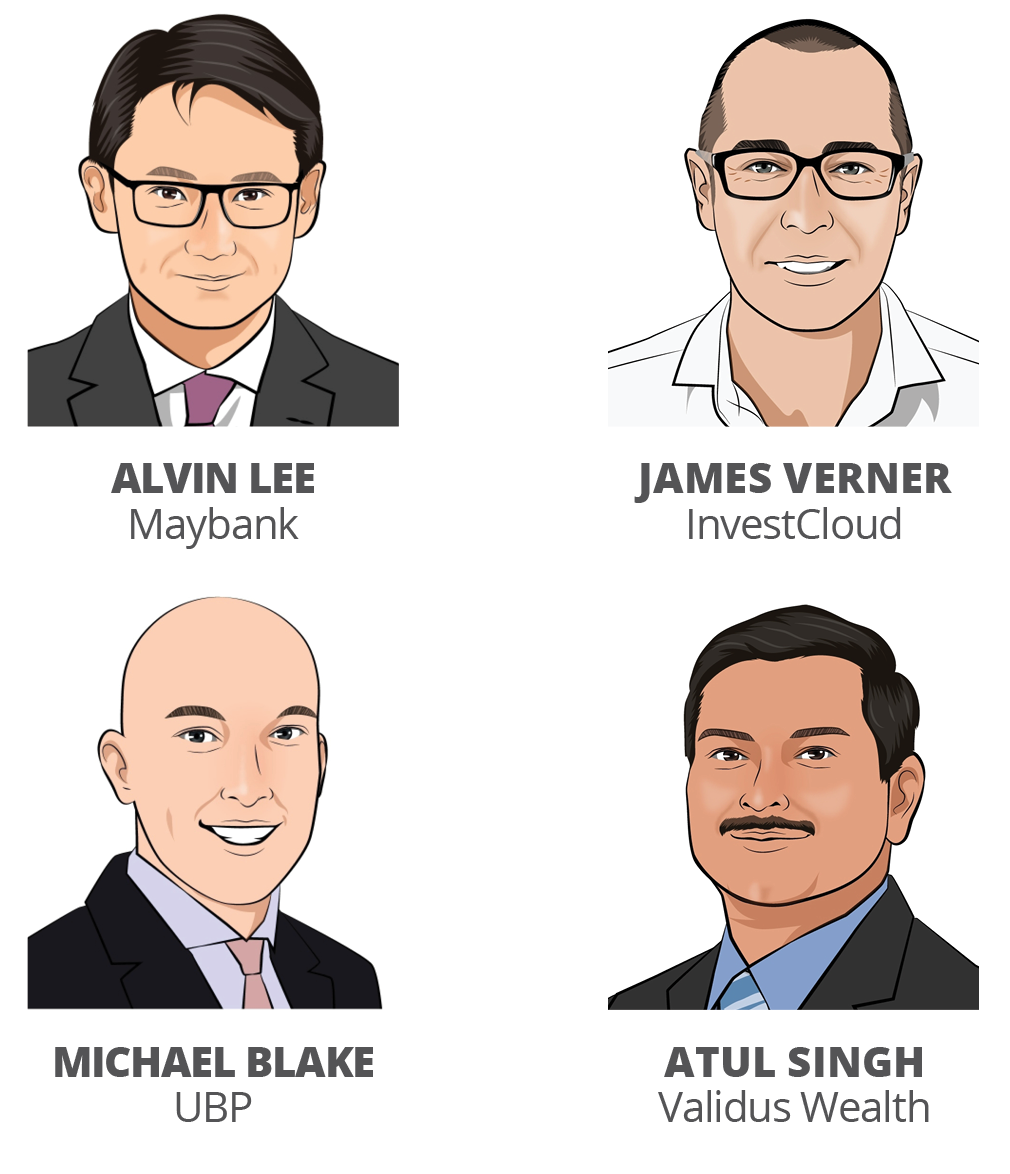

The Panel:

- James Verner, President, APAC, InvestCloud

- Alvin Lee, Head of Group Wealth Management & Community Financial Services, Maybank

- Michael Blake, CEO Wealth Management Asia, UBP

- Atul Singh, Founder & Chief Executive Officer, Validus Wealth

Setting the Scene

The pandemic hit in early 2020 but after early sharp falls in mainstream asset prices and high volatility, the markets recovered and so too did volumes. People had more time on their hands to adjust their investments and their estate planning, hence private bank and independent wealth firm activity levels and also profitability both surged. It was even better in 2021, as analysts and investors brushed aside the threats of inflation and higher rates.

