In the Hubbis Digital Dialogue event of February 2, our panel of experts explored the state of the life solutions industry today, reviewing the latest trends in products, identifying the optimal solutions for individual and family needs, and analysing where demand is on the rise from different segments of HNW and UHNW clients in the Asia region. The conclusions of the panel can be condensed into several key observations. Life solutions are seen as increasingly valuable for smart estate and legacy planning in a world of heightened regulation and tax surveillance, for liquidity at difficult and stressful times for the families, and for portability for increasingly mobile family members. The wealth management industry – advisors and RMs – can and indeed should participate in the commission streams as trusted advisors who are compliantly by broaching these awkward but very important conversations with their clients; once over the initial discussions and guidance, the RMs and advisors can then working confidently and compliantly with the insurance brokers, lawyers and other specialists who can convert these concepts to realities that are ideally tailored to the particular individuals. Understanding the clients and their families is therefore the first key step. Both empathy and outstanding communication skills are vital, and so too sophisticated knowledge of the products and the ability to convey the importance of these solutions to robust estate & legacy planning. And relationships with trusted insurance experts, lawyers and others are critical to bringing the clients the right team of experts to their side of the table to ensure optimal outcomes.

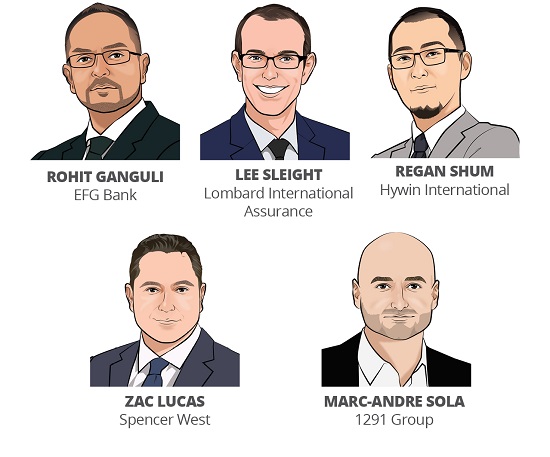

The Panel:

- Marc-Andre Sola, Founder & Chairman, 1291 Group

- Rohit Ganguli, Head of Wealth Planning Asia, EFG Bank

- Regan Shum, Head of Insurance Brokerage, Hywin International

- Lee Sleight, Head of Business Development, Asia, Lombard International Assurance

- Zac Lucas, Partner – International Private Wealth, Spencer West

Setting the Scene

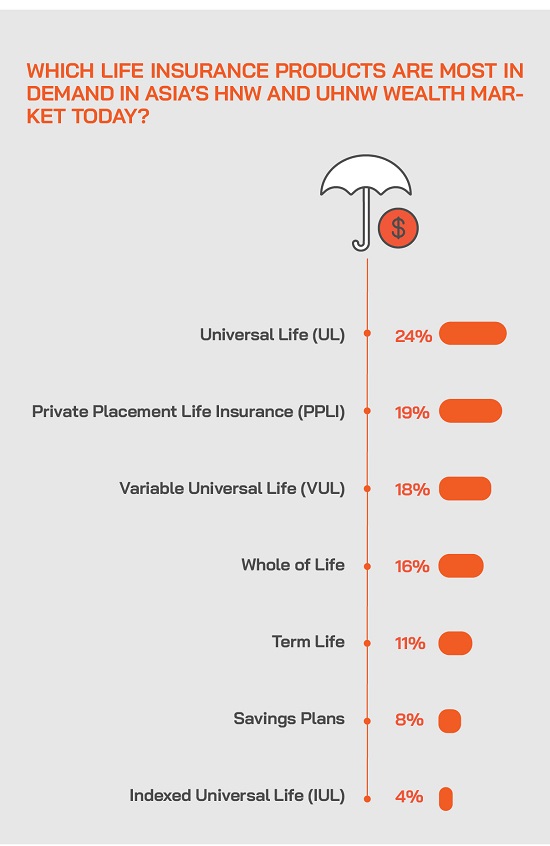

The global life insurance solutions business is replete with a host of acronyms, from UL, to VUL, IUL, PPLI, and there are policies such as Savings Plans and Whole of Life. In the current global economic and interest rate environment, given the still uncertain outlook for financial markets, and with memories of the pandemic far from dimmed, the experts helped delegates understand how to navigate these different tributaries safely and professionally.

