Publications & Thought Leadership

Digital Transformation – Are Asia’s Private Banks and Wealth Management Firms on Track to Realise their Hopes and Visions?

Jan 2, 2022

On December 16, a panel of experts at the Hubbis Digital Dialogue delved into a virtual discussion on the application of the latest digital solutions to the world of Asian wealth management as technology revolutionises the offerings and efficiencies of private wealth managers and the broad wealth management community across the region, focusing on the strategies and processes for ensuring that curation and then implementation of the decisions are soundly based, well-judged and then executed with precision, in a timely manner and to great effect. To do so, the experts – representing both technology experts and wealth management decision-makers in the region, first set the scene and provide the context, with the panel analysing the state of the digital transformation journey thus far, defining the evolving business trends, and therefore identifying the digital needs for the years ahead, and naturally what technologies and solutions can and should be employed. And then they addressed the many key issues ahead.

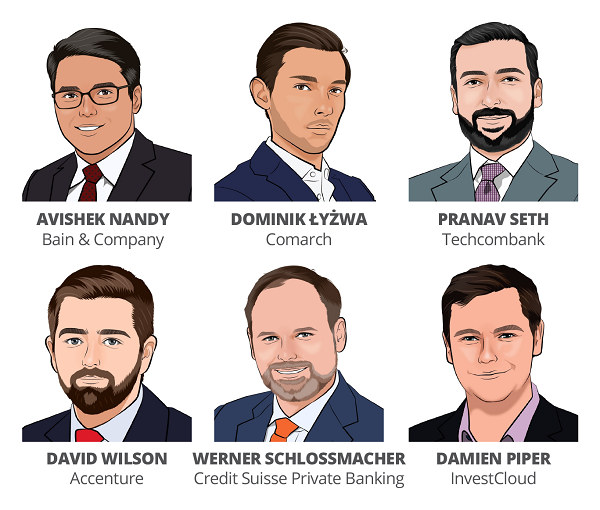

Panel Members

- David Wilson, APAC Wealth Management Lead, Accenture

- Avishek Nandy, Partner, Bain & Company

- Dominik Łyżwa, Business Consultant, Comarch

- Werner Schlossmacher, Managing Director, (Digital) Platform Management, Asia Pacific, Credit Suisse Private Banking

- Damien Piper, Regional Director, Asia, InvestCloud

- Pranav Seth, Chief Digital Officer, Techcombank

These are some of the questions the panel addressed:

These are some of the questions the panel addressed:

- What are the key trends taking place in wealth management globally and especially in Asia, and where are the biggest challenges and opportunities?

- How can the new wealth model align both the human and digital in a seamless collaboration for the delivery of optimised investment products, ideas and advice for private wealth clients?

- What is coming next in the world of digital technologies and services that will further enhance the wealth management offering in the region, and how can those improve the proposition?

- Is there a sufficiently strategic approach to using digital to improve systems and processes, as well as to help these banks and private wealth management firms better engage with their clients?

- How do the private banks and retail banks make the right decisions, firstly on what areas to focus on, and then which solutions to adopt and which technology partners to work with?