However, fast forward to 2022, and the world is very different today. Inflation is hitting some shocking headline numbers in the US and Europe, rate rises are coming thick and fast there, and the world is seriously worried about the actions and future ambitions of Russia under Putin. In Asia, of course, many of these concerns are less acute, as the region feels somewhat distanced from Russia, as inflation is generally less pernicious across APAC, and few of the region’s central banks had thus far turned hawkish. China, for example, is more likely to be able to cut rates than raise them.

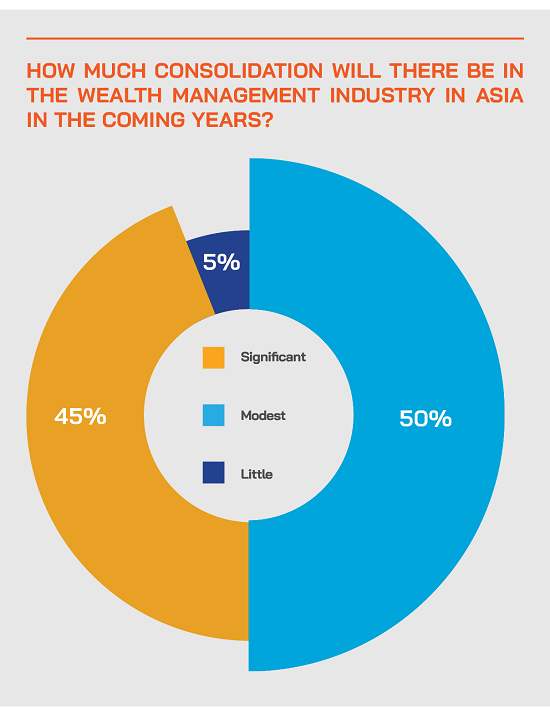

But putting all these more immediate issues aside, there remains great optimism over the growth potential for Asia’s relatively youthful wealth markets. Not only do these leaders anticipate significant growth in the offshore models – particularly driven out of Singapore and Hong Kong – but they report that the onshore wealth markets offer immense potential for those banks and other players that want to scale up to compete in the rapidly expanding mass affluent segments.

Expert Opinion - Michael Blake, CEO Wealth Management Asia, UBP: “As to the growth potential we see for 2022 and beyond, and our key opportunities in Asian private banking, there are some key areas. China remains a highly attractive domestic wealth market for us, and we’re delighted to become the first Swiss wealth and asset manager to open an office in Hainan under the QDLP programme. More broadly, the fundamentals of the wealth management industry remain attractive. Wealth continues to accumulate in Asia faster than anywhere else in the world and much of it is not professionally managed. We see continued demand for a Swiss, family-owned, specialist wealth manager that delivers Asian-attuned investment solutions. And despite the challenging market environment, we continue to see positive external cash inflows across both our North and South Asia markets.”

Expert Opinion - James Verner, President, APAC, InvestCloud: “As to the growth potential we see ahead in 2022 and beyond, and the key opportunities in Asia private banking, we consider the market potential in the next five years is significant, with AUM expected to double. Opportunities and challenges include the need to extend out the offering to next gen customers and build clients across the wealth continuum. They need to help clients manage the transition of wealth from older to younger generations and help clients of all categories plan for retirement. We see considerable opportunities ahead in private markets and in digital assets. A core objective should be for these competitors to become the lead bank, the trusted advisor, in a region where customers have tended to have multiple relationships. We see some exciting opportunities in India, as well.”

For some, the offshore private banking model remains more appealing than trying to compete in Asia’s rapidly growing, but challenging onshore wealth markets

A guest opened his commentary by explain that his private bank remains true to its vision of providing excellent advice and customised investment guidance to private clients out of the three core offshore financial centres of Dubai, Singapore, and Hong Kong. He explained how the bank’s model is high touch and highly personalised, not the low-touch, digital-first model. He said that the bank has no intention to compete onshore in the region, however dynamic the growth in those markets might be. And he reported that China is also a key focus, but that the aim will be to serve only those Mainland clients that want to diversify portfolios overseas.

He agreed that private wealth continues to grow rapidly across Asia, and there is an immense opportunity as so much of that wealth remains self-directed or uninvested, rather than being allocated to more sophisticated investments, or being professionally managed.

Capturing the potential

“While there is that immense opportunity, the perennial question is always how we can capture that potential,” he observed. “For us, we are an international wealth manager, with the main focus on the primary international financial centres such as Dubai, Hong Kong, and Singapore, and while the region’s onshore markets are of course incredibly attractive from a scale and growth perspective, they can also be extremely complex to approach and very costly markets in which to build a genuinely competitive position. Look at China, for example – there is that immense potential, but we have seen in the past decade how an awful lot of firms trying to compete locally have been very consistently successful at only one thing, and that is losing money.”

