ETFs: Their Global Rise and Increasing Adoption in Asia’s Wealth Management Markets

Jul 30, 2020

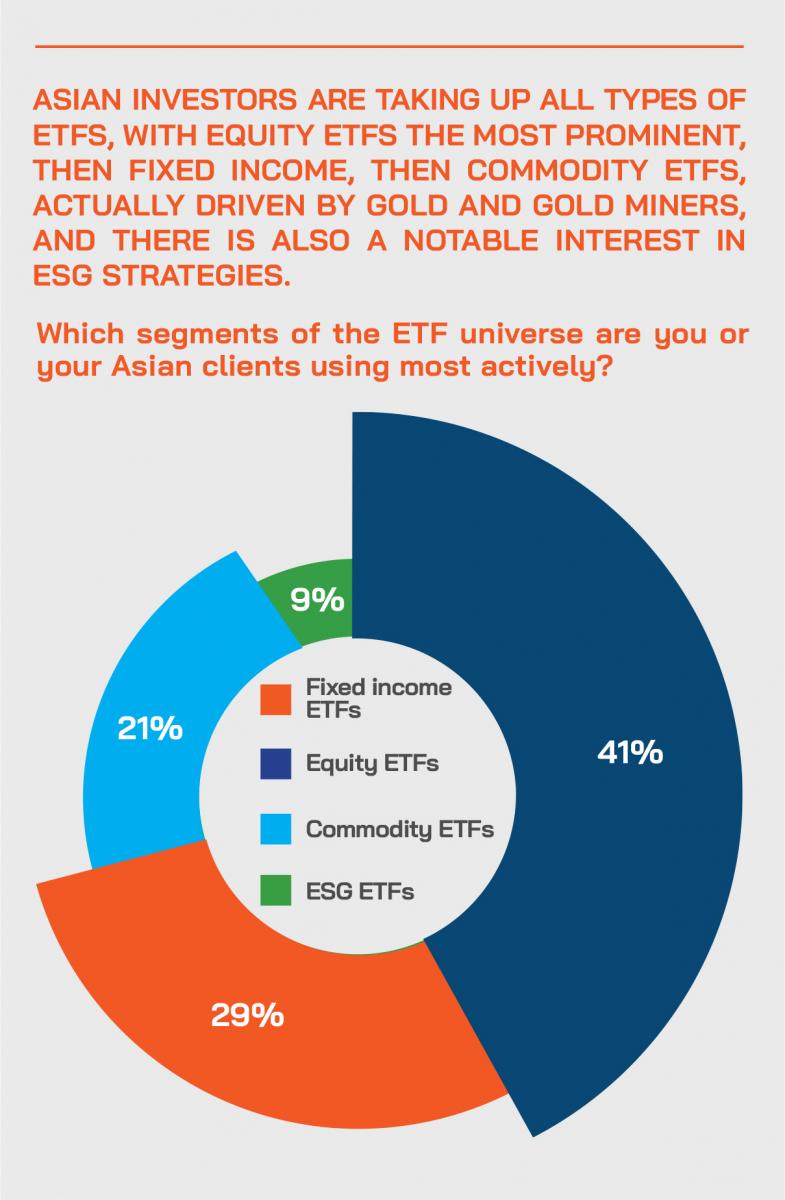

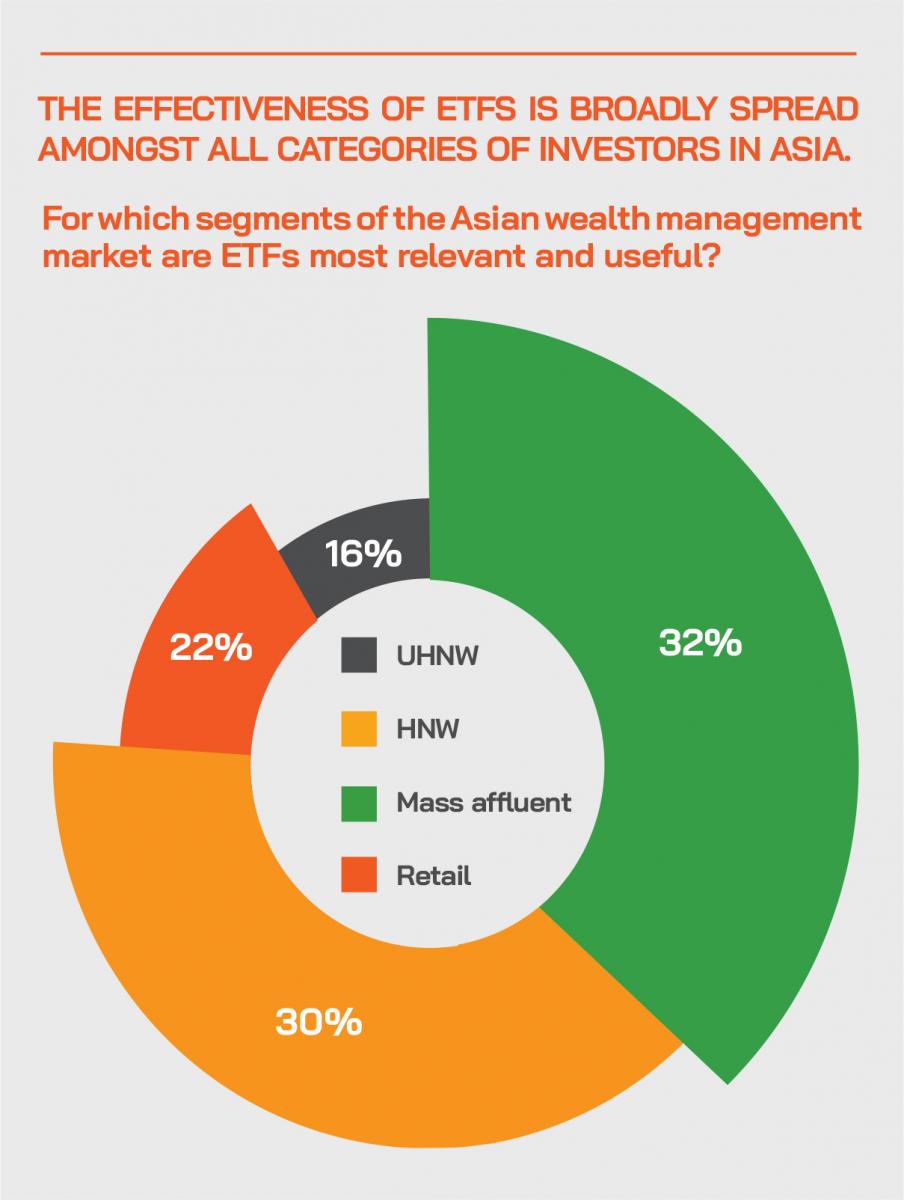

On July 23, Hubbis hosted a virtual Digital Dialogue panel discussion on Exchange Traded Funds (ETFs) and their rising prominence for the wealth management community in Asia. There has been a rising tide of interest in Asia for ETFs in Asia in recent years. The discussion ranged over the global surge of ETF investment and trading, their effectiveness in sophisticated and robust portfolios, their value for self-directed investors and, for the wealth advisors of Asia, for advisory and DPM. The panel looked at ETFs and the curation of portfolio models via robo-advisory. And the panel discussed the arrival of ETF-only portfolios, and essentially the encouragement to adopt a more comprehensive portfolio approach for the wealth management community, based on clearly defined goals, and in which ETFs play an increasingly important role is smart portfolio construction. Fixed-income ETFs have proven themselves to offer investors both liquidity and performance, especially during the market stresses of Q1, 2020. Asian investors are also gravitating towards ESG ETFs, either investing or exploring with their advisors. The panel were as enthusiastic about the rising adoption of ETFs in Asia as they were about the value of those ETFs to Asia’s wealth market portfolios.

ETFs in Asia – The Growth Accelerates

