Publications & Thought Leadership

Alternative Investments - Their Rising Prominence in Asia's HNW Portfolios

Jul 6, 2022

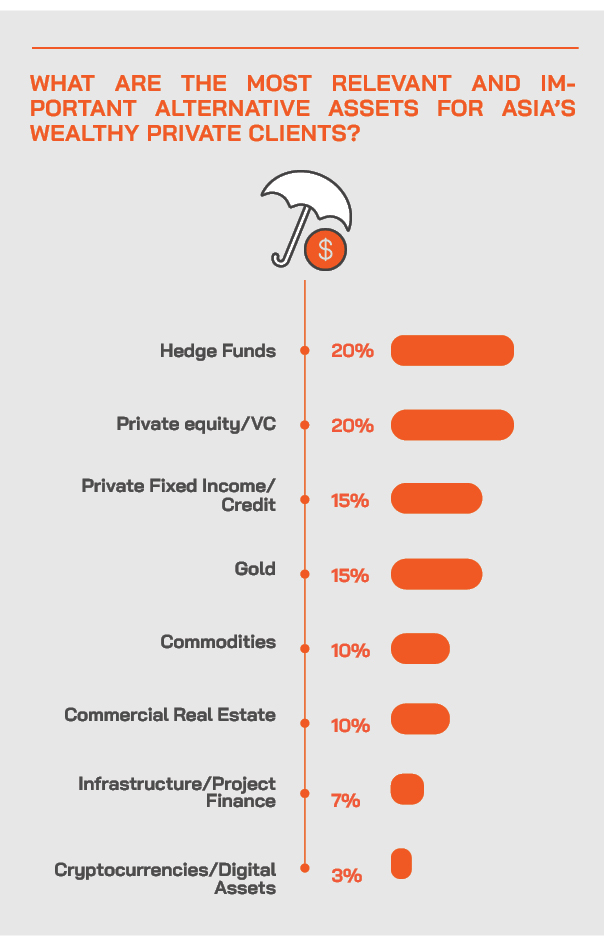

For our Digital Dialogue discussion of 16th June, Hubbis assembled a remarkably erudite and experienced panel of experts to review the expanding universe of alternative investments and to analyse why, for Asia’s HNW and UHNW investors, alternatives offer an increasingly appealing set of opportunities alongside their core, mainstream public financial market assets. The word ‘alternative’ today spans all types of non-mainstream investments, from private equity, debt and real estate, gold/precious metals, digital assets/cryptocurrencies, hedge funds, and even fine art and collectables of all types from cars to luxury yachts. The overriding impression from the discussion and from the Hubbis post-event survey was that global financial conditions are providing further wind in the sails for alternatives, that Asia’s private clients are increasingly interested in diversification and non-correlated returns, but that any private client needs to be careful in their selection, and wary of excessive, perhaps unnecessary complexity.

The Panel

- Julian Howard, Lead Investment Director of Multi-Asset Solutions, GAM Investments

- Tommy Garvey, Portfolio Strategist - London, GMO

- Frank Yu, Head of Private Markets, Hywin International

- David Storm, Chief Investment Officer - British Isles & Asia, RBC Wealth Management