To your own self be true

Accordingly, he said that his bank is highly objective about its own position and had rigorously analysed where its own niches are. “We focus on clients who want to invest up to or above USD10 million with us, and we work only with experienced RMs who can handle such types of clients,” he explained. “We try to aim for the flexibility of the family office, but also at the same time, deliver the balance sheet and the investment platform of a global bank. And that's how we have chosen to build the business.”

He reported that having travelled in recent months to those major centres of Dubai, Hong Kong, and Singapore, he was even more optimistic about the potential. “In the foreseeable 12 to 18 months at least, those centres will enjoy a very interesting phase, with significant growth and diversification ahead.”

Consolidation of wealth and governance

“We are especially bullish on the growth of family offices in each location, and we see big opportunities in all of those centres for asset governance, wealth governance, and family governance,” he added. “That will be a very strong theme for us over the next 10 years. We will remain committed to our core competency of delivering the best international wealth management expertise and service from those centres.”

The offshore wealth management model will continue to flourish – there is both great demand and excellent infrastructure

An expert countered the theory espoused by some that international offshore financial centres have had their day. “Some might say the IFCs will struggle as the world goes digital and advice and expertise can be delivered from anywhere,” he said. “I fundamentally disagree with that point of view.”

He said the three centres he had mentioned, namely Dubai, Hong Kong, and Singapore, all enjoy their own hinterlands, for example the ASEAN region for Singapore, or North Asia and China for Hong Kong.

“They all enjoy an established and robust commercial infrastructure and legal framework, they have an outstanding base of financial services expertise and talent, and professional services support,” this guest added. “And whilst talent can always be improved, I think on a relative basis, Hong Kong, Singapore, Dubai, all have the components that are required to continue to be successful as regional wealth management centres. We need to be able to offer clients a multijurisdictional service for their investment strategies, and wherever they choose to be serviced from, it's our job to make those choices available for them and to deliver the expertise and capabilities of a global wealth management institution.”

He said that the bank’s typical HNW and UHNW clients and the family offices are all essentially multi-jurisdictional in their investment approach. “We see continuing strong demand from those core client segments for the bank to deliver expertise and services in each of those jurisdictions,” he explained.

Agility and client centricity should be key watchwords for any banks and firms wanting to compete profitably in Asia’s wealth markets

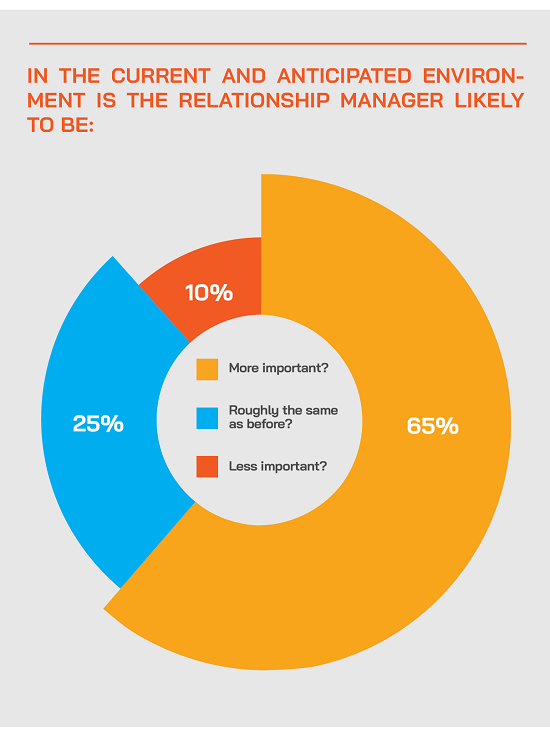

A speaker explained that leaders in the wealth industry are enhancing their value proposition, products, and service offering. “Agility remains the watchword today,” he commented. “The last two years offered a great environment for flow trading. But the current market environment requires a different advisory approach, with much more focus on alternatives and return diversifiers. We consider ourselves a banker’s bank. Our approach is to build our investment expertise around our RMs. Technology is there to assist – but not replace - our bankers.”

Each client is unique

As to the clients themselves, he observed that each is unique and has a unique set of expectations and hopes. “We can generalise by saying they want to preserve wealth and grow their wealth,” he said, “but the beauty of this business is the individuality. A core challenge is to therefore manage that great differentiation amongst clients, while also at the same time achieving the right sort of scale required to operate profitably. And the reality is there is no blueprint to enable us to get there.”

He elaborated on these comments, noting that when he meets with wealthy clients, and asks them for their views on what they expect from a private bank, there are generally three common themes.

