Publications & Thought Leadership

How can you improve client communication, engagement and experience?

Apr 22, 2022

The wealth industry has shifted significantly in recent years towards a client-centric model that sidesteps ‘product pushing’ in favour of carefully curated concepts, information and products delivered by the advisory community in a far more nuanced fashion. The delivery of this information and these ideas is, of course, increasingly digital for the lower end of the wealth spectrum, but the higher up the wealth ladder one rises, the more there is the hybrid model, which scales up the personal or human delivery and connectivity with the clients. The premise for our Digital Dialogue discussion of March 31 is that the RM (here a catch-all for all client-facing bankers and advisors) will continue to be emancipated by technology from a host of more mundane tasks, freeing him or her to focus more intently and productively on the delivery of a more personalised and far more relevant wealth management offering in all its guises.

The Panel

- Thomas Bosshard, CEO, Adviscent

- Jessica Cutrera, Founding Partner, Leo Wealth

- Damien Ryan, Senior Advisor, Teneo

- Dominic Gamble, CEO and Founder, Upscale

- Karen Tan, Head of Private Banking, Asia, VP Bank

These are some of the questions the panel addressed:

- How can relationship managers improve their communication with clients?

- How can you engage prospects and clients in a more impactful manner?

- How can clients engage more with what RMs are discussing with them?

- How can RMs use analytics in a more meaningful way to improve their engagement with clients?

- Clients today expect bespoke, tailor-made advisory – how are you delivering that?

- What’s changed in the post-covid world?

- How can content be presented to the RM and client in a more personal way?

- How important is agility and flexibility in handling clients effectively?

- What can the institutions do to help train professionals in these matters?

- What does being client-centric really mean? Do we have enough time for clients?

- Do RMs have the right tools to get the job done?

- How can technology help? How can it help manage the RMs day?

- Are RMs dedicated to delivering the best and most relevant solutions and practices for your clients?

- Do Relationship Managers send engaging information to their clients?

Setting the Scene

In today’s intensely competitive world of wealth management, private banks and independent wealth managers of all types are seeking differentiation, and one way is to make sure their bankers, RMs, advisors and investment counsellors are more efficient and effective by arming them with smart content solutions. With the right type of relevant, well structured, easy-to-digest ideas and content that those client-facing team members and their private clients can easily peruse and digest, the banks and other institutions are further along the road to helping drive revenues and enhance client loyalty.

The discussion on March 31 analysed what tools, processes and technologies the RM can be provided with to make them more efficient, more productive, more empathetic, more nuanced in approach, and more client-centric. And the panel considered how all that will result in more revenues and more clients, and discuss the additional benefits as well, such as greater job satisfaction and better retention of the top industry talent.

The experts offered a valuable glimpse into the future of how to deliver the right combination of information and detail, how to enhance relevance and personalisation, and how to help build the wealth management offering for the future.

The Discussion: Key Insights & Takeaways

In a rapidly changing world, significant shifts are taking place, including in the typically conservative wealth management industry

“The wealth management landscape has changed,” a guest reported. “The pandemic has really forced investment professionals to think more deeply and more creatively about how they engage with clients and how they use technology in a way that is personalised and enhances that engagement.”

She explained there has been too great a focus on quantity over quality, and as a result, that overcommunication actually had a negative effect. “There is still too much content that is not well thought out, that is not necessarily relevant to the clients, that feels impersonal, that is tough to digest. It adds up to being overwhelming. In our experience, the right way to communicate is often not to say anything until you have thoughtful, relevant content to deliver.”

She explained that they had introduced a monthly report for clients, tailored to be as comprehensive but also as relevant to the client base as possible.

“What that means for us as a business is that we have more human capital and more resources to devote to clients who truly have needs,” she said. “We all have high and low maintenance clients, those who might also go through personal or career turmoil, and then need greater support. Accordingly, we need to use our resources wisely, so we are there for this personal touch as and when needed.” She added how vital personalisation is to the proposition, whether in the content produced, or the way it is communicated to clients, or the sales and marketing strategy.

