Publications & Thought Leadership

Family Offices in Singapore – the Market Evolution, the Mission and the Operational Challenges

Jan 20, 2021

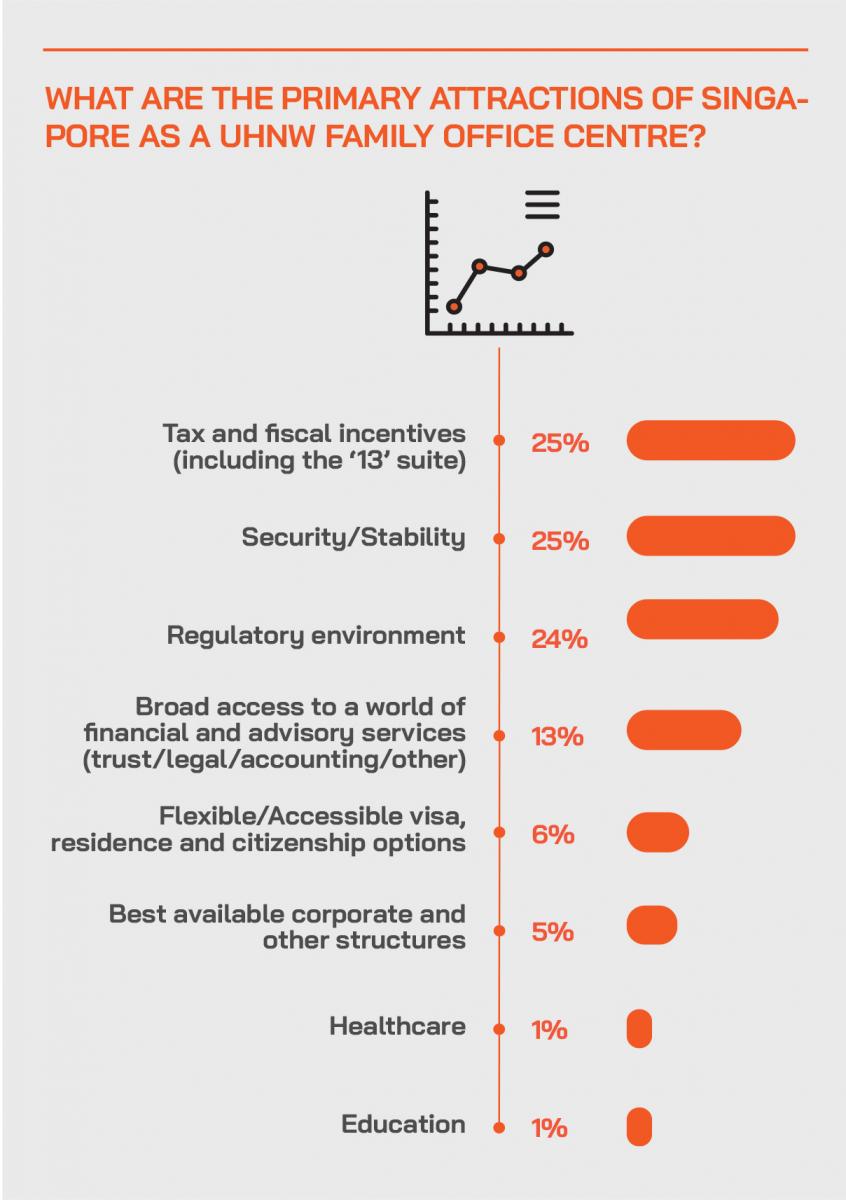

Asia’s growing ranks of UHNW and HNW individuals and families in recent years have increasingly been selecting Singapore as the jurisdiction of choice for their single-family offices, and at the same time, more and more multi-family offices are also making use of the remarkably advanced infrastructure to establish and/or expand their client base in the region and indeed across the globe. Not only is the island state now almost ideally set up for the creation of such family offices due to the structures available (including the early 2020 arrival of the VCC), the accommodating regulation and the wide range of government incentives available, but Singapore offers a deep and wide range of wealth management, legal, accounting, consulting and other services, as well as great flexibility and quality for such families regarding immigration/residence, education, healthcare, security, housing, and lifestyle. And in more normalised times, the travel infrastructure is second to none. Why exactly is Singapore becoming the go-to location for single- and multi-family offices and for UHNW and HNW clients in Asia and from further afield? What developments are actually taking place, and what is the progress so far? How are the HNW and UHNW client requirements changing, and why? What are the key regulatory and compliance developments and challenges? How deep and developed is the wealth and asset management community in Singapore today? How do the private clients identify the right firms and the right experts for professional advice? These and many other issues were debated in what was a lively and informative Digital Dialogue event on January 14.