An expert opened the discussion by reporting that the firm’s ETF business in Asia had been growing about 20% a year over the last five years. “The driver for that is ETFs within portfolios,” he explained. “ETFs give distributors a way to put a framework around and perhaps distribution fees charged on top. A major driver in private banking is their use in DPM, and we see their use more now in the emerging digital advice space, where ETFs are used as portfolio building blocks.”

Wealth managers befriend ETFs

Another expert invited delegates to cast their minds back 5-10 years, when ETFs were seen as a threat to the wealth management industry, being low cost, easy to buy into and simple. “But actually,” they said, “quite the reverse has happened, and the wealth industry has begun to increasingly embrace ETFs as a product and also as a tool for us to express investments and for asset allocation decisions as well.”

For advisory, this panellist explained that this year, in particular, has seen a significant rise in trading of ETFs, especially large-cap index ETFs. In addition, the use of derivatives with ETFs underlying increased, including structured products with ETFs underlying. And fixed income and commodity ETFs are also on a growth trend. DPM managers are using ETFs increasingly, with some 15% of this expert’s DPM portfolios in ETFs.

Expert Opinion - Anthony Arthur, Director, Head of iShares Asia ex-Japan Wealth Distribution, BlackRock: “Regional wealth providers are using ETFs predominantly as portfolio building blocks, which highlights both the importance of asset allocation as a driver of returns and how this application can generate distribution fees. The trend also shows how ETFs adoption within asset allocation frameworks potentially reduces end-investor costs versus traditional solutions.”