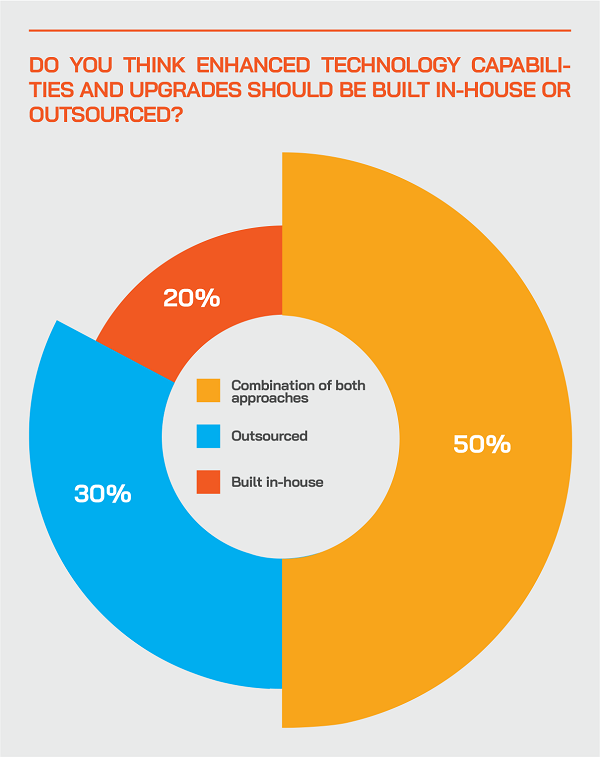

- What approaches does the panel consider the market players should take? Should they build, buy, or outsource, and how can they properly assess the providers?

- Which teams are involved in the decision-making to select the solutions, why, and are the right approaches being taken?

- Similarly, who implements the decisions and is enough being done to ensure the right levels of internal adoption/buy-in, and to make sure that the private clients understand the advantages and can make full use of the new and improved suite of capabilities on offer?

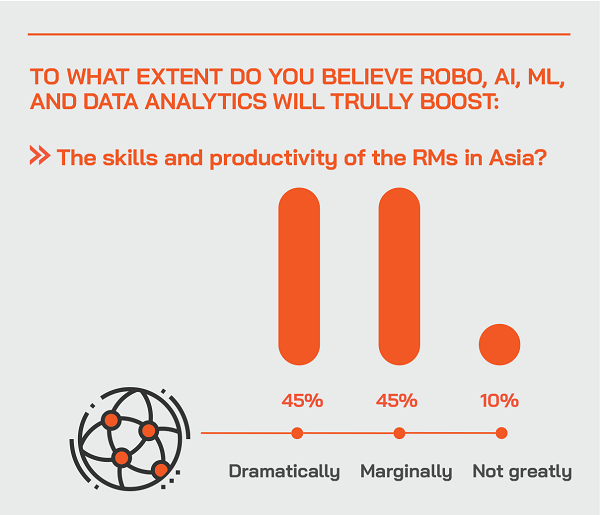

- Are these digital tools really elevating the skills, capabilities and productivity of the client-facing RMs and advisors?

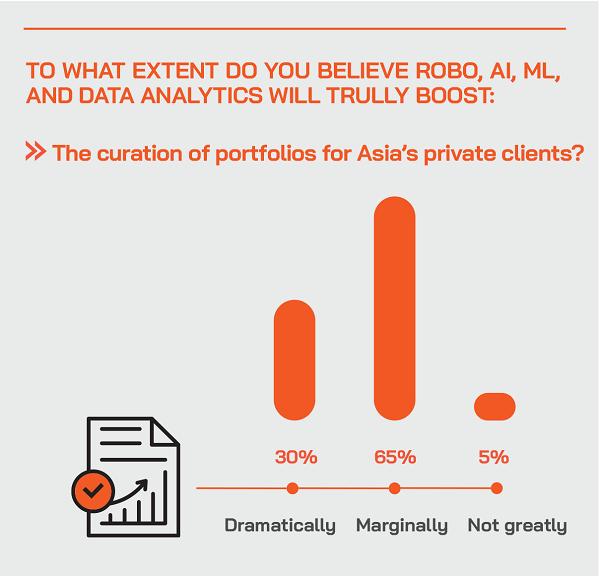

- Do the banks and wealth firms know enough about the vital role of data management and analytics and the application of AI and Machine Learning?

- Is enough being achieved in the field of CLM/CRM to deliver personalisation, relevance, suitability and thereby achieve better levels of client loyalty?

- What's coming next and are you prepared?