The trusted advisor

“They really value that long-term trusted advisory connection with their relationship manager, and when that gels, these clients tend to want to stick with that trusted individual,” he reported. “Secondly, they look for financial stability in a private bank, especially in times of greater uncertainty. And thirdly, they look for a customised investment strategy which speaks to their needs.”

Do you have a magic sauce?

He explained that this third element is where, as a private bank, they can add their ‘magic sauce’. “It is easy to talk the talk but to truly deliver that type of customised investment approach is very challenging, and it is exactly there that we concentrate so much effort,” he told delegates. “We genuinely strive to deliver the type of investment strategies that will work with clients for the years ahead, not just for the shorter-term. We have chosen to be a specialist niche wealth management expert, delivering high touch solutions and advice to a lower number of clients. We are not going towards high volume, low touch, and digital-first type delivery. We remain true to our vision.”

Expert Opinion - Michael Blake, CEO Wealth Management Asia, UBP: “Leaders in our industry are enhancing their value proposition, products and service offering. Agility remains the watchword. The last two years offered a great environment for flow trading. The current market environment requires a different advisory approach, with much more focus on alternatives and return diversifiers. UBP is philosophically a banker’s bank. Our approach is to build our investment expertise around our RMs. Technology is there to assist - not replace - our bankers.”

Expert Opinion - James Verner, President, APAC, InvestCloud: “There are some key challenges ahead. Money is often on the move as investors are dissatisfied with the customer experience they receive and also as markets are more volatile. The increasingly competitive market means increased customer expectations, with more banks vying for the clients, which in turn means retention and growing the share of wallet is getting harder. Banks also need to improve the scalability of their operating models. Finally, they need to solve the challenge of delivering a truly integrated advisory solution.”

The quest to elevate the offering, build client loyalty and cement the role as trusted advisor

An expert said that a core mission that informs all their decisions was the quest to be the premier trusted advisor to its key clients. “We know that clients in this region all tend to work with a number of banks and other providers, but we focus intently on the special relationships where the client truly shares their financial situations and also their family situations, and their hopes and desires in terms of the next generation as well. It is that type of trusted advisor relationship that we aspire to and that we believe we are so good at.”

Expert Opinion - James Verner, President, APAC, InvestCloud: “Leaders in this industry are highly focused on enhancing their value proposition, their products, and the overall service offering. The digital experience is central to this, with the drive to deliver personalised and hyper-personalised solutions and advice based on multiple data sources and aggregated for a single view of wealth – essentially, the advisor in your pocket. The role of the RM or advisor cockpit is critical to helping enhance the customer experience and enable scalable growth. The providers need to think about evolving from CRM to CLM. Technology is also able to help that transition from the product-centric offering to the advice-driven model, again based on data and AI to help deliver far greater personalisation.”

Great potential in Asia’s dynamic markets and the emerging economies of ASEAN

A guest opened his commentary by offering delegates a very quick snapshot of his bank’s wealth business, explaining that the bank remains focused entirely on Asia, enjoying the unique position of being the only bank with presence in all the 10 ASEAN countries. “As a bloc, ASEAN is more than 600 million people and has a combined GDP that would rank the region as the world’s sixth largest country,” he reported. “I run the wealth management business for the group, and we span all the way from retail to high net worth and beyond across the region.”

The wealth continuum

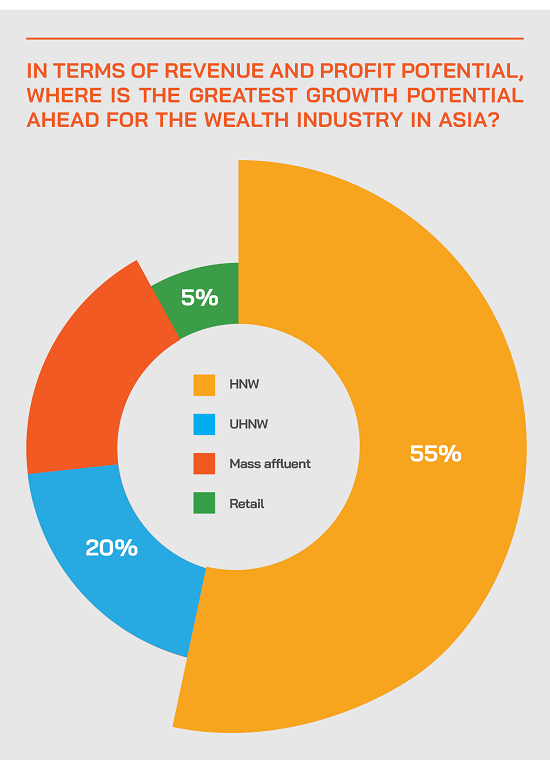

He said that while private banks tend to concentrate on the HNW and UHNW market segments, as a leading regional commercial bank, they concentrate their wealth management offering in particular on the mass affluent segment where more and more private wealth is being minted every day.

