2021 in India was a remarkably good vintage for wealth management, and a very solid platform for sustained growth, diversification and dynamism ahead. In some ways, 2021 was the year that genuine confidence and belief arrived in India’s wealth market, with few having anticipated how bullish things would turn out across the various markets and asset classes, and few expecting such diversification towards a greater array of advisory propositions and services, include legacy & succession planning. But how about 2022 so far? Has that measured up to or surpassed 2021? Yes, is the very short answer. The Hubbis Digital Dialogue event of November saw a panel of experts look under the hood of what remains an incredibly dynamic wealth management and investment market, one whose momentum appears thus far unaffected by the troubles in the developed world and leading capital markets around the world.

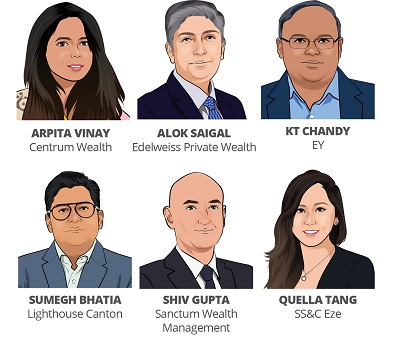

The Panel:

- Arpita Vinay, Managing Director and Co-Head, Centrum Wealth

- KT Chandy, Partner and India Private Tax Co-Leader, EY

- Amit Saxena, Senior Managing Partner, Edelweiss Wealth Management

- Sumegh Bhatia, CEO & Managing Director - India, Lighthouse Canton

- Quella Tang, Sales Director, ASEAN & India, SS&C Eze

- Shiv Gupta, Founder & Chief Executive Officer, Sanctum Wealth Management

Setting the Scene

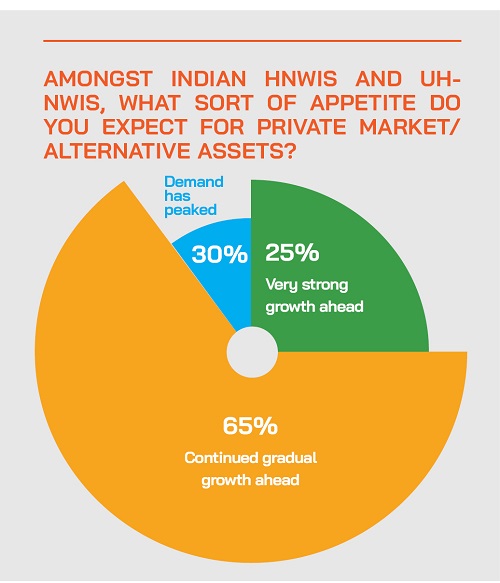

In 2022 to date, economic momentum picked up across the nation, not only in the biggest cities but across many of the second and third tier cities. Technology sector entrepreneurial activity accelerated, with more Unicorns being created domestically, and at the same time FDI inflows accelerated and foreign investor appetite in general surged. It was not only the public sector and mainstream asset markets that performed well, as investor appetite for private markets surged both in terms of domestic demand but also foreign demand for private assets, especially the new wave of tech sector enterprises.

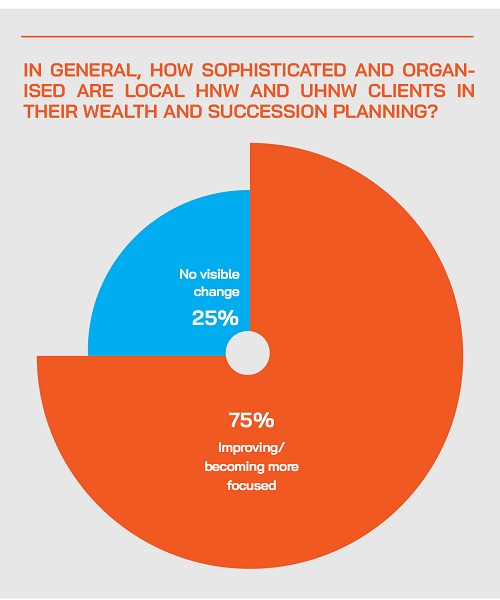

As all this has moved into sharper focus, wealth management experts are reporting having new seams of client interest and demand from the younger, technology-centric generations to add to the rich seams of client demand for both investments as well as wealth and legacy planning from the older generations of wealthy Indians, many of whom are seeking to pass assets on to the younger generations of their families.

