Wealth Solutions & Wealth Planning

Choosing the Jurisdiction for Your Family Office – Getting it Right

May 19, 2022

A Hubbis Mini Survey and Feature - Sponsored by Jersey Finance

INTRODUCTION

Creating a new family office is a massive undertaking. The right choice of jurisdiction is crucial and there are many key factors to consider that will influence any final decision.

Hubbis conducted a mini survey focusing on the needs of, and choices for, Asia’s UHNW community as they scan the globe for optimal wealth management advice. This includes execution and structuring for greater simplicity and enhanced transparency, privacy and security, connectivity, stability and an increased focus on lifestyle and healthcare options for their families in the post-pandemic world.

To arrive at the findings, Hubbis surveyed 83 senior wealth management professionals in Asia, each of whom offered their own insights into these key issues and their own priorities as to the factors that will most influence their final decisions.

The Report

Single-family offices (SFOs). When a SFO is being relocated or incorporated, they will bring with them hundreds of millions or even billions of dollars of assets under management. The SFO will also likely create major fee revenues for the domestic advisory community and, of course, significant spending power in the local economy.

This has not been lost on the major offshore and midshore financial centres around the globe. All of them have been expanding and aiming to improve their range of appeals and incentives for global ultra-wealthy families, both for the creation of family offices, and in many cases, for associated investment migration for key family members and key non-family executives.

A 360-degree vision required

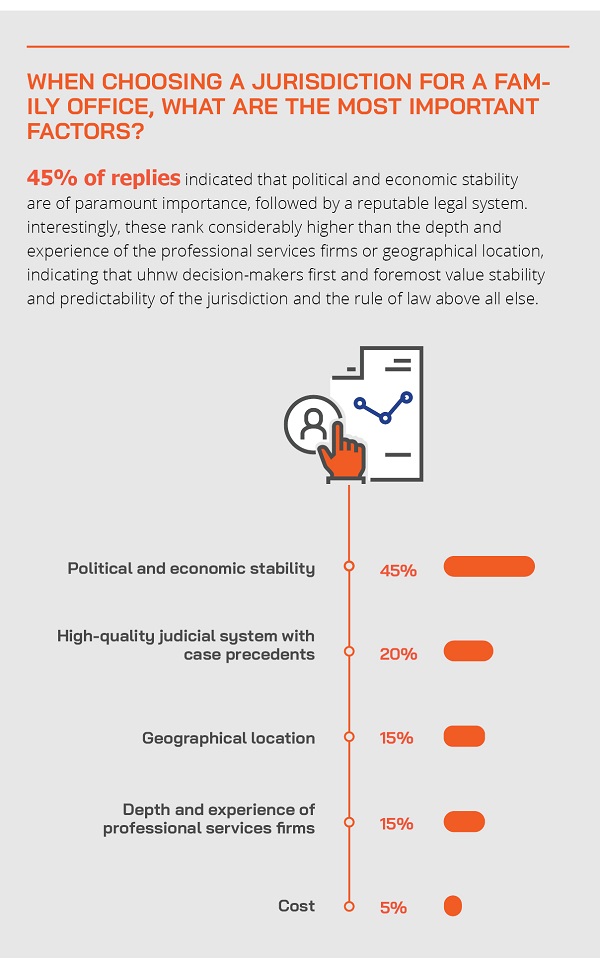

There are, understandably, numerous considerations involved when deciding where to base a family office. The issues they face encompass the jurisdiction’s financial markets capabilities and specialisations, the investment and wealth management infrastructure, as well as the depth of professional and ancillary services.

Considerations include, the regulatory and tax environment, the rule of law, security, communications, connectivity and access to the best technology solutions. There has also been an increased focus on the residence opportunities for family and key personnel, factoring in lifestyle, education, culture and, of course, the need for excellent healthcare facilities.

Elevating the proposition

Within Asia, the key midshore wealth centres such as Hong Kong SAR and Singapore have seen the introduction or expansion of a range of government tax and regulatory incentives for family offices to complement other appeals around infrastructure, leisure and lifestyle, education and healthcare, all of which are increasingly important to decisions these days.

Hong Kong SAR has for many decades been a global financial and capital markets centre. In recent years they have upgraded their range of incentives for family offices, partly as a result of intensifying competition from Singapore, Dubai and as other financial centres around the world improve their propositions.

Some advances, some steps back

Even though the political situation and social unrest have somewhat undermined Hong Kong SAR in favour of other jurisdictions in the eyes of the UHNW community, it continues to be favoured by those servicing mainland Chinese clients (both private and institutional) and has thus remained the key gateway for outward bound investment from mainland China.