“The best outcome for the end user will always emerge from having taken the time to understand the client needs and for relevant information and advice to be reflected throughout the whole engagement process,” she said.

She added that working with external parties to refine content and delivery can be a tremendous investment that ultimately benefits your end client by tailoring the strategy, content, and communication directly to those clients. “Ultimately, that is how you improve sales, but nurturing and build the relationships that help you to grow your business sustainably,” she stated.

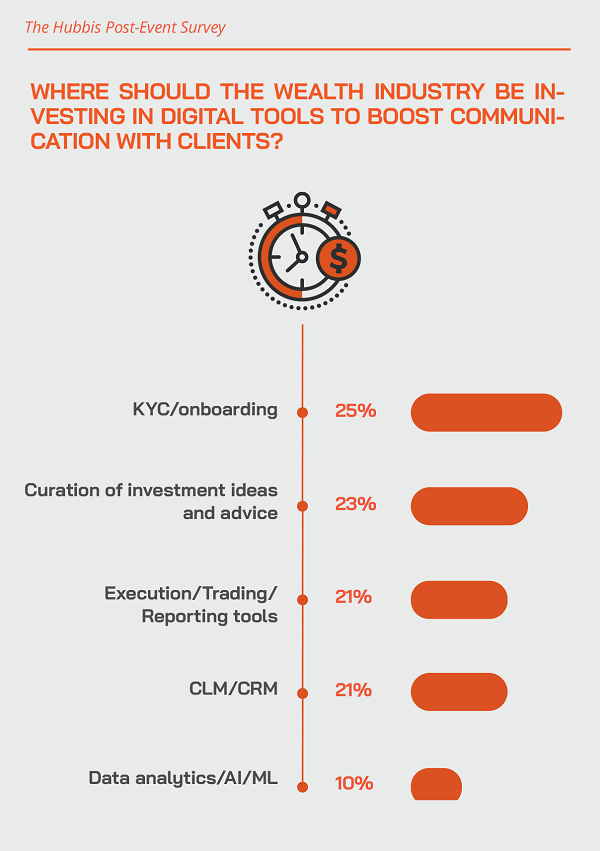

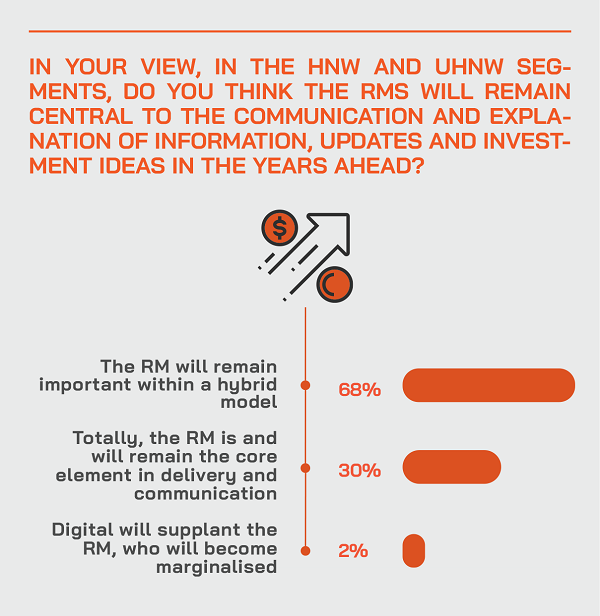

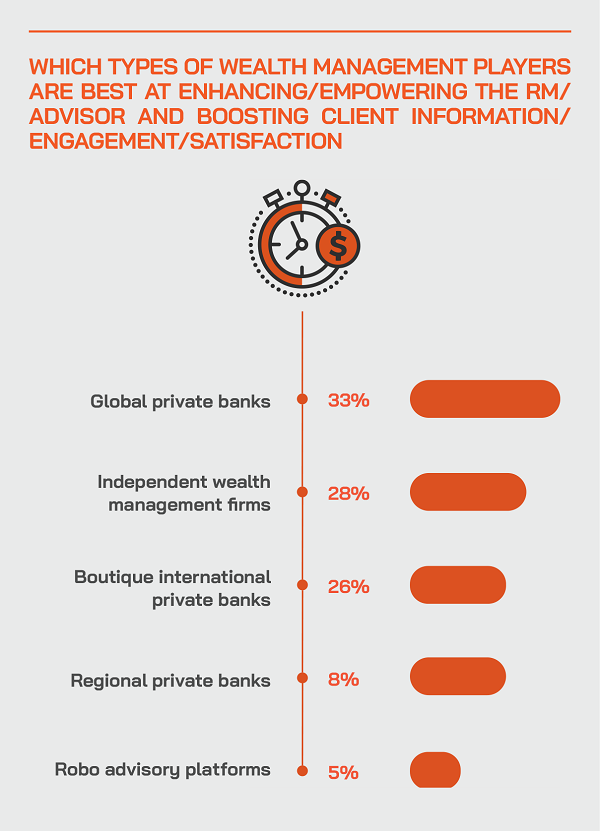

The Hubbis Post-Event Survey

We enjoyed many replies from the delegates who joined the event, and we have distilled those views into the following snapshot.

Hubbis: How can you communicate more effectively with your clients?

- In formats that they are used to and prefer

- Understand their needs and risk appetites

- Quality over quantity

- Don’t overload them with information, and don’t go borderline harassment

- Entirely relevant communication, don’t waste your and their time

- Avoid generic information and content

- Periodic phone calls to stay up-to-date are useful, but listen don’t preach

- Provide RMs and advisors with relevant, digestible, easily communicated points to relay to client

- Don’t get wrapped up in jargon, as it looks more like you don’t know what it all means in simple language

- Listen, listen and listen some more

- Be flexible, empathetic, and build rapport before building sales

- Try to be ‘connected’ in each conversation, think client train of thought

- Be clear, concise and succinct

Engagement is the touchpoint for future-focused wealth management

A guest highlighted his view that engagement between the RMs/advisors and clients/prospects has not been prioritised, but that is changing, as banks and other providers recognise that wealth management is really a client-driven consumer business, and that consumer is constantly evolving. there's a sea change coming, all about to be enforced on the industry in this engagement world. Digital had accelerated the changes, but a major sea change lies ahead, he told delegates.

Smart content is required for better engagement and superior outcomes

Another panellist pointed to his firm’s expertise as a smart content hub for research analysts, investment writers, sales managers and other content owners at wealth managers and private banks. He said that their solutions are part of the revolution that is indeed now taking place in how the wealth industry delivers information and ideas to its private clients in a more engaging, more accessible and easier to comprehend manner.