Expert Opinion - Freddy Lim, Co-Founder & Chief Investment Officer, StashAway: “Today, portfolio managers no longer need to construct a large basket of securities to track an asset class. They do not need to concern themselves with rebalancing the basket either. These tasks can be accomplished by ETFs which means fund managers can focus more on delivering higher value-added services.”

Expert Opinion - Vivek Mohindra, Co-Founder & Chief Responsible Officer, Kristal.AI: “If you have more than 30 stocks in your portfolio or more than five actively managed funds or structured notes, you would benefit from using ETFs for the majority of your investment allocation. You will achieve the same diversification and performance at a fraction of the costs.”

Fixed income – continuing growth

“Fixed income ETFs have been adopted increasingly this year,” explained one expert, “particularly during the worst phases of the sell-off, as pricing dislocations and liquidity challenges of single bond and other fixed-income investments drove portfolio managers to build fixed income ETF positions to provide liquid positions that can be flexible in periods of volatility. Seeing their value in sharper focus during this crisis, their adoption has continued to expand robustly through the better market conditions that followed from late April onwards.”

“Fixed income is very hard for retail investors to assess as it is quite tricky to try to buy single bonds,” proffered another guest. “But the fixed income ETF is a very easy way to do that and they are therefore probably under-represented versus their equity counterparts, in most wealth portfolios. We hope for, and indeed expect much more growth in the fixed income arena in Asia.”

The representative from a robo-advisory platform then explained that for the purpose of tracking some preferred asset classes and segments of the markets the ETF is predominantly the most efficient vehicle today. “We run based on a very macroeconomic model driven basis, so we prefer to switch between asset classes based on the factors that we track, a lot of which is based on leading economic factors. Over the past four years, we have re-optimised thousands of portfolios three times significantly. The strategy changes over time, allocation changes over time, and the changes are done primarily with being in and out of ETFs.”

Expert Opinion - Freddy Lim, Co-Founder & Chief Investment Officer, StashAway: “Regarding fixed income ETFs, due to margin calls and liquidity squeeze, protective assets were also assaulted by challenging liquidity conditions during the Covid-19 global market crash. Although liquidity did come with a price tag, fixed income ETFs have lived up to their reputation as liquid vehicles of investing.”

Many different appeals

Another expert, who works with clients via a digital interface in the range of USD10000 up to HNW clients, explained that due to transparency, low-cost, diversification and ease of access, some 75% are invested through a variety of equity and fixed income ETFs, with the other 25% in more bespoke asset categories, for example derivatives on ETFs, hedge funds for alpha, and alternatives.

“We have about 20,000 users,” he reported, “those clients will at least get a customised portfolio of ETFs only. “The wealthier HNW clients do not work so much via robo-advisory, but more of a hybrid and self-directed approach, and while the background is that they used to go into bonds and single stocks, we have moved them into equity ETFs and bond ETFs, so now they are dominated by ETF usage.”

Expert Opinion - Anthony Arthur, Director, Head of iShares Asia ex-Japan Wealth Distribution, BlackRock: “We are seeing some wealth providers build fixed income ETF sleeves and portfolios as substitutes for individual bonds and fixed income instruments. Fixed-income ETFs have passed yet another test in Q1 2020, where investors turned to fixed income ETFs to provide deeper liquidity, continuous price transparency and lower transaction costs than were available in individual bonds.”

Another panellist who said their platform has some 30000 users agreed with all the positives for ETFs, adding that in particular the more institutional clients had been expanding their use of ETFs to cover more fixed income, high yield, volatility ETFs, actively managed ETFs, and so forth. “Our end-user customers are certainly investing in more ETFs than single stock allocations these days,” he said.

Post-Event Perspectives from the audience on the main attractions of ETFs for HNW clients in Asia?

After the discussion, Hubbis immediately sent out a post-dialogue Survey to delegates. We asked them to briefly list the key appeals of ETFs for Asia’s wealthy private clients. There was overwhelming positivity amongst the delegates surveyed. We have edited their replies to provide the following insights from the wealth management community.

What are the core appeals of ETFs for Asia’s HNW and UHNW investors?

- Beta exposure at a low cost.

- Simple and transparent.

- Low-cost, transparent and for a diversified portfolio.

- Wide range of choice.

- Relatively high liquidity and transparent price quotes.

- The Gold ETFs are the main attraction for HNW clients in Asia.

- Simplicity, ease-of-access, portfolio selection/some degree of diversification.

- Low cost, better liquidity, easy to access, transparent, diversification across all sectors of the financial product, and beta driven.

- Clients like passive investments and believe passive will outperform active in the long run.

- It is so comprehensive now that the clients can invest literally in anything they can imagine or think of.

- ETFs are especially useful when the clients have a macro view or judgement to express.

- Ease of access compared with normal fixed income investments, which are more complex.

- Time zone, cross border investment convenience and transparent pricing.

- Global coverage.