Panel Members

- Lee Woon Shiu, Managing Director & Regional Head of Wealth Planning Family Office & Insurance Solutions, DBS Private Banking

- Ee Lin Chan, Director, Tax & Legal, Family Enterprise Consulting, Deloitte

- Edmund Leow, Senior Partner, Dentons

- Rolf Haudenschild, Co-Founder, Ingenia Consultants

- Damian Hitchen, Chief Executive Officer, Singapore, Swissquote

An expert opened the discussion by offering his perspective on what a family office is. “It is an entity through which a family tries to manage their affairs, not only their financial affairs but also their personal affairs, including their family succession issues. The family wealth is a big part of it, but we are working with more and more family offices in other areas including, for example, effective transitioning of assets through the generations, means to avoid family disputes, ways to ensure good family relationships, especially these days when families are ever larger and are increasingly cross-border, and multi-generational. In Singapore, when people use the term family office, they normally think in terms of tax and other incentives.”

The family office can play a vital role in the dissemination of ideas and decisions amongst different generations in order to avoid disputes and avoid the pitfalls of litigation and/or value destruction.

Plenty of incentives

“When people say they are establishing a family office here,” said another guest, “what they actually mean is they are applying for the set of tax incentives, and need the structure that will qualify, which is at least two entities. One entity, a fund entity, holds the family assets. The other entity is the management company, which manages the assets, and that is the entity that will house the family office, the employees and so forth.”

He added, for example, how most family office investments in most jurisdictions would generate income and capital gains tax liabilities, while in Singapore, they enjoy tax exemption both on income and gains. “Add to that the potential path towards PR for these UHNW families in Singapore, and you can see how exceptionally attractive the environment is here.”

