Asia’s Private Wealth Clients and the World of Private Assets & Private Markets

Aug 31, 2021

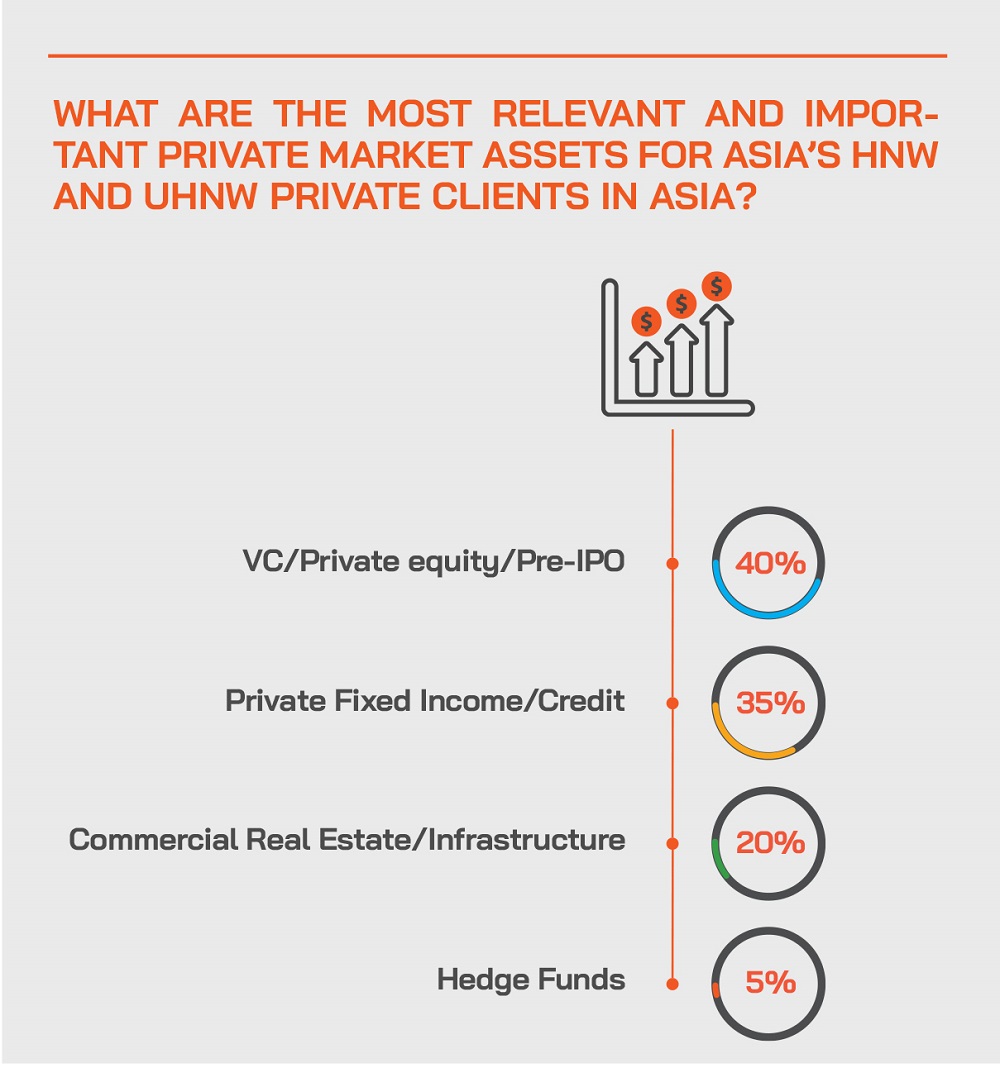

The expanding universe of private markets encompasses private equity, private debt of all types, venture capital, distressed debt, hedge funds (often considered more in the alternatives basket) and some parts of commercial real estate, and all are non-listed. More of the world’s leading institutions and wealthiest investors are allocating more and more to these private assets, and the investor pool seeking out such prospects today is truly gigantic. The Asian HNW and UHNW clients that are taking up more of such opportunities need a highly professional point of access via private banks and other key specialists who can filter, package, promote and then monitor these investments, thereby opening the door to what are considerably more complex but also higher fee deals than in the very low commission public markets. The leading mainstream equity indices have recovered dramatically since the slump induced by the onset of the pandemic, but valuations are increasingly challenging, volatility remains elevated, and performance has been more selective towards certain key sectors, especially technology, healthcare and selector other sectors. Diversification to private equity deals offers investors the chance to get into good companies earlier, albeit with the trade-off being far lower liquidity, and requiring the investor to hold for a considerably longer time. Our Digital Dialogue assembled a top-flight panel of experts to take an in-depth look at the evolution of the private markets from the Asian investor perspective.

Panellists

- Chau Ly, Senior Investment Specialist, Private Markets, Aberdeen Standard Investments

- Gary Leung, Head of Managed Investments and Private Equity, Hong Kong, Bank of Singapore

- Nick Xiao, Chief Executive Officer, Hywin International

- Manmohan Mall, Head, Private Markets, Kristal.AI

- Conor Smyth, Founder & CEO, TritonLake

The growth of the private debt markets has been simply phenomenal over the last decade as the market has developed to offer additional yield to investors who are prepared to accept less liquidity and often considerably longer holding periods. Whether debt or equity, the private markets bypass the volatility and uncertainty that afflicts the public equity and debt markets. The combination of all these attributes has been driving a rising tide of enthusiasm and money to private markets from leading sovereign, quasi-sovereign, institutional and of course, private wealth market investors across the globe, and this is a phenomenon that is very evidently now playing out in the Asian private wealth markets.