- Dr Andrew Freris, Chief Strategist, UCAP Asset Management

Setting the Scene

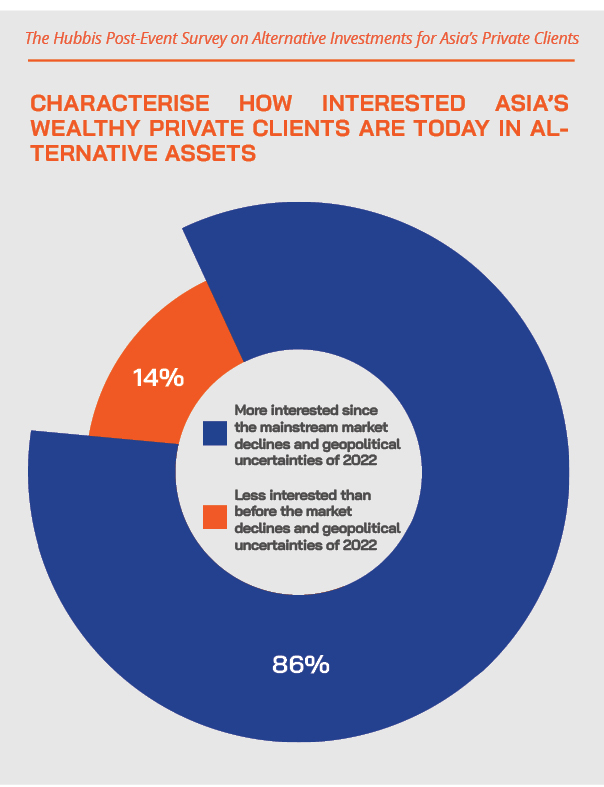

The world of alternative investments has been diversifying, expanding and moving increasingly centre stage for some years already, and the appeals of diversification have definitely caught on amongst wealthy private clients in Asia, especially in more recent times.

Experts are even more positive about private clients raising allocations to alternatives, given the volatility of the public markets, stretched mainstream asset valuations and the historical performance of many of the alternatives that investors might have bought into. Further fuel to accelerate this trend comes in the form of global geopolitical uncertainties, worries over inflation and rising rates, and concerns about government finances.

Accordingly, our panel of experts reviewed the main drivers for rising allocations to alternatives and considered in the current and anticipated environment which assets offer the most appeals and advised investors how to go about finding the best opportunities.