“It is about the wealth continuum,” he told delegates. “And with our extensive network across ASEAN we can really mine into this rich seam of customers, as well as serving the HNW and upper tiers of wealth. Moreover, this is a profitable segment, as gone are the days when the products offered at the premier banking level are simply plain vanilla. Actually, what used to be just private banking products are now available to the premier segment as well.”

Accordingly, he observed that the bank is involved in the democratisation of access to wealth management products, advice and services in what is a remarkably dynamic and diverse region. “Additionally, we see that our customers are increasingly international, increasingly savvy and keen to diversify their wealth. The opportunities are outstanding.”

But there are many challenges to delivering the right wealth proposition, in particular a shortage of talent across the board

A guest offered delegates some notes of caution as banks and other players seek to take advantage of the region’s undoubted potential. He pointed to the dearth of talent across the board, not just in the advisor/RM category but also in terms of support functions, technology and compliance. “It is tough to hire and keep the right people,” he conceded. “And we also need to be cognisant of regulations, as well as the intensifying competition from non-bank players and new entrants.”

He gave some insights into how his bank positions its RMs and advisors, aiming, he reported, to have each of them serve as many as 200 customers in the mass affluent/premier segment and as many as 70 in the HNW category. “This is far from easy,” he conceded, “especially with a shortage of talent and experience in the market. We have our KPIs, but the big picture is that we aim to attain a balance between giving what customers they need and want and achieving that with optimum efficiency. And that's where technology comes in.”

Another guest whose business is centred in India agreed that this shortage of talent is widespread across Asia’s markets. He said that whatever the growth potential, talent is a major limiting factor in achieving scalability and exploiting that growth potential. “The industry recognises this shortage, and we are focusing a lot of effort on almost creating our own financial advisors, with intense focus on training, advice, essentially leveraging the incredibly smart people this country has and shaping them into experts in our field,” he explained.

No substitute for experience

Nevertheless, he also conceded that there is no substitute for experience. “We can train and nurture, but there is no experience like going through crises, through the ups and downs of the markets,” he said. “We can't make smart financial advisors in a classroom, so the reality is that we do face an issue in bringing these younger, very smart individuals, up to the levels of experience they need to handle what are almost exclusively first-generation wealth here in their 60s, 70s or even older.”

To deliver a great customer experience and great service, technology and culture must combine effectively

The same expert elaborated on those views, noting that products offer little or no differentiation, but levels of service are what customers remember. “Yet while that is true,” he said, “it is still tough for the RMs to focus on that service all the time, because in this industry, they will usually have their KPIs, their monthly targets. However, we strive to focus our efforts on genuinely delivering that level of service, that attention to their needs and expectations, and certainly not simply paying lip service to this concept.”

Build the right culture

He also offered a comment on the value and delivery of advice, which he said comes not only from the RMs but from the collective effort and culture of the institution. “We need to present the right culture, we must not be overly focused on short-term revenue goals, we need to extend the KPIs to cover multiple quarters if not years and try to look at the RM performance over time rather than a discrete period of time,” he explained.

Keep your clients close

And he said that he continually stresses the need to offer to handhold customers through periods of financial or global anxieties, helping them build diversified and robust portfolios that are well balanced at home and increasingly overseas. “And to stay relevant in the market, we need to continue to invest in our people, systems, leveraging digital and other means to become more customer centric as well as more efficient,” he reported. “And never lose sight of the fact that private banking is predominantly a people business, based on trust and relationships.”