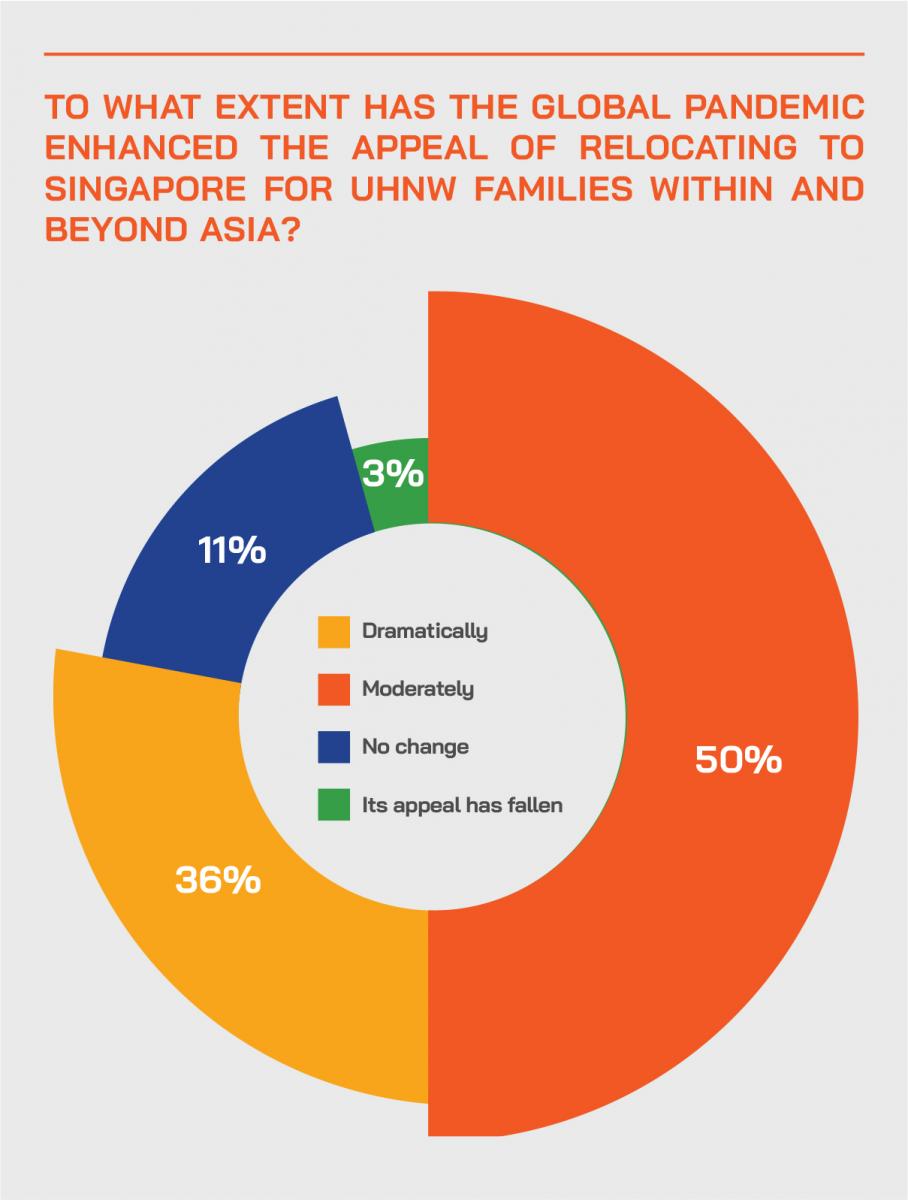

Expert Opinion - Lee Woon Shiu, Managing Director & Regional Head of Wealth Planning Family Office & Insurance Solutions, DBS Private Banking: “Singapore Inc. has embellished its leading position as a trustworthy and safe bastion for ultra-high-net-worth families during the Covid pandemic through its transparency and agility in crisis handling. The compelling and convincing narrative as a forward-thinking hub for family offices will continue to position Singapore as the preferred jurisdiction of choice for family offices for the foreseeable future.”

Expert Opinion - Edmund Leow, Senior Partner, Dentons: “The Singapore government has been proactive in developing skills and training for people here to serve global family offices and trusts. In addition, we have seen an influx of bankers, trustees, lawyers and other related professionals from around the world.”

Strategic growth

Another panel member highlighted how Singapore’s family office star is rising due to transparency, tenacity and a forward-thinking mindset, as well as financial strength and political and regulatory stability.

