Publications & Thought Leadership

In a World of Near-Term Uncertainty, Alternatives Move Centre Stage for Asia’s Wealthy

Sep 9, 2020

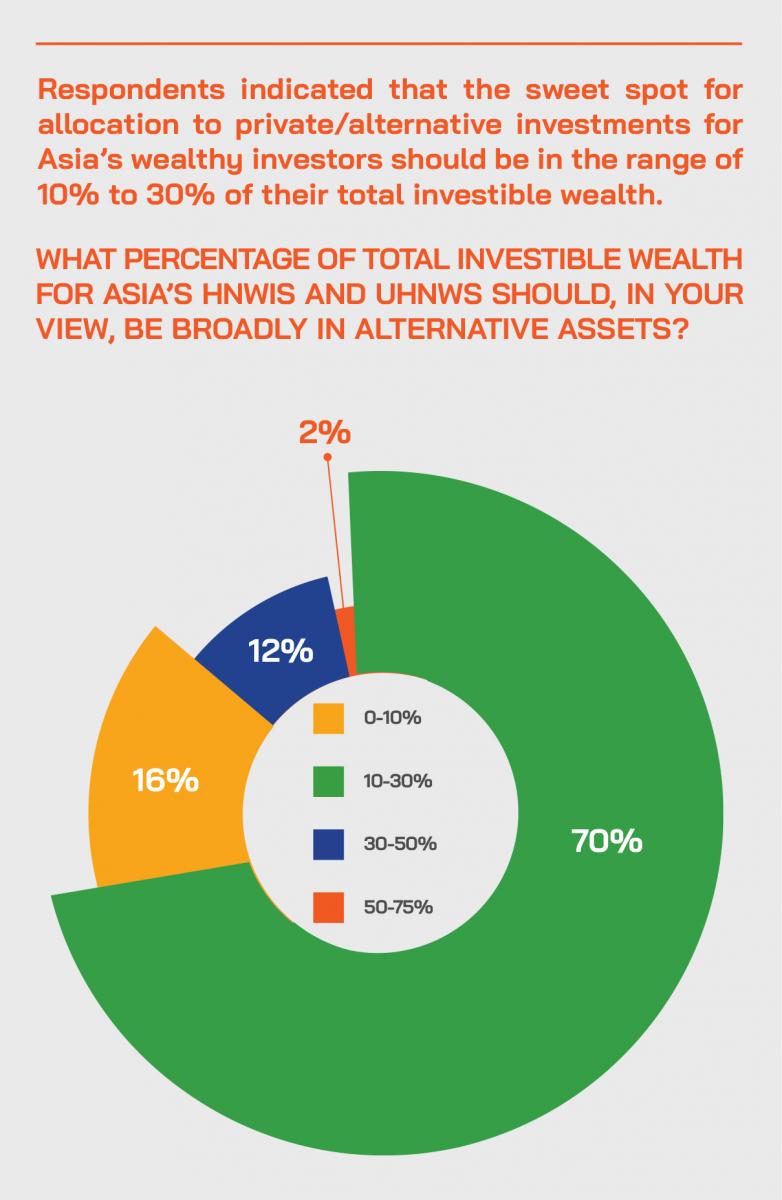

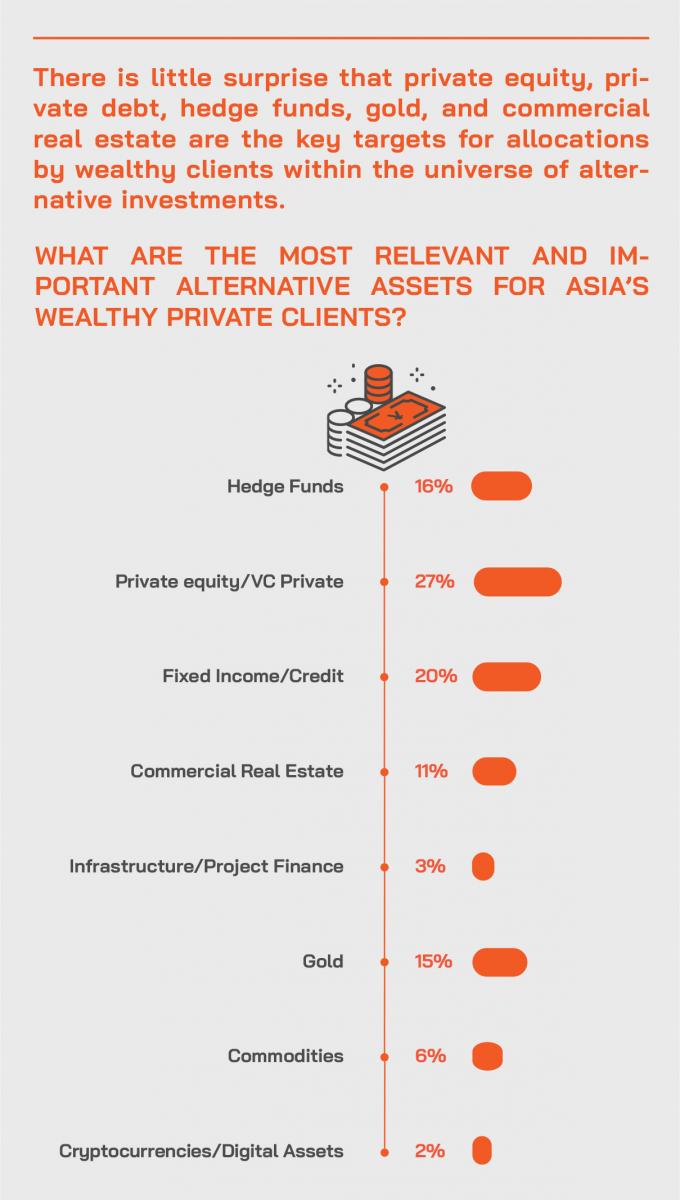

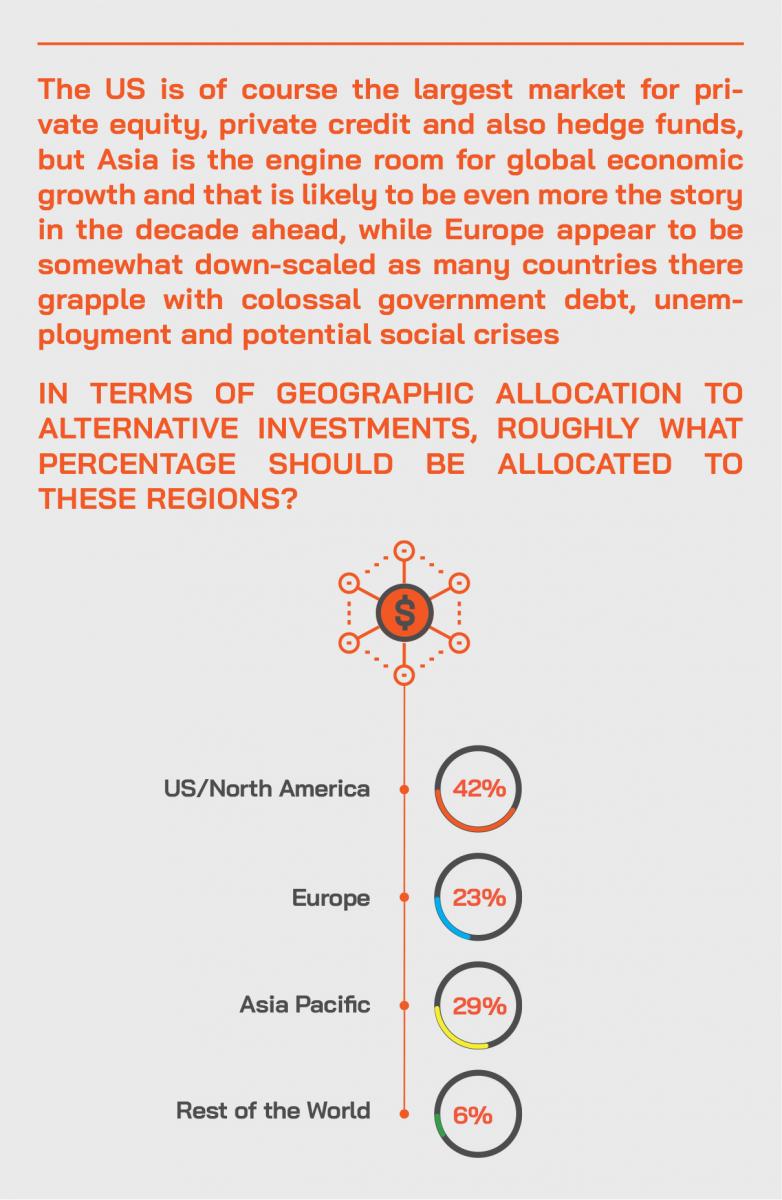

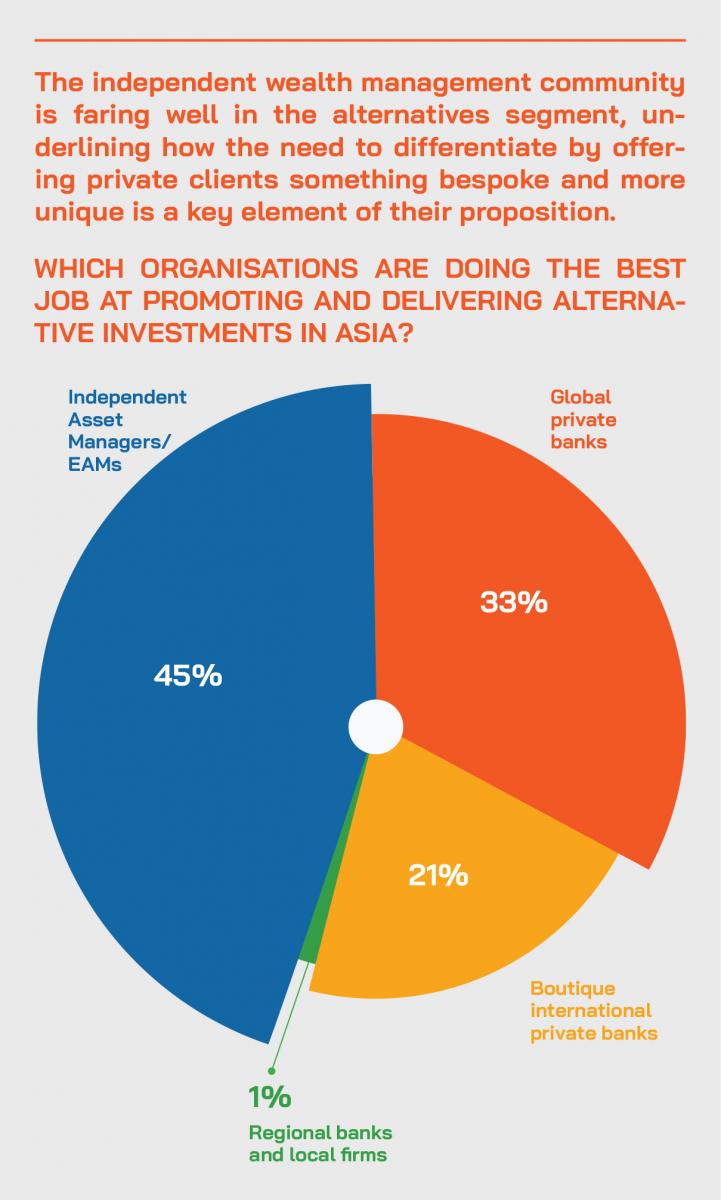

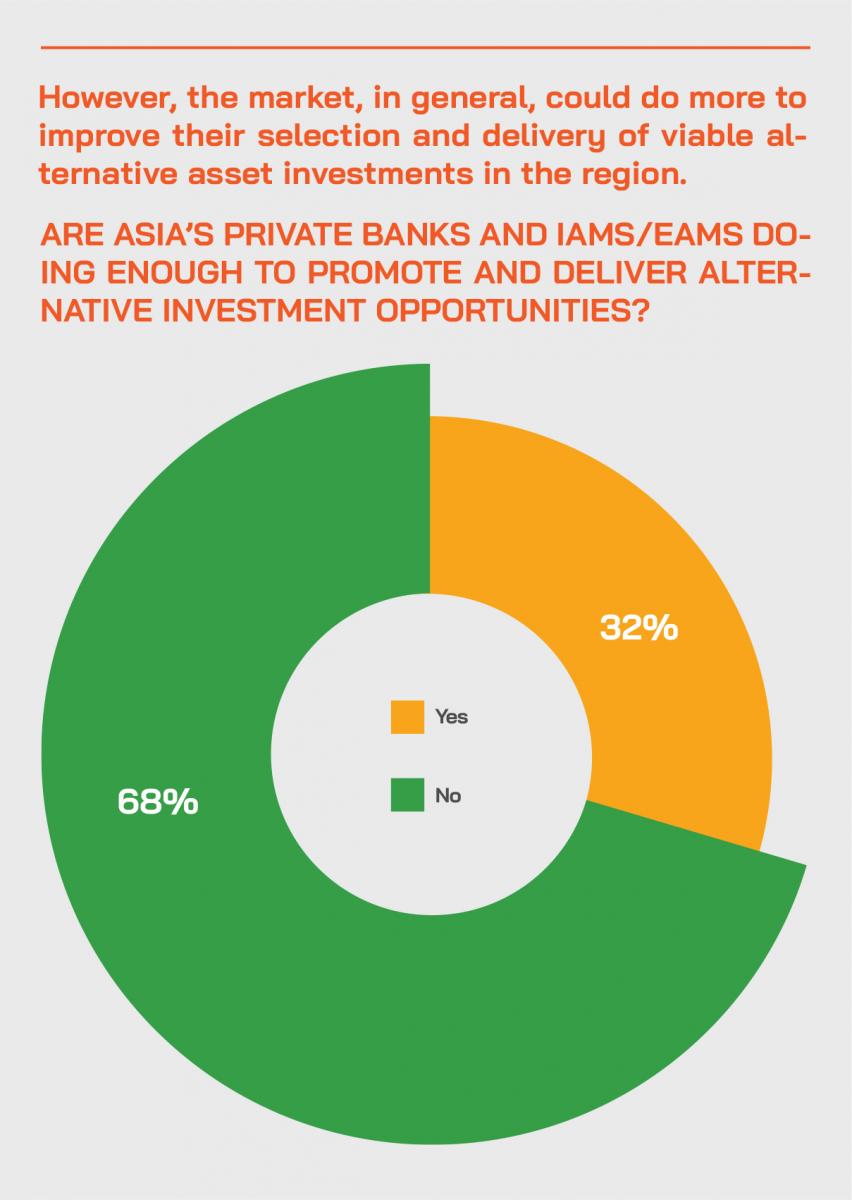

The world of alternative investments has been expanding for some years already, and the theme has definitely caught on in Asia in more recent years. We assembled six experts for a lively, informative discussion on the key trends and the outlook for our Digital Dialogue of September 2. Their broad conclusion, reinforced by views from the delegates in our post-event survey, was evidently that for Asia’s HNW and UHNW investors, alternatives offer an increasingly appealing alternative to the mainstream public financial markets. Many questions were addressed during the discussion. Are alternative investments now a core