The advances in Singapore’s allure for Asian and indeed international UHNW families are well documented. The jurisdiction today stands out as offering UHNW families an appealing mix of modern regulations, tax and other incentives, as well as a growing array of special-purpose corporate and asset management vehicles. Singapore also offers a highly sought-after lifestyle, good education, strong rule of law, and good quality infrastructure and communications. It also boasts an excellent public and private healthcare system, which of course is increasingly important in today’s environment.

Weighing up the pros & cons

But there are also negatives to both these leading Asian centres. Compared to some of the longer-established international financial centres (IFCs) such as Jersey, some respondents believe that Singapore, for example, has not yet developed the full depth of financial know-how, expertise and sufficiently widespread talent. Moreover, there are other impediments – for example, Singapore still does not permit trusts of longer than 100 years and may lack depth in trust case law precedents compared to other mature IFCs. SFOs are also deterred from using the popular Variable Capital Company in Singapore due to asset manager licensing requirements even though they are managing their own money.

In September 2021, the European Union added Hong Kong SAR, along with several other territories, to its ‘grey list’ of jurisdictions. According to a comment by KPMG at the time, this means that the EU considers that aspects of Hong Kong SAR’s territorial tax system may facilitate tax avoidance or other tax practices regarded as potentially harmful. It also means that Hong Kong SAR had agreed to make changes to the relevant legislation, with the EU granting the affected jurisdictions until 31 December 2022 to make necessary changes. This raises a question around certainty, a vital consideration in the decision-making process for the location of any family office. This, on top of the continuing talent drain from Hong Kong SAR and uncertain future, are driving UHNW family advisors to seek out jurisdictions that can offer stability.

For some, Asia also loses some of its attractiveness due to its time zone, with Europe cited as more ideal for ease of communication with international UHNW multi-generation family members and with family business advisors located across the globe.

The appeal of both Hong Kong SAR and Singapore has also diminished due to their approach to the pandemic and the major difficulties of flying in and out without quarantine and other restrictions. Meanwhile, much of Europe is increasingly striving to live with the pandemic, and many countries, especially the UK and Switzerland, are trying their utmost to keep borders and their economies as open as possible.

Perspectives – Selected Insights and Observations from the Respondents

Hubbis: In your conversations with ultra-wealthy families in Asia, what are the key areas of focus and concern at this time?

Selected replies:

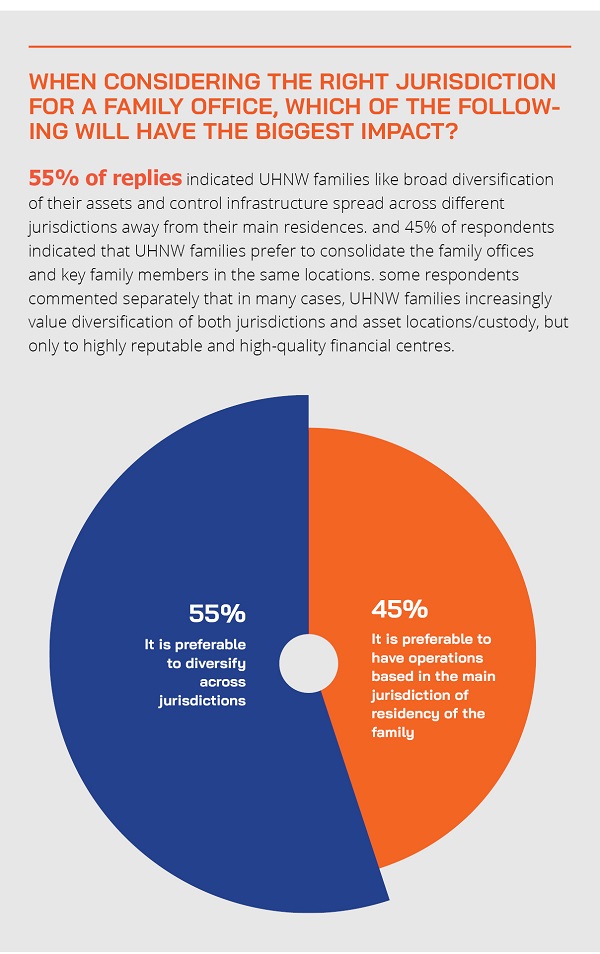

- They want to diversify their jurisdictions, their residences, and where they hold their assets/wealth.

- They want to protect their wealth and assess the right strategies for mitigating risk via diversification of jurisdictions.

- They are highly focused on estate, succession and legacy planning.