They discussed the impact of inflation on life policies and their efficacy. They also looked at the important issue of whether policies should be funded by borrowings, and whether larger, more leveraged policies are advisable given the state of the financial markets and potentially sustained or even higher rates.

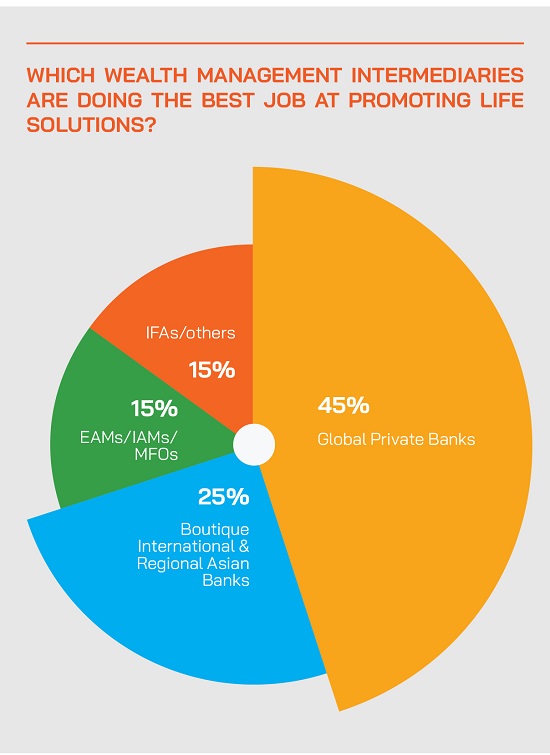

They considered whether private banks and independent wealth management firms are doing the best they possibly can in order to help deliver insurance concepts and solutions in a compliant manner, discussing how they work or perhaps could work with the specialist agents and distributors in the market.

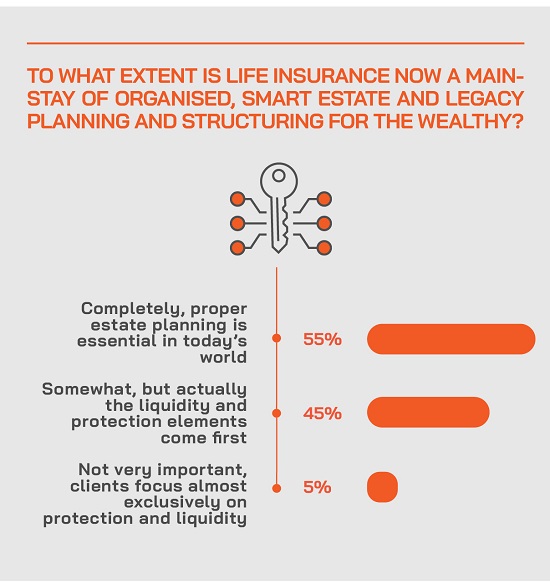

They analysed how agile the product providers have become in tailoring new products to appeal to current and future market demand. And the experts discussed how life solutions are playing an increasingly central role in estate & legacy planning, and facilitating the smooth transition of wealth from policyholders to their chosen beneficiaries, something that is especially important in a world of intense and proliferating tax, regulation and compliance.