An expert opened the discussion by reporting that their firm holds some USD80 billion AUM across private markets, in private equity, private debt, infrastructure, as well as real estate, both multi manager and direct products. “We have solutions that we've developed, that really target some of the HNW and UHNW investors,” he explained. “These are private market solutions across all the best ideas across private markets, and we manage the investment selection, the due diligence, and the risk management implementation for our clients.”

He said the firm also offers very specialised strategies, mid-market buyouts that are typically tougher to access or harder to find or require more extensive due diligence for clients in Asia. “We have a lower mid-market North American buyout strategy with a tilt towards tech and healthcare and some of the essential business services, and we also tactically manage the portfolio so that we add in co-investments and secondaries.”

VC is a key subset of the private markets

He explained that for clients in Asia, the firm also manages venture capital portfolios, backing the next wave of category-defining disruptive technologies; they tend to back early-stage managers, taking sizeable positions in companies at an early stage, usually the first round of institutional capital. “Venture capital is one of those areas where clients can't really access some of the top tier names, but we've been doing it for over 25 years,” he reported. “Since 2015, we've been an investor in over 80% of venture-backed tech sector exits over USD300 million. We also have strategies in infrastructure and real estate, and private credit as well.”

Expert Opinion - Conor Smyth, Founder & CEO, TritonLake: “In addition to building relationships to ensure that we understand the investment preferences and needs of the investors we work with, TritonLake employs technology to make our interactions as impactful as possible through our portal, opportunity summary emails, and proprietary investment matching algorithms to prioritise what we share with who.”