portion of the portfolio for Asia’s wealthy investors, or should they be? What allocation should they make to alternatives? What alternative assets should they be buying, or considering, and why? How should investors look at alternatives for yield, gain, risk mitigation, downside protection, and in terms of the maturity profile of their investments? Is this the right time to consider long/short equity strategies? How much new money is heading into the alternatives’ markets, or has it slowed this year? Where are the best opportunities - in private equity, private debt, hedge funds, real estate/infrastructure, or commodities? How does gold fit in, as an alternative or as a mainstream public market asset? What are the liquidity and time horizon trade-offs investors need to make to obtain higher yield or higher gains? Who is doing the best job of delivering opportunities and advice to Asia’s HNW and UHNW community? What is the outlook ahead? These are other key issues were debated in what was a fascinating and highly informative discussion.

The appeal of alternative investments will rise significantly in the post-Covid world, an expert said on opening the discussion. We are optimistic about the growing appeal of alternatives, with some fine nuances subject to different asset classes, as the driving factors include the persistent low rate environment, the hunt for yield, concern about uncertainty in market and economy, and downside protection. As to hedge fund allocation, we saw slower activity this year, but sentiment has been improving and growing demand amongst clients. For private equity, this is, in the medium-to-longer term, still a favoured asset class. There is the potential for a slowdown or stop-and-go dynamic in the shorter-term, given the market environment, but a good tailwind for more attractive priced asset classes as of today and looking ahead.

Another guest noted how alternatives (alts) offer an alternative source of income to traditional portfolios, providing diversification and return enhancement through access to a wider set of strategies and investment styles. Alternative assets have delivered good relative returns through previous market downturns and may likely do so again, an expert commented.

An expert also commented on how a number of custodial platforms, like Pershing, utilise other specialist platforms in order to allow access to alternatives investment opportunities, namely alternative funds. Tokenisation has also increased the accessibility to such alternative investment opportunities, he reports, by creating a system in which investments such as real estate and infrastructure projects, which previously would have only been accessible to institutional investors. He elucidated that demand for such access to alternatives is on the rise, as evidenced by the comments made by other experts participating in the discussion.