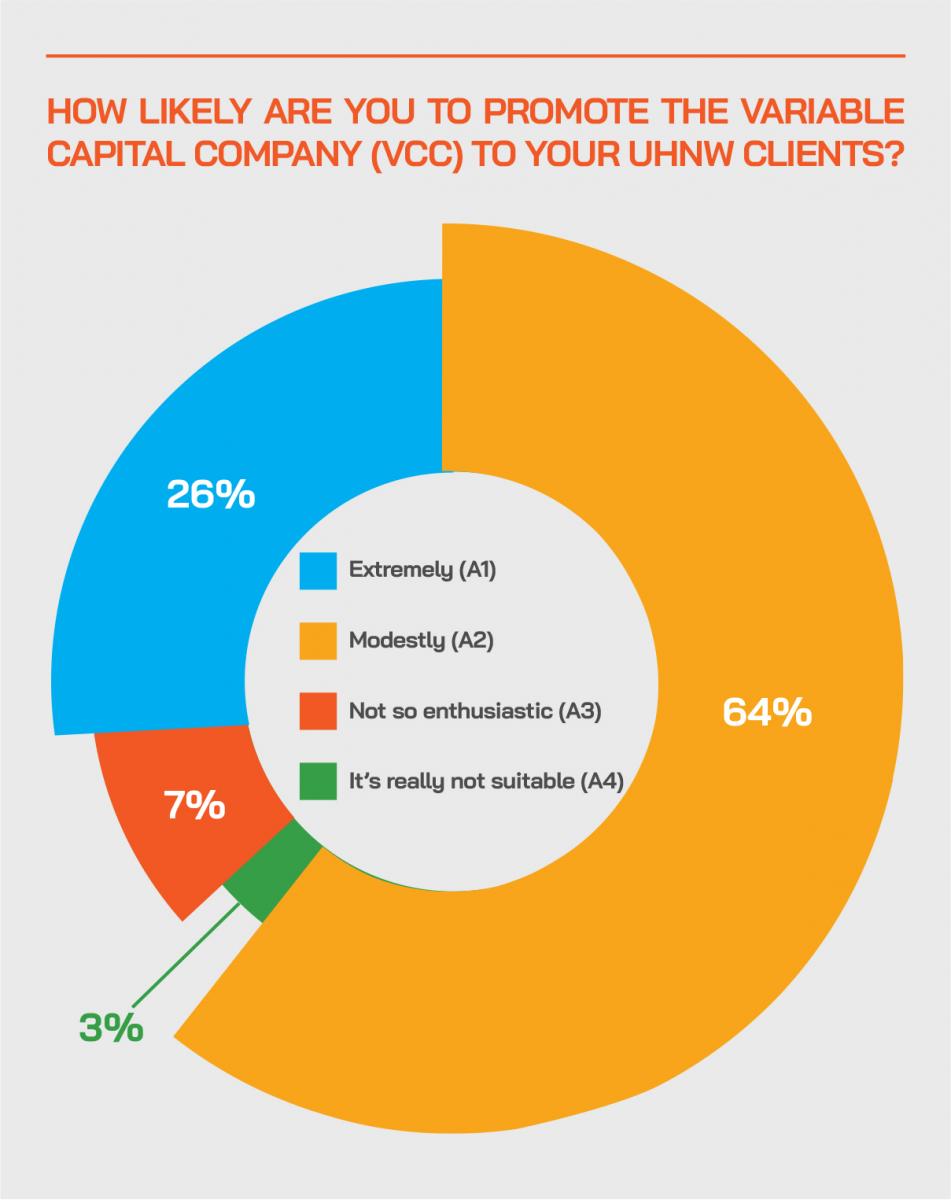

“And throughout the pandemic, those strengths have become even more highly valued amongst HNW and UHNW families, especially from China and the rest of Southeast Asia,” he remarked. “Additionally, it is worth noting the continuous enhancement of Singapore's legal and regulatory framework for family offices, the new Variable Capital Company (VCC) regime introduced in January 2020, as well as enhancements to what is known as the option ‘C’ for the Global Investor Programme from the Economic Development Board (EDB) to qualify up and coming entrepreneurs. All these were more evidence of government agencies listening intently to feedback and acting on it.”

He also highlighted another key reason for Singapore’s continuing expansion in these areas. “It is somewhat intangible, but there is a level of connectivity and engagement between the government agencies and the industry, which is among the very best in the world. This is highlighted to us by some of the biggest billionaire families that came through the doors over the last year.”

The Post-Event Survey

Many reasons for growth

Another expert added how robust the family office space in Singapore remains, even throughout the pandemic. “People have not been deterred, and in fact, Singapore is even more popular than before, with people setting up all types of structures, from trusts to holding companies, family offices and so forth. With the tax exemption on the income and gains from family office funds managed by a Singapore fund management company, there are obvious attractions for wealthy families from the world over, especially from countries within Asia. Moreover, Singapore is benefitting from investors also shifting their structures to Singapore from the some of the more exotic or traditional offshore centres, following increased pressure from the OECD, from the EU and from other quarters."