- They want to ensure they have the right level of control, hence the rise of the family office and the importance of selecting the right jurisdiction.

- They want centres that are safe and secure, that are excellent hubs for global investments, and which offer access to the increasingly wide range of assets, including private investments of all types and digital assets.

- Many UHNWIs, including some from India and South Asia, are increasingly looking to Dubai, largely because it has remained open and far less restricted in terms of government approach to the pandemic, and also as it is fairly close-by. Chinese UHNWIs and many of Asia’s wealthy are especially attracted to Singapore due to the range of incentives and the excellent lifestyle on offer there. Hong Kong SAR remains of considerable interest for many Asians, but not so much for global UHNWIs from outside Asia.

- Long-established, well-regarded and well-regulated IFCs are gaining traction with the global UHNW community; basing family offices in such jurisdictions offers them both reassurance and a positive reputational sheen.

- Clients want to make sure they have robust succession planning in place, as many of the younger generations do not want to take over the family businesses. The consolidation of wealth and control in a family office infrastructure does, however, help keep the younger generations together with the family, as they can assume important roles managing the family wealth without taking on day-to-day duties managing the operational businesses, which can increasingly be handled by professionals.

- Wealthy clients are increasingly seeing that their authorities are monitoring their wealth more carefully, which is encouraging them to further consider asset and jurisdiction diversification.

- We see trends such as the consolidation of wealth, a greater emphasis on private deals and on control, greater receptiveness to geographical and jurisdictional diversification, more involvement by the Nextgens, and greater willingness to employ outside, professional talent/specialists.

- Families typically prefer to adopt a more professional approach to managing wealth and therefore require a sophisticated and efficient set-up with relevant expertise available either in-house or through retained consultants. In this way, they get proper advice to assist them with suitable decision making and also to ensure they have proper compliance in place.

- There is a thrust towards consolidation of locations and control, so that these ultra-wealthy families do not need to have multiple structures in multiple jurisdictions and multiple teams reporting in. Families are also increasingly cognisant of rising taxes and changing government policies. They want to simplify their regulatory footprint as far as possible, and they want access to the best range of investment management, banking, legal infrastructure, and global connectivity, as well as easy access to tax residency, permanent residency and such types of long-term arrangements for family and key personnel.

- Many UHNW decision-makers are increasingly concerned about the changing geopolitical environment, and in particular, the worsening diplomatic relationship between US and China and want to consolidate assets and resources. They want better and more immediate access to professional advisors, and they are increasingly considering more robust risk mitigation and disclosure.

- They focus more and more on global regulations, which are no longer distant; they are everywhere and cannot be avoided.

- Families are increasingly wanting to set up family offices to manage their wealth rather than relying on private bankers, who are increasingly being pushed to the role of product or platform providers, and many of whom have lost their traditional importance for the ultra-wealthy.

- The trend among the very wealthy Asian investors is to diversify out of jurisdictions and situate companies in highly credible jurisdictions to avoid situations such as the Pandora papers, the Panama papers and so forth. They want to also use a variety of service providers instead of concentrating on one or two; this is for risk mitigation in case of a “disclosure Tsunami” brought about by global and regional/local regulations. In short, they want more control.

- Families are increasingly looking for safe and stable jurisdictions with supportive tax schemes, great connectivity and a powerful business ecosystem and welcoming psychology.

UHNW families seek quality and integrity

The demand for family offices has accelerated in recent years. With increased sophistication and a focus on strong governance and effective succession planning, UHNW families are planning long-term and not just 5 or 10 years ahead. As some respondents indicated clearly, many UHNW families are now taking a pro-active over re-active approach to planning i.e., not waiting for the next pandemic to disrupt their business before they act; The choice of jurisdiction plays an integral role in this process as they seek stability, resilience and flexibility to grow and evolve with the changing aspirations of future generations.

Indeed, quite often, as our experts highlighted in some of their responses, many UHNWIs and families were lacking effective policy and framework before the pandemic hit. Situations may be considerably better now, but a rigorous, deep-dive assessment and thorough analysis are essential before they can review viable options for establishing their family offices.

A world of choice

Taking the wide-angle perspective, the survey revealed that the consensus amongst many experts is that within Asia, Singapore appears best positioned for establishing a family office. They indicated that Hong Kong SAR remains competitive, and that further west, Dubai is an up-and-coming jurisdiction, albeit relatively less developed than Singapore or Hong Kong SAR.

We also found that there is growing interest amongst international UHNW families in long-established, high-quality IFCs, such as Jersey. To attract Asia’s UHNW decision-makers, they must offer the right combination of a proven history, well-devised corporate and fund vehicles, high-quality advisory expertise and the right range of structuring expertise.