Setting the Scene

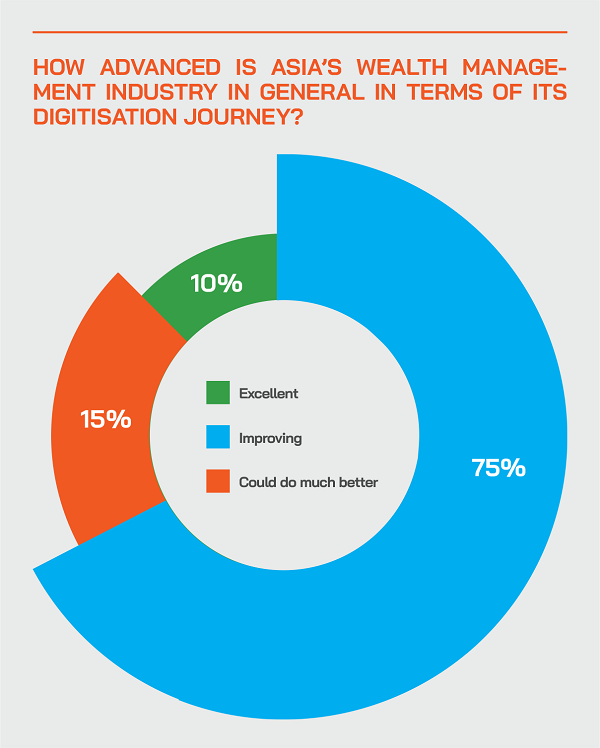

We all know how the pandemic has turbo-charged the drive towards digitisation that had been gaining momentum for quite some years, and against that backdrop, the panel of wealth management leaders discussed the nature of the Asian wealth management market, whilst defining their business and digital needs for the years ahead. They pondered whether this broad digital revolution is being properly embraced, and if not, who might get left behind.

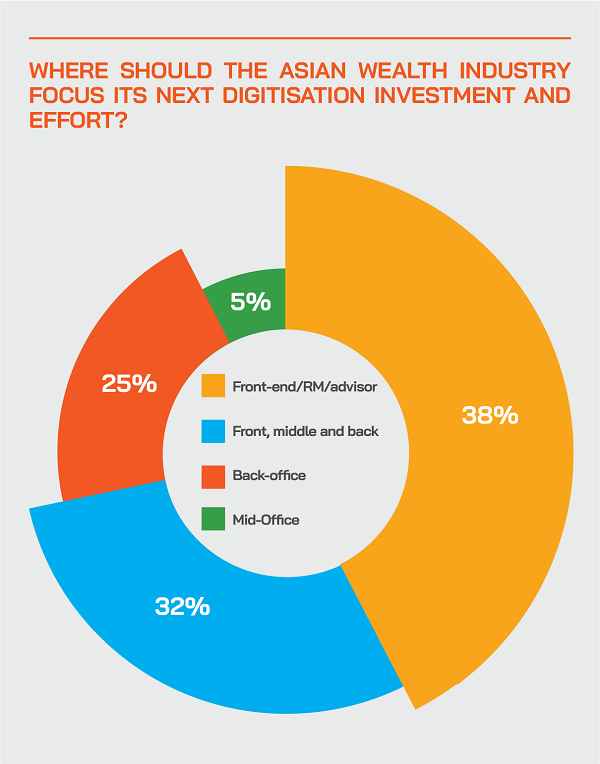

The experts analysed where technology investment is focused today, from back-end to front-end and where the latest and forthcoming digital solutions will be able to significantly enhance the offerings, and just as importantly, how to make the right decisions and follow through to an outstanding outcome with the relevant, necessary buy-in from the various teams within each organisation, from back and mid-office through to the client-facing RMs, CROs and advisors.

The panel also looked into the obvious pitfalls and tricky nuances of implementing and executing these decisions so that these often very significant technology investments are not wasted by not taking the right approach to digitalisation. They elaborated how smart, targeted investment with clearly defined operational and business goals in sight – all with the private client’s needs and experience front of mind - can and will significantly boost their competitive position.

The Key Observations & Insights

The Key Observations & Insights

There is a positive picture in Asia with underlying market growth and rapid digital adoption

A guest opened proceeding by highlighting the strong private wealth creation market, despite the pandemic, and rising AUM at the incumbent private banks and EAMs, as well as at the new entrants/disruptors. “The pie keeps getting bigger, especially when you look outside of the traditional centres of Singapore and Hong Kong. And a lot of this wealth is new to the wealth industry, so you can actually even increase your share of that pie if you have a compelling proposition.