The expanding ecosystem

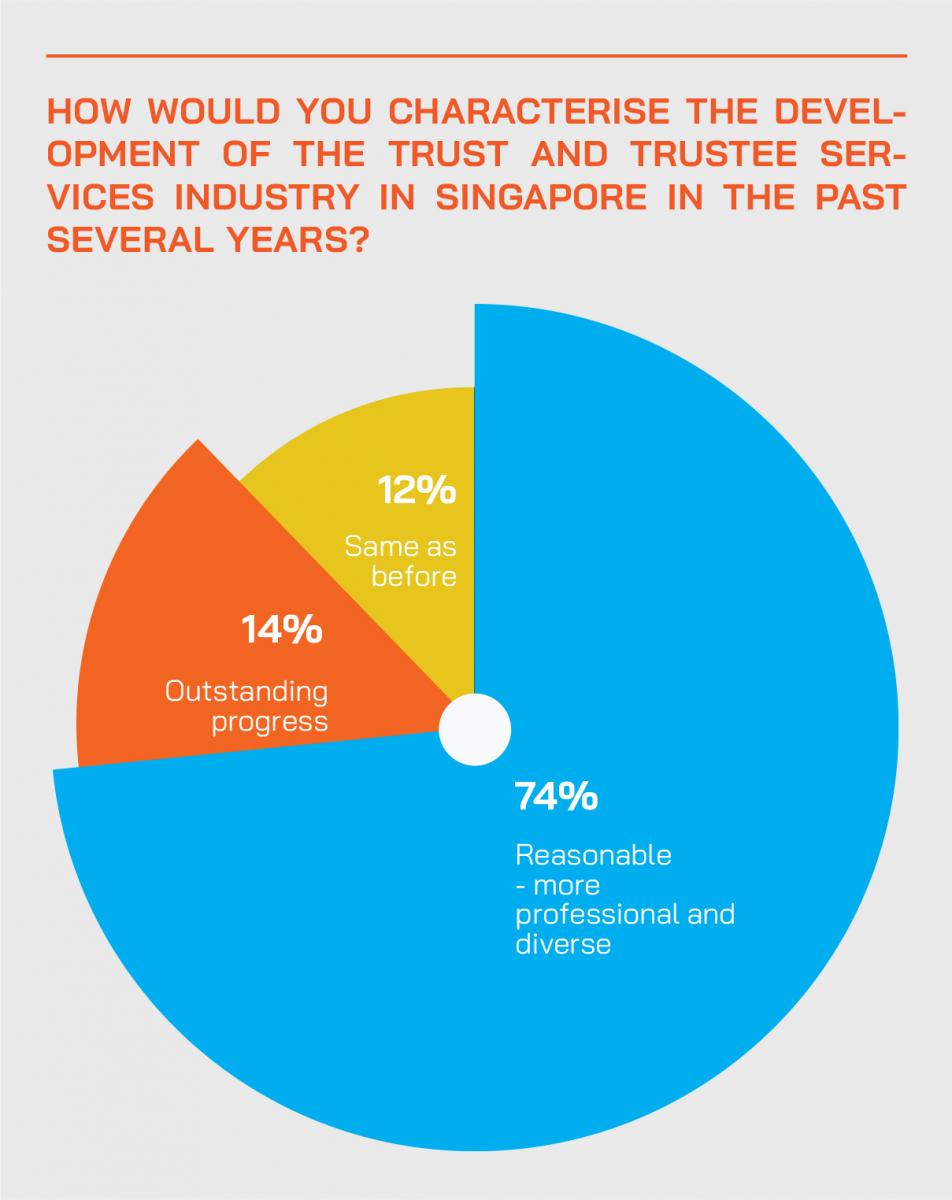

He also observed that the ecosystem in Singapore has grown to the stage where it is both diverse and working very well, with the right service and advisory providers from the lawyers, accountants, trustees, company secretaries and others available and offering the right levels of expertise.

Expert Opinion - Rolf Haudenschild, Co-founder, Ingenia Consultants: “Multi-family offices are allowed to make extensive use of outsourced service providers.”

“And we see more trust specialists, more law firms, more accountants moving in, and others, as they see the scale of the opportunity and extrapolate forward,” he remarked. “There is also growing expertise in the field of trusts, and the standard of trustees available here has risen significantly.”

Expert Opinion - Edmund Leow, Senior Partner, Dentons: “Family offices are still new in Asia, and although many people use the term “family office”, there is not yet a clear consensus on what a family office is, or what it does. This is partly because most Asian wealth is new, and if people have not been wealthy for a long time, they are not familiar with the infrastructure needed to manage family wealth on a long-term basis.”

Expert Opinion - Lee Woon Shiu, Managing Director & Regional Head of Wealth Planning Family Office & Insurance Solutions, DBS Private Banking: “The expertise of the Family Office advisors in Singapore has significantly deepened in the last five years. This is amplified by initiatives launched by Singapore’s Institute of Banking & Finance to develop a comprehensive Family Office Advisor Skills Map, which will continuously enhance the depth and breadth of talent here.”

Post-Event Survey

We asked delegates to offer their insights into Singapore’s development as a family office centre. We have summarised their views here…

Hubbis: In brief, what do you think are Singapore's key attractions as a go-to Asian centre for UHNW family relocation and for family offices?

- Commonwealth based rule of law, well established and developed banking system and a wide array of professional service providers.

- Stability and security. Strong government policy support. Good governance.

- The regulatory framework, political stability, an efficient legal system, and a business-friendly environment.

- Low tax, ease of doing business, strong talent pool, broad-based financial hub.

- Political issues that triggered in Hong Kong increased its appeals.

- Ease of PR for UHNW family relocation alongside appropriate investments.

- Singapore is a well-regulated international financial centre with an attractive tax regime, a high standard of living and a low crime rate.

- Common law and the use of English.

- Central location within Asia.

- Strong IT base and expertise.

- Singapore is proven to be amongst the safest places on earth so far during pandemic. More and more UNHW family are seriously considering locating their wealth in Singapore.

- The clear scheme for families in terms of setting up SFOs and the global residence programme.

- Singapore’s wide array of appeals and incentives and expertise make it an ideal location for multi-family offices.

- The various tax incentives and permanent residence incentives.

- Tenacity, transparency, and trustworthiness. Singapore is a global business and financial hub, where the required financial and professional services are readily available.

- The robust regulatory framework, an established and heavily/well-regulated financial services sector, government-offered tax incentive schemes, a stable rule of law and politics, and transparency. Singapore is a well-developed country with clear laws and regulations that oversee the financial industry, thus giving confidence to investors to park their money in the country. The tax laws are similar to Hong Kong nowadays.

- Singapore’s strategic location, stable economy with good governance, as well as political neutrality and common law.

- Singapore is Asia's financial hub and aviation hub and offers a stable jurisdiction with transparent policies.

- Security is definitely one of the biggest attraction for Singapore as a go-to centre for family offices. It's favourable legal structures as well as absolute rule of law help make the future more predictable.

- For many years, Singapore has proven its stability therefore it becomes the place where Asian UHNW families tend to go as a centre of trust.

Hubbis: In your view, does Singapore now compete effectively on a global scale as a UHNW centre, or is Singapore only competitive within Asia? Why, or why not?

- It is increasingly gaining global recognition, as evidenced by the number of foreign investors setting up family offices here.

- It has global scale, with many new initiatives like the VCC making Singapore appealing to set up investment schemes and to relocate.

- Definitely strong on a global level, especially as other jurisdictions have come under pressure, and as Singapore has introduced schemes like VCC and other incentives to make it more attractive.