Their solutions are aimed at the private banks, in particular, and provide a means to elevate their client connectivity and to differentiate themselves in what is an increasingly commoditised wealthy industry that has been driven to standardisation by regulatory and cost pressures combined. Asia is now in the sights of the firm, which has a team of around 50 and a track record of more than 11 years, and that has been working with many of the leading mid-to-large private banks in Switzerland and elsewhere in Europe.

He told delegates how the more relevant the banks think their content is to their success, the better of course it is for them and for the banks. Some, he said, have been keenly focused on the topic of high-grade personalised investment content for some years, and others are coming round to this vision. He explained that if content, form and delivery can be smart and aligned, then the outcomes and results for all the parties improve.

Tailored, relevant, personalised, easy to view and digest – these are all vital qualities for improving client engagement via ‘smart content

A panel member observed that it is more important than ever that if a banker or advisor wants to make an impact with an individual client, the information they deliver, its form and its delivery must be tailored, personalised, relevant, easy to access and simple to digest.

“It is crucial that companies in this world of wealth management think deeply about client engagement,” he told delegates. “First, this is a highly competitive industry and share of voice is tough, and too many are employing a fairly similar playbook. Second, as we recover from the pandemic, people are looking towards engagement in a different way, be it through a digital lens or even anxiety around public gatherings. So, with those factors in mind, anyone who gets it right will enjoy a real competitive advantage.”

Make sure that unnecessary fences are built that by default become obstructions to your collective vision

An expert elaborated on the approach to the content creation and delivery problem they are trying to solve. They call it the ‘Fence Analogy’. On one side of a fence, there are the production teams, meaning the investment office, the research department, the product teams. And on the other side of the fence, there is the advisory process, meaning the interaction between advisors, clients, and prospects.