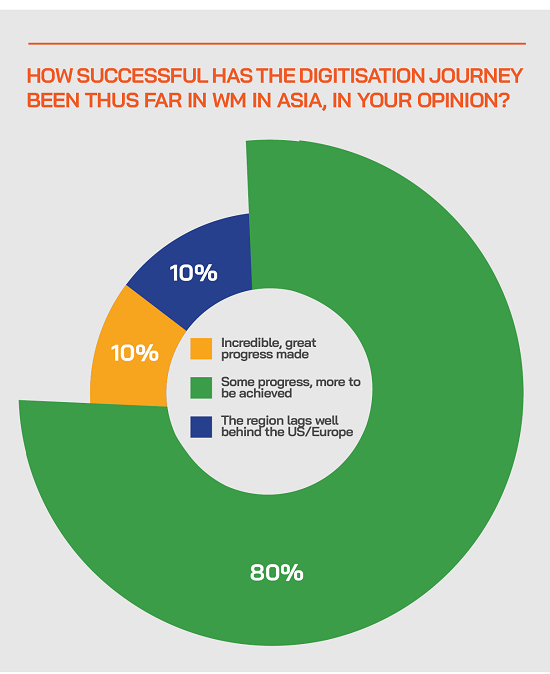

Expert Opinion – James Verner, President, APAC, InvestCloud: “Wealth management competitors in the region re at different stages in the digital transformation journeys, and it also depends greatly on which country they are in to see the proper context. It depends on their legacy systems, their missions, their management, and strategies and of course their target markets. At InvestCloud, we work with clients pragmatically to integrate with what they have (where it makes sense to) so that they can create a positive impact quickly and then grow from that point. More broadly, we think there is still a long way to go to develop the advisor and customer experience whist also boosting operational efficiencies. And there is also far to go still in leveraging data that will help the banks and others grow their revenues, AUM, and customer numbers.”

The Indian wealth management market offers immense potential, but smart and focused local banks and firms, and not the global players, are proving most adept at seizing the opportunities

A guest highlighted his firm’s broad-based wealth offering in what he explained is an incredibly dynamic onshore India wealth management market. He explained that while historically their business had been local currency investments, one aspect of the business is evolving rapidly, namely the increasing globalisation of wealthy Indian families. “This is a major trend,” he reported, “and we believe we are remarkably well-positioned to help them globalise in the right manner and to diversify some of their portfolios into overseas assets and different currencies, especially the US dollar.”

He explained that to achieve those goals, their approach is to work with selected banks with operations in Hong Kong and Singapore. “As a result of the trends and these relationships, some 20% of our overall business is now overseas investments for our clients,” he reported.

India’s vast potential

He stated emphatically that growth is not an issue for India. “India is already the world’s sixth largest economy, and growth is dramatic, with expectations that within a decade we will be the world’s third largest economy, and wealth at every level is exploding,” he reported. “The market is also incredibly underpenetrated from a financial advisory perspective, so the potential is simply vast. The challenge is more in delivering a wealth management offering that not only reaches these clients, but also makes money.”

Accordingly, he said this is where the efforts of the top tier investment private banking firms are focused. “The market is more regulated and more complex than ever before,” he explained, “and that is good because the products and services and advisory are somewhat less prone to the inevitable trend towards commoditisation. Actually, we have seen over the past several years that there is greater diversification, for example towards alternative investments and multi-asset portfolios, towards global asset allocations, and in a number of other areas. All of which means that the growth in business related to HNW and UHNW clients is going skywards at a remarkable pace.”

The great wealth transfer

He also pointed to the historical creation of wealth amongst first generation entrepreneurs over the past two plus decades, and the inevitable transition to younger generations within those families that is now taking place.

“The challenge of succession planning means we need to focus on helping them and also on paving the way for relationships with those younger generations who will inherit,” he explained. “There really is no second or third generation wealth in India at all, pretty much everything is first generation, so we need to help with this transition and upgrade our capabilities to serve these current and future clients.”

His final comment was to note that the Indian onshore wealth market is 95% plus dominated by domestic players, with foreign boutique and global international private banks having largely exited the market over the years.

Locals are the winners

“Most foreign banks have tried and then exited, and honestly there is not a single proper global bank ready to serve Indian clients onshore here,” he stated. “It is not a shortage of demand, but because the global banks have not been able to customise their business offering to the Indian clients. There is a vacuum, and this makes it easier for firms such as Validus, which are local but with global perspectives and capabilities, to compete here. It would appear this is fertile ground for global banks, but actually leading local firms like ours are leading the way, both for domestic advice and investments, but also for international portfolios services, working with offshore banks and other experts.”

Whatever the potential, digitisation and smart solutions are vital to seize the opportunities ahead.