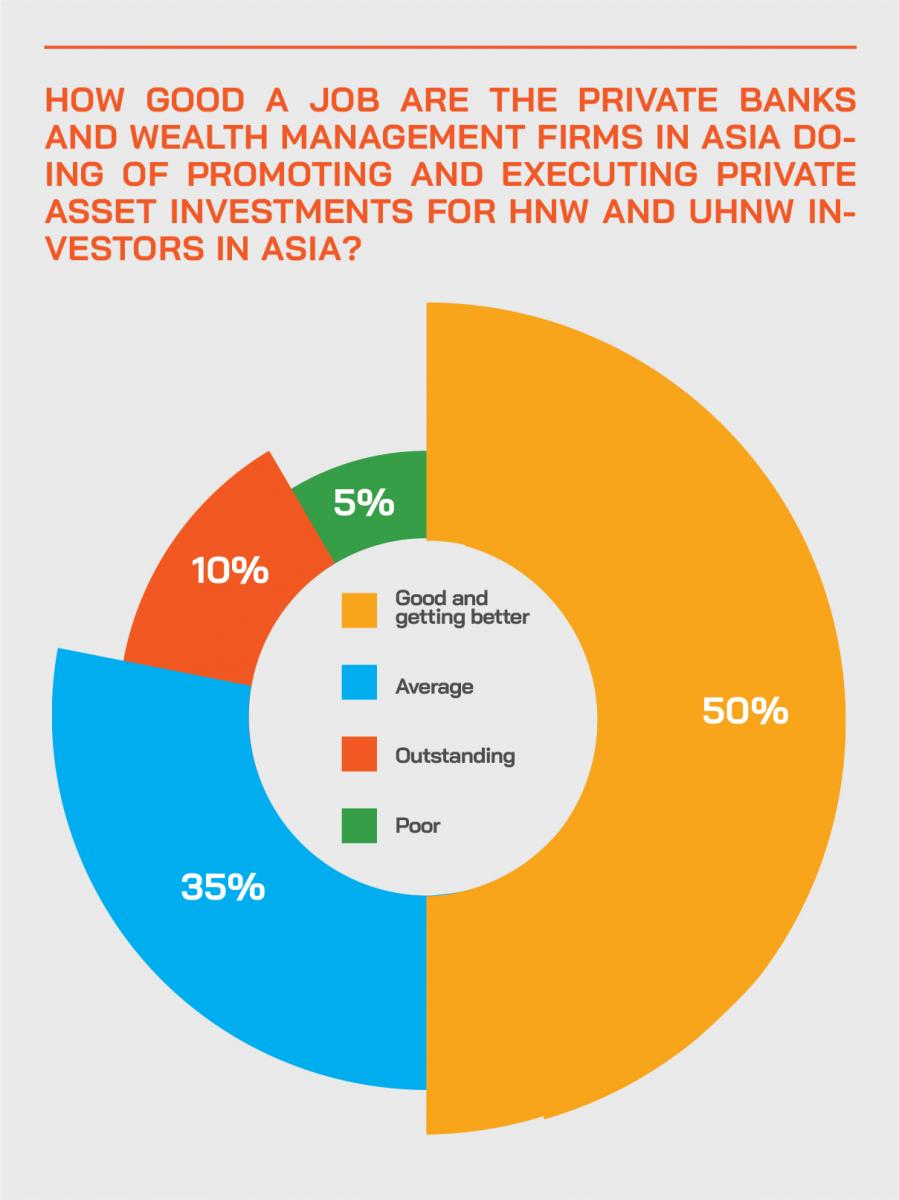

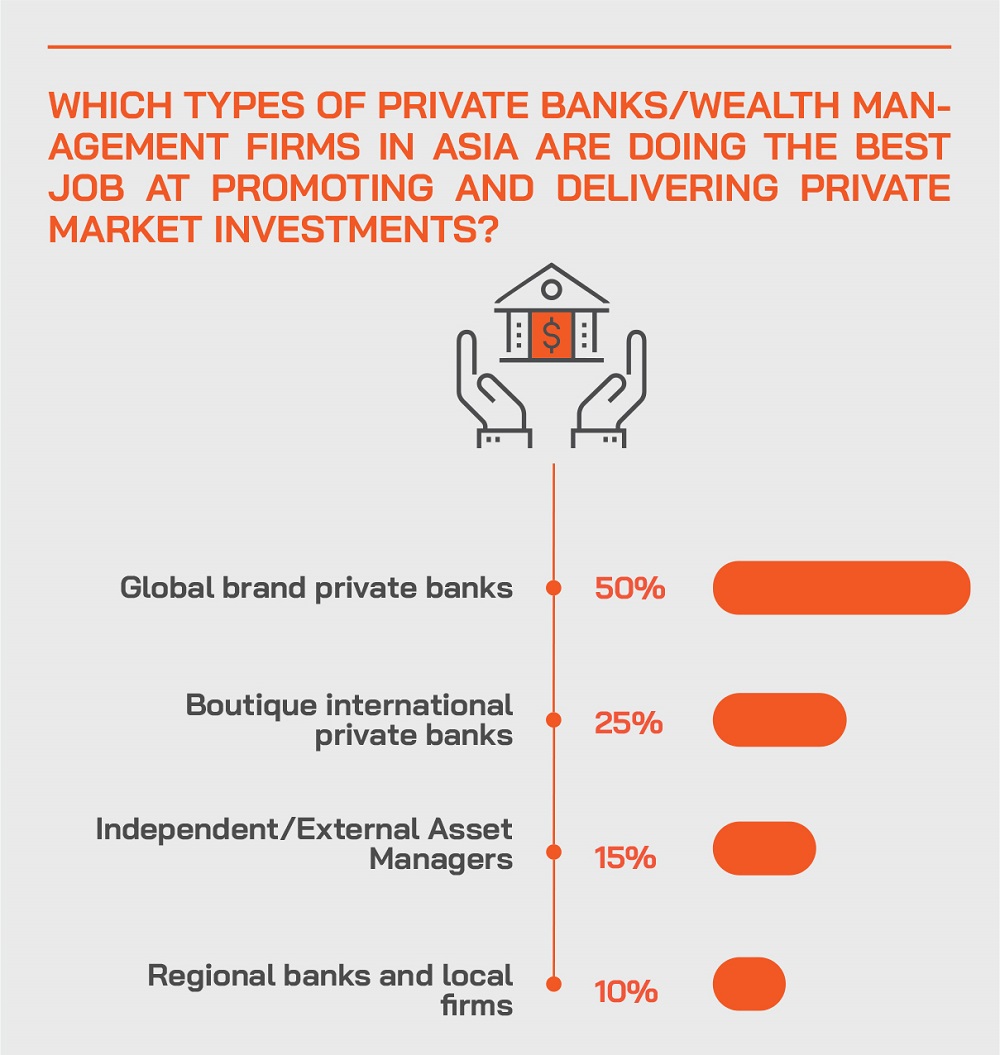

Expert Opinion - Manmohan Mall, Head, Private Markets, Kristal.AI: “As to who is best positioned to deliver the private market products and advice, I would say that private market investments, whether equity or debt, require an investment banking approach to originating, structuring and syndicating such assets. As such, a typical private banking investment distribution model usually may not be adequate. Specialist platforms and EAMs/IAMs have been able to make a real difference in this space.”

Expert Opinion - Chau Ly, Senior Investment Specialist, Private Markets, Aberdeen Standard Investments: "We see opportunities in the venture capital space to back the next wave of disruptive technologies and category-defining companies. Leading franchise managers don’t readily accept new investors and top quartile managers outperform the median by a significant margin, and we can provide access to these top quartile managers."

The mid-market offers more deals and less competition

Another guest whose firm has made a specialisation of private markets for its Asian wealth clients, predominantly for UHNWIs and family offices. “We have a particular focus on the relatively smaller end of the market, we are not working with the major KKRs and others, we are typically talking to those raising funds of less than USD500 million. We often work with commingled diversified pools of capital, they're the types of entities we would be talking to.”

He explained that historically, his firm had been very focused on North America, but has been doing more in Europe, and offers the clientele the deals through the firm’s online portal.