They must have excellent reputations and great integrity, as well as forward-thinking regulations and regulators. Jersey, some experts reported, demonstrates those characteristics well.

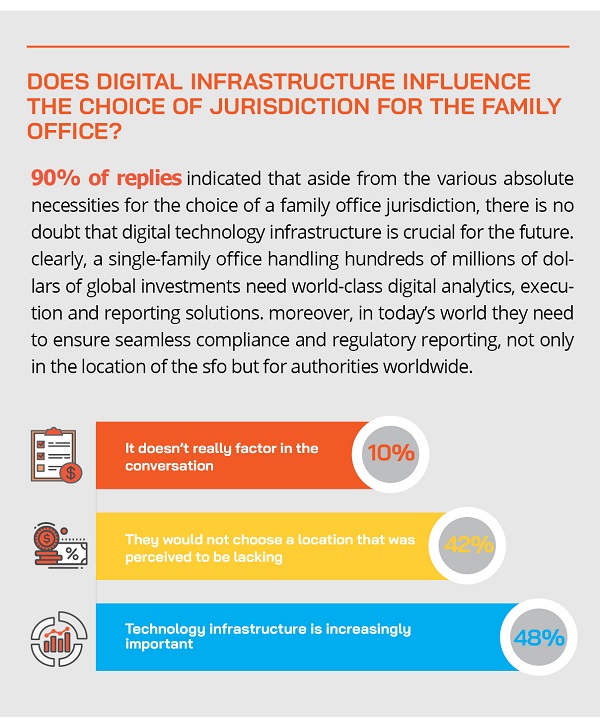

Interestingly, Asia was not cited as the clear winner that one might imagine in technology, which is another very important factor in decisions regarding SFOs. Jersey, for example, is also highly regarded for its technological infrastructure, full fibre network and lightning-fast broadband.

Rigorous analysis needed

There are most certainly some very important ‘rules’ for UHNW families and their advisors to follow when considering the establishment of a family office in any chosen jurisdiction. First, those families need access to the best advisors, and they need to recognise they must pay the necessary fees for their expertise. Those families and their advisors then need to be extremely thorough in their analysis of what they want to achieve and why. Only then will they be in a position to proceed with the right level of professionalism and confidence, with their decisions endorsed by the relevant experts and advisors.

A family office is a very expensive vehicle to assemble and manage properly with numerous decisions to make on how much of each function is handled in-house, or perhaps outsourced to other parties. Decision-makers must look at the entire governance framework of the family, consider all the regulations and tax issues, and understand the multiple components that need to be coordinated correctly to achieve the best results.

They need to determine which family members are central to the proposition and which non-family executives they will need, whether CIOs, COOs, CTOs or others. If all these decisions are conducted efficiently and comprehensively, both the family office and the family are more likely to be positioned to thrive for many generations ahead.

UHNWs bring real wealth

In addition to a SFO’s considerable wealth, they are also the source of significant fees for the financial and advisory community. Furthermore, they can create employment opportunities for CIOs, COOs, CTOs, in-house fund managers, as well as administrative and secretarial staff.

Through local employment and payment of significant salaries, this generates meaningful government taxes and other dues. This in turn creates increased spending power within those economies, from high-end housing to private planes, education and healthcare.

Perspectives – Selected Insights and Observations from the Respondents

Hubbis: What factors influence the UHNW family decision as to where to base a single-family office today?

Selected replies:

- The original and planned location of key family members.

- The location of the core financial assets.

- A tax-efficient, tax-incentivised and friendly environment.

- Skilled staff locally and the capability to relocate key personnel to the chosen jurisdiction.

- Communication standards, privacy and confidentiality must be optimal.

- The infrastructure must be excellent, with easy access to airports for both scheduled services and private jet services.

- Political stability.

- The rule of law and a reliable and sensible, pragmatic legal system.

- Good and progressive regulation.

- Privacy.

- Access to high-quality financial services and a wide range of professional services, from legal to accounting, corporate and trust.

- Quality of life, given that key family members and key decision-makers will often want to relocate their residency or even citizenship to this chosen jurisdiction.

- They seek economic stability and a positive economic and social outlook.

- There is little doubt that privacy concerns are central to personal migration and residency for UHNW families, who will naturally feel more secure in locations where regulation, practices and technology are all sufficiently robust.

- Security and safety.

- Excellent healthcare infrastructure and professionals.

- An excellent educational infrastructure.