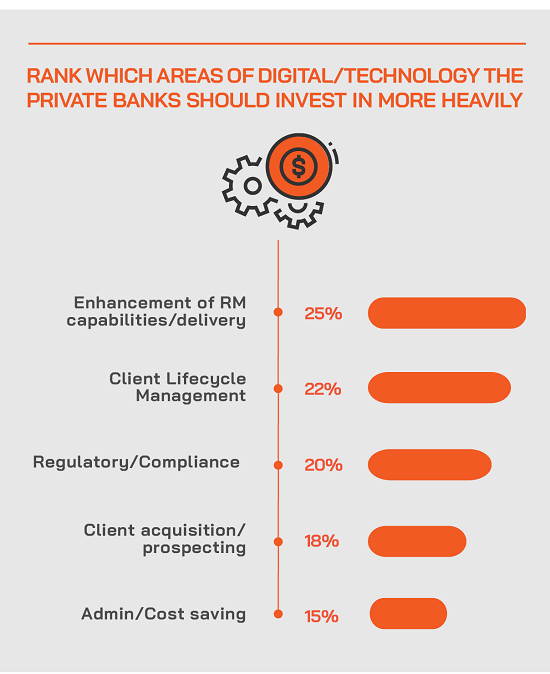

A guest said that to truly explicit this enormous potential in the region, there is a huge need for digitisation and creating and then delivering the best possible platform. “We need the right platform to deliver the right products and to do so compliantly,” he reported. “There is huge scope for innovation around processes and the customer experience,” he said. “For us, we believe digital can help in that regard, but the true delivery of our firm is through the RM and his or her level of expertise, experience, and client management. Operational efficiencies should be a given, but the delivery of expertise and the client experience are the core focus of differentiation for us.”

Another expert agreed, noting that the right technology solutions, if conceived with the right strategies and delivered efficiently and effectively, can facilitate, and even fast-track the ability of private banks and other wealth firms to seize the many opportunities of on offer in the dynamic Asia Pacific markets.

His firm, he told delegates, provides digital transformation guidance and solutions that help customers retain their private clients, and also then win new clients. And the firm also helps its customers boost their operational efficiency.

“We do this for over 400 wealth managers, private banks, consumer banks, insurance companies and asset managers around the world and we have just over USD6 trillion of assets on the platform, 7000 user experiences, and over 20 million customer accounts using the technology today,” he reported. “We are a global organisation, and in Asia work out of four key centres and with many of the larger and leading players in each of those markets, both locally and regionally.”

Dynamic markets, huge potential

He explained that the regional market remains dynamic, with expectations of a doubling of the wealth management’s AUM in APAC by 2025. “The opportunity is most certainly there, and one of the key challenges is in building the scale to really access these opportunities across this huge and diverse region,” he said. “Other major challenges are to deliver a genuinely excellent customer experience, and to build relationships across the generations.”

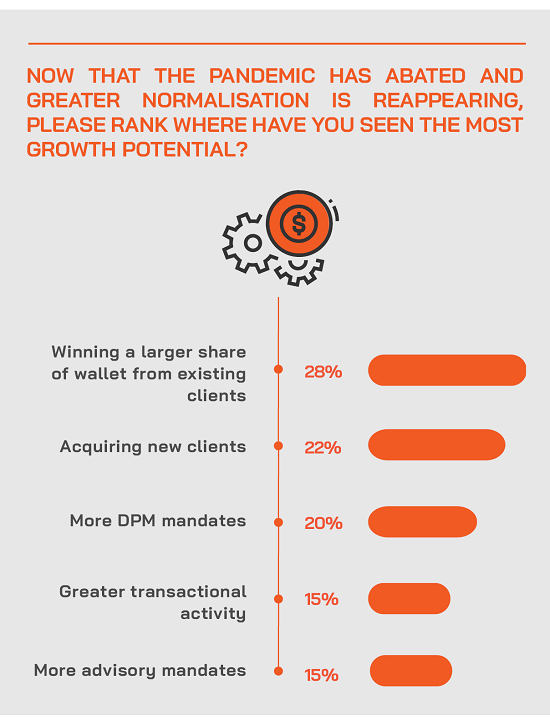

Another challenge is for the lead banks and other firms to become the trusted advisor to the clients. “On this point,” he said, “I can refer to the Capgemini report that came out last month, which indicates that 73% of people, when they cross the million dollar of investable assets threshold, switch their lead wealth managers. This means that to hold onto these clients, you need to provide something better, something different.”

Expert Opinion – James Verner, President, APAC, InvestCloud: “The competitive environment will keep shifting. In certain markets, vertical integration will drive change, in others, some banks or firms will work out how to work effectively up and down the wealth continuum. There will be increased fee pressure, which will reward the innovators who can operate at scale. The two big areas that will receive the most focus for digital transformation include enhancing the client experience and also boosting the efficiency and effectiveness of advisors.”

Digital-led enhancements across the board

He then zoomed in further on technology’s role in helping drive more efficiencies, achieve greater scale, in helping boost revenues per RM or advisor, and generally enhancing both the skills and productivity of client-facing experts and also the client experience and satisfaction.

“Our collective optimism for the opportunity in this region is indeed justified,” he said, “but also we all need to be thinking about how we hold on to what we have, how we can grow through new customer acquisition, and how you can do so in more efficient and more profitable ways.”