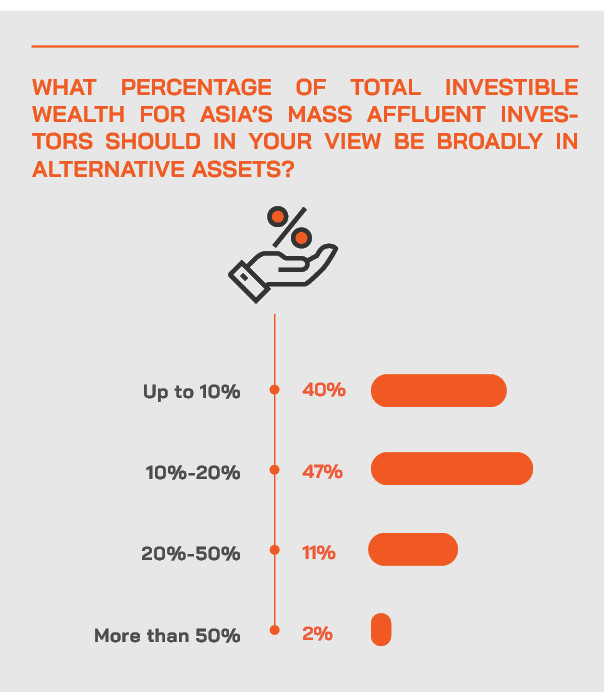

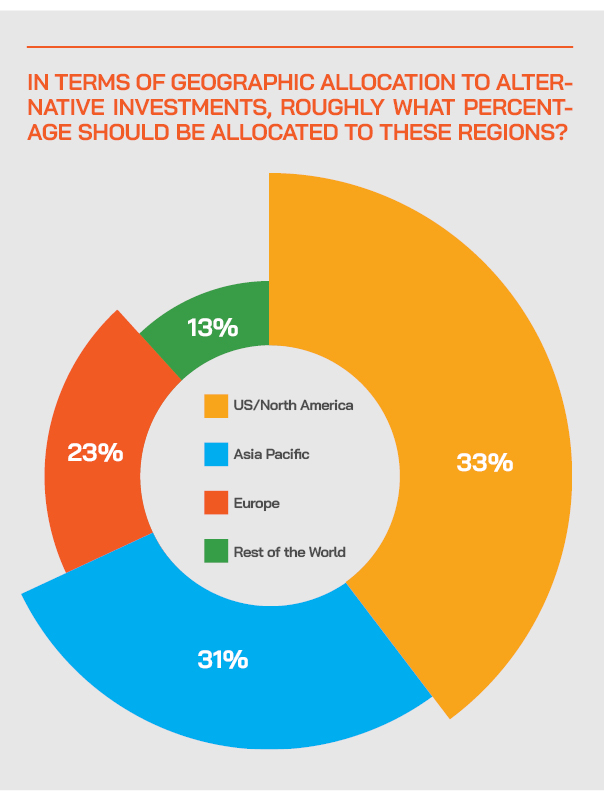

They also debated how the wealth management industry in Asia can curate the right products, services, talent, and strategies to capture more of this business. They discussed the potential for the 'democratisation' of access to alternatives, as digital technologies and the blockchain open the door to delivering some of these alternatives in more ‘bite-size’ portions to the growing ranks of mass affluent investors in Asia.

Interpretations of what counts as alternative assets might differ, but the objectives are similar throughout – diversification and minimal correlation to mainstream assets

A guest opened proceedings by offering his views on what the universe of alternatives comprises today. “This is an investment or a strategy that does something different from those long only traditional elements that you would have in a portfolio such as equities, fixed income, and even commodities,” he explained. “The return drivers aren't just that long beta, and the selections tend to encompass a broader use of instruments. Derivatives can hedge the exposures but involve more illiquidity and more complexity. The key component really, when you're thinking about alternatives, is that the dispersion of returns can also be far wider.”

Accordingly, he said this is a broad space, but very useful for portfolios because investors are deriving returns from different sources.

Another expert conceded that he did not have a precise definition of alts. “Back in my consulting days, I did absolutely the most amazing business with small hedge funds that involved alternative investments, involving guns, coloured diamonds, watches, sports cars, stamps, wine, and whisky, amongst others, and that is as alternative as you can get,” he quipped. “But of course, they’re illiquid, and they are difficult to quantify or to index.”

But to try to pin things down, he said alts means different things to institutions and to private investors. “Institutions have to have alternatives in their package, and it is nowadays part of their ESG investment approach, while individuals do not, they will take them only if the returns are sufficiently interesting, or the diversification aspect is sufficiently valuable,” he reported. “So, selling to institutional investors is much, much easier than selling to individual clients.”

Expert Opinion - Julian Howard, Lead Investment Director of Multi-Asset Solutions, GAM Investments: “We like to expand the definition of alternatives to include ‘alt-bonds’, which are more sophisticated bond strategies able to deliver a modest but consistent return with low correlation.”

A simpler approach to alts came from a China expert who said that Chinese and other clients are increasingly interested in the private markets, pre-IPO investments, property-related investing ideas – for example he mentioned a Japan hotel fund – and other such diversification opportunities away from their mainstream equity and fixed income allocations.

“The market is changing,” this guest observed, “and customers are not so focused on high liquidity stocks and other assets, as they are performing badly, so they are more receptive to these alternative investments with a longer-term outlook perhaps of five years or more, and that opens the door to real estate, or pre-IPO funding instead of the IPOs themselves, and all these things are happening amongst Chinese private investors. Certainly, pre-IPO stage investing is really hot in the China market now.”

He added that rates in China are falling, unlike the rest of the world, resulting in greater appeal for overseas assets as the Renminbi currency is depreciating.

“We are seeing Chinese investors looking to move their Renminbi assets to overseas to make, for example, US dollar investments, and this means we can show them interesting ideas such as a global real estate fund, for example, or the hotel or property assets in Japan and even Southeast Asia as they diversify their allocations away from just China and seek stable annual cash flows that are safer haven and less volatile. We are actively looking for alternative investment products for Chinese domestic investors.”

The global financial conditions are now conducive to a rising allocation to alternatives

“Now we are into an environment where central banks are tightening; this all becomes a richer environment for alternative strategies, particularly macro,” a guest reported. “We've seen that so far this year, systematic macro has done really well, discretionary macro has done fairly well. It's been that sort of rich environment where liquidity is going to start to be withdrawn from the system. Volatility is no longer completely dampened, you start getting a real repricing of risk and that's when truly active managers that think of alternatives are being truly active, can come to the fore.”