- Wealthier families usually consider tax mitigation, but this is now no longer the only factor to consider. Many of them want to consolidate wealth, and to carry out their succession plan, especially since the pandemic. Accordingly, the high predictability of the future political and economic stability, a reliable legal system, and the depth of expertise available are all more important factors than simply tax issues.

- Ease of access to leisure and other facilities, as the pandemic has restricted a lot of activities and a lot of travel that was so easily available in the past.

- The Nextgens are starting to adopt a train of thought of pursuing structures in jurisdictions where they can see themselves settling in the future, in other words their families are moving their wealth and their different generations, rather than simply benefitting from the wealth in their country of origin. They will, however, usually retain close and strong ties to the original home bases and cultures.

- They seek transparency and a welcoming environment for high-end family wealth and relocation. Key factors include where the family habitually resides, what support they need in relation to the jurisdictions where they reside and where their assets are held or located. It is very useful to draft a list of potential jurisdictions where the family has the closest connections, and where they hold their bank accounts. These and other key factors will help them rank those jurisdictions from a variety of viewpoints, thereby helping them to select the most appropriate jurisdiction to site their SFO.

- They value tax fairness, transparency and the right array of double-tax treaties.

Taking the practical approach

UHNW families, therefore, have multiple aspects to consider before they arrive at their decisions on the family office. They must make a thorough evaluation of their current family dynamics, the scale, range and location of all their assets, their investment goals, as well as their estate, succession and legacy objectives. They need to consider the fiscal, tax and other incentives available in each jurisdiction and the regulatory situation. And as they move ahead, they must think about staffing, management and technology amongst a much longer list of matters to consider in support of a well-informed decision.

Theory and pragmatism must also align in all decision-making. In Asia, dominated as it is by a very high percentage of family-controlled businesses, many of these UHNW families still have family members deeply involved in their management. Accordingly, it is sometimes impractical for them to relocate, especially outside their main region, such as Asia.

On the other hand, some of the key individuals can move jurisdiction to help consolidate the oversight of both the family financial investments and the operational businesses. For this, consolidation of control through the SFO is ideal. This also opens a bridgehead for other key personnel and family members to perhaps move to the chosen family office jurisdiction at a later date.

Tax – important but no longer a core driver of decisions

Respondents remarked that while tax considerations are, of course, very important, tax mitigation is no longer a key driver in the choice of family office jurisdictions or centres for structuring wealth. That has levelled up the playing field for the more reputable jurisdictions with stronger regulations, oversight and protocols, leaving the more ‘exotic’ offshore centres struggling with portraying the right identity and delivering a strong proposition.

Substance matters

There is also a greater emphasis placed by International and domestic authorities on the concept of economic substance. This is particularly relevant in relation to what might be deemed shell companies or non-operational holding companies. With changes to regulation, increased focus on transparency and exchange of information, what was permissible a decade or more ago is often regarded suspiciously.

Accordingly, substance plays an increasingly important role in these arrangements to ensure effective compliance with management and control expectations. Again, this is another driver for family offices moving to jurisdictions that offer the right blend of structures, corporate vehicles, tax or other incentives, as well as robust economic connectivity to the world.

Age-old truths

At the same time, the pandemic seems to have also reinforced the age-old adage that the two inevitabilities of life are death and taxes. UHNW families can also see the potential for intensifying pressure on the wealthy to pay a higher share of their income or overall wealth in taxes. It is therefore even more vital than ever before that the financial and broader regulatory affairs of these UHNW families are in order and that they fully anticipate any such tax and compliance risks ahead. Again, this tilts the balance further in favour of stable, well-regulated jurisdictions with a robust rule of law.

It is also important to note here that legitimate and well-regulated jurisdictions that are tax neutral by design should not be tarred with the brush of ‘tax havens’.

There will always be positives and negatives associated to every jurisdiction, but the replies we received, highlighted the importance of effective oversight and vigilance. Even for those with significant structures or with SFOs already established, they need to review the latest regulations around the world to establish the impact on their current arrangements and then, working with their professional advisors, make the necessary adjustments.

Easier in Asia, but things can change…

One of the big advantages that many UHNW clients in Asia enjoy is that they often live in countries where there are no gift taxes. This might make it easier for those family members that cannot move (perhaps as they are running the family businesses) to shift assets to other family members who can move both assets and their residence overseas. This helps these families shift assets to new jurisdictions and offers them greater flexibility in the establishment of their SFOs.

But there is little doubt that many wealthy people and advisors have their eyes on potential changes in tax rules even in Asia, as countries and governments scramble to shore up their finances, which have been almost universally hard hit by the pandemic.