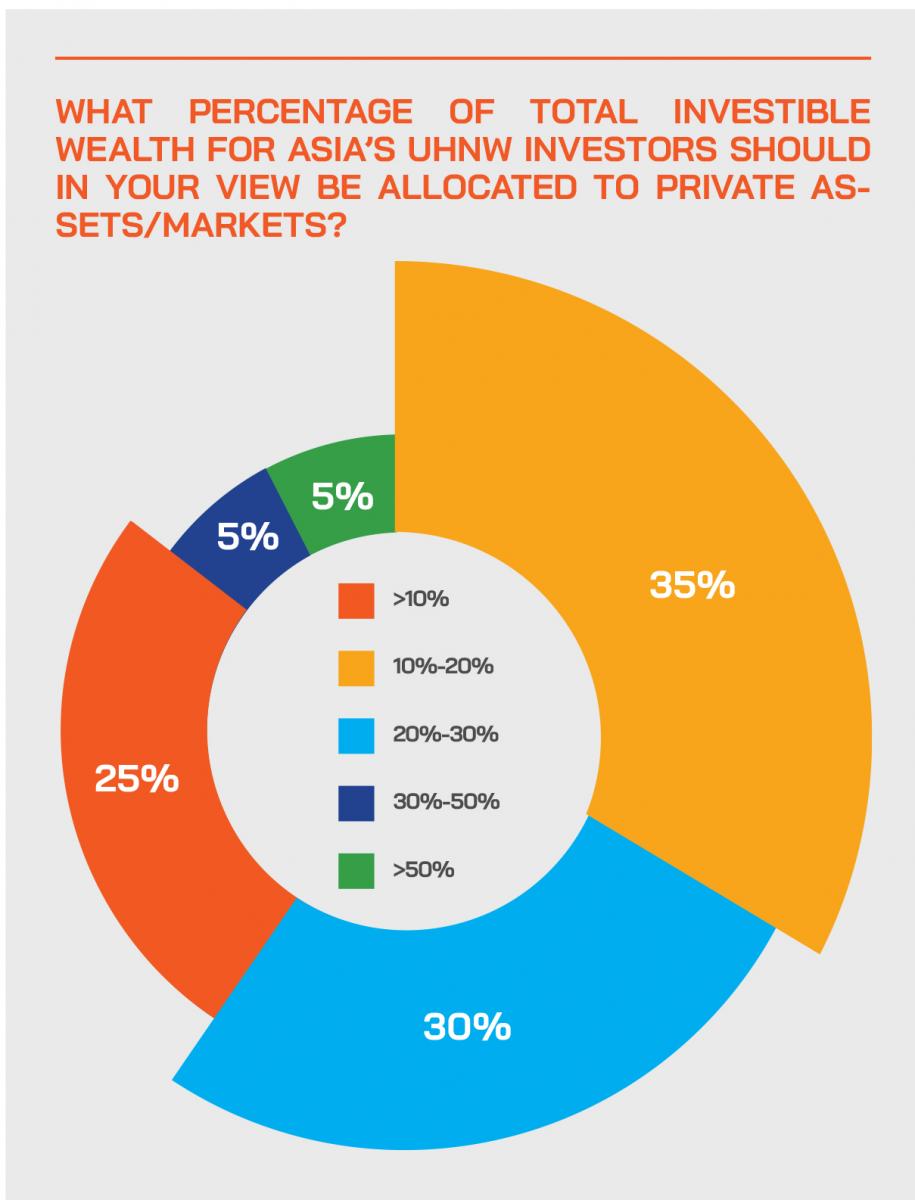

Targeting the right deals to the right investors

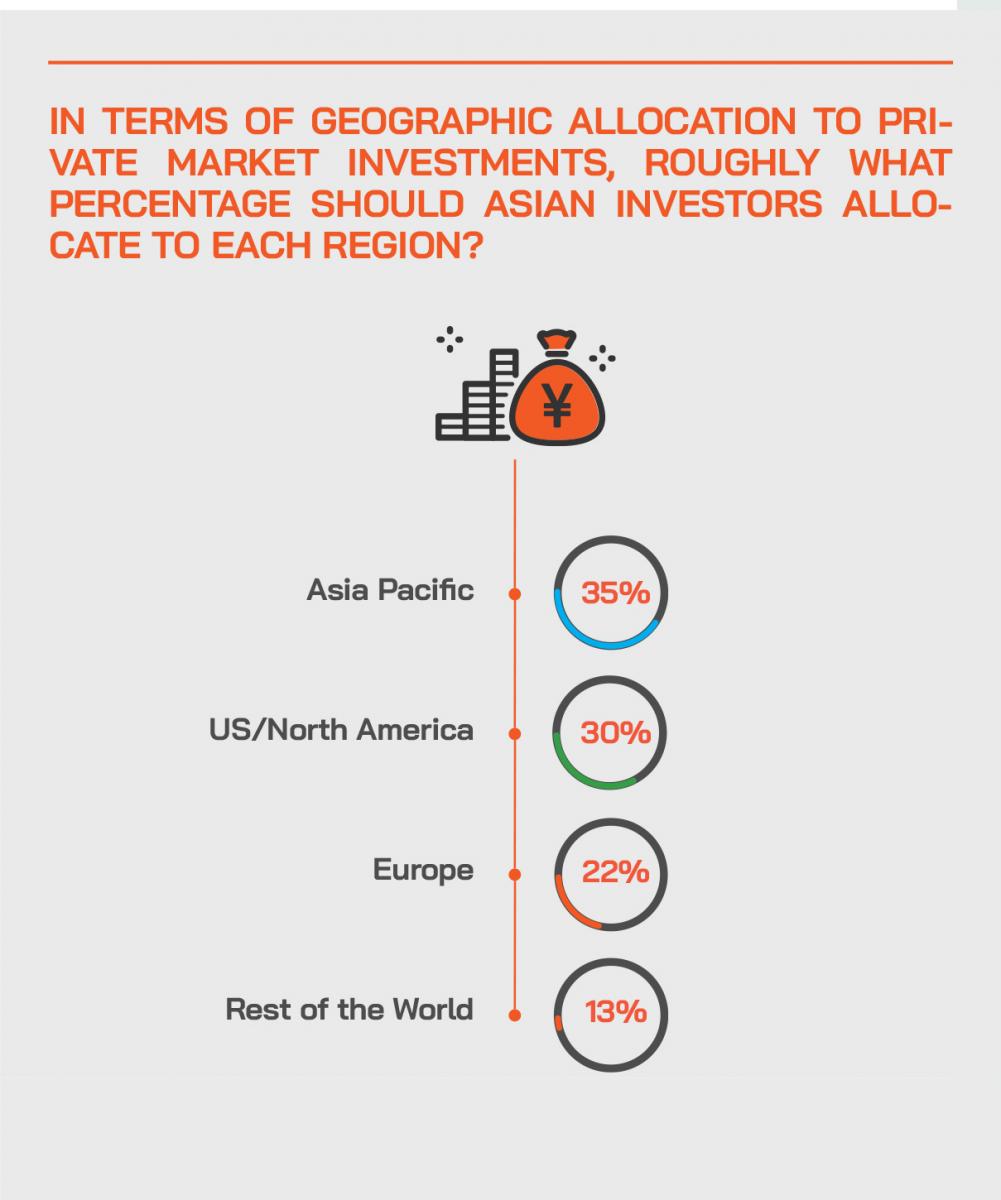

“We work hard to fully understand their investment preferences, so that we can be very targeted in terms of the opportunities that we put in front of them,” he reported. “We see a typical exposure of 20% to 30% to private markets for these clients, as a fellow panellist alluded to, and some might go higher. We are also expanding into Asia more in terms of opportunities, and we believe as an Asian-based firm we can really add value here.”