- ETFs help investors to trade intraday, investors can use speculative trading strategies such as short selling and trading on margin, and allow clients to trade the entire market without being exposed to a single stock risk.

- Asian markets are pretty volatile recently and ETFs provide high liquidity.

Mitigating risk

An expert commented that ETFs have all the well-known characteristics and are also ideal for risk management. “When we build our global portfolios, they have global equities, bonds, commodities and so forth, and we always use ETFs to achieve this because they have become such an easy way to access and build this type of diversified portfolio. Another good example is we launched a product recently which was essentially like a smart beta product, but it is just built off ETFs. We are giving users access to 1500 stocks which are listed on global exchanges but these are managed through 10 ETFs only, and that is such a powerful tool because you have these managers who are essentially managing everything for you.”

Liquidity

And on the issue of liquidity, a guest reported that through the worst days of the sell-off, ETF liquidity I fixed income was present, often very good, while bonds themselves had virtually no bid-offer, and at the very worst moment, ETFs still offered liquidity, even if at the widest of an unusually wide 3% to 5% bid-offer.

“ETFs lived up to liquidity promise during the worst market conditions,” agreed another guest, “but the liquidity does sometimes come with a price tag. Nevertheless, that price is the price you pay for demanding to have your money right away in a very unprecedented time of stress. Some ETFs far a bit better, some a bit worse, but in general they perform up to their liquidity promise.”

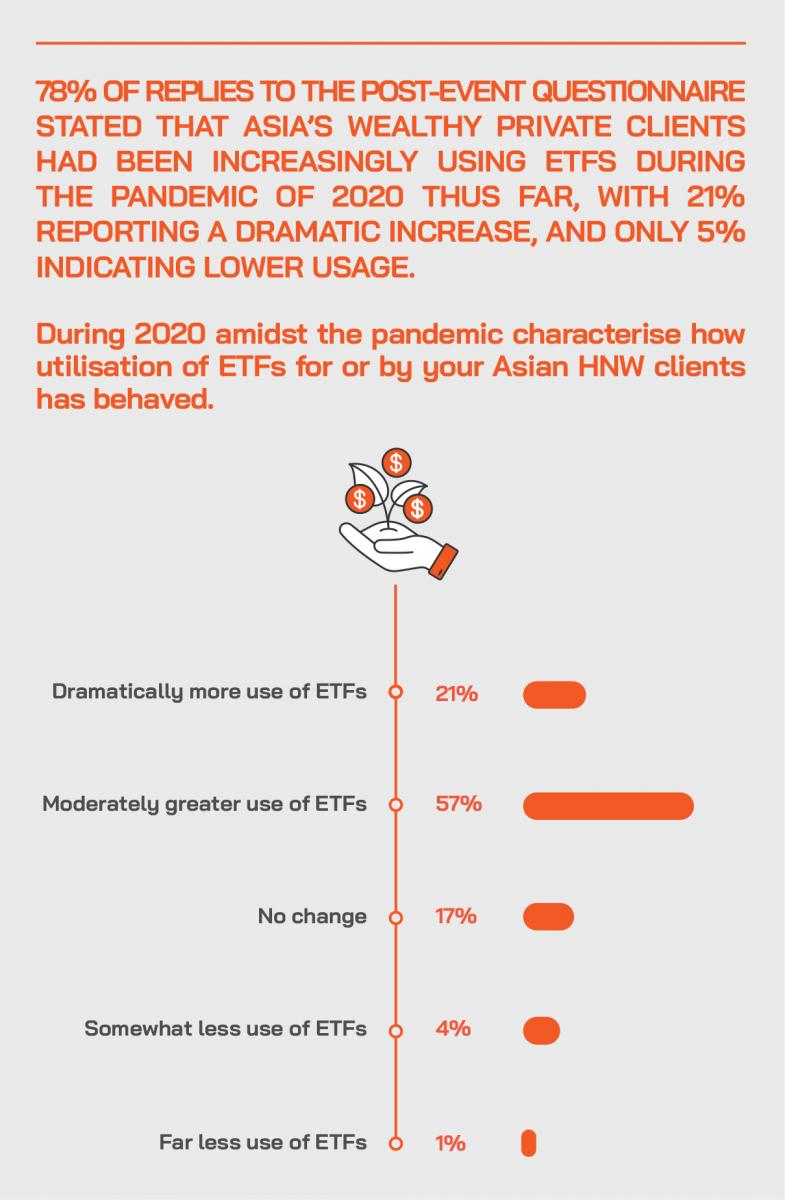

Post-Event Perspectives from the audience on the impact of the pandemic on ETF usage in Asia.

After the discussion, Hubbis immediately sent out a post-dialogue Survey to delegates. We asked them to offer their insights on whether the pandemic and especially the market crisis of March and April had conspired to drive greater ETF adoption amongst Asia’s wealthy private clients. There was an overwhelming surge of replies saying that ETF activity had increased, for a variety of reasons. We have edited their replies as below.