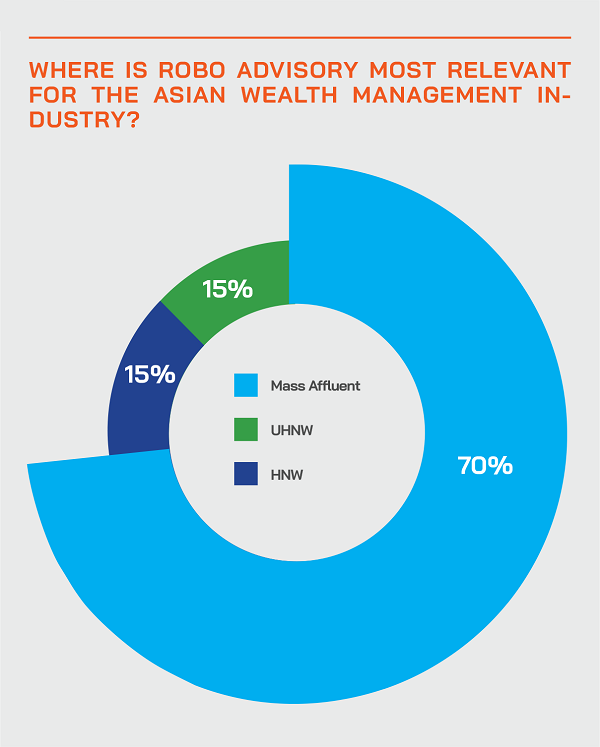

Shifts in the market and expectations

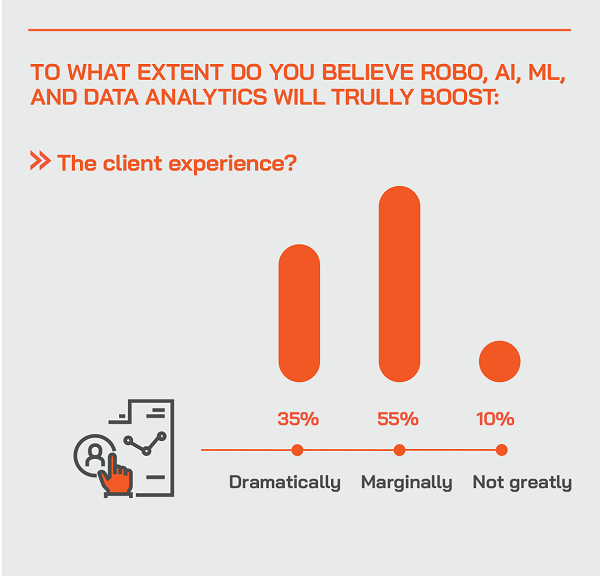

The same expert reported that more and more clients want control and personalisation in their engagement with their advisors and their firms, often shaped by their experiences outside financial services, for example by the Netflix type experience, especially for the mass affluent wealth market, and luxury retail at the higher end of the HNW and UHNW segments, for example with top brand hotels remembering all your preferences and choices from past visits.

RMs must be empowered and freed up by technology, or scale and targets won’t be met

As to the RMs, he reported that digitisation is driving empowerment and productivity, but so too targets top down get higher and higher in terms of net new money and revenue for the coming years, and meanwhile the number of systems and admin tasks they have to navigate increases all the time. “The challenge is that this all necessitates two things, one, a significant ramp up of your RM acquisition, but there is a finite number of good ones out there, so it is difficult to scale unless you empower them and take away some of those onerous hygiene or administrative tasks, so the digital proposition, by definition, is going to be a key enabler of that significant growth trajectory.” But he also conceded that is not easy to get right.

Getting it right and making digital transformation successful is far from simple

Another panellist agreed, adding that the big question is really translating all these trends and plans into reality, getting internal adoption as well as ensuring the clients adopt these new solutions. “The organisation complexity around bringing together business, IT and then making it very user centric, and the whole complexity of the architecture, and so forth, those are the challenges our [consulting] clients face constantly.