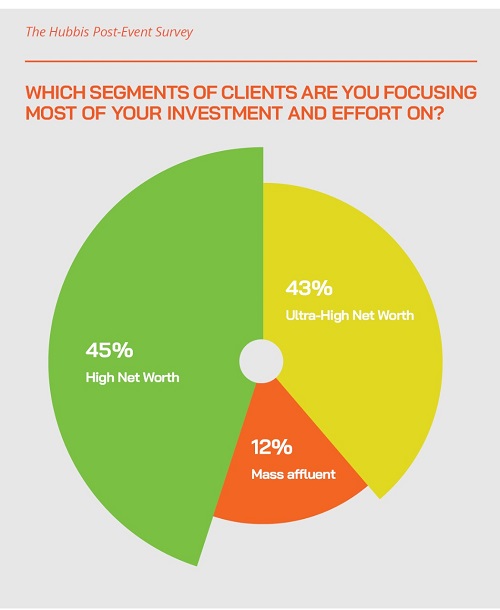

Across the board in India, there is an ongoing diversification and upgrading of private client portfolios as the wealth industry delivers more interesting mainstream products, including mutually funds and more ETFs, and across the private markets. Meanwhile, the mass affluent sector of the nation continues to expand apace, just as HNW and UHNW wealth keeps rising significantly.

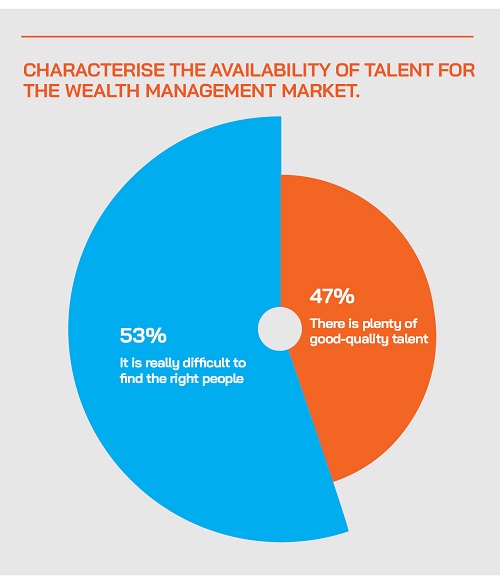

On the slightly less positive side, there is clearly a shortage of experienced RM talent to cater to all these private clients, but the banks and the numerous independent wealth firms in India – many of which are now very large indeed – are making ever greater efforts to boost training and to further develop a culture of professionalism in the wealth sector.

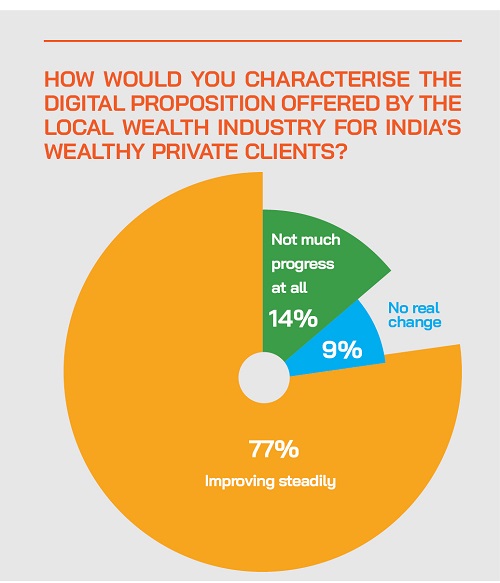

And of course, India is a truly vast and immensely populous country, hence the great need for digitalisation, which continues apace, helping the competitors in the wealth industry reach out to the many often huge pockets of client demand in all quarters of the country. The need to differentiate from the competition and pressures from rising costs in all areas are also other key drivers for the thrust towards a far more digital wealth management offering.

Hubbis’ chosen experts drilled down to uncover these and other key evolutionary trends and highlighted the incredible potential that India’s wealth management market represents.