- It does still tend to be an Asian UHNW centre given its location, time zone and cultural considerations.

- Singapore’s work efficiency is still not good as Hong Kong’s.

- Singapore is becoming more competitive in Asia but not globally yet, as compared to other jurisdiction like the US, or Switzerland, Singapore is still lacks some areas of expertise.

- Definitely the prominent centre in Asia, but not globally yet as there are major competitors such as New York, London, Zurich, for example.

- We think it is right up there on a global scale because of its stability, world-class financial and other services and good lifestyle, as well as good connectivity and low or modest taxes.

- Singapore is now a preeminent centre attracting funds and families from across the globe.

- Singapore can be especially competitive in Asia and beyond given the growth in China as an economic giant. Singapore can play a vital role as a bridge for Chinese money moving into other markets.

- In my view, we are doing well among the Asian neighbours but still have a way to go to compete on the world stage. We need time and dedication to nurture our local financial sector workforce, but with the right mindset and support from the government and regulators, we will definitely compete on a par as a global UHNW centre.

- In our view, Singapore and more broadly Asia, does not have the levels of skills and expertise as the US or Europe, but things are improving all the time.

- Singapore is becoming relatively more at an advantage within Asia after Hong Kong’s troubles.

- Yes, we are now able to compete on a global scale as a UHNW centre as in term of personal safety, political stability, and as a sound financial centre.

- Singapore might lag behind a little today still, as it has risen up over a relatively short time, but in

- many areas it has already caught up with other financial centres.

- Globally competitive, as it offers a favourable tax system, physical safety, the rule of law and political stability, and is able to target existing and new wealth globally.

- Yes, it is now a global centre, but ultimately Asia will be the main portion of its business.

- Singapore is competitive on a global scale for many reasons, and it has established itself as a global private banking services provider, competitive to the likes of Switzerland and Hong Kong, the US, some countries in Europe and the UK.

- Yes, globally competitive and part of that is why many banks are setting up offices here or even moving their regional HQs to Singapore and why we see a huge influx of wealth coming to Singapore.

- Yes, Singapore can compete effectively on global scale with its economically strategic presence in Asia and around the world coupled with good governance.

- We feel the lack of transparency in some court judgements will continue to be an issue holding Singapore back.

- Personally, I feel Singapore is only competitive in Asia, as Europe and US have already a head start in their respective regions as financial hubs, and we do not think families already established in Europe and the US will move to Singapore.

- The biggest family offices in the world are based in the US, and while I believe that

- Singapore is a go-to destination for family offices and family wealth, I think we have a greater appeal in Asia rather than on a global basis.

- Singapore will continue to face competition from Hong Kong as far as a UHNW centre is concerned with the regulators battling it out. It still has some way to go to on the global stage, but investors are getting more comfortable with the jurisdiction.

- As of now, only really ultra-competitive in Asia, as the traditional UHNW centres such as London and New York have had a long head-start. UHNWs rely much on deep and long-term relationship, and it takes time to develop such relationships.

Expert Opinion - Edmund Leow, Senior Partner, Dentons: “Singapore has always been a substance jurisdiction, even before economic substance became a global issue.”

Expert Opinion - Edmund Leow, Senior Partner, Dentons: “In the current global environment political stability and the rule of law has become a concern in many countries, and Singapore has gained in popularity as a result.”

Governance – a vital element

Another guest agreed, noting how many Malaysian and Indonesia families are adopting Singapore for their family offices. “Governance, succession, proper planning in a stable environment, these are all key issues to some many founders and patriarchs. Many come to realise that every family member amongst the different generations has different needs and objectives, but they so often feel lost about how to manage these expectations. And that is where we come in, bringing the concept of fairness.”

This expert added that so often these family leaders might be incredibly wealthy and successful, but they are deeply unhappy. “Helping to professionalise the whole planning and governance around the business and the family office is a great step,” they added.

A panellist observed that the sweet spot for starting a single-family office should in his view begin with USD50 million or more of investible wealth and a net worth of at least USD200 million. For those with lower categories of wealth, they should consider the MFO route.

He explained that advising would-be SFO creators on accessing the entire Singapore financial and services ecosystem is a vital part of his role. He explained that the mechanics of establishing an SFO were not so complicated but ensuring that the clients are introduced to the broader Singapore ecosystem was vitally important.

Social responsibility

“Some families are, for example, highly focused in how they can connect to make a real, meaningful impact on communities, they want to be philanthropic, and we have a foundation where we actively match social enterprises and entrepreneurs with family offices to see how they can add value not just by giving financial grants but also by mentoring these social entrepreneurs. That sort of purposeful approach for family offices works very well, so major institutions such as ours can really act as a bridge to help offer access to these ideas and opportunities.”