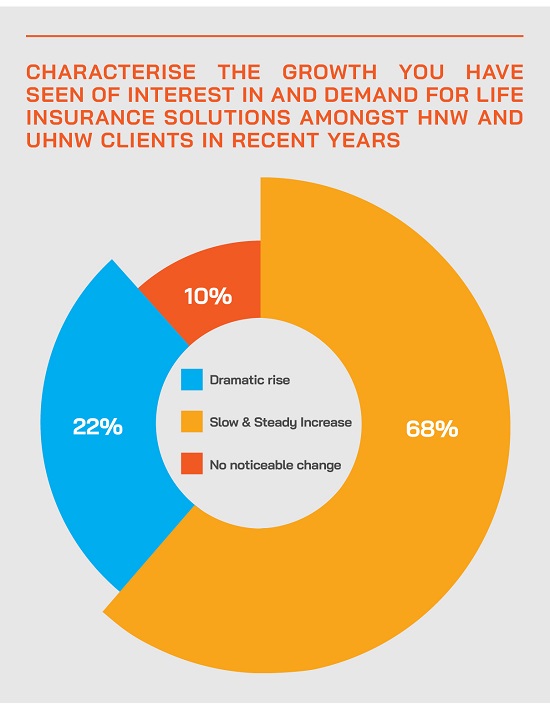

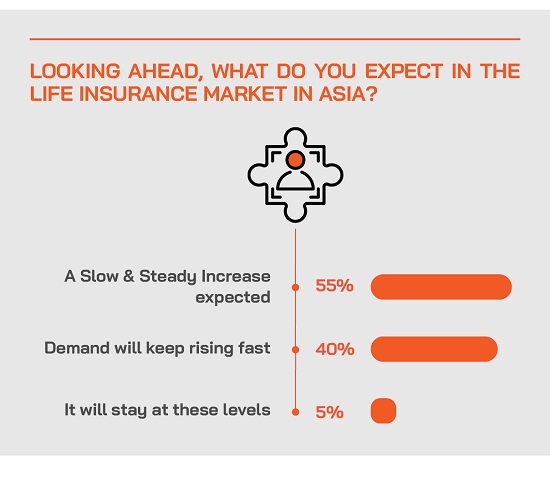

The market is most certainly there to be grasped - Asia-Pacific remains one of the world’s fastest growing major regions for HNW individuals (HNWIs). And at the same time, naturally the pandemic, now fading into the background thankfully, also dramatically increased awareness amongst clients of all ranges of wealth in the areas of health, longevity, and robust estate & legacy planning.

In short, HNWI Life Insurance Solutions are most definitely now centre stage in Asia’s dynamic, expansive wealth market.

Those from the wealth industry who fail to grasp the opportunity are missing out on a signification weapon in their revenue generation arsenal and essentially failing their clients, many of whom might seek initial guidance and direction from their bankers and advisory firms; those bankers and advisors, within the guidelines of compliance, can certainly help oil the wheels and also participate to varying degrees in the very substantial commission income being generated.

These are some of the questions the panel addressed:

- Why are life insurance solutions so important for smart estate and legacy planning? •

- What is the state of the life solutions market in Asia?

- UL, VUL, IUL, Whole of Life, Savings Plans, PPLI? Other new products? What types of solutions are in vogue in Asia today, what are the key differences, and what suits which types of clients?

- Does the average private banker or EAM RM/advisor understand enough about the life products and solutions, or what needs to happen to boost their knowledge, engagement and involvement?

- If you work directly with private clients, how should you begin the conversations, how should you then work with the specialist distributors and agencies to further advance these solutions for Asia’s private clients, and very importantly, how do you participate properly and compliantly in the significant fee income/commission streams?

- How exactly do wealth managers promote each of these solutions yet stay within the bounds of regulation/compliance, and are the rules/guidelines changing, in other words where are the lines in the sand?

- Why are life solutions so valuable for providing both liquidity and portability?

- Why do HNW and UHNW clients increasingly need portability?

- Leverage is also an important part of the life solutions market, so how does leverage apply to life policies, does it still work with higher/rising rates, who can provide the funding and how and when do you get involved?

- Do life solutions work well alongside other structures such as trusts, foundations and other asset holding vehicles?

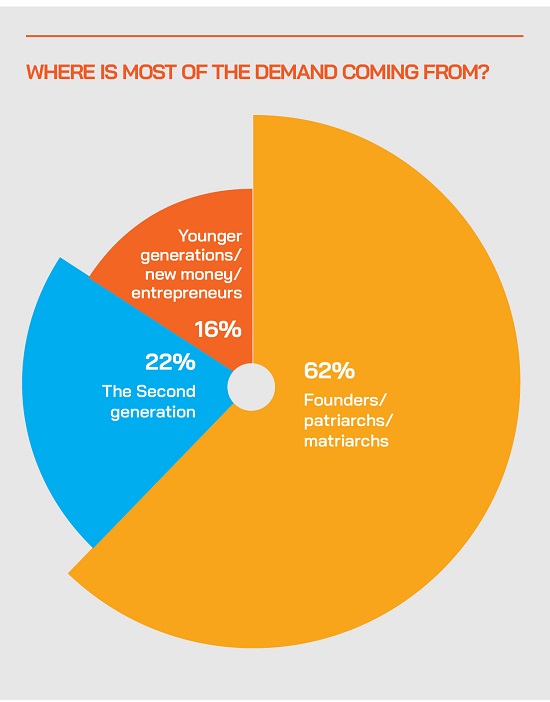

- Should the wealth industry be engaging the second and third generations in such discussions, and if so, how?