Two key camps?

A panellist remarked that there are essentially two camps amongst the investors migrating to alternatives. One segment is looking for return enhancement and the second segment looking for yield combined with lesser correlated alpha generation and risk mitigation. In an ideal world, they advised, you may want to have a combination of these for risk diversification purpose in addition to your traditional asset allocation.

In the private space, in particular PE and VC, fundraising did in fact come off slightly looking in Q1 and Q2, but a guest explained that the trend was not as pronounced in magnitude as compared to the fundraising targeting the hedge fund space. So, they concluded, we can see that investors have certainly taken a pause during Covid-19 to re-assess their portfolios. However, we don't think investor appetite has completely retracted. Clients are still selectively looking at managers that they have monitored or started work on already, but realistically it is a somewhat slower, more prolonged process. Also, we see the trend of fewer commitments, but not necessarily less dollar amount of those commitments.

Views from the Experts

Expert Opinion - Jolyn Dang, Vice President and Director, Alternative Investments, APAC, Wellington Management: “Clients are becoming increasingly biased towards dispersion, diversification, and dislocation. Interest in credit funds has been spiking as clients look to tap into dislocated opportunities. The number of diversification-seeking clients is also rising, looking at macro or multi-strategy approaches to gain access to different asset classes and downside protection.”

Expert Opinion - Brenda Lau, Head of Asset Management Asia, Private Markets & Alternatives Markets, Investments & Structuring, Hong Kong, Indosuez Wealth Management: “The impact of Covid-19 will persist for some time. Despite of the challenges ahead, we are confident that private equity will continue to adapt and evolve. The private equity industry's entrepreneurial spirit, resilience, flexibility and adaptability form sturdy pillars allowing it to weather the current storm.”

Going with the flows

An expert reported how in the private equity space this year, companies went from panicking in March/April by cutting forecasts and reducing spend to realising things aren't quite so bad, and then seeing their businesses rebound later in Q2.

There was a significant jump in opportunities in June versus the previous several months, they explained, and a renewed sense of optimism leading to increased liquidity with many of our portfolio companies raising sizeable amounts of additional capital in the quarter and we even saw some public offerings coming to the market. Interestingly, wariness over what the future may hold is keeping private valuations relatively in check and causing companies to accelerate their financing plans, and at the same time there is renewed confidence in the IPO market.

Expert Opinion - Brenda Lau, Head of Asset Management Asia, Private Markets & Alternatives Markets, Investments & Structuring, Hong Kong, Indosuez Wealth Management: “It is important to main a diversified portfolio at all times. In the near term, distressed and secondaries will be an attractive play.”

Two key ‘buckets’ for private equity

Looking ahead, this same expert anticipates that future PE deal activity will primarily fall into two buckets - sectors with realised or newfound growth due to Covid-19 and sectors with disruption to growth. With this as a context, she reported, outside of our traditional focus areas within consumer, tech and FinTech, we see opportunity in areas such as travel, retail, direct-to-consumer retail space, distanced learning, connectivity or payments, telemedicine and medical tech/devices.

As to the wider fallout from the pandemic, a guest remarked that it is still a bit early to predict, but that they expect consolidation of managers, an acceleration of digitalisation and shift from offline to online on all levels of doing business, as well as the increased exploration, realisation and adaption/implementation of ESG metrics or policies.

Views from the Audience

Hubbis: Do you think alternative investments are becoming more important for HNW clients in Asia? If so, why?

- Yes. Traditional investment products are no longer enough for diversification. Investors

- knowledge of finance is increasing, and more people are interested in non-traditional types of investments.

- Yes, as HNW clients nowadays are seeking a higher and more stable return, relying on the products that are widely available in the mainstream markets will not be able to achieve that.

- In an ever-changing world, alternatives provide both risk diversification and yield enhancement options.

- Yes, due to fear and doubt about the sustainability of current levels of traditional markets.

- Alternative investments are good for diversification purposes and good in a zero-interest environment.

- Yes, for diversification and higher potential returns.

- Yes. Especially now during the pandemic phase as we see how reluctant clients have been

- to participate in mainstream investments and are hoarding cash. As opposed to generating zero returns, they should park their money in alternative investments instead that seem to be performing well.

- Yes because they help diversify portfolios and generate alpha.

- Yes, we see them as offering uncorrelated returns.

- Yes, because the major assets are looking more and more correlated to each other, therefore lessening diversification. Alternative investments become ever more crucial in giving your portfolio both diversification and alpha.