Screening and filtering – essential steps

He added that legal structuring and due diligence was very much integral to his firm’s proposition, as these are vital elements. He said the clients need the right partners, managers, structures and protocols in place in order to invest wisely and safely.

“We probably screen north of 1500 General Partnerships every year, we probably speak to several hundred, and we end up with perhaps 15 to 25 good ideas that we bring to the network. There are many criteria, including all the financial metrics and making sure they have the appropriate team to deliver on that thesis, that they have a track record that provides the evidence to be able to underwrite it, to whittle things down to what we consider the best deals.”

Europe coming up, and Asia rising gradually in prominence

He observed that the European venture industry remains some years behind the US but has been improving significantly and rapidly, especially in the past several years. “VC has performed remarkably well as an asset class, outperformed phenomenally, globally. So, investors have been paying more attention to VC, not simply allocating to private assets, but selecting certain niches within those, such as VC.”

He noted that lower rates globally had also been driving greater demand for private assets. “Investors want yield and being able to have a portion of your portfolio that's delivering higher returns than fixed income is capable of doing is important to them.”

Building the global network of deals and investors

The democratisation of private markets is another phenomenon this expert wanted to highlight, although he said this was not a mission for his firm. “What we're doing first and foremost, is building out a global network of sophisticated investors that have an appetite for the types of opportunity we work with, and the value proposition to those investors is that we're going to be bringing opportunities that you wouldn't be hearing from directly. I think technology is key to it, but as an enabler. We use an online portal to deliver those tools, we just built out a recommendation engine, which gives a match rating for any opportunity we have against any individual investor that's on our portal. So, based on their investment preferences, and the interactions that they've had with us, we're able to score those opportunities, which is very useful for targeting or prioritising, but first and foremost, it's down to having personal relationships.”

He added that the hybrid model is the most effective in terms of delivering to the UHNW channel. “I'm not saying there isn't a role for the democratisation for maybe a broad or more retail oriented market or even high net worth, but I think for UHNWIs, it's a combination of the two.”

Private companies are staying private for longer, driving the need for investor liquidity

Another guest commented that private companies are today staying private longer, creating a need for liquidity for employees and early investors. The increased liquidity in the primary fund raising is not in sync with need for liquidity for the secondaries. There is increasing interest from private clients to participate in significant growth of new age start-ups. We see a trend toward democratising access in the private markets space. There is a need for solving information asymmetry, asset curation and investor education.

Investors in Asia seeking low correlation to public markets

An expert on the panel offered his assessment by telling delegates that he sees two core reasons for the expansion of private assets. First, investors are seeking uncorrelated returns away from the increasingly volatile and highly valued public markets. He observed that private assets are not traded, and information flows are far less efficient than in the highly efficient public space, where information is abundant, transparent and where there are vast volumes of capital swilling around, sponsored by the central banks and their vast liquidity programmes.

Value creation and value extraction at the core of the mission

Secondly, he observed that private markets are about the value creation, with much of the robust value creation taking place from inception of the company to the time of listing publicly. “And investors, especially in the HNW and above segments, are savvier than before, and seeking more access to that value,” he reported, “and their objectives are being matched more efficiently nowadays with a lot more private market products available.”

The vital art of rigorous analysis of deals and structures

“We have a very stringent sourcing and due diligence process,” this expert reported, “working with some of the largest alternative asset managers as well as some of the emerging players as well. We look at the universe of deals, then analyse what is sustainable, what the clients might want and what might suit them, and then apply our judgement on behalf of the clients. We have had a lot of success in recent times, including with our direct investment side, where we are making a lot of inroads.”

The Hubbis Post-Event Survey

In your view, what has been driving the growing global demand for private market investments, and will the demand continue/grow?

- Wider choice and increasingly sophisticated clients.

- An alternative source of growth outside of traditional asset classes, with lower correlation.

- Asia is now emulating what has transpired in Europe and the US.

- Search for higher returns without elevated risk. The equation is longer holding times and more ‘manageable’ returns.

- Public market products have become commoditised and investors looking for better and more interesting and less correlated returns.

- Wealth Managers are being squeezed on fees with the advent of FinTech and cost-effective products and hence are looking for ways to differentiate themselves as well as provide investment solutions with a higher fee base.

- The high return perspective and the fees which can be charged in this space.

- Yes, demand will continue and grow, as the sector shows continuing attractive returns.

- People are gaining knowledge and becoming more sophisticated, they are looking for more competitive pricing and products, so demand will certainly grow.

- I believe the demand will continue to grow, especially related to China, where growth is rapid and more and more HNW clients who look for private market investments.

- HNWIs are getting savvier and are willing to take on riskier investments against expectations of high returns.

- Easier and broader access to deals. The low yields in fixed income. The increased access to information. It has never been as easy as today to follow what the big guys are investing in!

- Less correlation to public markets and no mark to market on client statements make for compelling reasons to buy private assets.

- PE firms have demonstrated the ability to continue to deploy capital efficiently, to help guide portfolio companies through the pandemic, and return capital to their investor.

- Cheap borrowing costs and increasing wealth for the HNWIs and UHNWIs. The demand will grow. There is innovation, population growth, and ESG all of which are affecting the future of markets in the short and long term.

- It seems everybody wants to get into the space now, it is highly overcrowded, so investor need to be cautious that they are getting the right and best opportunities, not the deals major investors do not fancy.