Do you think the events of 2020 so far have increased or decreased demand for ETFs in Asia’s wealth management markets? Why, or why not?

- Increased demand, as uncertainties over profitability/cash-flows make it more difficult for investors to research underlying equities or bonds.

- Yes. People tend to avoid single investments due to higher risk and uncertainties.

- Yes, for diversification and lower costs during a volatile market like in 2020.

- Yes. During the March 2020 markets meltdown, liquidity generally dried up very fast in the traditional trading asset class where ETF seems to provide more liquidity.

- Yes. The events of 2020 have created an uncertainty whereby investors feel more comfortable buying into ETFs with exposure to a multitude of stocks and industries as opposed to the need to make individual stock picks.

- Due to the higher volatility of the capital market, asset managers and investment advisors can use ETFs to lower clients' portfolio risk.

- Increasing. Investors are more knowledgeable and prefer cost effective ETFs for an exposure to a particular market or theme.

- Yes, investors demand more diversification after the violent market fall due to Covid-19.

- Increased. The crisis has shown that not all companies are able to withstand the negative effects of a pandemic, so diversification is valuable.

- Increased. The recent market crash reiterated the point that active managers are unable to beat the market in most cases.

- Marginally on the positive side, as HNWIs overall want to keep liquidity and cash at hand for any untoward circumstances.

- Increased, but the Asia ETF market is not matured as in Europe and US and has considerable room for growth and maturity.

- It has increased the demand for ETFs because investors will definitely not prefer a single stock exposure or risk.

- Increased. ETFs allow flexibility to switch between asset sectors in a more efficient and effective manner than a single stock or single bond investment.

- It has increased the demand for ETFs for many reasons, and also as financial advisors have increasingly also understood the importance of ETFs.

- Yes, it has increased demand for ETFs in Asia as most private banks are using them more as part of their DPM, and for diversification.

- Due to increased geopolitical tensions, central banks have been flooding the system with liquidity, and ETFs make it easier for investors to access asset classes such as gold and US Treasuries.

- Increased, due to less interaction between RMs and investors.

- Increased activity in 2020 as ETFs have proven to offer investors liquidity, performance, speed of execution and transparency especially during the market stress of Q1. The use of derivatives with underlying is quite unique.

- Increased, due to volatility, so we are seeing increased interest amongst clients to buy at the dip via ETFs, which enables clients to mitigate risks via its diversified portfolio. Some clients prefer to invest in synthetic ETFs that enable them to short the market.