- What sort of additional training and education is required for any RMs or advisors to be able to promote these sophisticated products?

Key Insights & Observations from the Experts

Insurance is a vital solution and wealth management experts should be front and centre

An expert opened by stating that life insurance is probably the best and most rounded wealth protection tool in the market, allowing policy holders to house assets in a legally fully protected structure, and with great privacy. Moreover, in most countries, wealth in the structure grows on a tax deferred basis. “Accordingly, this is a vital solution for the wealth industry to expand their relationships with the clients, and with the next generations,” he said.

He added that for estate & legacy planning, and for family liquidity in the event of death. He said if clients wrap their assets into insurance, and here he was referring mainly to PPLI or VUL, then liquidity and its distribution to the beneficiaries is very rapid and simple. “Very often even the wealthiest families don't have enough liquidity to take care of everything immediately. And therefore, you need life cover. You can also see a life cover or high death benefit policies as an investment class for the next generations.”

Expert Opinion - Lee Sleight, Head of Business Development, Asia, Lombard International Assurance: “Often with interests and family members spread across multiple jurisdictions, HNW and UHNW families need portable wealth and succession planning options. They want solutions working equally well in their current home country of residence, as well as where they may subsequently relocate to or where their children (often the legal heirs) are resident. In this regard, PPLI as an internationally recognised solution is key.”

Life solutions should be considered in the context of robust wealth and legacy planning

Another guest concurred, adding that life policies should be adopted in the context of broader wealth & estate planning. “Clients have come through the pandemic, and they really want to have these discussions, in my view,” he reported. “We are doing them a disservice by not having that discussion.”

He said the bankers, become more the trusted advisor, open up sensitive but very important issues, they can retain the assets under management, build connectivity to the nextgens, and potentially make additional fees as well. “I really do think it's a win-win to have that discussion,” he stated. “And knowledge is key, it is vital to properly grasp the concepts and structures.”

Privacy should not be underestimated, especially as the tax authorities tighten their grip

Another panellist picked up on the issue of privacy, relating this to the even-tightening noose of tax and tax audits. “Being defensive is important,” he said. “This is among the critical devices to help remedy and ameliorate some of those risks.”

He added that the traditional trust structure had become incredibly complex to administer and quite inefficient in many ways, he said trust laws are somewhat outdated, and therefore life products are rising in prominence as one of or they key solutions.

“We must remember that not one size fits all, so being able to pivot between the different solutions, given the client demand, will be quite critical going forward,” he commented. “Accordingly, we all need to get smart at making comparisons between the different solutions and not just excluding one solution. We need to be more knowledgeable, more skilled.”

Expert Opinion - Lee Sleight, Head of Business Development, Asia, Lombard International Assurance: “Few Asian countries have gift or estate taxes. Therefore, Asia-based (U)HNW individuals and families are often not aware they would be subject to it and are somewhat puzzled when told that it actually affects them due to asset location or where family members (their heirs) are resident in other jurisdictions.”

Helping clients choose the right product requires proper understanding and excellent communication

An expert laid out the key requirements. “First, we must understand the clients we have to understand the clients, take a step back and think of his or her wider family situation, their locations, their assets, businesses, and plans,” he said. “Only then can we move to the solutions. My preference is PPLI because of the ability to wrap, to place assets that the client has with an existing asset manager or an existing bank within a structure that allows a clear succession plan to be put in place. Those assets can be maintained for the family and passed on to the next generations.”

He said there are also the pure risk coverage elements that focus on the liquidity that families may need as and when they have an event, when they will need perhaps funds to settle inheritance tax or other requirements. For example, he mentioned having a pure risk policy to meet inheritance tax on a property the client might have in London, where there are rather punitive IHT taxes today.

For the advisors, he explained that understanding the products, for example PPLI, is vital to matching those products to the needs of the clients.

Another guest agreed, adding that advisors need to drive for a much more holistic discussion, not a commoditised type of conversation. “It then becomes about what fits in best for those clients, from a very broad estate and legacy planning viewpoint. Actually, for private bankers and EAMs, if you have such discussions, then you can bring in the experts, the professional brokers and insurers who can structure the right products.”