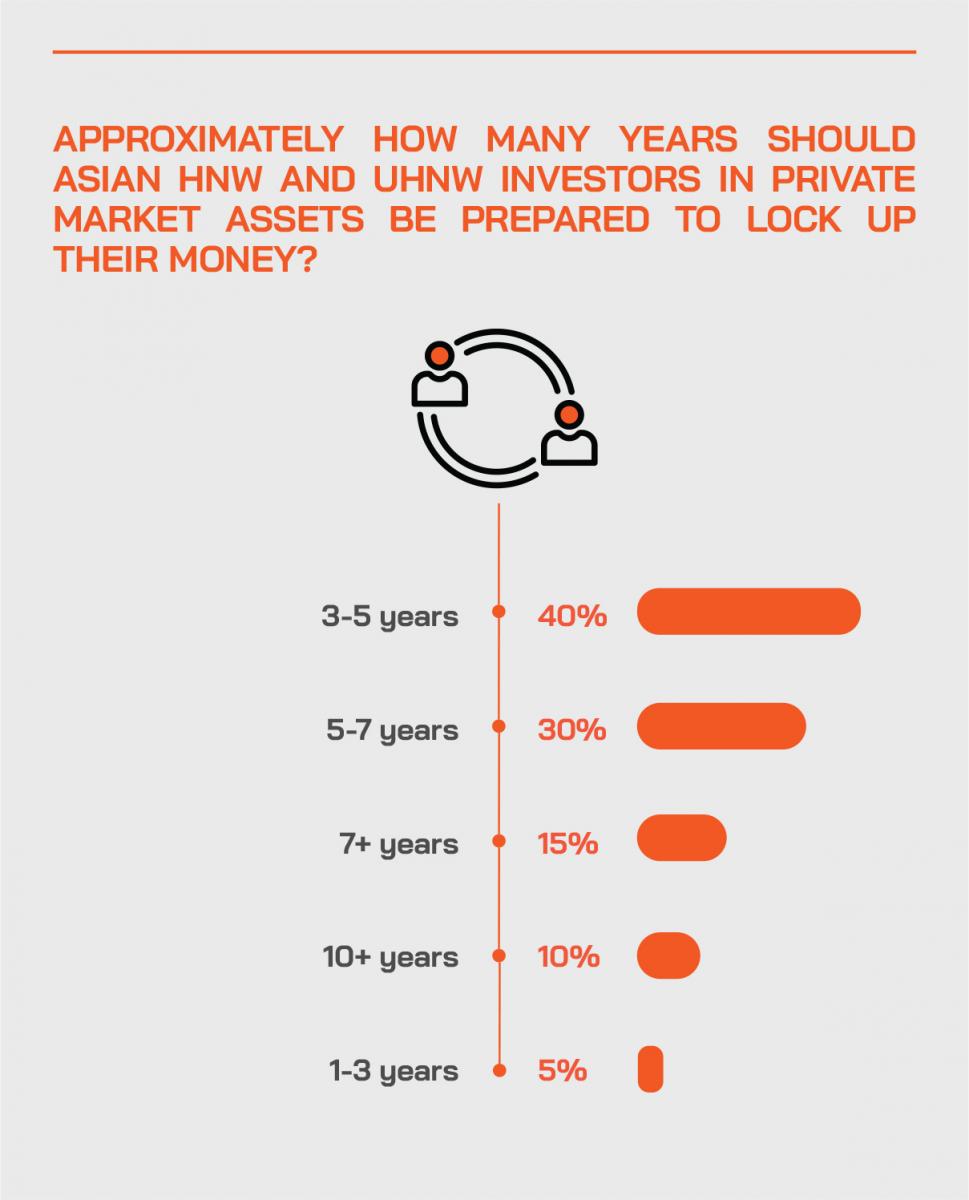

- Interest is more at the UHNW end of the spectrum, but there is growing interest amongst HNWIs, although long lock-up periods are probably an issue to contend with.

- We are attempting some democratisation of this asset class using blockchain/tokenisation.

- I believe both segments HNW and UHNW will continue demand for private market investments but majority in high demand will come from HNW segment clients, because for HNW clients looking for capital appreciation and for UHNW more on capital preservation.

What key skills and qualities are investors in Asia seeking from the banks/firms they will work with for private market investments?

- Unique investment style and elevated returns on a regular basis.

- Ability to do the appropriate due diligence and bring new ideas to the table.

- Experience and track record.

- In depth knowledge of the options.

- Trust, technical capabilities, experience, confidence.

- Ability to identify and conduct due diligence on investments and managers.

- Access to leading managers.

- Access to top tier funds.

- Quality advice on structuring and legal issues.

- Broad understanding of the universe of deals available.

- Access to deals that makes sense, ability to explain the risks and returns of the deals, professionalism and integrity.

- Ability to sort the wheat from the chaff.

- They must know their markets and be able to share market trends and market information like pricing date for secondaries. They must also be competitive in their fee structures.

- Their internal operational expertise, as well as specialised advisors to assist portfolio companies on areas such as customer behaviour changes; recapitalising the business and raising additional capital; reconfiguring supply chains; making strategic acquisitions and portfolio company bolt-ons, among many others. PE firms rely on their internal teams to identify and capture value opportunities within the portfolio and in some cases to help stabilise businesses. Operational teams are helping portfolio companies to identify appropriate capital structures to stave off liquidity or solvency issues, digitalise business models, drive top-line growth and cut costs.

- Integrity and transparency.

- Access to exclusive deals.