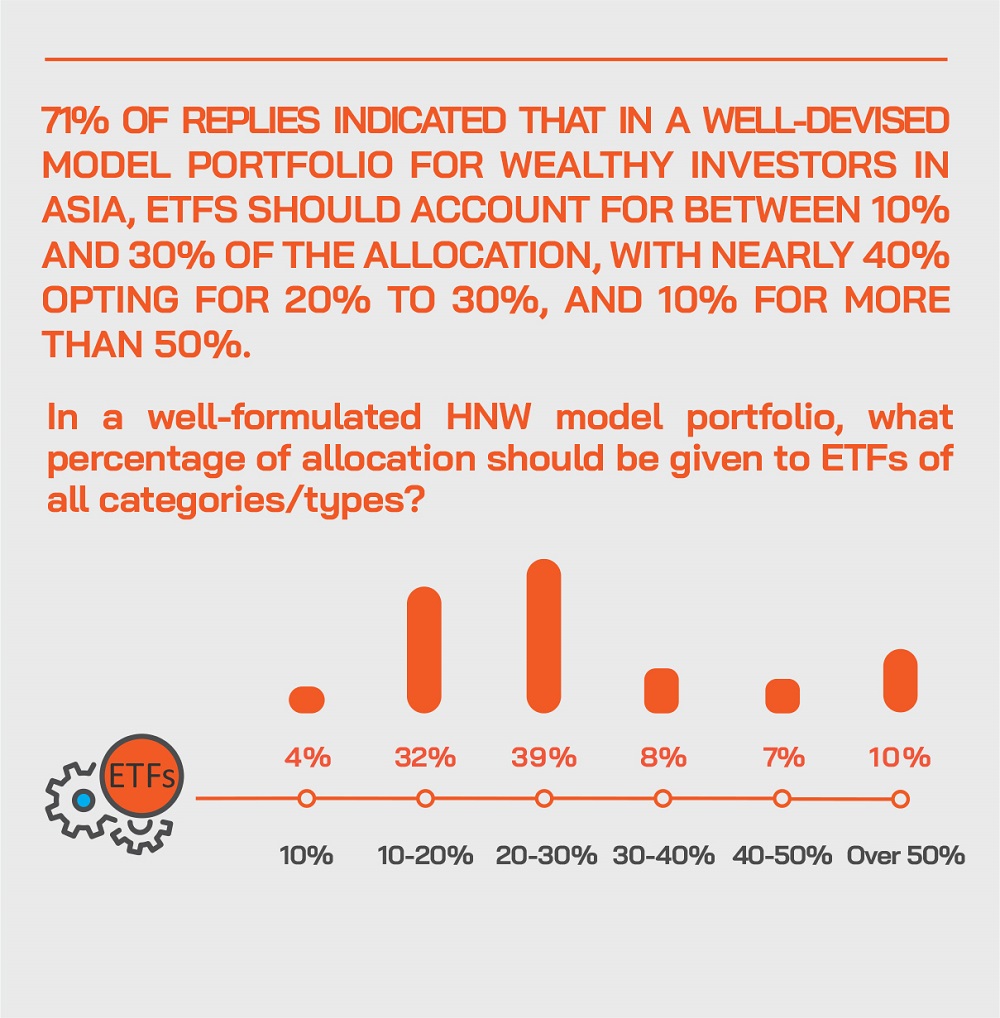

ETFs: a driver for DPM and the whole portfolio approach

An expert then referred back to the growing role of ETFs in DPM in Asia. “The larger banks have stated they want more DPM penetration, but the region is lagging behind in this regard,” he commented. “So, the banks are trying to persuade some clients to move to a fee-based advice type offering, perhaps where they can’t get clients to move directly into DPM, so offering a portfolio type approach, charging for an asset allocation which gives them a distribution fee over and above what they might receive from an underlying instrument used in those allocations.”

He explained that this is manifested in the shift towards ‘whole portfolio’ thinking in wealth management, which is really about co-constructing solid portfolios for wealth clients and institutional quality portfolios where there is analysis in advance of what the goals are, then the implementation of a relevant strategy.

Such goals might be long-term savings, a liquidity buffer, steady yield, education planning and so forth. Whatever the outcome the clients seek, asset allocation must be constructed efficiently, and ETFs help achieve that, aligned perhaps to active funds and also single-line securities. This is an approach that is helping create a valid portfolio for the mission identified at the outset and is evidently a growing trend today.

And the fees that can be derived from these kinds of solutions are recurring and more likely to be sticky. From a revenue perspective, this therefore helps the banks and others achieve more predictable revenues, lessens reliance on transactional income, and if executed properly, achieves better outcomes for the end clients, as generally there is a less emotional approach to the portfolio, which tends to be better constructed to anticipate volatility.

“The biggest driver for ETF use is as portfolio construction tools, as they allow distribution fees to be charged,” said another panellist, “and they deliver multi-asset solutions to clients, and of course, they can minimise costs versus mutual fund solutions.”

Promoting the agnostic approach

A guest also highlighted how ETFs are highly democratic instruments, with virtually the same entry price open for retail investors, or pension funds or sovereign funds or even central banks. “The pricing is transparent, and the costs are transparent,” he said, “so this represents a massive democratisation shift. And they work so well for DPM, because they are low cost and easy and flexible to use. And with the wide range of strategies that can be expressed through ETFs today, they offer wonderful diversification.”

Expert Opinions - Vivek Mohindra, Co-Founder & Chief Responsible Officer, Kristal.AI: “ETFs represent true democratisation of the investment process since they are used equally by retail investors to pension funds and even central banks. Even access and pricing for various participants are virtually identical, i.e. investors can buy at the same price as the US Federal Reserve.”

“The ETF universe helps liberate the wealth manager in terms of being agnostic to the products,” came another opinion. “We should choose the right product for the right portfolio as opposed to being motivated by fees. But as to risk, we must acknowledge that there are risks in ETFs as in any financial asset, so I think more education and risk disclosure should be prevalent, and remember there are also very poorly managed and constructed ETFs as well. Some of the bigger players are also trying very hard to educate the investment public about the risks involved in ETFs, as there is of course systemic risk, so we have a duty in this regard.”

Here comes the ESG phenomenon

The other major development taking place is towards ESG ETFs. Experts report more of the private banks and family offices in Asia increasingly interested in ESG as their underlying clients seek more sustainable exposures, resulting in the flows into ESG strategies being remarkably strong this year, albeit from a low base, as the market is tiny – less than USD30 billion by some estimates – compared to more than USD6 trillion in all ETFs globally.

Nevertheless, it does show innovation and ESG is a rising tide across the world, with ESG ETFs demonstrating the type of growth that was only seen in the very early days of the ETF phenomenon. Many now expect the evolution to follow the recent year trend in fixed income ETFs, which have grown dramatically in prominence. “Quite a few banks here in Asia have been building ESG solutions for individual clients in their discretionary mandates, and generally promoting the whole area,” a guest reported.