The pandemic has also focused greater attention on the value of social and philanthropic endeavours amongst UHNW families, an area in which Jersey, for example, has made great strides forward with its foundation offering.

Perspectives – Selected Insights and Observations from the Respondents

Hubbis: When and why do you think it is necessary or at least very beneficial to set up a family office?

Selected Replies:

- A single and full-service family office is for those with a bare minimum of USD50 million of assets, and more generally, several hundred millions of dollars of assets. There are then various models, depending on what fits the needs of the family, but it would encompass coordination in all areas, such as legal, tax, investments, family concierge and so on. The key is how the family office is implemented. Clearly, the largest families may bring more activities in-house, but in the current era, it is possible to contract out many of the functions and have a smaller in-house coordination team. Even the CIO functions and asset management can be contracted to a multi-family office, the structures and administration to a trustee and corporate services provider, and so forth.

- Generational transition of wealth and control – and there are literally trillions of dollars of wealth due to shift generations in Asia in the next decade or more - is a powerful catalyst to outsource progressively and segregate business ownership from wealth ownership. Many families still opt for a two-step approach: first, being part of a multi-family office, and subsequently, transition to a single-family office if/when privacy, costs and bespoke arrangements warrant that significant step.

- Once a family achieves a significant size of portfolio (and people have differing views on the threshold), they will often start looking at options and move towards establishing a family office to manage all that centrally for the family with suitable guidance being received from external experts. Even if they are big enough to hire many of the experts in-house, they will still need plenty of external expertise and will indeed be better able to coordinate and leverage such capabilities and expertise, which is likely to boost the success of their investments and structuring.

- It depends on the family and their sophistication in managing their assets. A family office is not right for every very wealthy client. Clients tend to set up a SFO if they have a very big portfolio of investments to manage and want to involve key family members in the active management of the portfolio. It is also useful for a change of residency and even citizenship immigration, for example, to shift themselves and key family and personnel to certain preferred locations. The SFO is also an ideal vehicle through which to coordinate structures and legacy/succession planning.

- The SFO helps UHNW families manage wealth seamlessly and also in the most tax-efficient manner. It is also important, now more than ever, as regulations and laws have become so complex and there is the constant shifting of the authorities’ approach to tax, making the SFO an ideal hub for the optimisation of these families’ oversight of their assets and regulatory matters of all descriptions and globally.

- Major business families with substantial wealth should plan early to avoid the potential dissipation of wealth and to uphold the unity of the family, with well-planned succession arrangements and family governance for the avoidance of or for resolving conflicts amongst beneficiaries and successors.

- The family office is an ideal vehicle for the expression and coordination of wealthy families’ personal investment objectives, including the increasing drive towards impact, ESG and philanthropy, as well as for asset protection, growth and estate/legacy planning.

- In the next decade and beyond, Asia will experience a major transitioning of wealth to the tune of literally trillions of dollars across generations of HNW and UHNW families, so the time is ripe now for such significant families to set up a family office. Such an organisational structure will help families by providing them with a structured approach to manage and preserve family wealth. It will also provide a forum for the family to facilitate discussions on topics such as estate/succession planning and inheritance issues. In addition, the hub will enable families to better manage their risks and create a formal structure for philanthropy, ESG and impact investing, all important trends in Asia and globally.

- Subject to the definition and understanding of a family office, in its purest and simplest form, it operates as an investment management function. The ‘why’ centres on consolidation; this achieves a more holistic view and better control of the family's portfolio. It promotes tax efficiency, better reporting, and improved compliance. It achieves a generally more professional set-up. The ‘when’ to set one up can be determined by a liquidity event or lack of time and/or human resources amongst the family. It might be a collective realisation and decision that the time is right, seeing that the complexity of wealth and diversity of assets and jurisdictions merits it. They might then decide that delegating the management and all the investment and reporting tasks to an independent professional structure enhances their overall situation.

Keeping things private

Turning to the issues of confidentiality of information, a respondent highlighted how the authorities’ efforts at maximising tax revenues poses an increasing threat to privacy. But they also noted that people today only have that right to privacy if their tax and regulatory affairs are in order.

A wider concern in recent years is the major information leaks on wealthy and prominent people, such as those highlighted in the Pandora Papers. Wealthy families want comfort that the jurisdiction and the parties connected can reliably protect them from unforeseen and unwelcome revelations in the media.

There is also the risk of becoming ‘guilty by association’ with jurisdictions that have been, or that might later be, tarnished with reputational stigma, whether justifiably or not.