Suitability is essential and allocations must be tailored to the individuals

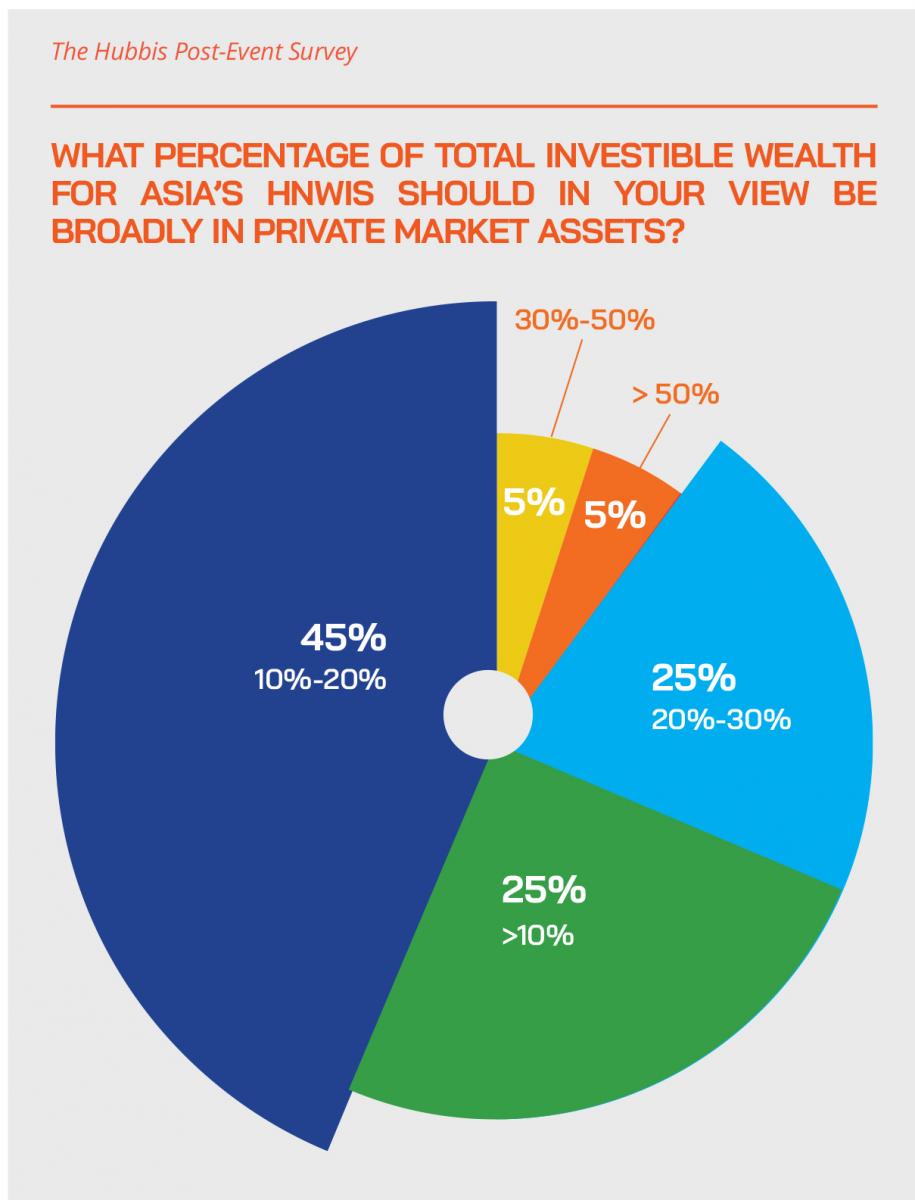

As to the extent of the allocation to private markets amongst clients, a guest pointed out that this should entirely depend on the circumstances and preferences of those clients, especially perhaps regarding liquidity, as private assets require longer holding period and are far less liquid. “For the clients who have greater need for liquidity or who perhaps that cannot invest over such long horizons, they will typically be allocating on the low side,” he reported. “But for the more professionally managed clients, such as single-family offices, they might feel comfortable allocating much more, for example between 20% and 30% to private assets.”

The AAA protocol – access, analysis, action

A guest explained that access to the right deals is crucial to the offering his bank provides clients. “Access to deals, access to the right transactions is important, and consistency too,” he observed. “When we invest in the private markets, we're looking at decorrelating from the typical market cycle, because if you think about private equity, for example, you're are participating in driving the value by becoming involved in a company. And in the private credit markets, similarly. In these segments, there is less efficiency in the allocation of capital and that is exactly where asset managers can add a lot of value.”

He also observed that finding the right manager is very important, and that is exactly where an elevated, robust diligence process is so important. And he added that it also comes down to the quality of the manager and the transparency of information flows they provide.

A marriage made in heaven…hopefully!

“The investment side is easy,” he said, “but many of these deals are longer term, they might be over 10 years, so it is more like a marriage between the various parties. We need to make sure and monitor the adherence of these partners to the structures and the rules, and make sure there is the right degree of information and communication. And that is exactly what we do. Finally, suitability must be aligned with transparency.”

Sustained low rates and volatility driving huge fund raising

Another guest added some views on the growth potential and recent track record, noting that sustained low rates combined with high valuations and volatility in the public arena had helped further magnetise wealthy investors towards the private markets. “That is why we are seeing more successor [follow-on] funds and so much capital being raised,” he reported. “We are seeing some of those 50% larger than the original funding, and we are seeing a huge amount of funding raised in the mega-cap space.”

Expert Opinion - Conor Smyth, Founder & CEO, TritonLake: “In this ‘lower for longer’ interest rate environment – investors are continuing to turn to private markets to deliver the prospect of uncorrelated returns from mainstream asset classes. As private market specialists, TritonLake are ideally positioned to identify the most appropriate and relevant differentiated and under-the-radar managers for our investors.”