Expert Opinion - Lee Sleight, Head of Business Development, Asia, Lombard International Assurance: “PPLI by its very nature lends itself to estate and legacy planning – the ability to protect and preserve an existing portfolio and ensure a smooth transition of this family wealth on to the next generations is key – especially where family members scattered across multiple countries or jurisdictions. It is also worth stressing that PPLI can complement existing wealth structures. It can be combined with Trust structures or offshore financial holding companies, therefore enhancing existing plans and making them future-fit for the next generation.”

China’s doors are opening ever wider to life insurance solutions

A speaker highlighted how Asia’s demand for life products is rising fast and within the region, China is registering even more rapid expansion. “It is even higher partly because after three years of pandemic, a lot of demand has been pent up and a lot of them are preparing to come to Hong Kong and visit us to buy insurance, to open bank accounts and so forth,” he reported. The penetration of insurance in China is still relatively low, only like 4% compared to 8% in Europe, so the growth potential is huge.”

He added that they are advising clients to take out very extensive health insurance as well. “We have heard of some elderly people paying USD1 million hospital bills in the US,” he reported. “People need coverage now that the travel and borders have reopened from China.”

Policy portability is essential in today’s ‘globalised’ world

An expert reported that when it comes to geographical flexibility and the policy holder and/or beneficiaries living in multiple jurisdictions, insurance really kicks in. “Assets wrapped in an insurance policy will pass completely separate from the ordinary estate, and normally paid out within 30 days of the death certificate, dramatically cutting through all the time and formalities that the beneficiaries or the heirs normally face,” he reported. “Moreover, you will be able to cover potential taxes in different jurisdictions, providing that is you have worked with an advisor that actually understands international complexities and international laws.”

With the right structure, the assets can also be wrapped and enjoy tax deferred growth, estate planning advantages, robust asset protection in law, privacy, and policy holders can also borrow against assets if they need liquidity during the life of the policy.

This same expert expanded on these comments. “These families are increasingly mobile once again and diverse often in terms of the countries where family members settle or want to move to,” he observed. “Portability needs to be thought about well in advance, not after the fact. And you need to think about associated structures, for example the trust, to make sure that it is relevant to and accepted in the chosen jurisdiction. PPLI has excellent characteristics for portability and works ideally alongside trusts, for example.”

Insurance is a tool that has for many, many decades had the support of governments across the globe

An expert commented on the longevity of the life solutions market. He observed: “Insurance is the most complete wealth protection tool. The insurance industry has the strongest political lobby in each country and therefore the tax benefits are certain to last. Insurance is an asset class that every wealthy individual should hold in his/her portfolio. Even the wealthiest do not generally have enough liquidity available at the moment they die. Insurance - especially PPLI - substantially reduces cross border, client protection and AML risks for asset managers and bank.”

Higher sums and more sophisticated structuring are increasingly prevalent, leading to the need for more multi-disciplinary advisory teams

A panellist observed that private client wealth is rising in Asia, and policies becoming larger. Clients are also increasingly aware of the need to adopt the right structures alongside these policies for the ultimate beneficiaries. “We need the right types of different professionals coming together and building one nice solution around this,” he said. “We should not see any gaps; we need multidisciplinary teams dealing with these clients.”

Do not hesitate to bring these conversations to the table with the clients and their families

The same China expert observed how it is surprising how many clients had not heard about specific life policies such as term life, where there are lower commissions. But he said term policies offer both decent cash yields and also excellent protection.

Keep open minds when talking to your clients, he advised, saying the advisors might be surprised that even if they have had many conversations with bankers on this, they might not know about some of the simpler solutions that might suit those clients well.

“We do not necessarily focus on the highest premium or most complex products,” he said. “You will surprised perhaps how you become the ‘champion’ of the client by offering good advice from the client’s view point.”

Bringing the right team of experts to the table

The discussion drew to a close with the panel agreeing that wealth management professionals need to build an ecosystem of trusted experts and advisors that they can bring to the table to support their clients on this journey. These experts need to be able to help the clients navigate the different products, cross-border issues, structuring matters, and all the various regulations and tax issues that might unfold.

“RMs should have enough information, so they can hold their own in the introductory meetings,” said one panellist. He said they need to know enough to guide the clients and formulate these introductions, to help set the right thinking and the right courses for these clients. “But they don't need to know everything and anything,” he said, adding that the ecosystem of experts they can then bring to the table offer those next levels of detail and precision.”