He turned his gaze on the quest for differentiation, noting that from his perspective of working across the region with many leading banks and firms, a key objective must be to make the client journey more seamless, less ‘clunky’ as he termed it.

“As a general theme, a lot of the technologies and the customer experiences today are still quite siloed, so there is a resultant friction in the system, where things that you think should be obvious and easy to do, are not actually,” he explained. “This means a fairly quick win can be to focus on data, to connect all these data dots in your organisations and thereby to make client journeys more intuitive, more friction-free, and also more personalised.”

He acknowledged that the wealth industry is as yet still far from delivering hyper-personalisation. “We know from surveys that customers see that way they ‘feel’ about their experience influences some 70% of their buying decision, meaning that it is their emotional response to the customer experience that drives their loyalty and activity,” he explained.

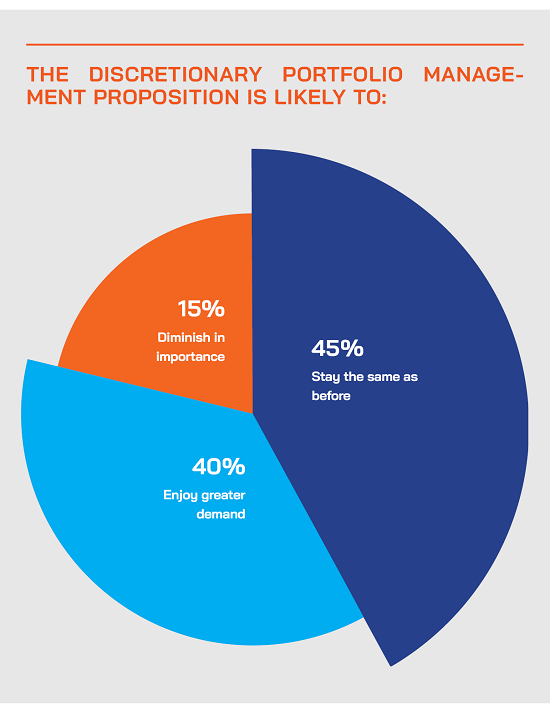

The transition to fee-based advisory

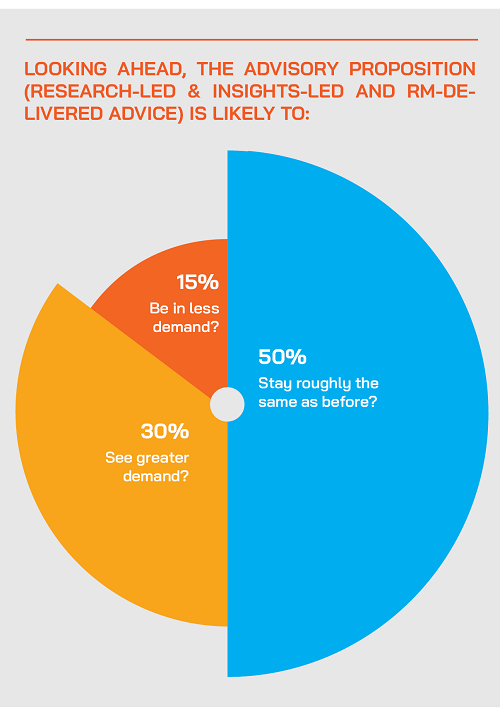

He expanded on these concepts, noting that within APAC, Australia and Japan are the most advanced in these areas, with a transition taking place from product-driven wealth management to more of an advisory and fee-based proposition. He explained that the advisory-based offering is driven not be age or wealth but more by planning, helping clients understand and communicate their goals and hopes, and then helping deliver planning around achieving those life goals.

And a lot of this can be significantly accelerated and improved by the smart use of data, which drives personalisation, relevance, and helps tailor conversations, advice and also products around the framework of longer-term horizons and conversations, he explained. “But actually, we are rather at the beginning of the journey to shift from product sales to advisory income and DPM in most of Asia, without a doubt,” he said. “Nevertheless, the journey can start, and it should begin with the right combination of leveraging data and smart digital tools.”

The need for empathy

He added that another core element is what he called digital ‘empathy’, which he said is an understanding between the advisor and the end client, so they see themselves on the journey together and the RMs and advisors are cognisant of the customer's hopes, dreams, and fears. “In this way, it really becomes personalised planning, and to achieve that at scale you need the right technologies,” he stated.

He drew his observations towards a close by noting that if the providers manage to retain their clients and win a greater share of wallet as trusted advisors, the next step should be to leverage those successes through stimulating a network effect to bring in new clients as well. “You then achieve growth through retention and growth through new clients coming into the network,” he explained.