- Yes. In a low yield environment and with the volatility of the markets, alternatives play the role of diversifier and alpha generator.

- Yes. The yields on conventional investments are at its historic low given the global interest rate environment

- Yes, because of low interest rates and high valuations in public markets in general.

- Yes, partially because they like shiny new things that are exclusive and partially because a lot of other more traditional exposures have run up so much already.

- Absolutely. It helps to reduce volatility, long term yield enhancement and diversification, especially for a sizable portfolio.

- Yes. The role of alternatives in managing a portfolio has become increasingly important

- for Asian Clients, because correlation amongst asset classes overall has been on the rise, so we are looking for more choices to maintain the diversification for the portfolio.

- Yes, and there is increasing awareness of HNW clients and increasing accessibility of alternative investments.

- Yes, alternative investments are becoming more important in terms of long-term positioning as we see increased volatility in their traditional portfolio mix.

- They have been important for some time now and are becoming even more popular.

- Yes, clients are increasingly looking for alternative sources of portfolio diversification that are not directly correlated to the usual equities and fixed income.

Defying the models

A guest then attempted to more accurately categorise alternative investments, describing them as assets that usually defy traditional modelling techniques, and do not fit into a conventional strategic or tactical asset allocation framework.

These are typically assets that are not in the in the normal domain of liquid, mark-to-market public markets, and that cannot be modelled or easily labelled, they observed. Of course, the assets generally fit into the categories of fixed income, or equity, or infrastructure, but these are at the end of the day assets that defy the normal easy definition of liquid, marketable investments.

A broad universe of opportunity

Another expert, representing a USD28 billion global alternatives platform explained that they invest across a wide spectrum of hedge funds with different focuses on asset classes, geographies, and with different strategy approaches, and with a growing focus on private equity in recent years, now totalling USD4 billion in aggregate, focusing mostly on later-stage growth opportunities and biotech.

We are global with 14 offices worldwide, they reported, and our clients want to find sources of income that can behave differently to the typical equity and bond portfolios. Alternative assets have been a good source of relative returns. What are our clients looking for? One category primarily looks for return enhancements above their traditional portfolios, so we tend to focus them on private equity, aiming for higher octane returns, which we have achieved historically in the double-digit range, with the quid pro quo of illiquidity. And for those clients looking for potential upside and at the same time, less correlated alpha generation and also with an element of downside protection, then hedge funds are a suitable complement to their portfolios, and they also provide better liquidity.

Hedging the bets

She explained that this year's market downturn was a great example of how hedge funds can add value, as on average the hedge funds were only down about 6% to 9% while markets slumped about 20% to 30% at the worst times. And most of them are now positive, she added, so the credit funds for instance or even macros have already been achieving double-digit return levels this year.

Another expert pointed to key areas of focus for their organisation as private equity, private credit, and potentially real estate and infrastructure, with the more liquid side being towards hedge funds.

Seeking alpha – slowly and privately

Alternatives, he commented, can actually help investors to extract potential alpha from the private market space where the assets are less volatile. And so too hedge funds offer lower volatility. Certainly, we find that alternatives have been becoming increasingly in vogue in the Asian high net worth space in the last few years already. And globally, there are moves afoot to help expand the field of alternatives to a broader range of investors, so we see moves afoot in that direction from the US SEC. In short, we see great popularity and greater understanding ahead. Moreover, in this type of environment where markets are so fickle, I think this definitely is a good area of investment to consider.

A guest agreed completely with these views and added that the momentum is indeed in favour of alternatives, with the traditional 60:40 allocation to equities and bonds less able to generate the returns investors expected and realised in the past.

Avoiding correlation

As to correlation, she said, some of the alternative assets have very low correlation or even negative correlation to other [mainstream] asset classes. And I would comment that alts are no longer really so alternative today, as institutional investors some long time ago started to invest quite a lot of money in private equity and hedge funds, and then the HNW and UHNW investors and family offices followed suit. The trend is certainly on the rise.

An expert did, however, point to the downside of some of the positive attributes of such assets. Illiquidity is a real practical concern for us, he cautioned, as there are instances when an investment needs sudden liquidation, perhaps because of divorce, so we try to split these assets into different portfolios.

Is gold an alternative investment, or is it a highly liquid, highly visible, short or long-term investment? For the purposes of this discussion, gold was considered an alternatives investment, largely as it has no financial return in terms of yield, is non-correlated, and defies any valuation metrics.