The Post-Event Survey: Selected Views from the Wealth Management Delegates

The Post-Event Survey: Selected Views from the Wealth Management Delegates

- “The ability to enable the RM is the most important thing and same needs to be made available to the client as well. Digital along with data is a major thrust for the RMs and customers as well.

- It is all about digital and innovation to produce automation and add personalisation for the clients, and to allow for the interface they prefer.

- As new technologies and digitalisation continue to change the way wealth managers operate, it's more essential now than ever to understand the changing needs and requirements of clients and capitalise on client-centricity and to digitally enable a wide range of channels to achieve the omnichannel experience.

- Most clients prefer more personalise attention in order to build their relationships and produce better outcomes for their needs and expectations.

- Personalisation and hyper-personalisation driven by analysis of customer behaviour are very important and will enable the RM to capture the insights that will help them deliver more relevant and suitable products, ideas and services, thereby boosting the experience and the outcomes for those clients.

- No personalisation means no differentiation in your wealth management offering, which ultimately means you will fail in both your fiduciary duty and your business, ultimately, even if it takes time to who through. But with a genuine digitally-enabled drive to personalisation, you are future-proofing your business against incumbents who are progressing and against the increasing numbers and strengths of the disruptors.

- Personalising the online experience improves engagement, educates investors, boosts customer loyalty and ultimately helps to grow lifetime value.

- Segmentation is one level, but do not hide behind that segmentation, as you then need to drive towards a more personalised and relevant experience for everyone in those segments. To do this, you need all the technology and software at your disposal, to learn and continue learning from each unique client. If you do so, you will be able to better serve those clients, whose expectations continue to evolve.

- Personalisation and hyper-personalisation can be delivered digitally, but also via the RMs and advisors. It is up to each bank or EAM to determine which clients should receive which approach. Clearly, the higher up the wealth tree you climb, the higher the expectation of human interaction and delivery, but even the very wealthiest clients sometimes prefer to be largely digital in their interaction, only referring back to their RMs when they need extra support.

- We see more data-driven insights and algorithmic view of the markets as developments that will enhance the overall WM offering in the region. Besides this there will also be robotic advisory which will drive the future of wealth business. The evolution will enable the RMs to have content and product and ideas ready at all times and personalised to the customer, but the quid pro quo is that the RMs must then deliver on that personalisation by greater productivity and better outcomes, because the relevance of the portfolio of products and services delivered will be far greater than in the past.

- With volatility and uncertainty in markets, the need for highly incisive and totally real-time investment information and optimal client servicing mean that dramatic improvements must be made generally across the industry. This is happening, but it is not happening as fast as it could or should.

- The digitisation of account opening, KYC, AML, and broadly the onboarding process, as well as account transitions and e-signatures has helped in reducing errors and in boosting operational scale, which means the banks and EAMs should be capable of becoming more profitable and at the same time aligning themselves more to their clients. Moreover, there are major advantages to digitisation in terms of compliance and reducing operational risks.

- Changing regulations and the evolution of a broader mixture of asset classes – for example the arrival of digital assets and cryptocurrencies, present challenges as they will have major impact on the wealth management business worldwide. Those who fail to see and react to these developments will see their competitive position eroded.

- There are dangers, as some of the incumbents and some of the newer players will fail to invest wisely in the right technologies, and the right partners and the right staff to help them realise their digital transformation. This will cost a lot of money and a number of years in the wilderness, so getting the strategy and the decisions right from the outset are vital ingredients. Beware – this is far from simple.”

Seeking the differentiation and then driving through to achieve those key goals

Another expert reported that each of the major banks and wealth firms they had worked with is seeking three or four key pillars of differentiation. “They are seeking those angles, those nuances,” he reported. “Some organisations are focusing a little bit more on the data side of things, trying to have smarter analytics and so forth. Others might focus a little bit more on aggregation of content and productivity for relationship managers. But everyone is seeking to rise as the tide rises.”