Another expert picked up on these points, noting that when rates are rising, this raises the correlations on all financial asset classes. “All financial assets are effectively claims on future cash flows,” he said. “So, if you raise interest rates, that is going to affect everything universally. So, fixed income duration is no escape, property is no escape, because that's basically a bunch of cash flows in the form of rents. Structurally, alternatives can offer a true and genuine diversification away from a high correlation risk event, which is what we are effectively going through now.”

He said he was in his role during the global financial crisis and that there are not so many investors and analysts around now who have seen that value destruction and volatility. He said that was an environment where correlations all went to ‘1’ and nothing worked, so alternatives didn't really work either. Everything failed.

“I think it therefore pays to be quite sceptical and quite agnostic about what you include in portfolios, and certainly alternative investments have not fared particularly well,” he cautioned. “On paper alternatives are assets that we should all aspire to as a genuinely uncorrelated asset class, but in practice, structuring and sizing an alternative sleeve, particularly for a private wealth client, can be quite challenging, and it only mistake and that can turn them off for many years to come.”

He said that was definitely his and his firm’s experience during the GFC, and even today, those very longstanding clients remain very wary of alternative investments and are not receptive to the next great idea. “However,” he said, “that doesn't mean we throw everything out and there are areas which we do favour. One of the areas we like in the fixed income market we have labelled Alt Bonds, so this is alternative fixed income such as catastrophe bonds, for example, or MBS. These can offer the kind of profile that gives you, perhaps a 3% annualised return and a consistent diversification away from equities.”

He expanded on this, stating that wealth management is partly about the growth of assets but also significantly about capital preservation. We consider areas of fixed income that we can call alternative fixed income that can offer a lot of interesting solutions for private wealth clients who seek a little more consistency in their diversification.”

He said their general approach is from a very slightly different angle, perhaps born of experience. “We keep obviously assessing the market very carefully, we just keep refining the definition a little bit to include assets that actually genuinely work consistently,” he explained. “Macros had a great year this year but had a torrid few years before that. We believe private clients need much more consistency, because what you could find is if your alternatives all don't work at the same time as your mainstream investments in equities and bonds, and that is highly problematic. In short, we are circumspect about the asset class.”

Asia’s private clients are diversifying towards alts and providing they take good advice this is a sensible strategy during these times

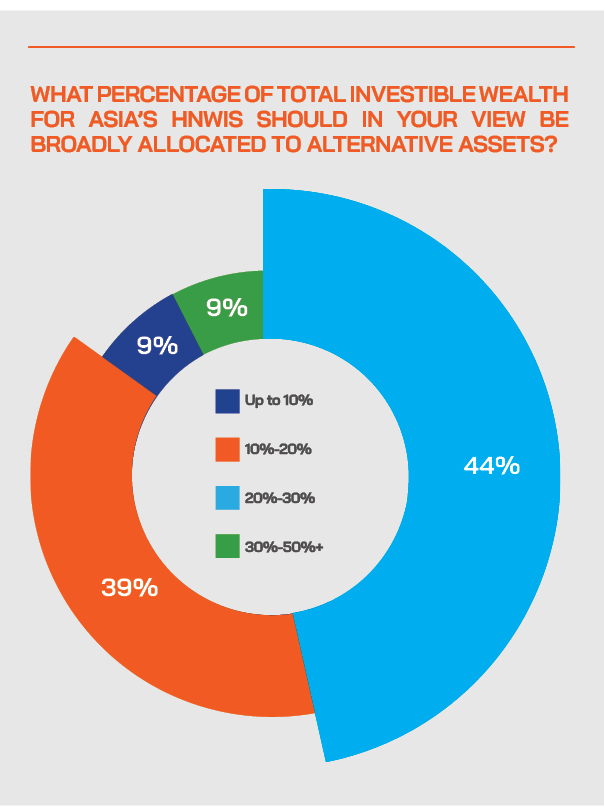

On the question of whether alternative investments are now, or should be, a core element in the portfolios for Asia’s wealthy investors, an expert reported that a carefully structured allocation to alternatives can optimise diversification in portfolios, but warned that if people get it wrong, they can worsen diversification and cause further pain in falling traditional markets.