Liquid gold

As to investing in gold as part of portfolio allocation, a gold market expert asserted that physical gold remains the best, most liquid and most appealing safe-haven option for investors seeking non-correlated assets and a hedge against all types of uncertainties. He strongly advised against paper gold, such as ETFs, arguing that ETFs are really a sort of promissory note.

Looking back at April, he said, there was a huge disruption in the futures market because if you traded futures and you wanted physical delivery, actually there was no physical gold available. So back in April, we saw an arbitrage of USD80 per ounce which is almost a 5% arbitrage between the gold price in the futures market and the gold price in London because to fulfil this futures contract on COMEX, you had to ship it from London to New York. And actually, what we saw the first half of the year is huge amounts of gold moving from Switzerland, from Hong Kong from Singapore and from London, over to New York to fill the COMEX vault.

Physical gold is not complex to deal with; there are leading firms to deal with professionally and securely, he added. It is very liquid and very easy to transact in volume. We have seen a lot of demand from the private banks in Asia this year, and more and more asset management company interest, bringing physical gold to the table for their clients because of real concerns with what’s happening in the financial markets. And gold has stayed incredibly liquid throughout the crises we have seen in the past and indeed this year.

More ahead for gold?

“As to the outlook, given the strong rise in gold prices, this same expert observed that the world is very far from out of the woods,” said one expert. “We are in a recession, and uncertainty is high, negative yield bonds proliferate, and central bank interest rates in the developed markets are almost zero at the moment. I therefore encourage people not to give up on gold because the inflation-adjusted price is still relatively low and at the end of the day, even when Covid passes we will remain with the consequences, we’ll remain with geopolitical tensions and again, the very low interest rates, so there's still more to go for gold.”

The discussion turned to credit and private debt. Investors can earn higher returns than the remarkably low yields available on higher-rated public market debt, but it comes down to what the investor is willing to sacrifice, whether this is liquidity, or some transparency, or extended duration perhaps.

Open the right dialogue

So, that's the first conversation you need to have with your clients around return expectations and what they are willing to sacrifice, he observed. Each segment has different attributes, so infrastructure investments are very long-lived, some peer-to-peer lending is well regulated, some is less so, trade finance has different characteristics. Opportunities exist across the board, but it comes down to the right conversations with the clients to find suitable investments. These assets are available, and that is partly why allocations are increasingly tilted towards alternatives, but it comes down to the conversations being conducted properly.

Another panellist agreed, noting that their range of hedge funds offer investors exposures ranging from equity-focused strategies, sector-focused, region focused, fundamental to systematic and all the way to fixed income. They explained it does indeed depend on the client's risk-return appetite, on the profile they're looking for, how much liquidity they're willing to sacrifice, how much volatility they can stomach. They explained that they see most demand nowadays from clients looking into dislocations, dispersions or diversification, so that investors with specifics view on asset classes will tilt more towards specific strategies.

Distress – a growing opportunity?

A guest pointed to some interesting opportunities ahead, for example, in the distressed space. If you look at the end of last year, actually, the amount of debt that had already built up in the system was already then very high. Defaults are not high elevated, but this is just the beginning, with many businesses still shut. Governments cannot save the world. And then there is the danger of employees getting more income from the subsidies instead of actually working, so that is a great danger. So, we think the default rates will be quite high, especially in certain areas like our retail, shipping, energy, hospitality, and some others.

Another area of focus ahead is the secondary market in alts. We see investors perhaps wanting or needing to offload some of their portfolios in order to compensate for the revenue losses elsewhere, a guest reported. Add to that the US Dollar weakness, and there could be opportunities on the private market side, so both distressed and secondary market assets. Two interesting areas, we think, for the coming few years.

Dislocations ahead

A fellow panel member agreed, adding that there will be opportunistic openings ahead, with increased market dislocation. We have different segments of clients, from UHNWIs to HNWIs, and within those segments different appetite and criteria, some more aggressive, some more conservative, he remarked. Some are looking at private credit and some real estate as well, both across the equity and debt structures. But we must be very selective in different sectors, so retail is weak, while logistics, technology, data centres, these are strong and long-term themes. Infrastructure is long-term and offers stable, contracted assets providing a very secure revenue stream, so in favour with more conservative clients. Senior credit is attractive for them as well, while investors that are more opportunistic and more aggressive are attracted more to private equity.