“And therein lies the problem,” he explained. “One side produces quality content but tends to sort of throw it over the fence in a rather ineffective way by blasting out emails, publishing, presenting some research on internet pages and so forth. And the problem on the other side of the fence is they often think there is too much content, that it is not relevant and that it is awkward to share those pieces they do want to relay to clients.”

But you need to have proper orchestration, he asserted, and for those creating and delivering the information to understand how the information is received and reviewed by clients. “Accordingly, we employ an API which allows the bank to embed the content in their own channels feed on an e-banking environment or on a client advisor front-end. In short, the right content in the right format.”

As content moves centre stage, you need to tell stories and in the right ways to properly engage your audience

Out with the pdf and in with new methodologies and approaches, another guest said. “Advisors are receiving an estimated up to 20 ideas a day, so many of which are simply filed and never looked at,” he said. There is simply not enough visibility for the content creators of the end clients, and the feedback from the RMs/advisors is poor, and the clients are receiving what are effectively product ‘pushes’ which are no longer appropriate for this day and age. Accordingly, he advised the industry to switch to storytelling, or more specifically a story themed approach.

“How do we generate or source more friendly content that our client base in general wants to read, and in a device friendly format they're capable of reading on the move and amidst all their clients’ other distractions?” he pondered. “Content is king, and the way that we approach that is incredibly important for this business can win more traction with the customer base, rather than lose traction, as is happening now.”

He added that the RM is the centrepiece of delivery and the creation and build of trust. “We as an industry need to invest a lot more in this element of sales and marketing,” he stated, “in order to dramatically improve content creation, creating better looking sales and marketing material and updates. We are soon to launch new solutions to provide organisations easy, cost effective, fast ways to make a more comprehensive sales and marketing library in-house avoiding the need for so much time spent on trying to create in-house.”

Another guest agreed with all she had heard, adding that if at the same time the RMs and advisors are freed up by technology to spend more time on their client-facing roles rather than mundane chores then the outcomes will be ever better.

The content you produce, the form it takes and the means by which you deliver should all reflect the values and character of the organisation

An expert explained that you are what you deliver. “You want to run a programme of engagement that has impact, and which makes a difference for both clients and the business itself,” he said. “To do so, actions and approaches must reflect the firm’s values and positioning. So, if your positioning is to be a trusted and considered custodian of assets, your activity, be it a dinner, or conference, a newsletter, or whatever, should be aligned towards that. Likewise, if you're seeking to project an image of being innovative and dynamic, the choice of menu, your venue, the speakers, the wines and so forth, should have those attributes.”

He said the image should be reflected also in the projects that the bank or firm supports, for example related to philanthropy, or support for causes, such as the arts or community projects. “Some might feel their business is too small or too young to present these facets, but I believe this must be addressed, in other words the actions and decisions must represent who they are trying to be.”