“Much depends on the ability to understand the underlying risks and the potential performance profile, and the ability to select and structure,” he explained.

He added that clearly more interest is being generated, since rising discount rates cause high cross-asset correlation, in other words they hurt equities, bonds and real estate since all of these assets are at their heart claims on future cashflows. “Alternatives with any correlation or beta to the market are being ‘found out’ now,” he warned. “Equity long/short has not worked.”

On the issue of how investors should look at alternatives - for yield, gain, risk mitigation, or downside protection, for example, and the typical holding periods they should be considering, he explained the following. “We divide our portfolios into growth and capital preservation – a barbell structure. Growth comes from equities while capital preservation is designed to smooth out the journey. Alternatives serve to protect downside for us. If they can make a little on the way, that is great.”

Expert Opinion - Julian Howard, Lead Investment Director of Multi Asset Solutions, GAM Investments: “HNW investors should not be structurally wedded to any asset class (except equities for growth) – as discount rates go up, an opportunity is arising to make a guaranteed positive nominal return with no volatility. All non-equity assets should be compared to that emerging ‘benchmark’ when client portfolios are being constructed and reviewed.”

Private clients should indeed diversify, but carefully, analytically and strategically

Looking at the types of portfolio allocations HNW and UHNW investors have so far made to alternatives, and their advised positioning they should adopt for the future, an expert observed that in his experience they have been cautious given the longer-term history since 2008 and observed elevated correlations amongst the hedge fund sector as a whole to the S&P 500.

“We do allocate to alternatives in discretionary portfolios and also advisory, but experience from 2008 onwards highlights the challenges of consistency in turbulent markets,” he told delegates. “However, we like to expand the definition of ‘alternatives’ to alternative fixed income and here we see some interesting opportunities for long term portfolio diversification.”

Opining on the alts Asia’s wealthy could be buying, a guest explained that they like the concept of convertible arbitrage because it can introduce some ‘skewness’ to portfolios, in other words upside participation with downside protection. “Strategies which short the equities of the convertible bonds held can achieve this,” he said. “We hold some merger arbitrage too. But our real alternatives focus is in ‘alt-bonds’ – catastrophe bonds, MBS paper, sub and junior debt of investment grade financials. And some premium can also be had from illiquid private credit, but suitability is vitally important here.”

A panellist remarked that there are significant offerings available to Asia-based clients across the board. “Private equity, private credit and other sophisticated but less liquid alternatives are all being taken up,” he reported. “We hold private credit for some clients, but the illiquidity and reporting challenges mean it has to be approached carefully – and well understood. Again, suitability is key.”

Where there is appetite, a larger allocation to alternatives could be considered which diversifies across macro, merger arbitrage, commodities and so forth, he elaborated. This can potentially produce a 3-4% return profile with diversification in the event that a single underlying strategy underperforms.

“However,” he continued, “we find that a ‘core’ of alternative fixed income with 2-3 high conviction alternative ‘satellites’ is equally as effective over time. It is important to note that as discount rates go up across the US, UK and Europe, the relative nominal attraction of alternatives (and indeed all non-equity assets) generating 3% with some volatility begins to fade. We have to be aware of this changing market dynamic in the short to medium term since it affects optimal portfolio construction. As cash becomes king, this should alter any agnostic portfolio managers’ allocations and alternatives are not immune from this.”

Looking at the safest ways to gain access and the dangers to be aware of in building greater exposures to alternative assets, an expert observed that a dedicated manager research team is important for performing due diligence and reviewing the investment process and personnel of underlying alternative funds.

Raising the allocations to alternatives in a world where growth is out and value is back in

Another expert explained that his firm focuses on a multi-year view and allocates across asset classes in an unconstrained fashion in their flagship fund.

“At time, we have no alternatives in there but right now we have just over 50% in alternatives,” he reported. “And that really is driven by the fact that we think the outlook for traditional asset classes is uncertain over the medium term, primarily because of very high valuations, but also because of the uncertainties around inflation, monetary policy, geopolitical risk. In brief, we really are very wary of traditional asset classes at the moment.”