EAMs and MFOs

Expanding the discussion, an expert commented that there are increasing numbers of multi-family offices (MFOs) as well. He explains that external asset managers (EAMs) and MFOs both primarily focus on asset management more than on governance, but it does depend on the MFO concerned. The requisite licenses for both must be obtained from the MAS; this allows them to manage funds on a discretionary basis and provide financial advice. And there are different categories, starting with the so-called registered fund management companies, or RFMC, that allows the holder to service up to 30 accredited institutional investors and up to SGD250 million in AUM. More than that requires the AILFMC license, but that is still only for services provided to accredited and institutional investors, but with no restrictions on numbers.

He reported that the licenses take some six to nine months generally and basic requirements are for at least two dedicated professionals managing that family office and the capital base at least SGD250,000. “There are other requirements, of course, but those are the key stipulations.”

Another expert agreed, highlighting how robust the EAM ecosystem is today, and how the EAM and MFO ecosystem continues to grow. “Usually,” he explained, “it is the private banker that is leaving a bank and bringing across a number of clients to the new EAM or MFO, with that AUM shifting over the base for those new entities, and I would say it should be at least USD100 million or preferably at least USD150 million. If so, those new entities can cover their costs.”

He also observed also that Singapore had been successful in establishing a very strong ecosystem overall for wealth management for all the different types of firms, with plenty of service providers supporting them, from lawyers, to accountants, trustees, company secretarial, fund administrators, specialists in compliance, and so forth. Then there are plenty of vehicles, including the newer VCC. And as to government initiatives, there are the various obvious incentive schemes, but also softer initiatives such as a special training programme that has been launched for family offices to increase the level of professionalism in the industry. “In brief, we are well on track to build even further on where we are already,” he concluded.

Platform for excellence

A guest then focused on the need for digital custody and execution for the independent segment and family offices. “We are part of the overall landscape offering the new and future family offices and independents far more choice in professional service providers available to them, allowing them greater flexibility in how they structure the family offices, for example. We are therefore seeing a significant change from the older way of doing things, with the private banks dominating. Digital solutions offer everyone a far greater range of choice and agility, as well as better cost-effectiveness.”

For any firm or family offices seeking a prime brokerage type relationship, they would need at least USD500 million of AUM, but then they might not get the attention they would hope for. Whereas the digital platforms can happily service lower levels of AUM efficiently and with high levels of attention and service. “There is a real breadth of service providers in the marketplace now,” this expert concluded, “and that augurs well for the whole family office environment seeking to expedite their custody and global market access and execution needs efficiently and in a cost-effective manner.”

Building blocks

A guest then highlighted the value of traditional banking relationships, but also connectivity to all types of different elements of the Singapore and indeed regional corporate and investor and investment landscape. “Aside from all these footprints across the region,” he said, “there are the other elements a major bank or operator can offer, including help designing structures and also putting into place well-customised family governance structures, working with a network of law firms and other experts we can bring to the table, selected by us based on quality and experience. This type of broad-based holistic approach is vital for many of the new family offices establishing themselves here.”

Pulling it all together

A panellist offered some insights into particular assignments their firm had worked on in recent times, both related to establishing governance for new SFOs for ultra-wealthy families. These families all have very large listed family businesses that they still own and operate, with some putting more than 50% of those shares into a structure that the SFO then manages.

“A mistake some families make is to focus only on the trust, foundation, or the family office, and forget to address the overarching family governance that needs to come into place to also look at the family business. Why? Because if you have a structure or family office that is actually managing or representing more than 50% of the shares, obviously, the family office is going to have to make big board appointments and decisions. I cannot sufficiently emphasise the importance of families thinking about who is going to make these decisions when the founder is no longer around because that is when problems arise.”

Fairness and transparency

Another area to be addressed, this expert advised, is distribution policies for when family members reach a certain age. “These can be very sensitive issues for the second and other generations, or those family members closes to the centre, so we spend a,ot of time with family members on these issues. We need to be helping them avoid some of the very high-profile type of family disputes as we have seen, for example in some of the huge Hong Kong families.”

A fellow expert concurred, adding that it was vital to advise clients on a holistic basis, working not only on structures but also on the wider family issues, on governance, on global tax implications and so forth, for example if some key family members live overseas, or if perhaps some of the key family members might be going through a divorce, or to plan ahead for such eventualities, and others, arising in the future. Sometimes the patriarch might even have a mistress and children with her. “And succession planning that is properly structured and thought through is essential to properly structuring the family wealth,” he added.

He also remarked that in his view the competitor to his firm was not another firm but the very wealthy individuals who did not or do not believe they need advice. “If all such individuals and families saw the need for advice, there would be more than enough work for all the law firms in the market,” he quipped.