Expert Opinion - Freddy Lim, Co-Founder & Chief Investment Officer, StashAway: “ESG ETFs are just getting started within ETF investing. According to UNCTAD, there are only about USD25 billion of assets thus far being managed by ETFs in the ESG space as of June 2019. This is merely a drop in the ocean when you consider that ETFs today manage close to USD6.06 trillion of assets.”

Expert Opinion - Anthony Arthur, Director, Head of iShares Asia ex-Japan Wealth Distribution, BlackRock: “Demand for ESG portfolios is emerging in Asia within the wealth segment. ETFs provide a ready-made way to build multi-asset ESG portfolios, built to a chosen level of ESG integration and maximise returns.”

The pandemic has reinforced these trends. Social responsibility, the environment, the planet, governance, sustainability, these are all central topics at this time, so it is not surprising that corporations have been further shifting towards these goals, these ideals, and investors increasingly realise the power they have to help drive this evolution through their choices.

“Just to give you an idea of scale,” one expert commented, “we have seen a doubling of our assets under management in ESG ETFs this year, driving really from the US, while it was already more established in Europe. It shows that you now have a range of established options if you want to build portfolios using ESG ETFs that weren't there before and didn't have a scale behind them. As to themes, the path towards more niche exposures or alternative ways of creating ETFs is there, and it develops a storyline for retail or mass affluent investors.”

Expert Opinion - Freddy Lim, Co-Founder & Chief Investment Officer, StashAway: “Just think about it - the MSCI World ESG Leaders Index has persistently outperformed the MSCI World Equity by 26.3% in cumulative return (or 1.1% each year) between FY2008 and FY2019. Yes, we do value social responsibility and sustainability, but I think there is also a commercial case for ETFs to do more to make ESG investing more accessible.”

“ESG is definitely a very key area for our clients,” another panel member reported, “as a lot of people want to be responsible as well as make money. I also want to see more diversity in fixed income, as rates are so low and more people want easier ways to access returns with lower risks. So some sort of ETF solution at low entry cost and liquid is an appealing alternative to money market funds or similar, as alternatives to the low returns on leaving money in the banks.”

Looking ahead – more than just wishful thinking

Looking ahead and thinking about a wish list for the ETF market in Asia, a guest remarked that the ETF market in Asia would benefit from greater depth, more high-quality providers, greater competition and a generally healthier ecosystem amongst a wide variety of investors. While retail is the largest category of buyers in Asia, there is far greater investor diversity in Europe and the US.

A guest commented that they would like to see some form of rating criteria and governance requirements for ETFs to ensure that the industry keeps improving and transparency and accountability keep improving. “The type of DNA we see more in the mutual fund and institutional space could also be transported into the ETFs space to raise the standards,” they reported, “and to give everyone better visibility about the quality of ETFs, so yes, more research, ratings, industry standards, all would be welcomed.”

Expert Opinion - Freddy Lim, Co-Founder & Chief Investment Officer, StashAway: “Not all ETFs are made the same. At StashAway, our due diligence focuses on the credibility and reputation of ETF managers, the behaviour of ETFs’ tracking error in up and down markets, liquidity profile and cost efficiency, amongst other factors.”

Expert Opinions - Vivek Mohindra, Co-Founder & Chief Responsible Officer, Kristal.AI: “The problem for ETFs is that there is no sponsor paying incentives for their usage. Funds have managers paying retrocession and Structured Notes have banks paying commissions. Even equities have brokers sharing brokerage.”

Asia - could do better

And in Asia, there is a call for more involvement from all parties, from the regulators down, and also for greater diversification of ETFs with Asian assets.

A guest expressed dissatisfaction with the evolution of the Hong Kong listed ETF market, which he reported had not really taken off yet. “And we want to see more expression of sector-specific bets across the broad ETF market out here,” he added.

Greater liquidity and tradability in the Asian time zone is high on another expert’s wish list. “I think there is still a misconception about onscreen liquidity, people looking at the screen and having the impression that an ETF might be thinly traded, when actually there are many other ways around that. There are not a lot of market makers in Asia and our national exchanges in the region could be savvier or more accommodative of this asset class, but they remain primarily focussed on liquidity for single stocks. If you want more UHNW and HNW buyers in this region, liquidity will play a big part, and you also want active derivatives trading on the back of ETFs to improve size in ETF trading. The US and London ETF markets are far, far deeper.”

Post-Event Perspectives from the audience on what improvements they would like to see in the ETF market in Asia.

After the discussion, Hubbis immediately sent out a post-dialogue Survey to delegates. We asked them to offer their views on what improvements they would like to see in the ETF market in Asia.

What are the main improvements you would like to see to the ETF market for Asia-based wealth managers and investors?

- More choice and variety in local (SGD/HKD) currencies.

- More discount on management fees.