However, for the major banks, a key hurdle is often their long heritage of client data sitting in many different siloed systems and of inconsistent formats and being quite troublesome to aggregate and then actually use. Another key hurdle is machine learning, which is tough to manage and achieve the right results from. And then they also want to rise to the challenge of creating personalised engagement experiences, where rather than the classic traditional wealth manager printing out a PDF report of the client performance once a month, they want to build dynamic visual tools.

Machine learning – get it right and you are well on the way to hyper-personalisation

Another guest picked up on the comment on ML, noting that there is indeed a great gap between the amount of data that clients provide and their capability to use it effectively. “That is great news for differentiation, because if you can leverage ML now you can get ahead of the competition. So, my message today is simple – it doesn’t really matter about the channel of communication, what really matters for the client is how personalised and thoughtful the whole experience is, and ML allied to data analytics can really help. We see every day how data can be transformed, and how the relevance and the experience can be greatly improved for the clients.”

The challenges of data mining for major banks and institutions should not be underestimated

A guest agreed that legacy systems and practices are indeed making the gathering of data and the ensuing insights tough both down and upstream in major organisations. And that is hampering personalisation.

But the omnichannel experience and data security also rank highly for clients

But he said as well as personalisation, clients greatly value omnichannel so they can select according to their preferences and habits, and he also explained how the hybrid approach of human connectivity as and when required is similarly extremely important within this overall protocol. Additionally, clients and the banks or other providers are all highly focused on ensuring data privacy and online security.

Compliance is another vital issue and a constantly evolving challenge for the wealth management providers to address

The same expert noted how the banks have highly complex businesses and are multi-jurisdictional, and therefore need technology to help manage extremely onerous and constantly changing regulatory requirements, while at the same time managing to also make it as simple and manageable for the end clients as possible. He explained that maintaining the client centricity amidst all these challenges comes first and foremost in their approach.

Working with the right partners, working on the best solutions and communicating effectively and with the right taxonomy are all essential to getting this right. He explained that the competitive environment needs monitoring constantly to ensure that at each level, the organisation is at the leading edge or ahead of the game.

To keep pace with the evolution of wealth amongst younger generations, data and personalisation are both key to the tailored approach clients increasingly expect

The same expert explained that their APAC business was still benefitting from the expanding wealth of the founder generations as their key clients in the region, but that they also want to ensure they are transitioning to the second generation and beyond for business continuity and expansion.

“There are many considerations to bear in mind above simple execution for clients,” he said. “We need to bear in mind the governance aspects, how we transition to the next generations, and how digital can help support this. We are strong believers in the hybrid approach, an approach where you combine the strengths of a very seasoned banker with the ability to scale through digital excellence. That's an approach we continue to drive forward, as it is the key difference that we believe we have over the competitors. And ultimately that’s where data management needs to come in so robustly, as we need to make sure that we are understanding the client from the various channel interactions, be that face to face or digital, and to ensure that we capture the understanding of the client holistically. And with that, we can drive forward a very tailored experience to the client, which is tapped and closely mapped by the value proposition of our bank.”

Whatever personalisation you imagine delivering, excellent in the approach and execution of digital transformation is vital to the proposition

A guest observed that no matter how smart of the banks or firms they work with, one of the perennial challenges is execution, the decision making to actually getting digital transformation on track. “Many firms are still on that journey, increasing the rigour of how they prioritise, take decisions, and drive from ideation into not just getting it launched, but the commercialisation and getting it adopted to actually delivering the business case. In short, it's not just coming up with good ideas. It's getting them realised, then adopted and driven through to the value case.”

Maybe I can just pick on three areas, decision making, the methodology and then change management. So, I think decision making is always a bit of a challenge in a bank because it's not always codified in terms of whether it is budget driven, who gets to make the decision and if it needs to go to the executive committee, which runs every month, and where there are always competing agendas. You usually have a lot of change to get through that very small funnel of decisioning, and then if you don't get approvals, you have to wait and retry. So, some form of codifying some decisions of a certain materiality can help empower the process.”