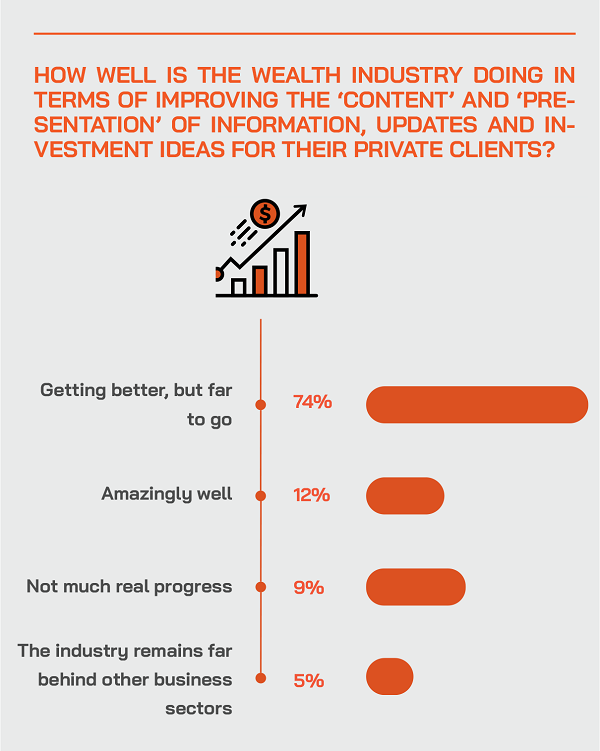

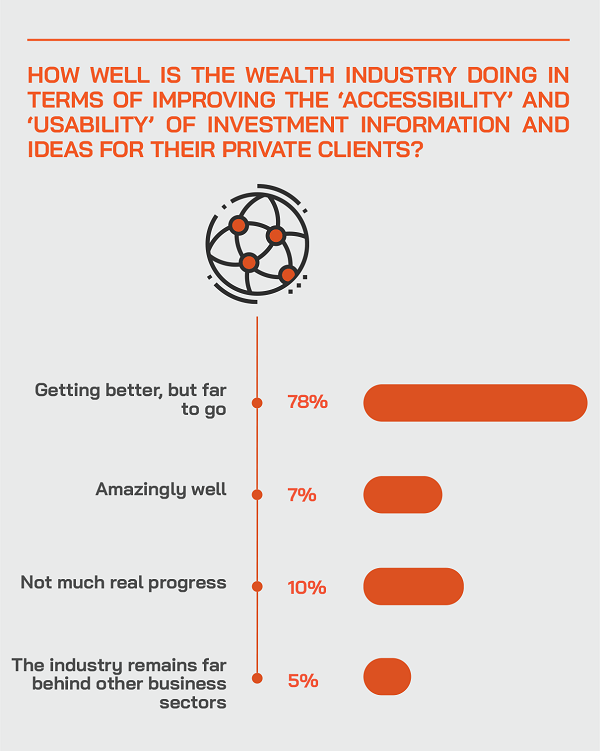

The Hubbis Post-Event Survey

We enjoyed many replies from the delegates who joined the event, and we have distilled those views into the following snapshot.

Hubbis: What can be improved within your own organisation to help drive the efficiency and impact of your

interactions with clients?

- Try to create an environment where client focus is a mindset and priority of everyone in the organisation

- More training and role-play sessions.

- A smart digital platform.

- Better content generation, improving marketing of content so that it can reach more clients

- Quality of information, don’t be box ticking and delivering communication for communication’s sake

- Upskilling the sales effort to the modern word and new industry sector standards

- The senior management/partners should take even more initiative to develop a personal rapport with

- clients, and support the RMs in their client relationships

- Keep things relevant and concise, not lengthy and unapproachable

- Train teams to appear and actually be sincere, not looking through clients to their end of year bonuses

- Streamline administrative work, allow more time for RM's to engage with clients with energy

- Delivery accessible investment communication via mobile phone and other applications rather than just by email

- To provide solutions to meet clients' needs, information must be timely and outline actions and rationale for decisions, so that dialogue can be started with the aim of arriving at solutions

Shake off the old habits, regulator-driven conservatism and embrace the new world and new methodologies

A guest observed that too much of client information and ideas is delivered in the form of difficult to digest and fairly generic content delivered through a PDF. “These are often unopened, and not trackable,” he said. “In a world of intense regulation, the pdf has come to be the safe option for the wealth industry, but other business sectors are far more dynamic in how they embrace both technology and content, to inform and influence their stakeholders.”

He pointed to rapid growth and profitable ‘smart’ media organisations in the US such as Axios and Politico. “They're dynamic in their delivery, using things like Instagram, amongst others, to get the content out there. Secondly, they make it a bit of a surprise, where it's short form content, the articles are broken out, they highlight using bold, there's Q&A in there. And importantly, there's multimedia such as video, and short form video. All of this is designed to be read quickly on the go, on a mobile device, which can be shared, and thereby growing the audience and the influence all the time.”

He conceded that he does not have a perfect answer for how the finance industry can proceed but said that new entrants are quickly showing the limitations of the established model, which has emerged partly due to the limitations imposed by the conservative regulatory environment. “But what we need to do is look across at those businesses winning market share and it is so often those that are dynamic in their delivery, and importantly, are taking risks with their content.”