To this end, there were comments that the leading midshore and IFC jurisdictions are preferred by more and more UHNW families these days. Transparency and disclosure are essential, and those centres that exude an image of the rule of law and good governance are winning more and more clients.

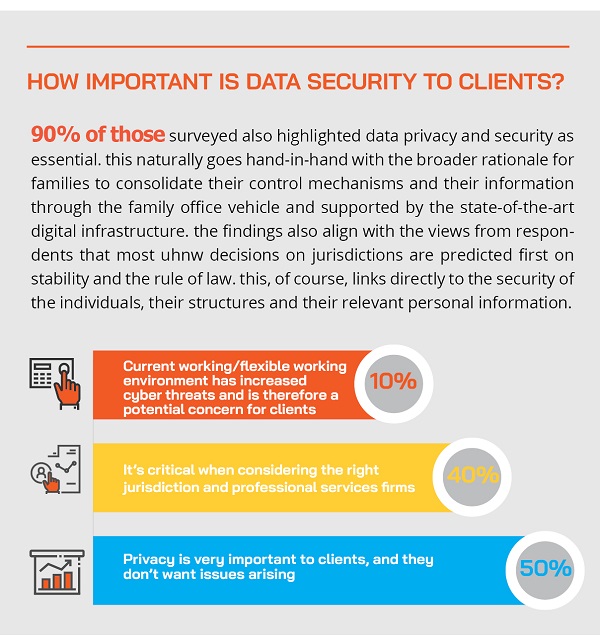

Respondents also noted how leading jurisdictions and the banks, advisory, accounting, trust and other firms working from those centres are increasingly using the latest technologies and software to ensure security and safeguarding of illegal disclosure of information.

Lines in the sand…

Respondents noted that the wider issue of privacy also overlaps with the pressure to adopt public registers in financial centres. But as that takes place, the respondent also suggested that jurisdictions must be careful to avoid these pressures to make private information fully available to members of the general public simply to satisfy their curiosity.

There is an increasing move towards public registers of everything, even though there are still voices of dissent who argue this is both undesirable and completely unnecessary. As respondents pointed out, the best jurisdictions adhere to the global regulatory efforts and evolving standards to tackle financial crime, but at the same time provide their clients with the right environment, technologies and protocols to protect their privacy.

An expert noted, for example, that Jersey - unlike Hong Kong SAR or Singapore – does not make private company shareholder information publicly available. Jersey has collected and maintained details on beneficial ownership since 1989, but has never made the information accessible to the public, although relevant information is made available on request to law enforcement and competent authorities.

The compliance net will only tighten

And this is all of course part of the broader motivation for the establishment of the SFO in a welcoming jurisdiction. The ‘big picture’ reality is that the mantra must now be that one assumes everything is known to any inquisitive authorities around the world, or at least that soon will be the case, given the proliferation of regulatory acronyms in recent years such as FATCA, CRS, AEOI and MDR.

Families and their advisors must therefore operate on the basis that everything is going to be open and transparent in the future. This also means that it has become even more essential that these families can access top-quality professional advice and expertise in each jurisdiction. If so, they will be better situated to navigate this challenging and constantly changing global regulatory landscape.

Indeed, ultra-wealthy families that do not acknowledge this reality as part of their family office planning are taking unnecessary risks. Accordingly, those well-regarded jurisdictions that do their utmost to protect the clients’ privacy while also providing the platform for high-quality professional services and regulatory compliance are increasingly in favour.

With the move towards increasing openness and transparency comes the increased risk to data privacy. SFOs have the right to ensure that their privacy is safeguarded from those with no legitimate right of access to the information. Whilst both Singapore and Hong Kong SAR have data protection legislation in place, they don’t go nearly as far as the EU General Data Protection Regulation (GDPR) introduced in 2018. GDPR is a game changer in international data protection regulation, setting a higher bar of accountability to those responsible for collecting and processing of personal data and offering increased protection and recourse for data subjects. An IFC that complies with GDPR, or has equivalent data protection legislation in place, will be attractive to SFO’s looking to legitimately safeguard their privacy.

Perspectives – Selected Insights and Observations from Respondents

Hubbis: Has the Covid-19 pandemic made any significant difference to the decision-making amongst these ultra-wealthy families?

Selected replies:

- The ease of access in and out of, and the location of key jurisdictions have become more important.

- People have become more fearful of the future, more cognisant of their mortality and therefore more determined to reorganise and restructure their affairs and assure themselves of the appropriate estate, succession and legacy planning and structures.

- We think the UAE is a big winner, thanks in no small part to its handling of the pandemic. Indeed, even some UHNW Singapore families shifted their epicentre to the Gulf in 2021.

