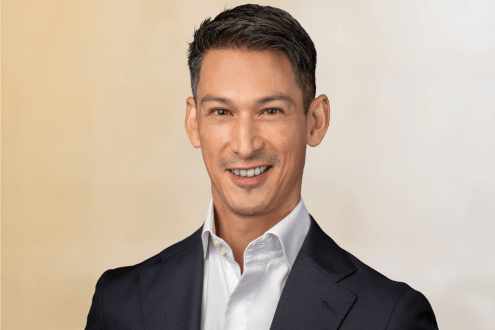

Long-Established EAM Leader Philipp Piaz on the Drive to Differentiate the Independent Wealth Model

Jul 4, 2022

The Hubbis Independent Wealth Management event of May 11 in Singapore featured a panel discussion that focused attention on how EAMs can strive to differentiate themselves through the curation of new and interesting investment and product ideas and through more comprehensive engagement with clients and family members. Philipp Piaz, Co-founder and Managing Partner of Finaport, a firm created in 2009, back in the early days of the independent wealth management expansion, sat as one of our expert panellists. Philipp is a well-known character in the EAM community in Singapore and one of its key ambassadors. We have summarised some of his insights in this short report.

Philipp Piaz is a well-known member of the independent wealth management community in Singapore and across Asia. He is Managing Partner at Finaport, the firm he co-founded in 2009, and has overseen the creation and then expansion of the firm's Asian operations. He is also one of the founding committee members of the Association of Independent Wealth Managers in Singapore, and was appointed President in 2018.

Philipp, of Swiss-Thai origin, joined Credit Suisse in 1998 embarking on a career in private banking and wealth management. He relocated from Zurich to Singapore in 2001 to join Credit Suisse’s Private Banking team developing the Thailand business as Vice President. In 2004, Philipp joined the senior management team at Deutsche Bank AG as Director in the bank’s Private Wealth Management team, increasing its footprint in Thailand.

Listen first, talk later

Philipp opened his observations by focusing on the drive towards differentiation. “Listening is our first priority,” he told delegates. “We take the time to listen - ‘Selling’ is not on our minds. Only once we really know what the clients want can we put our heads together amongst the partners and team members and consider how we can best help those clients address their challenges and achieve their goals.”

He observed that a major difference between the EAM community and the banks is really that the products the EAMs source for clients can and should truly suit their needs, as the incentive is always to make it right by the clients. There is no focus on selling existing “in-house products stock” but instead the EAMs strive to find “best of breed” by being fully independent.

Top of the game

“Typically our peers in the EAM space have a solid background of working with and within the private banks, and we know what they do,” he reported. “We know that to remain on top of the game, we need a constant effort to stay on top of the clients’ requirements and expectations, on top of global markets and geopolitical developments, on top of the products and current offerings, on top of wealth planning trends, and at the forefront of all the new products out there - even digital assets and so forth. We also need to be able to determine what new ideas are out there that we can deliver to clients, for example, tailored overseas mortgages for real estate in the US, Europe and elsewhere - a recent addition to the services provided out of Singapore.”

A circle of trust

Philipp also addressed the issue of building trust and retention of clients. He said that in attaining real trust with clients and by building a network of trusted partners of whom they have conducted due diligence, they now have a solid foundation to build more business with those clients in the future, often connecting multiple specialized partners to address complex challenges.

“Generally, within our peer group here in Singapore, we are all diligent and open - we have a good circle of professional service providers, which allows us to put the pieces of the puzzle together as the client’s team, acting as GP” he added. “We do not recommend any ideas or products just because of potential benefits to the firm - the focus is always on the client, as the client is who pays us ultimately. We ensure the right products and the right ideas - and the right introductions - go to the clients based on merit and suitability alone.”

Compliance and values

He explained that a strict compliance regime is initially challenging for all, but in the end definitely helpful.

“Robust compliance – and Singapore is strong in this regard – means we are seen as a serious, clean, efficient, and well-regulated platform from which to provide these qualities, relevant products and services. These are values that must not be compromised.”

On the other hand, he admitted that dealing with compliance can often be onerous. “It's frankly frustrating sometimes to deal with the banks and their compliance officers who might for example sit on documents a lot longer than necessary - often due to internal back logs. It is challenging to explain to the client why this takes so long despite all the documentation being complete and detailed, because it seems to go against common sense,” he said. “But at the end of the day, in the bigger picture, we all (EAMs and Banks) must adhere to MAS guidelines and ensure we are all fully compliant. All in all, this provides the robust base from which we can all operate: Compliance is not optional - but if a bank’s overwhelmed compliance department is a bottleneck, EAMs like us can also look at alternative banks.”

Transparency – core to the proposition

Philipp addressed the perennial issue of retrocessions, otherwise known as trailer fees. “It is all about transparency,” he commented. “Clients can always choose how to pay us, but they need the information to be clearly and accurately conveyed. We are very careful indeed about trailer fees, as we typically charge a management fee unless clients opt for trailer fee or performance fee based payment schemes. Long-term trust is a lot more important than earning a fee here or there - aligned interest goes a long way.”

Partner at Finaport

More from Philipp Piaz, Finaport

Latest Articles

Wealth Solutions & Wealth Planning

Investment Migration, Residency & Citizenship – Key Trends Relevant to HNW and UHNW Private Clients