Expert Opinion - Chau Ly, Senior Investment Specialist, Private Markets, Aberdeen Standard Investments: "Given sustained low interest rates and public markets volatility, investors have increasingly looked to private markets for potential higher returns, higher yields and diversification from public markets. Some of the opportunities we see appealing to Asian investors include North American mid-market buyouts, early stage venture capital and semi-liquid private markets solutions."

The mega-cap private equity funds dominate the landscape

He offered some data points, noting that over the past five years only about 3% of the funds were mega-cap funds of more than USD5 billion each, but those funds accounted for some 45% of the total money raised. “We are seeing the managers driving the raising of a lot of new money and also seeing a lot of these managers who started off with these flagship private equity strategies branch into other areas chasing yield, perhaps real estate or infrastructure or private credit, and now, we're also seeing a lot of these more innovative products,” he commented. “There are also some funds, and we have offered these ourselves, that offer semi liquidity for those HNW and UHNW investors that historically just can't lock themselves up for too long. So, we are seeing growth from the investor side and also from the supply side, the fund manager side as well.”

Expert Opinion - Conor Smyth, Founder & CEO, TritonLake: “With the increasing number of opportunities available to private market investors – more than 1,500+ new fund launches a year – cutting through the noise to find the ones worth spending time is nigh on impossible. TritonLake do that work so that the investors that avail themselves of our services don’t have to.”

Expert Opinion - Manmohan Mall, Head, Private Markets, Kristal.AI: “As to allocations should HNW and UHNW investors be making to private assets as a percentage of their total portfolios, asset allocation preferences have varied between HNW and UHNW investors. There is a higher appetite for illiquidity within a UHNW investment portfolio seeking superior investment returns and as such, the usual allocation to private/alternative assets tends to be around 40%, compared to roughly 20% for an HNW investment portfolio.”

Expert Opinion - Chau Ly, Senior Investment Specialist, Private Markets, Aberdeen Standard Investments: "We find the mid-market space attractive because there is a larger opportunity set (deals below $500 million represent over 90% of deal volume) than the larger end of the market. It is also less efficient (there are thousands of funds to evaluate in the US alone), less intermediated, less competitive, uses less leverage and has lower purchase price multiples."

A tsunami of money awaits, mostly targeted at the mega deals

He observed that this leads into some of the risks that have been arising, as so much capital has been raised that there is the risk that these GPUs are actually becoming asset gatherers, rather than focus on creating outperformance for their investors. “If you look at the dry powder available, as of Q1 2021, there was about USD3 trillion raised for private markets but not yet invested yet, and therefore seeking deals. This leads to the concern that competition for the deals intensifies, especially in the larger end of the market, and that will drive purchase price multiples up.” And that should mean returns moderate as a result.

As available money surges, so do risks and new deal valuations

He extrapolated that this in turn means that it is even more essential to partner properly so that investors can work with those who can add value and differentiation to their portfolios. “There was a study by Bain that shows that in the last 10 years average returns declined, but the top quartile managers returns have held steady, again supporting the argument that you need to invest with a manager that has access to the best deal flow.”

He clarified that the dry powder was largely in the mega-cap space, and that is where competition is especially intense for deals. “We tend to like the mid-market space, so we seek out funds that are less than one billion dollars in size, oftentimes less than USD500 million, that are less intermediated, that find lower purchase price multiples, use less leverage, and actually the opportunity set is just a lot larger for medium sized companies,” he explained.

Yet more reasons for Asia’s investors to seek out mid-market deals

Another guest agreed with this observation, noting that in that lower-middle market, it is possible to execute deals at purchase price multiples of up four or five or six times instead of 13 or 15 times and then apply the operational expertise of the managers to help deliver returns.

A panellist picked up on an earlier comment regarding the democratisation of private assets, explaining that as an upcoming FinTech platform out of Singapore that has been operational for roughly five years, the private market is a relatively newer business within the platform.

Democratising access with diversity of investors and technology

“Our banner is to democratise access high quality, high yielding assets globally for the HNW and UHNW investor base and in the private space, we are focusing mostly on tech, high growth stories, early stage, mid stage, pre-IPO, and also looking at debt solutions. When we started this business there were 500 unicorns, and now we're looking at almost 800 unicorns globally, with the scene in China changing by the day. So, there's significant action globally in this space. And that's where we believe all the effort that we put in from a platform perspective helps our clients, firstly better understand the assets and then make informed decisions. Information from top quality sources is the advantage required to invest wisely and to have an edge. And that is the edge that we try to bring in for the clients to our platform. We are starting with tech, but then also looking at more opportunistic investment around real estate and other asset classes in the private space.”

Investor education is core to the democratisation proposition

He added that their model is to democratise access to these assets, speaking to a very large number of investors. “Every deal that we launch, it goes out to let’s say 1000 plus investors, and then we go through the painful process of educating them, answering their questions and so on, just to make sure that they've got the full picture before they make the investment,” he explained. “That differentiation in terms of approach really matters. What we add value in is providing a platform, providing a better understanding of these assets to the investors, deciphering the complexities around, let's say, private credit, or pre-IPO investment ideas, but we need to be able to access a very large number of investors. And for that, we are partnering up with larger institutions in different markets such as Singapore, Hong Kong, India, and the Middle East. That type of expansion through partnership will be the way forward for us.”

Despite massive competition for deals, there is still massive opportunity ahead

The panel closed the discussion in broad agreement that the investor market in Asia for private markets will continue to expand in the foreseeable future, with the key challenges being the filtering required to deliver the best opportunities, and the ongoing commitment to delivery information and transparency on the investments that clients choose. The Asian market itself will also likely deliver more of the actual deals to bring the flow more into line with the economic power in the region, especially with deal flows from China rising all the time. Across such a vast region that is so diversified in terms of languages, cultures – so different from the US and Europe – this will present even more challenges ahead, driving an even more professional approach from the promoters and the investors alike.