- More products and more liquidity.

- More investor education.

- More frequent and available analysis of the underlying assets of the ETFs.

- More promotion and subsequent exposure to ETFs in general, so that more Asian advisors and investors can proactively promote and invest them as a tool for times of uncertainty such as now.

- If ETF managers can publish fact-sheet (like Mutual Funds) for wealth managers and investors that can help understanding and then increase investment in the ETFs. The fact-sheet would help investors to understand the ETF easily and improve transparency.

- More marketing of ETFs as many investors are still not exposed to ETFs.

- More choice of ETFs tracking US/Europe performance during Asian trading hours.

- More variety.

- How can Asian based investors avoid the withholding taxes that are being imposed on the dividends the ETF distribute? This needs addressing. Also, unknown to many investors, when an Asian investor passes on, his US domiciled investments may be subject to estate duty.

- More innovative and targeted sector ETFs.

- More efficient data feeds on portfolio holdings and trading.

- More ETFs listed in Hong Kong.

- I still think that market education supported by timely market data will help grow the acceptance; there is still quite a journey ahead.

- To create more awareness and training for wealth managers and investors.

- More ETFs with Asian and ASEAN market exposure.

- More focus on ETFs for less accessible Asian markets.

- More Shariah funds to be made available.

- More ESG ETFs.

- Increased product offering in local markets, as currently the majority of the well managed ETFs are still based in the US.

Common sense required

“ETFs should not be considered a get out of jail free card,” said another guest, “as the investors is always holding the underlying assets and asset class that the ETF is exposed to, but they do give some certainty and price transparency and diversity.“

Another expert concurred, adding that ETFs must be probably labelled. “When it comes to things like ETNs, you are really buying a debt instrument, or when you are buying a synthetic ETF, you have got additional risks, such as counterparty risks, over and above a physically tracking ETF.”

A panellist agreed, noting that there are numerous advantages, but that everyone must see the disadvantages as well. “We have seen a few of the ETFs delisted recently or trading on a discount,” he remarked. “However, we see most mass affluent investors we deal with investing mostly in top 30, top 40 listed ETFs, and for those the demands placed on those ETFs are largely met in terms of development and innovation, so ETFs as an investment vehicle are valid not only for retail mass affluent, HNWIs, institutions, and the wealth managers, and across a very wide range of assets and sectors.”

“Not all ETFs are made equal,” said another guest. “We focus a lot of attention on due diligence, we focus beyond simple numbers and into the credibility, the reputation of the ETF managers, the network of authorised participants that stands behind an ETF, that helps provide the liquidity behind the ETF, and we look at the behaviour, the tracking errors in up and down markets, liquidity and so forth. We must not be here to endorse ETFs blindly, care, proper research and due diligence apply to the ETF space as well.”

An expert agreed that more information and possibly ratings would be preferable, but explained that Morningstar has ETF ratings, and private platforms and other firms also offer their own public or accessible filters, or screens. “Moreover,” he said, “if you think of an individually buying into an ETF or buying a single share, that investors can definitely lose much more there through the single stock, than in a broad basket.”

Opening up new avenues

Another guest added that more access to markets which are inaccessible, or that people find difficult to access, such as some of Asia’s frontier or emerging markets, would be appealing, and would also address some of the more logistical, cross-currency, cross-jurisdiction issues hindering access to such markets, or sectors.

“I would like to see more Sharia-compliant ETFs, a segment largely ignored so far,” said another guest. et is completely ignored as well. “This would complement that growth of more thematic ETFs in ESG, SRI, impact investing and satisfy some of the Islamic communities, not leaving them out as an afterthought.”

The final word went to an expert who commented that it makes absolute sense to see more and better trading conditions for ETFs in Asia, and that he expects significant improvements in this regard, with the help of the main exchanges and regulators and other parties in markets such as Hong Kong and Singapore at first as they are the core centres for investors to trade non-domestic exposures in the region.

Conclusion

The panel was both remarkably optimistic about ETFs in wealth management in Asia, but equally realistic about where there are shortcomings that need to be addressed. There is very evidently growing institutionalisation of fixed income ETFs within professional portfolio construction in Asia, and Q1 2020 was cathartic in some ways, with the liquidity on offer then via ETFs prompting more and more institutional clients and private banks to build sleeves of fixed income ETFs into their overall bond strategies, and as more HNW and UHNW investors seek alternatives to single bonds. Moreover, the significant growth in equity ETFs continues and has actually accelerates as investors become warier of individual stocks, given the great uncertainties that lie ahead, preferring to mitigate risk via baskets, while also hoping to capture upside of market moves. And of course, there is the rising interest in ESG, and there is optimism for greater ETF trading and ecosystem advances in Asia, as well as the arrival of new strategies and other innovations. In short, exciting times lie ahead for Asia’s ETF adoption.