A guest highlighted the ongoing dislocation in the public markets where winners just keep winning, largely the tech and medical sectors, and losers keep losing, for example, retail, or commercial travel and hospitality. If you look across the hedge fund space compared to mutual funds and their counterparts, the dispersion of returns can be very large, he observed, so looking at the equity long-short bucket alone, the monthly dispersion in terms of return can be as high as 16%.

Find the right manager

He commented that, accordingly, finding the right managers for alternatives is very important. And that is our role as a private wealth manager, we need to identify the best for our clients, he said. And of course, in terms of the portfolio allocation side, we always recommend clients to allocate to a diversified portfolio. Potentially we can use the core and satellite approach, so a multi-strategy, stable strategy as a core holding and then on the side perhaps sector strategies, sector equity long/short, and so forth.

Another panel member agreed that manager selection is indeed very important, whether in the public or private market domain. Having spoken to our in-house hedge fund specialist, a long-short strategy is difficult at this moment because short comes with a cost and that cost has been quite high since April, she commented, but for us, we are very lucky, because we selected the right managers, and the long-short strategy has given us quite decent returns year to date in the portfolio from certain sectors and also from themes related to China. Accordingly, I think it's good to keep this exposure in order to preserve capital for the clients.

The long/short game – all about timing

Whether this is a great time to consider long/short equity strategies, the current environment lends itself to certain of these types of strategies and funds for those looking to exploit dispersion between and within equity markets or sectors. So, these are still amongst the most favoured strategies looking ahead into the next 6-12 months based on investor sentiment data. However, equity long/short bifurcates into two camps, one that involves investors looking for very specific sector exposure and another that prefers low net market-neutral approaches.

Most of our client conversations have been revolving around credit approaches for dislocations, they added, macro for diversifying purposes, or equity long/shorts that are focused on playing the dispersion amongst equity assets.

Looking ahead through the Covid-19 mists

Shifting the conversation to strategies for the foreseeable future, a guest indicated that taking a two to three year view, it is advisable to realise some of the gains from this year and boost diversification and downside protection in the portfolios.

With virtually zero or negative rates, everyone thinks equity markets are now on an indefinite uptrend, he said, but we have heard that story before, and that tends never to be the case. So, I'd say hedge, diversify and structure portfolios, even if you sacrifice some return now, in order to capture some of the downside if it happens, or to hedge because maybe, just maybe, there's not a perpetual profit machine out there, and we might just see another down.

Caution is a buzzword

Another expert agreed, noting that while investors have enjoyed what amounts to a get out of jail free card this year, his firm has been cautioning clients since July to put in some protection against vulnerabilities, as certainly a lot of things can go wrong from here on out, especially over the next couple of months. So, yes, he said, we've been quite actively having that conversation with clients and actually having that protection also enables us to run with some ideas that we have high conviction on, but that we couldn't achieve without adequate protection.

The 3 Ds - diversification, dispersion and dislocation

A guest mined further into the concepts of diversification, dispersion and dislocation. If clients are looking for dislocations, they said, then very clearly the credit space would be a space to be in, while if clients are looking for broader diversification there is increasing interest in some macro strategies, which is maybe a little bit counterintuitive just given how out of favour macro strategies have been in the last decade, but I think there is a value proposition for macros in the portfolio, and you have this year had some of the stellar performances coming from macro managers, but again it all depends on the selection of the managers.

They added that also for diversification, one way to diversify is multi-strategy as this works particularly well for clients that have a fairly directional portfolio, who may not have a strong view on asset classes, but who just want to be able to tap into different opportunity sets when they arise across different regions. Multi-strategy can also provide some downside protection and offer upside potential.

And if clients are looking specifically just to play dispersion, conversations have been evolving around equity long-shorts, and interestingly enough, here these split into camps. We have clients that are either looking for very straight out specific sector exposures, perhaps tech or healthcare to ride the longer term secular growth, or for rebound sectors such as financials or energy, and to exploit some of the largest dispersions that we have seen recently where there are such wide gaps between winners and losers. Finally, there are the buyers who seek low net market neutral approaches, where investors want the upside potential but have a much larger focus on downside risk mitigation given the uncertain market environment.

The discussion closed with the panel agreeing that the world of alternative investments remains robust, but that like with the public markets, the pandemic demands greater selectivity, and some additional caution. For Asia’s HNW and UHNW investors, there will be likely be a wider array of prospects ahead, and an increasing effort amongst the wealth management community to curate and deliver the best opportunities.