He addressed the importance of the VCC, explaining that it was originally introduced to serve the fund industry, the original idea being that it was a vehicle for establishing a hedge fund, a private equity fund perhaps, or a venture capital fund.

“The VCC has certain advantages, for example, over a normal company,” he explained. “The VCC is able to make distributions without any profits, you can have funds and sub-funds so assets and liabilities can be ring-fenced, and a number of other key advantages.”

But nowadays, he remarked, the VCC is also being used for family offices, but perhaps more for MFOs, where a family might want to manage not only their own funds, but other families’ assets as well, to make things more efficient, bringing in assets perhaps from distant family members, close friends or others.

A guest added that a fund management license is required to actually set up and manage a VCC. “And in fact, the MAS has become increasingly stringent in this regard, looking more closely into whether the applicant will carry out only regulated activity. It is imperative that you actually want to manage assets on a discretionary basis for multiple clients. If you just want to manage your own assets, or if you only want to manage assets on an advisory basis, where the client always takes the decision and you do not take any investment decisions, the MAS will be very reluctant to grant you a fund management license, and that means you will then also not be allowed to set up a VCC.”

Post-Event Survey

Hubbis: In your experience, are single family offices hiring CEOs/CIOs from the wealth management industry, or using their own family members, and why?

- Those SFOs that feel that they do not have the financial expertise within the family may turn to outside professionals for help.

- From the wealth management industry, because to run the family office effectively, you will need that type of expertise.

- They often tend to start off from within only to realise that they have to look externally later on.

- A combination is best, as having people from the industry and family members creates a good balance of expertise and understanding of the nuances within the family.

- They tend to prefer to have young generation of family member in the committee, but we see them may often hire independent CIOs for the bigger sizes of family office.

- Hiring from the WM industry helps with fair and objective decision that are not affected by family relationships.

- They will hire professionals to manage their portfolios as not many family members are familiar these skills.

- If the family has relevant (and qualified) expertise, they tend to hire their own family members.

- If they need greater expertise in-house, they tend to hire from the wealth management industry.

- I think single family offices prefer to use their own family members, but they also like to recruit personnel from the wealth management industry for checks and balances in their investment activity.

- They often like to build their own expertise amongst family members, for the future.

- Many hire from outside, for example from the WM industry, as their own family members may present conflicts of interest in some key decisions.

- Family offices have become more and more complex and uniqueness within that diversity of

- needs may need leaders with different skill sets and backgrounds than those of existing family office leaders.

- Single family offices prefer to hire CEOs/CIOs from the wealth management industry as they are more professional and independent than some of the family members.

- They are hiring from WM industry, largely because of a desire to create a professional framework for managing family wealth. Family members still retain the veto power.

- As UHNW families build experience and become increasingly aware of the purposes of setting up family offices, I believe that external CEOs/CIOs are preferred over own family members for the reason of avoidance of conflict of interest; in this way, it is a more effective way of managing the family office in an unbiased manner and in accordance to the mandate and requirements of these families.

- Asian families like to use their own family members or close advisors. They often lack the trust and relationships with third parties who might fill those CEO and CFO positions. The role of CIO for portfolio investments and general investing is often less of a sensitive issue.

- They will often use their own family members for the running of the family office, while at the same time hiring wealth management professionals to leverage their portfolio investment expertise.

- Certainly professionals more than family members, but not at CEO/CIO status, as the family wants to generally retain complete control.

- Yes, they value their industry experience and independent views. However, they may have complications if hiring family members into SFOs where proper governance frameworks are not implemented.

- Single-family offices in Asia have traditionally been using their own family members, as they often mistrust the financial professionals and are also afraid of losing control.

- Both family and external, as that provides a good balance between having expertise and understanding nuances within the family.

- A bit of both. Some single-family offices hold the view that their family members know their business and family dynamics best, so they prefer to engage from among their own. Other family offices own businesses where they are more exposed to externally-sourced professional experts, and the merits of doing that; these are more open to hiring outsiders.

The same expert commented on the costs of setting up an EAM or MFO, estimating that at a minimum for a properly structured and organised operation, costs would run at least USD1 million a year including salaries, which would clearly need to be covered by client fees.

Building the right network of advisors

The discussion drew to a close with an expert offering some detail on establishing an EAM or MFO, and on the various steps required, and another expert offering some guidance on selecting the right advisors, especially for those families who are not familiar with Singapore, advising that those successful advisors and experts in the legal, consultancy and other professions ensure that they discuss openly with their clients to ensure they have a complete picture of their assets, their families and then direct those families to specialists to advise on different areas on which they will need support. There are many issues to address, and many pitfalls ahead for these families if they do not approach these matters with transparency and professionalism.