He said the relative value approach leads them to sell assets that are expensive and own assets that look cheap and that appear to have the potential to do very well. “We have quite a few relative value strategies, such as systematic global macro, or our equity dislocation strategy, which is long value, short growth at the moment,” he told delegates. “They have done very well in this environment.”

He did however agree with an earlier comment about being highly selective. “You must understand why they are in there, so for example, you see the relative value opportunity, because you're looking for diversification, and so forth, and then analyse how your alternatives perform in different environments,” he elucidated.

He offered more insights into their views on mainstream and alternative markets. “I reiterate that we see equities as predominantly being overpriced, even after the falls of this year, and we remain very worried about the medium-term outlook for most equities. Similarly, with bonds in a rising rate environment as already been noted, having duration is very dangerous. As a result, we are currently using our alternatives as a return-seeking asset rather than diversification.”

He explained that they are excited by the fact that growth assets, growth equities in particular, are in a very big bubble, while value equities have underperformed by 200% over the last 15 years and therefore relative to growth equities, they look very attractively priced.

“As a result, more than 20% of our flagship unconstrained portfolio at the moment is our Equity Dislocation Strategy, which basically is long cheap value equities and short expensive growth equities. We have seen very strong returns of about 20% this year as growth stocks really took the brunt of the falls and interest rate rises. But we think that there's still an awful long way for that to run. This means we continue to focus on pockets of relative mispricing and trying to be long a cheap asset and short another asset, and what that means you can generate returns without being beholden to the actual direction of markets.”

He also indicated they did not want to get side tracked too much into ESG. No investment conversation is complete without ESG these days, and the panel spent considerable time analysing the linkages between ESG and alts of all kinds. But this expert commented that while ESG is clearly a hot topic, he would not want it to fit on top of alternatives.

“Everybody seems to be looking at their whole investment portfolio with an ESG lens these days, but I don't want to hijack the alternative investments part of this to branch out to ESG. We remain focused on our approach of zeroing in on value minus, value long value equity, short growth equity, which is very exciting in the near term.”

He explained that the results are definitely coming through in their equity dislocation, systematic global macro, and also fixed income absolute return strategies. “The key premise is relative value is more attractive now than it often is,” he stated. “And we extend into areas such as event-driven assets or distressed credits, or indeed, asset-backed and mortgage-backed securities, badging them all as alternatives as well.”

Some experts are sceptical about private credit, one of the go-to alternatives of recent years

A guest said his firm is concerned about the sphere of private credit, not just due to its illiquidity. He explained that the proceeds of private credit might be financing risky areas and on a relative basis, mainstream liquid credit markets have been re-pricing to a more appealing level in terms of yields. “As a result, investors do not have such a need to take that significant liquidity risk of private credit to get the level of income or the level of return that they might be seeking,” he reported.

Another guest took a more positive view on private credit, noting that it is possible to pick up high yields – he mentioned yields of up to 9% - and that type of return buys a lot of mitigation for potentially rising rates and default rates.

The wealth management industry has plenty of challenges ahead in curating the optimal alternatives opportunities

The panel offered their different perspectives on what types of alternatives they prefer and then turned the spotlight on how the wealth industry can help clients sort the wheat from the chaff.

“We take an outcomes approach,” one guest reported. “In other words, you start with the absolutely the simplest possible solution, because in general, it turns to be right. In other words, we go for low hanging fruit. We don't pretend that we can possibly examine everything available. We have a very simple filtering of both equities and bonds, and we take it from there, and our universe is limited. Clients like simplicity.”

Another expert agreed, adding that there is no premium on complexity. “For most private wealth portfolios, I think the more complexity and the less transparency, the more problematic it is when something goes wrong, because you then really have to be able to explain the advice and recommendations,” he said. “It is all very well having an investment which sounds great and should work in all environments for us, but if it goes wrong, that is a different story. We learned that lesson in the GFC. We like the world of alternative fixed income for these reasons. And in general, we agree with keeping it all as simple and transparent as possible.