The other key is methodology, he observed. Approvals might have taken place seamlessly, but then it can too often fall down by poor methodology, without the necessary centralised in terms of how those institutions then deliver change. “We see some movement here,” he reported, “such as setting up internal transformation management offices or transformation teams, or even, heaven forbid, bringing consultants in to help with that.” In brief, he advised that having an end-to-end methodology to move from decision gate one through to commercialisation, and with the steps properly devised and executed is vital to the outcome. “This will result is a lot more predictability on getting to the end goal,” he reported.

And he elaborated on change management. “In general, firms tend to be so focused on getting it done that then once it's done, it's not often adopted at the rate they would have expected,” he cautioned. “And that's because you didn't bring either the frontline or the clients on the journey.” He advised that brining in frontline ‘champions’ and ‘ambassadors’ for these changes such as senior RMs, who can if well on side truly help deliver adoption internally and for the clients. “If your essential non-frontline person is not with you on this journey, you'll never be as taken seriously,” he warned, adding that ongoing training is then also vital for continuity and further internal and external adoption and evolution.

Personalisation needs to be aligned with delivery that is educational and encouraging, and providers must be careful not to appear as product pushers

A guest pointed out that there is a fine line between personalisation and ideas and products following from understanding the client better and appearing to be product pushing. “We see that working with some of the largest global wealth managers, these organisations spend millions creating brilliant research every week on FX rates, on market trends and so forth, but perhaps few read it. They need to use technology to actually break that content up and make it a bit more bite sized, and then actually match that to the customers who need to read it. We believe personalisation is a lot less about finding the right product for the right person, but actually just educating them step by step without actually asking them to buy something.”

There are dangers in not involving RMs and other key staff early enough, as you might be able to cut costs through technology but fail to boost the overall wealth management proposition

“Start thinking about your employees, start thinking about your RMs first, instead of only focusing on customers, because in my opinion your employees are, let's say, your first customers,” an expert opined. “That means that if you bring perfect technology, if you bring actual help and normalise their competency level amongst different employees, your clients will benefit because they will get more personalised service and they will be just happier from all the touch points that they have with your institution.”

Making the right decisions on the right digital solutions and the right partners is immensely challenging

An expert warned that the software houses will all tend to say they can solve this, that and the other challenges for the banks and other clients. But of course, they cannot, and even if they could, they would not be able to solve all of the pain points and achieve all of the missions at the same time. He advised that what really matters is to cooperate with the right people, to have great partners for the years to come. “What I would recommend is to take a look at the introduction of new technology and the partners that you have not only for the situation at this particular moment, but definitely take a look into the future, and see what you can do together to make your institution even more competitive, either five or maybe 10 years from now. And make sure your teams internally are fully engaged from the outset, to ensure internal and later external adoption.”

Co-creation and agile development must be fully endorsed by the organisation back to front

Another guest agreed, commenting that from a major organisation’s perspective, it is extremely crucial that co-creation and agile development is fully endorsed throughout. He said with the right approach and the right software, the right adoption internally and amongst the clients will flow naturally. “And when you have the ability to understand the behaviour of the client through data insights, you have the ability to also understand that he or she might be interested in other asset classes, in other investment products, and that improves the ability to broaden the wallet share, it broadens the appreciation and the experience. And that's the ultimate end goal, namely that the value proposition of the firm is being delivered to the client in the channel of their choice.”

Stay true and committed to the key areas of success and achievement, or you risk failing in digital transformation and ongoing innovation

The final comment went to a guest who said that organisations need to be careful to maintain constant capacity in the areas where they have successful digital engagement. “As soon as you take capacity away from a certain area, it means that your innovation in that area goes down, and that's very risky in this very fast changing world we are in,” he cautioned. “We need to continuously enhance to make sure the digital transformations are being actively managed. Based on discussions with colleagues in all sorts of industries, I don't think that there is yet enough investment into digital transformation. And there is not enough tech talent to cope with the increase in demand for digitisation. In turn, that means we have a challenge in understanding of how to attract the employees and tech talents into the various organisations.”