He said there are numerous topics to latch onto. “There is no shortage of engaging topics for content, but what we do lack is the combination of creativity, boldness, and risk taking to derive content and communicate it properly,” he said. “But if you can create a platform that is a forum where speakers could be brought in, where external voices come together to discuss these matters, and if you do that in a genuine thoughtful way, ultimately this will build trust and boost the brand. In short, be perceptive and be bold.”

Excessive use of quantitative portfolio optimisation engines and data is obscuring engagement

An expert warned that the rise of quantitative portfolio optimisation engines in the wealth industry and the delivery of data on that to clients were causing barriers in the communication and understanding.

“They create a lack of talking points for real meaningful dialogue,” he cautioned. “It is clear, especially in an advisory context, that you need to give people content and context also, in order to understand, for example, a risk-based portfolio approach. Simple demonstrations of relevance and connectivity that clients understand are much more effective than if you just bombard the audience with numbers.”

He explained that you need to communicate the findings or the data in a way that really resonates with people, you then need to contextualise the findings by finding the context clients can actually relate to. And after that, you need to make sure that the RMs/advisors and the clients really understand it all, and then that there is a proper bridge between the numbers, the technicalities, and the front office by using investment stories and content recommendations.

“In this way,” he reported, “we think the private bank can give back the decision-making power again to the advisors and the clients. And you can scale the business while offering the high touch experience, especially important for the higher wealth clients.”

The wealth management industry needs to acknowledge that it is indeed a ‘sales-driven’ business

Stripping everything back, anyone advising or providing a solution to a client for which they are getting remunerated is working in a sales organisation.

“The industry has become wary of being tarnished by the ‘sales’ label,” a guest observed, “especially since the global financial crisis brought about by excessive product pushing, particularly of hyper-complex products. We like to come up with these other ways of presenting ourselves, as holistic advisors, trusted advisors, as solutions providers, but not as sellers of products. But I think we need to get over all that. There is such a thing as good sales and good relationship management, and the corollary.”

He expanded on this view, stating that sales engagement centres on understanding how to win a prospect, and how to grow a client relationship. “Whoever you are you can get better, and training and upskilling are essential. If we are to build scalable commercial businesses, we need to find an approach where quality, personalised service, storytelling, are present, as all of these good things are scalable. Technology is no silver bullet, but if implemented well does enable us to scale these businesses and not just have more sales, but better sales.”

Soft skills are essential, and provide the foundations from which to grow the wealth industry

Another guest agreed, adding that she sees the development of soft skill training as one of the most important foundations of any banker, whether corporate banker, investment banker, or private banker. “You need to understand the whole process, from how to start a sale, to proper engagement and then closing,” she said. “On top of that, you need the negotiation skills as well, because a lot of time clients would be bargaining, and you therefore need to be able to negotiate in such a way that you will create a win-win and not leave the client feeling they are losing out. These skills make a world of difference.” She said that training in their organisation was core to their very being, and that the training goes throughout the teams and levels.

Spend on content, spend on better engagement and you will reap the rewards but if you fail to grasp this nettle new entrants will eat into your rice bowl

An expert closed his observations by stating that budgets and established practices have long been impediments to moving to personalised, relevant, easy to view, simple to digest content.

“But we need to grasp these concepts, otherwise the industry will be upended by start-ups who are challenging the norms and deliberately using content as an engagement tool in different platforms. And the first steps are to explore ideas as teams. You might not end up with the perfect outcome, but the journey will at least bring various views out there.”

He said that ultimately, the bigger the organisation, the greater the need for consensus to get this done, but as a guide they need to look outside the wealth industry, for example at the high-end luxury market which is forging new ways and means to connect with their customers.

His final comment was that post-pandemic, there will be greater weight and value ascribed to authenticity and substance. “Whatever you do, your compass should be not straying too far from where your roots are and who or what you represent,” he concluded. “Those who get that right will have a lot of those elements in common, and they will be most successful.”