- The notably disproportionate reaction of some governments globally to the pandemic has been witnessed clearly in Hong Kong SAR and Singapore, relative to (for example) Dubai, Switzerland, London and some other jurisdictions. Furthermore, Covid has highlighted the ability to work virtually/remotely. For the more sophisticated families, this has enhanced the flexibility for the family office base. For example, some family members may prefer the quality of life in Singapore to Dubai, but perhaps Dubai provides a more attractive location to HQ the family office due to tax simplicity, the time zone and costs. Similarly, a family may prefer to reside in London, but have the family office run from perhaps Jersey or elsewhere, offering them choice and diversification.

- Very simply, families are travelling less and having less meetings and less social activities. They have more time on their hands to pursue what is evidently their growing interest in much more professionalised wealth preservation, succession and wealth transfer solutions. The activity around all of these areas has picked up tremendously since the pandemic hit.

- There is the expression that there is no substitute for a handshake and look in the eye, but I think we may be seeing that there actually is. This pandemic has illustrated that businesses and people can work perfectly well wherever they are, and the idea that you must be near your office is being proven somewhat false. This is to some extent also freeing up UHNW families as to their choice of jurisdictions for their SFOs. Moreover, UHNW families may increasingly be realising that they can be anywhere they wish and operate very effectively and at least reduce travel with some significant environmental benefits. So why not go somewhere where there may be a very advantageous tax climate and a pleasant way of life?

- People with real wealth are now more often looking to migrate to live in a secure jurisdiction which has the amenities for their lifestyles and the relevant infrastructure and regulatory environment to help them consolidate and manage their wealth. Access to top quality healthcare is essential.

- Technology has freed people up to operate from preferred locations hence the diversification to new bases for remote control of wealth and indeed businesses. With the pandemic fully set in, this has become much more acceptable than before, and it is in many ways the new normal. The family office can be anywhere, while key financial assets can be spread all over, and key management can still be located at or nearer the operational businesses. In short, there is a world of choice for these families.

- The pandemic has instigated a greater focus on family governance, family connectedness and on robust legacy and succession planning. Families realise they must address the ’what if’ scenarios earlier than might normally have been the case had the pandemic not struck the world.

Lifestyle and health matters

Another factor - and this is also closely inter-twined with a host of issues including tax - is the optionality to select jurisdictions that ideally suit both the location of the family office and the lifestyle and residency objectives of the key family members.

There are, of course, many more countries that suit the UHNW community in terms of lifestyle than there are jurisdictions that are also ideal for the family office HQ. However, respondents cited locations such as Singapore in Asia, or Geneva and Zurich in Switzerland, Dubai and Jersey as offering a good combination of qualities and attractions.

The investment migration industry has expanded rapidly in the past decade, focused mostly on HNW and UHNW clients seeking visa-free travel and a more robust passport than perhaps their countries can offer.

But nowadays, migration related to the establishment of a family office is another level entirely, and in some markets – and a good number of replies cited Singapore and Dubai as good examples - there are often government incentives regarding residence and even citizenship for key individuals related directly to the establishment of family offices or significant fund/asset management operations.

Health takes centre stage

The respondents also highlighted how the Covid-19 pandemic has dramatically impacted lives all around the world. While in the past, wealthy clients sought to establish a second citizenship or residence in countries that provided the best access, resources and opportunities, now the ability to reside in a country with a world-class healthcare system and health security is very much at the forefront of decisions.

Conclusion

This mini survey very clearly identified the many key concerns that Asia’s UHNW families must address in their selection of a jurisdiction for a family office. It served to highlight how this pandemic has given Asia’s wealth management and client community time to pause for due consideration on these matters, as well as an additional impetus to reach their decisions in a timely and professional manner.

It identified the key motivations and challenges for Asia’s ultra-wealthy families in establishing their SFOs and pinpointed the importance of security, stability and also lifestyle in these decisions. It also highlighted how vital it is to approach these decisions methodically and armed with the best professional advice.

There is little doubt that the momentum for the establishment of family offices by Asia’s rapidly growing UHNW community will only continue as transparency and professional planning becomes more of a necessity than a luxury. In a world of regulation, compliance and increasing state ‘interference’ internationally, smart people are making smart moves. UHNW wealth is increasingly turning its back on some of the more ‘exotic’ offshore and opaque jurisdictions, other than for certain compliant and transparent structures. UHNW decision-makers are today concentrating their focus and their resources on well-established, high-quality, well-regulated, transparent and well-diversified midshore locations, in addition to the top tier of IFCs.